Market Growth Forecast

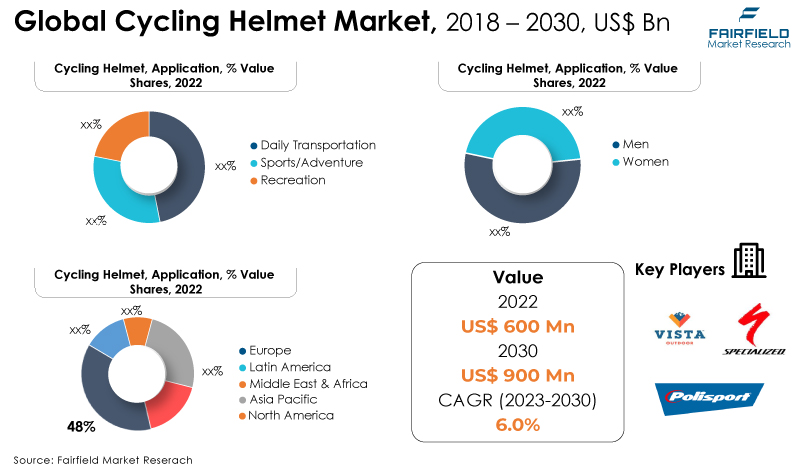

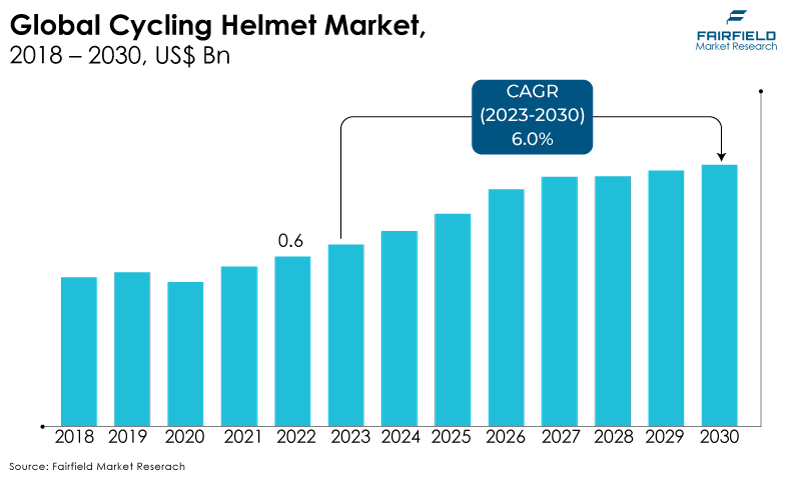

- Approximately US$0.6 Bn (2022) market for cycling helmets to be worth US$0.9 Bn by 2030

- Market valuation to expand at a CAGR of more than 6% over 2023 - 2030

Quick Report Digest

- The main factors boosting market growth include increased bicycle accidents, tight laws regulating helmet use, and a propensity for professional cycling contests.

- The growing manufacturing of smart helmets with attractive features like LED indications, water resistance, and shock proofing presents a market growth opportunity.

- The development of safety features is constrained by the fact that many individuals, especially in developing and undeveloped countries, overlook the use of helmets due to a lack of awareness about safety and limited purchasing power.

- In 2022, the road helmet category dominated the industry. In most countries, significant market law requiring helmets during routine travel has boosted the segment's growth and development.

- In terms of market share for cycling helmets globally, the daily transportation segment is anticipated to dominate. The factors driving the expansion are increased injuries and the laws regulating helmet use by on-road bikers.

- In 2022, the men category led the market. The adoption is anticipated to be fuelled by a growing number of motorbike and sports bike aficionados and growing global worries about traffic injuries.

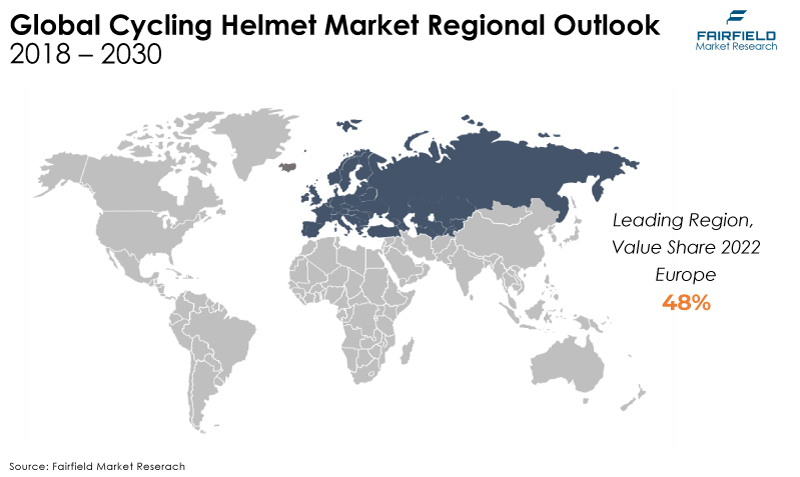

- The European region is predicted to hold the largest share of the global cycling helmet market due to increased cycle production brought on by the industry's major players and a shift towards more environmentally friendly means of transportation.

- The market for cycling helmets is expanding in Asia Pacific due to the two-wheeler market's strong consumer base in nations like India, China, Indonesia, and Vietnam. To achieve maximum customer penetration in the area, major manufacturers, including DaineseSpA, Shoei Co. Ltd, HJC Europe S.A.R.L, Arai Helmet Ltd, and Schuberth GmbH are launching new goods.

A Look Back and a Look Forward - Comparative Analysis

The demand for cycles, the promotion of helmet use, the rise in safety concerns, and governmental laws and regulations about road safety are some factors influencing the growth of the cycling helmet market.

Opportunities for the global market may arise from an increase in riders competing in riding contests, an increase in revenue, and stricter regulation of road safety.

The market witnessed staggered growth during the historical period 2018 – 2022. An important element in the market's expansion was the rising production of bicycles in numerous nations worldwide, which has increased consumer demand for the product.

For instance, statistics published by India Today in September 2020 state that the country manufactures 22 million bicycles annually with a roughly US$94.46 Mn revenue.

Manufacturers are using operational improvements for customer satisfaction and to maintain market competitiveness due to the rising requirement for extra safety and high consumer expectations. This presents a big opportunity for the bicycle helmet to gain consumer acceptability quickly in the upcoming years.

Technological advancements have significantly influenced the evolution and development of numerous bicycle helmets.

Key Growth Determinants

- Increasing Awareness About Road Safety

One of the main drivers of the global market for bicycle helmets is the rising awareness of traffic safety. Over the past several years, there has been an increased emphasis on road safety measures due to the rise in accidents and deaths brought on by traffic accidents.

Cycling helmets are an essential part of the strict safety requirements that governments worldwide are putting in place to enhance road safety.

The demand for cycling helmets is driven by the rising awareness of the importance of wearing a helmet when cycling, which is anticipated to accelerate market expansion throughout the forecast period.

- Growing Popularity of Cycling

The increasing acceptance of cycling as a recreational and competitive sport is another factor driving the global market for cycling helmets. Cycling is a great exercise form with many health advantages, so there is a high demand for cycling gear, especially cycling helmets.

Additionally, the increasing trend of environment-friendly transportation solutions drives the demand for cycling helmets. The demand for high-performance cycling helmets is driven by increased cycling events, including road races and mountain biking competitions, which are anticipated to accelerate market expansion over the forecast period.

- Growth in Bicycle Tourism

The cycling helmet has expanded favourably due to the developing trend in bicycle tourism. Given the numerous diverse forms of riding and the wide range of visitor tastes, the options for bicycle tourism destinations are limitless.

For people who prioritise fitness, opt more for cycling helmets expanding its demand. Since they provide full-body muscular action, bicycles are one of the greatest cardiovascular exercises for people.

The cycling helmet market has improved as sales of the helmet have expanded as a piece of safety equipment for rookie riders.

Major Growth Barriers

- High Cost of Bike Helmets

The cost of cycling helmets is a major impediment to the expansion of the industry worldwide. The high cost of high-performance cycling helmets, which provide improved protection and ventilation, may deter consumers on a tight budget from buying them.

Cycling helmet prices vary widely depending on several variables, including the kind of helmet, quality, and brand. Typically, a simple cycle helmet costs US$20 to US$40, while more expensive cycle helmets made for competitive cycling can cost as much as US$300.

- Poor Bicycle Infrastructure in Developing and Developed Countries

Europe has established itself as a desirable cycling destination for ambitious riders because of its extensive network of lanes. However, many developing nations with sizable populations cannot benefit from this incentive and must instead rely on public transport for travel.

Some nations, like the US, and the UK, may have provided bike lanes for cyclists, but these roads have since suffered damage, discouraging cyclists from using this means of transportation. These factors discourage riders from preferring bicycles over public transportation, which hinders the expansion of the cycling helmet market.

Key Trends and Opportunities to Look at

- Increasing Demand for Customised Gears and Accessories

Customising a cycling helmet is an increasing trend among target customers, notably business users, organisations, and clubs. The designs, colours, names, logos, and raw materials easily accessible for various bike helmets are the foundation for cycling helmet customisation.

Over the past five years, the demand for customised products has increased in developed regions like the Americas, and Europe. Cycling helmets are among the popular customised goods in emerging markets like China, and India.

- Increased Passion for Sports Like Bicycling, and Racing

Young people are now adopting bike sports as a new trend because of the popularity of bike sports like bike racing, cycling, and others, and participation in such sports requires the use of excellent helmets. This has boosted the manufacturers' ability to provide excellent helmets for racing purposes on the global market for cycling helmets.

Strict enforcement of the rule regarding helmet use when riding two wheels has improved the manufacturing company's growth potential.

- Technological Advancements

Technology developments have produced more aesthetically beautiful, lightweight, and comfortable helmets. Fashion-conscious customers who may have previously been reluctant to wear helmets now find them more appealing.

Further enhancing helmets' appeal, manufacturers include amenities like ventilation systems, anti-fog visors, and Bluetooth connectivity.

How Does the Regulatory Scenario Shape this Industry?

Due to the increase in traffic congestion in cities, many countries, including the US, Germany, and Sweden, are pushing the use of bicycles as a form of transportation. Grants from the Better Utilising Investments to Leverage Development Transportation Discretionary (BUILD) program of the US Department of Transportation considerably support national bicycle programs.

Similarly, the European Union (EU) has prioritised including cycling in Europe's multimodal transport policy. This calls for incorporating cycling into currently running city management initiatives like CIVITAS (City Vitality and Sustainability) and the drive for European Mobility Week.

The EU collaborates with allies and international organisations in numerous fields, including bicycle transportation and road safety. Other government initiatives, including the municipal winter biking programs in Sweden, Norway, and Finland, as well as Germany's 2020 National Cycling Plan, are meant to encourage eco-mobility through cycling.

Fairfield’s Ranking Board

Top Segments

- Road Helmets Dominant over Sports Helmets

The road helmet segment dominated the market in 2022. In most countries, significant market law requiring helmets during routine travel has boosted the segment's growth and development.

Expanded polystyrene (EPS) foam has created elongated designs with vents that characterise modern road helmets. Market regulations forcing helmet producers and manufacturers to provide lightweight and safe products would help hasten the industry's growth.

The sports helmet category will likely see the fastest CAGR during the projection period. The growing market need for athletic activities, particularly in developed countries, is fuelling the growth of the international segment.

Because sport bikers are more prone to fall off their bikes due to the difficult terrain, these helmets are made to offer additional protection for the back and sides of the head.

- Daily Transportation Segment Will Surge Ahead

In 2022, the daily transportation segment had a greater market share for cycling helmets worldwide. The rise in bicycle-related fatalities, increased prevalence of concussions, and strict government laws regarding cycling helmets in many nations contribute to the segment's growth.

The increase in viewers and interest in biking, which is driving up helmet demand worldwide, has a favourable impact on the segment's growth.

The sports sector is estimated to account for the second-largest segment share of the cycling helmet market during the estimated time frame because of the growing awareness of cycling as a leisure and competitive sport. Helmets made for road cycling, mountain biking, triathlon, and other competitive events are included in the sports category.

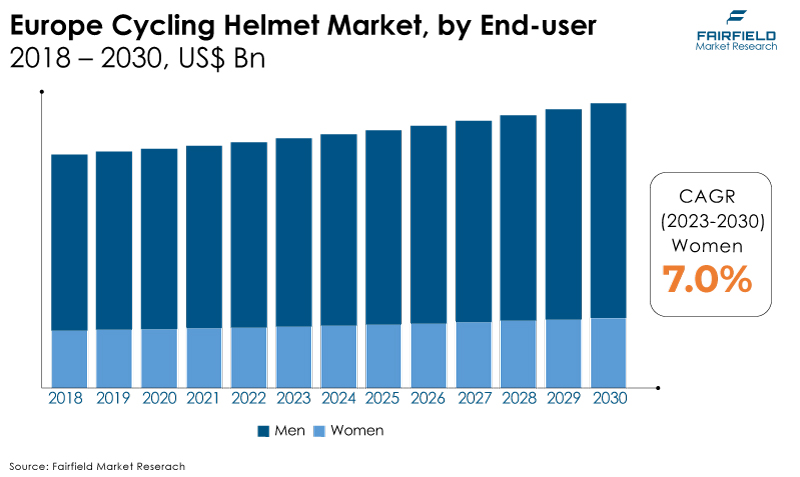

- Men Lead in Creating Demand

The men's segment dominated the market in 2022. It is projected that the popularity of motorbikes and sports bikes will rise throughout the forecast period and that concerns about traffic-related injuries will expand globally.

The women's sector category is expected to experience the fastest growth within the forecast time frame. When cycling, women appear to wear helmets less frequently than males.

Women who commute or ride do not favour donning a full-face helmet. The women's open-face helmets are now available. This model combines comfort and style for women, making it a great choice.

Regional Outlook

Europe Remains the Largest Revenue Contributor

The abundance of cycling apparel available in Europe is one of the major drivers of the market's growth. There is a great desire for luxury cycling apparel in this region because of the high living conditions of the inhabitants, the introduction of novel products, and the strong brand recognition of premium goods.

Products from France, Italy, and the UK have a substantial local market share. Local governments and several organisations encourage outdoor and active pursuits like cycling.

For instance, the demand for bike helmets in the region has increased due to government-sponsored initiatives and the World Health Organisation (WHO), as well as the growing popularity of riding as a sport and fitness activity.

Asia Pacific to Witness Significant Growth in Sales

Over the projection period, Asia Pacific is expected to grow at the quickest CAGR. Cycling events have attracted much interest from nations like South Korea, Japan, and China, which will likely propel the local industry.

Cycling activity is expanding nationwide due to consumer preference for high-quality cycling attire and safety equipment. Asia Pacific's emerging markets for cycling apparel include Japan, and South Korea.

China is one of the region's more well-known marketplaces. Another factor driving the growth of the cycling helmet market is the government's rigorous regulations requiring the use of helmets when riding two-wheelers for transportation.

Who are the Leaders in Global Cycling Helmet Space?

- Polisport Group

- Vista Outdoor Operations LLC

- Specialized Bicycle Components, Inc.

- UVEX WINTER HOLDING GmbH and Co. KG

- Trek Bicycle Corporation

- MET

- Limar Srl

- Tiivra

- Lazer

- Hexr

- Nox Cycles

- BMZ Group

- Tocsen

- SCOTT Sports SA.

- Giant Bicycle India

Fairfield’s Competitive Landscape Analysis

The market for cycling helmets on a global scale is competitive. The major firms are launching new items and enhancing their distribution networks to increase their global footprint. In addition, Fairfield Market Research anticipates that there will be further market consolidation during the next few years.

Significant Company Developments

New Product Launches

- June 2023: Lazer unveils the Chase KinetiCore, a DH helmet with a 5-star rating from Virginia Tech. The Chase KinetiCore DH helmet incorporates Lazer's KinetiCore technology. The helmet incorporates rotational and direct impact protection. Lazer's Chase KinetiCore has six colourways and various sizes (XS / S / M / L / XL). It boasts a breakaway peak for better neck protection, a flexible front grid to shield the face from splashes, and tick padding for a snug and comfortable fit.

- September 2022: Tiivra, a Mumbai-based start-up, has launched the world's first composite fibre helmet, providing a new option to the luxury helmet category. The new offering is priced at INR 15,000 and are entirely manufactured in India with an aim of offering superior protection while being less in weight.

- August 2020: Hexr has released its new Voronoi bicycle helmet, which features a parametric design. The new parametric helmet was inspired by 3D voronoi structures seen in nature, such as turtle shells and animal bones. As a result, the design seeks to minimize the amount of material required to provide a safe cycling helmet.

Acquisition Agreements

- September 2023: In the form of a strategic investment, BMZ Group, a global specialist in lithium-ion batteries, announced the acquisition of Nox Cycles Austria, all its sister companies in Germany and Switzerland, as well as the Hawk Bikes brand, primarily represented in Germany, including the DACH-Benelux license of the British premium eBike manufacturer Whyte Bikes.

- March 2023: Aleck, a manufacturer of wireless audio and communication devices, has acquired Tocsen, a German manufacturer of clever smart bike helmet crash sensors. Tocsen's crash sensor is now available as a stand-alone accessory or incorporated component in select Uvex, Alpina, and EKO helmet models.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, an increase in cycling activities and recreational sports is driving the market. The rising number of road accidents may result in a growth in road helmets, where daily transportation helmets are favoured in large quantities, increasing the need for cycling helmets.

Technical advancements have tremendously aided the evolution and development of different bicycle helmets. Due to the high initial cost, the cycling helmet market is anticipated to experience significant difficulties.

Supply Side of the Market

According to our analysis, the cycling helmet market's makers are concentrating on improving helmet safety and comfort by releasing new models that will assist end users in acclimating to the device for a hassle-free and comfortable ride.

For instance, in November 2022, with the introduction of the Sintesi, KASK added a highly adaptable addition to its cycling helmet lineup. The Sintesi was created for cyclists who ride various cycles for various reasons, whether on the road, gravel, or trails or simply cruising about town.

To boost production, comfort, and road safety, cycling helmet manufacturers are developing technologically sophisticated models that require integrating automation, robotics, and safety. Real-time monitoring and intelligent features are becoming more common.

Many manufacturers are implementing AI technologies, utilising environmentally friendly materials, and optimising helmet design to reduce helmet weight. These might increase the demand for cycling helmets.

Global Cycling Helmet Market is Segmented as Below:

By Type:

- Road Helmet

- Sports Helmet

- MTB Helmet

- Others

By Application:

- Daily Transportation

- Sports/Adventure

- Recreation

- Miscellaneous

By End User:

- Men

- Women

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Cycling Helmet Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value/Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cycling Helmet Market Outlook, 2018 - 2030

3.1. Global Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Road Helmet

3.1.1.2. Sports Helmet

3.1.1.3. MTB Helmet

3.1.1.4. Others

3.2. Global Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Daily Transportation

3.2.1.2. Sports/ Adventure

3.2.1.3. Recreation

3.2.1.4. Misc.

3.3. Global Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Men

3.3.1.2. Women

3.4. Global Cycling Helmet Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Cycling Helmet Market Outlook, 2018 - 2030

4.1. North America Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Road Helmet

4.1.1.2. Sports Helmet

4.1.1.3. MTB Helmet

4.1.1.4. Others

4.2. North America Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Daily Transportation

4.2.1.2. Sports/ Adventure

4.2.1.3. Recreation

4.2.1.4. Misc.

4.3. North America Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Men

4.3.1.2. Women

4.4. North America Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Cycling Helmet Market Outlook, 2018 - 2030

5.1. Europe Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Road Helmet

5.1.1.2. Sports Helmet

5.1.1.3. MTB Helmet

5.1.1.4. Others

5.2. Europe Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Daily Transportation

5.2.1.2. Sports/ Adventure

5.2.1.3. Recreation

5.2.1.4. Misc.

5.3. Europe Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Men

5.3.1.2. Women

5.4. Europe Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cycling Helmet Market Outlook, 2018 - 2030

6.1. Asia Pacific Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Road Helmet

6.1.1.2. Sports Helmet

6.1.1.3. MTB Helmet

6.1.1.4. Others

6.2. Asia Pacific Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Daily Transportation

6.2.1.2. Sports/ Adventure

6.2.1.3. Recreation

6.2.1.4. Misc.

6.3. Asia Pacific Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Men

6.3.1.2. Women

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cycling Helmet Market Outlook, 2018 - 2030

7.1. Latin America Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Road Helmet

7.1.1.2. Sports Helmet

7.1.1.3. MTB Helmet

7.1.1.4. Others

7.2. Latin America Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Daily Transportation

7.2.1.2. Sports/ Adventure

7.2.1.3. Recreation

7.2.1.4. Misc.

7.3. Latin America Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Men

7.3.1.2. Women

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cycling Helmet Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Road Helmet

8.1.1.2. Sports Helmet

8.1.1.3. MTB Helmet

8.1.1.4. Others

8.2. Middle East & Africa Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Daily Transportation

8.2.1.2. Sports/ Adventure

8.2.1.3. Recreation

8.2.1.4. Misc.

8.3. Middle East & Africa Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Men

8.3.1.2. Women

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Polisport Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Vista Outdoor Operations LLC

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Specialized Bicycle Components, Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. UVEX WINTER HOLDING GmbH and Co. KG

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Trek Bicycle Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. MET -Helmets

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Limar Srl

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Tiivra

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Lazer

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Hexr

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Nox Cycles

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. BMZ Group

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Tocsen

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. SCOTT Sports SA

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Giant Bicycle India

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |