Global Electric Cargo Bike Market Forecast

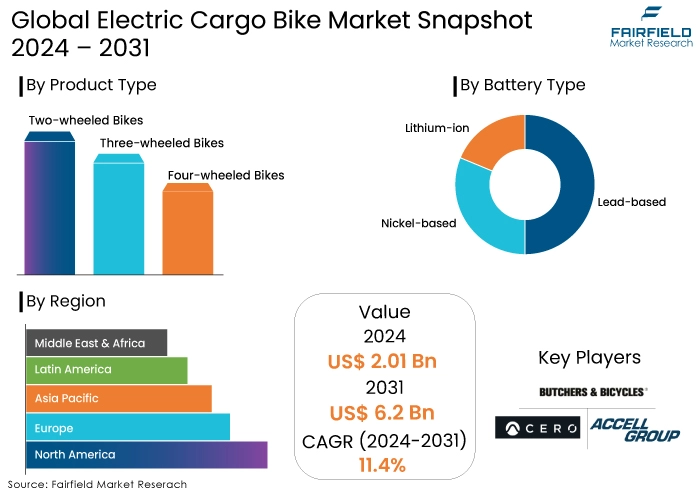

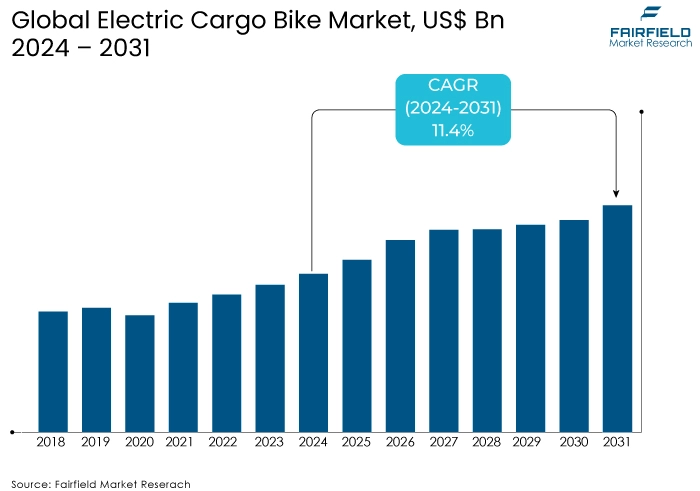

- Electric cargo bike market size projected to reach US$ 6.2 Bn by 2031, showing significant growth from the US$2.01 Bn estimated in 2024

- Global electric cargo bike market revenue likely to exhibit a CAGR of 11.4% during 2024-2031

Electric Cargo Bike Market Insights

- Electric cargo bike market is booming due to sustainability, rising fuel costs, and e-commerce surge.

- Advancements in battery technology and the need for efficient last-mile delivery solutions are driving the market forward.

- Last-mile delivery fosters demand for efficient and cost-effective cargo bikes to a significant extent.

- Government incentives and policies continue to be a strong support for electric bike adoption rates.

- Battery advancements and innovative designs enhancing cargo bike performance will be the crucial trend in the market.

- High initial costs, and limited range remain challenges for market growth.

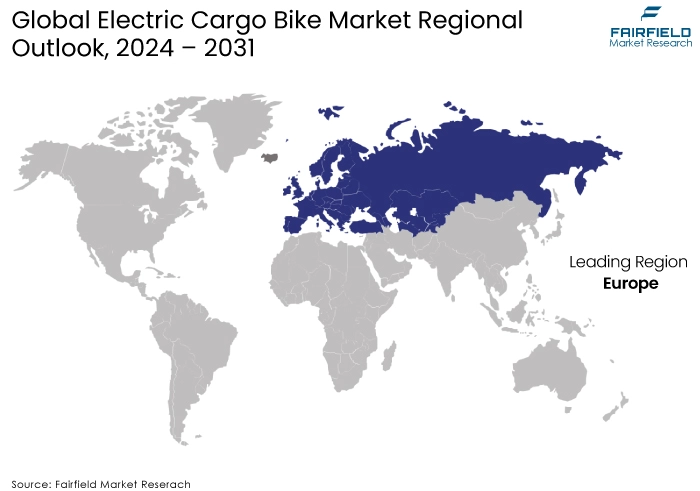

- Europe dominates the global market for electric cargo bikes, followed by North America, and Asia Pacific emerging.

- Cargo bikes are rapidly becoming integral to urban transportation and logistics.

- Environmental concerns predominantly fuel demand for sustainable transport solutions, thereby driving market growth.

- The surge in e-commerce, and last-mile delivery services is a significant driver for the expansion of the e-cargo bike industry.

A Look Back and a Look Forward - Comparative Analysis

The global market for electric cargo bikes has experienced significant growth in recent years and is expected to continue growing. Electric cargo bikes or e-cargo bikes are fuel-efficient, environment-friendly, long-lasting, and offer expanded product options that customers highly seek after. From 2017 to 2021, sales of electric cargo bikes increased at a CAGR of 6.7%. Developed countries such as Germany, the UK, France, and the US accounted for a large portion of the global market during this period.

According to the electric cargo bike market analysis, the market is expected to reach a valuation of US$ 6.2 billion by 2031, rising at a CAGR of 11.4% during the forecast period. This growth is driven by increasing environmental concerns, rising fuel prices, and government initiatives to promote cycling and eco-friendly transportation alternatives. Additionally, the surge in e-commerce has emerged as a potential driver for the electric cargo bike market expansion.

Fairfield's industry assessment shows that the market is not just growing, but experienced accelerated growth due to significant advancements in battery technology. These advancements, coupled with the need for efficient last-mile delivery solutions, are expected to propel the market forward, attracting more consumers and businesses towards adopting e-cargo bikes as a viable and eco-friendly mode of transportation.

Key Growth Determinants

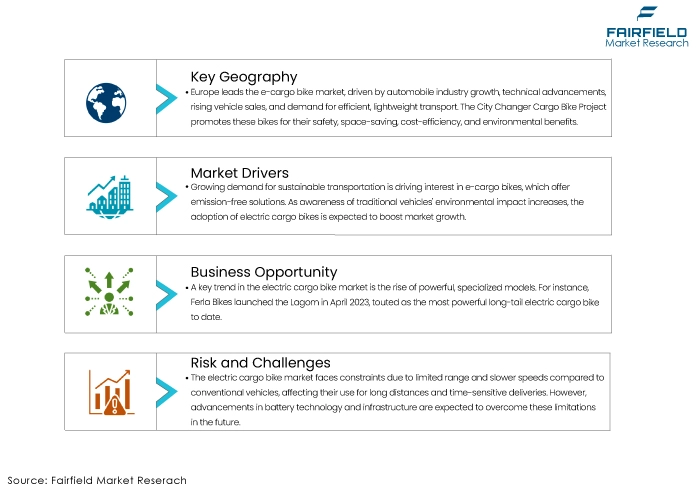

- Increasing Demand for Sustainable Transportation Solutions

There is a growing demand for sustainable transportation solutions that reduce carbon emissions and promote environmental conservation. E-cargo bikes, offering emission-free transportation solutions, are optimally positioned to meet this demand. As governments and individuals become more conscious of the environmental impact of traditional vehicles, the adoption of electric cargo bikes as a greener alternative is expected to boost the electric cargo bike market shares.

- Exceptional Surge in E-commerce and Last-Mile Delivery Services in Recent Years

The surge in e-commerce has emerged as a significant driver for the expansion of the e-cargo bike industry. According to industry analysis, the e-commerce sector possesses significant potential for expansion, with the possibility of scaling up from its current value of US$3.4 trillion to a projected US$5.3 trillion by 2026. E-cargo bikes are well-suited for last-mile delivery services, offering efficient and cost-effective transportation for small goods. Collaborations between delivery service providers and electric cargo bike manufacturers further contribute to the electric cargo bike market demand.

- Government Support and Initiatives

Governments worldwide are implementing supportive measures and initiatives to promote the adoption of electric cargo bikes. These measures include subsidies, grants, tax incentives, and regulatory adjustments specifically tailored to encourage the use of e-cargo bikes. For example, the UK transport department announced a $2 billion plan to boost cycling and walking, including a program to support e-cycles. Such government support provides a favorable environment for the electric cargo bike market expansion and encourages businesses and individuals to invest in e-cargo bikes.

Key Growth Barriers

- Limited Range and Speed

One of the major restraints for electric cargo bike market revenue is limited range and relatively slower speed compared to conventional vehicles. E-cargo bikes typically have a shorter range due to battery limitations, which may restrict their use for longer distances or in areas without adequate charging infrastructure.

Additionally, their lower speed compared to motorized vehicles may limit their efficiency in certain delivery scenarios, especially when time-sensitive deliveries are required. However, advancements in battery technology and infrastructure development are expected to address these limitations in the future, mitigating this restraint.

- High Initial Costs

Another growth restraint for the electric cargo bike market sales is the relatively high initial costs associated with purchasing electric cargo bikes. E-cargo bikes often come with a higher price tag compared to traditional cargo bikes or conventional vehicles. The cost is primarily driven by the inclusion of advanced electric components, such as batteries and motors, which contribute to the overall price of the bike.

The higher upfront investment required may deter some potential buyers, especially small businesses or individuals with budget constraints. However, as the market continues to grow and economies of scale come into play, it is expected that the cost of e-cargo bikes will gradually decrease, making them more accessible and affordable for a wider range of users.

Electric Cargo Bike Market Trends and Opportunities

- Increasing Adoption of Powerful and Specialized Models

One of the notable electric cargo bike market trends is the increasing adoption of powerful and specialized models. Manufacturers are introducing innovative and high-performance e-cargo bikes to cater to specific needs and requirements. For example, in April 2023, Ferla Bikes introduced their latest cargo bike model called Lagom, which is hailed as the most powerful long-tail electric cargo bike ever constructed.

This trend is driven by the need for efficient and reliable transportation solutions for various industries, including last-mile delivery services, logistics, and urban mobility. As per the electric cargo bike market overview, these powerful and specialized e-cargo bikes offer enhanced capabilities, such as increased load capacity, improved battery range, and advanced features for better handling and maneuverability. They are designed to handle heavy loads and navigate through urban environments with ease. They present multiple market opportunities for manufacturers to cater to specific market segments and meet the evolving needs of businesses and individuals.

- Government Incentives and Subsidies

One significant opportunity for the electric cargo bike industry lies in the availability of government incentives and subsidies. Governments worldwide are implementing supportive measures and initiatives to promote the adoption of electric vehicles, including e-cargo bikes. These measures include subsidies, grants, tax incentives, and regulatory adjustments specifically tailored to encourage adoption. As per the report, government incentives and subsidies provide a favorable environment for market growth by reducing the upfront costs associated with purchasing.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario for the electric cargo bike market growth is evolving, with governments taking steps to promote electric and hybrid freight bikes and reduce pollution levels. These regulatory measures include limitations on the use of conventional motorbikes, tariffs, subsidies, incentives, and adjustments tailored to encourage the adoption.

Governments are providing owners of electric cargo bikes with lucrative subsidies and incentives to promote their use. In March 2023, the UK transport department announced a US$ 2 billion plan to boost cycling and walking, including US$ 200 million for new active travel schemes and US$ 8 million for a new e-cycle program.

Government initiatives include subsidies, grants, tax incentives, and regulatory adjustments specifically tailored to encourage the adoption of e-cargo bikes. Dublin City Council in Ireland provides a substantial 60% subsidy on rental costs for local businesses experimentation.

Segments Covered in Electric Cargo Bike Market

- Two-Wheeled Bikes Set to Dominate with their Versatility

As per the forecast, the two-wheeled e-cargo bike category is expected to dominate the market, capturing a market share of more than 57% by the end of 2032. This category's rise is attributed to its versatility and widespread applications in both large-scale deliveries and personal mobility.

With a projected volume CAGR of 12.4% from 2022 to 2032, the two-wheeled product segment is poised for significant expansion. The increasing demand for efficient and sustainable transportation solutions is driving the growth of this segment, making it a key player in the electric cargo bike industry's future.

- Lithium-ion Battery to Lead the Way Through Superior Charging Capabilities

The electric cargo bike market update shows that lithium-ion batteries are set to dominate the e-cargo bike industry, accounting for more than 83% of the market share by 2032. Their fast-charging capabilities significantly reduce the time required for the bike to be connected to a charging station.

Moreover, lithium-ion batteries can be charged during periods of non-use, eliminating the need for extensive downtime. With no cleaning processes required to accommodate full charging between uses, these batteries offer convenient and efficient operation. The lithium-ion battery segment is primed for substantial growth and is projected to expand at a volume CAGR of 11.7% from 2022 to 2032.

Regional Analysis

- Europe Emerges as Dominant Regional Market, Technical Advancements Drive Growth

Europe takes the lead as the most prominent regional market for e-cargo bikes, benefiting from the expansion of automobile manufacturing and their widespread use. Rising technical breakthroughs, increasing vehicle sales, and the growing demand for fuel-efficient and lightweight transportation contribute to the region's market growth.

The City Changer Cargo Bike Project, a European initiative, aims to promote electric cargo bikes as a safe, space-saving, cost-efficient, and environmentally responsible mode of transportation for personal and commercial purposes.

With over 67% market share valued at US$479.4 Mn in 2022, Europe dominates the global electric cargo bike market. The region is projected to experience rapid expansion at a value CAGR of 13.5% throughout the forecast period.

- North America Soars High with Increasing E-Mobility Adoption in US

With a 17% share of the global e-cargo bike industry by volume, the US is positioned to gain traction in the coming years. The country benefits from strong government support and well-developed infrastructure, leading to high investment in e-mobility.

With rising research efforts, the presence of prominent companies, and increased focus on fuel-efficient solutions, the US electric cargo bike market demonstrates significant potential. With these industry trends, the North American market is estimated to dominate with over 90% share; the market is projected to expand at a value CAGR of 8.3% by 2032.

- Asia Pacific Sees Rapid Growth, Led by China

The Asia Pacific region is experiencing significant traction in the electric cargo bike market value, with several countries witnessing market expansion. China, in particular, stands out as one of the most profitable demands for market players. The market in China is projected to grow at a volume CAGR of 4.5% during the forecast period.

Increased investments in infrastructure to meet the demands of the country's large population further contribute to market growth. China's focus on deploying modern digital technology in manufacturing and rising investments in the e-mobility sector, along with advancements in battery technology, is anticipated to drive the demand for e-cargo bikes in the country.

Recent Industry Developments

- In April 2024, Mercedes-Benz Vans has partnered with ONOMOTION to improve last-mile delivery efficiency. The collaboration combines the Mercedes-Benz eSprinter with ONOMOTION's e-cargo bikes, reducing CO2 emissions and enhancing efficiency. The eSprinter acts as a mobile hub, delivering pre-packaged goods to the e-cargo bikes, reducing idle times and allowing quick transitions between stages. The eSprinter also offers enhanced energy management, with near-body heating and zonal air conditioning. The SUSTAINEER model, central to the logistics solution, incorporates technological enhancements for sustainability and driver welfare.

- In January 2024, Cargo bikes are a promising solution for urban logistics, as they offer a cleaner and greener alternative to traditional vehicles. Despite their limited cargo capacity, the EAV 2Cubed, introduced by UK-based Electric Assisted Vehicles Limited (EAV), offers a compact and efficient solution. With two cubic meters of cargo space and the ability to carry up to 150 kg, the EAV 2Cubed is a significant step forward in last-mile delivery services. Its zero-emission drivetrain, covered cab, 60 Ah battery, and swappable battery make it an eco-friendly addition to delivery fleets.

Competitive Landscape Analysis

The e-cargo bike industry is relatively competitive, with numerous players competing. According to Fairfield Market Research, electric cargo bike market manufacturers focus on reducing emissions, expanding their product offerings, and forming long-term supply agreements with manufacturing firms and distribution channel players to gain a competitive advantage.

The market is also witnessing collaborations and partnerships between electric cargo bike manufacturers and delivery service providers. For example, Tern collaborated with Dutch-X to deliver goods to retail customers across New York, utilizing a fleet of Tern electric cargo bikes for greener and more efficient deliveries.

Key Market Companies

- Accell Group N.V.

- Amsterdam Bicycle Company

- Butchers & Bicycles Ltd.

- CERO

- Derby Cycle AG (Pon Holdings BV)

- Giant Bicycles

- Mahindra & Mahindra Limited

- Rad Power Bikes Inc.

- Riese & Müller GmbH

- Worksman Cycles

- Xtracycle Cargo Bikes

- Yuba Bicycles

An Expert’s Eye

- A robust growth trajectory for the e-cargo bike industry attributes to the convergence of multiple factors such as escalating fuel prices, stringent environmental regulations, and the burgeoning e-commerce sector.

- Advancements in battery technology and the development of specialized models for various applications are further bolstering industry prospects.

- However, challenges like high initial costs and infrastructure limitations persist. To sustain growth, industry players must focus on affordability, expanding charging networks, and exploring innovative business models.

- Government support through incentives and policies will also be pivotal.

- The e-cargo bike market is poised for significant expansion worldwide, with a potential to revolutionize urban logistics and personal transportation.

Global Electric Cargo Bike Market is Segmented as-

By Product Type

- Two-wheeled Bikes

- Three-wheeled Bikes

- Four-wheeled Bikes

By Battery Type

- Lead-based

- Nickel-based

- Lithium-ion

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Electric Cargo Bike Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

3.1. Global Electric Cargo Bike Market, Production Output, by Region, 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2018-2030

4.1. Key Highlights

4.2. Global Average Price Analysis, by Type/Battery Type/End-use, US$ per Unit

4.3. Prominent Factors Affecting Electric Cargo Bike Market Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Electric Cargo Bike Market Outlook, 2024 - 2031

5.1. Global Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

5.1.1. Key Highlights

5.1.1.1. Two-wheeled Bikes

5.1.1.2. Three-wheeled Bikes

5.1.1.3. Four-wheeled Bikes

5.2. Global Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

5.2.1. Key Highlights

5.2.1.1. Lead-based

5.2.1.2. Nickel-based

5.2.1.3. Lithium-ion

5.3. Global Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

5.3.1. Key Highlights

5.3.1.1. Courier & Parcel Service Providers

5.3.1.2. Large Retail Suppliers

5.3.1.3. Personal Transportation

5.3.1.4. Service Delivery

5.3.1.5. Waste, Municipal Services

5.4. Global Electric Cargo Bike Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2024 - 2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Electric Cargo Bike Market Outlook, 2024 - 2031

6.1. North America Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.1.1. Key Highlights

6.1.1.1. Two-wheeled Bikes

6.1.1.2. Three-wheeled Bikes

6.1.1.3. Four-wheeled Bikes

6.2. North America Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.2.1. Key Highlights

6.2.1.1. Lead-based

6.2.1.2. Nickel-based

6.2.1.3. Lithium-ion

6.3. North America Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.3.1. Key Highlights

6.3.1.1. Courier & Parcel Service Providers

6.3.1.2. Large Retail Suppliers

6.3.1.3. Personal Transportation

6.3.1.4. Service Delivery

6.3.1.5. Waste, Municipal Services

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Electric Cargo Bike Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1. Key Highlights

6.4.1.1. U.S. Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1.2. U.S. Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1.3. U.S. Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1.4. Canada Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1.5. Canada Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.1.6. Canada Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Electric Cargo Bike Market Outlook, 2024 - 2031

7.1. Europe Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.1.1. Key Highlights

7.1.1.1. Two-wheeled Bikes

7.1.1.2. Three-wheeled Bikes

7.1.1.3. Four-wheeled Bikes

7.2. Europe Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.2.1. Key Highlights

7.2.1.1. Lead-based

7.2.1.2. Nickel-based

7.2.1.3. Lithium-ion

7.3. Europe Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.3.1. Key Highlights

7.3.1.1. Courier & Parcel Service Providers

7.3.1.2. Large Retail Suppliers

7.3.1.3. Personal Transportation

7.3.1.4. Service Delivery

7.3.1.5. Waste, Municipal Services

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Electric Cargo Bike Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1. Key Highlights

7.4.1.1. Germany Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.2. Germany Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.3. Germany Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.4. U.K. Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.5. U.K. Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.6. U.K. Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.7. France Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.8. France Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.9. France Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.10. Italy Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.11. Italy Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.12. Italy Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.13. Turkey Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.14. Turkey Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.15. Turkey Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.16. Russia Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.17. Russia Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.18. Russia Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.19. Rest of Europe Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.20. Rest of Europe Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.1.21. Rest of Europe Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Electric Cargo Bike Market Outlook, 2024 - 2031

8.1. Asia Pacific Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.1.1. Key Highlights

8.1.1.1. Two-wheeled Bikes

8.1.1.2. Three-wheeled Bikes

8.1.1.3. Four-wheeled Bikes

8.2. Asia Pacific Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.2.1. Key Highlights

8.2.1.1. Lead-based

8.2.1.2. Nickel-based

8.2.1.3. Lithium-ion

8.3. Asia Pacific Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.3.1. Key Highlights

8.3.1.1. Courier & Parcel Service Providers

8.3.1.2. Large Retail Suppliers

8.3.1.3. Personal Transportation

8.3.1.4. Service Delivery

8.3.1.5. Waste, Municipal Services

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Electric Cargo Bike Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1. Key Highlights

8.4.1.1. China Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.2. China Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.3. China Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.4. Japan Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.5. Japan Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.6. Japan Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.7. South Korea Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.8. South Korea Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.9. South Korea Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.10. India Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.11. India Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.12. India Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.13. Southeast Asia Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.14. Southeast Asia Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.15. Southeast Asia Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.16. Rest of Asia Pacific Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.17. Rest of Asia Pacific Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.1.18. Rest of Asia Pacific Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Electric Cargo Bike Market Outlook, 2024 - 2031

9.1. Latin America Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.1.1. Key Highlights

9.1.1.1. Two-wheeled Bikes

9.1.1.2. Three-wheeled Bikes

9.1.1.3. Four-wheeled Bikes

9.2. Latin America Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.2.1. Key Highlights

9.2.1.1. Lead-based

9.2.1.2. Nickel-based

9.2.1.3. Lithium-ion

9.3. Latin America Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.3.1. Key Highlights

9.3.1.1. Courier & Parcel Service Providers

9.3.1.2. Large Retail Suppliers

9.3.1.3. Personal Transportation

9.3.1.4. Service Delivery

9.3.1.5. Waste, Municipal Services

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Electric Cargo Bike Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1. Key Highlights

9.4.1.1. Brazil Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.2. Brazil Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.3. Brazil Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.4. Mexico Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.5. Mexico Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.6. Mexico Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.7. Argentina Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.8. Argentina Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.9. Argentina Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.10. Rest of Latin America Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.11. Rest of Latin America Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.1.12. Rest of Latin America Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Electric Cargo Bike Market Outlook, 2024 - 2031

10.1. Middle East & Africa Electric Cargo Bike Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.1.1. Key Highlights

10.1.1.1. Two-wheeled Bikes

10.1.1.2. Three-wheeled Bikes

10.1.1.3. Four-wheeled Bikes

10.2. Middle East & Africa Electric Cargo Bike Market Outlook, by Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.2.1. Key Highlights

10.2.1.1. Lead-based

10.2.1.2. Nickel-based

10.2.1.3. Lithium-ion

10.3. Middle East & Africa Electric Cargo Bike Market Outlook, by End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.3.1. Key Highlights

10.3.1.1. Courier & Parcel Service Providers

10.3.1.2. Large Retail Suppliers

10.3.1.3. Personal Transportation

10.3.1.4. Service Delivery

10.3.1.5. Waste, Municipal Services

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Electric Cargo Bike Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1. Key Highlights

10.4.1.1. GCC Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.2. GCC Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.3. GCC Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.4. South Africa Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.5. South Africa Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.6. South Africa Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.7. Egypt Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.8. Egypt Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.9. Egypt Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.10. Nigeria Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.11. Nigeria Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.12. Nigeria Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.13. Rest of Middle East & Africa Electric Cargo Bike Market by Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.14. Rest of Middle East & Africa Electric Cargo Bike Market Battery Type, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.1.15. Rest of Middle East & Africa Electric Cargo Bike Market End-use, Value (US$ Bn) and Volume (Units), 2024 - 2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. End-use vs Battery Type Heatmap

11.2. Manufacturer vs Battery Type Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Jiangsu Xinri E-Vehicle Co. Ltd.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. DOUZE Factory SAS

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. XYZ CARGO

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Babboe

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Yuba Electric Cargo Bikes

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Riese & Müller GmbH

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Rad Power Bikes Inc.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Pedego Electric Bikes

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Yuba Electric Cargo Bikes

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Tern Bicycles

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Battery Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |