Global Diamond Tools Market Forecast

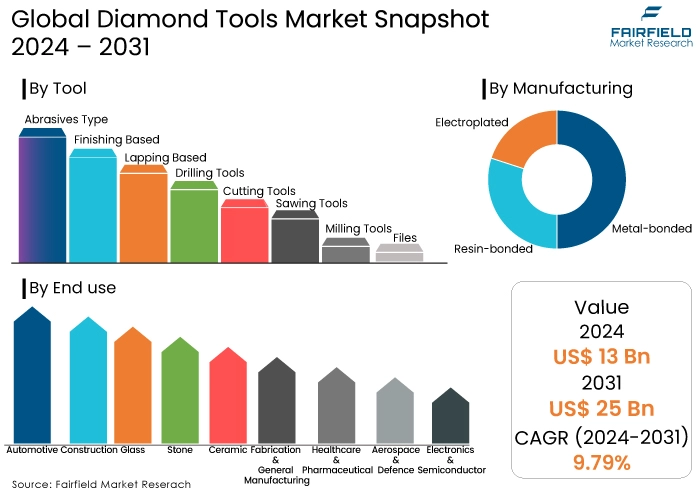

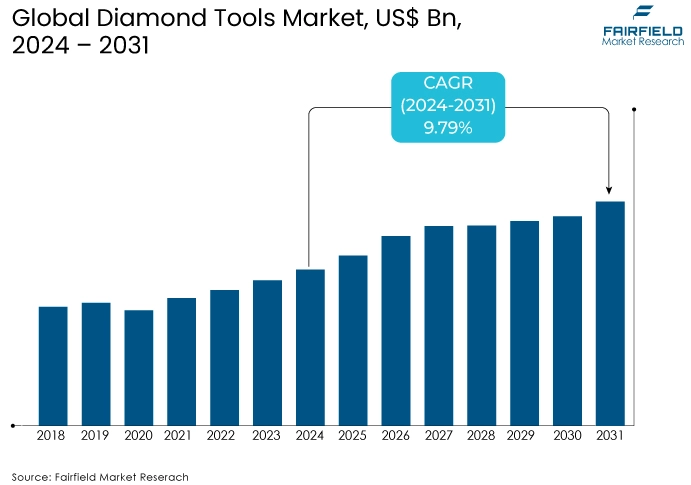

- Global diamond tools market size to reach US$25 Bn in 2031, up from US$13 Bn estimated as of the end of 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 9.79% during 2024-2031

Quick Report Digest

- Growth of the market between 2019 and 2023 was driven by technological advancements, and the increasing demand for precision cutting in industries like automotive, aerospace, and construction.

- Factors fuelling future growth include continuous innovation in manufacturing technologies, automation, and efficiency demands in manufacturing processes.

- Emerging markets, particularly in Asia Pacific, offer significant growth opportunities due to rapid industrialisation and infrastructure development.

- Major growth determinants include technological advancements, increasing construction activities, and the growing automotive sector.

- Some of the key growth barriers include high initial investment, environmental concerns, and intense competition leading to price pressures.

- Key market trends include the adoption of Industry 4.0 technologies, the rise of synthetic diamonds, and expansion in emerging markets.

- Regulatory scenarios shape the industry through responsible diamond sourcing, safety standards, and trade restrictions.

- Fairfield's ranking board highlights top segments like abrasives, finishing-based, and lapping-based tools, with regional frontrunners in North America, Asia Pacific, and Europe.

- Leaders in the global diamond tools space include Hilti Group, Sumitomo Electric Industries, Husqvarna AB, and Saint-Gobain Abrasives Inc.

A Look Back and a Look Forward - Comparative Analysis

The diamond tools market experienced a period of growth between 2019 and 2023, driven by factors like advancements in technology and the increasing demand for precision cutting in industries like automotive, aerospace, and construction. This resulted in a preference for diamond tools, known for their unparalleled durability and cutting performance. The market was likely segmented by product type (solid vs. indexable), and application (metal fabrication, and construction).

Looking ahead to the 2024-2031 forecast, the diamond tools market is expected to continue expanding. Several forces are fuelling this optimism. Manufacturers are constantly innovating to create even more capable diamond cutting tools. Additionally, the rise of automation and the relentless pursuit of efficiency in manufacturing processes are expected to significantly increase demand for these tools.

Furthermore, regions like Asia Pacific, with its rapid industrialisation and growing infrastructure projects, are poised to be major contributors to market growth. Overall, the diamond tools market shows promise for sustained growth in the coming years, driven by technological advancements, efficiency demands, and a booming industrial sector, particularly in developing regions.

Key Growth Determinants

- Technological Advancements

The diamond tools market is experiencing significant growth due to advancements in manufacturing technologies, such as laser cutting and 3D printing, which enhance the precision and efficiency of diamond tool production. These technologies enable the creation of diamond tools with superior durability, precision, and versatility, driving demand across various industries including construction, automotive, and aerospace.

- Momentous Construction Activities

With the global construction industry witnessing steady growth, there's a rising demand for diamond tools used in cutting, drilling, and grinding applications for materials like concrete, stone, and ceramics. Rapid urbanisation, infrastructure development projects, and the renovation sector are key drivers propelling the demand for diamond tools, particularly in emerging economies.

- Growth of Automotive Sector

The automotive industry's shift towards lightweight materials, such as carbon fibre composites and high-strength alloys, necessitates the use of diamond tools for precision machining and shaping. As automotive manufacturers strive for greater fuel efficiency and performance, the demand for diamond tools for machining engine components, body panels, and other critical parts is on the rise, fostering growth in the diamond tools market.

Major Growth Barriers

- High Initial Capital

The diamond tools market faces a challenge due to the high initial investment required for manufacturing and purchasing diamond tools. The specialised equipment and technology needed for diamond tool production, along with the cost of raw materials like synthetic diamonds and metal powders, contribute to significant upfront expenses for manufacturers. This can deter new entrants, and smaller players from entering the market and limit the expansion of existing businesses.

- Growing Environmental Concerns

Environmental regulations and concerns surrounding the extraction and processing of diamonds and other raw materials used in diamond tool manufacturing pose a restraint on market growth.

Sustainable sourcing practices and eco-friendly production methods are increasingly demanded by consumers and regulatory bodies, requiring diamond tool manufacturers to invest in environmentally responsible processes, which can add operational costs and complexity.

Key Trends and Opportunities to Look at

- Expansion of Industry 4.0

The diamond tools market has seen a trend towards the integration of Industry 4.0 technologies, such as automation, IoT (Internet of Things), and data analytics, into manufacturing processes. Diamond tool manufacturers are leveraging these technologies to optimise production efficiency, enhance product quality, and minimise downtime. For example, IoT sensors are being utilised to monitor tool performance in real-time, allowing for predictive maintenance and reducing the risk of unexpected tool failures.

Automation, including robotic systems for tasks like tool handling and quality inspection, is streamlining production processes, improving consistency, and reducing labour costs. Data analytics tools are being employed to analyse production data and optimise manufacturing parameters, leading to increased productivity and competitiveness in the market.

- The Rise of Synthetic Diamonds

Another notable trend in the diamond tools market is the increasing use of synthetic diamonds as an alternative to natural diamonds in tool manufacturing. Synthetic diamonds offer several advantages, including consistent quality, greater availability, and lower cost compared to natural diamonds.

Advancements in synthetic diamond production techniques, such as high-pressure high-temperature (HPHT) and chemical vapor deposition (CVD), have led to the development of high-quality diamond abrasives and cutting tools suitable for a wide range of applications.

As the demand for diamond tools continues to grow across industries like construction, automotive, and aerospace, the availability of high-performance synthetic diamonds presents significant opportunities for market players to expand their product offerings and capture new market segments.

- Unlocking Windows of Opportunity in Developing Markets

One of the biggest potential opportunities for diamond tools market players lies in expanding their presence in emerging markets, particularly in regions experiencing rapid industrialisation and infrastructure development. Countries in Asia Pacific, such as China, India, and southeast Asian nations, offer immense growth potential due to increasing construction activities, automotive production, and manufacturing sectors.

By establishing strategic partnerships, distribution networks, and localised manufacturing facilities in these markets, players can capitalise on growing demand for diamond tools and gain a competitive edge over rivals.

How Does the Regulatory Scenario Shape this Industry?

The regulatory environment significantly shapes the Diamond Tools Market. Stricter regulations on responsible diamond sourcing can affect the cost and availability of raw materials, potentially driving innovation in recycled diamond content or alternative super-abrasives. Safety standards for tool design, manufacturing, and user training can also be impacted, leading to safer tools but potentially higher production costs.

Similarly, regulations around worker safety and fair labour practices can increase production costs but also enhance the industry's reputation and attract skilled workers. Trade restrictions and quotas can influence global pricing and competition within the market.

Regulations governing used diamond tool disposal can create opportunities for companies specialising in recycling or developing eco-friendly disposal methods. In conclusion, regulations act as a double-edged sword. While they can increase costs and introduce challenges, they also push for advancements, ethical practices, and a more sustainable industry. Companies that can adapt and comply with these evolving regulations will likely be better positioned for long-term success.

Fairfield’s Ranking Board

Top Segments

- Synthetic Diamond Abrasive Type at the Forefront

Abrasives are a crucial component in diamond tools, and among them, synthetic diamonds stand out for their exceptional hardness, and durability. They dominate this segment due to their ability to withstand high pressures and temperatures, making them ideal for cutting and grinding hard materials like concrete, stone, and ceramics.

Manufacturers are increasingly focusing on developing advanced synthetic diamond abrasives with superior properties, such as enhanced thermal stability and wear resistance, to meet the growing demand for high-performance tools in industries like construction and automotive. The steady growth of these industries, coupled with ongoing technological advancements in synthetic diamond production, ensures the sustained dominance of synthetic diamond abrasives in the market.

- Polishing Pads and Discs Account for a Significant Market Share

The finishing-based segment of the diamond tools market caters to industries requiring precision, and high-quality surface finishing, such as electronics, optics, and aerospace. Diamond tools excel in providing impeccable surface finishes due to their unparalleled hardness, and abrasion resistance. Within this segment, polishing pads, and discs hold significant market share, especially in applications like semiconductor manufacturing, and optical lens production.

Manufacturers continually innovate to enhance the efficiency and precision of diamond-based finishing tools, incorporating advanced materials and design improvements. The increasing demand for precision-engineered components in various industries, driven by technological advancements and quality standards, ensures the continued growth and dominance of finishing-based diamond tools in the market.

- Diamond Pastes and Suspensions Rank Top by Lapping

Lapping is a precision finishing process used to achieve tight tolerances and exceptional surface flatness in critical components across industries like automotive, aerospace, and medical devices. Diamond lapping compounds and slurries are indispensable in this process due to their ability to achieve ultra-smooth surface finishes with minimal material removal. Within the lapping-based segment, diamond pastes and suspensions are widely preferred for their consistency, particle size distribution, and uniformity, enabling precise control over the lapping process.

As industries increasingly demand higher precision and tighter tolerances in their products, the demand for diamond lapping tools continues to grow. Manufacturers are investing in research and development to formulate advanced diamond lapping solutions tailored to specific industry requirements, ensuring the sustained dominance of diamond-based lapping tools in the market.

Regional Frontrunners

- North America to be the Strongest Regional Market

This region boasts the largest market share due to a strong presence of automotive, aerospace, and construction industries. High levels of construction activity and ongoing infrastructure projects further fuel demand for diamond tools due to their superior cutting performance. Additionally, government initiatives promoting infrastructure development contribute to market growth.

- Asia Pacific’s Growth Prospects Led by China, Japan, and India

This region is experiencing rapid industrialisation, and significant investments in infrastructure projects. This surge in industrial activity translates to a growing demand for efficient and precise cutting tools, making diamond tools a prime choice. China, Japan, and India are the key contributors in this region due to their flourishing manufacturing sectors.

- Europe Benefits from a Strong Focus on Precision Engineering

Europe has a well-established manufacturing base, and a long history of using diamond tools in various industries. The focus on precision engineering and adherence to strict safety standards make Europe a significant market for high-quality diamond tools. However, mature markets and potential regulations might limit the growth compared to the fast-paced Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The competition landscape of the diamond tools market is characterised by intense rivalry among key players striving to gain a competitive edge through innovation, strategic partnerships, and expansion into new markets. To maintain their competitive positions and drive growth, key players in the diamond tools market employ various strategies such as product innovation, where they focus on developing advanced diamond tools with enhanced durability, precision, and performance to meet evolving customer demands.

Additionally, strategic alliances and acquisitions are utilised to expand market reach, access new technologies, and strengthen competitive capabilities. Moreover, investments in research and development, along with marketing initiatives to promote product differentiation and brand recognition, are crucial growth strategies adopted by key companies to stay ahead in this dynamic and competitive market landscape.

Who are the Leaders in Global Diamond Tools Space?

- Hilti Group

- Sumitomo Electric Industries, Ltd.

- Husqvarna AB

- Saint-Gobain Abrasives Inc

- Shinhan Diamond Industrial Co. Ltd

- Toolgal Degania Industrial Diamonds Ltd.

- Sanwa Diamond Tools

- Monte-Bianco Diamond Applications Co. Ltd.

- Shijiazhuang Kitsibo Tools Co., Ltd.

- Syntec Diamond Tools, Inc

- Tyrolit SchleiPMRttelwerke Swarovski KG

- Texas Diamond Tools, Inc.

- EWHA Diamond Industrial Co. Ltd.

- Kyocera Unimerco A/S

- Dellas S.p.A

- G&G Surface Technology

- ALPHA DIAMOND TOOLS CO., Ltd

- Hunan Qiliang Abrasive Co. Ltd.

- Danyang Tianyi Diamond Tools Co., Ltd.

- FUJIAN QUANZHOU JINLI DIAMOND CUTTING TOOLS CO., Ltd.

- Quanzhou JDK Diamond Tools Co., Ltd.

- Fujian Wanlong Group (Hong Kong) CO., Ltd

- Quanzhou Huangchang Diamond Tools Co., Ltd

- Strauss & Co - Industrial Diamonds Ltd

Significant Company Developments

- December 2023

The month marked an important acquisition in the industrial distribution industry. SurfacePrep, a company that distributes abrasives and related equipment, acquired Diamond Tool & Abrasives (DTA). The latter is a technical abrasive source that provides bonded, coated and superabrasive products. The former aims enhanced capabilities and product offerings.

- June 2023:

Robert Bosch GmbH unveiled its latest range of diamond cutting tools designed for the automotive industry. These innovative tools feature advanced diamond coating technology, enhancing cutting efficiency and precision in machining high-strength alloys and composite materials used in modern vehicle manufacturing.

- September 2023:

Husqvarna AB introduced its next-generation diamond grinding discs optimised for concrete polishing applications. These new discs incorporate proprietary diamond formulation and segment design, delivering superior surface finish and prolonged tool life in concrete polishing operations.

- November 2023:

3M Company announced a strategic distribution agreement with a leading industrial supply chain distributor to expand its market presence for diamond abrasive products in Asia Pacific. This partnership aims to strengthen 3M's distribution network and improve accessibility of its diamond tools to customers across diverse industries in the region.

An Expert’s Eye

Analysts anticipate a continuous increase in demand for diamond tools across various industries such as construction, manufacturing, automotive, and aerospace. This demand is driven by ongoing infrastructure development projects, increasing construction activities, and the growing adoption of advanced materials in manufacturing processes.

The market is expected to benefit from ongoing technological advancements in diamond tool manufacturing, leading to the development of more efficient, durable, and precise tools. Innovations such as advanced diamond coatings, multi-layered structures, and improved bonding techniques are enhancing the performance and versatility of diamond tools, thereby expanding their applications, and driving market growth.

Analysts highlight the significant growth potential offered by emerging markets, particularly in Asia Pacific, and Latin America, where rapid industrialisation, urbanisation, and infrastructure investments are creating robust demand for diamond tools.

Moreover, the increasing focus on sustainability and eco-friendly manufacturing practices presents opportunities for market players to develop environmentally responsible diamond tool solutions, catering to the evolving needs of customers and regulations.

Global Diamond Tools Market is Segmented as Below:

By Tool Type:

- Abrasives Type

- Finishing Based

- Lapping Based

- Drilling Tools

- Cutting Tools

- Sawing Tools

- Milling Tools

- Diamond Gauging Finger

- Files

By Manufacturing Method:

- Metal-bonded

- Resin-bonded

- Electroplated

By End use:

- Automotive

- Construction

- Glass

- Stone

- Ceramic

- Fabrication & General Manufacturing

- Healthcare & Pharmaceutical

- Aerospace & Defence

- Electronics & Semiconductor

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middles East & Africa

1. Executive Summary

1.1. Global Diamond Tools Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2024

3.1. Global Diamond Tools, Production Output, by Region, 2019 - 2024

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2024,

4.1. Key Highlights

4.2. Global Average Price Analysis, by Tool Type/ Manufacturing Method/ End Use, US$ per Unit

4.3. Prominent Factors Affecting Diamond Tools Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Diamond Tools Market Outlook, 2019 - 2031

5.1. Global Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Abrasives Type

5.1.1.1.1. Finishing Based

5.1.1.1.2. Lapping Based

5.1.1.2. Drilling Tools

5.1.1.3. Cutting Tools

5.1.1.4. Sawing Tools

5.1.1.5. Milling Tools

5.1.1.6. Diamond Gauging Fingers

5.1.1.7. Files

5.2. Global Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Metal Bonded

5.2.1.2. Resin Bonded

5.2.1.3. Electroplated

5.3. Global Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.2. Construction

5.3.1.2.1. Glass

5.3.1.2.2. Stone

5.3.1.2.3. Ceramic

5.3.1.3. Fabrication & General Manufacturing

5.3.1.4. Healthcare & Pharmaceuticals

5.3.1.5. Aerospace & Defence

5.3.1.6. Electronics & Semiconductors

5.4. Global Diamond Tools Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Diamond Tools Market Outlook, 2019 - 2031

6.1. North America Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Abrasives Type

6.1.1.1.1. Finishing Based

6.1.1.1.2. Lapping Based

6.1.1.2. Drilling Tools

6.1.1.3. Cutting Tools

6.1.1.4. Sawing Tools

6.1.1.5. Milling Tools

6.1.1.6. Diamond Gauging Fingers

6.1.1.7. Files

6.2. North America Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Metal Bonded

6.2.1.2. Resin Bonded

6.2.1.3. Electroplated

6.3. North America Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.2. Construction

6.3.1.2.1. Glass

6.3.1.2.2. Stone

6.3.1.2.3. Ceramic

6.3.1.3. Fabrication & General Manufacturing

6.3.1.4. Healthcare & Pharmaceuticals

6.3.1.5. Aerospace & Defence

6.3.1.6. Electronics & Semiconductors

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Diamond Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1.2. U.S. Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1.3. U.S. Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1.4. Canada Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1.5. Canada Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.1.6. Canada Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Diamond Tools Market Outlook, 2019 - 2031

7.1. Europe Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Abrasives Type

7.1.1.1.1. Finishing Based

7.1.1.1.2. Lapping Based

7.1.1.2. Drilling Tools

7.1.1.3. Cutting Tools

7.1.1.4. Sawing Tools

7.1.1.5. Milling Tools

7.1.1.6. Diamond Gauging Fingers

7.1.1.7. Files

7.2. Europe Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Metal Bonded

7.2.1.2. Resin Bonded

7.2.1.3. Electroplated

7.3. Europe Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.2. Construction

7.3.1.2.1. Glass

7.3.1.2.2. Stone

7.3.1.2.3. Ceramic

7.3.1.3. Fabrication & General Manufacturing

7.3.1.4. Healthcare & Pharmaceuticals

7.3.1.5. Aerospace & Defence

7.3.1.6. Electronics & Semiconductors

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Diamond Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.2. Germany Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.3. Germany Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.4. U.K. Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.5. U.K. Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.6. U.K. Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.7. France Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.8. France Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.9. France Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.10. Italy Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.11. Italy Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.12. Italy Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.13. Turkey Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.14. Turkey Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.15. Turkey Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.16. Russia Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.17. Russia Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.18. Russia Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.19. Rest of Europe Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.20. Rest of Europe Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.1.21. Rest of Europe Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Diamond Tools Market Outlook, 2019 - 2031

8.1. Asia Pacific Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Abrasives Type

8.1.1.1.1. Finishing Based

8.1.1.1.2. Lapping Based

8.1.1.2. Drilling Tools

8.1.1.3. Cutting Tools

8.1.1.4. Sawing Tools

8.1.1.5. Milling Tools

8.1.1.6. Diamond Gauging Fingers

8.1.1.7. Files

8.2. Asia Pacific Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Metal Bonded

8.2.1.2. Resin Bonded

8.2.1.3. Electroplated

8.3. Asia Pacific Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.2. Construction

8.3.1.2.1. Glass

8.3.1.2.2. Stone

8.3.1.2.3. Ceramic

8.3.1.3. Fabrication & General Manufacturing

8.3.1.4. Healthcare & Pharmaceuticals

8.3.1.5. Aerospace & Defence

8.3.1.6. Electronics & Semiconductors

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Diamond Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. China Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.2. China Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.3. China Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.4. Japan Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.5. Japan Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.6. Japan Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.7. South Korea Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.8. South Korea Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.9. South Korea Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.10. India Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.11. India Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.12. India Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.13. Southeast Asia Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.14. Southeast Asia Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.15. Southeast Asia Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.16. Rest of Asia Pacific Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.17. Rest of Asia Pacific Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.1.18. Rest of Asia Pacific Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Diamond Tools Market Outlook, 2019 - 2031

9.1. Latin America Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Abrasives Type

9.1.1.1.1. Finishing Based

9.1.1.1.2. Lapping Based

9.1.1.2. Drilling Tools

9.1.1.3. Cutting Tools

9.1.1.4. Sawing Tools

9.1.1.5. Milling Tools

9.1.1.6. Diamond Gauging Fingers

9.1.1.7. Files

9.2. Latin America Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Metal Bonded

9.2.1.2. Resin Bonded

9.2.1.3. Electroplated

9.3. Latin America Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Automotive

9.3.1.2. Construction

9.3.1.2.1. Glass

9.3.1.2.2. Stone

9.3.1.2.3. Ceramic

9.3.1.3. Fabrication & General Manufacturing

9.3.1.4. Healthcare & Pharmaceuticals

9.3.1.5. Aerospace & Defence

9.3.1.6. Electronics & Semiconductors

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Diamond Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.2. Brazil Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.3. Brazil Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.4. Mexico Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.5. Mexico Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.6. Mexico Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.7. Argentina Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.8. Argentina Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.9. Argentina Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.10. Rest of Latin America Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.11. Rest of Latin America Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.1.12. Rest of Latin America Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Diamond Tools Market Outlook, 2019 - 2031

10.1. Middle East & Africa Diamond Tools Market Outlook, by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Abrasives Type

10.1.1.1.1. Finishing Based

10.1.1.1.2. Lapping Based

10.1.1.2. Drilling Tools

10.1.1.3. Cutting Tools

10.1.1.4. Sawing Tools

10.1.1.5. Milling Tools

10.1.1.6. Diamond Gauging Fingers

10.1.1.7. Files

10.2. Middle East & Africa Diamond Tools Market Outlook, by Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Metal Bonded

10.2.1.2. Resin Bonded

10.2.1.3. Electroplated

10.3. Middle East & Africa Diamond Tools Market Outlook, by End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Automotive

10.3.1.2. Construction

10.3.1.2.1. Glass

10.3.1.2.2. Stone

10.3.1.2.3. Ceramic

10.3.1.3. Fabrication & General Manufacturing

10.3.1.4. Healthcare & Pharmaceuticals

10.3.1.5. Aerospace & Defence

10.3.1.6. Electronics & Semiconductors

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Diamond Tools Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.2. GCC Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.3. GCC Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.4. South Africa Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.5. South Africa Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.6. South Africa Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.7. Egypt Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.8. Egypt Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.9. Egypt Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.10. Nigeria Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.11. Nigeria Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.12. Nigeria Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.13. Rest of Middle East & Africa Diamond Tools Market by Tool Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.14. Rest of Middle East & Africa Diamond Tools Market Manufacturing Method, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.1.15. Rest of Middle East & Africa Diamond Tools Market End Use, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. End Use vs Manufacturing Method Heatmap

11.2. Manufacturer vs Manufacturing Method Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. De Beers Group (Element Six)

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Husqvarna AB

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Saint-Gobain Abrasives

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Asahi Diamond Industrial Co., Ltd.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Norton Abrasives (Saint-Gobain)

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. LEUCO Ledermann GmbH & Co. KG

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Tyrolit Group

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Bosch Power Tools (Robert Bosch GmbH)

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Diamond Products Limited

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. MK Diamond Products, Inc.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Hilti Corporation

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. EHWA Diamond Industrial Co., Ltd.

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Husqvarna Construction Products

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Lackmond Products, Inc.

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Guilin Hualun Diamond Tools Co., Ltd.

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Tool Type Coverage |

|

|

Manufacturing Method Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |