Global EMI Shielding Market Forecast

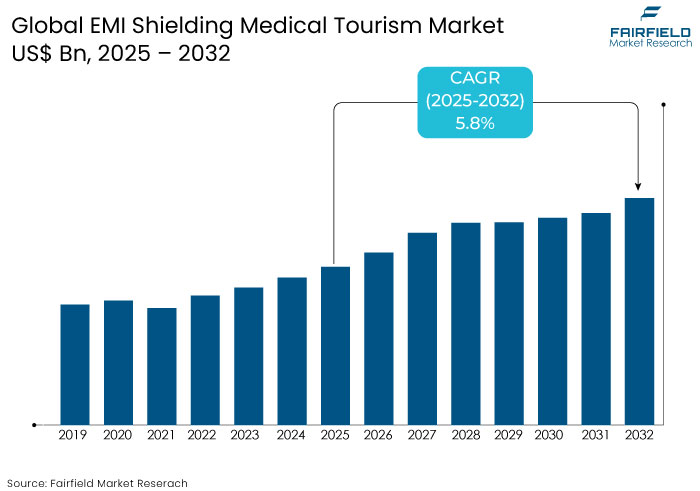

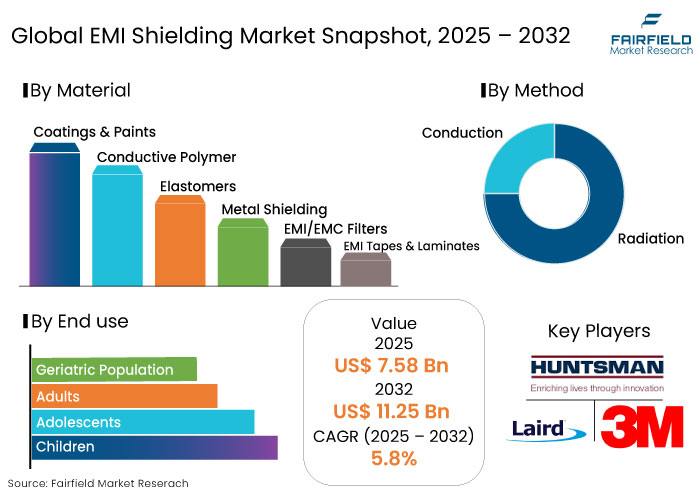

- The EMI shielding market is projected to reach a size of US$ 11.25 Bn by 2032 from US$ 7.58 Bn estimated in 2025.

- The market for EMI shielding is likely to show a considerable CAGR of 5.8% from 2025 to 2032.

EMI Shielding Market Insights

- Increasing complexity and miniaturization of electronic devices boost the need for unique EMI shielding materials.

- Rollout of 5G technology and expansion of IoT networks have surged demand for EMI shielding.

- With the rise of Electric Vehicles (EVs) and autonomous vehicles, the automotive industry is becoming a significant consumer of EMI shielding.

- Conductive coatings, metallic foils, and specialized composite materials are being developed to perform EMI shielding better at high frequencies.

- Growing emphasis on eco-friendly and recyclable materials is influencing the development of sustainable EMI shielding solutions.

- Asia Pacific dominates the global market for EMI shielding with a substantial market share.

- Based on end use, the automotive segment is likely to dominate in terms of market share in 2025.

- Radiation method is projected to be highly preferred in the forecast period.

Key Growth Determinants

- Rising Adoption of Novel Electronics across Industries

Growing integration of novel electronics across various sectors, including automotive, consumer electronics, aerospace, and telecommunications, is a significant driver for the EMI shielding market. With increasing complexity of modern electronic devices, there is a rising need for shielding solutions to protect sensitive components from Electromagnetic Interference (EMI).

Industries like automotive, where EVs and autonomous driving systems rely on high-performance electronic components, drive this demand. Surging use of consumer electronics such as smartphones, laptops, and wearable devices has further amplified the need for effective EMI shielding materials. As these devices operate at high frequencies and are often compact in design, these become more susceptible to EMI, necessitating unique shielding solutions.

- Booming Electric Vehicle and Autonomous Vehicle Markets

Rapid growth of the EV and autonomous vehicle markets has emerged as a significant driver for the EMI shielding industry. EVs and autonomous vehicles rely heavily on complex electronic systems, such as battery management systems, inverters, electric motors, Advanced Driver-Assistance Systems (ADAS), and Vehicle-to-Everything (V2X) modules.

EMI shielding materials and technologies are essential to protect these systems, ensuring smooth vehicle communication and functionality. Government incentives promoting electric mobility and stringent emission regulations have accelerated the adoption of EVs, further boosting demand for shielding solutions.

As automotive manufacturers innovate and integrate new features into their vehicles, robust electromagnetic protection becomes even more critical. It positions the automotive sector as a key contributor to growth of the EMI shielding market.

Key Growth Barriers

- Complexity of Meeting Stringent Regulatory Standards

The stringent and evolving regulatory landscape for Electromagnetic Compatibility (EMC) compliance is a key restraint for the EMI shielding market. Industries such as telecommunications, healthcare, and aerospace must adhere to rigorous EMI and EMC standards to ensure the safety and reliability of their products.

Meeting these regulatory requirements often involves extensive testing, redesigning components, and integrating additional shielding measures. Start-ups and small-scale manufacturers may struggle with the resources needed to comply with these regulations, limiting their ability to compete.

As governments introduce new standards for emerging technologies like 5G, IoT, and electric vehicles, the complexity of compliance continues to surge. This evolving regulatory environment can act as a barrier, slowing the adoption of EMI shielding solutions and creating uncertainty for manufacturers.

EMI Shielding Market Trends and Opportunities

- Developments in 5G and IoT Technologies

The rapid rollout of 5G technology and the proliferation of Internet of Things (IoT) devices present a key opportunity for the EMI shielding market. As industries and consumers increasingly rely on 5G networks for high-speed data transmission, demand for robust EMI shielding solutions intensifies.

The high frequency of 5G signals makes devices more susceptible to Electromagnetic Interference (EMI). This is creating a surging need for effective shielding materials that ensure seamless operation.

From smartphones to smart cities, protecting electronic components from EMI is crucial for maintaining performance, reliability, and compliance with EMC standards. As the 5G infrastructure broadens, it opens a significant avenue for innovation and growth in EMI shielding products. It is especially evident in consumer electronics, telecommunications, and industrial applications.

- Skyrocketing Demand for Consumer Electronics

With continuous innovation in consumer electronics, there is an increasing need for sophisticated EMI shielding solutions. Devices like smartphones, laptops, wearable technology, and gaming consoles are becoming more compact and operate at higher frequencies, making these immensely vulnerable to electromagnetic interference.

As consumer demand for these devices rises, so does the need for unique shielding materials to mitigate EMI and ensure optimal device performance. The trend for smart homes, where multiple IoT-enabled devices interact with each other, further elevates demand for EMI shielding solutions.

Growing reliance on electronics and connectivity creates a substantial opportunity for EMI shielding manufacturers to develop specialized products. They are set to meet the evolving needs of the consumer electronics segment, creating opportunities in the EMI shielding market.

Segments Covered in the Report

- Radiation Method Gains Traction Amid Miniaturization of Devices

Radiation is projected to lead the EMI shielding market in terms of method. It is driven by the rising complexity and frequency of electromagnetic emissions in today’s compact electronic devices.

As devices become smaller and more powerful, the propagation of electromagnetic waves through the air increases, leading to radiation interference. It poses a significant challenge to the performance and reliability of modern electronics.

The rise of high-frequency technologies like 5G, Wi-Fi 6, and novel IoT devices has amplified the risk of radiation-induced EMI. Unlike conduction interference, which occurs through physical contact like wires and circuits, radiation interference spreads across broader areas. It makes shielding essential for telecommunications, automotive, aerospace, and consumer electronics industries.

- Automotive Industry Leads with Surging Adoption of EVs

The automotive industry dominates by end use in the EMI shielding market. It is driven by increasing adoption of unique electronics in modern vehicles, particularly EVs and autonomous driving systems.

Modern vehicles rely heavily on electronic systems for navigation, communication, safety, and control functions that are highly vulnerable to EMI. Rapid growth of the EV market is a key driver behind this trend.

EVs are equipped with high-capacity components, such as electric motors, inverters, and battery management systems, which generate substantial electromagnetic interference. Government initiatives, including subsidies and incentives, are set to boost EV adoption. These efforts are creating a high demand for innovative EMI shielding materials.

Regional Analysis

- Asia Pacific to Dominate Backed by Favorable Government Policies

Asia Pacific is projected to lead the EMI shielding market during the forecast period. It is set to be driven by rising demand for electronics and strong government support for innovative technologies.

Countries like China, Japan, South Korea, and Taiwan play a pivotal role in the market as a global hub for electronics manufacturing. Key products such as consumer electronics, automotive components, and industrial machinery require effective EMI shielding to ensure high performance and compliance with EMC standards.

The region’s low-cost production capabilities, supported by a well-established manufacturing infrastructure, are a key catalyst for global demand. The booming automotive and EV industries in Asia Pacific are further fueling the need for innovative EMI shielding solutions. Growing adoption of EVs has increased demand for reliable electromagnetic interference protection to ensure the safety and efficiency of critical electronic systems.

Rapid development of 5G networks, the Internet of Things (IoT), and smart city initiatives in the region has led to increased electromagnetic interference, making robust EMI shielding solutions essential. These factors position Asia Pacific as the key growth hub for the EMI shielding market, driven by innovation, booming industries, and rising technological developments.

- North America Sees High Demand from Space Exploration Industry

North America is a technologically advanced region driven by significant research and development efforts in space exploration, healthcare, and defense technology. The U.S., with the world's largest defense budget, plays a pivotal role in shaping the region's innovation landscape.

North America’s healthcare sector is also projected to rise steadily, supported by a growing population and surging disposable income. The region accounted for a substantial global revenue share in the EMI shielding market, with the U.S. contributing 82.1% of the regional share.

Factors such as innovations in space exploration and ongoing research and development activities in the healthcare and aerospace industries are set to fuel growth. A favorable environment is also projected to drive demand for EMI shielding solutions, particularly in the defense industry. As a result, North America remains a key market for adopting innovative EMI shielding products.

Fairfield’s Competitive Landscape Analysis

The EMI shielding market is highly competitive, with several players striving to establish a stronghold. Leading companies like 3M, Parker Hannifin, Laird Performance Materials, and PPG Industries dominate the landscape, driven by continuous innovation and strategic partnerships.

Small-scale players also contribute by catering to niche applications and offering customized solutions. Rising demand across industries like electronics, automotive, and telecommunications fuels the market's growth.

Companies are focusing on bolstering material technologies, such as conductive coatings and metal shielding, to stay ahead. As consumer electronics and 5G technologies rise, the competition intensifies, pushing players to enhance product performance and reduce costs to meet evolving customer demands.

Key Market Companies

- 3M

- Laird Technologies, Inc.

- Huntsman International LLC

- RTP Company

- Marktek Inc.

- ETS-Lindgren

- Tech-Etch

- Omega Shielding Products

- HEICO Corporation

- SCHAFFNER HOLDING AG

- Parker Hannifin Corporation

- PPG Industries

- Henkel AG and Co. KGaA

Recent Industry Developments

- In July 2024, Tech Etch introduced DigiKey as its new distribution partner, to enhance accessibility to Tech Etch's unique products and solutions for a broader international clientele.

- In October 2023, PPG announced that its SEM Products division launched GLADIATOR XC Matte Extreme Coating, a premium, low-gloss urethane protective coating.

Global EMI Shielding Market is Segmented as-

By Type

- Narrowband EMI

- Broadband EMI

By Method

- Radiation

- Conduction

By Material

- Coatings & Paints

- Conductive Polymer

- Elastomers

- Metal Shielding

- EMI/EMC Filters

- EMI Tapes & Laminates

By End Use

- Consumer Electronics

- Automotive

- Telecommunications & Information Technology

- Healthcare

- Aerospace

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global EMI Shielding Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global EMI Shielding Market Outlook, 2019 - 2032

3.1. Global EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Narrowband EMI

3.1.1.2. Broadband EMI

3.2. Global EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Radiation

3.2.1.2. Conduction

3.3. Global EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Coatings & Paints

3.3.1.2. Conductive Polymer

3.3.1.3. Elastomers

3.3.1.4. Metal Shielding

3.3.1.5. EMI/EMC Filters

3.3.1.6. EMI Tapes & Laminates

3.4. Global EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Consumer Electronics

3.4.1.2. Automotive

3.4.1.3. Telecommunications & Information Technology

3.4.1.4. Healthcare

3.4.1.5. Aerospace

3.4.1.6. Others

3.5. Global EMI Shielding Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America EMI Shielding Market Outlook, 2019 - 2032

4.1. North America EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Narrowband EMI

4.1.1.2. Broadband EMI

4.2. North America EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Radiation

4.2.1.2. Conduction

4.3. North America EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Coatings & Paints

4.3.1.2. Conductive Polymer

4.3.1.3. Elastomers

4.3.1.4. Metal Shielding

4.3.1.5. EMI/EMC Filters

4.3.1.6. EMI Tapes & Laminates

4.4. North America EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Consumer Electronics

4.4.1.2. Automotive

4.4.1.3. Telecommunications & Information Technology

4.4.1.4. Healthcare

4.4.1.5. Aerospace

4.4.1.6. Others

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America EMI Shielding Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.2. U.S. EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.3. U.S. EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.4. U.S. EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.5. Canada EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.6. Canada EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.7. Canada EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.1.8. Canada EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe EMI Shielding Market Outlook, 2019 - 2032

5.1. Europe EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Narrowband EMI

5.1.1.2. Broadband EMI

5.2. Europe EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Radiation

5.2.1.2. Conduction

5.3. Europe EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Coatings & Paints

5.3.1.2. Conductive Polymer

5.3.1.3. Elastomers

5.3.1.4. Metal Shielding

5.3.1.5. EMI/EMC Filters

5.3.1.6. EMI Tapes & Laminates

5.4. Europe EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Consumer Electronics

5.4.1.2. Automotive

5.4.1.3. Telecommunications & Information Technology

5.4.1.4. Healthcare

5.4.1.5. Aerospace

5.4.1.6. Others

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe EMI Shielding Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.2. Germany EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.3. Germany EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.4. Germany EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.5. U.K. EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.6. U.K. EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.7. U.K. EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.8. U.K. EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.9. France EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.10. France EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.11. France EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.12. France EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.13. Italy EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.14. Italy EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.15. Italy EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.16. Italy EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.17. Turkey EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.18. Turkey EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.19. Turkey EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.20. Turkey EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.21. Russia EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.22. Russia EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.23. Russia EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.24. Russia EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.25. Rest of Europe EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.26. Rest of Europe EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.27. Rest of Europe EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.1.28. Rest of Europe EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific EMI Shielding Market Outlook, 2019 - 2032

6.1. Asia Pacific EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Narrowband EMI

6.1.1.2. Broadband EMI

6.2. Asia Pacific EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Radiation

6.2.1.2. Conduction

6.3. Asia Pacific EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Coatings & Paints

6.3.1.2. Conductive Polymer

6.3.1.3. Elastomers

6.3.1.4. Metal Shielding

6.3.1.5. EMI/EMC Filters

6.3.1.6. EMI Tapes & Laminates

6.4. Asia Pacific EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Consumer Electronics

6.4.1.2. Automotive

6.4.1.3. Telecommunications & Information Technology

6.4.1.4. Healthcare

6.4.1.5. Aerospace

6.4.1.6. Others

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific EMI Shielding Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. China EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.2. China EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.3. China EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.4. China EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.5. Japan EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.6. Japan EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.7. Japan EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.8. Japan EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.9. South Korea EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.10. South Korea EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.11. South Korea EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.12. South Korea EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.13. India EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.14. India EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.15. India EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.16. India EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.17. Southeast Asia EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.18. Southeast Asia EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.19. Southeast Asia EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.20. Southeast Asia EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.21. Rest of Asia Pacific EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.22. Rest of Asia Pacific EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.23. Rest of Asia Pacific EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.1.24. Rest of Asia Pacific EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America EMI Shielding Market Outlook, 2019 - 2032

7.1. Latin America EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Narrowband EMI

7.1.1.2. Broadband EMI

7.2. Latin America EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Radiation

7.2.1.2. Conduction

7.3. Latin America EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Coatings & Paints

7.3.1.2. Conductive Polymer

7.3.1.3. Elastomers

7.3.1.4. Metal Shielding

7.3.1.5. EMI/EMC Filters

7.3.1.6. EMI Tapes & Laminates

7.4. Latin America EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Consumer Electronics

7.4.1.2. Automotive

7.4.1.3. Telecommunications & Information Technology

7.4.1.4. Healthcare

7.4.1.5. Aerospace

7.4.1.6. Others

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America EMI Shielding Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.2. Brazil EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.3. Brazil EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.4. Brazil EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.5. Mexico EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.6. Mexico EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.7. Mexico EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.8. Mexico EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.9. Argentina EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.10. Argentina EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.11. Argentina EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.12. Argentina EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.13. Rest of Latin America EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.14. Rest of Latin America EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.15. Rest of Latin America EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.1.16. Rest of Latin America EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa EMI Shielding Market Outlook, 2019 - 2032

8.1. Middle East & Africa EMI Shielding Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Narrowband EMI

8.1.1.2. Broadband EMI

8.2. Middle East & Africa EMI Shielding Market Outlook, by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Radiation

8.2.1.2. Conduction

8.3. Middle East & Africa EMI Shielding Market Outlook, by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Coatings & Paints

8.3.1.2. Conductive Polymer

8.3.1.3. Elastomers

8.3.1.4. Metal Shielding

8.3.1.5. EMI/EMC Filters

8.3.1.6. EMI Tapes & Laminates

8.4. Middle East & Africa EMI Shielding Market Outlook, by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Consumer Electronics

8.4.1.2. Automotive

8.4.1.3. Telecommunications & Information Technology

8.4.1.4. Healthcare

8.4.1.5. Aerospace

8.4.1.6. Others

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa EMI Shielding Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.2. GCC EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.3. GCC EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.4. GCC EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.5. South Africa EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.6. South Africa EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.7. South Africa EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.8. South Africa EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.9. Egypt EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.10. Egypt EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.11. Egypt EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.12. Egypt EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.13. Nigeria EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.14. Nigeria EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.15. Nigeria EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.16. Nigeria EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.17. Rest of Middle East & Africa EMI Shielding Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.18. Rest of Middle East & Africa EMI Shielding Market by Method, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.19. Rest of Middle East & Africa EMI Shielding Market by Material, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.1.20. Rest of Middle East & Africa EMI Shielding Market by End Use, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Method Heat Map

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. 3M

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Laird Technologies, In

9.4.3. Huntsman International LLC

9.4.4. RTP Company

9.4.5. Marktek Inc.

9.4.6. ETS-Lindgren

9.4.7. Tech-Etch

9.4.8. Omega Shielding Products

9.4.9. HEICO Corporation

9.4.10. SCHAFFNER HOLDING AG

9.4.11. Parker Hannifin Corporation

9.4.12. PPG Industries

9.4.13. Henkel AG and Co. KGaA

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Method Coverage |

|

|

Material Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |