Global EMC Filtration Market Forecast

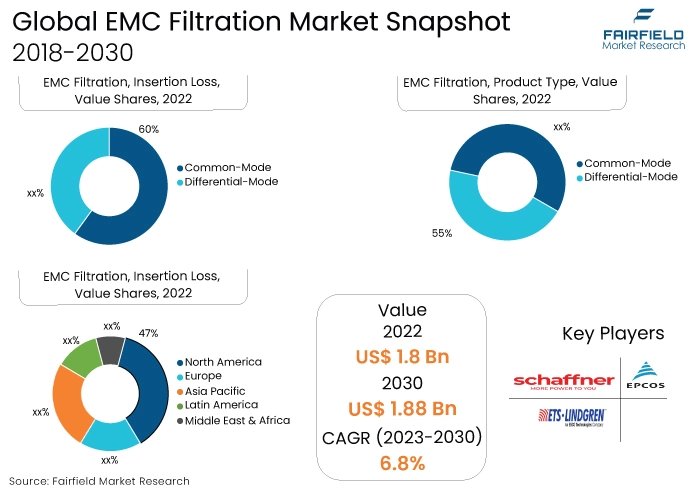

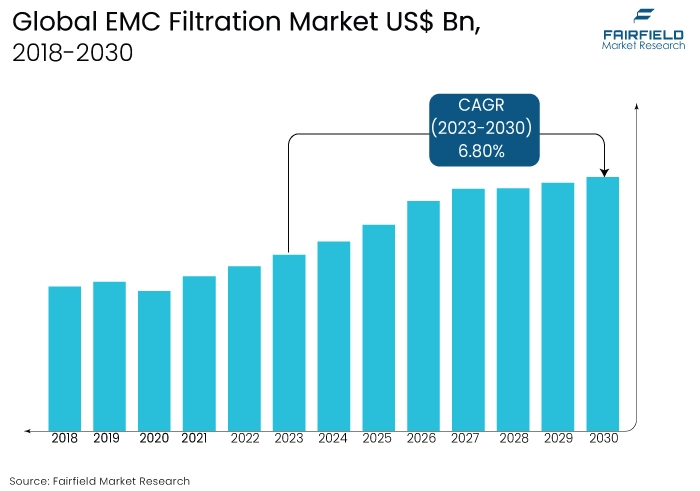

- The approximately US$1.18 Bn EMC filtration market (2022) poised to reach US$1.88 Bn by 2030

- Global EMC filtration market size projected to experience 6.8% CAGR between 2023 and 2030

Quick Report Digest

- The EMC filtration market is growing due to increased electronic device usage, stringent regulatory standards, and the proliferation of wireless technologies. As industries prioritize electromagnetic compatibility, the market sees rising demand for effective filtration solutions to ensure optimal performance and reliability in electronic systems across diverse applications.

- Another major market trend expected to fuel the growth of the EMC filtration market is the rapidly expanding global industrial automation. The market is also predicted to profit from the expanding worldwide medical and data centre industries.

- EMC filters have secured the largest market share in the EMC Filtration market due to their critical role in mitigating electromagnetic interference (EMI) across diverse applications. With the rising complexity of electronic systems and stringent regulatory standards, the demand for effective EMC solutions has surged, contributing to the dominance of EMC filters.

- Common-mode insertion loss has captured the largest market share in the EMC filtration market due to its crucial role in reducing common-mode electromagnetic interference. Its effectiveness in suppressing unwanted common-mode noise makes it essential for ensuring optimal electromagnetic compatibility in various applications, contributing to its dominance in the market.

- The commercial end industry holds the largest market share in the EMC Filtration Market due to extensive applications in offices, retail, and commercial buildings. Rising demand for energy-efficient solutions, coupled with advancements in building management systems, drives the dominance of the commercial sector, shaping its significant market share.

- Industrial automation applications are growing in the EMC filtration market due to the extensive use of electronic systems in manufacturing and process automation. The complexity and sensitivity of these systems demand effective electromagnetic interference mitigation, driving the demand for EMC filtration solutions and contributing to the growth in this application segment.

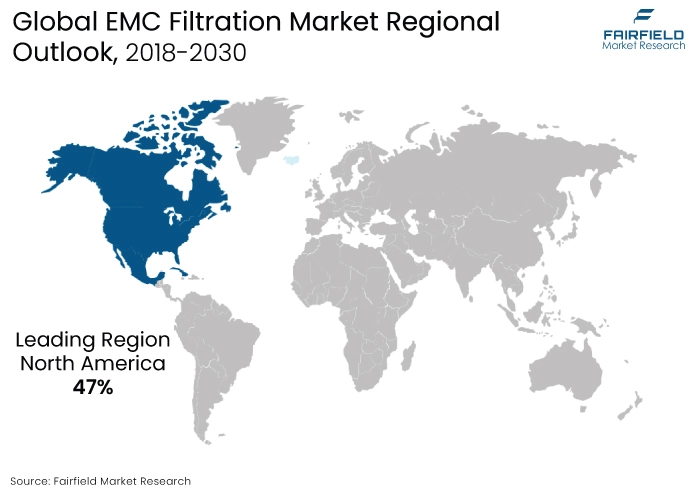

- North America has secured the largest market share in the EMC filtration market due to its robust technological infrastructure, stringent regulatory standards, and widespread adoption of electronic systems. The region's mature automotive sector, coupled with the rapid growth of electric vehicles, significantly contributes to the demand for EMC filtration solutions, solidifying its dominant market share.

- Asia Pacific is growing in the EMC filtration market due to rapid industrialization, technological advancements, and increasing adoption of electronic systems. The region's burgeoning automotive sector, expanding manufacturing activities, and the growing electric vehicle market contribute significantly to the demand for EMC filtration solutions, driving its growth.

A Look Back and a Look Forward - Comparative Analysis

The EMC filtration market is growing due to increasing electronic device usage and the proliferation of wireless technologies, which intensify electromagnetic interference (EMI) concerns. Stringent regulations and standards mandating EMC compliance drive the adoption of EMC filtration solutions. As industries like telecommunications, automotive, and healthcare rely heavily on electronic systems, the demand for effective EMI mitigation solutions rises, contributing to the growth of the EMC filtration market globally.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of the major application sectors such as industrial automation, building technologies, and others. However, in some applications, the demand for EMC filtration has increased, including energy & utilities and EV charging.

The future of the EMC filtration market looks promising, driven by the continued expansion of electronic devices, rising concerns over electromagnetic interference (EMI), and evolving regulatory standards. With increasing reliance on advanced technologies in various industries, the demand for effective EMC filtration solutions is expected to grow. As connectivity and electronic components become more pervasive, the EMC filtration market is likely to witness sustained growth to ensure optimal electromagnetic compatibility in diverse applications.

Key Growth Determinants

- Rising Adoption of Electronic Devices

Rising electronic device usage is a primary driver of the EMC filtration market, as the proliferation of devices introduces higher levels of electromagnetic interference (EMI). The increasing complexity and density of electronic components lead to elevated EMI risks, impacting the performance of adjacent devices and systems.

To ensure optimal functionality and prevent signal degradation, industries invest in EMC filtration solutions. This is crucial in sectors like automotive, healthcare, and telecommunications, where electronic devices play integral roles. The demand for EMC filtration is further heightened by stringent regulatory standards and the need to maintain electromagnetic compatibility, making it an essential component in safeguarding electronic systems from interference and ensuring their reliability.

- Rising Proliferation of Wireless Technologies

The proliferation of wireless technologies is a significant driver of the EMC filtration market due to the associated increase in EMI. The expanding deployment of wireless technologies, such as 5G, Wi-Fi, and IoT, intensifies EMI risks, impacting the performance of electronic devices and systems. To ensure optimal functionality and prevent signal degradation, industries invest in EMC filtration solutions.

These solutions are crucial in mitigating the effects of EMI and maintaining electromagnetic compatibility in wireless communication environments. The continuous growth of wireless technologies amplifies the demand for advanced EMC filtration, positioning the market as an essential component in safeguarding the reliability and performance of wireless electronic systems.

- Technological Advancements

Technological advancements are propelling the EMC filtration market by introducing more sophisticated and sensitive electronic devices. As technology evolves, the complexity and frequency of electronic components increase, heightening the risk of electromagnetic interference (EMI). Advanced technologies, including 5G, IoT, and high-speed data communication, demand robust EMC filtration solutions to ensure optimal electromagnetic compatibility.

Innovations in EMC filtration technologies, such as advanced filtering materials and designs, are essential to mitigate the impact of EMI on sensitive electronic systems. The continuous evolution of electronics and communication technologies drives the need for cutting-edge EMC solutions, positioning the market as a critical component in maintaining the integrity and performance of modern electronic devices and systems.

Major Growth Barriers

- Increasing Complexity of Electronic Systems

The increasing complexity of electronic systems poses a challenge in the EMC filtration market. As electronic devices become more intricate and densely packed, managing and mitigating electromagnetic interference (EMI) sources becomes more complex.

Designing effective EMC filtration solutions that address a wide array of interference challenges and frequencies in modern, multifunctional electronic systems requires continuous innovation. The dynamic nature of electronic systems, coupled with their evolving functionalities, demands adaptable EMC filtration solutions to ensure optimal performance and reliability in diverse applications, contributing to the challenges faced by the market.

- Miniaturization of Electronics

The trend towards miniaturization in electronics presents a challenge for the EMC filtration market. As electronic devices become smaller, accommodating effective EMC filters within limited space without compromising performance becomes challenging. Miniaturization leads to tighter spaces, making it difficult to integrate traditional EMC filtration solutions.

Innovations in compact and efficient filtration technologies are essential to address this challenge, ensuring that miniaturized electronic devices maintain optimal electromagnetic compatibility and meet stringent interference requirements.

Key Trends and Opportunities to Look at

- Advanced Filtering Materials

The advanced filtering materials trend in EMC filtration involves the use of innovative materials, such as nanocomposites and advanced alloys. This technology enhances filtering efficiency and adaptability to diverse interference sources, ensuring optimal electromagnetic compatibility and addressing the evolving challenges posed by complex electronic systems and frequencies.

- IoT Integration

The IoT integration trend in EMC filtration incorporates solutions compatible with the Internet of Things (IoT) devices. This technology ensures effective filtering in interconnected smart device environments, adapting to the growing prevalence of IoT applications and addressing the specific electromagnetic interference challenges associated with diverse and connected electronic systems.

- Wideband EMC Filters

Wideband EMC filters are a technology trend involving the development of filters capable of addressing a broader range of frequencies. This innovation ensures versatile interference mitigation, catering to the diverse spectrum of electromagnetic interference sources in modern electronic systems and meeting the demand for more comprehensive and adaptable EMC solutions.

How Does the Regulatory Scenario Shape this Industry?

Global and regional regulatory frameworks influence the EMC filtration market to ensure electromagnetic compatibility. Key entities include the International Electrotechnical Commission (IEC), which establishes global standards, and the Federal Communications Commission (FCC) in the US. Specific guidelines include IEC 60974 for welding equipment and IEC 61000 series for generic EMC standards.

Region-specific changes may include updates to the European Union's EMC Directive and conformity assessment procedures. Compliance with these regulations is crucial for market entry and product acceptance, influencing the design and functionality of EMC filtration solutions. Adherence to evolving standards ensures that products meet electromagnetic compatibility requirements, fostering innovation and quality assurance in the EMC filtration market.

Fairfield’s Ranking Board

Top Segments

- EMC Filters Dominant Product Type

EMC Filters have captured the largest market share in the EMC filtration market due to their pivotal role in mitigating electromagnetic interference (EMI) across diverse applications. With the rising complexity of electronic systems and stringent regulatory standards, the demand for effective EMC solutions has surged. EMC filters, designed to suppress unwanted EMI, have become indispensable in ensuring electromagnetic compatibility. Their widespread adoption in various industries, including automotive, telecommunications, and healthcare, contributes to their dominance and significant market share.

Power quality filters, on the other hand, will witness a higher growth rate in the long run, attributing to the increasing focus on ensuring stable and high-quality power supply. As industries strive for improved power reliability and efficiency, the demand for advanced power quality filters rises. These filters play a critical role in minimizing harmonics, voltage variations, and other power disturbances, making them essential in applications where maintaining a high standard of power quality is paramount.

- Common-Mode Insertion Loss to Surge Ahead Throughout the Forecast Period

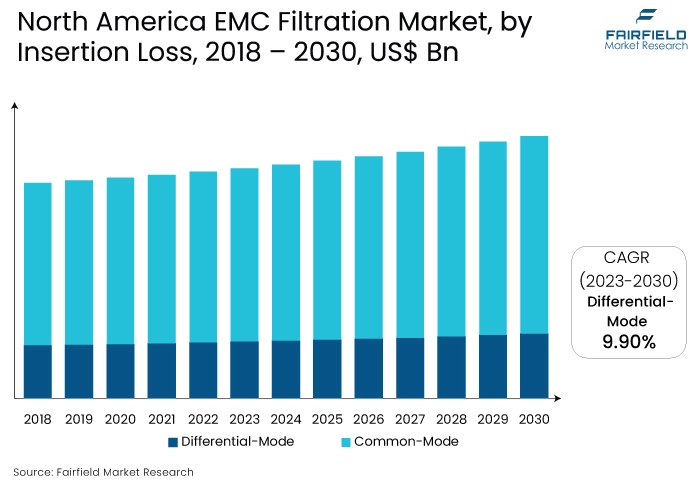

Common-mode insertion loss has captured the largest market share in the EMC filtration market because of its crucial role in reducing common-mode electromagnetic interference. With the proliferation of electronic devices, addressing interference issues becomes essential. Common-mode insertion loss filters effectively suppress unwanted common-mode noise, ensuring optimal electromagnetic compatibility in diverse applications. Their widespread adoption in various industries, where maintaining signal integrity is critical, contributes to their dominance and substantial market share.

Differential-mode insertion loss is projected to experience the highest CAGR by 2030 due to the increasing demand for enhanced filtering of differential-mode electromagnetic interference. As electronic systems become more sophisticated, the need for effective suppression of differential-mode noise rises. Differential-mode insertion loss filters play a pivotal role in mitigating such interference, making them integral for ensuring optimal performance and electromagnetic compatibility. This heightened demand contributes to their significant growth and the highest CAGR in the market.

- Industrial Automation Takes the Lead in Adoption

Industrial automation applications have captured the largest market share in the EMC filtration market due to the extensive use of electronic systems in manufacturing and process automation. The complexity and sensitivity of these systems demand effective electromagnetic interference mitigation to ensure continuous and reliable operation. EMC Filtration solutions are integral in suppressing interference, minimizing disruptions, and maintaining the precision and efficiency of industrial automation processes, contributing to the substantial market share in this application segment.

The EV charging application is likely to witness the highest CAGR in the EMC filtration market due to the increasing adoption of electric vehicles (EVs). The expansion of EV charging infrastructure demands robust EMC filtration to ensure the reliability and safety of charging systems. As the electric mobility sector continues to grow globally, the demand for effective electromagnetic interference suppression in EV charging applications rises, contributing to the segment's accelerated growth and the highest CAGR in the market.

Regional Frontrunners

North America Continues to be at the Forefront

North America has captured the largest market share in the EMC filtration market due to the region's robust technological infrastructure, stringent regulatory standards, and widespread adoption of electronic systems across industries. The mature automotive sector, coupled with the rapid growth of electric vehicles, significantly contributes to the demand for EMC filtration solutions.

Moreover, the presence of key market players and a strong emphasis on research and development activities further propels the market. The region's commitment to maintaining high electromagnetic compatibility standards in diverse applications positions North America at the forefront, solidifying its dominance and substantial market share in the EMC filtration market.

Asia Pacific Unlocks Remarkable Opportunity

Asia Pacific secures a significant position in the EMC filtration market due to rapid industrialization, technological advancements, and increasing adoption of electronic systems across diverse applications. The region's burgeoning automotive sector, expanding manufacturing activities, and the growing electric vehicle market contribute significantly to the demand for EMC filtration solutions. Furthermore, supportive government initiatives, economic development, and the integration of advanced technologies drive the accelerated growth of the EMC filtration market in Asia Pacific.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the EMC filtration market is dynamic, featuring key players such as Schaffner Group, T.E. Connectivity, TDK Corporation, and Laird Performance Materials. Intense competition is driven by innovations in filtering materials, IoT integration, and advancements in wideband filters.

Companies focus on strategic collaborations, product enhancements, and acquisitions to strengthen their market positions. The evolving landscape, coupled with stringent regulatory standards, fosters a competitive environment encouraging innovation and continuous improvement in EMC filtration solutions.

Who are the Leaders in Global EMC Filtration Space?

- Schaffner Holding AG

- ETS-Lindgren

- EPCOS AG

- TE Connectivity Ltd.

- Schurter Holding AG

- PREMO Corporation S.L.

- REO Ltd.

- Total EMC Products Ltd.

- DEM Manufacturing Ltd.

- Astrodyne Corporation

- Chokes International

- Laird Performance Materials

- TDK Corporation

- Astrodyne TDI

- Ferrishield

Significant Company Developments

New Product Launch

- September 2022: Pall Corporation introduced three innovative Allegro Connect Systems. These encompass solutions for Depth Filtration, Virus Filtration, and Bulk Fill of drug substances. Additionally, a buffer management system was introduced to streamline the establishment of manufacturing workflows.

Distribution Agreement

- April 2022: Eaton has broadened its selection of filter media incorporating activated carbon. The enhanced BECO CARBON depth filter sheets exhibit exceptional adsorption characteristics for the precise filtration of liquids. Noteworthy for their effective decolorization, adsorptive elimination of undesired by-products, and correction of taste, odor, and color, these sheets are well-suited for applications in the pharmaceutical and biotechnology industries

An Expert’s Eye

Demand and Future Growth

The EMC filtration market is witnessing robust demand driven by the escalating use of electronic devices, stringent regulatory standards, and the proliferation of wireless technologies. As industries prioritize electromagnetic compatibility, the market anticipates sustained growth.

Future expansion is expected with the continuous evolution of electronic technologies, advancements in filtering materials, and the increasing deployment of IoT, and 5G. The demand for EMC filtration solutions will likely persist, ensuring optimal performance and reliability in electronic systems across diverse applications.

Supply Side of the Market

The increasing demand for electronic devices, stringent regulatory standards, and evolving technologies influences the demand-supply dynamics in the EMC filtration market. The current pricing structure is shaped by factors such as technological advancements, material costs, and market competition. Pricing is expected to influence long-term growth as it impacts product accessibility and market penetration.

Major trends driving competition include innovations in filtering materials, IoT integration, and wideband filters. Supply chain analysis involves assessing the global procurement of raw materials, manufacturing processes, and distribution networks. Sustainable practices and efficient supply chains are crucial, ensuring market resilience and growth in the EMC filtration market.

Global EMC Filtration Market is Segmented as Below:

By Product Type:

- EMC Filters

- 1-Phase EMC Filters

- 3-Phase EMC Filters

- DC Filters

- IEC Filters

- Chokes

- Power Quality Filters

- Passive Harmonic Filters

- Active Harmonic Filters

- Output Filters

- Reactors

By Insertion Loss:

- Common-Mode

- Differential-Mode

By Application:

- Commercial

- Industrial Automation

- Building Technologies

- Energy & Utilities

- EV Charging

- Medical

- Data Centers

- SMPS/Power Supplies

- Smart Infrastructure

- Energy Storage

- UPS

- Oil & Gas

- Military

- Home Appliances

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global EMC Filtration Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global EMC Filtration Market Outlook, 2018 – 2030

3.1. Global EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. EMC Filters

3.1.1.1.1. 1-Phase EMC Filters

3.1.1.1.2. 3-Phase EMC Filters

3.1.1.1.3. DC Filters

3.1.1.1.4. IEC Inlets

3.1.1.1.5. Chokes

3.1.1.2. Power Quality Filters

3.1.1.2.1. Passive Harmonic Filters

3.1.1.2.2. Active Harmonic Filters

3.1.1.2.3. Output Filters

3.1.1.2.4. Reactors

3.2. Global EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Common-Mode

3.2.1.2. Differential-Mode

3.3. Global EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Industrial Automation

3.3.1.2. Building Technologies

3.3.1.3. Energy & Utilities

3.3.1.4. EV Charging

3.3.1.5. Medical

3.3.1.6. Data Centers

3.3.1.7. SMPS/Power Supplies

3.3.1.8. Smart Infrastructure

3.3.1.9. Energy Storage

3.3.1.10. UPS

3.3.1.11. Oil & Gas

3.3.1.12. Military

3.3.1.13. Home Appliances

3.4. Global EMC Filtration Market Outlook, by Region, Value (US$ Mn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America EMC Filtration Market Outlook, 2018 – 2030

4.1. North America EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. EMC Filters

4.1.1.1.1. 1-Phase EMC Filters

4.1.1.1.2. 3-Phase EMC Filters

4.1.1.1.3. DC Filters

4.1.1.1.4. IEC Inlets

4.1.1.1.5. Chokes

4.1.1.2. Power Quality Filters

4.1.1.2.1. Passive Harmonic Filters

4.1.1.2.2. Active Harmonic Filters

4.1.1.2.3. Output Filters

4.1.1.2.4. Reactors

4.2. North America EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Common-Mode

4.2.1.2. Differential-Mode

4.3. North America EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. Industrial Automation

4.3.1.2. Building Technologies

4.3.1.3. Energy & Utilities

4.3.1.4. EV Charging

4.3.1.5. Medical

4.3.1.6. Data Centers

4.3.1.7. SMPS/Power Supplies

4.3.1.8. Smart Infrastructure

4.3.1.9. Energy Storage

4.3.1.10. UPS

4.3.1.11. Oil & Gas

4.3.1.12. Military

4.3.1.13. Home Appliances

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America EMC Filtration Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. U.S. EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

4.4.1.2. U.S. EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

4.4.1.3. U.S. EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

4.4.1.4. U.S. EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

4.4.1.5. Canada EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

4.4.1.6. Canada EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

4.4.1.7. Canada EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

4.4.1.8. Canada EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe EMC Filtration Market Outlook, 2018 – 2030

5.1. Europe EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. EMC Filters

5.1.1.1.1. 1-Phase EMC Filters

5.1.1.1.2. 3-Phase EMC Filters

5.1.1.1.3. DC Filters

5.1.1.1.4. IEC Inlets

5.1.1.1.5. Chokes

5.1.1.2. Power Quality Filters

5.1.1.2.1. Passive Harmonic Filters

5.1.1.2.2. Active Harmonic Filters

5.1.1.2.3. Output Filters

5.1.1.2.4. Reactors

5.2. Europe EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Common-Mode

5.2.1.2. Differential-Mode

5.3. Europe EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. Industrial Automation

5.3.1.2. Building Technologies

5.3.1.3. Energy & Utilities

5.3.1.4. EV Charging

5.3.1.5. Medical

5.3.1.6. Data Centers

5.3.1.7. SMPS/Power Supplies

5.3.1.8. Smart Infrastructure

5.3.1.9. Energy Storage

5.3.1.10. UPS

5.3.1.11. Oil & Gas

5.3.1.12. Military

5.3.1.13. Home Appliances

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe EMC Filtration Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Germany EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.2. Germany EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.3. Germany EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.4. Germany EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.5. U.K. EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.6. U.K. EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.7. U.K. EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.8. U.K. EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.9. France EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.10. France EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.11. France EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.12. France EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.13. Italy EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.14. Italy EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.15. Italy EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.16. Italy EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.17. Turkey EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.18. Turkey EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.19. Turkey EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.20. Turkey EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.21. Russia EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.22. Russia EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.23. Russia EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.24. Russia EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.1.25. Rest of Europe EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

5.4.1.26. Rest of Europe EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

5.4.1.27. Rest of Europe EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

5.4.1.28. Rest of Europe EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific EMC Filtration Market Outlook, 2018 – 2030

6.1. Asia Pacific EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. EMC Filters

6.1.1.1.1. 1-Phase EMC Filters

6.1.1.1.2. 3-Phase EMC Filters

6.1.1.1.3. DC Filters

6.1.1.1.4. IEC Inlets

6.1.1.1.5. Chokes

6.1.1.2. Power Quality Filters

6.1.1.2.1. Passive Harmonic Filters

6.1.1.2.2. Active Harmonic Filters

6.1.1.2.3. Output Filters

6.1.1.2.4. Reactors

6.2. Asia Pacific EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Common-Mode

6.2.1.2. Differential-Mode

6.3. Asia Pacific EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. Industrial Automation

6.3.1.2. Building Technologies

6.3.1.3. Energy & Utilities

6.3.1.4. EV Charging

6.3.1.5. Medical

6.3.1.6. Data Centers

6.3.1.7. SMPS/Power Supplies

6.3.1.8. Smart Infrastructure

6.3.1.9. Energy Storage

6.3.1.10. UPS

6.3.1.11. Oil & Gas

6.3.1.12. Military

6.3.1.13. Home Appliances

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific EMC Filtration Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. China EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.2. China EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.3. China EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.4. China EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.1.5. Japan EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.6. Japan EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.7. Japan EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.8. Japan EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.1.9. South Korea EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.10. South Korea EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.11. South Korea EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.12. South Korea EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.1.13. India EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.14. India EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.15. India EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.16. India EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.1.17. Southeast Asia EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.18. Southeast Asia EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.19. Southeast Asia EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.20. Southeast Asia EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.1.21. Rest of Asia Pacific EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

6.4.1.22. Rest of Asia Pacific EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

6.4.1.23. Rest of Asia Pacific EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

6.4.1.24. Rest of Asia Pacific EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America EMC Filtration Market Outlook, 2018 – 2030

7.1. Latin America EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

7.1.1.1. EMC Filters

7.1.1.1.1. 1-Phase EMC Filters

7.1.1.1.2. 3-Phase EMC Filters

7.1.1.1.3. DC Filters

7.1.1.1.4. IEC Inlets

7.1.1.1.5. Chokes

7.1.1.2. Power Quality Filters

7.1.1.2.1. Passive Harmonic Filters

7.1.1.2.2. Active Harmonic Filters

7.1.1.2.3. Output Filters

7.1.1.2.4. Reactors

7.2. Latin America EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

7.2.1. Key Highlights

7.2.1.1. Common-Mode

7.2.1.2. Differential-Mode

7.3. Latin America EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. Industrial Automation

7.3.1.2. Building Technologies

7.3.1.3. Energy & Utilities

7.3.1.4. EV Charging

7.3.1.5. Medical

7.3.1.6. Data Centers

7.3.1.7. SMPS/Power Supplies

7.3.1.8. Smart Infrastructure

7.3.1.9. Energy Storage

7.3.1.10. UPS

7.3.1.11. Oil & Gas

7.3.1.12. Military

7.3.1.13. Home Appliances

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America EMC Filtration Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Brazil EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

7.4.1.2. Brazil EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

7.4.1.3. Brazil EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.4. Brazil EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

7.4.1.5. Mexico EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

7.4.1.6. Mexico EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

7.4.1.7. Mexico EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.8. Mexico EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

7.4.1.9. Argentina EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

7.4.1.10. Argentina EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

7.4.1.11. Argentina EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.12. Argentina EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

7.4.1.13. Rest of Latin America EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

7.4.1.14. Rest of Latin America EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

7.4.1.15. Rest of Latin America EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

7.4.1.16. Rest of Latin America EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa EMC Filtration Market Outlook, 2018 – 2030

8.1. Middle East & Africa EMC Filtration Market Outlook, by Product Type, Value (US$ Mn), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. EMC Filters

8.1.1.1.1. 1-Phase EMC Filters

8.1.1.1.2. 3-Phase EMC Filters

8.1.1.1.3. DC Filters

8.1.1.1.4. IEC Inlets

8.1.1.1.5. Chokes

8.1.1.2. Power Quality Filters

8.1.1.2.1. Passive Harmonic Filters

8.1.1.2.2. Active Harmonic Filters

8.1.1.2.3. Output Filters

8.1.1.2.4. Reactors

8.2. Middle East & Africa EMC Filtration Market Outlook, by Insertion Loss, Value (US$ Mn), 2018 – 2030

8.2.1. Key Highlights

8.2.1.1. Common-Mode

8.2.1.2. Differential-Mode

8.3. Middle East & Africa EMC Filtration Market Outlook, by Application, Value (US$ Mn), 2018 – 2030

8.3.1. Key Highlights

8.3.1.1. Industrial Automation

8.3.1.2. Building Technologies

8.3.1.3. Energy & Utilities

8.3.1.4. EV Charging

8.3.1.5. Medical

8.3.1.6. Data Centers

8.3.1.7. SMPS/Power Supplies

8.3.1.8. Smart Infrastructure

8.3.1.9. Energy Storage

8.3.1.10. UPS

8.3.1.11. Oil & Gas

8.3.1.12. Military

8.3.1.13. Home Appliances

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa EMC Filtration Market Outlook, by Country, Value (US$ Mn), 2018 – 2030

8.4.1. Key Highlights

8.4.1.1. GCC EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

8.4.1.2. GCC EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

8.4.1.3. GCC EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.4. GCC EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

8.4.1.5. South Africa EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

8.4.1.6. South Africa EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

8.4.1.7. South Africa EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.8. South Africa EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

8.4.1.9. Egypt EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

8.4.1.10. Egypt EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

8.4.1.11. Egypt EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.12. Egypt EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

8.4.1.13. Nigeria EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

8.4.1.14. Nigeria EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

8.4.1.15. Nigeria EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.16. Nigeria EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

8.4.1.17. Rest of Middle East & Africa EMC Filtration Market by Product Type, Value (US$ Mn), 2018 – 2030

8.4.1.18. Rest of Middle East & Africa EMC Filtration Market Insertion Loss, Value (US$ Mn), 2018 – 2030

8.4.1.19. Rest of Middle East & Africa EMC Filtration Market Application, Value (US$ Mn), 2018 – 2030

8.4.1.20. Rest of Middle East & Africa EMC Filtration Market End Use, Value (US$ Mn), 2018 – 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Application vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Schaffner Holding AG

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. ETS-Lindgren

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. EPCOS AG

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. TE Connectivity Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Schurter Holding AG

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. PREMO Corporation S.L.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. REO Ltd.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Total EMC Products Ltd.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. DEM Manufacturing Ltd.

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Astrodyne Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Chokes International

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Laird Performance Materials

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. TDK Corporation

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Astrodyne TDI

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Ferrishield

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Insertion Loss Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |