Global Electric Vehicle Telematics Market Forecast

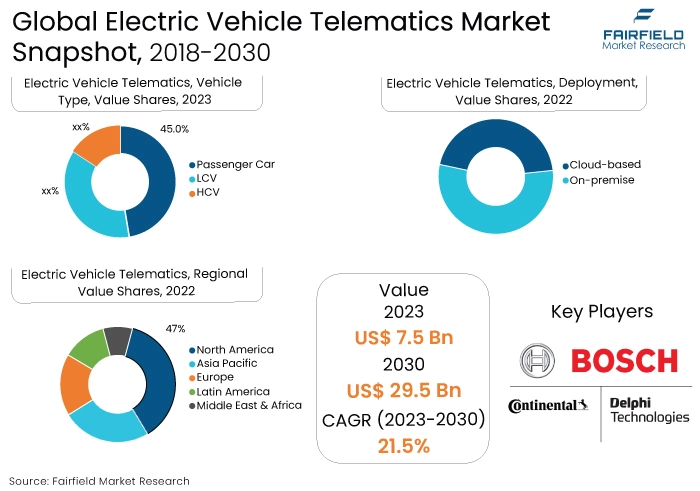

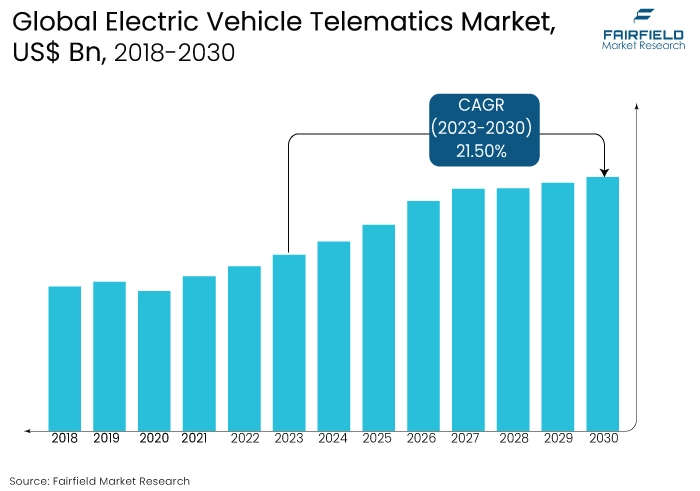

- Electric vehicle telematics market size to take a leap from US$7.5 Bn in 2023 to US$29.5 Bn by 2030

- Global electric vehicle telematics market valuation projected to see 21.5% CAGR over 2023-2030

Major Report Findings - Fairfield's Perspective

- The electric vehicle telematics market is growing due to the rising adoption of electric vehicles (EVs), driven by environmental concerns and supportive government initiatives. Telematics systems in EVs enhance efficiency, provide real-time monitoring, and contribute to the overall growth of the electric vehicle market by ensuring effective management and performance optimization.

- Another major market trend expected to fuel the growth of the electric vehicle telematics market is the rapidly expanding safety and security services. The market is also predicted to profit from the expanding worldwide entertainment industries.

- Embedded technology is growing in the electric vehicle telematics market due to its integral role in providing real-time data and connectivity. Embedded systems enable seamless integration of telematics features within electric vehicles, enhancing communication, monitoring, and control capabilities. This technology is vital for optimizing vehicle performance, efficiency, and user experience.

- The passenger car vehicle type is growing in the electric vehicle telematics market due to increasing consumer adoption of electric passenger cars. Telematics systems enhance the driving experience, providing features like real-time monitoring, navigation, and connectivity. The demand for these advanced features in electric passenger cars is driving the growth of telematics in this vehicle segment.

- Safety and security applications are growing in the electric vehicle telematics market due to the heightened emphasis on driver and vehicle safety. Telematics systems offer features like emergency assistance, remote vehicle tracking, and theft prevention, enhancing overall safety and security. Increasing awareness and regulatory initiatives contribute to the growing adoption of these applications.

- The increasing growth of electric vehicles is driving the electric vehicle telematics market as the adoption of telematics becomes integral to optimizing performance, managing charging, and enhancing the overall user experience. Telematics systems in electric vehicles contribute to efficiency, range optimization, and the seamless integration of smart features, fostering market growth.

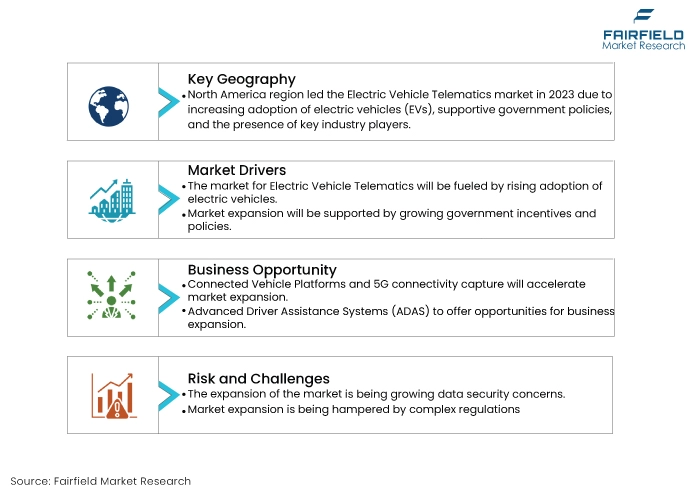

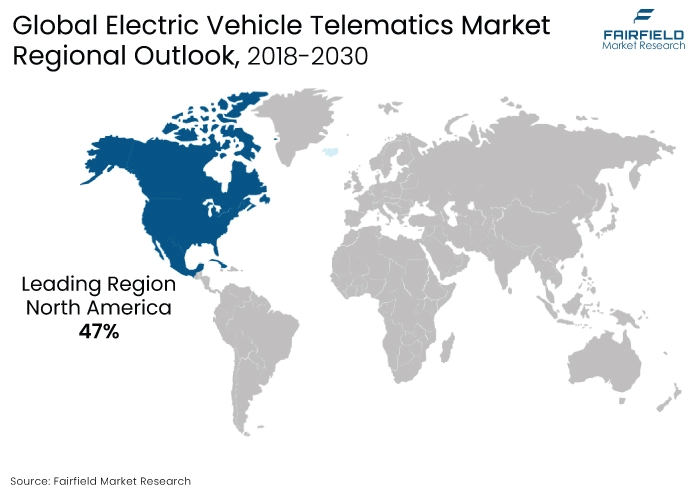

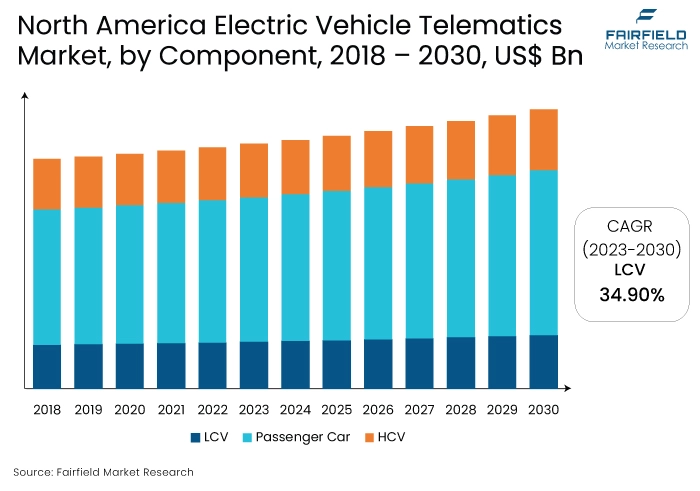

- North America is growing in the electric vehicle telematics market due to the increasing adoption of electric vehicles, supportive government policies, and the presence of key industry players. Stringent emissions regulations, a growing awareness of environmental sustainability, and a well-established automotive industry contribute to the region's prominence in the EV telematics market.

- The Asia Pacific region is growing in the electric vehicle telematics market due to the rapid adoption of electric vehicles, government initiatives promoting clean mobility, and the expanding automotive sector. Increasing urbanization, environmental concerns, and supportive policies contribute to the significant growth of EV telematics in the Asia Pacific region.

A Look Back and a Look Forward - Comparative Analysis

The electric vehicle telematics market is growing due to the rising adoption of electric vehicles worldwide. With an increasing focus on environmental sustainability, government incentives, and advancements in electric vehicle technology, the demand for telematics solutions has surged. Telematics systems provide real-time data, connectivity, and safety features, enhancing the overall driving experience for electric vehicle users. The growing awareness of these benefits and the expansion of electric vehicle fleets contribute to the continuous growth of the electric vehicle telematics market.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of major applications such as safety, security, and entertainment. However, in some applications, the demand for Electric Vehicle Telematics has increased, including in diagnostics, and other areas.

The future of the electric vehicle telematics market looks promising, driven by the ongoing global shift towards electric vehicles. Increasing environmental concerns, supportive government policies, and advancements in telematics technologies will fuel market growth. The integration of innovative features, enhanced connectivity, and the development of smart charging solutions are expected trends. As the electric vehicle market expands, the electric vehicle telematics market will continue to play a pivotal role in optimizing performance and enhancing the overall user experience.

Key Growth Determinants

- Rising Adoption of Electric Vehicles

The rising adoption of EVs is a primary driver of the electric vehicle telematics market. As the automotive industry undergoes a transformative shift towards cleaner and sustainable mobility, E.V.s are gaining traction globally.

Telematics systems play a crucial role in enhancing the performance, efficiency, and user experience of electric vehicles. They provide real-time data, connectivity, and smart features, addressing challenges like range anxiety and optimizing charging processes.

The demand for telematics solutions is propelled by consumers' growing preference for EVs, supported by government incentives, environmental concerns, and the continuous technological advancements in electric vehicle technology.

- Growing Government Incentives, and Policies

The growing support from Government Incentives and Policies is a significant driver for the electric vehicle telematics market. Governments worldwide are actively promoting the adoption of electric vehicles through financial incentives, subsidies, and regulatory frameworks. Incentives such as tax credits, rebates, and favorable policies create a favorable environment for consumers and businesses to embrace electric mobility.

Telematics systems align with these initiatives by offering features that enhance the efficiency, safety, and overall performance of electric vehicles. The integration of telematics becomes a crucial aspect of meeting compliance requirements and leveraging incentives, thereby accelerating the growth of the electric vehicle telematics market.

- Growing Smart Charging Solutions

The growing emphasis on smart charging solutions is a key driver for the electric vehicle telematics market. As electric vehicle infrastructure expands, smart charging solutions become essential for optimizing charging processes. Telematics systems play a pivotal role by providing real-time data on charging status and energy consumption and optimizing charging schedules.

These solutions address range anxiety, enhance charging efficiency, and contribute to the overall user experience. The integration of telematics with smart charging infrastructure ensures seamless communication between electric vehicles and charging stations, facilitating efficient energy management. The increasing demand for intelligent and connected charging solutions propels the growth of the electric vehicle telematics market.

Major Growth Barriers

- Growing Data Security Concerns

The growing data security concerns pose a significant challenge to the electric vehicle telematics market. Telematics systems collect and transmit sensitive vehicle and user data, raising concerns about privacy breaches and cyber threats. As the volume of data exchanged increases, ensuring robust cybersecurity measures becomes imperative to protect against unauthorized access and potential misuse.

Addressing these concerns requires the implementation of advanced encryption, secure authentication protocols, and adherence to stringent data protection standards. Building trust among consumers and stakeholders regarding the security of their data is crucial for the sustained growth of the electric vehicle telematics market amidst the evolving landscape of cybersecurity challenges.

- Global Regulatory Variations

Global regulatory variations present a significant challenge for the electric vehicle telematics market. Differing standards and regulations across regions complicate the development and deployment of standardized telematics features. Manufacturers must navigate diverse compliance requirements, impacting the uniform implementation of telematics solutions globally.

Varied protocols related to data privacy, connectivity, and safety standards necessitate adaptable systems. Addressing these challenges requires industry collaboration, advocacy for standardized regulations, and agile development strategies. Harmonizing global regulatory frameworks will be crucial for streamlining telematics functionalities, ensuring interoperability, and fostering a cohesive market for electric vehicles across diverse international markets.

Key Trends and Opportunities to Look at

- Connected Vehicle Platforms

Advanced connected vehicle platforms provide comprehensive telematics solutions, enabling real-time data exchange, remote monitoring, and over-the-air updates.

- 5G Connectivity

The adoption of 5G technology enhances data transfer speeds and Connectivity, facilitating faster and more efficient communication between electric vehicles and telematics systems.

- Advanced Driver Assistance Systems (ADAS)

Integration with ADAS features enhances safety by providing real-time alerts, collision avoidance, and assistance to electric vehicle drivers.

How Does the Regulatory Scenario Shape this Industry?

The regulatory framework for the electric vehicle telematics market varies globally, with key entities and guidelines influencing the industry. In the United States, the Federal Communications Commission (FCC) oversees wireless communication regulations, impacting telematics connectivity. Europe follows regulations like the General Data Protection Regulation (GDPR) for data privacy.

In China, the Ministry of Industry and Information Technology (MIIT) sets standards for telematics systems. Region-specific changes include the European Union's ongoing efforts to standardize EV charging infrastructure and data access. The California Consumer Privacy Act (CCPA) in the US and the European Union's eCall mandate also influence data protection in telematics. Adhering to these regulations is critical for telematics providers to ensure compliance and facilitate market growth in specific regions.

Fairfield’s Ranking Board

Top Segments

- Embedded Technology at the Forefront

Embedded technology captured the largest market share in the electric vehicle telematics market due to its integral role in providing seamless and integrated solutions. Embedded systems are directly incorporated into the vehicle's architecture, offering enhanced reliability, real-time connectivity, and efficient data processing. They provide continuous access to telematics features without relying on external devices.

This inherent integration addresses user preferences for built-in, user-friendly systems and ensures stable performance. The dominance of embedded technology reflects its ability to deliver a comprehensive and immersive telematics experience, contributing to its significant market share in the electric vehicle telematics landscape.

Retrofitted technology, with its adaptability to existing vehicles, is likely to exhibit a notable CAGR through 2030. Retrofitted solutions enable the integration of telematics features into older or non-equipped vehicles, meeting the growing demand for aftermarket solutions. This flexibility appeals to a broad user base, allowing a wider range of vehicles to benefit from telematics functionalities.

The retrofitting trend is driven by consumers seeking cost-effective ways to upgrade their vehicles with advanced features, contributing to the robust growth of retrofitted technology in the electric vehicle telematics sector.

- Passenger Cars Creats Maximum Demand for Telematics

The passenger car vehicle type captured the largest market share in the electric vehicle telematics market due to the substantial adoption of electric passenger cars globally. Consumers increasingly prioritize telematics features for enhanced driving experience, safety, and connectivity. Telematics systems in passenger cars offer navigation assistance, real-time monitoring, and entertainment features.

The growing popularity of electric passenger cars, coupled with the integration of advanced telematics technologies by automakers, contributes to the dominance of the passenger car segment, making it the primary contributor to the largest market share in the electric vehicle telematics landscape.

On the other hand, the light commercial vehicle (LCV) segment is expected to witness a noteworthy CAGR in the electric vehicle telematics market due to the increasing adoption of electric LCVs for commercial purposes. Businesses are leveraging telematics systems to enhance fleet management, optimize routes, and monitor vehicle performance. The demand for efficient and connected solutions to improve operational efficiency is propelling the integration of telematics in electric LCVs. This trend is expected to contribute significantly to the robust growth of the LCV vehicle type within the electric vehicle telematics sector.

- Safety & Security Application to be the Leading Segment

The safety and security application captured the largest market share in the electric vehicle telematics market due to the paramount importance consumers place on safety features. Telematics systems play a vital role in enhancing safety by offering services such as emergency assistance, real-time vehicle tracking, and theft prevention.

As safety remains a top priority for consumers, the demand for telematics solutions providing comprehensive safety and security features drives the dominance of the safety and security application, making it a major contributor to the largest market share in the electric vehicle telematics industry.

The information & navigation application also gains momentum in the market on account of the increasing emphasis on user experience and convenience. As electric vehicles become more prevalent, users seek advanced navigation features, real-time traffic updates, and points of interest information.

Telematics systems offering comprehensive information & navigation functionalities fulfil these demands, contributing to the rapid growth of this application. The integration of innovative mapping technologies, predictive navigation, and user-friendly interfaces further propels the popularity of information and navigation applications, driving their high CAGR in the market.

Regional Frontrunners

North America Stands as the Strongest Regional Contributor

North America captured the largest market share in the electric vehicle telematics market due to several factors. The region has witnessed widespread adoption of electric vehicles supported by government initiatives, incentives, and a growing awareness of environmental sustainability. Advanced technological infrastructure, coupled with a robust automotive industry, has facilitated the integration of telematics systems into electric vehicles.

Stringent regulations promoting clean mobility, along with the presence of key industry players, have contributed to the dominance of North America in the electric vehicle telematics landscape. Additionally, a proactive approach to innovation and the increasing demand for connected car features have further propelled the growth of the market in the region.

Asia Pacific Boasts Fertile Growth Environment for Market Growth

The Asia Pacific region is likely to experience the fastest CAGR in the electric vehicle telematics market due to several factors. The region has witnessed a surge in electric vehicle adoption, driven by urbanization, government incentives, and environmental concerns.

Increasing disposable income, rapid technological advancements, and a growing middle class contribute to the rising demand for electric vehicles with advanced telematics features. Additionally, a burgeoning automotive industry, and the deployment of supportive charging infrastructure further boost the growth of electric vehicle telematics in the Asia Pacific region, positioning it as a key market for the industry's expansion.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the electric vehicle telematics market is characterized by key players such as Targa Telematics, Bridgestone Mobility Solutions, and various digital service providers. Strategic partnerships, acquisitions, and innovations drive market competitiveness.

Companies focus on enhancing connectivity, safety features, and user experiences to gain a competitive edge. The evolving landscape sees collaborations between telematics providers, automotive manufacturers, and IoT specialists, shaping a dynamic industry with a strong emphasis on technological advancements and customer-centric solutions.

Who are the Leaders in the Global Electric Vehicle Telematics Space?

- Robert Bosch GmbH

- Continental AG

- Delphi Technologies (Aptiv)

- CalAmp Corporation

- Agero, Inc.

- Airbiquity, Inc.

- Sierra Wireless, Inc.

- Trimble, Inc.

- TomTom N.V.

- Verizon Communications, Inc.

- Spireon, Inc.

- Tata Communications Ltd.

- Omnitracs, LLC

- Mix Telematics Ltd.

- Teletrac Navman

Significant Industry Developments

New Product Launch

- May 2023: Targa Telematics recently announced the acquisition of Viasat Group Spa, leading to the establishment of a major global player in the IoT sector. This strategic move is poised to usher in inventive solutions and digital services for connected mobility, encompassing eight pivotal European countries—Italy, Portugal, Spain, France, the U.K., Belgium, Poland, and Romania—alongside a company in Chile.

- May 2023: Bridgestone Mobility Solutions has unveiled a collaboration with RIO, a digital service provider. This partnership allows for the seamless integration of Bridgestone's Webfleet telematic solutions into all MAN trucks that come equipped with the pre-existing original equipment manufacturer (OEM) hardware RIO boxes from MAN.

An Expert’s Eye

Demand and Future Growth

An increase in consumer demand for safety and security is driving the market. The electric vehicle telematics market is experiencing robust demand driven by the increasing adoption of electric vehicles, rising consumer preference for connected features, and government initiatives promoting clean mobility.

Future growth is anticipated as technological advancements enhance telematics capabilities, providing real-time data, safety features, and improved user experiences. The expanding global electric vehicle market further fuels the demand for advanced telematics solutions, positioning the industry for sustained growth in the foreseeable future.

Supply Side of the Market

The demand-supply dynamics in the electric vehicle telematics market are influenced by increasing demand for connected features in electric vehicles. The current pricing structure reflects a balance between technological innovation and market competitiveness. Pricing is expected to influence long-term growth by becoming more competitive as economies of scale are achieved and technology costs decrease.

Major trends driving competition include the integration of advanced features, partnerships, and strategic alliances. Supply chain analysis reveals the importance of reliable hardware and software components, effective distribution networks, and collaborations with key suppliers. As the market matures, cost-effective sourcing, efficient logistics, and robust partnerships will play pivotal roles in shaping the dynamics and sustaining growth.

Global Electric Vehicle Telematics Market is Segmented as Below:

By Technology:

- Embedded

- Retrofitted

By Vehicle Type:

- Passenger Car

- LCV

- HCV

By Application:

- Safety & Security

- Entertainment

- Information & Navigation

- Diagnostics

- Misc

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Electric Vehicle Telematics Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Electric Vehicle Telematics Market Outlook, 2018 – 2030

3.1. Global Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Embedded

3.1.1.2. Retrofitted

3.2. Global Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Passenger Car

3.2.1.2. LCV

3.2.1.3. HCV

3.3. Global Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Safety & Security

3.3.1.2. Entertainment

3.3.1.3. Information & Navigation

3.3.1.4. Diagnostics

3.3.1.5. Misc

3.4. Global Electric Vehicle Telematics Market Outlook, by Region, Value (US$ Mn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Electric Vehicle Telematics Market Outlook, 2018 – 2030

4.1. North America Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. Embedded

4.1.1.2. Retrofitted

4.2. North America Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Passenger Car

4.2.1.2. LCV

4.2.1.3. HCV

4.3. North America Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. Safety & Security

4.3.1.2. Entertainment

4.3.1.3. Information & Navigation

4.3.1.4. Diagnostics

4.3.1.5. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Electric Vehicle Telematics Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

4.4.1.2. U.S. Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

4.4.1.3. U.S. Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

4.4.1.4. Canada Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

4.4.1.5. Canada Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

4.4.1.6. Canada Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Electric Vehicle Telematics Market Outlook, 2018 – 2030

5.1. Europe Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. Embedded

5.1.1.2. Retrofitted

5.2. Europe Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Passenger Car

5.2.1.2. LCV

5.2.1.3. HCV

5.3. Europe Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. Safety & Security

5.3.1.2. Entertainment

5.3.1.3. Information & Navigation

5.3.1.4. Diagnostics

5.3.1.5. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Electric Vehicle Telematics Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Germany Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.2. Germany Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.3. Germany Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.4. U.K. Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.5. U.K. Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.6. U.K. Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.7. France Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.8. France Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.9. France Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.10. Italy Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.11. Italy Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.12. Italy Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.13. Turkey Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.14. Turkey Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.15. Turkey Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.16. Russia Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.17. Russia Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.18. Russia Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.19. Rest of Europe Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

5.4.1.20. Rest of Europe Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

5.4.1.21. Rest of Europe Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Electric Vehicle Telematics Market Outlook, 2018 – 2030

6.1. Asia Pacific Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. Embedded

6.1.1.2. Retrofitted

6.2. Asia Pacific Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Passenger Car

6.2.1.2. LCV

6.2.1.3. HCV

6.3. Asia Pacific Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. Safety & Security

6.3.1.2. Entertainment

6.3.1.3. Information & Navigation

6.3.1.4. Diagnostics

6.3.1.5. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Electric Vehicle Telematics Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. China Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.2. China Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.3. China Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.4. Japan Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.5. Japan Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.6. Japan Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.7. South Korea Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.8. South Korea Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.9. South Korea Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.10. India Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.11. India Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.12. India Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.13. Southeast Asia Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.14. Southeast Asia Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.15. Southeast Asia Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.16. Rest of Asia Pacific Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

6.4.1.17. Rest of Asia Pacific Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

6.4.1.18. Rest of Asia Pacific Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Electric Vehicle Telematics Market Outlook, 2018 – 2030

7.1. Latin America Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

7.1.1. Key Highlights

7.1.1.1. Embedded

7.1.1.2. Retrofitted

7.2. Latin America Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

7.2.1. Key Highlights

7.2.1.1. Passenger Car

7.2.1.2. LCV

7.2.1.3. HCV

7.3. Latin America Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. Safety & Security

7.3.1.2. Entertainment

7.3.1.3. Information & Navigation

7.3.1.4. Diagnostics

7.3.1.5. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Electric Vehicle Telematics Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

7.4.1.2. Brazil Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

7.4.1.3. Brazil Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.4. Mexico Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

7.4.1.5. Mexico Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

7.4.1.6. Mexico Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.7. Argentina Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

7.4.1.8. Argentina Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

7.4.1.9. Argentina Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.10. Rest of Latin America Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

7.4.1.11. Rest of Latin America Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

7.4.1.12. Rest of Latin America Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Electric Vehicle Telematics Market Outlook, 2018 – 2030

8.1. Middle East & Africa Electric Vehicle Telematics Market Outlook, by Technology, Value (US$ Mn), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. Embedded

8.1.1.2. Retrofitted

8.2. Middle East & Africa Electric Vehicle Telematics Market Outlook, by Vehicle Type, Value (US$ Mn), 2018 – 2030

8.2.1. Key Highlights

8.2.1.1. Passenger Car

8.2.1.2. LCV

8.2.1.3. HCV

8.3. Middle East & Africa Electric Vehicle Telematics Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

8.3.1. Key Highlights

8.3.1.1. Safety & Security

8.3.1.2. Entertainment

8.3.1.3. Information & Navigation

8.3.1.4. Diagnostics

8.3.1.5. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Electric Vehicle Telematics Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

8.4.1. Key Highlights

8.4.1.1. GCC Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

8.4.1.2. GCC Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

8.4.1.3. GCC Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.4. South Africa Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

8.4.1.5. South Africa Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

8.4.1.6. South Africa Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.7. Egypt Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

8.4.1.8. Egypt Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

8.4.1.9. Egypt Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.10. Nigeria Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

8.4.1.11. Nigeria Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

8.4.1.12. Nigeria Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.13. Rest of Middle East & Africa Electric Vehicle Telematics Market by Technology, Value (US$ Mn), 2018 – 2030

8.4.1.14. Rest of Middle East & Africa Electric Vehicle Telematics Market Vehicle Type, Value (US$ Mn), 2018 – 2030

8.4.1.15. Rest of Middle East & Africa Electric Vehicle Telematics Market Application, Value (US$ Mn), 2018 – 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Robert Bosch GmbH

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Continental AG

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Delphi Technologies (Aptiv)

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. CalAmp Corporation

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Agero, Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Airbiquity, Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Sierra Wireless, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Trimble, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. TomTom N.V.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Verizon Communications, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Spireon, Inc.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Tata Communications Ltd.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Omnitracs, LLC

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Mix Telematics Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Teletrac Navman

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Technology Coverage |

|

|

Vehicle Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |