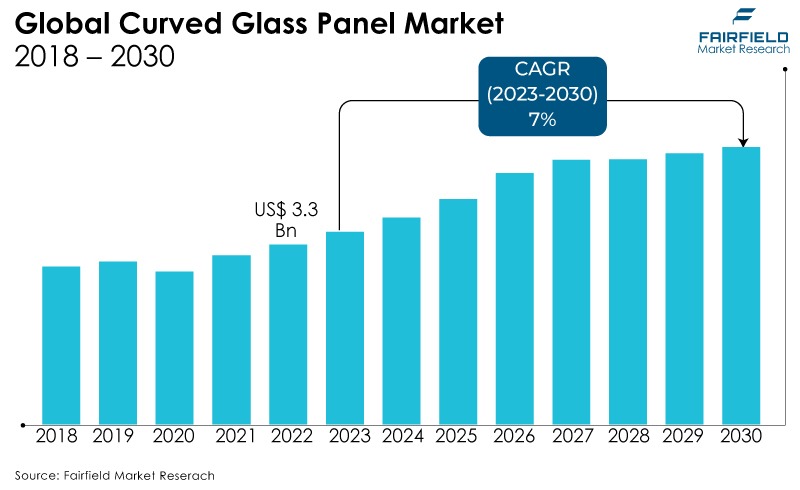

Global Curved Glass Panel Market Forecast

- Global curved glass panels market valuation to reach US$ 5.2 Bn in 2030, up from nearly US$ 3.3 Bn in

- Market size anticipated to expand at a CAGR of 7% during 2023 - 2030

Quick Report Digest

- The main trend expected to drive the market growth for curved glass panels is increased demand for healthcare and medical devices. Furthermore, the medical devices include patient monitoring diagnostic tools, and medical kiosks use curved glass panels with touchscreen capability.

- The rapidly growing automotive industry integration is another significant trend anticipated to drive curved glass panel growth. Electric and autonomous cars (EVs and AVs) commonly use curved glass panels. Curved glass has a cutting-edge, futuristic appearance that complements the cutting-edge technology found in these cars.

- The rising demand for distinctive and aesthetically beautiful building designs presents a considerable potential opportunity. Stunning and recognizable structures are made with curved glass panels.

- Curved glass panels use expensive, difficult procedures like precision bending, tempering, and laminating. Curved glass panels may not be as affordable for various end-users due to the high manufacturing costs.

- The double-glazed curved glass panels segment dominate the market in 2022. Compared to single-pane glass, double-glazed curved glass panels provide better insulation. As an insulating barrier, the area between the glass layers slows heat transfer.

- In 2022, the architectural category dominated the industry. These panels can be bent in various forms, such as cylindrical, spherical, or conical shapes, giving the outside of buildings a distinctive and futuristic feel.

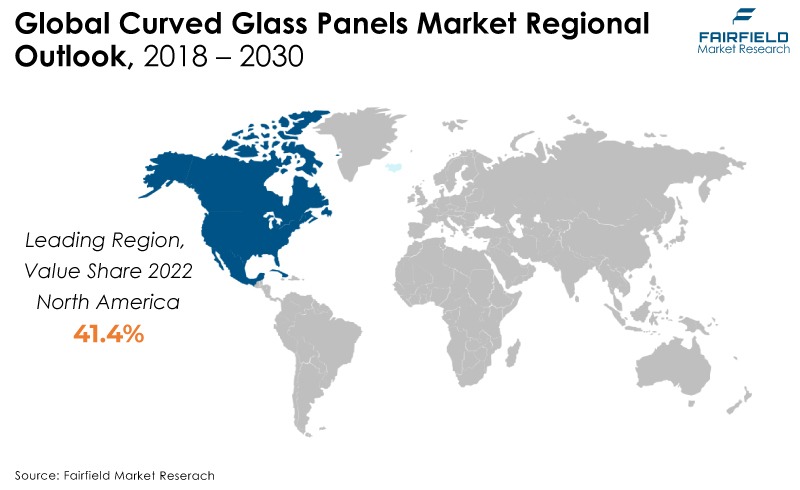

- In the market for curved glass panels, Asia Pacific is anticipated to grow at the fastest rate. This is due to the creation of cutting-edge curved glass panel solutions, including smart glass technologies and interactive displays.

- The North American region will dominate the curved glass panel market throughout the forecast period. Curved glass panels are frequently used to construct famous structures in North America, which is renowned for its inventive architectural ideas. Skyscrapers with curved glass facades are commonly found in major cities like New York, Los Angeles, and Chicago, which increases demand for these panels.

A Look Back and a Look Forward – Comparative Analysis

Leading manufacturers of smartphones and tablets are switching to curved glass displays. These curved screens enhance touch sensitivity, give consumers a more comfortable grip, and add a sleek and contemporary design. Modern television and monitor designs primarily incorporate curved glass panels. These curved screens provide a larger field of vision and less distortion at the screen's corners, resulting in a more immersive viewing experience.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use end-user sectors such as architecture and construction, automotive, consumer electronics, furniture and interior design, and others. However, the demand for curved glass panels has increased in some end-users, including hospitality, healthcare, transportation, museums, and exhibitions.

Medical imaging devices like MRI (magnetic resonance imaging) and CT (computed tomography) scanners frequently use curved glass panels. Curvature enhances picture visibility, facilitating precise diagnosis and treatment planning in the coming years.

Additionally, there are opportunities for research and development to identify novel materials and production techniques for enhanced functionality and cost-effectiveness. Furthermore, The demand for curved glass panels in creative architectural designs is still significant, especially for high-rise buildings, bridges, and contemporary constructions during the next five years.

Key Growth Determinants

- Increasing Application Across Automotive Industry

Automobile designers frequently use curved glass panels to produce svelte, contemporary, and aesthetically pleasing vehicles. The curved design can provide a touch of sophistication and elegance to the exterior of cars. Curved windscreens and windows can improve an automobile's aerodynamics, improving fuel efficiency and reducing wind noise, making them desirable to both manufacturers and buyers.

Laminated and tempered glass choices are frequently used in curved glass panels on autos to ensure that they meet safety standards. When there is an accident, these safety features safeguard the passengers, making such cars more desirable. Curve glass panels in cars are frequently made of laminated or tempered glass to meet safety requirements. These safety features safeguard passengers in collisions, enhancing the allure of such cars.

- Growing Technological Innovations

Curved glass panels are now easier and more efficiently produced due to the development of innovative manufacturing techniques like hot bending, cold bending, and chemical strengthening. Because of this, curved glass is now more widely available in numerous industries. Curved glass panels now have better durability, scratch resistance, and energy efficiency due to advancements in glass coating technology.

Due to these coatings, curved glass panels are now more appealing for use in architectural and automotive end-users. Due to the incorporation of smart glass technology, curved glass panels now have more options for use in dynamic facades, interactive displays, and privacy glasses. Smart glass technology allows the glass to switch between transparent and opaque states electrically.

- Growing Demand for High-resolution Displays in Consumer Electronics to Drive The Market Growth

The immersive viewing experience of high-end televisions with curved panels has increased in popularity. These TVs use curved glass panels for a larger field of vision and a more immersive experience. Computer monitors use curved glass panels to create a more immersive and comfortable viewing environment.

Professionals and gamers frequently prefer curved displays because of their improved visual engagement and decreased glare. Curved glass panels are a common feature of top smartphones. These curved screens enhance aesthetics while providing a more immersive viewing experience for multimedia content.

Major Growth Barriers

- High Manufacturing Costs

Curved glass panel manufacturing demands specialised tools, materials, and methods, which can drastically increase production costs. Due to this, curved glass panels are less economical than traditional flat glass substitutes. Many sectors, like consumer electronics and construction, are price-sensitive markets.

Curved glass panels can become pricey due to high manufacturing costs, losing some of their appeal to consumers and businesses on a tight budget. Companies producing curved glass panels may find it challenging to compete with manufacturers of flat glass products that can offer lower prices due to economies of scale and lower production costs.

- Complex Installations

Curved glass panel installation frequently necessitates the use of specialised knowledge and abilities. The lack of expertise of some installation or building teams may result in delays and inflated expenses. The exact installation of curved glass panels necessitates skilled labour, which can be costly and drive up project costs.

Longer project timelines may not be possible for projects with tight deadlines due to the difficulties of installing curved glass panels. Curved glass panel's unique shape can make them more vulnerable to damage during installation, raising the possibility of breakage and the accompanying costs.

Key Trends and Opportunities to Look at

- Energy-efficient and Sustainable Panels

Advanced coatings and insulating features can enhance thermal performance in curved glass panels. This contributes to energy-efficient building designs by minimising heat gain during the summer and heat loss during the winter.

Curved glass panels with solar control coatings can reduce solar heat gain while letting in plenty of natural light, making them more energy-efficient. In turn, energy efficiency is improved because there is less reliance on air conditioning equipment.

Achieving LEED certification and other green building criteria can be facilitated by the use of curved glass panels in sustainable building designs. These qualifications are being sought after by architects and contractors more frequently.

- Smart Glass Technology

Curved glass panels with smart glass can dynamically transform between transparent and opaque states, allowing for improved sight, privacy, and light transmission. Both automobile and architectural end-users of this property are widely desired.

Smart glass can save energy by managing the quantity of sunlight entering a structure or vehicle. When tinted or opaque prevents solar heat gain, lowering the need for air conditioning and enhancing energy efficiency.

- Growing Interactive Surfaces and Digital Displays

In retail environments, curved glass panels create eye-catching, interactive displays that draw people and improve the shopping experience. Interactive displays can provide product details, simulated fittings, and tailored recommendations.

In museums and exhibitions, curved glass panels display artwork, artifacts, and interactive educational displays. They increase visitor interaction and produce a memorable experience.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, the market for curved glass panels has been governed by several regulatory frameworks and standards that guarantee the products' compliance, quality, and safety in various end-users. American National Standards Institute (ANSI) standards cover safety glazing materials in automobiles and structures. These standards require glass's ability to withstand impacts, breaks, and other safety-related factors.

A global leader in safety certification, Underwriters Laboratories (UL) assesses and certifies goods for compliance with safety standards. Underwriters Laboratories (UL) standards cover a variety of glass panel-related topics, including building construction safety and fire resistance.

Industry organisations, like the Glass Association of North America (GANA), significantly impact the development and promotion of industry standards and best practices. They collaborate closely with oversight organisations to guarantee compliance with industry standards.

Curved glass panels are required to meet safety, performance, and environmental regulations in various end-users, including construction, automotive, and consumer electronics.

Fairfield’s Ranking Board

Top Segments

- Double-glazed Panels Preferred over Single-glazed Counterparts

In 2022, the category of double-glazed curved glass panels dominated the market. Compared to single-pane glass, double-glazed curved glass panels provide better insulation. As an insulating barrier, the area between the glass layers slows heat transfer. As a result, buildings use less energy and spend less money on heating and cooling.

Sound insulation is further aided by the air or gas-filled gap between the panes of glass. Double-glazed curved glass panels are frequently used when noise reduction is crucial, such as in cities or near busy roads.

Furthermore, the single-glazed curved glass panels category is anticipated to grow fastest. Because of their streamlined, contemporary design, single-glazed curved glass panels are highly sought after. They are favoured in modern architectural designs because they don't have an additional glass layer or insulation, which gives them a simple and clear appearance.

- Architectural End User Category Spearheads

The architecture category dominated the market in 2022. This is due to the modern architectural ideas that used curved glass panels to provide appealing and distinctive building facades. These panels can be bent in various forms, such as cylindrical, spherical, or conical shapes, giving the outside of buildings a distinctive and futuristic feel.

Entrance systems, such as revolving doors and glass canopies, frequently use curved glass panels. They protect us from the weather and provide a welcoming, contemporary entrance.

During the forecast period, the electronics category is expected to grow significantly. This is because many consumer electronics products, including curved TVs, computer monitors, and gaming displays, are made using curved glass panels.

By providing a panoramic and immersive view, the curvature improves the viewing experience. Curved glass panels give high-end audio devices, including soundbars and speakers, a sleek, contemporary look.

Regional Frontrunners

North America Brings in the Maximum Revenue

North America is expected to dominate the curved glass panel market during the forecast period. Curved glass panels are extensively used in commercial and residential construction in North America, particularly in large cities like New York, Chicago, and Los Angeles. These panels are utilised for interior design components, curtain walls, and facades.

Moreover, Curved glass panels are included in automobiles made in the United States, a hub for the worldwide automotive industry. Curved windscreens, sunroofs, and cutting-edge displays are examples of this in automobiles, SUVs, and trucks.

Asia Pacific Grows Lucrative

Asia Pacific is expected to be the fastest-growing curved glass panel market region. This is due to the demand for high-end products and homes driven by the region's expanding affluent middle class. Curved glass panels create distinctive and aesthetically beautiful designs in opulent residences, hotels, and commercial buildings.

The development of advanced curved glass panel solutions, including smart glass technology and interactive displays, was facilitated by the Asia Pacific region's role as a center of technical innovation. Large-scale consumer electronics manufacturing is located in the area.

Curved glass panels are used in goods like curved TVs, smartphones, and gaming displays to improve aesthetics and give customers immersive experiences. India is increasingly implementing strict safety regulations in the automotive and construction industries. These standards are preferred for curved glass panels because of their dependability and safety features.

Fairfield’s Competitive Landscape Analysis

It is a market with several significant players present globally, and the worldwide curved glass panel market is consolidated. The major firms are launching new items and improving the distribution networks to increase global visibility. More market consolidation is also expected in the upcoming years, according to Fairfield Market Research.

Who are the Leaders in Global Curved Glass Panel Space?

- AGC Inc.

- Saint-Gobain S.A.

- Schott AG

- Guardian Industries

- Corning Incorporated

- Bent Glass Design, Inc.

- HHH Tempering Resources Inc.

- Goldray Industries Ltd.

- Viracon

- Vitro Architectural Glass

- GSC Glass Ltd.

- Duratuf Glass Industries Pvt. Ltd.

- PRL Glass Systems Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Euroglas GmbH

Significant Company Developments

New Product Launches

- September 2020: AGC announced that Cadillac's new 2021 Escalade luxury SUV features curved-large cover glass for car-mounted screens. The industry's first curved P-OLED (Plastic OLED) display, provided by LG Electronics and LG display, LG's display manufacturer, which began mass-production of P-OLED earlier this year, was made with AGC's product, which includes Dragon Trail, a specialty glass highly responsive to chemical strengthening that has been enhanced with chemical reinforcement treatment, optical thin coating, decorative printing, and curved shaping.

- September 2019: It has been announced that AGC's car-mounted display cover glass will be used in Lexus' new RX series, released on August 29.

- December 2018: AGC announces that the "Copen Coupe," a limited-distribution vehicle from Daihatsu Motor Co., Ltd., has the world's first use of its "eXeview" anti-fogging glass in its windscreen.

Distribution Agreements

- December 2021: The MultiViu Sports display platform, a highly customizable instrument cluster for bicycles and scooters, was introduced by Continental AG. The MultiViu Sports displays are developed on a scalable architecture that is easily adaptable to satisfy the requirements of different motorbike riders. The platform is now being used by KTM, a well-known Austrian manufacturer, who will install the MultiViu Sports 7 on its KTM 1290 Super Adventures.

- December 2021: The Pioneer car navigation system is a factory-installed option for the SUV, the New S-CROSS, manufactured by Suzuki Motor Corporation. Pioneer's automotive navigation system is used for the first time in a Suzuki vehicle for the European market. The navigation system in this car has a 9-inch HD high-precision display with a dashboard-fitting frame. The system connects to cellphones via Apple CarPlay, Android AutoTM, and other media sources, in addition to its high-performance navigation features. It offers a personalised home screen with three different area displays for navigation, vehicle information, and audio, enabling users to operate various functions easily.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, with increasing technological advancements, the production of curved glass panels has become simpler and more affordable because of advancements in glass manufacturing techniques, including hot bending and cold bending. By making curved glass more widely available this promotes market growth.

Furthermore, increased skyscraper and high-rise building construction result from the global trend towards urbanisation. However, the curved glass panel market is expected to face considerable challenges because of high manufacturing costs.

Supply Side of the Market

These producers use specialised tools and procedures to produce curved glass panels with different dimensions, shapes, and requirements. They frequently provide customisation choices to satisfy certain project requirements. The raw material suppliers needed to produce curved glass panels are part of the supply chain. This includes the glass substrates, finishes, interlayers, and additional components required to produce curved glass panels with the desired properties.

In the supply chain, distributors and wholesalers are essential because they offer curved glass panels to various end-use sectors, building projects, and consumer electronics and automotive goods producers. The curved glass panel market's supply chain is a complex ecosystem of several players, including distributors, manufacturers, and raw materials suppliers. The sector's success depends on its capacity to meet the demand for curved glass panels while maintaining quality, safety, and sustainability standards standards.

Global Curved Glass Panel Market is Segmented as Below:

By Type:

- Single-glazed Curved Glass Panels

- Double-glazed Curved Glass Panels

- Laminated Curved Glass Panels

- Annealed Curved Glass Panels

By End User:

- Architectural

- Transportation

- Electronics

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Curved Glass Panel Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Curved Glass Panel Market Outlook, 2018 - 2030

3.1. Global Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Single-glazed curved glass panels

3.1.1.2. Double-glazed curved glass panels

3.1.1.3. Laminated curved glass panels

3.1.1.4. Annealed curved glass panels

3.2. Global Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Architectural

3.2.1.2. Transportation

3.2.1.3. Electronics

3.2.1.4. Misc.

3.3. Global Curved Glass Panel Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Curved Glass Panel Market Outlook, 2018 - 2030

4.1. North America Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Single-glazed curved glass panels

4.1.1.2. Double-glazed curved glass panels

4.1.1.3. Laminated curved glass panels

4.1.1.4. Annealed curved glass panels

4.2. North America Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Architectural

4.2.1.2. Transportation

4.2.1.3. Electronics

4.2.1.4. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Curved Glass Panel Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Curved Glass Panel Market Outlook, 2018 - 2030

5.1. Europe Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Single-glazed curved glass panels

5.1.1.2. Double-glazed curved glass panels

5.1.1.3. Laminated curved glass panels

5.1.1.4. Annealed curved glass panels

5.2. Europe Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Architectural

5.2.1.2. Transportation

5.2.1.3. Electronics

5.2.1.4. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Curved Glass Panel Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.1.9. Russia Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Russia Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.1.11. Rest of Europe Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Rest of Europe Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Curved Glass Panel Market Outlook, 2018 - 2030

6.1. Asia Pacific Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Single-glazed curved glass panels

6.1.1.2. Double-glazed curved glass panels

6.1.1.3. Laminated curved glass panels

6.1.1.4. Annealed curved glass panels

6.2. Asia Pacific Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Architectural

6.2.1.2. Transportation

6.2.1.3. Electronics

6.2.1.4. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Curved Glass Panel Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Curved Glass Panel Market Outlook, 2018 - 2030

7.1. Latin America Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Single-glazed curved glass panels

7.1.1.2. Double-glazed curved glass panels

7.1.1.3. Laminated curved glass panels

7.1.1.4. Annealed curved glass panels

7.2. Latin America Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Architectural

7.2.1.2. Transportation

7.2.1.3. Electronics

7.2.1.4. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Curved Glass Panel Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

7.3.1.5. Rest of Latin America Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Rest of Latin America Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Curved Glass Panel Market Outlook, 2018 - 2030

8.1. Middle East & Africa Curved Glass Panel Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Single-glazed curved glass panels

8.1.1.2. Double-glazed curved glass panels

8.1.1.3. Laminated curved glass panels

8.1.1.4. Annealed curved glass panels

8.2. Middle East & Africa Curved Glass Panel Market Outlook, by End-user, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Architectural

8.2.1.2. Transportation

8.2.1.3. Electronics

8.2.1.4. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Curved Glass Panel Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Curved Glass Panel Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Curved Glass Panel Market End-user, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs End-user Heatmap

9.2. Manufacturer vs End-user Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. AGC Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Saint-Gobain S.A.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Schott AG

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Guardian Industries

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Corning Incorporated

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Bent Glass Design, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. HHH Tempering Resources Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Goldray Industries Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Viracon

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Vitro Architectural Glass

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. GSC Glass Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Duratuf Glass Industries Pvt. Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. PRL Glass Systems Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Fuyao Glass Industry Group Co. Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Euroglas GmbH

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |