Global Dry Mouth Relief Market Forecast

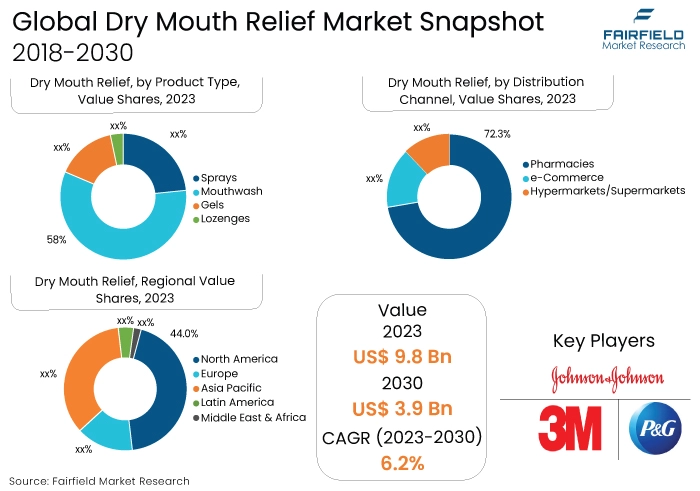

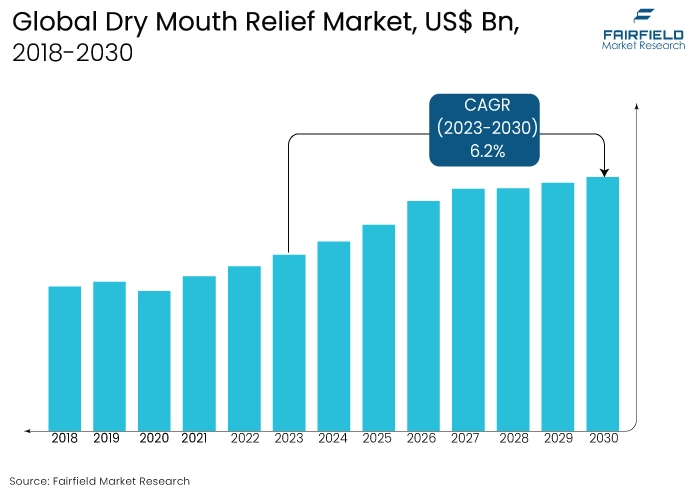

- Global dry mouth relief market valuation to increase from US$2.5 Bn in 2023 to US$3.9 Bn in 2030

- Market size of dry mouth relief to expand at a CAGR of 6.2% over 2023-2030

Quick Report Digest

- Consumers' growing health consciousness is driving an increase in the demand for dry mouth relief products containing natural and medicinal ingredients.

- Busy lifestyles are increasing the demand for portable dry mouth relief products, such as lozenges and mists, which are also convenient and easy to use while on the move.

- Incorporating cutting-edge technologies such as microencapsulation and nano-formulations into dry mouth relief products to increase their efficacy and duration of action.

- The prevalence of customised and individualised dry mouth management solutions that accommodate the preferences and particular requirements of consumers is on the rise.

- Out of the four product categories—sprays, lozenges, gels, and mouthwash—mouthwash is anticipated to hold the largest market share. Mouthwash is favoured by consumers due to its extended duration of action, comprehensive coverage of the oral cavity, and familiarity with oral hygiene routines.

- except for e-commerce and hypermarkets/supermarkets, pharmacies are anticipated to hold the largest market share. By providing individualised suggestions and expert guidance, pharmacies foster consumer confidence and facilitate convenient access to an extensive selection of oral hygiene products.

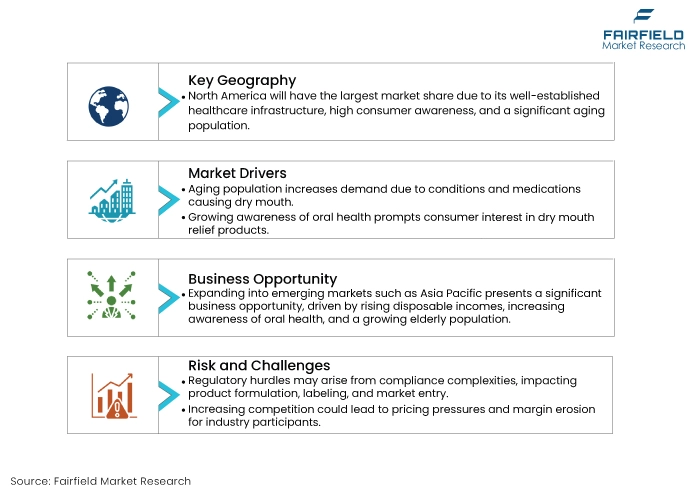

- It is anticipated that North America will have the highest market penetration rate regarding dry mouth relief products worldwide. Frequent applications encompass the mitigation of medication-induced discomfort, stimulation of salivary secretion, and preservation of oral sanitation.

- It is expected that the Asia Pacific region will witness the most rapid expansion in market penetration with regard to dry mouth relief products. Common applications encompass the management of post-operative dry mouth symptoms, the alleviation of medication-induced dry mouth, and the improvement of overall oral comfort.

A Look Back and a Look Forward - Comparative Analysis

Given the prevailing market conditions, the worldwide dry mouth relief industry is experiencing substantial expansion propelled by several pivotal factors. The demand for efficacious relief solutions is being fuelled by a combination of rising instances of dry mouth caused by medical conditions and medication adverse effects, as well as an increased awareness of oral health. In addition, the incorporation of technological progress and the development of novel product compositions are augmenting the effectiveness and desirability of oral hygiene products in the eyes of consumers.

Upon reflecting on the past decade of market activity, it is evident that the dry mouth relief market has exhibited consistent expansion. The expansion of the market can be attributed to developments in product research and development as well as the expansion of distribution lines. The market environment has also been influenced by the changing preferences of consumers for natural and customised solutions.

According to a market outlook for the future, the dry mouth relief industry will continue to expand. It is anticipated that demand will continue to be propelled by an ageing population, a rising prevalence of chronic diseases, and an increased emphasis on preventive healthcare. Furthermore, the continuous advancements in product formulations and the increasing market share in developing countries are expected to offer profitable prospects for industry participants.

Key Growth Determinants

- Expanding Ageing Population

The global geriatric population is a substantial factor propelling the dry mouth relief market. ageing increases the susceptibility to dry mouth-causing medications and medical conditions, including diabetes, hypertension, and melancholy. The increasing elderly demographic has led to a concomitant surge in the need for dry mouth relief products, which serve to mitigate discomfort and preserve oral health.

Prominent figures in the market are currently emphasizing the creation of tailored solutions that address the requirements of this demographic. Such solutions may comprise products that feature mild formulations and exhibit extended durations of effectiveness. Additionally, efforts to enhance knowledge and understanding regarding oral health among the elderly demographic serve to bolster market expansion and generate prospects for novel product introductions and product innovation.

- Increasing Chronic Disorders

The escalating incidence of chronic ailments such as hypertension, diabetes, and autoimmune disorders greatly influences the dry mouth relief market. A greater proportion of patients experience dry mouth due to the xerostomic adverse effects of numerous medications prescribed to treat these conditions. The global incidence of chronic diseases is concurrently increasing the need for efficacious solutions to alleviate parched mouths.

Prominent figures in the market are fostering innovation to create products that are uniquely designed to meet the requirements of those who are managing these conditions. For instance, some formulations are intended to offer sustained hydration and safeguard against oral complications. This phenomenon is stimulating spending on research and development and broadening the market for products that alleviate parched mouth.

- Recognition Between Oral Health and Overall Wellbeing

The increasing recognition of the correlation between oral health and general welfare is propelling the market demand for products that alleviate parched mouth. A growing number of consumers are becoming aware of the critical nature of preserving ideal oral moisture levels to avert oral distress, decay, and infections that are commonly linked to dry mouth. Increased consciousness motivates individuals to actively pursue specialised products that are specifically formulated to effectively mitigate symptoms of dry mouth.

In the light of this, industry participants are initiating educational initiatives, advocating for the advantages of adequate oral hydration, and introducing novel approaches to address consumer demands. The market for dry mouth alleviation products is anticipated to experience further growth as consumer awareness increases and oral health becomes a more significant component of their holistic wellness routine.

Major Growth Barriers

- Potential Allergic Reactions Post-Consumption

Certain individuals may experience adverse effects or allergic reactions when using dry mouth relief products, which restricts their widespread application. This limitation requires comprehensive testing and meticulous formulation to guarantee the safety of the product and reduce any negative impacts that may impede market expansion and consumer acceptance.

- Limited Knowledge Regarding Product Availability

A notable impediment to the growth of the dry mouth relief industry is consumers' limited knowledge regarding the availability of such products and the advantages they offer. Insufficient knowledge regarding the products can result in inadequate utilisation of dry mouth relief solutions, thereby impeding the expansion of the market. To navigate this limitation and broaden the scope of the market, it is critical to implement successful marketing tactics and educational initiatives.

Key Trends and Opportunities for the Dry Mouth Relief Market

- Increasing Consumer Interest

As consumer apprehension regarding synthetic additives grows, there is a growing preference for dry mouth relief products that contain natural and medicinal ingredients. This phenomenon is significantly influencing market expansion on a global scale, particularly in North America, and Europe. Biotene, and TheraBreath are among the companies that are incorporating natural formulations into their product lines.

To satisfy consumer demand for natural alternatives, brands will probably capitalise on this trend through the implementation of measures such as partnerships with botanical suppliers, ingredient transparency, and eco-friendly packaging.

- Growing Focus on Convenience

There is an increasing need for portable dry mouth relief options that are convenient and suitable for use while on the move. This trend is undergoing substantial expansion, specifically in urban regions spanning all geographical areas.

OraCoat, and Xerostom are among the companies that are pioneering the use of dissolvable lozenges and compact aerosols. By prioritizing product portability, simplicity of use, and packaging formats that are convenient for travel and daily life, brands are expected to capitalise on this trend.

- Escalating Demand for Tailor-Made Solutions

There is an increasing demand among consumers for customised dry mouth relief products that address their individual preferences and requirements. With a growing global interest in customised formulations and delivery methods, this trend is gaining momentum. To develop customised products, corporations such as Colgate, and GSK are allocating resources towards research and development.

Brands will probably capitalise on this trend by providing customizable features, including flavour varieties, adjustable dosage levels, and subscription services that are tailored to specific conditions and preferences.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks are of paramount importance in the dry mouth relief industry as they establish and uphold standards for product safety, efficacy, and quality. Wet Mouth Relief Products in the United States Are Subject to Regulation by the Food and Drug Administration (FDA) following a range of statutes and regulations. These include the Over-the-counter (OTC) Drug Review and the Federal Food, Drug, and Cosmetic Act (FD&C Act). Market entry is contingent upon adherence to FDA regulations, which exert an impact on product formulation, labeling, and marketing strategies.

Likewise, the European Medicines Agency (EMA) regulates dry mouth relief products in the European Union via directives including the Pharmaceutical Legislation and the Medical Devices Directive. Adherence to EU regulations guarantees manufacturers entry into the market throughout its member states, thereby incentivizing them to satisfy rigorous quality and safety criteria. Sector-specific regulatory modifications, including revisions to ingredient restrictions or labelling mandates, have the potential to influence market dynamics and the accessibility of products.

An example of this can be seen in the impact of recent modifications to the Medical Devices Regulation (MDR) of the European Union on the strategies and techniques employed by manufacturers in the marketplace to obtain new certifications (EMA, 2022). These regulatory bodies and principles influence market behaviour and consumer confidence through the maintenance of benchmarks for the safety and effectiveness of products.

Fairfield’s Ranking Board

Top Segments

- Mouthwash to be the Dominant Product Category

Mouthwash is anticipated to hold the most substantial portion of the product category. Mouthwash provides a holistic approach to maintaining good oral hygiene by offering respite from dry mouth, thereby appealing to a wide range of consumers. Its widespread availability in diverse formulations, low cost, and familiarity all accommodate various consumer preferences, thereby contributing to its market dominance.

On the contrary, the aerosols segment is anticipated to undergo the most rapid expansion. Because of their portability and convenience, sprays are gaining popularity among consumers in search of dry mouth relief solutions that can be applied quickly and while on the move.

Furthermore, advancements in aerosol formulations, including the incorporation of natural components and the provision of extended-lasting effects, are stimulating consumer curiosity and propelling the sector's exponential growth. With the increasing emphasis on convenience and effectiveness among consumers, the spray industry is anticipated to experience substantial expansion in the future years.

- Pharmacies Surge Ahead in Distribution

It is anticipated that pharmacies will hold the most substantial market share in the dry mouth relief industry among the segments mentioned. Pharmaceutical establishments provide a comprehensive range of healthcare products, including those that alleviate parched mouth symptoms. The segment's dominant market position can be attributed to consumers' trust and preference for purchasing these products from pharmacies, which is facilitated by the guidance and professional recommendations of pharmacists.

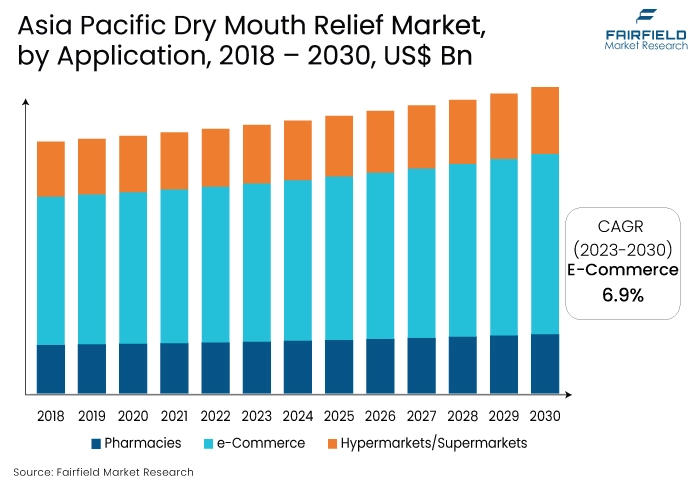

Conversely, the most rapid growth is anticipated in electronic commerce. Consumers in search of dry mouth relief solutions are attracted to the extensive selection of products offered at competitive prices and the convenience of online shopping.

Moreover, the proliferation of smartphones and internet connectivity contributes to the expansion of electronic commerce within this industry. With the increasing adoption of online shopping by consumers for healthcare products, the e-commerce sector is positioned to experience substantial growth in the future years.

Regional Frontrunners

North America at the Forefront of Demand Creation

The region of North America is positioned to hold the largest market share in the worldwide dry mouth relief industry. This is predominantly attributable to several factors, including the region's sizable elderly population, well-established healthcare infrastructure, and high prevalence of dry mouth-causing conditions such as diabetes and Sjogren's syndrome.

Moreover, in North America, consumer awareness regarding oral health is comparatively high, resulting in a substantial demand for products that alleviate parched mouth. Further bolstering North America's market dominance are the continuous product innovations and the presence of key market participants.

Asia Pacific to Grow at a Rapid Pace as Focus on Oral Health Soars

It is expected that the Asia Pacific region will witness the most rapid expansion of the worldwide dry mouth relief market. Increasing awareness regarding oral health, rising disposable incomes, and an ageing population in nations such as China, Japan, and India are all contributors to this expansion.

Furthermore, there is an increasing prevalence of dry mouth-inducing conditions and medications in the area. Consequently, there is an increasing need for efficacious solutions that alleviate parched mouths. In addition to the expanding healthcare infrastructure and increased availability of dry mouth relief products, these factors contribute to the Asia Pacific market's explosive growth.

Fairfield’s Competitive Landscape Analysis

Prominent factors influencing competition in the market for dry mouth relief encompass strategies for product differentiation, brand positioning, and distribution. To differentiate their products and gain market share, businesses are emphasizing on developing novel formulations that incorporate natural and herbal components.

In addition, to extend market penetration, the significance of strategic alliances with retail channels and healthcare practitioners is growing. In addition, the competitive environment is being transformed by mergers and acquisitions among major participants, as larger firms strive to solidify their market position and attain economies of scale.

Who are the Leaders in the Global Dry Mouth Relief Space?

- Johnson & Johnson Services, Inc.

- Procter & Gamble

- GlaxoSmithKline Plc

- 3M

- Colgate-Palmolive

- Sanofi

- Mars, Incorporated

- Bioxtra

- Sunstar Suisse S.A.

- Fresh

An Expert’s Eye

Demand and Future Growth

Several foreseeable future factors are anticipated to sustain the expansion of the dry mouth relief industry over an extended period. Initially, it is anticipated that the prevalence of conditions causing dry mouth will rise due to the ageing of the global population, thereby maintaining the demand for relief products. Additionally, increasing knowledge and understanding regarding the significance of preserving ideal moisture levels in the buccal cavity will contribute to the expansion of the market.

Moreover, technological innovations and product developments that are designed to improve convenience and effectiveness are likely to appeal to a greater number of consumers. The confluence of these factors indicates a sanguine future for the market's growth in the distant future.

Supply Side of the Market

The demand-supply dynamics in the dry mouth relief market exhibit a relatively stable state on the supply side. In the light of increasing consumer demand, manufacturers are augmenting their product portfolios and increasing production capacity to accommodate a wider range of consumer preferences.

Nonetheless, supply chain challenges and price fluctuations in basic materials, such as those resulting from natural disasters or geopolitical tensions, may affect production costs. However, by implementing strategic sourcing and inventory management practices, these risks can be mitigated and a steady supply to satisfy market demand can be maintained.

Global Dry Mouth Relief Market is Segmented as Below:

By Product Type:

- Sprays

- Mouthwash

- Gels

- Lozenges

By Distribution Channel:

- Pharmacies

- e-Commerce

- Hypermarkets/Supermarkets

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Dry Mouth Relief Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Dry Mouth Relief Market Outlook, 2018 - 2030

3.1. Global Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Sprays

3.1.1.2. Mouthwash

3.1.1.3. Gels

3.1.1.4. Lozenges

3.2. Global Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Pharmacies

3.2.1.2. e-Commerce

3.2.1.3. Hypermarkets/Supermarkets

3.3. Global Dry Mouth Relief Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Dry Mouth Relief Market Outlook, 2018 - 2030

4.1. North America Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Sprays

4.1.1.2. Mouthwash

4.1.1.3. Gels

4.1.1.4. Lozenges

4.2. North America Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Pharmacies

4.2.1.2. e-Commerce

4.2.1.3. Hypermarkets/Supermarkets

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Dry Mouth Relief Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Dry Mouth Relief Market Outlook, 2018 - 2030

5.1. Europe Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Sprays

5.1.1.2. Mouthwash

5.1.1.3. Gels

5.1.1.4. Lozenges

5.2. Europe Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Pharmacies

5.2.1.2. e-Commerce

5.2.1.3. Hypermarkets/Supermarkets

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Dry Mouth Relief Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Dry Mouth Relief Market Outlook, 2018 - 2030

6.1. Asia Pacific Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Sprays

6.1.1.2. Mouthwash

6.1.1.3. Gels

6.1.1.4. Lozenges

6.2. Asia Pacific Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Pharmacies

6.2.1.2. e-Commerce

6.2.1.3. Hypermarkets/Supermarkets

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Dry Mouth Relief Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Dry Mouth Relief Market Outlook, 2018 - 2030

7.1. Latin America Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Sprays

7.1.1.2. Mouthwash

7.1.1.3. Gels

7.1.1.4. Lozenges

7.2. Latin America Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Pharmacies

7.2.1.2. e-Commerce

7.2.1.3. Hypermarkets/Supermarkets

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Dry Mouth Relief Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Dry Mouth Relief Market Outlook, 2018 - 2030

8.1. Middle East & Africa Dry Mouth Relief Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Sprays

8.1.1.2. Mouthwash

8.1.1.3. Gels

8.1.1.4. Lozenges

8.2. Middle East & Africa Dry Mouth Relief Market Outlook, by Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Pharmacies

8.2.1.2. e-Commerce

8.2.1.3. Hypermarkets/Supermarkets

8.2.1.4. Middle East & Africa Dry Mouth Relief Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.2.2. Key Highlights

8.2.2.1. GCC Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

8.2.2.2. GCC Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.2.3. South Africa Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

8.2.2.4. South Africa Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.2.5. Egypt Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

8.2.2.6. Egypt Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.2.7. Nigeria Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

8.2.2.8. Nigeria Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.2.9. Rest of Middle East & Africa Dry Mouth Relief Market by Product Type, Value (US$ Mn), 2018 - 2030

8.2.2.10. Rest of Middle East & Africa Dry Mouth Relief Market Distribution Channel, Value (US$ Mn), 2018 - 2030

8.2.3. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Distribution Channel Heatmap

9.2. Manufacturer vs Distribution Channel Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Johnson & Johnson Services, Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Type Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Procter & Gamble

9.5.2.1. Company Overview

9.5.2.2. Product Type Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. GlaxoSmithKline Plc

9.5.3.1. Company Overview

9.5.3.2. Product Type Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. 3M

9.5.4.1. Company Overview

9.5.4.2. Product Type Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Colgate-Palmolive

9.5.5.1. Company Overview

9.5.5.2. Product Type Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Biocrates Life Sciences AG,

9.5.6.1. Company Overview

9.5.6.2. Product Type Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Sanofi

9.5.7.1. Company Overview

9.5.7.2. Product Type Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Mars, Incorporated

9.5.8.1. Company Overview

9.5.8.2. Product Type Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Bioxtra

9.5.9.1. Company Overview

9.5.9.2. Product Type Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Sunstar Suisse S.A.

9.5.10.1. Company Overview

9.5.10.2. Product Type Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Dr. Fresh

9.5.11.1. Company Overview

9.5.11.2. Product Type Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |