Global Dental Loupe Market Forecast

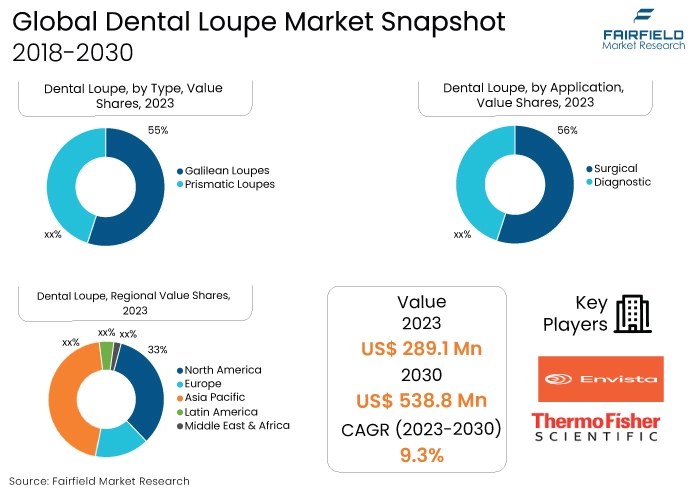

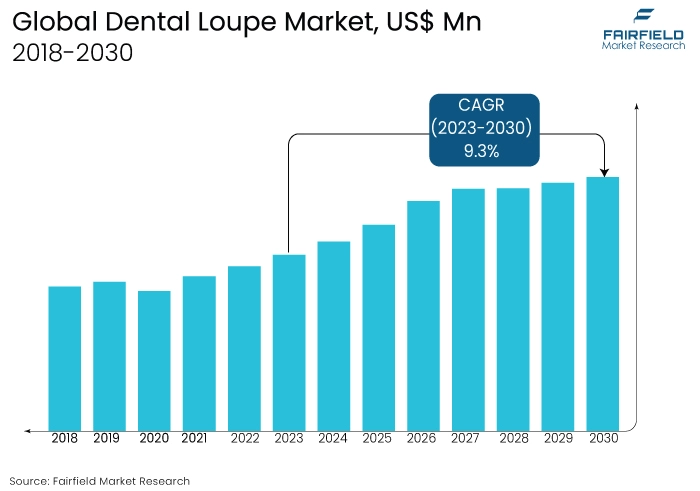

- Dental loupe market size to reach US$538.8 Mn in 2030 from US$289.1 Mn attained in 2023

- Global dental loupe market revenue likely to exhibit a CAGR of 9.3% through 2030

Quick Report Digest

- The dental loupe industry is currently experiencing a notable upswing in technological integration, as innovations such as enhanced optics and augmented reality are fundamentally altering the market structure. This phenomenon not only improves accuracy but also revolutionises the dental experience.

- The demand for ergonomic designs in dental loupes is on the rise, as practitioners seek to ensure their comfort and long-term health are not neglected. This phenomenon is indicative of the sector's dedication to delivering equipment that facilitates ideal working conditions and mitigates physical exertion.

- The demand for customised dental loupes is on the rise among dental professionals, who are increasingly interested in individualised solutions. Tailored designs accommodate particular medical requirements and personal preferences, demonstrating a market orientation that prioritises the customer.

- An emerging trend in the dental industry is the adoption of wireless loupes, which offer practitioners enhanced mobility, and flexibility. This transition obviates the limitations associated with tethered systems, thereby augmenting the overall effectiveness and convenience for dental practitioners.

- The segment specializing in prismatic loupes is anticipated to attain the largest market share in 2022. Their heightened global adoption can be attributed to their compact design, enhanced field of view, and superior optical clarity, which position them as the preferred option among dental professionals.

- In the surgical and diagnostic sectors, it is projected that surgical loupes will maintain the most significant market share by 2022. The increasing prominence of surgical loupes in the dental market can be attributed to the need for accurate visualisation during dental procedures.

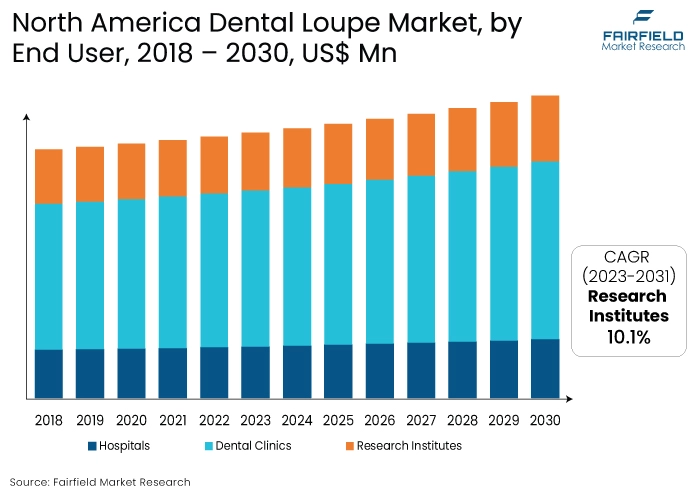

- In 2022, dental clinics are anticipated to hold the largest market share among hospitals, research institutes, and dental clinics. Increasing numbers of private practices and the availability of dental care services in clinics are factors contributing to this trend.

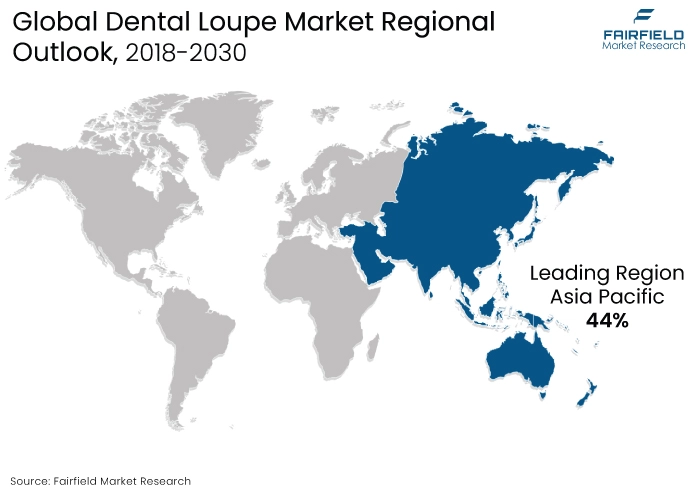

- Rapid market penetration in the Asia Pacific region is anticipated to have the most rapid market penetration growth. The demand for dental loupes is being propelled by a succession of factors, including a rise in disposable income, an expanding dental practitioner population in countries such as China, and India, and an increased awareness of oral health.

- The accelerated market penetration anticipated in North America can be attributed to the region's high rate of adoption of advanced dental technologies. The presence of significant market participants and the region's emphasis on upholding high healthcare standards both contribute to the accelerated growth of dental loupes.

A Look Back and a Look Forward - Comparative Analysis

The present dental loupes market is characterised by a dynamic environment characterised by technological progress and an increasing emphasis on user convenience. The market is undergoing a period of significant change due to the incorporation of wireless technology and an increase in the demand for ergonomic designs.

In 2022, prismatic loupes, which are renowned for their exceptional optical qualities, are the market leaders, reflecting dental professionals' preference for enhanced visibility. Additionally, surgical loupes are becoming increasingly popular, especially in dental procedures, which is a significant contributor to the market's current expansion.

Historically, the market for dental loupes has progressed from simple magnification instruments to sophisticated, customizable options. A key trend, the transition towards individualised, user-centric designs has contributed to a gradual but consistent growth trajectory.

The historical trajectory of the market illustrates a growing acknowledgment of the critical nature of accuracy in dental procedures and an ongoing quest for advancements to address these changing demands.

With an optimistic outlook, the future market situation for dental loupes seems to be bright. It is expected that the Asia Pacific region will serve as a significant catalyst for growth, owing to its brisk market penetration rate expansion.

The region's significant influence on the future of the market is attributed to the increasing number of dental practitioners in countries such as China, and India, as well as the increasing focus on oral health.

Furthermore, continuous technological progress and a continued emphasis on catering to the preferences of practitioners are anticipated to drive additional expansion, thereby reinforcing the essential nature of dental loupes in contemporary dental practices across the globe.

Key Growth Determinants

- Rapid Technological Progress

Rapid technological advancements propel the dental loupe market, as manufacturers integrate state-of-the-art functionalities such as augmented reality and enhanced optics. In addition to augmenting the accuracy of dental procedures, these developments also elevate the overall user experience.

The increasing desire of dentists for instruments that provide enhanced visibility and clarity throughout complex procedures is propelling the market demand for loupes equipped with cutting-edge technology.

The ongoing evolution of the industry ensures that the incorporation of cutting-edge technologies continues to be a significant catalyst, driving market growth and solidifying the position of dental loupes as indispensable instruments in contemporary dental practices.

- Growing Awareness, and Prioritisation of Ergonomic Design

An essential factor propelling the market is the increasing recognition and emphasis placed on ergonomic design in dental loupes. The long-term health advantages of utilizing loupes that prioritise comfort and alleviate physical distress during extended procedures are being acknowledged by dental professionals.

The trend towards ergonomic designs is consistent with the sector's dedication to improving the welfare of professionals, creating a need for tailored and intuitive solutions.

This factor exemplifies a more extensive pattern within the healthcare industry, wherein professionals are progressively in search of instruments that prioritise the health and comfort of those utilizing them in addition to ensuring optimal performance.

- Surge in Dental Surgeries

The surge in worldwide dental procedures constitutes a substantial factor in the escalating need for surgical loupes. In the light of the increasing complexity and specialisation of dental procedures, precise visualisation has emerged as an indispensable requirement. By providing clarity and magnification, surgical loupes enable dentists to perform procedures with greater precision.

The increasing incidence of endodontic procedures, dental implants, and other intricate surgical procedures has significantly increased the need for surgical loupes.

The market driver in question exhibits a strong correlation with the dynamic dental practice environment, where the criticality of attaining ideal results during surgical procedures emphasizes the indispensable function of sophisticated magnification instruments such as surgical loupes.

Major Growth Barriers

- Higher Costs

The cost implications of dental loupes impede their widespread adoption in the market. Slightly more expensive high-quality loupes that incorporate sophisticated functionalities may present a financial obstacle for individual practitioners or smaller dental practices that operate on a tight budget. The financial obstacle may impede the smooth incorporation of these indispensable instruments throughout the dental sector.

- Difficulty in Learning/Installation

An additional factor impeding market growth is the adjustment and learning curve that is inherent in the implementation of dental loupes. Dental practitioners, particularly those who are transitioning from conventional approaches, might initially encounter challenges when adjusting to the heightened magnification and modified field of view. Overcoming this period of adaptation may affect the rate of adoption, thereby impeding the expansion of the market.

Key Trends and Opportunities to Look at

- Integration of AR and VR to Improve Capabilities

There has been a significant increase in the incorporation of augmented reality (AR) into dental loupes, which serves to improve the capabilities of visualisation and diagnosis. Globally, this trend is expanding at a rapid rate, with North America being the frontrunner in terms of adoption.

Brands are anticipated to utilise augmented reality (AR) to implement enhanced training modules, real-time data overlays, and improved patient communication. This will establish AR as a revolutionary trend in dental practices across the globe.

- Rapid Customisation to Improve Market Demand

Adaptable and ergonomic designs are becoming increasingly popular in dental loupes, catering to the specific requirements of practitioners. This phenomenon is experiencing rapid expansion, specifically in the regions of Europe, and Asia Pacific.

Brands are poised to capitalise on this trend by catering to a discerning and diverse market by providing personalised solutions, emphasizing long-term health benefits, and concentrating on user-centric design.

- Integration of Wireless Technology to Widen Growth Potential

The implementation of wireless technology in dental loupes is an extensive and rapidly expanding phenomenon, particularly in Latin America, and the Middle East.

Brands are positioned to capitalise on this trend by emphasizing the benefits of wireless technology, which include convenience, flexibility, and the absence of congestion.

With the increasing demand for manoeuvrability among dental professionals, wireless integration is expected to emerge as a significant competitive edge in the international market.

How Does the Regulatory Scenario Shape this Industry?

Several regulatory frameworks govern the dental loupe industry on a global scale, assuring product standardisation and safety. Dental loupes are regulated by the Food and Drug Administration (FDA) in the United States by the Medical Device Amendments. Adherence to FDA regulations is of the utmost importance to enter the market, guarantee the effectiveness of products, and protect users.

Likewise, within the European Union, dental loupes are regulated by the Medical Devices Regulation, thereby guaranteeing adherence to critical criteria. Recent amendments to the Medical Devices Regulation (MDR) in Europe are an example of a region-specific change that affects the certification and marketing of dental loupes.

The primary objective of rigorous regulatory procedures is to augment the quality of products and ensure the safety of patients. Regulatory bodies and institutions have a significant impact on market development, manufacturing standards, and market entry approaches, thereby guaranteeing that dental loupes satisfy essential safety and performance criteria.

Fairfield’s Ranking Board

Top Segments

- Galilean Loupes to Hold Dominance over Prismatic Loupes

It is anticipated that Galilean loupes will hold the greatest market share in 2022. Galilean loupes, which are renowned for their affordability and straightforward design, are extensively utilised, especially in areas where financial factors substantially influence consumer purchasing choices.

Substantially favoured by novice practitioners and those operating within limited financial resources, they currently constitute the prevailing market segment.

The prismatic loupes segment, on the other hand, is anticipated to expand the most rapidly. Prismatic loupes are attractive to professionals in pursuit of exceptional performance due to their compact design and cutting-edge optics that deliver superior clarity and magnification.

The escalating need for improved visibility, specifically during complex dental procedures, drives the exponential growth of prismatic loupes, which has become the most rapidly adopted category within the dental loupe industry.

- Surgical Segment to Tower over its Counterpart

It is projected that the surgical segment will hold the most significant market share in the dental loupe industry by 2022. The increasing sophistication of dental procedures has led to a heightened need for accurate visualisation, thereby propelling the prevalence of surgical loupes.

The loupes' pivotal function in augmenting precision and accuracy throughout surgical procedures establishes them as the prevailing segment in the present market environment.

Concurrently, the diagnostic segment is anticipated to experience the most rapid growth. The increased focus on preventive dental care and early detection has resulted in a corresponding surge in the need for diagnostic loupes.

The utilisation of these loupes assists professionals in conducting thorough examinations, making diagnoses, and devising treatments, which has led to their increased acceptance and established the diagnostic segment as the most rapidly expanding sector within the dental loupe industry.

- Dental Clinics Lead Adoption

It is anticipated that dental clinics will hold the most significant market share in the dental loupe industry by 2022. The prevalence of private dental practices and the ease of access to dental care services in clinics are substantial factors contributing to the dominance of this market segment.

Dental loupes are considered indispensable by clinic-based dental professionals for ensuring precision during a variety of procedures, thereby contributing to their extensive utilisation.

Simultaneously, the research institutes sector is positioned for the most rapid expansion. As dental research advances, research institutes are increasingly in need of magnification instruments such as dental loupes.

Precise visualisation is imperative for the complex nature of research procedures; this has led to the rapid integration of dental loupes into research environments and established the research institutes sector as the most rapidly expanding in the dental loupe industry.

Regional Frontrunners

Asia Pacific Retains the Dominant Position

Asia Pacific is anticipated to account for the largest proportion of the worldwide dental loupe market. The region's burgeoning population, growing awareness regarding oral health, and an increasing number of dental practitioners—especially in China, and India—are factors contributing to this dominance.

Increasing levels of disposable income in these countries contribute to the heightened need for sophisticated dental technologies, such as dental loupes. With the ongoing prosperity of the dental industry in the Asia Pacific region, it is anticipated that the market share of dental loupes will experience significant expansion, thereby establishing the region as a prominent participant in the worldwide market.

North America Continues to Witness Exceptional Penetration of Dental Loupe

It is anticipated that North America will witness the most rapid expansion of market penetration within the dental loupe industry. Accelerated expansion is propelled by the region's sophisticated healthcare infrastructure and proactive implementation of cutting-edge dental technologies.

The increased prevalence of dental professionals and the influence of major market participants both contribute to the expedited adoption of dental loupes.

By emphasizing the preservation of elevated healthcare standards, North America establishes itself as a leader in adopting cutting-edge dental magnification instruments, thereby guaranteeing an unparalleled rate of market penetration expansion in the region.

Fairfield’s Competitive Landscape Analysis

To accommodate a diverse market, the current pricing structure strikes a balance between technological features and affordability. Nevertheless, the enduring impact of pricing is determined by its correlation with innovation. Brands that are capable of effectively managing the equilibrium between competitive pricing and cutting-edge features will have a significant impact on the market.

The competition is significantly propelled by key trends such as the pursuit of enhanced optical capabilities, customizable designs, and user-friendly technologies. From the procurement of raw materials to the delivery of finished goods, supply chain efficacy will be a crucial determinant in attaining a competitive advantage.

There are numerous prospects for expanding one's market presence, particularly in regions experiencing rapid growth in demand such as Asia Pacific. By establishing strategic alliances, maintaining a commitment to innovation, and maintaining a resilient supply chain, one can effectively navigate the competitive environment and capitalise on the numerous opportunities presented by the ever-evolving dental loupe market.

Who are the Leaders in Global Dental Loupe Space?

- NEITZ INSTRUMENTS

- Envista

- ErgonoptiX

- Thermo Fisher Scientific

- A. Lens

- LW Scientific

- Integra LifeSciences

- Den-Mat Holdings

- Optergo AB

- Enova Illumination

- SheerVision

- Eye Designs Group

Significant Industry Developments

New Product Launch

- In March 2023: Carl Seiss Meditec AG initiated the construction of a new facility in La Rochelle, Nouvelle-Aquitaine, thereby augmenting its presence in France. The purpose of the new structure is to manufacture ophthalmology consumables.

- March 2023: Halma plc completed the acquisition of FirePro, a prominent manufacturer and designer of aerosol fire suppression systems.

- February 2023: KG unveiled a novel collection of Ergo loupes, comprising the HDL Ergo 3.5x, and RDH Ergo 3.0x. By utilizing refractive prisms, these loupes enable clinicians to maintain an upright posture and mitigate neck tilt.

An Expert’s Eye

Demand and Future Growth

Moving forward, the dental loupe market will undoubtedly experience sustained success due to the growing recognition and emphasis on the importance of preventive oral hygiene. The increasing awareness among individuals worldwide regarding the critical nature of early detection and preventative dental care will likely contribute to a sustained demand for dental loupes, especially in diagnostic environments.

Furthermore, the increasing prevalence of dental issues and the aging of the population emphasize the necessity for precise and complex dental procedures, thereby strengthening the demand for sophisticated magnification instruments.

The incorporation of technological innovations, including ergonomic designs and augmented reality, will play a crucial role in satisfying the changing needs of dental professionals and guaranteeing sustained market expansion.

Supply Side of the Market

According to our analysis, obstacles could potentially manifest on the supply side as a result of the complex processes involved in producing dental loupes of superior quality. Faced with increasing demand, industry participants may encounter difficulty in maintaining stringent quality standards.

Moreover, potential supply chain bottlenecks may arise due to the devices' reliance on specialised materials and precision engineering. Nevertheless, using strategic partnerships and financial commitments to research and development, these obstacles may be alleviated, thereby promoting innovation and guaranteeing a consistent supply chain for the increasing need for state-of-the-art dental magnification instruments.

Global Dental Loupe Market is Segmented as Below:

By Type:

- Galilean Loupes

- Prismatic Loupes

By Automation:

- Surgical

- Diagnostic

By End User:

- Hospitals

- Dental Clinics

- Research Institutes

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Dental Loupe Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Dental Loupe Market Outlook, 2018 - 2030

3.1. Global Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Galilean Loupes

3.1.1.2. Prismatic Loupes

3.2. Global Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Surgical

3.2.1.2. Diagnostic

3.3. Global Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Dental Clinics

3.3.1.3. Research Institutes

3.4. Global Dental Loupe Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Dental Loupe Market Outlook, 2018 - 2030

4.1. North America Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Galilean Loupes

4.1.1.2. Prismatic Loupes

4.2. North America Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Surgical

4.2.1.2. Diagnostic

4.3. North America Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Dental Clinics

4.3.1.3. Research Institutes

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Dental Loupe Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Dental Loupe Market Outlook, 2018 - 2030

5.1. Europe Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Galilean Loupes

5.1.1.2. Prismatic Loupes

5.2. Europe Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Surgical

5.2.1.2. Diagnostic

5.3. Europe Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Dental Clinics

5.3.1.3. Research Institutes

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Dental Loupe Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Dental Loupe Market Outlook, 2018 - 2030

6.1. Asia Pacific Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Galilean Loupes

6.1.1.2. Prismatic Loupes

6.2. Asia Pacific Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Surgical

6.2.1.2. Diagnostic

6.3. Asia Pacific Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Dental Clinics

6.3.1.3. Research Institutes

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Dental Loupe Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Dental Loupe Market Outlook, 2018 - 2030

7.1. Latin America Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Galilean Loupes

7.1.1.2. Prismatic Loupes

7.2. Latin America Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Surgical

7.2.1.2. Diagnostic

7.3. Latin America Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Dental Clinics

7.3.1.3. Research Institutes

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Dental Loupe Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Dental Loupe Market Outlook, 2018 - 2030

8.1. Middle East & Africa Dental Loupe Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Galilean Loupes

8.1.1.2. Prismatic Loupes

8.2. Middle East & Africa Dental Loupe Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Surgical

8.2.1.2. Diagnostic

8.3. Middle East & Africa Dental Loupe Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Dental Clinics

8.3.1.3. Research Institutes

8.4. Middle East & Africa Dental Loupe Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Dental Loupe Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Dental Loupe Market Application, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Dental Loupe Market End User, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. NEITZ INSTRUMENTS

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Envista

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. ErgonoptiX

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Thermo Fisher Scientific

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. L.A. Lens

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. LW Scientific

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Integra LifeSciences

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Den-Mat Holdings

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Optergo AB

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Enova Illumination

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Enova Illumination

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. SheerVision

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Eye Designs Group

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Automation Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |