Global Electric DC Motors Market Forecast

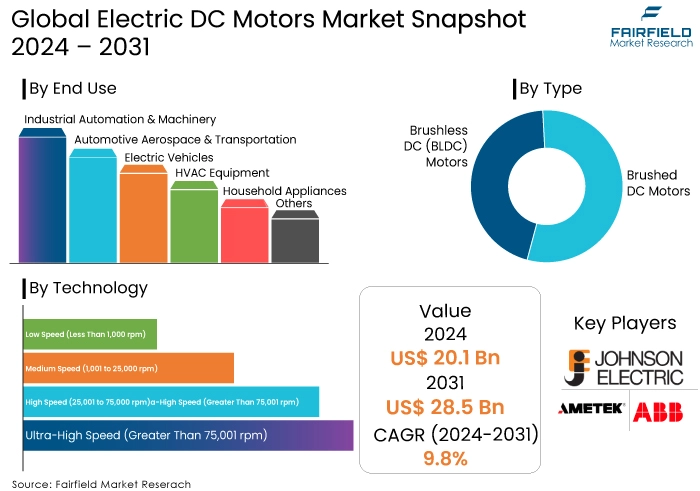

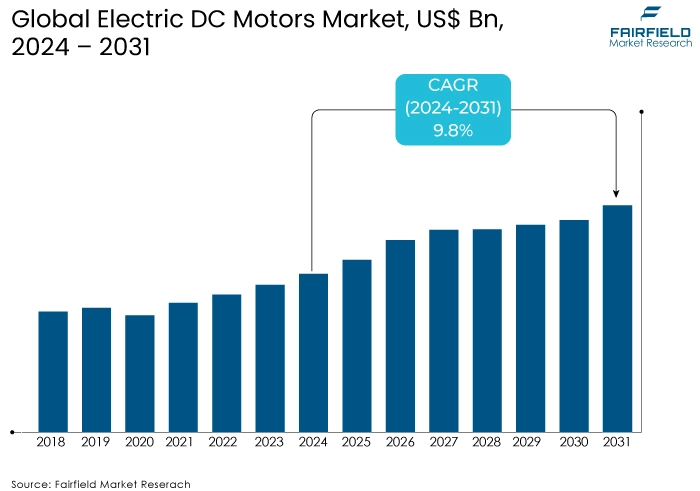

- Electric DC motors market size anticipated to rise high up to approximately US$28.5 Bn in 2031, up from US$20.1 Bn recorded in 2024

- Electric DC motors market revenue expects a CAGR of 9.8% over the forecast period of 2024-2031

Electric DC Motors Market Insights

- Electric DC motors market growth is predominantly driven by industrial automation and energy efficiency.

- Regulations push the electric DC motors industry towards sustainability and efficiency.

- Industrial automation, EVs, and focus on energy efficiency are key growth drivers.

- AC motor competition, and mature markets are key growth restraints.

- Miniaturization and automation in developing economies are key trends and opportunities.

- BLDC motors dominate due to superior efficiency and controllability.

- Industrial automation is the dominant application segment but EVs are catching up.

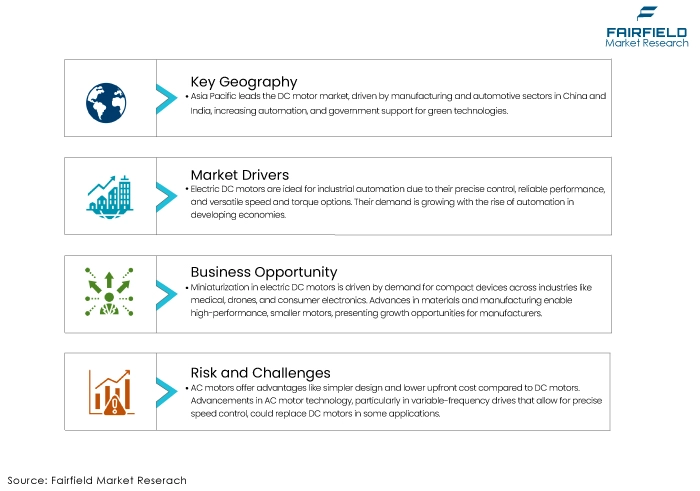

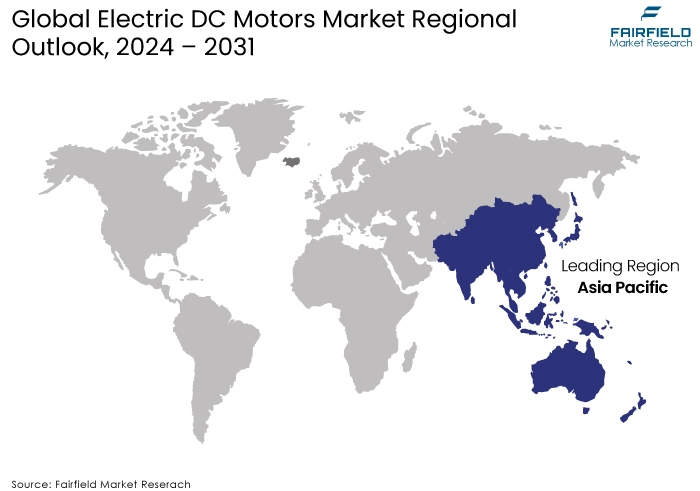

- Asia Pacific is the leading regional market due to manufacturing and automation.

- The future regional landscape depends on innovation, infrastructure, and policies.

A Look Back and a Look Forward - Comparative Analysis

The electric DC motors market experienced steady growth pre-2023, fueled by the increasing adoption of industrial automation and the rising demand for energy-efficient motors. Urbanization and automation advancements in emerging economies further propelled market expansion. However, post-2024 growth forecasts diverge.

Predictions suggest a slight decline due to advancements and cost-effectiveness of AC motors. The continued growth of the market is however fueled by niche applications and brushless DC motor advancements. The future trajectory will likely depend on the pace of technological innovation in both DC and AC motor technologies, along with the evolving regulatory landscape and cost pressures within key industries.

Key Growth Determinants

Growing Ubiquity of Industrial Automation

Electric DC motors offer several advantages for industrial automation applications, including precise control, reliable performance, and a wide range of speed and torque options. This makes them ideal for robots, conveyor systems, and machine tools. Growth in the industrial automation sector, particularly in developing economies with increasing industrialization and focus on automation, will drive demand for electric DC motors.

Additionally, the growing adoption of collaborative robots (cobots) in various industries is creating new opportunities due to their ability to provide the precise control and safety features needed for human-robot interaction.

Pacing Growth of Electric Vehicles (EVs)

The rise of electric vehicles is creating a significant demand for DC motors in various applications like power steering, window lifts, cooling fans, and pumps. As the EV market continues to expand globally, the demand for DC motors specifically designed for EV applications is expected to experience significant growth. Manufacturers are focusing on developing lightweight, high-efficiency DC motors to optimize vehicle range and performance, further propelling market growth in this segment.

Increasing Worldwide Focus on Energy Efficiency

With rising energy costs and growing environmental concerns, industries are increasingly adopting energy-efficient DC motors. These motors offer significant energy savings compared to traditional AC motors, particularly when combined with variable speed drives. Government initiatives promoting energy-saving technologies further propel this growth by providing incentives for businesses to adopt energy-efficient solutions. This focus on energy efficiency is expected to remain a key driver for the electric DC motors market in the coming years.

Key Growth Barriers

Competition from AC Motors

AC motors offer advantages like simpler design and lower upfront cost compared to DC motors. Advancements in AC motor technology, particularly in variable-frequency drives that allow for precise speed control, could replace DC motors in some applications.

Additionally, the development of more efficient AC motor designs could further erode market share for DC motors, especially in cost-sensitive applications. Manufacturers of DC motors need to focus on innovation to maintain their competitive edge, emphasizing factors like superior efficiency in specific applications, lower maintenance requirements, and potentially developing cost-competitive solutions for volume production.

Maturity in Traditional Markets

The electric DC motors market in mature industrial sectors might face saturation as many factories have already implemented automation solutions. Additionally, cost pressures within these sectors may incentivize companies to explore cheaper alternatives, such as lower-cost AC motors or even simpler mechanical solutions.

DC motor manufacturers can potentially mitigate this by focusing on offering customized solutions, providing value-added services like maintenance programs, and demonstrating the long-term cost benefits of high-efficiency DC motors compared to cheaper alternatives.

Electric DC Motors Market Trends and Opportunities

The Thriving Miniaturization Trend

Miniaturization is a growing trend in the electric DC motors market. Smaller, lighter DC motors cater to the demand for compact and portable devices in various industries, including medical equipment, drones, power tools, and even consumer electronics. This trend is driven by advancements in material science and manufacturing techniques that allow for the development of high-performance motors in smaller form factors. The increasing demand for these compact motors presents a significant opportunity for manufacturers who can develop and produce reliable, efficient miniaturized DC motors that meet the specific needs of various applications.

Rapid Expansion of Automation and Robotics Across Developing Markets

The growing automation and robotics market in developing economies presents a significant opportunity for DC motor manufacturers. These regions offer vast potential for market expansion due to increasing industrialization, government initiatives promoting automation, and a growing focus on technological adoption.

Manufacturers can capitalize on this opportunity by establishing a presence in these markets, tailoring their product offerings to meet local needs, and potentially developing partnerships with local companies for production or distribution. However, navigating the regulatory landscape and addressing potential infrastructure challenges in these regions will be crucial for success.

How is Regulatory Scenario Shaping this Industry?

Regulations are shaping the electric DC motors industry towards sustainability and efficiency. Stringent energy-saving mandates like Minimum Energy Performance Standards (MEPS) are pushing manufacturers to develop high-efficiency DC motors. These regulations not only improve overall energy consumption but also contribute to environmental benefits.

Additionally, regulations on hazardous materials restrict the use of certain components, impacting production costs for manufacturers. Companies need to adapt their production processes and material sourcing to comply with these regulations, which can influence overall motor pricing and potentially impact market dynamics.

Fairfield’s Ranking Board

Top Segments

Dominance of BLDC Motors Prevails Throughout Forecast Period

Brushless DC (BLDC) motors are expected to dominate the electric DC motors market due to their superior efficiency, lower maintenance needs, and precise controllability. Unlike brushed DC motors, BLDC motors utilize electronic commutation to control the rotation of the rotor, eliminating the need for physical brushes that wear out over time. This translates to longer lifespan, lower maintenance costs, and higher efficiency.

Additionally, BLDC motors offer superior controllability, making them ideal for applications requiring precise speed and torque regulation, such as electric vehicles and industrial automation equipment.

However, it is also important to note that brushed DC motors might still be relevant in some scenarios. Low-power applications where upfront cost is a primary concern, brushed DC motors might remain the preferred choice. In cases where high efficiency or precise control are not essential, brushed DC motors can be a viable option for low-speed, low-torque applications.

Overall, while brushed DC motors will likely experience a decline in market share, they might still retain a niche presence in specific applications. Nevertheless, the future of the electric DC motors market clearly lies with BLDC motors due to their numerous advantages.

While brushed DC motors might still find application in some cost-sensitive areas with less demanding performance requirements, the overall outlook for BLDC motors is positive. Their superior efficiency, lower maintenance needs, precise control, and longer lifespan make them a compelling choice for a growing number of applications.

Industrial Automation Maintains a Stronghold by Application

Industrial automation is currently the dominant application segment for DC motors, utilizing them in robots, conveyor systems, machine tools, and various other automated processes. Industrial automation continues to reign supreme as the leading application segment for DC motors. This dominance stems from the motors' ideal characteristics for automated systems, including durability, reliability, precise control, and availability of a wide range of options.

On the other hand, while industrial automation is a well-established market for DC motors, the electric vehicle (EV) market is rapidly emerging as a major driver for DC motors. As EV adoption accelerates, the demand for DC motors specifically designed for EVs is expected to surpass the demand from industrial automation in the long run. This shift will require manufacturers to focus on developing lightweight, highly efficient, and durable DC motors optimized for the unique requirements of electric vehicles.

The EV market is projected to experience significant growth in the coming years, creating a strong demand for DC motors specifically designed for EV applications. These motors need to be lightweight, highly efficient, and capable of withstanding the demanding operating conditions within an electric vehicle. As the EV market expands, the demand for DC motors in this segment is expected to surpass industrial automation in the long term.

Regional Frontrunners

Asia Pacific’s Prime Position Strengthens with Growing Emphasis on Automation and Electrification

Asia Pacific is currently the leading regional market for DC motors due to the strong presence of manufacturing and automotive industries, particularly in China, and India. These regions offer a large consumer base, and a growing focus on automation and electrification, driving demand for DC motors in various applications. Additionally, government initiatives promoting industrial automation and green technologies further contribute to market growth in this region.

Continued dominance of Asia Pacific is expected in the long term. If Asia Pacific can bridge the technological gap, address skill shortages, and leverage its vast market potential, it could solidify its position as the leader. Developing economies will most likely take the lead. Within Asia Pacific, individual emerging economies that successfully address the challenges and capitalize on their advantages could become regional leaders themselves.

Widespread Automation Adoption Keeps Market Prospects Afloat in North America, and Europe

Europe, and North America, on the other hand, are expected to maintain significant market share due to their technological advancements in motor design, and manufacturing. These regions are also at the forefront of automation adoption in various industries, creating a sustained demand for high-performance DC motors.

The future landscape of the dominant regional market might depend on the pace of technological innovation and infrastructure development in emerging economies, along with government policies, and incentives related to automation and energy efficiency.

The market could become bipolar, with Asia Pacific dominating in terms of volume, and North America and Europe focusing on high-performance, niche applications. In a nutshell, government policies, infrastructure development, technological innovation, and the success of automation initiatives will influence the future landscape of regional dominance in the electric DC motors market.

Fairfield’s Competitive Landscape Analysis

The electric DC motors market is a fragmented landscape with established players like ABB, Nidec, and Siemens holding significant market share. These established players have a global presence, strong brand recognition, and extensive product portfolios. However, rising players in emerging economies like China, and India are offering cost-competitive solutions, challenging the dominance of established players.

The competitive landscape revolves around factors like efficiency, reliability, cost-effectiveness, ability to cater to specific application needs, and responsiveness to evolving market demands. Manufacturers that can successfully navigate this dynamic environment by focusing on innovation, cost optimization, and regional expansion are likely to succeed in the long run.

Key Market Players

- ABB Ltd.

- AMETEK Inc. (Dunkermotoren GmbH)

- Johnson Electric Holdings Limited

- Nidec Corporation

- Siemens AG

- Franklin Electric Co.

- Maxon Motor AG

- Parker Hannifin Corporation

- Regal Beloit Corporation

- Rockwell Automation Inc.

- Emerson Electric Co.

- TE Connectivity Ltd.

Global Electric DC Motors Market is Segmented as-

By Type

- Brushed DC Motors

- Brushless DC (BLDC) Motors

By Voltage

- 0-750 Watts

- 750 Watts – 3KW

- 3KW – 75KW

- Above 75KW

By Technology

- Low Speed (Less Than 1,000 rpm)

- Medium Speed (1,001 to 25,000 rpm)

- High Speed (25,001 to 75,000 rpm)

- Ultra-High Speed (Greater Than 75,001 rpm)

By End Use

- Industrial Automation & Machinery

- Automotive Aerospace & Transportation

- Electric Vehicles

- HVAC Equipment

- Household Appliances

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middles East & Africa

1. Executive Summary

1.1. Global Electric DC Motor Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Electric DC Motor Market, Production Output, by Region, 2019-2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2023

4.1. Key Highlights

4.2. Global Average Price Analysis, by Type/Technology/Application, US$ per Unit

4.3. Prominent Factors Affecting Electric DC Motor Market Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Electric DC Motor Market Outlook, 2019-2031

5.1. Global Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Brushed DC Motors

5.1.1.2. Brushless DC Motors

5.2. Global Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Low Speed (Less Than 1,000 rpm)

5.2.1.2. Medium Speed (1,001 to 25,000 rpm)

5.2.1.3. High Speed (25,001 to 75,000 rpm)

5.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

5.3. Global Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

5.3.1. Key Highlights

5.3.1.1. HVAC Equipment

5.3.1.2. Aerospace & Transportation

5.3.1.3. Household Appliances

5.3.1.4. Industrial Machinery

5.3.1.5. Motor Vehicles

5.3.1.6. Others

5.4. Global Electric DC Motor Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019-2031

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Electric DC Motor Market Outlook, 2019-2031

6.1. North America Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Brushed DC Motors

6.1.1.2. Brushless DC Motors

6.2. North America Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Low Speed (Less Than 1,000 rpm)

6.2.1.2. Medium Speed (1,001 to 25,000 rpm)

6.2.1.3. High Speed (25,001 to 75,000 rpm)

6.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

6.3. North America Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

6.3.1. Key Highlights

6.3.1.1. HVAC Equipment

6.3.1.2. Aerospace & Transportation

6.3.1.3. Household Appliances

6.3.1.4. Industrial Machinery

6.3.1.5. Motor Vehicles

6.3.1.6. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Electric DC Motor Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1. Key Highlights

6.4.1.1. U.S. Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.2. U.S. Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.3. U.S. Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.4. Canada Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.5. Canada Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.1.6. Canada Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Electric DC Motor Market Outlook, 2019-2031

7.1. Europe Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Brushed DC Motors

7.1.1.2. Brushless DC Motors

7.2. Europe Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Low Speed (Less Than 1,000 rpm)

7.2.1.2. Medium Speed (1,001 to 25,000 rpm)

7.2.1.3. High Speed (25,001 to 75,000 rpm)

7.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

7.3. Europe Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.3.1. Key Highlights

7.3.1.1. HVAC Equipment

7.3.1.2. Aerospace & Transportation

7.3.1.3. Household Appliances

7.3.1.4. Industrial Machinery

7.3.1.5. Motor Vehicles

7.3.1.6. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Electric DC Motor Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Germany Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.2. Germany Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.3. Germany Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.4. U.K. Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.5. U.K. Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.6. U.K. Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.7. France Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.8. France Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.9. France Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.10. Italy Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.11. Italy Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.12. Italy Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.13. Turkey Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.14. Turkey Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.15. Turkey Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.16. Russia Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.17. Russia Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.18. Russia Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.19. Rest of Europe Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.20. Rest of Europe Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.1.21. Rest of Europe Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Electric DC Motor Market Outlook, 2019-2031

8.1. Asia Pacific Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Brushed DC Motors

8.1.1.2. Brushless DC Motors

8.2. Asia Pacific Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Low Speed (Less Than 1,000 rpm)

8.2.1.2. Medium Speed (1,001 to 25,000 rpm)

8.2.1.3. High Speed (25,001 to 75,000 rpm)

8.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

8.3. Asia Pacific Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.3.1. Key Highlights

8.3.1.1. HVAC Equipment

8.3.1.2. Aerospace & Transportation

8.3.1.3. Household Appliances

8.3.1.4. Industrial Machinery

8.3.1.5. Motor Vehicles

8.3.1.6. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Electric DC Motor Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1. Key Highlights

8.4.1.1. China Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.2. China Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.3. China Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.4. Japan Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.5. Japan Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.6. Japan Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.7. South Korea Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.8. South Korea Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.9. South Korea Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.10. India Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.11. India Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.12. India Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.13. Southeast Asia Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.14. Southeast Asia Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.15. Southeast Asia Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.16. Rest of Asia Pacific Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.17. Rest of Asia Pacific Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.1.18. Rest of Asia Pacific Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Electric DC Motor Market Outlook, 2019-2031

9.1. Latin America Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.1.1. Key Highlights

9.1.1.1. Brushed DC Motors

9.1.1.2. Brushless DC Motors

9.2. Latin America Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

9.2.1. Key Highlights

9.2.1.1. Low Speed (Less Than 1,000 rpm)

9.2.1.2. Medium Speed (1,001 to 25,000 rpm)

9.2.1.3. High Speed (25,001 to 75,000 rpm)

9.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

9.3. Latin America Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

9.3.1. Key Highlights

9.3.1.1. HVAC Equipment

9.3.1.2. Aerospace & Transportation

9.3.1.3. Household Appliances

9.3.1.4. Industrial Machinery

9.3.1.5. Motor Vehicles

9.3.1.6. Others

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Electric DC Motor Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1. Key Highlights

9.4.1.1. Brazil Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.2. Brazil Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.3. Brazil Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.4. Mexico Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.5. Mexico Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.6. Mexico Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.7. Argentina Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.8. Argentina Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.9. Argentina Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.10. Rest of Latin America Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.11. Rest of Latin America Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.1.12. Rest of Latin America Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Electric DC Motor Market Outlook, 2019-2031

10.1. Middle East & Africa Electric DC Motor Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.1.1. Key Highlights

10.1.1.1. Brushed DC Motors

10.1.1.2. Brushless DC Motors

10.2. Middle East & Africa Electric DC Motor Market Outlook, by Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.2.1. Key Highlights

10.2.1.1. Low Speed (Less Than 1,000 rpm)

10.2.1.2. Medium Speed (1,001 to 25,000 rpm)

10.2.1.3. High Speed (25,001 to 75,000 rpm)

10.2.1.4. Ultra-High Speed (Greater Than 75,001 rpm)

10.3. Middle East & Africa Electric DC Motor Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.3.1. Key Highlights

10.3.1.1. HVAC Equipment

10.3.1.2. Aerospace & Transportation

10.3.1.3. Household Appliances

10.3.1.4. Industrial Machinery

10.3.1.5. Motor Vehicles

10.3.1.6. Others

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Electric DC Motor Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1. Key Highlights

10.4.1.1. GCC Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.2. GCC Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.3. GCC Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.4. South Africa Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.5. South Africa Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.6. South Africa Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.7. Egypt Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.8. Egypt Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.9. Egypt Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.10. Nigeria Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.11. Nigeria Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.12. Nigeria Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.13. Rest of Middle East & Africa Electric DC Motor Market by Type, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.14. Rest of Middle East & Africa Electric DC Motor Market Technology, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.1.15. Rest of Middle East & Africa Electric DC Motor Market Application, Value (US$ Bn) and Volume (Units), 2019-2031

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Application vs Technology Heatmap

11.2. Manufacturer vs Technology Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Franklin Electric Co.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Asmo Co. Ltd

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Ametek Inc.

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Sony Corporation

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Bayer AG

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Whirlpool Corporation

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. American Crane & Equipment Corp.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Bruce Electric Equipment Corp

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Hansen Motors

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. ATS Automation Tooling Systems, Inc.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Voltage Coverage |

|

|

Technology Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |