Global Endodontic Reparative Cement Market Forecast

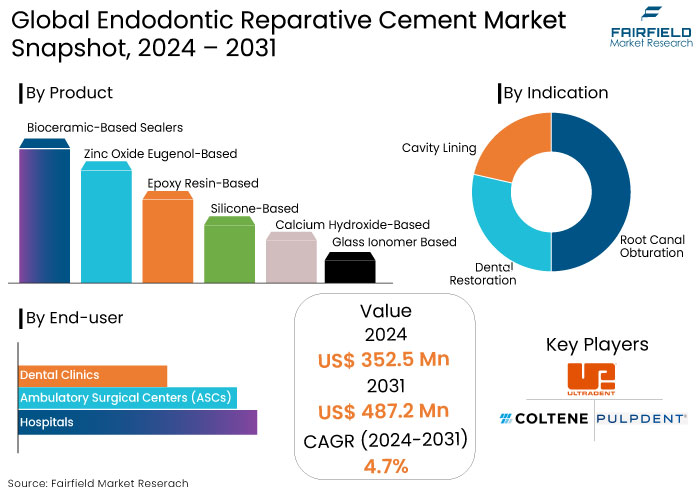

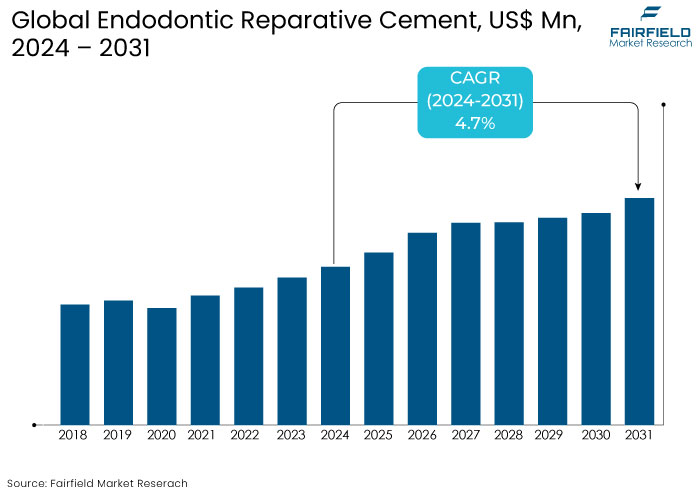

- The endodontic reparative cement market is likely to be valued at US$487.2 Mn by 2031, exhibiting significant growth from the US$352.5 Mn obtained in 2024.

- The market anticipated to showcase a CAGR of 4.7% during the forecast period between 2024 and 2031.

Endodontic Reparative Cement Market Insights

- The market is growing as the demand for advanced dental procedures rises, driven by an aging population and increased awareness of oral health.

- Key products in the market include mineral trioxide aggregate (MTA), calcium silicate-based cements, and bioactive cements, each offering different properties like biocompatibility and ease of use.

- The endodontic reparative cement market is benefiting from innovations in cement formulations, enhancing their bonding strength, sealing properties, and biocompatibility for better long-term outcomes.

- The shift toward minimally invasive techniques in endodontics is increasing the demand for reparative cements, as they aid in tissue regeneration and improve post-procedure recovery.

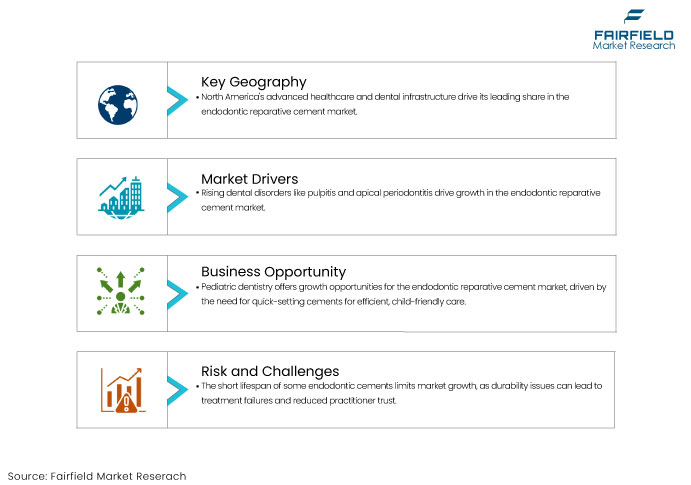

- North America holds a significant market share due to the presence of advanced healthcare infrastructure, high dental care expenditure, and growing awareness.

- The market faces challenges like the high cost of advanced cement products and the need for proper training to ensure correct application.

- The increasing preference for biocompatible and environmentally sustainable materials is an emerging trend, as patients and dental professionals seek safe, and more effective treatment options.

A Look Back and a Look Forward - Comparative Analysis

The endodontic reparative cement market has evolved significantly in recent years, driven by advancements in dental materials and an increased awareness of dental care. Historical trends show a steady rise in demand for reparative cements as endodontists and general dentists sought more effective solutions for root repair and apical sealing.

The market growth bolstered by innovations in biocompatible materials and improvements in cement formulations, making these products more effective and accessible. In particular, calcium silicate-based cements gained traction, valued for their sealing abilities and compatibility with periapical tissues. This innovation in materials has been crucial in addressing cases of root resorption and apexification, where precise sealing and tissue repair are critical.

The market for endodontic reparative cement is expected to continue its expansion, driven by the increasing incidence of dental disorders and a rise in patient awareness about oral health. New product developments are anticipated to focus on enhancing bioactivity, radiopacity, and ease of handling, ensuring great applicability in complex dental cases.

Advancements in delivery systems and minimally invasive techniques will likely support the integration of these materials in more dental practices. As the focus on sustainability and biocompatibility strengthens within healthcare, the adoption of reparative cements with low environmental impact will likely influence the market landscape in the coming years.

Key Growth Determinants

- Increasing Prevalence of Dental Disorders Emerged as a Key Driver

The increased incidence of dental disorders has emerged as a significant driver for the global endodontic reparative cement market. Dental conditions such as pulpitis, dental trauma, and apical periodontitis are becoming increasingly prevalent due to a combination of factors. These factors include poor oral hygiene practices, high sugar consumption, and a sedentary lifestyle that neglects preventive dental care.

Pulpitis, characterized by the inflammation of the dental pulp often results from untreated cavities or trauma, necessitating urgent endodontic treatment to alleviate pain and preserve tooth integrity. Additionally, dental trauma, which can occur from accidents or sports injuries, particularly among younger populations, leads to immediate dental intervention to prevent further complications.

According to a study published in the Journal of Endodontics, the incidence of traumatic dental injuries in children has shown an alarming rise, with up to 20% of school-aged children experiencing some form of dental trauma. This increase not only highlights the urgent need for effective endodontic treatments but also underscores the importance of utilizing advanced materials such as reparative cements that promote the healing and regeneration of dental tissues.

- Advancements in Bioactive Materials

Advancements in bioactive materials remain a prominent driving factor for endodontic reparative cement market growth. Notably, calcium silicate-based materials and mineral trioxide aggregate (MTA) have gained prominence due to their exceptional biocompatibility and regenerative properties. These materials facilitate a conducive environment for tissue regeneration, which is crucial for successful endodontic procedures.

Calcium silicate-based cements, for instance, release calcium hydroxide upon hydration, which not only promotes healing but also stimulates the formation of hydroxyapatite a critical component for tooth structure. This characteristic enhances the ability of these materials to bond effectively with dental tissues, resulting in improved clinical outcomes. A recent example of this advancement is the introduction of dentine, a calcium silicate-based reparative cement that has garnered attention for its excellent sealing properties and biological compatibility.

Study published in Dental Materials in 2023 highlighted biodentine's superior capacity to promote pulp cell proliferation compared to traditional materials, indicating its potential to accelerate the healing process following endodontic treatment. The study demonstrated that teeth treated with bio dentine showed significantly reduced recovery times, allowing for faste patient restoration and comfort.

The use of MTA has been pivotal in endodontic treatments involving root-end filling and pulp capping. Its ability to stimulate the regeneration of periapical tissues has made it a gold standard in endodontics.

Key Growth Barriers

- Limited Durability to Hinder Effectiveness of Root Canal Sealers

The relatively short lifespan of some endodontic reparative cements is a notable restraint for the endodontic reparative cement market growth as practitioners often seek materials that provide durable, long-term solutions for patients.

Reparative cement serves as a key material for sealing, filling, and repairing dental structures in endodontic treatments. However, when these cements exhibit limited durability, their effectiveness can diminish over time, leading to complications such as leakage, structural breakdown, and potential reinfection of treated areas. This, in turn, results in additional procedures, impacting both patient satisfaction and the overall reputation of these materials among dental professionals.

A short lifespan in reparative cement can lead to challenges in maintaining effective isolation and structural integrity, which are critical in preventing bacterial infiltration and preserving tooth health. Given the rigorous stress endured by dental materials in the oral environment, including exposure to chewing forces, temperature changes, and biochemical interactions, materials with limited durability may degrade quicker than anticipated.

Deterioration risks undermining the efficacy of the treatment, as compromised cements may fail to fully protect the treated area, creating susceptibility to further dental issues. The perception of a short lifespan also influences purchasing decisions, as dentists prioritize materials that reliably meet clinical demands for extended periods.

- Potential for Allergic Reactions

Concerns about allergic reactions to certain components in endodontic reparative cements present a significant barrier to their widespread acceptance in clinical practice. These cements often contain various compounds, such as resins, metals, or additives, that can trigger sensitivities or allergic responses in some patients.

Trace elements can sometimes induce reactions ranging from mild inflammation to severe hypersensitivity, affecting the surrounding gum tissue or even causing systemic responses. Such risks make practitioners cautious, as patient safety and comfort are top priorities in dental care.

The uncertainty surrounding potential allergens also complicates product selection for dentists, who may hesitate to use materials without a well-documented track record of biocompatibility. Furthermore, allergic reactions may lead to adverse outcomes that require additional treatments, placing a burden on both patients and practitioners. As a result, dental professionals often prefer materials with fewer allergenic components or those with a proven safety record, even if newer reparative cements offer other clinical advantages.

Endodontic Reparative Cement Market Trends and Opportunities

- High Growth in Pediatric Dentistry

The endodontic reparative cement market has a significant opportunity for growth in the pediatric dentistry, driven by the increased focus on early preventive and restorative dental care for children. Young patients present unique physiological and behavioral challenges, necessitating specialized products that cater to their dental needs.

Pediatric dental procedures require reparative cement that sets quickly, reducing time in the dental chair to help alleviate discomfort and anxiety. Quick-setting cements are crucial for treating children, as they enable more efficient procedures, reducing the need for multiple visits and helping keep treatment duration short.

Biocompatibility is a priority in pediatric dentistry, as children’s developing tissues are more sensitive to dental materials. Reparative cement designed with bioactive ingredients fosters healing and integration with natural tissue, ensuring that the materials used are gentle on young patients’ teeth and promote better outcomes.

Cement that can support natural tissue repair, maintain moisture control, and reduce post-operative sensitivity are in high demand in the pediatric segment, especially given the rise in childhood dental conditions like early childhood caries. These issues often require careful management with materials that both repair damage and protect against the future.

Parental awareness of preventive dental care is growing, with more parents seeking quality, biocompatible treatments for their children’s dental needs. This trend encourages dental practices to adopt materials specifically developed for pediatric use, creating a strong market demand for reparative cements that support long-term dental health.

- Rising Medical and Dental Tourism

Dental facilities in leading cities of India Indian cities boast state-of-the-art equipment, modern amenities, and English-speaking staff, ensuring a comfortable and seamless experience for international patients. As the dental tourism trend continues to grow fueled by increasing healthcare costs in Western countries, developing countries like India is poised to capture a significant share of the global endodontic reparative cement market.

India's reputation as one of the cheapest countries for dental procedures makes it an attractive destination for international patients seeking implant treatments. The cost of root canal treatment in emerging economies like India can be substantially lower than in countries like the United States, Europe, or Australia, without compromising on quality or safety standards. This cost advantage is particularly appealing to patients without adequate insurance coverage or those seeking elective procedures not covered by insurance.

According to World of Dentistry, India's advanced dental treatment technology broadens the scope of dental tourism worldwide (including Europe, the United States, and Africa). India provides affordable dental care from professional and trained dentists worldwide. In comparison to other nations, India has much lower costs for dental operations such as root canal therapy and dental implants.

India's diverse tourism offerings, including rich cultural heritage, scenic landscapes, and renowned hospitality make it an appealing destination for dental tourists. Patients can combine their dental treatment with leisure activities, transforming their healthcare journey into a rejuvenating and memorable experience.

How Does Regulatory Scenario Shape the Industry?

The regulatory scenario plays a pivotal role in shaping the endodontic reparative cement market by ensuring that materials used in dental procedures meet stringent safety, quality, and efficacy standards. Regulatory bodies like the FDA, EMA and CDSCO enforce guidelines for product approval, including requirements for biocompatibility, mechanical properties, and sterility.

The regulatory scenario greatly shapes the market by ensuring product safety and efficacy, influencing the pace of innovation, and governing market access across regions. While regulations protect patient health and promote product quality, they also introduce challenges in terms of compliance, time-to-market, and costs for manufacturers

The regulatory environment significantly impacts the market by shaping product development, manufacturing practices, and the speed at which new products enter the market. Stringent safety and efficacy regulations protect patient health, but they also increase the cost and complexity of bringing new products to market. As a result, companies must navigate a complex regulatory landscape to ensure compliance while fostering innovation in the development of more effective and safer reparative cements.

Segments Covered in the Report

- Bioceramic-Based Sealers Remain Top

Bioceramic-based sealers lead the position in the endodontic reparative cement market due to their exceptional biocompatibility, sealing capabilities, and bioactivity. These sealers bond effectively with dentin, minimizing microleakage and preventing bacterial reinfection, which is crucial for long-term root canal treatment success.

Unlike traditional materials, bioceramic-based sealers exhibit minimal shrinkage providing a stable, durable seal that encourages periapical tissue healing and bone regeneration. Additionally, they release calcium ions that promote mineralization and enhance tissue repair, making them ideal for complex cases such as root resorption and perforations. Their ease of use and compatibility with minimally invasive techniques also make bioceramic-based sealers a preferred choice for dental practitioners.

- Root Canal Obturation Segment Maintains Primacy in the Market

The root canal obturation segment leads in the endodontic reparative cement market due to its central role in sealing the root canal system post-cleaning and shaping. Obturation is critical for preventing bacterial invasion and reinfection, which are primary causes of endodontic treatment failure.

High-quality reparative cements, particularly those with bioceramic properties are essential as they offer superior sealing capabilities, bioactivity, and compatibility with dentin. These attributes make them ideal for filling canal irregularities and creating an effective barrier against microbes. The rising prevalence of root canal procedures worldwide, along with advancements in obturation techniques drives demand for cements specifically designed to meet the challenges of root canal obturation.

Regional Analysis

- High Dental Care Standards Sets Apart North to Grow Substantially

North America holds a substantial share of the endodontic reparative cement market due to its advanced healthcare infrastructure, high dental care standards, and strong adoption of cutting-edge dental materials. The region benefits from a well-established network of dental clinics and a high concentration of skilled endodontists, facilitating the use of innovative reparative cements in routine procedures.

Growing awareness about dental health among patients, coupled with the high prevalence of root canal treatments has increased the demand for effective and reliable endodontic materials. Additionally, favorable reimbursement policies and the presence of leading market players in the U.S. drive product development and accessibility, reinforcing North America’s lead in this segment.

- Asia Pacific Emerges Lucrative with Growing Awareness about Dental Health

Asia Pacific region is experiencing notable growth in the endodontic reparative cement market, driven by increasing awareness of dental health, a rising prevalence of dental conditions, and an expanding middle-class population with access to improved healthcare. As urbanization and disposable incomes grow, more people in countries like China and India can afford dental treatments, including advanced endodontic procedures.

The adoption of modern dental technologies is also increasing as dental practices upgrade to meet the rising demand. Additionally, local governments are investing in healthcare infrastructure, while the entry of international dental product manufacturers expands access to high-quality reparative cements. This combination of economic and healthcare development positions Asia Pacific as a key growth area in the endodontic cement market.

Fairfield’s Competitive Landscape Analysis

The endodontic reparative cement market is witnessing significant advancements as leading companies like Dentsply Sirona, Septodont Holding, Ivoclar Vivadent are leveraging innovative technologies and sustainable practices.

Industry leaders invest significantly in innovation, enabling them to create advanced materials that improve the efficacy, biocompatibility, and handling of endodontic cements. Their global reach allows them to serve diverse markets, while their established distribution networks ensure widespread product availability.

Market players prioritize regulatory compliance and quality standards, building trust with dental professionals worldwide. Their consistent focus on advancing endodontic technologies and meeting varied clinical needs gives them a competitive edge in the market.

Companies such as Ultradent Products Inc., Kerr Dental, Coltène Group these companies focus on developing high-quality endodontic solutions tailored to diverse market needs, including emerging economies where dental care access is rising. By establishing distribution networks in regions like Asia Pacific and Latin America, they ensure wider product availability and accessibility.

Key Market Companies

- Angelus Indústria de Produtos Odontológicos S/A

- Ultradent Products Inc.

- Pulpdent Corporation

- Coltène Group

- Ivoclar Vivadent

- Innovative BioCeramix, Inc.

- Septodont USA

- Brasseler USA

- J.M. Laboratories Ltd.

- Parkell, Inc.

- FKG Dentaire SA

- Essential Dental Systems, Inc.

- Insight Endo

- Kerr Corporation

- Pac-Dent

- Dentsply Sirona

Recent Industry Developments

- In October 2024, Septodont and Acteon announced an agreement to jointly acquire Inibsa, a global pharmaceutical group based in Barcelona, Spain. Under the agreement, pending regulatory approvals, Septodont takes controlling stake, with Acteon as a minority shareholder. Inibsa, with over 75 years of experience and a presence in more than 60 countries, will leverage this partnership to expand its global dental product sales. Both Septodont and Inibsa are dedicated to meeting the needs of dental professionals, while Acteon’s investment aims to strengthen its long-standing relationship with Inibsa.

- In August 2024, Ultradent Products, Inc., announced its acquisition of Medicinos Linija UAB, known as "i-dental," a prominent dental products manufacturer based in Siauliai, Lithuania. The acquisition expanded Ultradent's global reach, enhancing its ability to support dentists worldwide. With i-dental added to its portfolio, Ultradent now operates offices and subsidiaries in 12 countries.

- In May 2024, Ivoclar enhanced its Ivotion Denture System, known for efficient fabrication of aesthetic removable prostheses, by integrating with exocad’s DentalCAD software. This collaboration introduced a new add-on module, streamlining digital production and offering advanced design tools. Users with an Ultimate Lab license gained automatic access following the recent Elefsina upgrade.

An Expert’s Eye

- Bioceramic-based sealers and advanced calcium silicate cements are gaining popularity, innovations in bioactivity and ease of handling are central to endodontic reparative cement market These materials improve sealing, promote tissue regeneration, and address complex cases, making them preferred by dental professionals.

- North America dominates due to its established healthcare system and high dental awareness, while Asia Pacific’s rapid growth is fueled by increasing dental health awareness, urbanization, and improved healthcare access.

- Leaading companies like Dentsply Sirona, Kerr Dental, and Coltène Group lead through research and development investment, global distribution networks, and localized partnerships. Consequently, strengthening their market position and expanding access to advanced endodontic materials worldwide.

Global Endodontic Reparative Cement Market is Segmented as-

By Product

- Bioceramic-Based Sealers

- Mineral Trioxide Aggregate (MTA)-Based

- Calcium Silicate-Based

- Calcium Phosphate-Based

- Zinc Oxide Eugenol-Based

- Epoxy Resin-Based

- Silicone-Based

- Calcium Hydroxide-Based

- Glass Ionomer Based

- Methacrylate Resin-based

By Indication

- Root Canal Obturation

- Dental Restoration

- Cavity Lining

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Dental Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Endodontic Reparative Cement Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Endodontic Reparative Cement Market Outlook, 2019 - 2031

3.1. Global Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Bioceramic-Based Sealers

3.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

3.1.1.1.2. Calcium Silicate-Based

3.1.1.1.3. Calcium Phosphate-Based

3.1.1.2. Zinc Oxide Eugenol-Based

3.1.1.3. Epoxy Resin-Based

3.1.1.4. Silicone-Based

3.1.1.5. Calcium Hydroxide-Based

3.1.1.6. Glass Ionomer Based

3.1.1.7. Methacrylate Resin-based

3.2. Global Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Root Canal Obturation

3.2.1.2. Dental Restoration

3.2.1.3. Cavity Lining

3.3. Global Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Ambulatory Surgical Centers (ASCs)

3.3.1.3. Dental Clinics

3.4. Global Endodontic Reparative Cement Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Endodontic Reparative Cement Market Outlook, 2019 - 2031

4.1. North America Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Bioceramic-Based Sealers

4.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

4.1.1.1.2. Calcium Silicate-Based

4.1.1.1.3. Calcium Phosphate-Based

4.1.1.2. Zinc Oxide Eugenol-Based

4.1.1.3. Epoxy Resin-Based

4.1.1.4. Silicone-Based

4.1.1.5. Calcium Hydroxide-Based

4.1.1.6. Glass Ionomer Based

4.1.1.7. Methacrylate Resin-based

4.2. North America Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Root Canal Obturation

4.2.1.2. Dental Restoration

4.2.1.3. Cavity Lining

4.3. North America Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Ambulatory Surgical Centers (ASCs)

4.3.1.3. Dental Clinics

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Endodontic Reparative Cement Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Endodontic Reparative Cement Market Outlook, 2019 - 2031

5.1. Europe Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Bioceramic-Based Sealers

5.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

5.1.1.1.2. Calcium Silicate-Based

5.1.1.1.3. Calcium Phosphate-Based

5.1.1.2. Zinc Oxide Eugenol-Based

5.1.1.3. Epoxy Resin-Based

5.1.1.4. Silicone-Based

5.1.1.5. Calcium Hydroxide-Based

5.1.1.6. Glass Ionomer Based

5.1.1.7. Methacrylate Resin-based

5.2. Europe Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Root Canal Obturation

5.2.1.2. Dental Restoration

5.2.1.3. Cavity Lining

5.3. Europe Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers (ASCs)

5.3.1.3. Dental Clinics

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Endodontic Reparative Cement Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.7. France Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.8. France Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.9. France Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Endodontic Reparative Cement Market Outlook, 2019 - 2031

6.1. Asia Pacific Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Bioceramic-Based Sealers

6.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

6.1.1.1.2. Calcium Silicate-Based

6.1.1.1.3. Calcium Phosphate-Based

6.1.1.2. Zinc Oxide Eugenol-Based

6.1.1.3. Epoxy Resin-Based

6.1.1.4. Silicone-Based

6.1.1.5. Calcium Hydroxide-Based

6.1.1.6. Glass Ionomer Based

6.1.1.7. Methacrylate Resin-based

6.2. Asia Pacific Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Root Canal Obturation

6.2.1.2. Dental Restoration

6.2.1.3. Cavity Lining

6.3. Asia Pacific Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers (ASCs)

6.3.1.3. Dental Clinics

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Endodontic Reparative Cement Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.2. China Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.3. China Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.10. India Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.11. India Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.12. India Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Endodontic Reparative Cement Market Outlook, 2019 - 2031

7.1. Latin America Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Bioceramic-Based Sealers

7.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

7.1.1.1.2. Calcium Silicate-Based

7.1.1.1.3. Calcium Phosphate-Based

7.1.1.2. Zinc Oxide Eugenol-Based

7.1.1.3. Epoxy Resin-Based

7.1.1.4. Silicone-Based

7.1.1.5. Calcium Hydroxide-Based

7.1.1.6. Glass Ionomer Based

7.1.1.7. Methacrylate Resin-based

7.2. Latin America Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Root Canal Obturation

7.2.1.2. Dental Restoration

7.2.1.3. Cavity Lining

7.3. Latin America Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers (ASCs)

7.3.1.3. Dental Clinics

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Endodontic Reparative Cement Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Endodontic Reparative Cement Market Outlook, 2019 - 2031

8.1. Middle East & Africa Endodontic Reparative Cement Market Outlook, by Product, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Bioceramic-Based Sealers

8.1.1.1.1. Mineral Trioxide Aggregate (MTA)-Based

8.1.1.1.2. Calcium Silicate-Based

8.1.1.1.3. Calcium Phosphate-Based

8.1.1.2. Zinc Oxide Eugenol-Based

8.1.1.3. Epoxy Resin-Based

8.1.1.4. Silicone-Based

8.1.1.5. Calcium Hydroxide-Based

8.1.1.6. Glass Ionomer Based

8.1.1.7. Methacrylate Resin-based

8.2. Middle East & Africa Endodontic Reparative Cement Market Outlook, by Indication, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Root Canal Obturation

8.2.1.2. Dental Restoration

8.2.1.3. Cavity Lining

8.3. Middle East & Africa Endodontic Reparative Cement Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers (ASCs)

8.3.1.3. Dental Clinics

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Endodontic Reparative Cement Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Endodontic Reparative Cement Market by Product, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Endodontic Reparative Cement Market by Indication, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Endodontic Reparative Cement Market by End User, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Product vs by Indication Heat map

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Angelus Indústria de Produtos Odontológicos S/A

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Ultradent Products Inc.

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Pulpdent Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Coltène Group

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Ivoclar Vivadent

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Innovative BioCeramix, Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Septodont USA

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Brasseler USA

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. B.J.M. Laboratories Ltd.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Parkell, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. FKG Dentaire SA

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Essential Dental Systems, Inc.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Insight Endo

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Kerr Corporation

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Pac-Dent

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. Dentsply Sirona

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Indication Coverage |

|

|

End User |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |