Global Embolotherapy Market Forecast

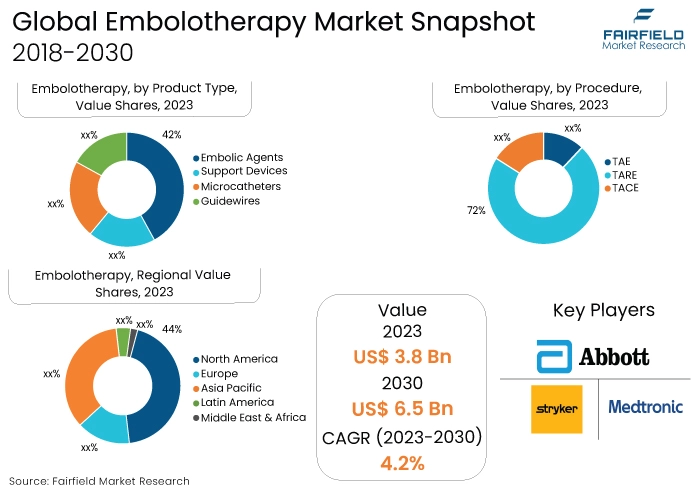

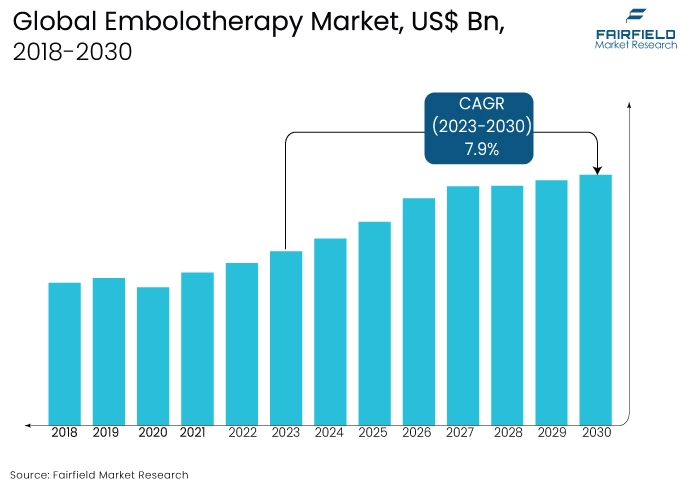

- The approximately US$3.8 Bn market for embolotherapy (2023) poised to reach US$6.5 Bn by 2030-end

- Global embolotherapy market size to witness robust expansion at a CAGR of 7.9% over 2023-2030

Quick Report Digest

- An observed pattern in the embolotherapy industry is the growing inclination towards minimally invasive procedures, which is motivated by patients' desire for expedited recuperation and diminished complications.

- An additional noteworthy development is the ongoing progression of embolic agents, which utilise cutting-edge technologies to improve the accuracy, effectiveness, and safety of embolization processes.

- As a targeted cancer therapy, embolotherapy is experiencing a surge in market demand, which reflects an industry-wide trend toward more individualised and effective treatment options.

- There is an emerging market trend that is moving beyond oncology to explore additional applications of embolotherapy, particularly in the treatment of vascular diseases. This development is expected to significantly broaden the market's potential and scope.

- Out of the market segments comprising guidewires, microcatheters, support devices, and embolic agents, Embolic Agents are anticipated to hold the most significant market share by 2023. The significant influence of these agents in obstructing blood vessels throughout therapeutic procedures is the reason for their preponderance.

- In the therapeutic segments of TAE, TARE/SIRT, and TACE, it is anticipated that Transcatheter Arterial Embolization (TAE) will hold the largest market share by 2023. This is because it applies to a vast array of conditions, such as tumours and vascular malformations.

- Except for ambulatory surgical centres and other end-user segments, hospitals and clinics are anticipated to hold the largest market share in 2023. The substantial contribution to the execution of embolization procedures in these contexts is attributable to the infrastructure and expertise that are accessible.

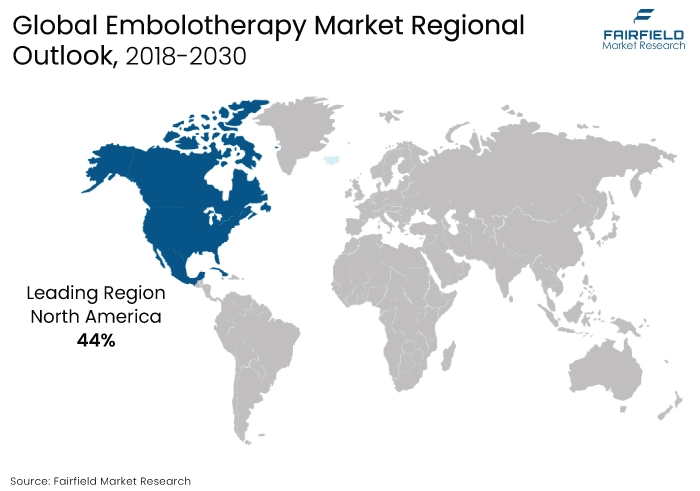

- North America is anticipated to have the highest market penetration on a global scale, owing to its firmly established healthcare infrastructure, the escalating incidence of vascular diseases, and the expanding acceptance of cutting-edge medical technologies. Embolotherapy is utilised in the region to treat a variety of conditions, including liver tumours and aneurysms.

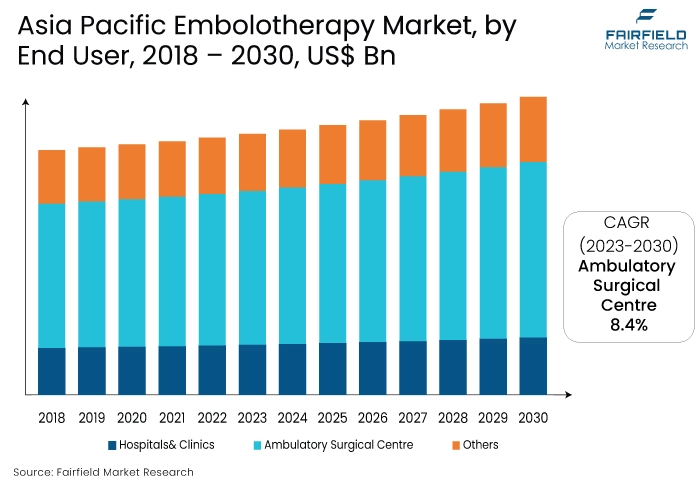

- The Asia Pacific region is expected to experience the most rapid market penetration growth, driven by factors such as increased accessibility to healthcare, heightened awareness regarding minimally invasive treatments, and a rising prevalence of cardiovascular diseases. In the region, embolotherapy is being utilised more frequently to treat conditions such as hepatocellular carcinoma and uterine fibroids.

A Look Back and a Look Forward - Comparative Analysis

At present, the worldwide embolotherapy market is undergoing substantial expansion, propelled by an upsurge in the need for minimally invasive procedures and developments in embolic agents and technologies. The market is experiencing growth due to the increasing utilisation of embolotherapy to treat vascular diseases and the growing trend toward targeted cancer therapies.

Throughout history, the market has undergone substantial transformations, during which technological advances have been instrumental. The shift from traditional treatment methods to minimally invasive techniques has emerged as a defining characteristic. The historical development of embolotherapy has been characterised by its increasing adoption in numerous medical specialties, which has established its effectiveness and safety in a wide range of clinical applications.

Concerning the future, the market for embolotherapy is positioned to experience consistent growth. Embedded agent innovations that are anticipated, in conjunction with an expanding comprehension of the efficacy of the technique, are likely to stimulate adoption. With the increasing emphasis on cost-effectiveness and patient satisfaction within healthcare systems across the globe, embolotherapy is poised to significantly influence the trajectory of interventional medicine, thereby making a substantial contribution to the ongoing expansion of the market.

Key Growth Determinants

- Constant Development Cycle

The constant development of embolic agents is a significant market driver. Advancements in embolic materials, including biocompatible polymers and microspheres, serve to augment the accuracy and efficacy of embolization protocols.

These developments enable precise obstruction of blood vessels, thereby reducing unintended harm and enhancing patient prognoses. The proliferation of customised and specialised embolic agents further broadens the spectrum of conditions that can be treated, thereby stimulating greater acceptance and utilisation in diverse medical fields.

- Rising Prevalence of Vascular Disorders

The increasing prevalence of vascular diseases, such as tumours, aneurysms, and malformations, serves as a substantial market catalyst for embolotherapy. The prevalence of these conditions is influenced by lifestyle choices and the ageing of the global population, which has led to an increased need for minimally invasive treatment alternatives. Embolotherapy, due to its broad range of applications for vascular disorders, emerges as the treatment of choice, propelling market expansion.

- Growing Inclination Towards Minimally Invasive Procedures

The increasing inclination of patients towards minimally invasive procedures is a pivotal factor. There's a growing trend among patients to seek out interventions that provide expedited recovery, diminished postoperative complications, and abbreviated hospital stays.

Embolotherapy, by its minimally invasive nature, is by these inclinations, which in turn motivates its implementation in numerous medical fields. This transition is additionally strengthened by technological developments that empower healthcare providers to deliver embolization procedures that are both safer and more efficient, thereby contributing to the market's continued expansion.

Major Growth Barriers

- Limited Market Knowledge

A significant impediment to the market is the inadequate knowledge and education possessed by healthcare professionals concerning embolotherapy techniques. The intricacy of the processes necessitates specialised expertise, and the absence of comprehensive training initiatives may impede wider implementation, thereby affecting the market's capacity for expansion.

- Lengthy Approval Process

Significant impediments are imposed on the embolotherapy market by regulatory and reimbursement concerns. The timely approval and adoption of new technologies may be hindered by rigorous regulatory processes and regionally inconsistent reimbursement policies. This can have adverse effects on market expansion and accessibility for healthcare providers and patients alike.

Key Trends and Opportunities to Look at

- Integration of AR and VR to Improve Capabilities

Rapid expansion is occurring in the integration of AI into embolotherapy, which streamlines the processes of diagnosis, treatment planning, and monitoring. Globally, this trend is becoming increasingly prevalent, particularly in North America, and Europe. Siemens Healthineers and GE Healthcare, among other major firms, are investing in AI-driven solutions. In the era of intelligent embolotherapy, brands will probably utilise AI to develop personalised treatment plans, enhance procedural precision, and improve patient outcomes, thereby establishing themselves as leaders.

- Increased Utilisation in Neurointerventional Procedures

There is a prevailing trend in the market toward the increased utilisation of embolotherapy in neuro-interventional procedures. This phenomenon is especially pronounced in the Asia Pacific, and North American regions. Prominent organisations such as Medtronic, and Stryker are proactively engaged in the advancement of specialised neuroembolization devices. Brands are anticipated to leverage this trend by endorsing neurointerventional solutions, to cater to the increasing need for minimally invasive neurology treatments.

- Widening Outpatient Reach

A discernible transition is occurring towards the execution of embolization procedures in outpatient settings, propelled by technological advancements and a growing patient inclination towards minimally invasive treatments. This trend is becoming increasingly prevalent in every region.

Terumo Corporation, and Boston Scientific are concentrating on the development of outpatient-appropriate devices that are simple to operate. Brands are expected to capitalise on this trend by positioning their products as aids that enable convenient embolotherapy on an ambulatory basis, which is consistent with the evolving models of healthcare delivery.

How Does the Regulatory Scenario Shape this Industry?

Strict regulatory frameworks exert a substantial impact on the market for embolic agents, support devices, microcatheters, and guidewires, as they guarantee the safety of patients and the effectiveness of these interventional products. These devices are regulated by the Food and Drug Administration (FDA) in the United States by the Medical Device Regulation Act.

Adherence to FDA regulations is of the utmost importance for entering, as it affects the schedules for product development and approval. In a similar vein, compliance with safety and performance standards is indicated through the European Medicines Agency (EMA)-supervised CE Marking process in the European Union.

The enforcement of regulatory scrutiny has been intensified due to region-specific modifications, such as the Medical Devices Regulation (MDR) in the European Union (EU), which has affected market entry and required compliance updates. Prominent organisations such as Cook Medical and Boston Scientific have modified their approaches to correspond with the ever-changing regulatory environments. To succeed amidst these frameworks, they continue to prioritise strong clinical evidence and quality standards.

Fairfield’s Ranking Board

Top Segments

- Embolic Agents to Hold Dominance within the Product Type

It is anticipated that the embolic agents segment will hold the greatest market share among the specified segments. The significant importance of embolic agents in obstructing blood vessels throughout therapeutic procedures, in addition to their extensive application in diverse medical fields, establishes this sector as a leader in the market.

The market for microcatheters is anticipated to expand at the quickest rate among embolotherapy devices. Their accelerated proliferation is a result of the rising demand for minimally invasive procedures and the adaptability of microcatheters in traversing complex vascular systems. With the progression of technology leading to improved accuracy, microcatheters are assuming a crucial role in enabling targeted embolization therapies, thereby stimulating substantial expansion in the market.

- Cancer Therapy to Accommodate the Largest Market Share

Cancer therapy is anticipated to hold the most substantial market share among the aforementioned healthcare segments. The prominence of this segment is attributed to the prevalence of cancer and the ongoing advancement of targeted therapies, both of which tackle a substantial global healthcare challenge.

It is anticipated that the urological and nephrological disorders segment will expand at the quickest rate. This segment is propelled by emerging technologies, growing awareness, and evolving treatment strategies for disorders affecting the urinary and renal systems. With the advent of personalised remedies and advancements in minimally invasive techniques, the urological and nephrological disorder sector is poised for substantial growth in the healthcare industry.

- Transarterial Chemoembolization to Hold Dominance over its Counterparts

It is expected that transarterial chemoembolization (TACE) will hold the most significant portion of the market within the segments specified. This is due to the extensive application of embolization and chemotherapy in the treatment of diverse liver cancers; the combination of these two approaches has demonstrated efficacy in the management of hepatic malignancies.

The most rapid growth is anticipated in transcatheter arterial radioembolization (TARE)/selective internal radiation therapy (SIRT). The growing prevalence of this segment can be attributed to its effectiveness in managing hepatic tumours, particularly in situations where conventional treatments may exhibit deficiencies. With the increasing recognition of the technology and the progress made in precision, the TARE/SIRT system has considerable capacity for swift growth in the market.

- Hospitals to be the Top Distribution Channel

The market share of hospitals and clinics is anticipated to be the greatest among the segments specified. These establishments function as the principal locations for embolization procedures, furnished with the essential infrastructure and proficiency to perform an extensive array of interventions. Hospitals and clinics maintain their dominant market position due to the accessibility and inclusivity of the healthcare services they offer.

It is anticipated that the ambulatory surgical centre (ASC) sector will expand the most rapidly. ASCs are becoming more prominent due to the growing demand for more convenient and cost-effective healthcare options and the increasing emphasis on outpatient procedures. The capacity of ASCs to execute specific embolization procedures in a more efficient and patient-centric setting establishes them favourably for swift expansion in the market.

Regional Outlook

The North American Market Ranks Top

It is anticipated that North America will hold the largest market share of the worldwide embolotherapy industry. The region's technological advancements, well-established healthcare infrastructure, and high prevalence of vascular diseases and malignancies account for this dominance. North America is positioned at the forefront due to the strong presence of key market participants and their proactive approach toward adopting innovative medical technologies. In addition, a favourable reimbursement environment and a growing demand for minimally invasive procedures contribute to the region's substantial market share.

Asia Pacific Gains from Improving Healthcare Access

It is anticipated that the Asia Pacific region will witness the most rapid expansion of the worldwide embolotherapy market. This expansion is fueled by factors including expanding healthcare access, increasing awareness of minimally invasive treatments, and the rising prevalence of cardiovascular diseases.

As the healthcare systems in the Asia Pacific region progress, there is a growing recognition and approval of embolization procedures, which presents a favourable environment for the expansion of the market. Changing lifestyles and the region's sizable and ageing population contribute to the increased demand for effective interventional therapies, establishing Asia Pacific as a key growth driver in the global embolotherapy market.

Fairfield’s Competitive Landscape Analysis

Significant trends that are anticipated to prevail in the competitive environment will concern technological innovation and strategic partnerships. AI-driven solutions and other cutting-edge technologies are likely to provide businesses with a competitive advantage. Furthermore, the establishment of strategic alliances and partnerships throughout the supply chain will assume paramount importance to guarantee the procurement of dependable raw materials and to streamline distribution processes.

Aspects including competitive positioning, production costs, and regulatory compliance will impact pricing structures. As the market progresses toward maturity, participants may encounter incentives to refine their pricing strategies to achieve a harmonious equilibrium between profitability and affordability.

Ensuring a resilient and efficient supply chain, while effectively navigating regulatory challenges, investing in innovation, and adapting to evolving demand dynamics, will be critical for companies to achieve long-term growth. In general, the embolotherapy industry can capitalise on opportunities by penetrating emerging markets, adapting to changing healthcare priorities and cultivating an environment that promotes ongoing innovation.

Who are the Leaders in Global Embolotherapy Space?

- Medtronic Plc.

- Stryker Corporation

- Johnson & Johnson

- BTG Plc.

- Cook Medical

- Penumbra Inc.

- Abbott Laboratories

- Boston Scientific Corporation

- Merit Medical Systems

- Terumo Corporation

An Expert’s Eye

Demand and Future Growth

Anticipated in the future is a sustained high demand for embolotherapy, primarily propelled by the worldwide transition towards minimally invasive procedures. The increasing incidence of vascular diseases and diverse types of malignancy will maintain the need for efficacious and focused therapeutic alternatives.

In addition, ongoing developments in embolic agents and technologies, including the incorporation of artificial intelligence, are anticipated to augment the accuracy and effectiveness of embolization processes, thereby propelling market expansion. Boasting a global emphasis on patient-friendly and cost-effective interventions, embolotherapy is strategically positioned to experience continued growth.

Supply Side of the Market

Industry participants may encounter difficulties on the supply side as a result of the ongoing demand for innovation and adherence to regulatory standards. Significant investments in research and development are required to advance embolic agents and devices, while also assuring strict compliance with regulatory frameworks.

In the light of the dynamic regulatory environment, particularly revisions such as the Medical Devices Regulation implemented by the European Union, adaptable and compliant approaches are imperative. In addition, it is imperative to establish and maintain a reliable supply chain to facilitate the manufacturing and dissemination of these specialised medical devices. This necessitates the implementation of strategic alliances and stringent quality control protocols.

The Global Embolotherapy Market is Segmented as Below:

By Product Type:

- Embolic Agents

- Microspheres

- Embolic coils

- Embolic Plug Systems

- Detachable Ballons

- Liquid Embolic Agents

- others

- Support Devices

- Microcatheters

- Guidewires

By Cancer Indication:

- Cancer

- Peripheral Vascular Disease

- Peripheral Vascular Disease

- Urological & Nephrological Disorder

- Gastrointestinal Disorder

- others

By Procedure:

- Transcatheter Arterial Embolization (TAE)

- Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

- Transarterial Chemoembolization (TACE)

By End User:

- Hospitals& Clinics

- Ambulatory Surgical Centre

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & and Africa

1. Executive Summary

1.1. Global Embolotherapy Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Embolotherapy Market Outlook, 2018 - 2030

3.1. Global Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Embolic Agents

3.1.1.1.1. Microspheres

3.1.1.1.2. Embolic coils

3.1.1.1.3. Embolic Plug Systems

3.1.1.1.4. Detachable Ballons

3.1.1.1.5. Liquid Embolic Agents,

3.1.1.1.6. others

3.1.1.2. Support Devices

3.1.1.3. Microcatheters

3.1.1.4. Guidewires

3.2. Global Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Peripheral Vascular Disease

3.2.1.3. Peripheral Vascular Disease

3.2.1.4. Urological & Nephrological Disorder

3.2.1.5. Gastrointestinal Disorder

3.2.1.6. others

3.3. Global Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Transcatheter Arterial Embolization (TAE)

3.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

3.3.1.3. Transarterial Chemoembolization (TACE)

3.4. Global Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights Snacks

3.4.1.1. Hospitals& Clinics

3.4.1.2. Ambulatory Surgical Centre

3.4.1.3. Others

3.5. Global Embolotherapy Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Embolotherapy Market Outlook, 2018 - 2030

4.1. North America Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Embolic Agents

4.1.1.1.1. Microspheres

4.1.1.1.2. Embolic coils

4.1.1.1.3. Embolic Plug Systems

4.1.1.1.4. Detachable Ballons

4.1.1.1.5. Liquid Embolic Agents,

4.1.1.1.6. others

4.1.1.2. Support Devices

4.1.1.3. Microcatheters

4.1.1.4. Guidewires

4.2. North America Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Infants

4.2.1.2. Children

4.2.1.3. Adolscents / Young Adults

4.2.1.4. Adults

4.3. North America Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Transcatheter Arterial Embolization (TAE)

4.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

4.3.1.3. Transarterial Chemoembolization (TACE)

4.4. North America Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. Hospitals& Clinics

4.4.1.2. Ambulatory Surgical Centre

4.4.1.3. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Embolotherapy Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.5.1. Key Highlights

4.5.1.1. U.S. Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.2. U.S. Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

4.5.1.3. U.S. Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

4.5.1.4. U.S. Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

4.5.1.5. Canada Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

4.5.1.6. Canada Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

4.5.1.7. Canada Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

4.5.1.8. Canada Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Embolotherapy Market Outlook, 2018 - 2030

5.1. Europe Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Embolic Agents

5.1.1.1.1. Microspheres

5.1.1.1.2. Embolic coils

5.1.1.1.3. Embolic Plug Systems

5.1.1.1.4. Detachable Ballons

5.1.1.1.5. Liquid Embolic Agents,

5.1.1.1.6. others

5.1.1.2. Support Devices

5.1.1.3. Microcatheters

5.1.1.4. Guidewires

5.2. Europe Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cancer

5.2.1.2. Peripheral Vascular Disease

5.2.1.3. Peripheral Vascular Disease

5.2.1.4. Urological & Nephrological Disorder

5.2.1.5. Gastrointestinal Disorder

5.2.1.6. others

5.3. Europe Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Transcatheter Arterial Embolization (TAE)

5.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

5.3.1.3. Transarterial Chemoembolization (TACE)

5.4. Europe Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Hospitals& Clinics

5.4.1.2. Ambulatory Surgical Centre

5.4.1.3. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Embolotherapy Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.5.1. Key Highlights

5.5.1.1. Germany Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.2. Germany Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.3. Germany Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.4. Germany Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.5. U.K. Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.6. U.K. Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.7. U.K. Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.8. U.K. Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.9. France Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.10. France Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.11. France Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.12. France Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.13. Italy Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.14. Italy Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.15. Italy Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.16. Italy Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.17. Turkey Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.18. Turkey Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.19. Turkey Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.20. Turkey Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.21. Russia Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.22. Russia Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.23. Russia Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.24. Russia Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.1.25. Rest of Europe Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

5.5.1.26. Rest of Europe Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

5.5.1.27. Rest of Europe Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

5.5.1.28. Rest of Europe Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Embolotherapy Market Outlook, 2018 - 2030

6.1. Asia Pacific Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Embolic Agents

6.1.1.1.1. Microspheres

6.1.1.1.2. Embolic coils

6.1.1.1.3. Embolic Plug Systems

6.1.1.1.4. Detachable Ballons

6.1.1.1.5. Liquid Embolic Agents,

6.1.1.1.6. others

6.1.1.2. Support Devices

6.1.1.3. Microcatheters

6.1.1.4. Guidewires

6.2. Asia Pacific Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cancer

6.2.1.2. Peripheral Vascular Disease

6.2.1.3. Peripheral Vascular Disease

6.2.1.4. Urological & Nephrological Disorder

6.2.1.5. Gastrointestinal Disorder

6.2.1.6. others

6.3. Asia Pacific Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Transcatheter Arterial Embolization (TAE)

6.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

6.3.1.3. Transarterial Chemoembolization (TACE)

6.4. Asia Pacific Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. Hospitals& Clinics

6.4.1.2. Ambulatory Surgical Centre

6.4.1.3. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Embolotherapy Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.5.1. Key Highlights

6.5.1.1. China Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.2. China Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.3. China Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.4. China Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.5. Japan Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.6. Japan Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.7. Japan Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.8. Japan Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.9. South Korea Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.10. South Korea Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.11. South Korea Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.12. South Korea Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.13. India Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.14. India Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.15. India Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.16. India Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.17. Southeast Asia Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.18. Southeast Asia Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.19. Southeast Asia Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.20. Southeast Asia Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.1.21. Rest of Asia Pacific Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

6.5.1.22. Rest of Asia Pacific Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

6.5.1.23. Rest of Asia Pacific Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

6.5.1.24. Rest of Asia Pacific Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Embolotherapy Market Outlook, 2018 - 2030

7.1. Latin America Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Embolic Agents

7.1.1.1.1. Microspheres

7.1.1.1.2. Embolic coils

7.1.1.1.3. Embolic Plug Systems

7.1.1.1.4. Detachable Ballons

7.1.1.1.5. Liquid Embolic Agents,

7.1.1.1.6. others

7.1.1.2. Support Devices

7.1.1.3. Microcatheters

7.1.1.4. Guidewires

7.2. Latin America Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cancer

7.2.1.2. Peripheral Vascular Disease

7.2.1.3. Peripheral Vascular Disease

7.2.1.4. Urological & Nephrological Disorder

7.2.1.5. Gastrointestinal Disorder

7.2.1.6. others

7.3. Latin America Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Transcatheter Arterial Embolization (TAE)

7.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

7.3.1.3. Transarterial Chemoembolization (TACE)

7.4. Latin America Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Hospitals& Clinics

7.4.1.2. Ambulatory Surgical Centre

7.4.1.3. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Embolotherapy Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.5.1. Key Highlights

7.5.1.1. Brazil Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.2. Brazil Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

7.5.1.3. Brazil Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

7.5.1.4. Brazil Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.5. Mexico Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.6. Mexico Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

7.5.1.7. Mexico Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

7.5.1.8. Mexico Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.9. Argentina Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.10. Argentina Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

7.5.1.11. Argentina Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

7.5.1.12. Argentina Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

7.5.1.13. Rest of Latin America Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

7.5.1.14. Rest of Latin America Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

7.5.1.15. Rest of Latin America Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

7.5.1.16. Rest of Latin America Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Embolotherapy Market Outlook, 2018 - 2030

8.1. Middle East & Africa Embolotherapy Market Outlook, by Product Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Embolic Agents

8.1.1.1.1. Microspheres

8.1.1.1.2. Embolic coils

8.1.1.1.3. Embolic Plug Systems

8.1.1.1.4. Detachable Ballons

8.1.1.1.5. Liquid Embolic Agents,

8.1.1.1.6. others

8.1.1.2. Support Devices

8.1.1.3. Microcatheters

8.1.1.4. Guidewires

8.2. Middle East & Africa Embolotherapy Market Outlook, by Disease Indication, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cancer

8.2.1.2. Peripheral Vascular Disease

8.2.1.3. Peripheral Vascular Disease

8.2.1.4. Urological & Nephrological Disorder

8.2.1.5. Gastrointestinal Disorder

8.2.1.6. others

8.3. Middle East & Africa Embolotherapy Market Outlook, by Procedure, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Transcatheter Arterial Embolization (TAE)

8.3.1.2. Transcatheter Arterial Radioembolization (TARE)/Selective Internal Radiation Therapy (SIRT)

8.3.1.3. Transarterial Chemoembolization (TACE)

8.4. Middle East & Africa Embolotherapy Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. Hospitals& Clinics

8.4.1.2. Ambulatory Surgical Centre

8.4.1.3. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Embolotherapy Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.5.1. Key Highlights

8.5.1.1. GCC Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.2. GCC Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

8.5.1.3. GCC Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

8.5.1.4. GCC Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.5. South Africa Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.6. South Africa Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

8.5.1.7. South Africa Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

8.5.1.8. South Africa Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.9. Egypt Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.10. Egypt Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

8.5.1.11. Egypt Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

8.5.1.12. Egypt Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.13. Nigeria Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.14. Nigeria Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

8.5.1.15. Nigeria Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

8.5.1.16. Nigeria Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

8.5.1.17. Rest of Middle East & Africa Embolotherapy Market by Product Type, Value (US$ Mn), 2018 - 2030

8.5.1.18. Rest of Middle East & Africa Embolotherapy Market Disease Indication, Value (US$ Mn), 2018 - 2030

8.5.1.19. Rest of Middle East & Africa Embolotherapy Market Procedure, Value (US$ Mn), 2018 - 2030

8.5.1.20. Rest of Middle East & Africa Embolotherapy Market End User, Value (US$ Mn), 2018 - 2030

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Procedure vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Medtronic Plc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Stryker Corporation

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Johnson & Johnson

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. BTG Plc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Cook Medical

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Penumbra Inc.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Abbott Laboratories

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Boston Scientific Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Merit Medical Systems

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Terumo Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Cancer Indication Coverage |

|

|

Procedure Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |