Global Dry Separator Lithium Battery Market Forecast

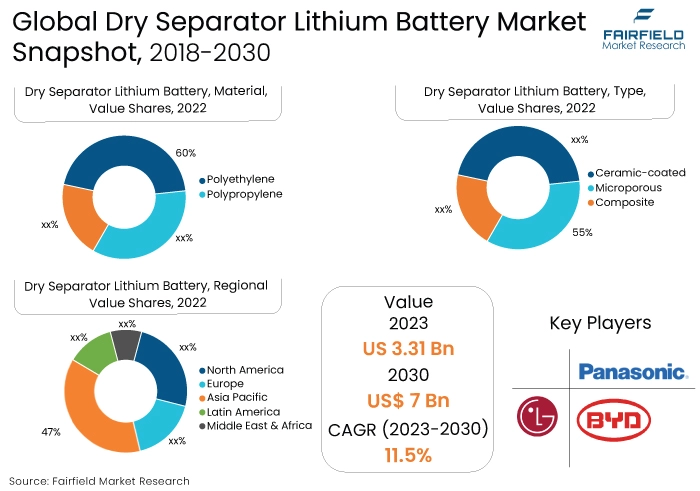

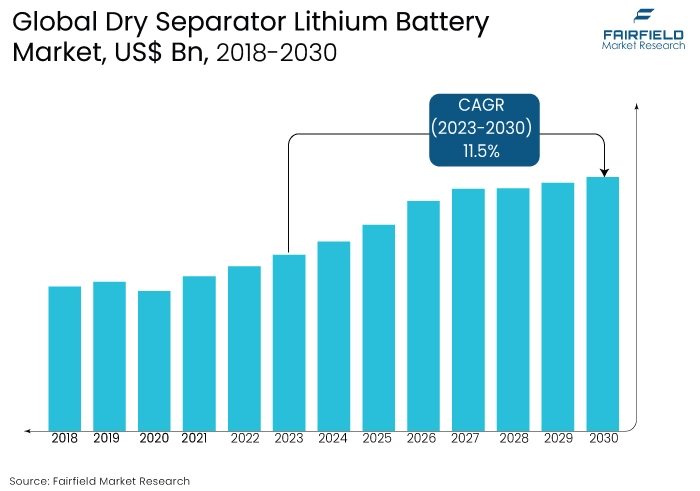

- Global dry separator lithium battery market size to take a leap from US$3.31 Bn in 2023 to approximately US$7 Bn by 2030

- Dry separator lithium battery market revenue poised for 11.5% CAGR between 2023 and 2030

Quick Report Digest

- The dry separator lithium battery market is growing due to increased demand for electric vehicles, renewable energy storage, and portable electronics. The technology's enhanced safety, improved energy density, and longer lifespan contribute to its appeal. Ongoing innovations and favourable market conditions position dry separator lithium batteries as key components in the evolving landscape of energy storage solutions.

- Another major market trend expected to fuel the growth of the dry separator lithium battery market is the rapidly expanding automotive industry. The market is also predicted to profit from the expanding worldwide consumer electronics industries.

- Microporous separators lead the dry separator lithium battery market due to their effective ion transport, preventing internal short circuits. Their porous structure allows efficient electrolyte permeation, enhancing battery performance. Microporous separators strike a balance between safety, reliability, and affordability, making them the preferred choice for diverse applications, including electric vehicles and portable electronics.

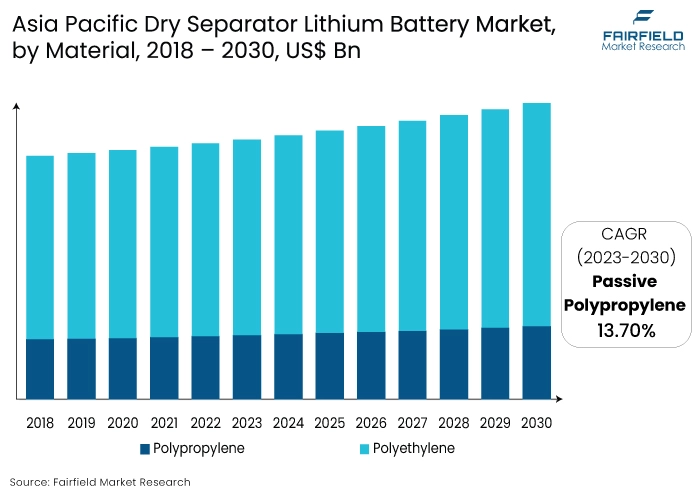

- Polyethylene material dominates the dry separator lithium battery market due to its favourable properties, providing good mechanical strength, thermal stability, and chemical resistance. Its cost-effectiveness further contributes to its widespread adoption. Polyethylene separators offer a reliable and affordable solution, making them the preferred choice and capturing the largest market share.

- The automotive sector leads the dry separator lithium battery market due to the escalating demand for electric vehicles (EVs). Dry separators offer safety, energy density, and longevity, making them ideal for EV applications. The global push toward sustainable transportation cements the automotive industry's dominance and its capture of the largest market share.

- The growing demand for consumer electronics is a key driver for the dry separator lithium battery market. Dry separators offer high energy density and longer cycle life, making them ideal for portable devices. As consumer electronics become more powerful and long-lasting, the adoption of dry separators continues to rise, driving market growth.

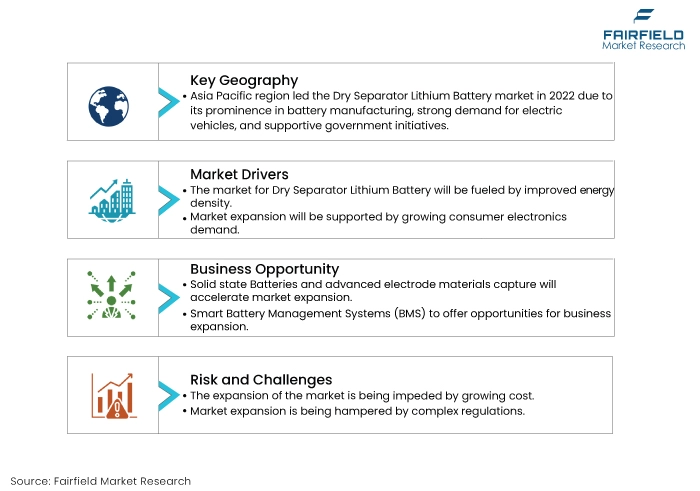

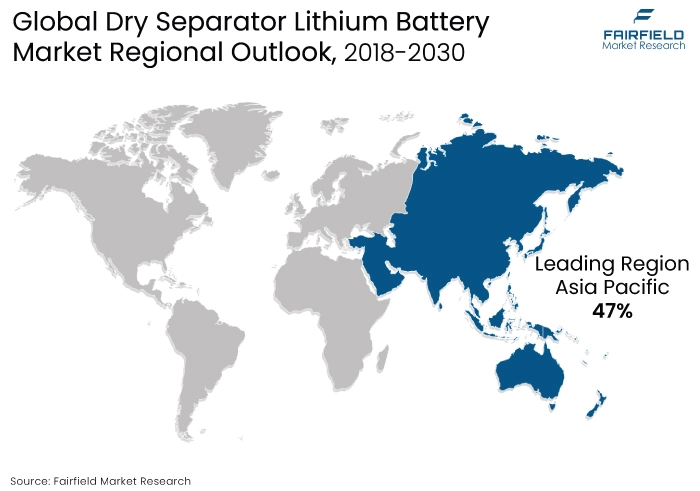

- The Asia Pacific region holds the largest market share in the dry separator lithium battery market due to its prominence in battery manufacturing, strong demand for electric vehicles, and supportive government initiatives. Ongoing technological advancements and a well-established supply chain contribute to the region's dominance in this rapidly growing market.

- North America is experiencing the highest CAGR in the dry separator lithium battery market due to increasing demand for electric vehicles, government support for clean energy initiatives, and technological advancements. The region's focus on sustainable transportation and favourable regulatory environment positions it for substantial growth in the dry separator lithium battery market.

A Look Back and a Look Forward - Comparative Analysis

The dry separator lithium battery market is experiencing significant growth due to its enhanced safety features, improved energy density, and longer lifespan compared to traditional lithium batteries. Dry separator technology eliminates the need for liquid electrolytes, reducing the risk of leakage and thermal runaway. This makes dry separator lithium batteries more appealing for various applications, including electric vehicles, renewable energy storage, and portable electronic devices, thus driving market expansion.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of major applications such as automotive, and consumer electronics. However, in some applications, the demand for dry separator lithium batterys has increased, including in energy storage and misc.

The future of the lithium battery market appears promising, driven by the increasing demand for electric vehicles, renewable energy storage, and portable electronic devices. Ongoing advancements in technology, coupled with efforts to improve energy density and reduce costs, will contribute to widespread adoption. Additionally, the integration of lithium batteries into various applications, such as grid storage and smart devices, positions the market for continued growth and innovation in sustainable energy solutions.

Key Growth Determinants

- Improved Energy Density

Improved energy density is a crucial driver for the adoption of dry separator lithium batteries. This technology allows for the creation of batteries with higher energy storage capacities in a more compact and lightweight form. The enhanced energy density addresses the growing demand for longer-lasting and more powerful batteries in applications such as electric vehicles and renewable energy storage.

As consumers and industries seek energy solutions with extended range and improved performance, the ability of dry separator lithium batteries to deliver superior energy density makes them a preferred choice. This feature not only meets current market needs but also positions these batteries as key contributors to the advancement of sustainable and high-performance energy storage technologies.

- Rocketing Consumer Electronics Demand

The growing demand for consumer electronics is a significant driver for the adoption of dry separator lithium batteries. Consumer electronics, such as smartphones, laptops, and wearables, increasingly rely on lithium batteries for their lightweight design, high energy density, and long cycle life. Dry separator technology further enhances these attributes by reducing the risk of leakage and improving overall safety.

As consumers seek more powerful and longer-lasting devices, the improved energy density of dry separator lithium batteries becomes a crucial factor. Their compatibility with the compact form factors of modern gadgets, coupled with a focus on safety and sustainability, positions dry separator batteries as a preferred choice in meeting the evolving needs of the consumer electronics market.

- Advancements in Technology

Advancements in technology are propelling the adoption of dry separator lithium batteries by addressing key challenges and improving overall performance. Ongoing innovations focus on optimising the design of dry separator technology, leading to enhanced safety, increased energy density, and longer cycle life. Advanced manufacturing processes and materials contribute to the scalability, and cost-effectiveness of these batteries.

As technology evolves, dry separator lithium batteries become more competitive and suitable for diverse applications, including electric vehicles, renewable energy storage, and portable electronics. The continuous integration of cutting-edge solutions positions dry separator batteries as a forefront choice, driving their market share and solidifying their role in the transition towards high-performance and sustainable energy storage technologies.

Major Growth Barriers

- Growing Costs

Growing costs pose a challenge to the widespread adoption of dry separator lithium batteries. The technology involves specialised manufacturing processes and materials, contributing to higher production expenses compared to traditional lithium-ion batteries with liquid electrolytes. This cost factor can limit the competitiveness of dry separator batteries, especially in price-sensitive markets.

As industries and consumers seek cost-effective energy storage solutions, the affordability of batteries becomes a critical factor. Striking a balance between performance improvements and cost reduction remains a challenge for the commercial viability and broader acceptance of dry separator lithium batteries in the market.

- Complex Regulations

Complex regulations present a challenge to the widespread adoption of dry separator lithium batteries. Stringent and evolving regulations governing the production, transportation, and disposal of batteries can increase compliance costs and create barriers to market entry.

Different standards across regions may complicate global supply chains. Manufacturers must navigate these regulations to ensure safety, environmental responsibility, and product quality. Additionally, meeting diverse regulatory requirements adds complexity to research, development, and production processes.

The ability to navigate and comply with these complex regulations is crucial for the successful integration of dry separator lithium batteries into various industries and markets.

Key Trends and Opportunities to Look at

- Solid-State Batteries

Research and development efforts are focusing on solid-state battery technology, which replaces the liquid or gel electrolyte with a solid electrolyte. Solid-state batteries offer potential advantages in terms of safety, energy density, and lifespan.

- Advanced Electrode Materials

Innovations in electrode materials, such as silicon-based anodes and high-capacity cathodes, aim to enhance the energy density and overall performance of dry separator lithium batteries.

- Smart Battery Management Systems (BMS)

Integration of sophisticated BMS enhances battery performance, optimises charging and discharging cycles, and ensures safety, contributing to the longevity of dry separator batteries.

How Does the Regulatory Scenario Shape this Industry?

Regulatory frameworks for the dry separator lithium battery market vary globally and can impact market dynamics significantly. Entities like the U.S. Federal Aviation Administration (FAA), and the International Civil Aviation Organization (ICAO) regulate transportation due to safety concerns. In the EU, directives such as RoHS restrict the use of hazardous substances in electronic products, influencing the manufacturing of lithium batteries.

Regional recycling and waste management regulations also affect the market. China's regulations on electric vehicles influence the demand for lithium batteries in the automotive sector. The UN Manual of Tests and Criteria outlines international standards for transporting lithium batteries. Ongoing and evolving regulatory changes worldwide, such as updates to safety standards and environmental regulations, directly influence the production, distribution, and adoption of dry separator lithium batteries.

Fairfield’s Ranking Board

Top Segments

- Microporous Type Category Dominant with Improved Performance and Safety

The microporous type has captured the largest market share in the dry separator lithium battery market due to its excellent properties. Microporous separators provide effective ion transport while maintaining a barrier to prevent internal short circuits. Their porous structure allows for efficient electrolyte permeation, enhancing battery performance.

Microporous separators also contribute to improved safety by minimising the risk of thermal runaway. As a result, their combination of high-performance characteristics, safety features, and widespread adoption in various applications, including electric vehicles and portable electronics, has positioned microporous separators as a dominant choice in the dry separator lithium battery market.

The ceramic-coated type is all set for a significant CAGR through 2030 as it enhances the thermal stability and mechanical strength of separators, contributing to improved safety and durability. This type offers better resistance to high temperatures and exhibits superior thermal shutdown characteristics.

As safety and performance become critical factors in various applications, the ceramic-coated type is gaining traction, especially in electric vehicles and energy storage systems. The increased focus on safety and longevity has propelled the growth of ceramic-coated separators at a higher CAGR in the market.

- Polyethylene Material Surges Ahead on Account of Versatility, and Cost Efficiency

Polyethylene material has captured the largest market share in the dry separator lithium battery market due to its favourable characteristics. Polyethylene separators offer good mechanical strength, thermal stability, and chemical resistance. They effectively prevent internal short circuits and provide reliable ion transport, contributing to the overall performance and safety of lithium batteries.

Additionally, polyethylene is a cost-effective material, making it a preferred choice for manufacturers seeking an optimal balance between performance and affordability. The widespread adoption of polyethylene separators in various applications, including electric vehicles and consumer electronics, has solidified its position as a dominant material in the dry separator lithium battery market.

Polypropylene separators offer good chemical resistance, thermal stability, and excellent dielectric properties. They are particularly well-suited for high-performance and safety-critical applications such as electric vehicles and energy storage systems.

The versatility and cost-effectiveness of polypropylene, coupled with ongoing research and development efforts to enhance its performance, are driving its increased adoption. As demand for lithium batteries continues to rise, especially in emerging applications, polypropylene separators are witnessing significant growth in market share.

- Automotive Industry to be the Largest End-Use Industry

The automotive end-use industry has captured the largest market share in the dry separator lithium battery market due to the surge in demand for electric vehicles (EVs). As the automotive sector transitions toward cleaner and more sustainable technologies, lithium batteries with dry separators play a crucial role in powering EVs.

The safety, energy density, and longer lifespan offered by dry separators make them a preferred choice. With global initiatives to reduce carbon emissions and increase the adoption of electric mobility, the automotive industry dominates the dry separator lithium battery market, driving innovations and substantial market growth.

Increasing demand for portable electronic devices is elevating the market psotioning of the consumer electronics segment in the market. Dry separator lithium batteries provide advantages such as high energy density, lightweight design, and longer cycle life, making them ideal for consumer electronics like smartphones, laptops, and wearables.

As consumers seek more powerful and longer-lasting devices, the adoption of dry separator batteries in the consumer electronics sector is accelerating. The ongoing technological advancements and innovations specifically catered to consumer electronics applications contribute to the industry's robust CAGR.

Regional Frontrunners

Asia Pacific at the Forefront of revenue Contribution

The Asia Pacific region has captured the largest market share in the dry separator lithium battery market due to several factors. This region is a major hub for battery manufacturing and electronic device production, fostering a high demand for lithium batteries. The rapid adoption of electric vehicles, particularly in countries like China, contributes significantly to the market share.

Moreover, the region benefits from extensive research and development activities, technological advancements, and a robust supply chain. Supportive government policies, incentives, and investments in renewable energy and electric mobility further propel the growth of the dry separator lithium battery market in the Asia Pacific, solidifying its position as the dominant market player.

North America Likely to Witness the Significant Growth in Sales During Forecast Period

The growth of the dry separator lithium battery market in North America is expected to witness the highest CAGR during the forecast period. Market growth here is primarily driven by the rising demand for EVs, and renewable energy storage solutions. With both governments and consumers increasingly prioritising environmental sustainability, EV adoption has seen a notable surge - necessitating advanced, efficient, and safer battery technologies. Dry separators, which enhance battery performance by improving thermal stability and lifespan, align well with these needs.

Additionally, the expansion of renewable energy sources, like solar and wind power, requires robust energy storage systems, further boosting the market. Technological advancements, and substantial R&D investments also contribute to the market's growth, ensuring continuous innovation, and improvement in battery efficiency and safety. Moreover, supportive government policies, and incentives for clean energy, and electric mobility play a crucial role in driving the adoption and development of dry separator lithium batteries in the region.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the dry separator lithium battery market is dynamic, featuring key players like Tesla, Panasonic, and CATL. These companies are engaged in continuous innovation to enhance safety, energy density, and production efficiency. New entrants, collaborations, and strategic partnerships contribute to market evolution. Factors such as technological advancements, cost competitiveness, and global expansion strategies are critical in shaping the competitive dynamics of this rapidly growing market.

Who are the Leaders in the Global Dry Separator Lithium Battery Space?

- Panasonic Corporation

- G. Chem Ltd.

- BYD Company Limited

- Samsung SDI Co. Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- A123 Systems LLC

- EnerDel

- SK Innovation Co., Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Sony Corporation

- SK Innovation Co., Ltd.

- Wanxiang Group Corporation

Significant Company Developments

New Product Launch

- November 2022: The Battery Materials Processing and Battery Manufacturing division of the U.S. Department of Energy has disclosed intentions to invest $0.2 billion in partnership with General Motors and Microvast. The objective is to advance specialised electric vehicle battery separators.

- April 2022: ENTEK has revealed its expansion strategy in the United States to address the growing demand in the lithium-ion battery separator market. The company aims to conclude the initial phase of expansion by 2025, followed by ongoing expansion efforts until 2027. The projected outcome is a total production capacity of 1.4 billion square meters, providing ample material for separators to support around 1.4 billion electric vehicles.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for Automotive is driving the market. The dry separator lithium battery market is experiencing robust demand driven by the rising adoption of electric vehicles, increasing demand for portable electronics, and the growing emphasis on sustainable energy solutions.

As technology advances and safety concerns are addressed, the market is poised for substantial future growth. The need for high-performance and long-lasting energy storage solutions fuels the demand. With ongoing innovations and favourable regulatory support, the dry separator lithium battery market is positioned for significant expansion in the foreseeable future.

Supply Side of the Market

The demand for dry separator lithium batteries is currently outpacing supply due to the escalating adoption of electric vehicles and portable electronics. This demand-supply gap is impacting pricing structures, resulting in higher prices. Production costs, technological advancements, and material availability influence the current pricing landscape. Pricing will play a pivotal role in long-term growth, as competitive costs are crucial for market penetration.

Major trends driving competition include innovations in battery technology, safety enhancements, and sustainable practices. Supply chain analysis reveals dependencies on raw materials, manufacturing efficiency, and global logistics. Collaborative efforts, regulatory compliance, and strategic partnerships will be key factors shaping the market's future dynamics and sustainability.

Global Dry Separator Lithium Battery Market is Segmented as Below:

By Type:

- Microporous

- Ceramic-coated

- Composite

By Material:

- Polyethylene

- Polypropylene

By End-Use Industry:

- Automotive

- Consumer Electronics

- Energy Storage

- Misc

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Dry Separator Lithium Battery Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Dry Separator Lithium Battery Market Outlook, 2018 - 2030

3.1. Global Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Microporous

3.1.1.2. Ceramic-coated

3.1.1.3. Composite

3.2. Global Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Polyethylene

3.2.1.2. Polypropylene

3.3. Global Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Automotive

3.3.1.2. Consumer Electronics

3.3.1.3. Energy Storage

3.3.1.4. Misc

3.4. Global Dry Separator Lithium Battery Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Dry Separator Lithium Battery Market Outlook, 2018 - 2030

4.1. North America Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Microporous

4.1.1.2. Ceramic-coated

4.1.1.3. Composite

4.2. North America Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Polyethylene

4.2.1.2. Polypropylene

4.3. North America Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Automotive

4.3.1.2. Consumer Electronics

4.3.1.3. Energy Storage

4.3.1.4. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Dry Separator Lithium Battery Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Dry Separator Lithium Battery Market Outlook, 2018 - 2030

5.1. Europe Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Microporous

5.1.1.2. Ceramic-coated

5.1.1.3. Composite

5.2. Europe Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Polyethylene

5.2.1.2. Polypropylene

5.3. Europe Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.2. Consumer Electronics

5.3.1.3. Energy Storage

5.3.1.4. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Dry Separator Lithium Battery Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Dry Separator Lithium Battery Market Outlook, 2018 - 2030

6.1. Asia Pacific Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Microporous

6.1.1.2. Ceramic-coated

6.1.1.3. Composite

6.2. Asia Pacific Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Polyethylene

6.2.1.2. Polypropylene

6.3. Asia Pacific Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.2. Consumer Electronics

6.3.1.3. Energy Storage

6.3.1.4. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Dry Separator Lithium Battery Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Dry Separator Lithium Battery Market Outlook, 2018 - 2030

7.1. Latin America Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Microporous

7.1.1.2. Ceramic-coated

7.1.1.3. Composite

7.2. Latin America Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Polyethylene

7.2.1.2. Polypropylene

7.3. Latin America Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.2. Consumer Electronics

7.3.1.3. Energy Storage

7.3.1.4. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Dry Separator Lithium Battery Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Dry Separator Lithium Battery Market Outlook, 2018 - 2030

8.1. Middle East & Africa Dry Separator Lithium Battery Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Microporous

8.1.1.2. Ceramic-coated

8.1.1.3. Composite

8.2. Middle East & Africa Dry Separator Lithium Battery Market Outlook, by Material, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Polyethylene

8.2.1.2. Polypropylene

8.3. Middle East & Africa Dry Separator Lithium Battery Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.2. Consumer Electronics

8.3.1.3. Energy Storage

8.3.1.4. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Dry Separator Lithium Battery Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Dry Separator Lithium Battery Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Dry Separator Lithium Battery Market Material, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Dry Separator Lithium Battery Market End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use Industry vs End-use Industry Heatmap

9.2. Manufacturer vs End-use Industry Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Panasonic Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. LG Chem Ltd.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. BYD Company Limited

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Samsung SDI Co. Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. CATL

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Codamotion

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. A123 Systems LLC

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Noitom Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. EnerDel

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. SK Innovation Co., Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Tianjin Lishen Battery Joint-Stock Co., Ltd.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Sony Corporation

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Phoenix Technologies Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Wanxiang Group Corporation

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. SK Innovation Co., Ltd.

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Material Coverage |

|

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |