Global Dental Adhesives Market Forecast

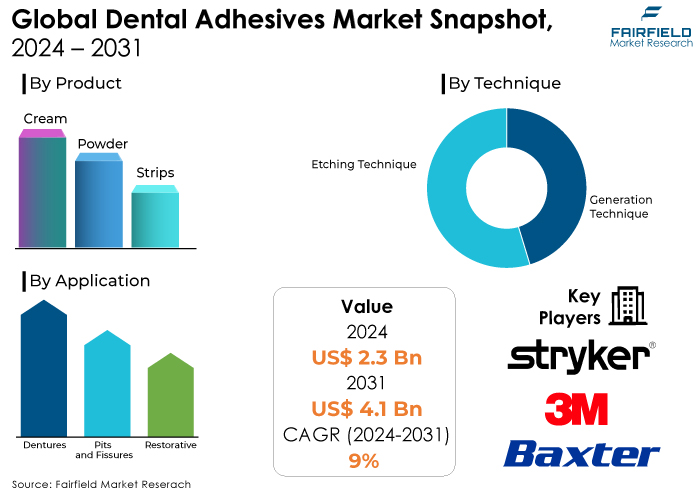

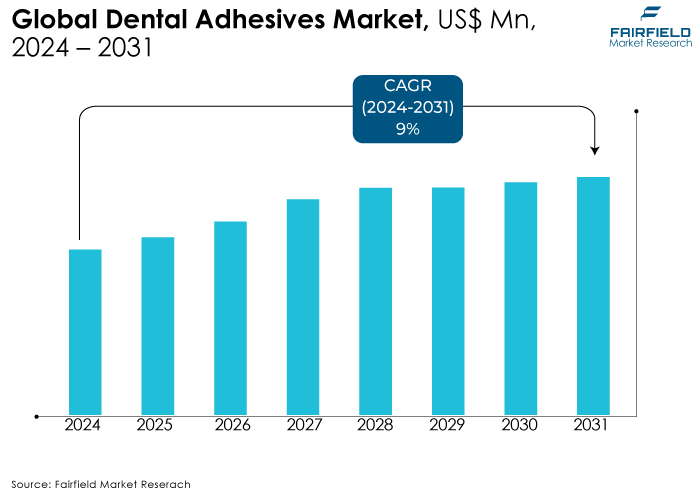

- Dental adhesives market size poised to reach US$4.1 Bn in 2031, up from US$2.3 Bn attained in 2024

- Dental adhesives market revenue projected to witness a CAGR of 8.6% during 2024-2031

Dental Adhesives Market Insights

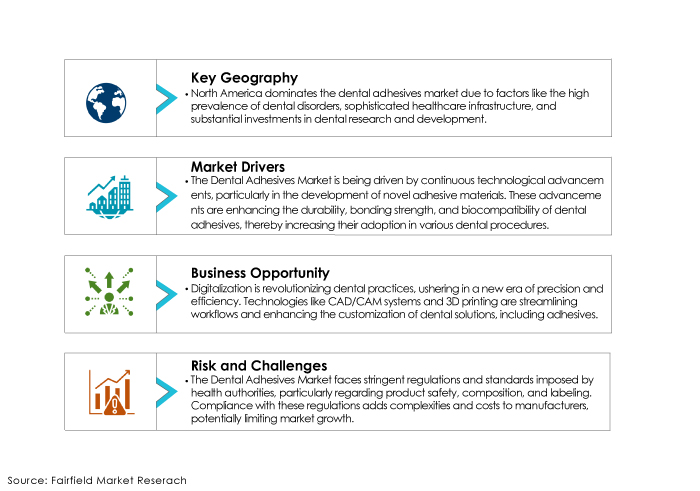

- The global dental adhesives market is experiencing robust growth, driven by increasing dental procedures and advancements in adhesive technology.

- Innovations such as self-etching adhesives, universal adhesives, and adhesive systems with enhanced bond strength and durability are shaping the market landscape.

- Rising demand for cosmetic dentistry, restorative procedures, and dental implants is fueling the adoption of dental adhesives globally.

- Growing preference for adhesive systems that simplify application procedures, reduce chair-side time, and improve patient comfort is a significant trend driving market growth.

- Stringent regulatory standards and approvals for dental adhesives ensure product safety, efficacy, and compliance with regional healthcare guidelines.

- Dental adhesives find extensive applications in bonding restorations, crowns, bridges, veneers, and orthodontic brackets, enhancing patient outcomes and treatment durability.

- North America, and Europe dominate the global market due to high healthcare expenditure, while Asia Pacific is witnessing rapid growth driven by increasing dental awareness and healthcare infrastructure development.

A Look Back and a Look Forward - Comparative Analysis

Due to increased patient demand for improved adhesives and a more aesthetically pleasing oral appearance, product development, and material development for durable treatment are growing at a rapid pace.

Dental adhesives benefit both the patient and the doctor by simplifying the procedure, unlike the mix-and-match procedure for adhesion that was used years ago. This is a major factor driving an increase in the production of high-quality dental adhesives.

The development of novel technologies to meet the demand for high-quality adhesives at reasonable prices is said to drive market expansion over the coming years.

Key Growth Determinants

Rising Demand for Minimally Invasive Procedures

The trend towards minimally invasive dentistry is a major growth driver for dental adhesives. These procedures aim to preserve as much natural tooth structure as possible.

Unlike traditional methods that involve significant drilling, minimally invasive techniques rely on strong adhesives to bond restorations like fillings, crowns, and veneers to the remaining tooth. This not only improves patient comfort during and after the procedure but also promotes better long-term oral health.

Advancements in adhesive technology, with improved bond strength and biocompatibility, are perfectly aligned with this growing demand for minimally invasive dentistry.

Increasing Prevalence of Dental Diseases

Unfortunately, dental diseases like tooth decay, gum disease, and tooth loss remain prevalent globally. This creates a continuous need for restorative procedures, where dental adhesives play a critical role. Factors like poor dietary habits, increasing consumption of sugary beverages, and inadequate oral hygiene contribute to the rise in dental problems.

Additionally, the ageing population requires more dental restorations due to wear and tear on teeth. This growing demand for restorative procedures translates to a higher need for effective dental adhesives to ensure the longevity and success of these treatments.

Growing Focus on Aesthetics, and Cosmetic Dentistry

The desire for a bright, healthy smile is driving the demand for cosmetic dentistry procedures. These procedures often involve bonding techniques to enhance the appearance of teeth. Dental adhesives play a crucial role in achieving natural-looking results. Advancements in adhesive technology are creating possibilities for bonding veneers and other cosmetic restorations with minimal tooth preparation.

Additionally, the development of tooth-colored adhesives improves the aesthetics of the final restoration. This growing focus on aesthetics, coupled with advancements in adhesive materials, is expected to significantly contribute to the dental adhesives market growth.

Key Growth Barriers

High Cost of Dental Care

Dental procedures, including those utilizing dental adhesives, can be very expensive, which can be a barrier for some patients seeking restorative or cosmetic treatments. The cost factors include material costs, dental professional fees and limited insurance coverage.

Dental adhesives, especially high-performance ones, can be expensive, which is a major restraining factor for the market. Further, the expertise required for procedures involving adhesives contributes to the overall cost of treatment, which includes the fees of dentists as well.

Moreover, dental insurance plans may not always cover the full cost of procedures using advanced adhesives. This high price point can deter patients from seeking necessary dental treatments, impacting the overall demand for dental adhesives.

Stringent Regulatory Requirements

The focus on safety and efficacy enforced by regulatory bodies like the FDA can act as a growth restraint. Rigorous testing and approval processes can delay the introduction of new and innovative adhesives to the market.

Additionally, constant advancements in technology often require revisions to regulatory guidelines, further adding complexity for manufacturers. While regulations are crucial for patient safety, these stringent requirements can limit the pace of innovation and product availability, potentially slowing down market growth.

Dental Adhesives Market Trends and Opportunities

Adoption of Bioactive Dental Adhesives

The global dental adhesives market is witnessing a growing trend towards the development and adoption of bioactive adhesives. These next-generation adhesives offer several advantages over traditional materials. The bioactive adhesives offer enhanced bond strength and durability and can not only create a strong initial bond between the restoration and tooth structure but also promote a chemical bond over time. This can lead to longer-lasting restorations and reduced risk of leakage and micro-failures.

Bioactive adhesives are designed to mimic the natural composition of tooth enamel and dentin. This minimizes the risk of allergic reactions and promotes better integration with the surrounding tooth structure. Some bioactive adhesives can stimulate the remineralisation of dentin, a process where lost minerals are redeposited into the tooth structure. This can help strengthen the tooth and potentially prevent future decay.

The development of bioactive adhesives is driven by the continuous pursuit of minimally invasive dentistry and the desire for long-lasting, biocompatible restorations. As research in this area progresses, we can expect to see even more advanced bioactive adhesives with additional functionalities emerge in the global dental adhesives market share.

Emerging Markets Globally

The dental adhesives market presents a significant opportunity for growth in emerging economies like those in southeast Asia, and Latin America. These regions are experiencing a rise in disposable incomes, leading to increased demand for dental care.

Additionally, there is a growing awareness of oral health and a growing middle class willing to invest in aesthetic dentistry procedures. However, these markets often have limited access to advanced dental technologies, lower penetration of dental insurance, and a need for cost-effective solutions.

Dental adhesive manufacturers can capitalize on this opportunity by developing cost-effective versions of high-performance adhesives, educational programs to raise awareness about oral health and partnerships with local dental providers to improve access to dental care.

By addressing these specific needs and creating a strong market presence, dental adhesive companies can tap into the vast potential of emerging markets and contribute to improved oral healthcare globally.

Segment Covered in the Report

Strips Remain Dominant in the Product Category

Strips represent the dominant market segment in the dental fluoride category. The ease of application, precise dosage, and growing consumer preference for convenient oral care products have contributed to the dominance of strips in the dental adhesives market. They offer a practical and effective way to deliver fluoride, leading to increased adoption among both adults and children. While creams and powders continue to hold a market share, strips have gained significant traction due to their user-friendly format.

Preference for Pit and Fissure Sealants Maximum Based on Application

Pit and fissure sealants is the dominant segment in the dental fluoride application category. The primary function of fluoride in preventing dental caries is by strengthening tooth enamel. Pit and fissure sealants are applied to the chewing surfaces of teeth to prevent cavities by filling in the grooves where food particles and bacteria can accumulate. This segment benefits significantly from increasing dental awareness and preventive dental care practices, driving its dominance in the market.

Dental Clinics Take the Charge in Distribution Channels

The dental clinics possessed the highest market share value at 40%. The rise in dental health awareness and the prevalence of restorative and prosthetic dental procedures among private dental practitioners are the primary factors contributing to the increased use of these adhesives in dental clinics.

Additionally, the placement of orthodontic brackets and their alignments is primarily performed in dental clinics, necessitating the use of etchants and adhesives. Therefore, dental clinics contribute to the demand for dental adhesives during the forecast period of 2024 to 2031.

Regional Analysis

North America Maintains the Most Prominent Position

High product availability, the presence of sophisticated technologies, and a favourable reimbursement structure are all potential explanations for this phenomenon.

For instance, the Children's Health Insurance Program (CHIP), and Medicaid offer coverage for dental sealants, which increases their affordability and subsequently promotes the adoption of sealants and related services.

The market in Asia Pacific is expected to experience rapid growth during the forecast period as a result of the rapidly ageing population, evolving lifestyles, and increasing awareness of oral health. Additionally, the prevalence of dental caries is expected to increase.

The demand for the "Hollywood smile" is expected to increase due to the increasing prevalence of social media and the growing awareness of attractiveness. This is expected to facilitate the growth of the market in the region.

Fairfield’s Competitive Landscape Analysis

The global dental adhesives market is fiercely competitive, characterized by a diverse range of players striving to innovate and capture market share. Key market participants include multinational corporations, regional players, and niche manufacturers, each leveraging distinct strategies to maintain and expand their foothold in the industry.

The global dental adhesives market is marked by intense competition driven by innovation, regional specialization, and strategic partnerships. Understanding these dynamics is crucial for stakeholders aiming to capitalize on growth opportunities in this dynamic and rapidly evolving sector.

Key Market Players

- Stryker Corporation

- 3M Company

- Dental Tech

- DENTSPLY International

- Baxter International

- Ultradent Products Inc.

- DETAX Ettlingen

- Procter and Gamble

- GlaxoSmithKline

- BISCO

- Dental Speed Graph

Recent Industry Developments

- In April 2022, Ultradent Products Inc. announced its expansion with a new subsidiary in South Korea to produce advanced dental materials, and to increase its capabilities in the Asia-Pacific region: Korea Ultradent Products LLC.

- In Febraury 2022, Dentsply Sirona introduced the Prime and Bond elect universal dental adhesive. It employs the dipentaerythritol penta acrylate monophosphate (PENTA) technology to achieve a low film thickness and viscosity, thereby establishing a robust bond with reduced sensitivity.

Global Dental Adhesives Market is Segmented as Below -

By Product

- Cream

- Powders

- Strips

By Technique

- Generations

- Etching Techniques

By Application

- Denture

- Pit and Fissure

- Restorative

By End User

- Dental Clinics

- Hospitals

- Academic Institutes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Dental Adhesives Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Dental Adhesives Market Outlook, 2019-2031

3.1. Global Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Cream

3.1.1.2. Powders

3.1.1.3. Strips

3.2. Global Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Generations

3.2.1.2. Etching Techniques

3.3. Global Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Denture

3.3.1.2. Pit and Fissure

3.3.1.3. Restorative

3.4. Global Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. Dental Clinics

3.4.1.2. Hospitals

3.4.1.3. Academic Institutes

3.4.1.4. Others

3.5. Global Dental Adhesives Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Dental Adhesives Market Outlook, 2019-2031

4.1. North America Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Cream

4.1.1.2. Powders

4.1.1.3. Strips

4.2. North America Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Generations

4.2.1.2. Etching Techniques

4.3. North America Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Denture

4.3.1.2. Pit and Fissure

4.3.1.3. Restorative

4.4. North America Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. Dental Clinics

4.4.1.2. Hospitals

4.4.1.3. Academic Institutes

4.4.1.4. Others

4.5. North America Dental Adhesives Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.5.1. Key Highlights

4.5.1.1. U.S. Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

4.5.1.2. U.S. Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

4.5.1.3. U.S. Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

4.5.1.4. U.S. Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

4.5.1.5. Canada Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

4.5.1.6. Canada Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

4.5.1.7. Canada Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

4.5.1.8. Canada Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Dental Adhesives Market Outlook, 2019-2031

5.1. Europe Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Cream

5.1.1.2. Powders

5.1.1.3. Strips

5.2. Europe Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Generations

5.2.1.2. Etching Techniques

5.3. Europe Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Denture

5.3.1.2. Pit and Fissure

5.3.1.3. Restorative

5.4. Europe Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Dental Clinics

5.4.1.2. Hospitals

5.4.1.3. Academic Institutes

5.4.1.4. Others

5.5. Europe Dental Adhesives Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.5.1. Key Highlights

5.5.1.1. Germany Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.2. Germany Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.3. Germany Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.4. Germany Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.5. U.K. Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.6. U.K. Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.7. U.K. Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.8. U.K. Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.9. France Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.10. France Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.11. France Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.12. France Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.13. Italy Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.14. Italy Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.15. Italy Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.16. Italy Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.17. Turkey Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.18. Turkey Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.19. Turkey Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.20. Turkey Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.21. Russia Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.22. Russia Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.23. Russia Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.24. Russia Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.1.25. Rest of Europe Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

5.5.1.26. Rest of Europe Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

5.5.1.27. Rest of Europe Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

5.5.1.28. Rest of Europe Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Dental Adhesives Market Outlook, 2019-2031

6.1. Asia Pacific Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Cream

6.1.1.2. Powders

6.1.1.3. Strips

6.2. Asia Pacific Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Generations

6.2.1.2. Etching Techniques

6.3. Asia Pacific Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Denture

6.3.1.2. Pit and Fissure

6.3.1.3. Restorative

6.4. Asia Pacific Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. Dental Clinics

6.4.1.2. Hospitals

6.4.1.3. Academic Institutes

6.4.1.4. Others

6.5. Asia Pacific Dental Adhesives Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.5.1. Key Highlights

6.5.1.1. China Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.2. China Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.3. China Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.4. China Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.1.5. Japan Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.6. Japan Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.7. Japan Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.8. Japan Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.1.9. South Korea Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.10. South Korea Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.11. South Korea Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.12. South Korea Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.1.13. India Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.14. India Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.15. India Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.16. India Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.1.17. Southeast Asia Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.18. Southeast Asia Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.19. Southeast Asia Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.20. Southeast Asia Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.1.21. Rest of Asia Pacific Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

6.5.1.22. Rest of Asia Pacific Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

6.5.1.23. Rest of Asia Pacific Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

6.5.1.24. Rest of Asia Pacific Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Dental Adhesives Market Outlook, 2019-2031

7.1. Latin America Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Cream

7.1.1.2. Powders

7.1.1.3. Strips

7.2. Latin America Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Generations

7.2.1.2. Etching Techniques

7.3. Latin America Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Denture

7.3.1.2. Pit and Fissure

7.3.1.3. Restorative

7.4. Latin America Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Dental Clinics

7.4.1.2. Hospitals

7.4.1.3. Academic Institutes

7.4.1.4. Others

7.5. Latin America Dental Adhesives Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.5.1. Key Highlights

7.5.1.1. Brazil Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

7.5.1.2. Brazil Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

7.5.1.3. Brazil Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

7.5.1.4. Brazil Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

7.5.1.5. Mexico Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

7.5.1.6. Mexico Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

7.5.1.7. Mexico Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

7.5.1.8. Mexico Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

7.5.1.9. Argentina Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

7.5.1.10. Argentina Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

7.5.1.11. Argentina Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

7.5.1.12. Argentina Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

7.5.1.13. Rest of Latin America Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

7.5.1.14. Rest of Latin America Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

7.5.1.15. Rest of Latin America Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

7.5.1.16. Rest of Latin America Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Dental Adhesives Market Outlook, 2019-2031

8.1. Middle East & Africa Dental Adhesives Market Outlook, by Product, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Cream

8.1.1.2. Powders

8.1.1.3. Strips

8.2. Middle East & Africa Dental Adhesives Market Outlook, by Technique, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Generations

8.2.1.2. Etching Techniques

8.3. Middle East & Africa Dental Adhesives Market Outlook, by Application, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Denture

8.3.1.2. Pit and Fissure

8.3.1.3. Restorative

8.4. Middle East & Africa Dental Adhesives Market Outlook, by End User, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. Dental Clinics

8.4.1.2. Hospitals

8.4.1.3. Academic Institutes

8.4.1.4. Others

8.5. Middle East & Africa Dental Adhesives Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.5.1. Key Highlights

8.5.1.1. GCC Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

8.5.1.2. GCC Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

8.5.1.3. GCC Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

8.5.1.4. GCC Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

8.5.1.5. South Africa Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

8.5.1.6. South Africa Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

8.5.1.7. South Africa Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

8.5.1.8. South Africa Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

8.5.1.9. Egypt Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

8.5.1.10. Egypt Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

8.5.1.11. Egypt Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

8.5.1.12. Egypt Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

8.5.1.13. Nigeria Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

8.5.1.14. Nigeria Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

8.5.1.15. Nigeria Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

8.5.1.16. Nigeria Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

8.5.1.17. Rest of Middle East & Africa Dental Adhesives Market by Product, Value (US$ Bn), 2019-2031

8.5.1.18. Rest of Middle East & Africa Dental Adhesives Market Indication, Value (US$ Bn), 2019-2031

8.5.1.19. Rest of Middle East & Africa Dental Adhesives Market Artery Type, Value (US$ Bn), 2019-2031

8.5.1.20. Rest of Middle East & Africa Dental Adhesives Market End User, Value (US$ Bn), 2019-2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Artery Type vs Indication Heatmap

9.2. Manufacturer vs Indication Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Stryker Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. 3M Company

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Dental Tech

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. DENTSPLY International

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Baxter International

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Ultradent Products, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. DETAX Ettlingen

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Procter and Gamble

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. GlaxoSmithKline

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. BISCO

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Dental Speed Graph

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Kerr Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Kuraray America, Inc

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Kulzer GmbH

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Den-Mat Holdings, LLC,

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Ivoclar Vivadent AG

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Technique Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |