Global Distributed Acoustic Sensing Market Forecast

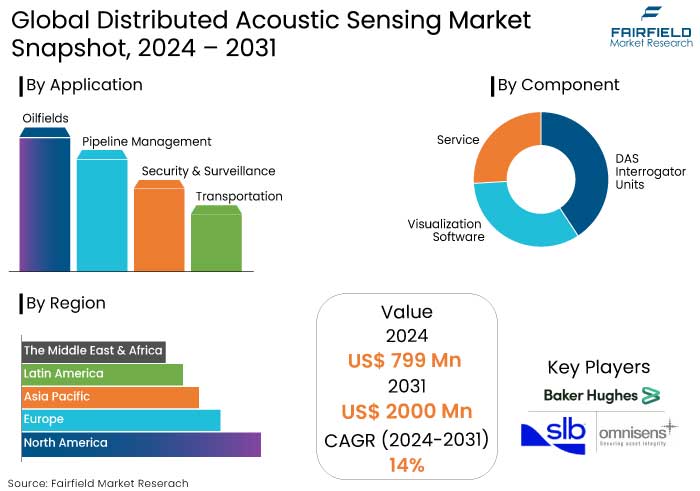

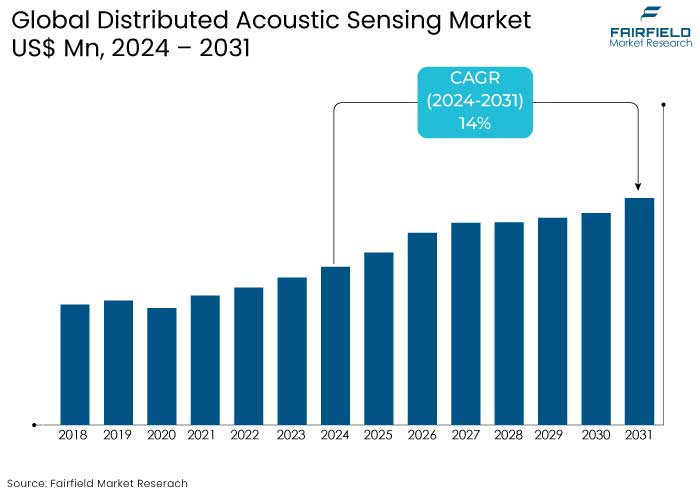

- The global distributed acoustic sensing market is projected to value at US$2000 Mn by 2031, showing significant growth from US$799 Mn recorded in 2024.

- The market is projected to exhibit a remarkable rate of expansion, with an estimated CAGR of 14% during the forecast period from 2024 to 2031.

Distributed Acoustic Sensing Market Insights

- DAS technology is gaining popularity in the oil and gas sector due to its ability to monitor pipeline integrity and assess infrastructure conditions over long distances.

- DAS interrogator units hold a significant share accounting for 42.7% of the total market share.

- Rapid urbanization and infrastructure development drive the demand for innovative monitoring solutions made with DAS technology.

- Europe is poised to grow with Germany's strong position in the market.

- Innovations in fiber-optic sensing, data analytics, and machine learning are enhancing the capabilities of DAS systems

- Transportation segment to lead the market with a 27.6% share.

- The market faces challenges due to the increasing focus on environmental sustainability and regulatory compliance in industries like oil and gas.

- Integrating AI and ML technologies is a significant trend shaping the market.

A Look Back and a Look Forward - Comparative Analysis

The distributed acoustic sensing (DAS) market has experienced notable growth trends both pre-2023 and is projected to continue evolving post-2024. In 2023, the market was valued at healthy CAGR, reflecting a growing recognition of DAS technology across various sectors, particularly in oil and gas, infrastructure monitoring, and defense applications.

The market is expected to exhibit a CAGR of 14% from 2024 to 2031 reaching an impressive market value. Several distributed acoustic sensing market trends and factors are fueling this growth. The increasing demand for real-time monitoring solutions to enhance safety and operational efficiency is a primary driver.

Advancements in technologies such as the integration of artificial intelligence (AI) and machine learning (ML) are improving data analysis capabilities making DAS systems more effective and user-friendly.

The rising focus on environmental sustainability and regulatory compliance in industries like oil and gas further propels the adoption of DAS technology. As organizations seek to optimize resource management and minimize risks, market demand is poised for significant expansion in the coming years.

Key Growth Determinants

- Increased Demand in Oil and Gas Sector

The oil and gas sector is one of the primary growth drivers for the distributed acoustic sensing market expansion. The industry is increasingly facing challenges related to the monitoring and maintenance of extensive pipeline networks. DAS technology offers a solution by enabling real-time monitoring of pipeline integrity, detecting leaks, and assessing the condition of infrastructure over long distances.

With the rising emphasis on safety and environmental protection, regulatory requirements are becoming strict pushing companies to adopt advanced monitoring techniques. Additionally, as exploration activities expand into more remote and challenging environments, the need for reliable monitoring solutions becomes even more critical.

- Increasing Infrastructure Needs

The rapid pace of urbanization and infrastructure development is another significant driver for the distributed acoustic sensing market growth. As cities expand and aging infrastructure necessitates upgrades, the demand for innovative monitoring solutions becomes paramount.

DAS technology offers unparalleled capabilities for assessing the health of critical infrastructure such as bridges, roads, railways, and pipelines. Furthermore, government investments in infrastructure projects worldwide are creating a fertile ground for DAS adoption.

With increasing budgets allocated for smart city initiatives and maintenance of existing assets, the importance of integrating advanced monitoring systems like DAS cannot be overstated. This trend is expected to drive substantial growth in the DAS market as stakeholders seek reliable solutions for effective infrastructure management.

- Advancements in Technology

As per the distributed acoustic sensing market analysis, the continuous advancements in DAS technology are significantly contributing to the industry growth. Innovations in fiber-optic sensing, data analytics, and machine learning are enhancing the capabilities of DAS systems, making them more efficient, accurate, and user-friendly. For instance, improved signal processing techniques allow for better noise reduction and data interpretation, leading to more precise measurements and insights.

The integration of Internet of Things (IoT) technology with DAS systems enables remote monitoring and data transmission facilitating timely decision-making and response to potential issues. These technological advancements are not only expanding the range of applications for DAS ranging from environmental monitoring to security and defense but also driving down costs. Consequently, making the technology more accessible to various industries.

Key Growth Barriers

- High Implementation and Deployment Costs

One of the significant restraints for the growth of the distributed acoustic sensing market sales is the high implementation and deployment costs associated with these systems. The initial investment required for DAS technology can be substantial primarily due to the need for specialized infrastructure and equipment.

Installing DAS systems involves deploying fiber optic cables over extensive distances, which can be labor-intensive and costly. Additionally, integrating advanced technologies such as data analytics and machine learning further adds to the overall expenses. These high costs can deter smaller companies or those with limited budgets from adopting DAS solutions, slowing market penetration.

Organizations may hesitate to invest in DAS technology without straightforward, immediate returns on investment particularly in industries where budget constraints are prevalent.

- Complexity of Data Interpretation

Another notable restraint for the distributed acoustic sensing market growth is the complexity of data interpretation generated by these systems. DAS technology produces vast amount of real-time data from fiber optic sensors, which can overwhelm organizations lacking the necessary expertise or resources to analyze it effectively. The challenge lies in extracting meaningful insights from this data, requiring advanced analytical capabilities and specialized knowledge.

Many companies may struggle to interpret the data accurately, leading to potential misinterpretations affecting decision-making processes. This complexity can result in organizations hesitating to adopt DAS solutions, fearing they may not fully leverage the technology's capabilities.

Distributed Acoustic Sensing Market Trends and Opportunities

- Integration of Artificial Intelligence and Machine Learning

A significant trend shaping the distributed acoustic sensing market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. As DAS systems generate vast amount of data from fiber optic sensors, the need for advanced analytical tools to interpret this data has become increasingly critical.

AI and ML algorithms can process and analyze complex acoustic signals, enabling organizations to derive actionable insights from the data collected. This integration enhances the accuracy of monitoring applications, such as detecting leaks in pipelines or identifying structural weaknesses in infrastructure.

The integration of AI and ML into DAS technology is not just a trend, but a potential game-changer. AI-driven predictive analytics can forecast potential issues before they escalate, allowing for proactive maintenance and reducing operational downtime. This combination not only enhances the efficiency of monitoring systems but also broadens their applicability across various sectors, including energy, transportation, and security.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the distributed acoustic sensing market growth. As industries increasingly adopt DAS technology for applications such as pipeline monitoring and infrastructure health assessments, regulatory bodies establish stringent guidelines to ensure safety and compliance. For instance, regulations focused on pipeline safety and environmental protection drive the demand for advanced monitoring solutions, compelling companies to integrate DAS systems into their operations to meet these requirements.

The complexity of DAS systems, which require specialized skills for installation and operation, has led to regulatory frameworks that emphasize training and certification for personnel involved in these technologies. This enhances operational safety, and fosters demand for distributed acoustic sensing by ensuring that organizations can effectively utilize DAS systems.

Privacy concerns related to DAS surveillance applications are prompting regulatory scrutiny. Companies must navigate these challenges by implementing robust data protection measures, which can influence market entry strategies and operational costs.

Segments Covered in the Report

- DAS Interrogator Units Poised to Dominate the Market

The DAS interrogator units hold a significant market share in 2024. This segment is poised to dominate the distributed acoustic sensing market accounting for 42.7% of the total market value. This growth underscores its importance in various sectors.

Industry growth is fueled by these units' crucial role in collecting data from DAS sensors that monitor environmental factors like vibrations and weather. These units are essential in industrial and mining applications for monitoring equipment and production processes as well as in transportation infrastructure for traffic flow and safety enhancements.

- Transportation Segment to Lead the Market

The transportation segment to lead the distributed acoustic sensing market. DAS technology plays a vital role in monitoring the health and safety of rail and road infrastructures including bridges and tunnels. This capability enables early detection of potential issues and supports proactive maintenance, minimizing transportation disruptions.

DAS enhances safety and security by monitoring the condition of transportation assets such as cars, buses, trains, and trucks allowing for the identification of problems before they escalate into serious concerns.

Regional Analysis

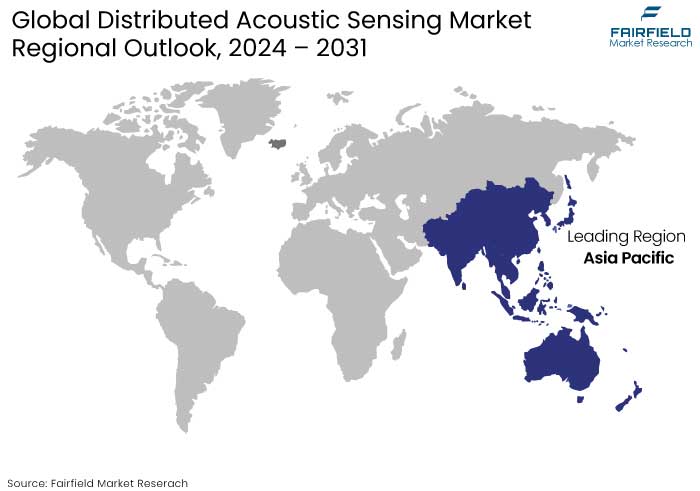

- Asia Pacific Distributed Acoustic Sensing Market to Grow Substantially

Asia Pacific distributed acoustic sensing market is estimated to grow significantly with India is projected to expand at a CAGR of 16.3% due to several key factors. The increasing adoption of DAS technology in the oil and gas sector for exploration, production optimization, leak detection, and safety enhancement is a major driver.

Government initiatives and investments in infrastructure monitoring are further propelling market growth. The rise of smart city projects is expected to significantly boost the demand for DAS solutions as these technologies are essential for efficient urban management and safety monitoring. Overall, these trends indicate a robust future for DAS in India.

- Europe Poised to Grow Rapidly with Germany's Strong Position in the Market

As per the distributed acoustic sensing market forecast, in Europe, Germany boasts a robust manufacturing sector and advanced automation enabling the production of high-quality distributed acoustic sensing products. Significant investments in research and development have led to the creation of innovative DAS technologies.

The country hosts numerous key players across industries such as automotive, machinery, and chemicals, which collectively command a substantial share of the DAS market. As a result, Germany accounted for 12.8% of the global DAS market in 2022 highlighting its influential role in the industry's growth and technological advancement.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the distributed acoustic sensing (DAS) market is characterized by several key players focusing on innovation and strategic partnerships to enhance their offerings. For example, Schlumberger Limited has made significant strides in this space by launching its "DAS for Pipeline Monitoring" solution in 2023. This innovative product leverages advanced fiber optic technology to provide real-time monitoring of pipeline integrity, enabling operators to detect leaks and other anomalies swiftly.

Key Market Companies

- Baker Hughes Company

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Fotech Group Ltd.

- Silixa Ltd.

- OptaSense

- Future Fibre Technologies

- Omnisens SA

- Bandweaver

- Ziebel

- Hifi Engineering Inc.

- Northrop Grumman Corporation

Recent Industry Developments

- July 2024

Viavi Solutions has introduced Nitro Fiber Sensing, a real-time asset monitoring and analytics solution for critical infrastructure in industries like oil, gas, water pipelines, electrical power transmission, border security, and data center interconnects.

- March 2024

TeraXion has launched the LXM, a Narrow Linewidth Laser Module for coherent applications. This cutting-edge DFB laser design, based on low-noise electronics expertise, offers superior performance, stability, and scalability for mass production. It features ultra-low phase noise and exceptional frequency modulation capabilities, making it ideal for various sectors. TeraXion offers two configurations to cater to diverse market demands, including wind sensing, distributed acoustic sensing, FMCW lidar, optical network monitoring, and quantum communications.

An Expert’s Eye

- AI and ML algorithms can process and analyze complex acoustic signals enhancing the accuracy of monitoring applications

- Regulatory bodies establish stringent guidelines to ensure safety and compliance.

- Integration of Internet of Thingss (IoT) technology for remote monitoring and data transmission fueling the industry demand.

- AI-driven predictive analytics can forecast potential issues before they escalate reducing operational downtime.

Global Distributed Acoustic Sensing Market is Segmented as-

By Component

- DAS Interrogator Units

- Visualization Software

- Service

- Deployment

- Maintenance

By Application

- Oilfields

- Pipeline Management

- Security & Surveillance

- Transportation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

1. Executive Summary

1.1. Global Distributed Acoustic Sensing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2024

3.1. Production by Region

4. Price Trend Analysis, 2019 - 2031

4.1. Key Highlights

4.2. Key Factors Impacting Component Prices

4.3. Prices By Component

5. Global Distributed Acoustic Sensing Market Outlook, 2019 - 2031

5.1. Global Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. DAS Interrogator Units

5.1.1.2. Visualization Software

5.1.1.3. Service

5.1.1.3.1. Deployment

5.1.1.3.2. Maintenance Services

5.2. Global Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Oilfields

5.2.1.2. Pipeline Management

5.2.1.3. Security & Surveillance

5.2.1.4. Transportation

5.2.1.5. Others

5.3. Global Distributed Acoustic Sensing Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Distributed Acoustic Sensing Market Outlook, 2019 - 2031

6.1. North America Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. DAS Interrogator Units

6.1.1.2. Visualization Software

6.1.1.3. Service

6.1.1.3.1. Deployment

6.1.1.3.2. Maintenance Services

6.2. North America Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Oilfields

6.2.1.2. Pipeline Management

6.2.1.3. Security & Surveillance

6.2.1.4. Transportation

6.2.1.5. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Distributed Acoustic Sensing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.2. U.S. Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.3. Canada Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.4. Canada Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Distributed Acoustic Sensing Market Outlook, 2019 - 2031

7.1. Europe Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. DAS Interrogator Units

7.1.1.2. Visualization Software

7.1.1.3. Service

7.1.1.3.1. Deployment

7.1.1.3.2. Maintenance Services

7.2. Europe Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Oilfields

7.2.1.2. Pipeline Management

7.2.1.3. Security & Surveillance

7.2.1.4. Transportation

7.2.1.5. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Distributed Acoustic Sensing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.2. Germany Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.3. U.K. Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.4. U.K. Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.5. France Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.6. France Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.7. Italy Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.8. Italy Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.9. Turkey Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.10. Turkey Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.11. Russia Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.12. Russia Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.13. Rest of Europe Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.14. Rest of Europe Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Distributed Acoustic Sensing Market Outlook, 2019 - 2031

8.1. Asia Pacific Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. DAS Interrogator Units

8.1.1.2. Visualization Software

8.1.1.3. Service

8.1.1.3.1. Deployment

8.1.1.3.2. Maintenance Services

8.2. Asia Pacific Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Oilfields

8.2.1.2. Pipeline Management

8.2.1.3. Security & Surveillance

8.2.1.4. Transportation

8.2.1.5. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Distributed Acoustic Sensing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.2. China Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.3. Japan Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.4. Japan Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.5. South Korea Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.6. South Korea Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.7. India Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.8. India Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.9. Southeast Asia Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.10. Southeast Asia Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Distributed Acoustic Sensing Market Outlook, 2019 - 2031

9.1. Latin America Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. DAS Interrogator Units

9.1.1.2. Visualization Software

9.1.1.3. Service

9.1.1.3.1. Deployment

9.1.1.3.2. Maintenance Services

9.2. Latin America Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Oilfields

9.2.1.2. Pipeline Management

9.2.1.3. Security & Surveillance

9.2.1.4. Transportation

9.2.1.5. Others

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Distributed Acoustic Sensing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.2. Brazil Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.3. Mexico Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.4. Mexico Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.5. Argentina Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.6. Argentina Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.7. Rest of Latin America Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.8. Rest of Latin America Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Distributed Acoustic Sensing Market Outlook, 2019 - 2031

10.1. Middle East & Africa Distributed Acoustic Sensing Market Outlook, by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. DAS Interrogator Units

10.1.1.2. Visualization Software

10.1.1.3. Service

10.1.1.3.1. Deployment

10.1.1.3.2. Maintenance Services

10.2. Middle East & Africa Distributed Acoustic Sensing Market Outlook, by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Oilfields

10.2.1.2. Pipeline Management

10.2.1.3. Security & Surveillance

10.2.1.4. Transportation

10.2.1.5. Others

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Distributed Acoustic Sensing Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.2. GCC Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.3. South Africa Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.4. South Africa Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.5. Egypt Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.6. Egypt Distributed Acoustic Sensing Market Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.7. Nigeria Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.8. Nigeria Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.9. Rest of Middle East & Africa Distributed Acoustic Sensing Market by Component, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.10. Rest of Middle East & Africa Distributed Acoustic Sensing Market by Application, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Manufacturers vs Application Heatmap

11.2. Company Market Share Analysis, 2023

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Halliburton Co.

11.4.1.1. Company Overview

11.4.1.2. Service Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Schlumberger Limited

11.4.2.1. Company Overview

11.4.2.2. Service Portfolio

11.4.2.3. Financial Overview

11.4.2.4. Business Strategies and Development

11.4.3. Optasense

11.4.3.1. Company Overview

11.4.3.2. Service Portfolio

11.4.3.3. Financial Overview

11.4.3.4. Business Strategies and Development

11.4.4. Future Fibre Technologies

11.4.4.1. Company Overview

11.4.4.2. Service Portfolio

11.4.4.3. Financial Overview

11.4.4.4. Business Strategies and Development

11.4.5. Fotech Solutions Ltd.

11.4.5.1. Company Overview

11.4.5.2. Service Portfolio

11.4.5.3. Financial Overview

11.4.5.4. Business Strategies and Development

11.4.6. Silixa Ltd

11.4.6.1. Company Overview

11.4.6.2. Service Portfolio

11.4.6.3. Financial Overview

11.4.6.4. Business Strategies and Development

11.4.7. Bandweaver

11.4.7.1. Company Overview

11.4.7.2. Service Portfolio

11.4.7.3. Financial Overview

11.4.7.4. Business Strategies and Development

11.4.8. Omnisens SA

11.4.8.1. Company Overview

11.4.8.2. Service Portfolio

11.4.8.3. Financial Overview

11.4.8.4. Business Strategies and Development

11.4.9. HiFi Engineering Inc.

11.4.9.1. Company Overview

11.4.9.2. Service Portfolio

11.4.9.3. Financial Overview

11.4.9.4. Business Strategies and Development

11.4.10. Baker Hughes Incorporated

11.4.10.1. Company Overview

11.4.10.2. Service Portfolio

11.4.10.3. Financial Overview

11.4.10.4. Business Strategies and Development

11.4.11. Qintiq Group PLC

11.4.11.1. Company Overview

11.4.11.2. Service Portfolio

11.4.11.3. Financial Overview

11.4.11.4. Business Strategies and Development

11.4.12. Febus Optics

11.4.12.1. Company Overview

11.4.12.2. Service Portfolio

11.4.12.3. Financial Overview

11.4.12.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |