Global De-aromatic Solvents Market Forecast

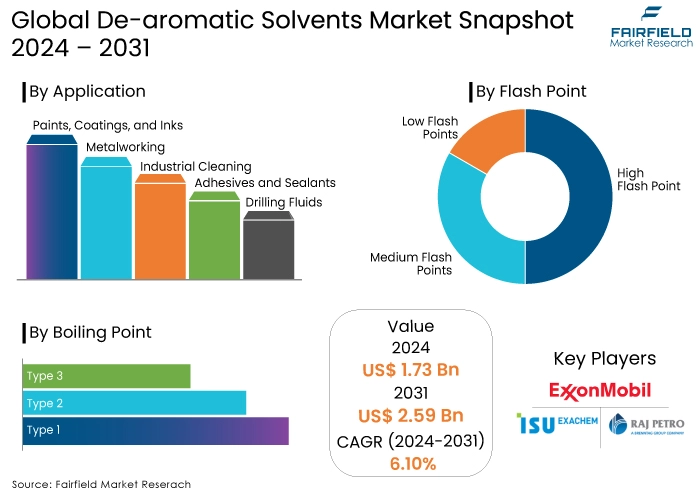

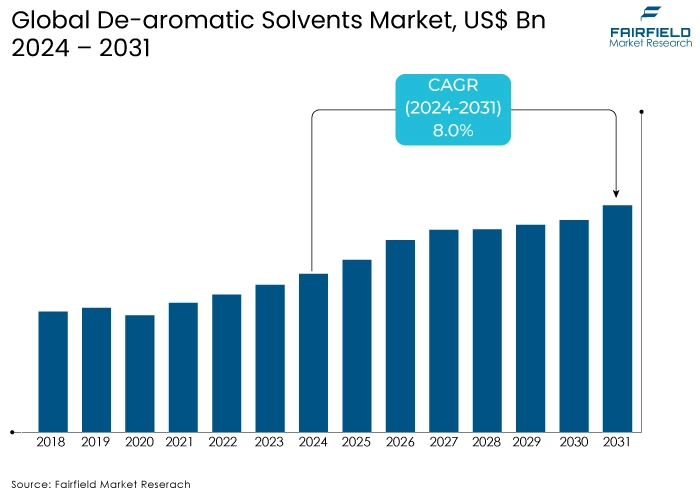

- De-aromatic solvents market size slated to rise high up to US$2.59 Bn in 2031 from US$1.7 Bn estimated in 2024

- Global de-aromatic solvents market revenue poised to see expansion at a CAGR of 6.10% over 2024-2031

De-aromatic Solvents Market Insights

- The de-aromatic solvents market is growing steadily, driven by increasing demand from paints, coatings, automotive, and industrial sectors.

- Environmental regulations are a key catalyst, pushing the industry towards sustainable and safer practices.

- Key challenges include crude oil price volatility and raw material availability.

- Opportunities lie in bio-based solvents, emerging markets, and value-added products.

- Low flash point solvents dominate industrial cleaning, while medium flash point are widely used in paints and coatings.

- Type 1 solvents excel in quick-drying applications, while Type 2 offer versatility.

- Paints and coatings, industrial cleaning, and metalworking are major segments.

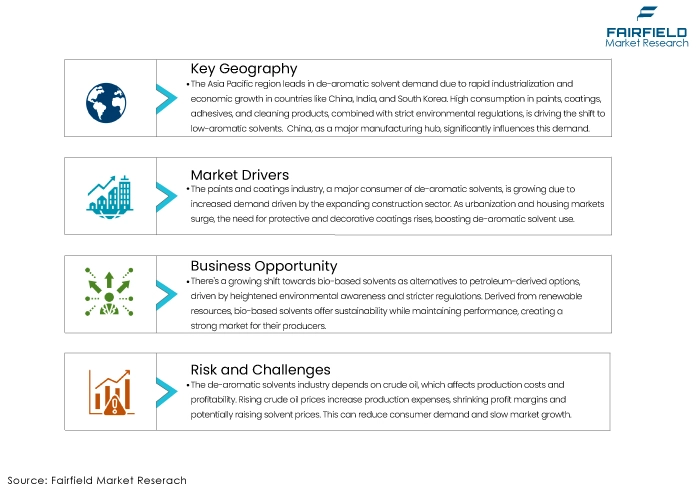

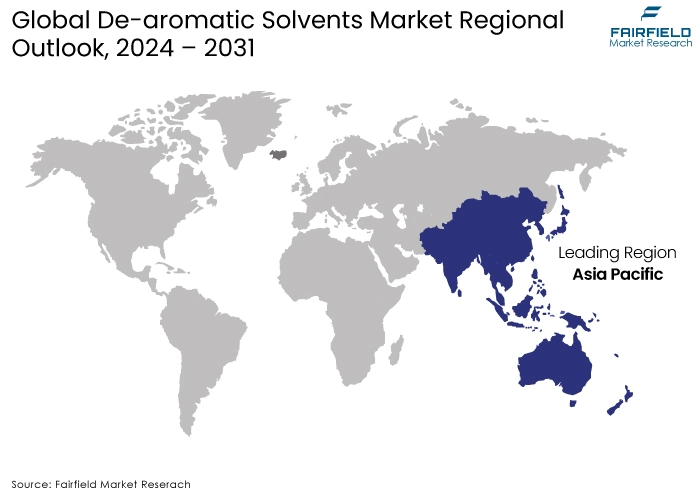

- Asia Pacific is the dominant market due to rapid industrialization and stringent regulations.

- The market is moderately competitive, with a mix of large and small players.

- Differentiation is based on product quality, price, and sustainability.

A Look Back and a Look Forward - Comparative Analysis

The de-aromatic solvents market experienced steady growth primarily driven by the increasing demand from the paints and coatings industry. The growing awareness about the environmental impact of aromatic solvents and stringent regulations prompted a shift towards greener alternatives. However, market expansion was tempered by fluctuations in crude oil prices, the primary feedstock for these solvents.

The market is anticipated to witness accelerated growth due to the escalating focus on sustainability and the proliferation of stringent environmental norms. The automotive, printing, and cleaning industries are emerging as significant consumers of de-aromatic solvents, contributing towards the expansion of the de-aromatic solvents market. Technological advancements in solvent production processes are expected to enhance efficiency and reduce costs, further bolstering market growth.

How is Regulatory Scenario Shaping this Industry?

The de-aromatic solvents industry is profoundly influenced by environmental regulations. Stringent emission standards, and volatile organic compound (VOC) restrictions have necessitated the adoption of low-aromatic or de-aromatic solvents across various applications. Compliance with these regulations has driven product innovation and market expansion.

Furthermore, safety regulations pertaining to solvent handling and storage have imposed stringent requirements on manufacturers and end-users. This has led to increased investments in safety infrastructure and the development of safer solvent formulations. While these regulations present challenges, they also create opportunities for companies that can effectively meet compliance standards and offer innovative solutions. The regulatory landscape, in a nutshell, is a key driver of the de-aromatic solvents market, pushing the industry towards more sustainable and safer practices.

Key Growth Determinants

Increasing Demand from Paints and Coatings Industry

The paints and coatings industry is a significant consumer of de-aromatic solvents, and its growth trajectory is directly linked to the expansion of several key sectors. The construction industry, encompassing both residential and commercial building projects, is a primary driver of demand. As urbanization accelerates and housing markets flourish, the need for paints and coatings to protect and enhance structures escalates, subsequently increasing the demand in the de-aromatic solvents market.

Furthermore, the automotive industry's emphasis on eco-friendly finishes and the rising popularity of vehicle refinishing have contributed substantially to solvent consumption. Modern vehicles often require specialized coatings that meet stringent environmental standards, necessitating the use of de-aromatic solvents. Additionally, the growing trend of vehicle customization and the need for repair work after accidents have fueled the demand for refinishing products, which heavily rely on these solvents.

Growing Environmental Concerns, and Stringent Regulations

Heightened global awareness of environmental issues has led to a surge in demand for eco-friendly products, including those with reduced environmental impact. De-aromatic solvents, with their lower volatile organic compound (VOC) emissions compared to their aromatic counterparts, have emerged as preferred alternatives. As a result, the paints, coatings, and other industries are increasingly adopting these solvents to comply with stringent environmental regulations imposed by governments worldwide.

Governments across the globe are implementing stricter emission standards to mitigate air pollution and protect public health. These regulations have created a compelling impetus for industries to shift towards more environmentally benign solvents. Compliance with these standards has become a prerequisite for entry in the de-aromatic solvents market and sustainability, driving the demand.

Expanding Automotive and Industrial Sectors

The automotive industry's robust growth, particularly in developing economies, has been a major catalyst for the de-aromatic solvents market. The increasing production of vehicles, from passenger cars to commercial vehicles, has led to a corresponding rise in demand for paints, coatings, and cleaning products that utilize these solvents. Moreover, the automotive industry's focus on aesthetic appeal and durability has driven the development of advanced coating formulations, which often rely on de-aromatic solvents.

Beyond the automotive sector, the expansion of manufacturing and industrial activities has also contributed to solvent demand. Industries such as electronics, machinery, and metalworking employ de-aromatic solvents in various processes, including cleaning, degreasing, and surface preparation. As these sectors continue to grow, so too does the demand for these solvents.

Major Growth Barriers

Volatility in Crude Oil Prices

The de-aromatic solvents industry is intrinsically linked to the petroleum market, as crude oil serves as the primary feedstock for these solvents. Consequently, fluctuations in crude oil prices exert a significant influence on the production costs and profitability of de-aromatic solvents. Periods of elevated crude oil prices directly translate to increased production expenses, compressing profit margins for solvent manufacturers. This can lead to higher solvent prices, which may dampen consumer demand and hinder market growth.

Conversely, periods of low crude oil prices can provide a temporary boost to profitability, but they may also encourage increased competition and price pressures within the industry. The overall volatility in crude oil prices creates a challenging operating environment for de-aromatic solvent producers, necessitating effective risk management strategies to mitigate the impact of price fluctuations.

Availability and Cost of Raw Materials

The availability and cost of raw materials constitute another critical factor influencing the de-aromatic solvents market. The production process relies on a specific mix of raw materials, including various hydrocarbon fractions and chemical additives. Shortages or supply disruptions of any of these components can disrupt production schedules, leading to supply constraints and potential price increases for de-aromatic solvents.

Moreover, fluctuations in the cost of raw materials directly impact the overall production cost, affecting profitability and market competitiveness. Solvent manufacturers must carefully manage their supply chain and raw material procurement to mitigate risks associated with shortages and price volatility. Additionally, the development of alternative feedstocks or raw material substitution strategies can help to reduce dependence on specific materials and enhance supply chain resilience.

De-aromatic Solvents Market Trends and Opportunities

Growing Preference for Bio-Based Solvents

A significant shift is underway towards the adoption of bio-based solvents as viable alternatives to petroleum-derived de-aromatic solvents. Driven by increasing environmental consciousness among consumers and businesses, there is a growing demand for products and processes with a reduced ecological footprint. Bio-based solvents, derived from renewable resources such as plants and agricultural waste, offer a sustainable solution while often maintaining performance characteristics comparable to their petroleum-based counterparts. This trend is being amplified by stringent environmental regulations and corporate sustainability initiatives, creating a favorable market environment for bio-based solvent producers.

Expansion into Developing Markets

Emerging economies in regions like Asia, South America, and Africa present substantial growth opportunities for the de-aromatic solvents market. These countries are experiencing rapid industrialization, urbanization, and economic development, which are driving demand for various solvent applications across sectors such as paints and coatings, automotive, and manufacturing. The growing middle class in these regions is also fueling consumption of consumer products that require solvents. By establishing a strong presence in these markets, companies can capitalize on the expanding solvent demand and contribute to the region's economic growth.

Development of Value-Added Products

The development of value-added products derived from de-aromatic solvents represents a strategic avenue for market expansion and increased profitability. By investing in research and development to create specialized solvents with tailored properties for specific applications, companies can differentiate their offerings and command premium prices.

For example, solvents with enhanced performance characteristics such as faster drying times, improved solubility, or lower toxicity can attract a premium in niche markets. Additionally, exploring new applications for de-aromatic solvents in industries beyond traditional sectors, such as personal care, pharmaceuticals, or electronics, can open additional revenue streams and contribute to market diversification.

Segments Covered in De-aromatic Solvents Market Report

Low Flash Point Segment Continues to Lead the Way

The industrial cleaning segment dominates the low flash point de-aromatic solvent market due to the solvents' quick evaporation properties, ideal for rapid cleaning and degreasing processes. Key applications include parts cleaning, metal degreasing, and equipment maintenance in various industries, such as automotive, aerospace, and manufacturing. While primarily associated with medium and high flash point solvents, low flash point solvents find some application in specific types of paints and coatings, such as quick-drying formulations for industrial applications like automotive refinishing and touch-up paints.

In the medium flash point, the paints, coatings, and inks segment is the largest consumer. They are essential for achieving desired film properties, such as gloss, adhesion, and durability. These solvents are used in a wide range of coatings, including architectural, industrial, and automotive coatings, as well as in inks for printing applications. On the other hand, medium flash point solvents are also versatile for industrial cleaning tasks. They balance cleaning efficiency with safety considerations and are used in various applications, such as parts cleaning, equipment maintenance, and general cleaning operations in manufacturing facilities.

Type 1 Solvents Take the Charge by Boiling Point

Type 1 solvents, with their low boiling points, evaporate quickly, making them ideal for achieving fast-drying finishes. They are widely used in industrial coatings, automotive refinishes, and wood coatings to reduce drying times and improve production efficiency. In industrial cleaning, Type 1 solvents are employed for rapid cleaning and degreasing operations. Their quick evaporation properties contribute to efficient cleaning processes and reduce drying times.

On the other hand, the Type 2 solvents offer a balance of evaporation rate and solvency power, making them suitable for a wide range of coating formulations. They are used in both architectural and industrial coatings to achieve desired film properties. Due to their versatility, Type 2 solvents find applications in various industrial cleaning processes, including parts cleaning, equipment maintenance, and general cleaning. They provide a good balance of cleaning efficiency and safety.

Paints, Coatings, and Inks Surge Ahead by Application

Architectural coatings is the largest segment within the paints, coatings, and inks category. De-aromatic solvents are used in various architectural coatings, including interior and exterior paints, emulsions, and varnishes. The demand for high-quality, low-VOC coatings is driving the growth of this segment. Industrial coatings represent another major consumer of de-aromatic solvents. These coatings are used in various industries, such as automotive, aerospace, and metal finishing. The need for durable and protective coatings is driving the demand in this segment of the de-aromatic solvents market.

In the industrial cleaning sector, metalworking is the prominent segment, as de-aromatic solvents are extensively used in the metalworking industry for cleaning and degreasing metal parts. They are essential for removing cutting fluids, oils, and other contaminants from metal surfaces before subsequent processes. On the other hand, general industrial cleaning is the segment that encompasses the use of de-aromatic solvents for cleaning various industrial equipment, machinery, and facilities. They are used to remove dirt, grease, and other contaminants, ensuring optimal equipment performance and safety.

Regional Analysis

Asia Pacific Remains the Dominant Regional Market

The Asia Pacific region has emerged as the dominant market for de-aromatic solvents. Rapid industrialization, urbanization, and economic growth in countries like China, India, and South Korea are driving the demand for paints, coatings, adhesives, and cleaning products. These applications are major consumers of de-aromatic solvents. Moreover, the region's stringent environmental regulations are accelerating the shift towards low-aromatic and de-aromatic solvents to comply with emission standards. China is especially a significant manufacturing hub, contributing significantly to the overall demand for de-aromatic solvents in the region.

Additionally, the growing automotive and construction sectors in Asia Pacific are fueling the de-aromatic solvents market growth. The increasing production of vehicles and the construction of infrastructure projects necessitate the use of de-aromatic solvents in various processes. Furthermore, the rising disposable income in the region is leading to increased spending on home improvement and consumer goods, further boosting the demand for de-aromatic solvents.

Fairfield’s Competitive Landscape Analysis

The de-aromatic solvents market is characterized by a mix of large, integrated petrochemical companies and smaller, specialized solvent manufacturers. Key players often possess strong distribution networks and established customer relationships. Competitive intensity is moderate, with differentiation primarily based on product quality, price, and environmental performance. Industry consolidation through mergers and acquisitions is a potential trend, as companies seek to expand their product portfolios and geographic reach.

While regional players dominate specific markets, global players are increasingly expanding their presence to capitalize on growth opportunities. The market is witnessing increased focus on sustainability and product innovation, with companies investing in research and development to develop environmentally friendly and high-performance solvents.

Key Market Players

- Exxon Mobil Corporation

- Shell Plc

- Idemitsu Kosan Co., Ltd.

- Compañía Española de Petróleos, S.A.U.(CEPSA)

- Neste Oyj

- Calumet Specialty Products Partner L.P.

- Mehta Petro-Refineries Limited

- Isu Exachem Co. Ltd

- SK Geo Centric

- DHC Solvent Chemie GmbH

- Avani Petrochem Private Limited

- Raj Petro Specialties Pvt Ltd

- TotalEnergies S.E.

Global De-aromatic Solvents Market is Segmented as-

By Flash Point

- Low Flash Point

- Medium Flash Point

- High Flash Point

By Boiling Point

- Type 1

- Type 2

- Type 3

By Application

- Paints, Coatings, and Inks

- Metalworking

- Industrial Cleaning

- Adhesives and Sealants

- Drilling Fluids

- Consumer Products

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

1. Executive Summary

1.1. Global De-aromatic Solvents Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global De-aromatic Solvents Market Outlook, 2019-2031

3.1. Global De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Low Flash Point

3.1.1.2. Medium Flash Point

3.1.1.3. High Flash Point

3.2. Global De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Type 1

3.2.1.2. Type 2

3.2.1.3. Type 3

3.3. Global De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Paints, Coatings, and Inks

3.3.1.2. Metalworking

3.3.1.3. Industrial Cleaning

3.3.1.4. Adhesives and Sealants

3.3.1.5. Drilling Fluids

3.3.1.6. Consumer Products

3.3.1.7. Others

3.4. Global De-aromatic Solvents Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America De-aromatic Solvents Market Outlook, 2019-2031

4.1. North America De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Low Flash Point

4.1.1.2. Medium Flash Point

4.1.1.3. High Flash Point

4.2. North America De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Type 1

4.2.1.2. Type 2

4.2.1.3. Type 3

4.3. North America De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Paints, Coatings, and Inks

4.3.1.2. Metalworking

4.3.1.3. Industrial Cleaning

4.3.1.4. Adhesives and Sealants

4.3.1.5. Drilling Fluids

4.3.1.6. Consumer Products

4.3.1.7. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America De-aromatic Solvents Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

4.4.1.4. Canada De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

4.4.1.5. Canada De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

4.4.1.6. Canada De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe De-aromatic Solvents Market Outlook, 2019-2031

5.1. Europe De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Low Flash Point

5.1.1.2. Medium Flash Point

5.1.1.3. High Flash Point

5.2. Europe De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Type 1

5.2.1.2. Type 2

5.2.1.3. Type 3

5.3. Europe De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Paints, Coatings, and Inks

5.3.1.2. Metalworking

5.3.1.3. Industrial Cleaning

5.3.1.4. Adhesives and Sealants

5.3.1.5. Drilling Fluids

5.3.1.6. Consumer Products

5.3.1.7. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe De-aromatic Solvents Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.2. Germany De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.3. Germany De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.7. France De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.8. France De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.9. France De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.10. Italy De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.11. Italy De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.12. Italy De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.16. Russia De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.17. Russia De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.18. Russia De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.1.19. Rest of Europe De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

5.4.1.20. Rest of Europe De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

5.4.1.21. Rest of Europe De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific De-aromatic Solvents Market Outlook, 2019-2031

6.1. Asia Pacific De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Low Flash Point

6.1.1.2. Medium Flash Point

6.1.1.3. High Flash Point

6.2. Asia Pacific De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Type 1

6.2.1.2. Type 2

6.2.1.3. Type 3

6.3. Asia Pacific De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Paints, Coatings, and Inks

6.3.1.2. Metalworking

6.3.1.3. Industrial Cleaning

6.3.1.4. Adhesives and Sealants

6.3.1.5. Drilling Fluids

6.3.1.6. Consumer Products

6.3.1.7. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific De-aromatic Solvents Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.2. China De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.3. China De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.1.4. Japan De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.5. Japan De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.6. Japan De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.1.10. India De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.11. India De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.12. India De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.1.16. Rest of Asia Pacific De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

6.4.1.17. Rest of Asia Pacific De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

6.4.1.18. Rest of Asia Pacific De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America De-aromatic Solvents Market Outlook, 2019-2031

7.1. Latin America De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Low Flash Point

7.1.1.2. Medium Flash Point

7.1.1.3. High Flash Point

7.2. Latin America De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Type 1

7.2.1.2. Type 2

7.2.1.3. Type 3

7.3. Latin America De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Paints, Coatings, and Inks

7.3.1.2. Metalworking

7.3.1.3. Industrial Cleaning

7.3.1.4. Adhesives and Sealants

7.3.1.5. Drilling Fluids

7.3.1.6. Consumer Products

7.3.1.7. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America De-aromatic Solvents Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

7.4.1.10. Rest of Latin America De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

7.4.1.11. Rest of Latin America De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

7.4.1.12. Rest of Latin America De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa De-aromatic Solvents Market Outlook, 2019-2031

8.1. Middle East & Africa De-aromatic Solvents Market Outlook, by Flash Point, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Low Flash Point

8.1.1.2. Medium Flash Point

8.1.1.3. High Flash Point

8.2. Middle East & Africa De-aromatic Solvents Market Outlook, by Boiling Point, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Type 1

8.2.1.2. Type 2

8.2.1.3. Type 3

8.3. Middle East & Africa De-aromatic Solvents Market Outlook, by Application, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Paints, Coatings, and Inks

8.3.1.2. Metalworking

8.3.1.3. Industrial Cleaning

8.3.1.4. Adhesives and Sealants

8.3.1.5. Drilling Fluids

8.3.1.6. Consumer Products

8.3.1.7. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa De-aromatic Solvents Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

8.4.1.2. GCC De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

8.4.1.3. GCC De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

8.4.1.13. Rest of Middle East & Africa De-aromatic Solvents Market by Flash Point, Value (US$ Bn), 2019-2031

8.4.1.14. Rest of Middle East & Africa De-aromatic Solvents Market by Boiling Point, Value (US$ Bn), 2019-2031

8.4.1.15. Rest of Middle East & Africa De-aromatic Solvents Market by Application, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Application vs by Boiling Point Heat map

9.2. Manufacturer vs by Boiling Point Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ExxonMobil Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Shell Plc

9.5.3. Idemitsu Kosan Co., Ltd.

9.5.4. Compañía Española de Petróleos, S.A.U.(CEPSA)

9.5.5. Neste Oyj

9.5.6. Calumet Specialty Products Partner L.P.

9.5.7. Mehta Petro-Refineries Limited

9.5.8. Isu Exachem Co. Ltd

9.5.9. SK Geo Centric

9.5.10. DHC Solvent Chemie GmbH

9.5.11. Avani Petrochem Private Limited

9.5.12. Raj Petro Specialties Pvt Ltd

9.5.13. TotalEnergies S.E.

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Flash Point Coverage |

|

|

Boiling Point Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |