Global Electric Vehicle Polymers Market Forecast

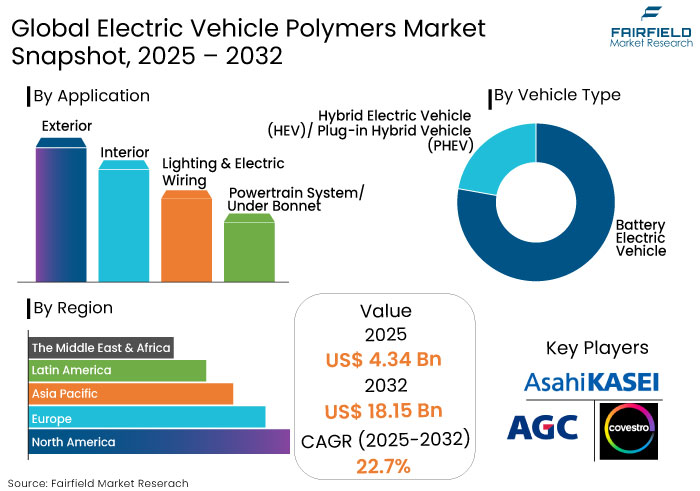

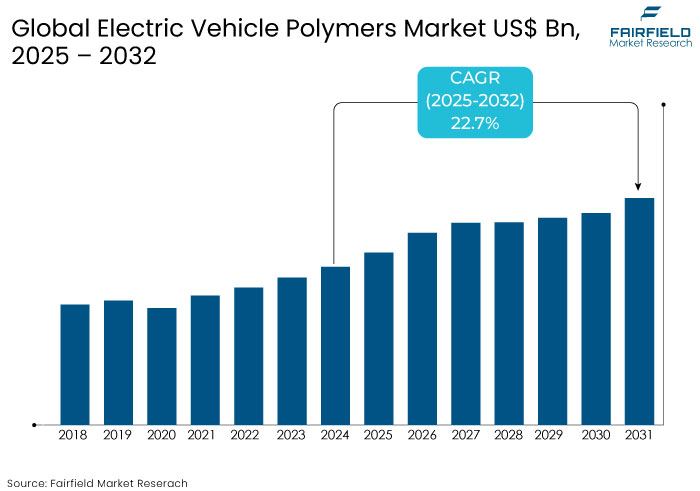

- The electric vehicle polymers market is projected to reach a size of US$18.15 Bn by 2032, showing significant growth from the US$4.34 Bn achieved in 2025.

- The market for electric vehicle polymers is expected to show a significant expansion rate, with a remarkable CAGR of 22.7% from 2025 to 2032.

Electric Vehicle Polymers Market Insights

- Lightweight polymers are critical for improving EV energy efficiency and extending driving range by reducing vehicle weight.

- Polypropylene is the most widely used polymer in EVs, accounting for 32% of the market share due to its versatility, cost-effectiveness, and recyclability.

- Battery electric vehicle (BEV) dominates the market with the global shift towards electric mobility.

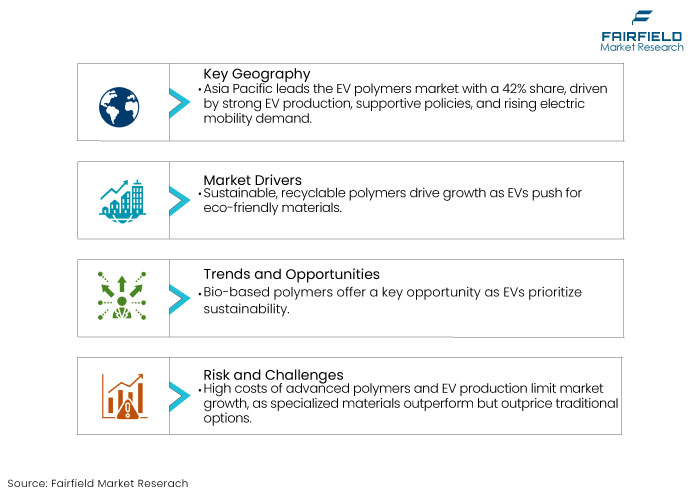

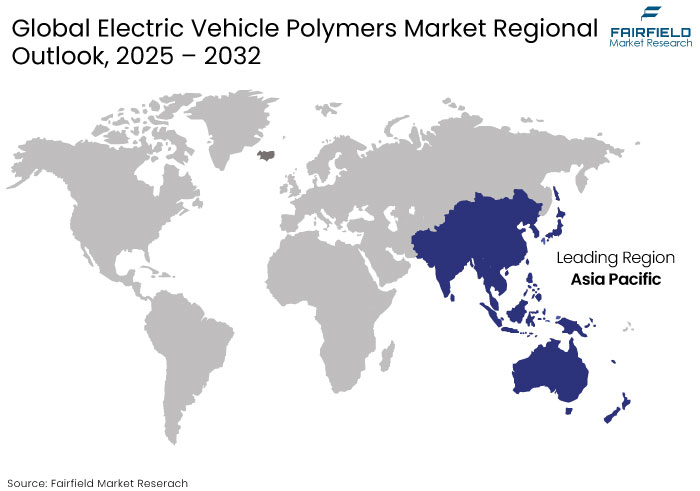

- Asia Pacific is estimated to account for a market share of 42% in 2025 driven by China’s leadership in EV production and supportive government policies.

- The push for green mobility is increasing demand for bio-based and recyclable polymers, aligning with circular economy goals.

- Polymers tailored for thermal management, electrical insulation, and safety are essential for next-generation batteries, including solid-state systems.

- Partnerships between automakers and polymer manufacturers are accelerating innovation and customized solutions for EV-specific challenges.

- Composite materials such as carbon fiber-reinforced polymers (CFRPs) are gaining traction for structural and functional components.

A Look Back and a Look Forward - Comparative Analysis

The electric vehicle polymers market experienced steady growth fueled by increasing EV adoption. The adoption of EV is driven by government regulations promoting zero-emission vehicles and rising environmental awareness.

Polymers such as polypropylene (PP), polycarbonate (PC), and polyamide (PA) found extensive applications in battery casings, interior components, and structural parts, contributing to weight reduction and energy efficiency. Asia Pacific dominated the market due to its robust EV manufacturing base, while Europe and North America exhibited growing momentum with initiatives supporting EV adoption.

The market is poised for accelerated growth as EV adoption reaches a tipping point, supported by declining battery costs, expanded charging infrastructure, and strict emission norms Over the forecast period, Innovations in advanced polymers, including recyclable and bio-based materials, are expected to drive sustainability in EV manufacturing.

Asia Pacific will likely retain its dominance, bolstered by China’s leadership in EV production, while Europe will strengthen its position with significant investments in green mobility.

Enhanced polymer applications in next-generation EV technologies, such as solid-state batteries and autonomous vehicles, will further boost market demand, setting the stage for transformative growth in the coming decade.

Key Growth Determinants

- Advancements in Sustainable Polymer Technologies Boosts Sales

The development of sustainable and recyclable polymer technologies is a key growth driver. As EVs are marketed as environment-friendly solutions, the demand for materials that align with sustainability goals has risen sharply.

Innovations in bio-based polymers and recyclable plastics are transforming the market landscape, allowing manufacturers to meet regulatory standards and consumer expectations for green products.

Sustainable polymers, such as those used in recyclable battery components and biodegradable interior materials, reduce waste and enhance the lifecycle efficiency of EVs. Such advancements not only support the circular economy but also strengthen the competitive position of manufacturers investing in environment-friendly solutions.

- Rising EV Production and Adoption Remains a Primary Driver

The global surge in EV adoption is a significant growth driver for the electric vehicle polymers market. Government policies, subsidies, and emission reduction targets have incentivized consumers and manufacturers to transition to electric mobility.

The demand for polymers used in battery casings, interior trims, and exterior parts has increased with EV production scaling rapidly. Polymers provide cost effective, durable, and customizable solutions to meet the unique requirements of EV manufacturing.

Asia Pacific, particularly China, dominates EV production, fueling regional demand for polymers. Europe and North America are witnessing significant growth due to favourable policies. The expanding production base ensures a sustained demand for polymers tailored for EV applications.

Key Growth Barriers

- High Initial Costs of EV Production and Polymers

One of the significant growth restraints for the electric vehicle polymers market is the high initial cost associated with EV production and advanced polymer materials. EVs typically require high-performance polymers that can withstand extreme temperatures, provide structural integrity, and ensure the vehicle is lightweight. However, these specialized polymers, such as engineering plastics and composites, are often more expensive than traditional materials like steel and aluminum.

The production cost of EVs is already higher than that of conventional vehicles, further amplifying the economic challenge. Smaller automakers and those with limited resources may struggle to integrate these polymers at scale, hindering widespread adoption.

- Recycling and End-of-Life Challenges

One of the key restraints is the difficulty in recycling advanced polymer materials used in EVs. Unlike traditional materials, high-performance polymers and composites are often complex to recycle due to their multi-layered and chemically treated structures. This limitation conflicts with EVs' sustainability promise, as disposing of non-recyclable polymer components contributes to waste and environmental concerns.

The lack of a robust infrastructure for recycling EV-specific materials worsens this challenge.

Regulatory bodies and consumers increasingly emphasize end-of-life solutions, and manufacturers who cannot ensure sustainable disposal or recycling methods may face penalties and reduced market appeal. Addressing these challenges requires substantial investments in recycling technologies and infrastructure, which could slow the overall growth of the EV polymers market.

Electric Vehicle Polymers Market Trends and Opportunities

- Integration of Sustainable and Bio-Based Polymers Boosts Market

The integration of sustainable and bio-based polymers represents another transformative opportunity in the electric vehicle polymers market. As environmental sustainability becomes a key selling point for EV, manufacturers are exploring bio-based alternatives to conventional petroleum-derived polymers.

Materials derived from renewable resources, such as polylactic acid (PLA) and bio-based polyethylene, are being developed for applications in interior trims, insulation, and exterior components.

Such sustainable materials reduce the carbon footprint of EV production and align with circular economy principles by making it easy to recycle or biodegrade. Governments and regulatory bodies incentivizing green technologies further amplify this opportunity, encouraging innovation and adoption across the industry.

- Innovations in Polymer Applications for Battery Technologies

The rapid evolution of EV battery technologies presents a significant opportunity for polymers in thermal management and energy storage solutions. Advanced polymers with superior thermal conductivity, electrical insulation, and flame retardancy are critical for improving battery safety and efficiency. Polymer-based separators and coatings are essential in preventing thermal runaway and enhancing energy density.

Innovations in solid-state battery technologies, which require specialized polymers for electrolyte containment and structural support, open a new frontier for polymer applications. The ability to customize polymer properties for specific battery designs positions this sector as a transformative driver for the future of EVs.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario shapes the electric vehicle polymer market by driving the demand for lightweight, high-performance, and sustainable materials. Governments worldwide enforce stringent emissions regulations to combat climate change and reduce greenhouse gas levels, compelling automakers to transition to electric mobility.

Regulations prioritize energy efficiency and vehicle range, pushing manufacturers to adopt advanced polymers that reduce vehicle weight and enhance performance. Sustainability regulations also influence polymer innovation, focusing on recyclable, bio-based, and low-carbon footprint materials.

Europe’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations and China’s green manufacturing policies encourage eco-friendly polymers. Manufacturers are investing in sustainable materials and recycling technologies, transforming regulatory compliance into an opportunity for market growth. The evolving policies ensure that the regulatory environment remains a key driver of innovation and expansion in the electric vehicle polymers market.

Segments Covered in the Report

- Polypropylene Maintains Primacy in the Market due to its Versatile Properties

Polypropylene (PP) stands out as the dominant polymer type in the electric vehicle polymers market due to its versatile properties, cost-efficiency, and widespread applicability in EV manufacturing.

PP holds a significant market share, estimated at around 32%, driven by its lightweight nature, excellent chemical resistance, and mechanical performance. These characteristics make it an ideal choice for various EV components, such as battery casings, interior trims, bumpers, and electrical housings.

Low density of PP contributes to vehicle weight reduction, a critical factor in improving EV efficiency and range. It is highly mouldable, enabling the production of complex shapes and designs, and is compatible with other materials for hybrid applications. Its recyclability also aligns with the EV industry's sustainability goals, further solidifying its market position.

The dominance of PP is projected to expand with the expansion of EV market supported by its adaptability to new designs and advancements in polymer technology tailored for electric mobility.

- Battery Electric Vehicle (BEV) Dominates the Market with Global Shift towards Electric Mobility

The battery electric vehicle (BEV) emerges as the dominant vehicle type in the electric vehicle polymers market holding a significant market share of approximately 60%. The dominance of BEV is attributed to the global shift toward fully electric mobility solutions, driven by the push for zero-emission vehicles, and increasing government incentives for BEV adoption.

BEVs rely entirely on electric propulsion, making them ideal candidates for lightweight and durable polymer applications to enhance vehicle range and performance. The extensive use of polymers in BEVs stems from optimizing energy efficiency and reducing vehicle weight, as the battery pack is one of the heavy components.

Polymers such as polypropylene (PP), polycarbonate (PC), and polyamides (PA) are widely used in battery casings, thermal management systems, and under-the-hood components. The superior properties of these materials, including their high strength-to-weight ratio, excellent thermal stability, and electrical insulation, contribute significantly to the market growth.

The increasing focus on improving the range and safety of BEVs has further accelerated the innovation in polymer applications, such as lightweight composite materials and advanced coatings for thermal and fire resistance. As automakers invest notably in BEV production and infrastructure, the demand for specialized polymers tailored for these vehicles continues to rise.

The growth trend is amplified by consumer preferences shifting toward environment-friendly and sustainable transportation options, making BEVs the cornerstone of the EV polymer market.

Regional Analysis

- Asia Pacific Remains a Prominent Hub for EV Production

Asia Pacific emerges as the dominant region in the in the regional analysis of the electric vehicle polymers market, commanding a substantial market share of approximately 42%. Asia Pacific's dominance is primarily driven by the region's status as a hub for EV production and consumption. It is supported by a robust automotive manufacturing ecosystem, favourable government policies, and increasing consumer demand for electric mobility.

Countries such as China, Japan, and South Korea are at the forefront of this market, with China leading as the world's largest EV market. The China government's aggressive incentives, subsidies, and stringent emission norms have propelled the rapid adoption of EVs, creating a thriving demand for EV polymers.

Japan and South Korea contribute significantly to regional dominance because they focus on innovation and technology development. Automakers in Japan like Toyota and Nissan and South Korea's Hyundai and Kia leverage high-performance polymers in-vehicle components to meet global safety and efficiency standards.

Asia Pacific is set to maintain its leading position with the global EV market poised for exponential growth, driven by continuous advancements in polymer technologies and a steadfast commitment to electrification and sustainability.

- Europe Market Emerges Lucrative with Presence of Leading Automotive Manufacturers

Europe’s significant presence in the global market is driven by its strong regulatory framework aimed at reducing carbon emissions, widespread EV adoption, and the presence of leading automotive manufacturers focusing on electric mobility.

The European Union has set ambitious targets for achieving net-zero emissions, with countries like Germany, Norway, France, and the Netherlands leading the way in EV adoption. Such nations provide generous subsidies, tax incentives, and infrastructure development initiatives, creating a favourable EV production and sales environment.

The demand for EV polymers is fueled by European automakers like Volkswagen, BMW, and Renault, increasingly using lightweight and durable polymers to meet stringent fuel efficiency and safety standards. Europe’s focus on sustainability has also driven innovation in the use of recyclable and bio-based polymers.

Developing high-performance materials for battery systems, interior trims, and thermal management solutions is particularly prominent in the region. As a major automotive hub, Germany plays a pivotal role in this growth, with significant investments in research and development of advanced polymer materials tailored for EV applications.

Fairfield’s Competitive Landscape Analysis

The electric vehicle polymers market is highly competitive, with key players focusing on innovation, strategic partnerships, and sustainability initiatives to gain notable market share. Prominent companies such as BASF SE, Covestro AG, SABIC, and Dow Inc. dominate the landscape, leveraging extensive research and development capabilities to develop advanced polymer solutions.

Emerging players and regional manufacturers are gaining traction by offering cost-effective, specialized materials. Collaborations between polymer producers and automakers are increasing to address specific design and performance challenges.

Advancements in battery technologies, increasing demand for lightweight materials, and regional policies promoting EV adoption, particularly in Asia Pacific and Europe, further shape the competitive environment.

Key Market Companies

- BASF SE

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG

- Dupont

- Sumitomo Chemicals Co. Ltd.

- LG Chem

- Asahi Kasei

- LANXESS

- INEOS Group

- Celanese Corp.

- AGC Chemicals

- EMS-Chemie Holding

- Mitsubishi Engineering Plastics Corp.

Recent Industry Developments

- In March 2024, LG Chem unveiled a new bio-based polypropylene product designed for use in EV interior trims and lightweight. The material is part of its Green Chemical initiative to enhance sustainability in the automotive sector.

- In June 2024, Arkema announced the development of Rilsan® Polyamide 11, a bio-based, high-performance polymer targeted at EV fuel lines and electrical insulation.

An Expert’s Eye

- Experts emphasize that lightweight polymers enhance EV efficiency and range, making them indispensable in battery casings, interior components, and structural parts.

- The importance of sustainable and recyclable polymers is rising as automakers face increasing pressure to reduce environmental impact and comply with stringent regulations.

- Asia Pacific is estimated to continue leading the market due to its robust EV manufacturing base and favourable government policies, with Europe following closely.

- Collaboration between automakers and material developers is vital for overcoming technical challenges and accelerating polymer adoption in next-generation EVs.

Global Electric Vehicle Polymers Market is Segmented as-

By Polymer Type

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (PA)

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl Butyral (PVB)

- Polyvinyl Chloride (PVC)

By Application

- Exterior

- Interior

- Lighting & Electric Wiring

- Powertrain System/Under Bonnet

By Components

- Battery

- Bumper

- Car Upholstery

- Connector and Cables

- Door Assembly

- Electric Wiring

- Exterior Trim

- Interior Trim

- Lighting

- Steering & Dashboards

By Vehicle Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Electric Vehicle Polymers Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Electric Vehicle Polymers Market Outlook, 2019 - 2032

3.1. Global Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

3.1.1.2. Polyamide (PA)

3.1.1.3. Polybutylene Terephthalate (PBT)

3.1.1.4. Polycarbonate (PC)

3.1.1.5. Polyethylene (PE)

3.1.1.6. Polyethylene Terephthalate (PET)

3.1.1.7. Polypropylene (PP)

3.1.1.8. Polyurethane (PU)

3.1.1.9. Polyvinyl Butyral (PVB)

3.1.1.10. Polyvinyl Chloride (PVC)

3.1.1.11. Others

3.2. Global Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Exterior

3.2.1.2. Interior

3.2.1.3. Lighting & Electric Wiring

3.2.1.4. Powertrain System/Under Bonnet

3.3. Global Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Battery

3.3.1.2. Bumper

3.3.1.3. Car Upholstery

3.3.1.4. Connector and Cables

3.3.1.5. Door Assembly

3.3.1.6. Electric Wiring

3.3.1.7. Exterior Trim

3.3.1.8. Interior Trim

3.3.1.9. Lighting

3.3.1.10. Steering & Dashboards

3.3.1.11. Others

3.4. Global Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Battery Electric Vehicle (BEV)

3.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

3.5. Global Electric Vehicle Polymers Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Electric Vehicle Polymers Market Outlook, 2019 - 2032

4.1. North America Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

4.1.1.2. Polyamide (PA)

4.1.1.3. Polybutylene Terephthalate (PBT)

4.1.1.4. Polycarbonate (PC)

4.1.1.5. Polyethylene (PE)

4.1.1.6. Polyethylene Terephthalate (PET)

4.1.1.7. Polypropylene (PP)

4.1.1.8. Polyurethane (PU)

4.1.1.9. Polyvinyl Butyral (PVB)

4.1.1.10. Polyvinyl Chloride (PVC)

4.1.1.11. Others

4.2. North America Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Exterior

4.2.1.2. Interior

4.2.1.3. Lighting & Electric Wiring

4.2.1.4. Powertrain System/Under Bonnet

4.3. North America Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Battery

4.3.1.2. Bumper

4.3.1.3. Car Upholstery

4.3.1.4. Connector and Cables

4.3.1.5. Door Assembly

4.3.1.6. Electric Wiring

4.3.1.7. Exterior Trim

4.3.1.8. Interior Trim

4.3.1.9. Lighting

4.3.1.10. Steering & Dashboards

4.3.1.11. Others

4.4. North America Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Battery Electric Vehicle (BEV)

4.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Electric Vehicle Polymers Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.2. U.S. Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.3. U.S. Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.4. U.S. Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.5. Canada Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.6. Canada Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.7. Canada Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.1.8. Canada Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Electric Vehicle Polymers Market Outlook, 2019 - 2032

5.1. Europe Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

5.1.1.2. Polyamide (PA)

5.1.1.3. Polybutylene Terephthalate (PBT)

5.1.1.4. Polycarbonate (PC)

5.1.1.5. Polyethylene (PE)

5.1.1.6. Polyethylene Terephthalate (PET)

5.1.1.7. Polypropylene (PP)

5.1.1.8. Polyurethane (PU)

5.1.1.9. Polyvinyl Butyral (PVB)

5.1.1.10. Polyvinyl Chloride (PVC)

5.1.1.11. Others

5.2. Europe Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Exterior

5.2.1.2. Interior

5.2.1.3. Lighting & Electric Wiring

5.2.1.4. Powertrain System/Under Bonnet

5.3. Europe Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Battery

5.3.1.2. Bumper

5.3.1.3. Car Upholstery

5.3.1.4. Connector and Cables

5.3.1.5. Door Assembly

5.3.1.6. Electric Wiring

5.3.1.7. Exterior Trim

5.3.1.8. Interior Trim

5.3.1.9. Lighting

5.3.1.10. Steering & Dashboards

5.3.1.11. Others

5.4. Europe Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Battery Electric Vehicle (BEV)

5.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Electric Vehicle Polymers Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.2. Germany Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.3. Germany Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.4. Germany Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.5. U.K. Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.6. U.K. Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.7. U.K. Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.8. U.K. Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.9. France Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.10. France Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.11. France Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.12. France Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.13. Italy Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.14. Italy Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.15. Italy Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.16. Italy Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.17. Turkey Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.18. Turkey Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.19. Turkey Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.20. Turkey Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.21. Russia Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.22. Russia Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.23. Russia Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.24. Russia Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.25. Rest of Europe Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.26. Rest of Europe Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.27. Rest of Europe Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.1.28. Rest of Europe Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Electric Vehicle Polymers Market Outlook, 2019 - 2032

6.1. Asia Pacific Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

6.1.1.2. Polyamide (PA)

6.1.1.3. Polybutylene Terephthalate (PBT)

6.1.1.4. Polycarbonate (PC)

6.1.1.5. Polyethylene (PE)

6.1.1.6. Polyethylene Terephthalate (PET)

6.1.1.7. Polypropylene (PP)

6.1.1.8. Polyurethane (PU)

6.1.1.9. Polyvinyl Butyral (PVB)

6.1.1.10. Polyvinyl Chloride (PVC)

6.1.1.11. Others

6.2. Asia Pacific Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Exterior

6.2.1.2. Interior

6.2.1.3. Lighting & Electric Wiring

6.2.1.4. Powertrain System/Under Bonnet

6.3. Asia Pacific Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Battery

6.3.1.2. Bumper

6.3.1.3. Car Upholstery

6.3.1.4. Connector and Cables

6.3.1.5. Door Assembly

6.3.1.6. Electric Wiring

6.3.1.7. Exterior Trim

6.3.1.8. Interior Trim

6.3.1.9. Lighting

6.3.1.10. Steering & Dashboards

6.3.1.11. Others

6.4. Asia Pacific Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Battery Electric Vehicle (BEV)

6.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Electric Vehicle Polymers Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.2. China Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.3. China Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.4. China Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.5. Japan Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.6. Japan Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.7. Japan Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.8. Japan Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.9. South Korea Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.10. South Korea Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.11. South Korea Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.12. South Korea Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.13. India Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.14. India Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.15. India Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.16. India Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.17. Southeast Asia Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.18. Southeast Asia Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.19. Southeast Asia Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.20. Southeast Asia Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.21. Rest of Asia Pacific Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.22. Rest of Asia Pacific Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.23. Rest of Asia Pacific Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.1.24. Rest of Asia Pacific Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Electric Vehicle Polymers Market Outlook, 2019 - 2032

7.1. Latin America Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

7.1.1.2. Polyamide (PA)

7.1.1.3. Polybutylene Terephthalate (PBT)

7.1.1.4. Polycarbonate (PC)

7.1.1.5. Polyethylene (PE)

7.1.1.6. Polyethylene Terephthalate (PET)

7.1.1.7. Polypropylene (PP)

7.1.1.8. Polyurethane (PU)

7.1.1.9. Polyvinyl Butyral (PVB)

7.1.1.10. Polyvinyl Chloride (PVC)

7.1.1.11. Others

7.2. Latin America Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Exterior

7.2.1.2. Interior

7.2.1.3. Lighting & Electric Wiring

7.2.1.4. Powertrain System/Under Bonnet

7.3. Latin America Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Battery

7.3.1.2. Bumper

7.3.1.3. Car Upholstery

7.3.1.4. Connector and Cables

7.3.1.5. Door Assembly

7.3.1.6. Electric Wiring

7.3.1.7. Exterior Trim

7.3.1.8. Interior Trim

7.3.1.9. Lighting

7.3.1.10. Steering & Dashboards

7.3.1.11. Others

7.4. Latin America Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Battery Electric Vehicle (BEV)

7.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Electric Vehicle Polymers Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.2. Brazil Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.3. Brazil Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.4. Brazil Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.5. Mexico Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.6. Mexico Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.7. Mexico Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.8. Mexico Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.9. Argentina Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.10. Argentina Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.11. Argentina Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.12. Argentina Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.13. Rest of Latin America Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.14. Rest of Latin America Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.15. Rest of Latin America Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.1.16. Rest of Latin America Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Electric Vehicle Polymers Market Outlook, 2019 - 2032

8.1. Middle East & Africa Electric Vehicle Polymers Market Outlook, by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Acrylonitrile Butadiene Styrene (ABS)

8.1.1.2. Polyamide (PA)

8.1.1.3. Polybutylene Terephthalate (PBT)

8.1.1.4. Polycarbonate (PC)

8.1.1.5. Polyethylene (PE)

8.1.1.6. Polyethylene Terephthalate (PET)

8.1.1.7. Polypropylene (PP)

8.1.1.8. Polyurethane (PU)

8.1.1.9. Polyvinyl Butyral (PVB)

8.1.1.10. Polyvinyl Chloride (PVC)

8.1.1.11. Others

8.2. Middle East & Africa Electric Vehicle Polymers Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Exterior

8.2.1.2. Interior

8.2.1.3. Lighting & Electric Wiring

8.2.1.4. Powertrain System/Under Bonnet

8.3. Middle East & Africa Electric Vehicle Polymers Market Outlook, by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Battery

8.3.1.2. Bumper

8.3.1.3. Car Upholstery

8.3.1.4. Connector and Cables

8.3.1.5. Door Assembly

8.3.1.6. Electric Wiring

8.3.1.7. Exterior Trim

8.3.1.8. Interior Trim

8.3.1.9. Lighting

8.3.1.10. Steering & Dashboards

8.3.1.11. Others

8.4. Middle East & Africa Electric Vehicle Polymers Market Outlook, by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Battery Electric Vehicle (BEV)

8.4.1.2. Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Electric Vehicle Polymers Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.2. GCC Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.3. GCC Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.4. GCC Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.5. South Africa Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.6. South Africa Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.7. South Africa Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.8. South Africa Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.9. Egypt Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.10. Egypt Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.11. Egypt Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.12. Egypt Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.13. Nigeria Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.14. Nigeria Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.15. Nigeria Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.16. Nigeria Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa Electric Vehicle Polymers Market by Polymer Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa Electric Vehicle Polymers Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa Electric Vehicle Polymers Market by Components, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa Electric Vehicle Polymers Market by Vehicle Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heat Map

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. BASF SE

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. SABIC

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. LyondellBasell Industries Holdings B.V.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Evonik Industries

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Covestro AG

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Dupont

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Sumitomo Chemicals Co. Ltd.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. LG Chem

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Asahi Kasei

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. LANXESS

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. INEOS Group

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Celanese Corp.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. AGC Chemicals

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. EMS-Chemie Holding

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Mitsubishi Engineering Plastics Corp.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Polymer Type Coverage |

|

|

Application Coverage |

|

|

Components Coverage |

|

|

Vehicle Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |