Global Digital Temperature and Humidity Sensor Market Forecast

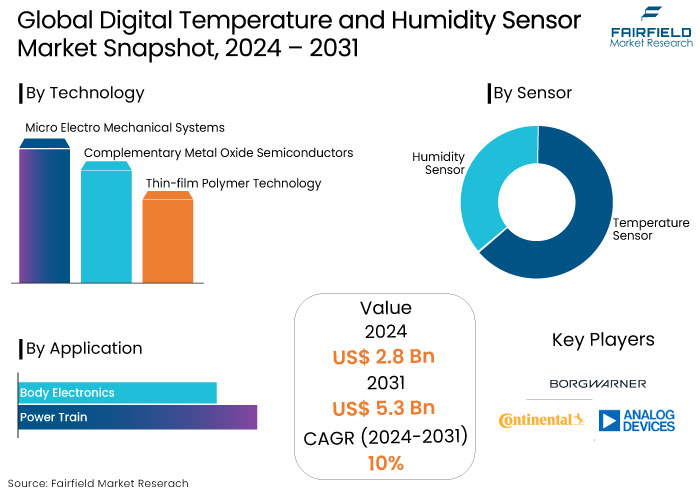

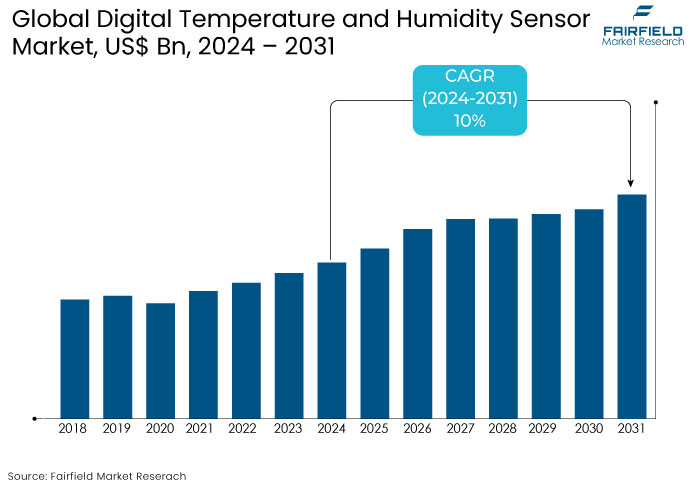

- The digital temperature and humidity sensor market is projected to reach a size of US$5.3 Bn by 2031, showing significant growth from the US$2.8 Bn achieved in 2024.

- The market for digital temperature and humidity sensor is likely to show a significant expansion rate, with projected CAGR of 10% from 2024 to 2031.

Digital Temperature and Humidity Sensor Market Insights

- Increasing integration with IoT systems is driving demand across smart homes, industrial automation, and healthcare sectors.

- Sensors are crucial for maintaining temperature-sensitive environments in pharmaceutical storage, vaccine transport, and hospital operations.

- The surge in smart cities and energy-efficient buildings has boosted sensor adoption in HVAC systems for optimized climate control.

- Precision monitoring in manufacturing, predictive maintenance, and environmental control in industrial settings are key growth areas.

- Miniaturization, wireless connectivity, and AI integration are enhancing sensor accuracy and functionality.

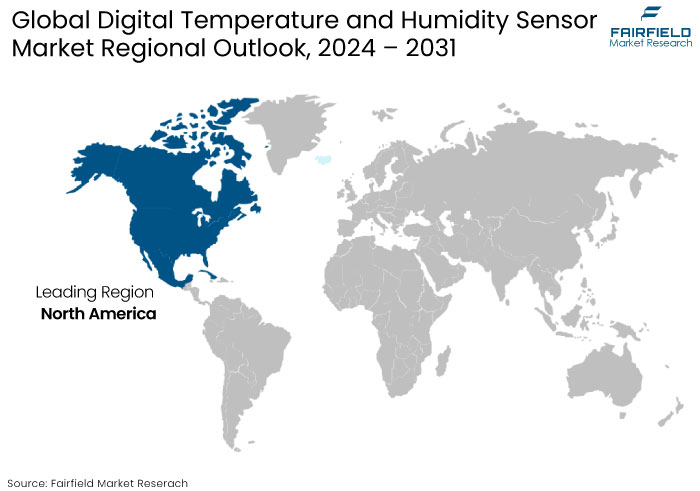

- North America and Europe lead the market due to advanced technology adoption.

- Asia Pacific grows notably with industrialization and smart infrastructure projects.

A Look Back and a Look Forward - Comparative Analysis

The global digital temperature and humidity sensor market witnessed significant growth during the period from 2019 to 2023. Market growth primarily fueled by increasing demand for smart home automation, and widespread adoption of these sensors in healthcare, agriculture, and automotive industries. The proliferation of wearable devices and environmental monitoring systems further bolstered market expansion during this phase.

The market is poised for accelerated growth over the forecast period fueled by integrating AI and machine learning technologies into sensor systems. The rising emphasis on sustainability and energy-efficient solutions is expected to drive demand for sensors in green building projects and renewable energy systems.

The increasing prevalence of Industry 4.0 and smart cities initiatives is likely to amplify the adoption of these sensors for real-time monitoring and predictive maintenance applications. Emerging markets in Asia Pacific and Africa are anticipated to provide lucrative opportunities spurred by rapid industrialization and technological advancements.

Key Growth Determinants

- Rising Need for Iot Sensors in Automotive Vehicles Spurs Demand

The rising deployment of autonomous and electric vehicles is anticipated to propel the market during the forecast period. The increasing demand for smart sensors in the automotive sector, facilitating data conversion and digital processing to develop a comprehensive thermal management solution that ensures the safety of essential applications is driving digital temperature and humidity sensor market growth.

The rising demand for rapid data processing is expected to substantially drive market expansion. In June 2023, Digital Matter introduced the Hawk solution utilizing the Nordic nRF9160 SiP, facilitating cellular IoT data logging with temperature sensors. The Hawk facilitates LTE-M/NB-IoT communication, augmenting temperature monitoring functionalities. These inventions are directing the market.

- Rising Use of Smart Sensors in Smart Utilities

The growing convergence of the utility sector with digitalization to implement an intelligent digital grid management system has fuelled market expansion. The increasing need to implement Advanced Metering Infrastructure (AMI) and Distribution Automation (DA) has substantially stimulated market growth.

The growing integration of smart sensors in the utility sector facilitates data transmission and connectivity with external equipment, transmission, and distribution, which is expected to propel market growth. The rapid and extensive deployment of smart meters for smart home applications is poised to influence the Digital Temperature and Humidity Sensor Market.

- In March 2022, Honor introduced the Earbuds 3 Pro, which includes integrated temperature monitoring technology. Honor's buds will feature a temperature sensor integrated with an AI temperature algorithm. These product launches are enhancing the market.

Key Growth Barriers

- Environmental and Operational Challenges May Impede Market Growth

Digital temperature and humidity sensors are susceptible instruments that external elements, including dust, moisture, and severe temperatures can negatively influence.

In sectors such as manufacturing, agriculture, and construction, where operational circumstances are severe, sensor efficacy may deteriorate over time, resulting in erroneous readings or device malfunctions. Reliability concerns lead to heightened maintenance expenses and diminish user trust in these systems.

The necessity for regular recalibration to ensure precision might pose a considerable operational burden, especially in distant or resource-limited areas. These constraints hinder market expansion, particularly in applications where durability and low maintenance are essential.

- High Initial of Advanced Sensors Restrict Market Growth

The principal constraint affecting the digital temperature and humidity sensor market expansion is the elevated initial expense linked to advanced sensor technologies. Numerous modern sensors incorporate attributes like wireless connectivity, self-calibration, and improved data correctness, substantially elevating their production cost.

The elevated pricing may dissuade small and medium-sized enterprises (SMEs), especially in cost-sensitive industries such as agriculture and residential applications.

The expenses related to supporting infrastructure, like IoT platforms and data management systems, exacerbate the financial strain, hindering adoption in developing nations. Consequently, the initial investment necessary for these sensors sometimes hinders their extensive implementation despite their long-term advantages.

Market Trends and Opportunities

- Integration with the Internet of Things and Smart Systems

Integrating digital temperature and humidity sensors with Internet of Things (IoT) platforms offers a significant opportunity in the digital temperature and humidity sensor market. As companies evolve into interconnected ecosystems, these sensors are essential for facilitating real-time monitoring and regulation of environmental conditions

Smart homes utilize these sensors to manage HVAC systems efficiently, ensuring optimal comfort and energy conservation. In agriculture, IoT-enabled sensors enhance precision farming by continually monitoring soil and atmospheric conditions, hence increasing crop yields and minimizing resource waste. The demand for integrated systems is anticipated to increase as IoT adoption advances across many sectors, creating new opportunities for sensor producers.

- Increasing Demand for Environmental Surveillance

The increasing emphasis on environmental sustainability has heightened the demand for sophisticated monitoring systems, generating significant potential for digital temperature and humidity sensors. These sensors are progressively utilized in sustainable building initiatives to enhance indoor air quality and energy efficiency.

Sensors are crucial to environmental research and catastrophe management systems, where precise climate data is vital. Governments and organizations worldwide are significantly investing in smart city initiatives that depend on sensors to monitor air quality, meteorological conditions, and urban microclimates. With the intensification of environmental restrictions, the utilization of these sensors is anticipated to increase, propelling substantial market expansion.

How Does Regulatory Scenario Shape the Industry?

The regulatory landscape significantly influences the digital temperature and humidity sensor market, particularly through stringent standards in sectors like pharmaceuticals, food safety, and data centers.

Adherence to guidelines such as the United States Pharmacopeia (USP) chapters 785, 797, 800, and 825 in the pharmaceutical industry necessitates precise environmental monitoring to ensure product integrity and patient safety. Similarly, the food industry must comply with the Hazard Analysis Critical Control Point (HACCP) system, which mandates meticulous monitoring of storage and processing conditions to prevent contamination.

In data centers, organizations like the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) provide thermal guidelines that recommend specific temperature and humidity ranges to optimize equipment performance and longevity. Such regulatory requirements drive the adoption of advanced sensor technologies capable of delivering accurate and reliable environmental data.

Manufacturers are responding by developing sensors that meet these stringent standards, thereby expanding their market presence. The evolving regulatory environment ensures compliance and propels innovation and growth within the market.

- Temperature Sensors Take the Lead

Temperature sensors have emerged as the dominant sensor type due to their extensive application across multiple industries and critical role in ensuring safety, efficiency, and performance.

Temperature sensors are integral to a wide range of sectors, including healthcare, automotive, industrial, and consumer electronics. In healthcare, they are vital for monitoring environmental conditions in pharmaceutical storage, vaccine transportation, and medical equipment calibration.

The automotive industry relies on temperature sensors for engine performance, battery monitoring in electric vehicles, and HVAC systems. Advancements in temperature sensor technology, such as increased sensitivity, miniaturization, and the integration of IoT capabilities have widened their scope.

Such Sensors are now commonly embedded in smart devices and wearables, further solidifying their dominance. The demand for real-time and precise temperature monitoring is also driven by stringent regulatory standards, especially in food safety and cold chain logistics.

- Widespread Adoption of Surface Mount Technology Makes It Leading Technology

SMT packaging is widely used in digital temperature and humidity sensors because of its compactness, cost-efficiency, and compatibility with advanced manufacturing processes. Unlike Pin Type Packaging, which requires through-hole soldering, SMT sensors are mounted directly onto the surface of printed circuit boards (PCBs), significantly reducing the size and weight of the final product.

SMT sensors are ideal for miniaturized electronics, such as IoT devices, wearables, and smart home products, where space is a premium concern. SMT supports automated assembly processes, leading to faster production times, reduced labour costs, and consistent quality.

SMT sensors deliver fast response times and better signal integrity with short electrical paths, which is crucial for applications requiring real-time monitoring and precision. From automotive to consumer electronics, SMT packaging suits a variety of industries, driving widespread adoption.

Regional Analysis

- North America Market Emerges Lucrative with Robust Industrial Infrastructures

North America holds a prominent position in the digital temperature and humidity sensor market, primarily driven by its early adoption of advanced technologies and strong industrial and technological infrastructure. The region, led by the United States and Canada, demonstrates consistent growth fueled by demand across diverse sectors.

North America is home to leading industries in healthcare, automotive, aerospace, and energy. Digital temperature and humidity sensors are widely used in these sectors for precise monitoring and control. The adoption of IoT-enabled devices is accelerating in North America, especially in smart homes and smart building automation.

Temperature and humidity sensors are integral to these systems, providing real-time monitoring for HVAC systems, energy optimization, and climate control. Smart city initiatives further enhance the demand for these sensors in environmental monitoring and sustainable urban development.

- Large Industrial Hubs in Europe Drive Regional Growth

Europe is a key region for the digital temperature and humidity sensor market, characterized by its strong regulatory framework, emphasis on sustainability, and advanced industrial base. Countries like Germany, France, and the United Kingdom lead the region’s adoption of these sensors, driven by applications in automotive manufacturing, industrial automation, and smart building technologies.

Europe market growth is significantly shaped by stringent environmental regulations that mandate precise monitoring of temperature and humidity to ensure sustainability and compliance. The Energy Performance of Buildings Directive (EPBD) requires optimized energy usage in buildings.

Digital temperature and humidity sensors play a pivotal role in achieving energy efficiency through smart HVAC systems and environmental monitoring. Europe’s advanced industrial automation relies on sensors for predictive maintenance, improving operational efficiency and reducing downtime. Industries like food and beverage and pharmaceuticals use these sensors to ensure quality control and regulatory compliance.

Fairfield’s Competitive Landscape Analysis

The presence of established global players and emerging regional manufacturers characterizes the competitive landscape of the digital temperature and humidity sensor market.

Key companies such as Honeywell International Inc., Sensirion AG, TE Connectivity, Texas Instruments, and Bosch Sensortec dominate the market, and leveraging technological innovation, extensive distribution networks. Companies focus on developing highly accurate, compact, and energy-efficient sensors with IoT integration to meet diverse industry needs.

Emerging players from regions like Asia Pacific are gaining traction by offering cost-competitive solutions. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their portfolios and market reach. Growing demand for sustainable and smart technologies continues to drive intense competition and innovation.

Key Market Companies

- Analog Devices, Inc.

- Continental AG

- BorgWarner Inc.

- TDK Corporation

- Honeywell International

- TE Connectivity

- Melexis NV

- NXP Semiconductors

- ON Semiconductor Corporation

- Robert Bosch GMBH

- Sensata Technologies, Inc.

- Sensirion AG

- STMicroelectronics

- Texas Instruments

Recent Industry Developments

In October 2023, Endress+Hauser Group Services AG and SICK intend to establish a strategic collaboration for SICK's process automation business area and have executed a joint understanding agreement.

In February 2023, TE Connectivity collaborated with Preddio Technologies to implement remote monitoring solutions for condition-based maintenance and operational productivity advantages.

An Expert’s Eye

Increasing adoption of smart homes, industrial automation, and healthcareare primary drivers for the market growth.

Integration with IoT, AI, and Machine Learningis revolutionizing sensor capabilities, enabling real-time monitoring and predictive analytics.

The growing focus on energy-efficient and green building technologies is boosting demand for advanced sensors.

Emerging applications in precision agriculture, renewable energy systems, and autonomous vehiclesare expected to shape the market future.

Global Digital Temperature and Humidity Sensor Market is Segmented as-

By Sensor Type

Temperature Sensor

Humidity Sensor

By Technology

Micro Electro Mechanical Systems (MEMS)

Complementary Metal Oxide Semiconductors (CMOS)

Thin-film Polymer Technology (TFPT)

By Packaging Type

Surface Mount Technology (SMT)

Pin Type Packaging

By Application

Power Train

Body Electronics

By Region

North America

Europe

Asia Pacific

Latin America

The Middle East & Africa

1. Executive Summary

1.1. Global Digital Temperature and Humidity Sensor Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

3.1. Global Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Temperature Sensor

3.1.1.1.1. Resistive Temperature Sensor

3.1.1.1.2. Capacitive Temperature Sensor

3.1.1.2. Humidity Sensor

3.1.1.2.1. Resistive Temperature Sensor

3.1.1.2.2. Capacitive Temperature Sensor

3.2. Global Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Micro Electro Mechanical Systems (MEMS)

3.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

3.2.1.3. Thin-film Polymer Technology (TFPT)

3.3. Global Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Surface Mount Technology (SMT)

3.3.1.2. Pin Type Packaging

3.4. Global Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Power Train

3.4.1.2. Body Electronics

3.4.1.2.1. Automotive HVAC Control

3.4.1.2.2. Auto Defogger System

3.4.1.2.3. Alternative Fuel Vehicle (AFV)

3.5. Global Digital Temperature and Humidity Sensor Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

4.1. North America Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Temperature Sensor

4.1.1.1.1. Resistive Temperature Sensor

4.1.1.1.2. Capacitive Temperature Sensor

4.1.1.2. Humidity Sensor

4.1.1.2.1. Resistive Temperature Sensor

4.1.1.2.2. Capacitive Temperature Sensor

4.2. North America Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Micro Electro Mechanical Systems (MEMS)

4.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

4.2.1.3. Thin-film Polymer Technology (TFPT)

4.3. North America Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Surface Mount Technology (SMT)

4.3.1.2. Pin Type Packaging

4.4. North America Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Power Train

4.4.1.2. Body Electronics

4.4.1.2.1. Automotive HVAC Control

4.4.1.2.2. Auto Defogger System

4.4.1.2.3. Alternative Fuel Vehicle (AFV)

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Digital Temperature and Humidity Sensor Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

4.5.1.2. U.S. Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

4.5.1.3. U.S. Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

4.5.1.4. U.S. Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

4.5.1.5. Canada Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

4.5.1.6. Canada Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

4.5.1.7. Canada Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

4.5.1.8. Canada Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

5.1. Europe Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Temperature Sensor

5.1.1.1.1. Resistive Temperature Sensor

5.1.1.1.2. Capacitive Temperature Sensor

5.1.1.2. Humidity Sensor

5.1.1.2.1. Resistive Temperature Sensor

5.1.1.2.2. Capacitive Temperature Sensor

5.2. Europe Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Micro Electro Mechanical Systems (MEMS)

5.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

5.2.1.3. Thin-film Polymer Technology (TFPT)

5.3. Europe Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Surface Mount Technology (SMT)

5.3.1.2. Pin Type Packaging

5.4. Europe Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Power Train

5.4.1.2. Body Electronics

5.4.1.2.1. Automotive HVAC Control

5.4.1.2.2. Auto Defogger System

5.4.1.2.3. Alternative Fuel Vehicle (AFV)

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Digital Temperature and Humidity Sensor Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.2. Germany Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.3. Germany Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.4. Germany Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.5. U.K. Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.6. U.K. Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.7. U.K. Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.8. U.K. Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.9. France Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.10. France Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.11. France Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.12. France Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.13. Italy Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.14. Italy Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.15. Italy Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.16. Italy Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.17. Turkey Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.18. Turkey Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.19. Turkey Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.20. Turkey Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.21. Russia Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.22. Russia Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.23. Russia Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.24. Russia Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.1.25. Rest of Europe Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

5.5.1.26. Rest of Europe Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

5.5.1.27. Rest of Europe Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

5.5.1.28. Rest of Europe Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

6.1. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Temperature Sensor

6.1.1.1.1. Resistive Temperature Sensor

6.1.1.1.2. Capacitive Temperature Sensor

6.1.1.2. Humidity Sensor

6.1.1.2.1. Resistive Temperature Sensor

6.1.1.2.2. Capacitive Temperature Sensor

6.2. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Micro Electro Mechanical Systems (MEMS)

6.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

6.2.1.3. Thin-film Polymer Technology (TFPT)

6.3. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Surface Mount Technology (SMT)

6.3.1.2. Pin Type Packaging

6.4. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Power Train

6.4.1.2. Body Electronics

6.4.1.2.1. Automotive HVAC Control

6.4.1.2.2. Auto Defogger System

6.4.1.2.3. Alternative Fuel Vehicle (AFV)

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Digital Temperature and Humidity Sensor Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.2. China Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.3. China Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.4. China Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.5. Japan Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.6. Japan Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.7. Japan Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.8. Japan Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.9. South Korea Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.10. South Korea Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.11. South Korea Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.12. South Korea Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.13. India Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.14. India Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.15. India Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.16. India Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.17. Southeast Asia Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.18. Southeast Asia Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.19. Southeast Asia Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.20. Southeast Asia Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

7.1. Latin America Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Temperature Sensor

7.1.1.1.1. Resistive Temperature Sensor

7.1.1.1.2. Capacitive Temperature Sensor

7.1.1.2. Humidity Sensor

7.1.1.2.1. Resistive Temperature Sensor

7.1.1.2.2. Capacitive Temperature Sensor

7.2. Latin America Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Micro Electro Mechanical Systems (MEMS)

7.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

7.2.1.3. Thin-film Polymer Technology (TFPT)

7.3. Latin America Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Surface Mount Technology (SMT)

7.3.1.2. Pin Type Packaging

7.4. Latin America Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Power Train

7.4.1.2. Body Electronics

7.4.1.2.1. Automotive HVAC Control

7.4.1.2.2. Auto Defogger System

7.4.1.2.3. Alternative Fuel Vehicle (AFV)

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Digital Temperature and Humidity Sensor Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

7.5.1.2. Brazil Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

7.5.1.3. Brazil Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

7.5.1.4. Brazil Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.5. Mexico Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

7.5.1.6. Mexico Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

7.5.1.7. Mexico Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

7.5.1.8. Mexico Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.9. Argentina Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

7.5.1.10. Argentina Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

7.5.1.11. Argentina Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

7.5.1.12. Argentina Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

7.5.1.13. Rest of Latin America Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

7.5.1.14. Rest of Latin America Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

7.5.1.15. Rest of Latin America Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

7.5.1.16. Rest of Latin America Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, 2019 - 2031

8.1. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, by Sensor Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Temperature Sensor

8.1.1.1.1. Resistive Temperature Sensor

8.1.1.1.2. Capacitive Temperature Sensor

8.1.1.2. Humidity Sensor

8.1.1.2.1. Resistive Temperature Sensor

8.1.1.2.2. Capacitive Temperature Sensor

8.2. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, by Technology, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Micro Electro Mechanical Systems (MEMS)

8.2.1.2. Complementary Metal Oxide Semiconductors (CMOS

8.2.1.3. Thin-film Polymer Technology (TFPT)

8.3. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, by Packaging Type, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Surface Mount Technology (SMT)

8.3.1.2. Pin Type Packaging

8.4. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Power Train

8.4.1.2. Body Electronics

8.4.1.2.1. Automotive HVAC Control

8.4.1.2.2. Auto Defogger System

8.4.1.2.3. Alternative Fuel Vehicle (AFV)

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Digital Temperature and Humidity Sensor Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

8.5.1.2. GCC Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

8.5.1.3. GCC Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

8.5.1.4. GCC Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.5. South Africa Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

8.5.1.6. South Africa Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

8.5.1.7. South Africa Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

8.5.1.8. South Africa Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.9. Egypt Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

8.5.1.10. Egypt Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

8.5.1.11. Egypt Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

8.5.1.12. Egypt Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.13. Nigeria Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

8.5.1.14. Nigeria Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

8.5.1.15. Nigeria Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

8.5.1.16. Nigeria Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Digital Temperature and Humidity Sensor Market by Sensor Type, Value (US$ Bn), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Digital Temperature and Humidity Sensor Market by Technology, Value (US$ Bn), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Digital Temperature and Humidity Sensor Market by Packaging Type, Value (US$ Bn), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Digital Temperature and Humidity Sensor Market by Application, Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Packaging Type vs by Technology Heat map

9.2. Manufacturer vs by Technology Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Analog Devices, Inc

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Continental AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. BorgWarner Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. TDK Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Honeywell International

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. TE Connectivity

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Melexis NV

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. NXP Semiconductors

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. ON Semiconductor Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Robert Bosch GMBH

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Sensata Technologies, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Sensirion AG

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. STMicroelectronics

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Texas Instruments

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Sensor Type Coverage |

|

|

Technology Coverage |

|

|

Packaging Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |