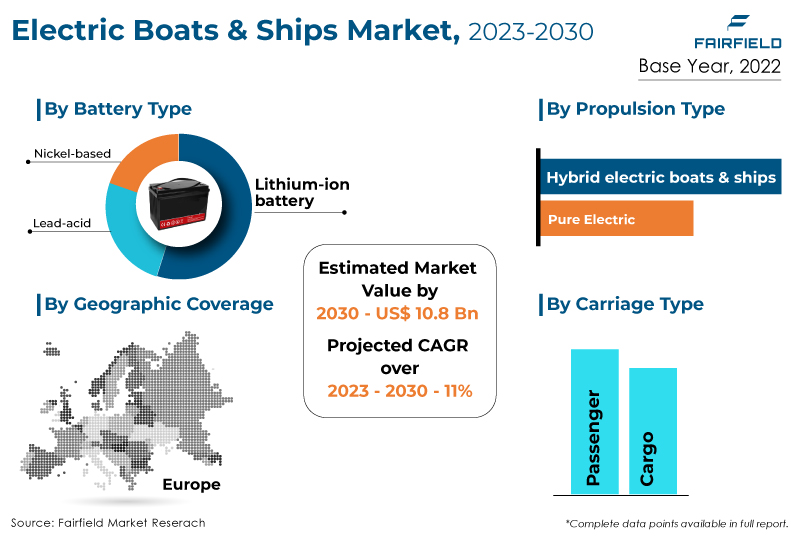

The global electric boats & ships market will rise at a significant pace of about 11% CAGR during the period of assessment 2023 - 2030, reaching a market value of around US$10.87 Bn by the end of 2030.

Market Analysis in Brief

Electric boats are nautical craft that use electric motors as their primary form of propulsion. These boats propel their rotors using battery power to achieve their maximum speed. Pure electric, hydrogen fuel cell electric, or hybrid electric boats are all forms of electric propulsion. An electric charger, battery bank, controller, and electric motor are essential elements of an electric boat. An electric motor of the boat transforms direct current into alternating current and improves boat control and orientation. Electric boats & ships are powered by clean energy and operate on batteries, hence are not responsible for pollution. Due to advancements in sensor technology for environmental monitoring and improved navigation, opportunities have developed for maritime shipping companies. To achieve their maximum speed, electric boats propel their rotors using battery power. The early take-off of electric engines over combustion engines is a significant advantage.

Key Report Findings

- The market for electric boats & ships will demonstrate more than 4x expansion in revenue over the decade, i.e., between 2023 and 2030.

- The hybrid demand for electric boats & ships will boost the market.

- Demand for lithium-ion remains higher in the electric boats & ships market.

- The passenger category held the highest electric boats & ships market revenue share in 2022.

- Europe will continue to lead, whereas the North America Electric boats & ships market will experience the strongest growth till 2030.

Growth Drivers

Global Expansion of Maritime Tourism Business

Maritime tourism which includes boating, cruising, yachting, and participating in nautical sports has been more popular recently all over the world. According to a World Economic Forum analysis, maritime and coastal tourism is predicted to increase. Additionally, several governments have launched campaigns to promote maritime travel and tourism. For instance, the Indian government planned to create 78 maritime tourism landmarks nationwide in 2021 to support the transformation of existing lighthouses and their surroundings into distinctive maritime tourism monuments.

The ships comprising yachts, ferries, and cruise ships or vessels typically have fossil fuel-powered engines, which produce harmful pollutants, including CO2, and nitrogen oxides. To boost maritime tourism activities and minimise carbon footprints and pollution, boat manufacturers have begun to produce electric-powered boats and ships, supporting market growth. For instance, Candela debuted its P-8 Voyager electric yacht in 2022. The vessel is intended to be a long-distance tourist water taxi. It travels at a speed of 22 knots and has a range of 40 nautical miles.

Increase in Maritime Trade Activity

The shipping industry is responsible for around 3% of the world's greenhouse gas emissions, transporting about 90% of all commodities. According to the United Nations Conference on Commerce and Development, maritime commerce growth would decelerate to 2.4% annually between 2022 and 2026 from 2.9% between 2000 and 2020. The adoption of electric boats will be boosted throughout the predicted period by increased seaborne trade operations brought on by rising consumer expenditure on products and the expansion of the eCommerce sector.

Diesel engines, which contribute to pollution by releasing toxic gases, are frequently used in ships to transport products via maritime routes. However, manufacturers of boats or ships are concentrating on the creation and implementation of electric ships for the transportation of commodities, which is anticipated to help the industry grow.

For instance, the Japanese shipping business Asahi Tanker presented their new electric ship in 2021. This ship is powered only by lithium-ion batteries provided by Corvus Energy. It is believed that the new ship would help Japan's shipping industry combat air pollution and carbon dioxide emissions from ships. As a result, market growth is anticipated to be fuelled by increased seaborne commerce activities.

Market Challenges

High Initial Investment

Retrofit ships with electric or hybrid propulsion systems demand more time and huge investments. Depending on the type of ship and configuration chosen, the capital expenditure needed to retrofit the ship alone is substantial and can reach millions of dollars. An additional element to consider while retrofitting is revenue loss resulting from the non-operation of their old ships.

According to Switzerland-based Leclanché, the average payback period for passenger ferries would be between five and six years. Therefore, to help reduce capital expenditure, ship owners should consider the current estimated life of the ship, the ship's potential to earn enough to repay the capital expenditure in the shortest amount of time, and the scrap value at the end of the life.

It has thus become more advantageous for ship owners to sell their old vessels and buy new ones that will last for 10 to 15 years. Shipowners are experiencing a significant decline in profits. Thus they do not want to invest in assets that will no longer be useful owing to evolving rules.

Overview of Key Segments

Hybrid Propulsion Technology Dominates

The electric boats & ships market is dominated by the hybrid category owing to its reduced fuel usage by over 20% and ship CO2 emissions by up to 15%. Increasing the adoption of zero-emission transportation systems and lowering carbon emissions support the hybrid segment's supremacy which combines both the electric and conventional propulsion systems. In addition to helping with enhanced range and handling heavier load needs, hybrid propulsion also provides for lower emissions.

Numerous firms worldwide have been encouraged to switch to green technology in their applications due to rising pollution levels and increased awareness of the need to conserve the environment. These boats contribute to a decrease in the atmospheric emissions of hazardous gases. Many countries all around the world have put in place emission guidelines or rules that control air pollution and outline the maximum quantity that can be discharged into the atmosphere by switching to battery-based technology. However, difficulty in designing longer voyages with electric boats due to the frequent need for docking to recharge their batteries is posing a challenge to the market.

Passenger Boats Maintain Momentum

The passenger category will dominate the electric boats & ships market over the forecast period. Since electric passenger boats are mostly used for recreational purposes, their designers prioritise creating a comfortable and appealing interior for the passengers. Additionally, because they are more frequently inland vessels that cover shorter distances than cargo ships, commercial vessels, particularly commercial passenger vessels are seeing an increase in the adoption of electric ship solutions. Passenger ferries are the category of passenger ships that are growing the fastest.

Demand for electric boats grows as cities become more populated, living standards improve, and people's spending power increases. Additionally, the market is expanding due to the growing trend and propensity of people toward recreational activities. One of the main drivers of the expansion of the electric boat market is the expanding tourism sector. In addition, electric boats' importance has increased for other tasks like maritime patrol, criminal surveillance, and rescue operations.

Growth Opportunities Across Regions

Europe Spearheads

The electric boats & ships market will continue to dominate in Europe due to the presence of major players, OEMs, and component makers, which are some of the factors anticipated to spur the growth of the electric ship market in the region. Electric boat manufacturers are seen to be continually spending on research and development to create solutions that are more dependable and efficient.

Additional factors influencing the growth of the electric ship market in Europe include their rising demand for civil and commercial applications and growing utility in the defence sector for carrying out persistent transport and surveillance activities. ABB (Switzerland), Leclanché S.A. (Switzerland), Siemens AG (Germany), Wartsila (Finland), and Kongsberg Gruppen (Norway) are some of the key manufacturers and providers of the electric ships in the region.

Furthermore, manufacturing businesses are also focusing on developing sophisticated battery systems to supply high-performance and longer-range batteries for boats. Numerous cities in this region are located next to seas and other bodies of water, which could present profitable business potential for electric boats.

Asia Pacific Develops a Lucrative Market

The market for electric boats & ships across the Asia Pacific will display a significant CAGR over the forecast period. Even though Asia Pacific is most likely to develop more quickly overall, South Asian countries are anticipated to be prominent players owing to the region's expanding environmental regulations and emission standards.

Technological advancements, including improved battery storage systems, more seaborne trade, and marine tourism, fuel the region's rapid expansion in the emerging economies of India, China, and Japan. Additionally, increasing demand for electric recreational and leisure vessels for fishing, water sports, and marine tourism is further propelling the market growth.

Electric Boats & Ships Market: Competitive Landscape

Some of the leading players at the forefront in the electric boats & ships market space include Vision Marine Technologies Inc., Wärtsilä, Grove Boats SA, Leclanche S.A., Siemens AG, Navalt, Inc., Ruban Bleu, ElectraCraft Boats, Greenline Yachts, Domani Yachts, Ganz Boats GmbH, Quadrofoil, Duffy Electric Boats, Groupe Beneteau, Hyundai Heavy Industries (Hyundai Electric Limited), Daewoo Shipbuilding and Marine Engineering (DSME), ABB Ltd, and Corvus Energy.

Key Company Developments

In March 2023, two new 110-meter-long amphibious transport ships are being built for the Chilean Navy. Wärtsilä will provide the primary propulsion gear and various additional equipment and systems which are ordered by the state-owned shipyard- Astilleros y Maestranzas de la Armada (ASMAR).

In February 2023, SDO-SuRS (Special and Diving Operations - Submarine Rescue Ship), which will be constructed by the Italian shipyard T.Mariotti for the Marina Militare Italiana (The Italian Navy), will receive a variety of equipment from Kongsberg Maritime (KONGSBERG).

In January 2023, For the next generation of hybrid ferries in the maritime sector, Leclanché got orders for 22.6 MWh of battery systems in January 2023 from Stena RoRo and Brittany Ferries.

The Global Electric Boats & Ships Market is Segmented as Below:

By Propulsion Type

- Hybrid

- Pure Electric

By Battery Type

- Lead-acid

- Lithium-ion

- Nickel-based

By Carriage Type

- Passenger

- Cargo

By Geographic Coverage

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- France

- Italy

- Norway

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Rest of the World

- Latin America

- Middle East and Africa

Leading Companies

- Vision Marine Technologies Inc.

- Kongsberg

- Siemens AG

- Leclanche S.A.

- Wärtsilä

- Navalt, Inc.

- ABB Ltd.

- Grove Boats SA

- Yara International ASA

- Hyundai Heavy Industries (Hyundai Electric Limited)

- GE Power Conversion, part of GE Vernova

- Others

1. Executive Summary

1.1. Global Electric Boats & Ships Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Electric Boats & Ships Market Outlook, 2018 - 2030

3.1. Global Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Hybrid

3.1.1.2. Pure Electric

3.2. Global Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Lead-acid

3.2.1.2. Lithium-ion

3.2.1.3. Nickel-based Batteries

3.3. Global Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Passenger

3.3.1.2. Cargo

3.4. Global Electric Boats & Ships Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Electric Boats & Ships Market Outlook, 2018 - 2030

4.1. North America Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Hybrid

4.1.1.2. Pure Electric

4.2. North America Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Lead-acid

4.2.1.2. Lithium-ion

4.2.1.3. Nickel-based Batteries

4.3. North America Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Passenger

4.3.1.2. Cargo

4.3.2. Market Attractiveness Analysis

4.4. North America Electric Boats & Ships Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Electric Boats & Ships Market Outlook, 2018 - 2030

5.1. Europe Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Hybrid

5.1.1.2. Pure Electric

5.2. Europe Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Lead-acid

5.2.1.2. Lithium-ion

5.2.1.3. Nickel-based Batteries

5.3. Europe Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Passenger

5.3.1.2. Cargo

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Electric Boats & Ships Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.13. Norway Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Norway Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.15. Norway Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Electric Boats & Ships Market Outlook, 2018 - 2030

6.1. Asia Pacific Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Hybrid

6.1.1.2. Pure Electric

6.2. Asia Pacific Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Lead-acid

6.2.1.2. Lithium-ion

6.2.1.3. Nickel-based Batteries

6.3. Asia Pacific Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Passenger

6.3.1.2. Cargo

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Electric Boats & Ships Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Electric Boats & Ships Market Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Electric Boats & Ships Market Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Electric Boats & Ships Market Outlook, 2018 - 2030

7.1. Latin America Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Hybrid

7.1.1.2. Pure Electric

7.2. Latin America Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

7.1.2. Key Highlights

7.2.1.1. Lead-acid

7.2.1.2. Lithium-ion

7.2.1.3. Nickel-based Batteries

7.3. Latin America Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

7.1.3. Key Highlights

7.3.1.1. Passenger

7.3.1.2. Cargo

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Electric Boats & Ships Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

7.4.1.7. Rest of Latin America Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Rest of Latin America Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

7.4.1.9. Rest of Latin America Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Electric Boats & Ships Market Outlook, 2018 - 2030

8.1. Middle East & Africa Electric Boats & Ships Market Outlook, by Propulsion Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Hybrid

8.1.1.2. Pure Electric

8.2. Middle East & Africa Electric Boats & Ships Market Outlook, by Battery Type, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Lead-acid

8.2.1.2. Lithium-ion

8.2.1.3. Nickel-based Batteries

8.3. Middle East & Africa Electric Boats & Ships Market Outlook, by Carriage Type, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Passenger

8.3.1.2. Cargo

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Electric Boats & Ships Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

8.4.1.7. Rest of Middle East & Africa Electric Boats & Ships Market by Propulsion Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Rest of Middle East & Africa Electric Boats & Ships Market by Battery Type, Value (US$ Bn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Electric Boats & Ships Market by Carriage Type, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Carriage Type Heatmap

9.2. Manufacturer vs Carriage Type Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Vision Marine Technologies Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Kongsberg

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Siemens AG

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Leclanche S.A.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Wärtsilä

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Navalt, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. ABB Ltd

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Grove Boats SA

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Yara International ASA

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Hyundai Heavy Industries (Hyundai Electric Limited)

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. GE Power Conversion, part of GE Vernova

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million Volume: Million Tons |

||

|

REPORT FEATURES |

DETAILS |

|

Propulsion Type Coverage |

|

|

Battery Type Coverage |

|

|

Carriage Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |