Global Electric Brooms Market Forecast`

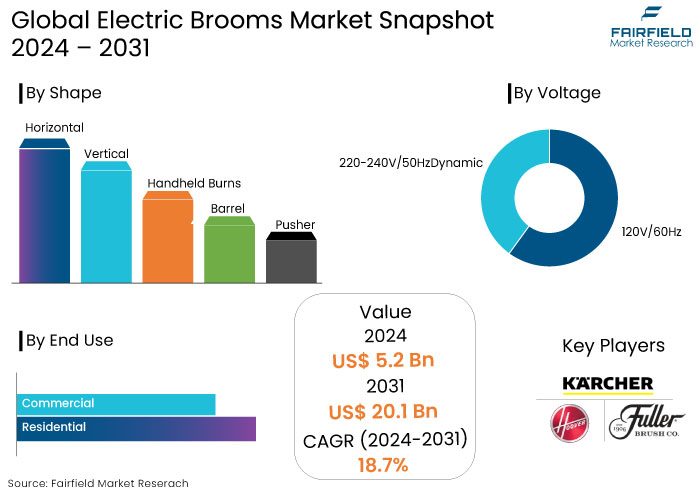

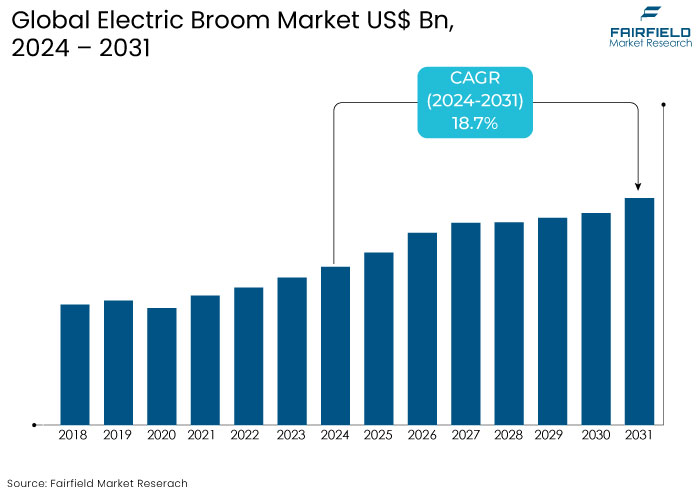

- The electric brooms market is projected to be valued at US$20.1 Bn by 2031, exhibiting significant growth from the US$5.2 Bn achieved in 2024.

- The market for electric brooms is expected to show a significant expansion rate with an a remarkable CAGR of 18.7% during the forecast period between 2024 and 2031.

Electric Brooms Market Insights

- Increasingly busy lifestyles especially among millennials are leading to a preference for lightweight and cordless electric brooms.

- The residential sector is anticipated to experience the significant growth in the electric brooms market due to urbanization and the need for compact cleaning devices in small living spaces.

- Increasing concerns over allergies and respiratory issues make electric brooms with advanced filtration systems appealing to consumers.

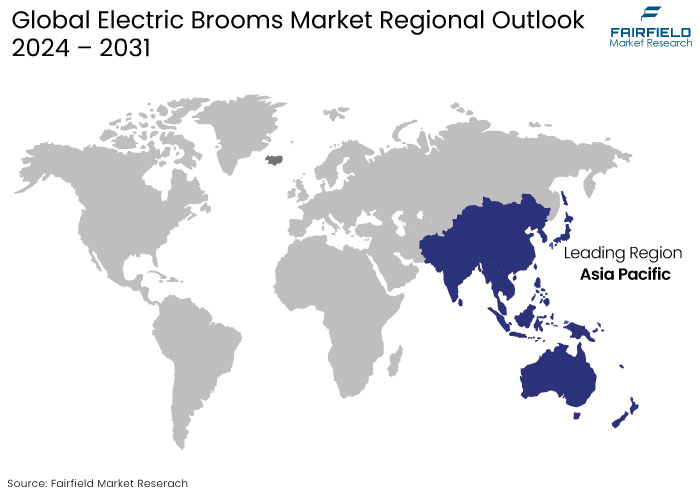

- Asia Pacific remains a significant market driven by consumer preferences for cleanliness and convenient cleaning solutions.

- Rising consumer interest in eco-friendly products prompts manufacturers to explore sustainable materials and energy-efficient technologies.

- Companies in the electric broom market have embraced acquisition as a central strategy for growth, allowing them to enhance their geographic presence and innovate their product technologies.

- Electric brooms represent cutting-edge technology, and leading companies in the industry are leveraging innovative advancements to enhance battery longevity and cleaning efficiency

A Look Back and a Look Forward - Comparative Analysis

The electric brooms market is highly competitive, with key players focusing on innovation, product differentiation, and strategic collaborations to gain significant market share. Prominent companies like SharkNinja, BISSELL, Dyson, and Hoover dominate the market offering a range of electric brooms featuring advanced cleaning technologies, cordless designs, and enhanced battery life.

Small players are emerging with cost-effective and eco-friendly options intensifying competition. The rise in demand for lightweight and convenient cleaning solutions has driven companies to invest in research and development and expand their product portfolios.

Partnerships with retailers, strong online distribution channels, and marketing strategies are crucial in capturing consumer attention. Regional players especially in Asia Pacific and Europe are also gaining ground with products tailored to local preferences.

Key Growth Determinants

- Growing Older Population Drives Demand for Electric Brooms

Electric brooms employ a combination of suction and brushes to clean the floors with the least effort possible. Key factors driving global electric brooms market expansion include changing lifestyles, increasing disposable incomes, a growing working population, and rising purchasing power. The consistently increasing aging population and the shortage of personal care assistance drive sales boosting the market growth.

According to the United Nations Database on World Population Ageing 2020, the global geriatric population will expand from 727 million in 2020 to 1.5 billion by 2050. Hence, the expanding aging population will remain one of the key factors elevating the prospects of the market worldwide.

The prevalence of chronic and bone diseases increases with the growing elderly population. The growing number of such diseases will likely to propel demand to help alleviate rising age-related fatigue.

The number of persons over 50 with reduced bone mass including osteoporosis increased from 54 million to 64.4 million in 2020. By 2030, this figure will rise to 71.2 million (a 29% increase from 2010). The number of fractures is expected to rise correspondingly. The growing number of such diseases will further contribute toward the mounting sales of electric brooms thereby fuelling market growth.

- Increasing Demand for Convenience and Efficiency in Cleaning

One of the primary growth drivers for the electric brooms market is the rising demand for convenient, efficient cleaning solutions. Modern consumers especially those living in urban areas have increasingly busy lifestyles and prefer cleaning tools that save time and effort.

Electric brooms being lightweight, cordless, and easy to use offer a practical alternative to traditional vacuum cleaners and manual brooms. The practicality of electric brooms in compact living spaces particularly in apartments and small homes, where bulky vacuum cleaners are less practical, further enhances their appeal. Features like quick charge, improved battery life, and portability make them a preferred choice for space-saving cleaning equipment.

Key Growth Barriers

- High Initial Cost of Advanced Electric Brooms

One of the key growth restraints for the electric brooms market is relatively high initial cost of advanced models. While basic electric brooms may be affordable, those equipped with cutting-edge features like smart sensors, high-capacity batteries, and advanced brushless motors can be significantly more expensive. It limits their appeal to budget-conscious consumers, especially in price-sensitive markets.

In regions where traditional vacuum cleaners or manual brooms are more widely accepted, the cost difference can be a deterrent to adopting electric brooms. Consumers may hesitate to invest in premium models if they feel the cleaning performance does not justify the high price point, particularly when cheap alternatives are available. This price-sensitive behaviour can slow market penetration particularly in emerging economies.

- Limited Battery Life and Performance Issues

Another significant restraint for the electric brooms market is some models' battery life limitations and potential performance issues. While technological advancements have improved battery capacity, many electric brooms still offer limited runtime compared to corded vacuum cleaners. This can be a drawback for users with large homes or extended cleaning needs.

Battery degradation over time can lead to reduced efficiency, requiring costly battery replacements. Performance issues like inadequate suction power or difficulty cleaning thick carpets and heavy debris can also hinder widespread adoption.

Consumers who prioritize deep cleaning may find electric brooms less effective than traditional vacuums limiting the market growth potential particularly among users with specific cleaning requirements.

Electric Brooms Market Trends and Opportunities

- Rise of Cordless and Lightweight Designs

The increasing consumer preference for cordless and lightweight designs is a prominent trend shaping the electric brooms market. As technology has improved, cordless electric brooms have become efficient and capable of providing extended battery life and robust cleaning performance.

Consumers, particularly in urban areas and small households appreciate these models' flexibility and convenience. Cordless brooms eliminate the inconvenience of tangled cords and allow users to clean hard-to-reach areas without being constrained by an electrical outlet. This trend aligns with the broader shift toward portable, easy-to-store household appliances that cater to fast-paced, modern lifestyles.

The trend toward minimalism and decluttering in home interiors has fueled the demand for compact, lightweight cleaning tools that take up less space but remain effective. Manufacturers are responding by designing slim, ergonomic electric brooms that are easy to manoeuvre, especially for elderly users or individuals with limited mobility.

Brands like Dyson, SharkNinja, and Hoover have already capitalized on this trend by offering models that combine powerful suction with user-friendly portability. As technology continues to improve, consumers can expect more advanced features like longer battery life, fast charging, and better filtration systems, reinforcing the appeal of cordless and lightweight designs.

- Integration of Smart Technology

One of the most transformative opportunities in the electric brooms market is the integrating smart technology. As smart homes become more common, there is a growing demand for appliances that can be integrated into these systems including cleaning tools.

Electric brooms with smart features like Wi-Fi connectivity, app controls, and voice-activated assistants (like Alexa or Google Home) can offer users enhanced convenience and efficiency. These devices can be programmed to start cleaning at specific times, notify users about battery levels, or provide cleaning performance data in real-time.

By incorporating such intelligent features, manufacturers can attract tech-savvy consumers willing to invest in smart appliances that make household chores easy. The opportunity is particularly significant as consumers increasingly look for personalized, automated solutions that allow them to maintain cleanliness with minimal effort.

The rise of Internet of Things (IoT) technology also means electric brooms could eventually be integrated into broad smart cleaning systems, communicating with other smart devices like robotic vacuums or air purifiers for a fully automated home cleaning experience. Smart technology adds value and enables manufacturers to differentiate their products in a crowded market creating a premium segment with high profit margins.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario is increasingly shaping the electric brooms market particularly with a growing emphasis on energy efficiency and environmental sustainability. Governments and regulatory bodies across the globe are implementing strict guidelines for energy consumption in household appliances. For instance,

Regulations from the European Union's Eco-design Directive and the U.S. Department of Energy's energy efficiency standards require manufacturers to meet specific energy performance benchmarks. Non-compliance could result in restricted market access or penalties.

Increasing environmental concerns have led to strict regulations regarding using non-recyclable plastics and hazardous materials in product manufacturing. Many countries, particularly in Europe and North America, promote eco-friendly materials and sustainable production practices. These regulations encourage companies to adopt green manufacturing methods including using recyclable materials and energy-efficient designs.

Safety standards for electrical devices such as those imposed by Underwriters Laboratories (UL) and the International Electro Technical Commission (IEC), also govern the quality and safety of electric brooms. These evolving regulations shape product innovation, ensuring manufacturers prioritize sustainability and safety in their designs.

Segments Covered in the Report

- Cordless Electric Booms Remain Top Product Category

The cordless electric brooms are leading product type in the electric brooms market. This dominance is driven by several factors primarily their mobility, convenience, and growing technological advancements.

Cordless electric brooms offer a hassle-free cleaning experience without the limitations of power cords making them highly suitable for quick, on-the-go cleaning tasks and for reaching difficult areas like stairs, under furniture, and car interiors.

The cordless design allows users to move freely throughout their homes without switching outlets or dealing with tangled cords. This level of convenience is particularly appealing to urban consumers with small living spaces where manoeuvrability is essential.

Cordless electric brooms are generally lightweight and easy to store making them ideal for consumers who value minimalism and space-saving designs. This portability factor is significant for elderly users or those with limited physical mobility.

- Residential Sector to Stand Out with Increased Time Spent at Home

The residential segment will lead the electric brooms market during the forecast period, accounting for a significant share of the market. The increasing prevalence of allergies and asthma caused by dust and grime in residential settings and the need to keep homes clean will likely to increase demand for the electric brooms market.

The increasing availability of improved products that can successfully capture the small contaminants is driving market expansion in residential applications.

Regional Analysis

- Asia Pacific Region to Acquire Notable Market Share

Asia Pacific is estimated to dominate the global electric brooms market accounting for a significant market share during the forecast period with China being one of the most important markets. Some of the primary elements fuelling demand for electric brooms in the region are the strong presence of regional enterprises, the availability of low-cost products, and customers' high spending power.

The increasing electrification of rural areas and the widespread use of online sales channels in developing countries such as India are boosting the demand for electric brooms. Japan has seen significant expansion in the global market for electric brooms due to the introduction of new technologies and novel products.

China is the world's most significant manufacturing hub with numerous local robotic vacuum machine producers. These companies also provide high-tech items at reduced costs and with increased productivity.

China's industrial robot manufacturing volume was over 363,000 units in 2021, a more than 50 percent increase over 2020. As China's manufacturing capacity expands, so does the need for residential and commercial robots. On the other hand, yellow sand from the Gobi Desert causes home and business pollution in China, North Korea, and South Korea. As a result, the manufacturing and sales of these automated devices are becoming more prevalent in Asia.

Fairfield’s Competitive Landscape Analysis

The electric brooms market is competitive with key players such as SharkNinja, BISSELL, Dyson, and Hoover leading the charge. These companies focus on product innovation, integrating advanced features like cordless designs, smart connectivity, and improved battery performance to differentiate their offerings.

Dyson and SharkNinja dominate the premium segment with high-performance technologically advanced models, while BISSELL and Hoover capture a wide audience with affordable, reliable products.

Emerging brands are entering the market with eco-friendly and cost-effective solutions, intensifying competition. Strong distribution networks both online and offline play a critical role in brand competitiveness. Regional players especially in Asia-Pacific are gaining market share by catering to local preferences with customized products at competitive prices.

Key Market Companies

- Viomi Technology Co., Ltd

- Diya Enterprises

- Alfred Kärcher SE & Co. KG

- Dyson Ltd.

- Makita Power Tools, Bissell Inc.

- The Hoover Company

- Tineco Ltd.

- SharkNinja Operating LLC

- Fuller Brush Company

Recent Industry Developments

- March 2024 –

SharkNinja has launched the Shark Stratos Anti Hair Wrap Plus Pet Pro IZ420UKT, a top-tier cordless vacuum targeting pet owners featuring an anti-hair wrap design and extended battery life for enhanced performance.

- February 2022 -

The Dyson V12 Detect Slim was introduced with a Laser Slim Fluffy cleaner head attachment that uses a Class 1 laser to reveal dust on floors and other surfaces that are otherwise invisible to the naked eye.

An Expert’s Eye

- The busy lifestyles of millennials are propelling the demand for electric brooms. These products are lightweight, cordless, and ideal for quick cleaning tasks catering to the need for convenience.

- Electric brooms' advanced filtration systems attract consumers who are concerned about allergies and respiratory issues.

- Leading companies in the electric broom market include Alfred Kärcher, Dyson, Bissell, and SharkNinja focusing on product innovation and partnerships to enhance their market presence.

- North America market is a key player with robust demand for electric brooms influenced by trends in home cleanliness and convenience

Global Electric Brooms Market is Segmented as-

By Product Type

- Corded Electric Brooms

- Cordless Electric Brooms

By Voltage

- 120V/60Hz

- 220-240V/50Hz

By Shape

- Horizontal

- Vertical

- Handheld

- Barrel

- Pusher

By End Use

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Electric Brooms Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Electric Brooms, Production Output, by Region, 2018 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Global Electric Brooms Market Outlook, 2019 - 2031

4.1. Global Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Corded Electric Brooms

4.1.1.2. Cordless Electric Brooms

4.2. Global Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. 120V/60Hz

4.2.1.2. 220-240V/50Hz

4.3. Global Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Horizontal

4.3.1.2. Vertical

4.3.1.3. Handheld

4.3.1.4. Barrel

4.3.1.5. Pusher

4.4. Global Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Residential

4.4.1.2. Commercial

4.5. Global Electric Brooms Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. North America

4.5.1.2. Europe

4.5.1.3. Asia Pacific

4.5.1.4. Latin America

4.5.1.5. Middle East & Africa

5. North America Electric Brooms Market Outlook, 2019 - 2031

5.1. North America Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Corded Electric Brooms

5.1.1.2. Cordless Electric Brooms

5.2. North America Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. 120V/60Hz

5.2.1.2. 220-240V/50Hz

5.3. North America Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Horizontal

5.3.1.2. Vertical

5.3.1.3. Handheld

5.3.1.4. Barrel

5.3.1.5. Pusher

5.4. North America Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Residential

5.4.1.2. Commercial

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. North America Electric Brooms Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. U.S. Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.2. U.S. Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.3. U.S. Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.4. U.S. Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.5. Canada Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.6. Canada Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.7. Canada Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.1.8. Canada Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Europe Electric Brooms Market Outlook, 2019 - 2031

6.1. Europe Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Corded Electric Brooms

6.1.1.2. Cordless Electric Brooms

6.2. Europe Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. 120V/60Hz

6.2.1.2. 220-240V/50Hz

6.3. Europe Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Horizontal

6.3.1.2. Vertical

6.3.1.3. Handheld

6.3.1.4. Barrel

6.3.1.5. Pusher

6.4. Europe Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Residential

6.4.1.2. Commercial

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Europe Electric Brooms Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. Germany Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.2. Germany Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.3. Germany Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.4. Germany Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.5. U.K. Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.6. U.K. Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.7. U.K. Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.8. U.K. Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.9. France Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.10. France Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.11. France Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.12. France Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.13. Italy Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.14. Italy Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.15. Italy Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.16. Italy Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.17. Turkey Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.18. Turkey Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.19. Turkey Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.20. Turkey Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.21. Russia Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.22. Russia Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.23. Russia Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.24. Russia Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.25. Rest of Europe Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.26. Rest of Europe Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.27. Rest of Europe Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.1.28. Rest of Europe Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Asia Pacific Electric Brooms Market Outlook, 2019 - 2031

7.1. Asia Pacific Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Corded Electric Brooms

7.1.1.2. Cordless Electric Brooms

7.2. Asia Pacific Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. 120V/60Hz

7.2.1.2. 220-240V/50Hz

7.3. Asia Pacific Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Horizontal

7.3.1.2. Vertical

7.3.1.3. Handheld

7.3.1.4. Barrel

7.3.1.5. Pusher

7.4. Asia Pacific Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Residential

7.4.1.2. Commercial

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Asia Pacific Electric Brooms Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. China Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.2. China Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.3. China Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.4. China Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.5. Japan Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.6. Japan Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.7. Japan Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.8. Japan Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.9. South Korea Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.10. South Korea Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.11. South Korea Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.12. South Korea Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.13. India Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.14. India Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.15. India Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.16. India Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.17. Southeast Asia Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.18. Southeast Asia Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.19. Southeast Asia Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.20. Southeast Asia Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.21. Rest of Asia Pacific Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.22. Rest of Asia Pacific Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.23. Rest of Asia Pacific Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.1.24. Rest of Asia Pacific Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Latin America Electric Brooms Market Outlook, 2019 - 2031

8.1. Latin America Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Corded Electric Brooms

8.1.1.2. Cordless Electric Brooms

8.2. Latin America Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. 120V/60Hz

8.2.1.2. 220-240V/50Hz

8.3. Latin America Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Horizontal

8.3.1.2. Vertical

8.3.1.3. Handheld

8.3.1.4. Barrel

8.3.1.5. Pusher

8.4. Latin America Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Residential

8.4.1.2. Commercial

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Latin America Electric Brooms Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. Brazil Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.2. Brazil Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.3. Brazil Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.4. Brazil Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.5. Mexico Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.6. Mexico Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.7. Mexico Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.8. Mexico Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.9. Argentina Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.10. Argentina Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.11. Argentina Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.12. Argentina Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.13. Rest of Latin America Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.14. Rest of Latin America Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.15. Rest of Latin America Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.1.16. Rest of Latin America Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Middle East & Africa Electric Brooms Market Outlook, 2019 - 2031

9.1. Middle East & Africa Electric Brooms Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Corded Electric Brooms

9.1.1.2. Cordless Electric Brooms

9.2. Middle East & Africa Electric Brooms Market Outlook, by Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. 120V/60Hz

9.2.1.2. 220-240V/50Hz

9.3. Middle East & Africa Electric Brooms Market Outlook, by Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Horizontal

9.3.1.2. Vertical

9.3.1.3. Handheld

9.3.1.4. Barrel

9.3.1.5. Pusher

9.4. Middle East & Africa Electric Brooms Market Outlook, by End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.4.1. Key Highlights

9.4.1.1. Residential

9.4.1.2. Commercial

9.4.2. BPS Analysis/Market Attractiveness Analysis

9.4.3. BPS Analysis/Market Attractiveness Analysis

9.5. Middle East & Africa Electric Brooms Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1. Key Highlights

9.5.1.1. GCC Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.2. GCC Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.3. GCC Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.4. GCC Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.5. South Africa Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.6. South Africa Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.7. South Africa Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.8. South Africa Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.9. Egypt Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.10. Egypt Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.11. Egypt Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.12. Egypt Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.13. Nigeria Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.14. Nigeria Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.15. Nigeria Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.16. Nigeria Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.17. Rest of Middle East & Africa Electric Brooms Market by Product Type, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.18. Rest of Middle East & Africa Electric Brooms Market Voltage, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.19. Rest of Middle East & Africa Electric Brooms Market Shape, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.1.20. Rest of Middle East & Africa Electric Brooms Market End-Use, Volume (Tons) and Value (US$ Bn), 2019 - 2031

9.5.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Shape vs Voltage Heatmap

10.2. Manufacturer vs Voltage Heatmap

10.3. Company Market Share Analysis, 2024

10.4. Competitive Dashboard

10.5. Company Profiles

10.5.1. Alfred Kärcher SE & Co. KG

10.5.1.1. Company Overview

10.5.1.2. Product Portfolio

10.5.1.3. Financial Overview

10.5.1.4. Business Strategies and Development

10.5.2. Dyson Limited

10.5.2.1. Company Overview

10.5.2.2. Product Portfolio

10.5.2.3. Financial Overview

10.5.2.4. Business Strategies and Development

10.5.3. Makita Corporation

10.5.3.1. Company Overview

10.5.3.2. Product Portfolio

10.5.3.3. Financial Overview

10.5.3.4. Business Strategies and Development

10.5.4. Bissell Inc.

10.5.4.1. Company Overview

10.5.4.2. Product Portfolio

10.5.4.3. Financial Overview

10.5.4.4. Business Strategies and Development

10.5.5. The Hoover Company

10.5.5.1. Company Overview

10.5.5.2. Product Portfolio

10.5.5.3. Financial Overview

10.5.5.4. Business Strategies and Development

10.5.6. SharkNinja Operating LLC

10.5.6.1. Company Overview

10.5.6.2. Product Portfolio

10.5.6.3. Financial Overview

10.5.6.4. Business Strategies and Development

10.5.7. Fuller Brush Company

10.5.7.1. Company Overview

10.5.7.2. Product Portfolio

10.5.7.3. Financial Overview

10.5.7.4. Business Strategies and Development

10.5.8. Black+Decker Inc.

10.5.8.1. Company Overview

10.5.8.2. Product Portfolio

10.5.8.3. Financial Overview

10.5.8.4. Business Strategies and Development

10.5.9. Eureka Forbes Limited

10.5.9.1. Company Overview

10.5.9.2. Product Portfolio

10.5.9.3. Financial Overview

10.5.9.4. Business Strategies and Development

10.5.10. Electrolux AB

10.5.10.1. Company Overview

10.5.10.2. Product Portfolio

10.5.10.3. Financial Overview

10.5.10.4. Business Strategies and Development

10.5.11. Morphy Richards Ltd.

10.5.11.1. Company Overview

10.5.11.2. Product Portfolio

10.5.11.3. Financial Overview

10.5.11.4. Business Strategies and Development

10.5.12. Rowenta Werke GmbH

10.5.12.1. Company Overview

10.5.12.2. Product Portfolio

10.5.12.3. Financial Overview

10.5.12.4. Business Strategies and Development

10.5.13. Miele & Cie. KG.

10.5.13.1. Company Overview

10.5.13.2. Product Portfolio

10.5.13.3. Financial Overview

10.5.13.4. Business Strategies and Development

10.5.14. Kärcher

10.5.14.1. Company Overview

10.5.14.2. Product Portfolio

10.5.14.3. Financial Overview

10.5.14.4. Business Strategies and Development

10.5.15. Stanley Black & Decker

10.5.15.1. Company Overview

10.5.15.2. Product Portfolio

10.5.15.3. Financial Overview

10.5.15.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Voltage Coverage |

|

|

Shape Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |