Global Epilepsy Treatment Market Forecast

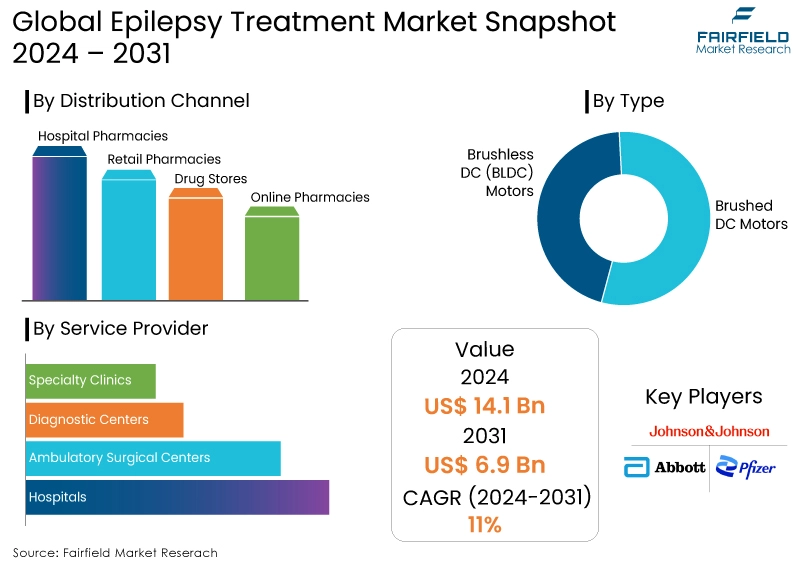

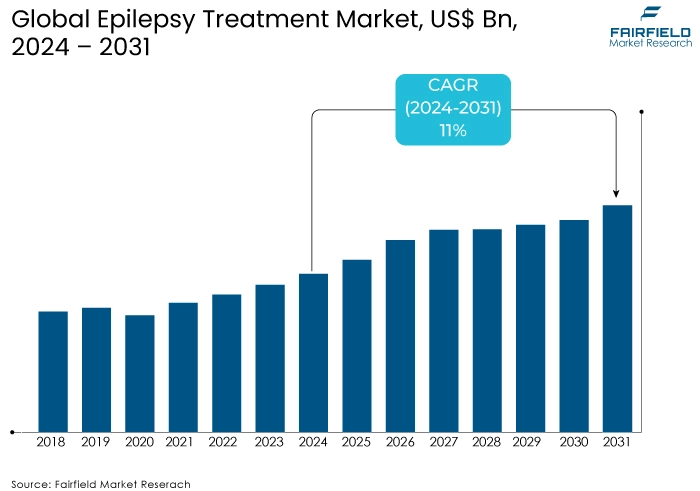

- Market for epilepsy treatment expected to rise high up to US$6.9 Bn in 2031, up from US$14.1 Bn attained in 2024

- Epilepsy treatment market size poised for expansion at a CAGR of 11% during 2024-2031

Quick Report Digest

- Epilepsy treatment market is expected to grow significantly due to new drug approvals, rising geriatric population, and increased public awareness.

- Post-COVID, there might be a rise in epilepsy diagnoses and need for treatment, especially for children.

- Stringent regulations ensure safety but can delay availability of new treatments.

- Key growth drivers include expanding treatment options, rising public awareness, and growing geriatric population.

- Key growth restraints include affordability hurdles and incomplete treatment efficacy.

- Personalized medicine is a key trend that tailors treatment plans to individual patients.

- Developing regions present an untapped opportunity due to rising patient population and healthcare spending.

- Second-generation AEDs dominate the drug class segment due to fewer side effects and broader efficacy.

- Medication remains the king of treatment types due to its non-invasive nature, convenience, and established efficacy.

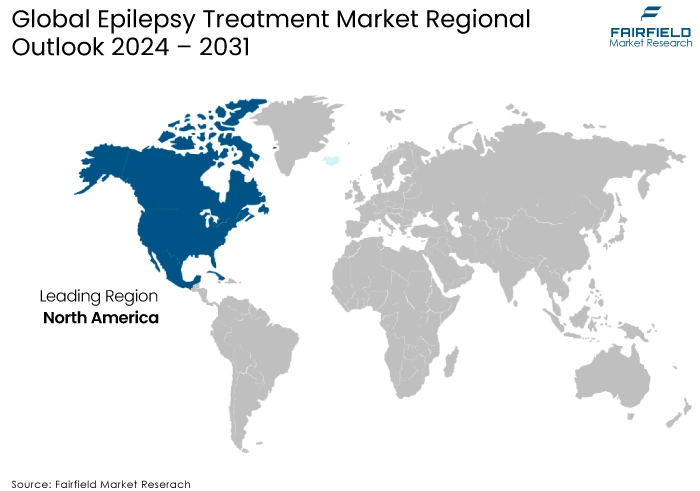

- North America is the current leader but Asia Pacific is expected to experience the fastest growth.

A Look Back and a Look Forward - Comparative Analysis

The epilepsy treatment market exhibited consistent growth in the years leading up to 2023. This can be attributed to two main factors: a rise in diagnosed epilepsy cases due to better diagnostic tools and growing public awareness, and a subsequent increase in the adoption of antiepileptic drugs (AEDs) as the primary treatment method.

However, the market is poised for a significant growth acceleration in the coming years. This is fueled by a confluence of factors, including the approval of new drugs targeting a wider range of seizure types, a growing geriatric population more susceptible to epilepsy, and rising public awareness campaigns that are encouraging earlier diagnosis and treatment initiation.

Epilepsy treatment demand has seen some shifts post-COVID, with potential for both increased demand and new considerations. Studies suggest a slight increase in new epilepsy diagnoses, particularly in non-hospitalized COVID-19 cases, compared to influenza. This could lead to a rise in demand for treatment, especially medications, for newly diagnosed patients.

Children seem to be at a higher risk of developing epilepsy after COVID-19. This might necessitate tailoring treatment approaches for this age group. The long-term impact of COVID-19 on epilepsy risk and treatment needs is still under investigation. More research is needed to fully understand the mechanisms at play and develop targeted treatment strategies for post-COVID epilepsy.

Key Growth Determinants

Expanding Treatment Options

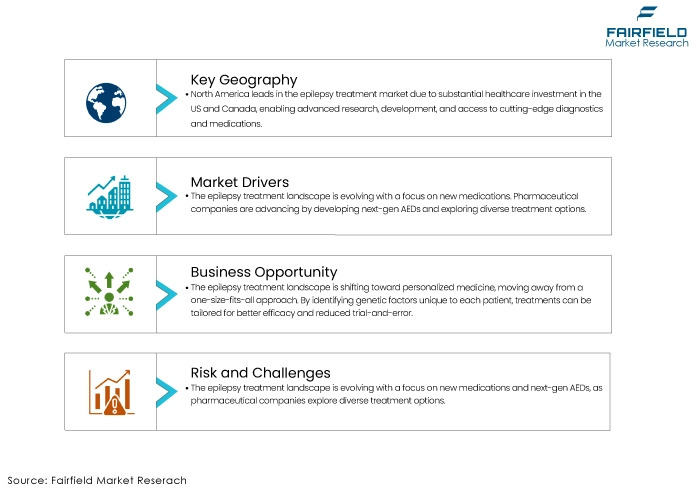

The epilepsy treatment landscape is constantly evolving, with a growing focus on developing new and improved medications. Pharmaceutical companies are actively pushing the boundaries by introducing next-gen AEDs, and exploring diverse treatment modalities.

The new medications aim to offer better efficacy against various seizure types compared to existing options. Additionally, they aim to minimize side effects, a major concern for patients on long-term treatment. Beyond medications, advancements in neuromodulation devices and surgical techniques are providing more targeted treatment options.

Neuromodulation devices like vagus nerve stimulators offer non-invasive seizure control, while surgical procedures can be highly effective for drug-resistant epilepsy. This broader treatment armamentarium empowers physicians to tailor therapy based on individual patient needs.

Rising Public Awareness About Early Diagnosis

Traditionally, epilepsy has been shrouded in stigma, discouraging individuals from seeking help. However, increased public awareness campaigns and educational initiatives are chipping away at this stigma. This empowers individuals to recognize symptoms and seek timely diagnosis. Early diagnosis is crucial for effective treatment and improved quality of life for patients.

Furthermore, advancements in diagnostic tools are enabling more accurate and efficient epilepsy detection. This allows for earlier intervention and potentially prevents the progression of the condition. Early diagnosis also opens a window for exploring preventive measures and minimizing the long-term impact of epilepsy on patients' lives.

Growing Geriatric Population, and Increasing Healthcare Expenditure

The global population is aging, with a significant rise in the geriatric demographic. This age group is more susceptible to epilepsy due to factors like increased stroke risk and neurodegenerative diseases. This growing patient population translates to an expanding demand for epilepsy treatment solutions.

Additionally, developing countries are witnessing a rise in healthcare expenditure. As these economies grow, there's a greater focus on improving healthcare infrastructure and access to treatment. This trend creates new opportunities for epilepsy treatment providers to expand their reach and cater to a broader patient base.

Key Growth Barriers

Affordability Hurdles, and Limited Access

Despite advancements in treatment options, the high cost of epilepsy treatment remains a significant barrier to access, particularly in developing countries. Newer and more specialized medications can be exorbitantly expensive, putting a strain on healthcare budgets and limiting treatment options for patients. Similarly, the cost of surgical procedures and neuromodulation devices can be prohibitive for many patients.

Limited access to healthcare infrastructure further exacerbates this issue. In resource-constrained settings, patients might lack access to specialists for diagnosis and treatment. Additionally, a lack of proper insurance coverage can make epilepsy treatment financially burdensome for patients and families. Addressing these affordability concerns and ensuring equitable access to healthcare will be crucial for sustained market growth.

Incomplete Treatment Efficacy, and Side Effect Challenges

While new medications are being developed, achieving complete seizure control remains a challenge for many patients. Existing medications may not be effective for all seizure types, and some patients experience drug resistance. Additionally, even effective medications can come with a range of side effects, such as drowsiness, cognitive impairment, and mood swings. These side effects can lead to patient non-adherence, hindering treatment success and impacting quality of life.

Continuous research and development are essential to overcome these limitations. Efforts are ongoing to create medications with broader efficacy and improved tolerability profiles. Additionally, personalized medicine approaches that tailor treatment plans based on individual patient characteristics hold promise for improving treatment outcomes and reducing side effects.

Key Opportunities and Trends to Look at

Personalized Medicine Revolutionizes Treatment

An influential shift toward personalized medicine remains a prominent market trend in the years to come. The epilepsy treatment landscape is undergoing a paradigm shift towards personalized medicine. This approach moves away from a one-size-fits-all strategy and focuses on tailoring treatment plans to individual patient needs. Identifying the underlying genetic factors contributing to an individual's epilepsy can guide the selection of the most effective medications. This approach has the potential to improve treatment efficacy and minimize unnecessary trial-and-error approaches.

Utilizing advanced brain imaging and monitoring techniques allows for a deeper understanding of individual seizure patterns. This information can be used to personalize medication dosages, select optimal neurostimulation targets, or even identify patients who might benefit most from surgical intervention. This emerging field explores how an individual's genetic makeup influences their response to medications. By analysing a patient's genetic profile, doctors can predict their response to specific AEDs, minimizing the risk of adverse reactions and maximizing treatment effectiveness.

Personalized medicine holds immense promise for the epilepsy treatment market. By offering a more targeted and tailored approach, it can improve treatment outcomes, reduce side effects, and ultimately enhance patient quality of life.

Untapped Potential in Developing Regions

Developing countries with growing economies and a rising middle class present a significant untapped opportunity for the epilepsy treatment market. As these economies grow, there's a rising focus on improving healthcare infrastructure and access to treatment. This translates to a larger patient population with greater demand for effective epilepsy treatments.

Factors like improved diagnostics and increased awareness are leading to a rise in diagnosed epilepsy cases in developing countries. This creates a need for readily available and affordable treatment options. Digital health solutions, including telemedicine and mobile health apps, have the potential to overcome geographical barriers and provide epilepsy patients with better access to specialists and treatment advice.

However, for this opportunity to be fully realized, certain challenges need to be addressed. Ensuring affordability of treatments, establishing robust healthcare infrastructure, and educating healthcare professionals about epilepsy management are crucial steps towards unlocking the full potential of emerging markets in the epilepsy treatment landscape.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a critical role in shaping the epilepsy treatment industry, acting as a double-edged sword. On one hand, stringent regulations enforced by bodies like the FDA ensure the safety and efficacy of new drugs entering the market. This protects patients from potentially harmful medications. However, these same regulations can also create hurdles for innovation. Lengthy approval processes can delay the availability of potentially life-changing treatments for patients.

Despite this delay, regulatory bodies play a vital role in fostering innovation within a safe framework. They encourage research and development of new epilepsy treatments by providing clear guidelines and pathways for drug approval. Additionally, regulations can promote competition by ensuring a level playing field for different pharmaceutical companies, ultimately benefiting patients with a wider range of treatment options.

The future of the regulatory scenario may involve a focus on streamlining approval processes while maintaining strict safety standards. This could involve utilizing innovative clinical trial designs or leveraging real-world data to expedite drug approvals for promising epilepsy treatments.

Fairfield’s Ranking Board

Top Segments

Second-Generation AEDs Reign Supreme in Drug Class

Within the drug class segment, second-generation antiepileptic drugs (AEDs) currently hold the dominant position. This dominance can be attributed to several key factors. Compared to first-generation AEDs, second-generation drugs generally exhibit fewer and less severe side effects. This translates to better tolerability for patients, leading to improved treatment adherence and overall quality of life.

While some second-generation AEDs excel against specific seizure types, many offer a wider range of efficacy compared to their predecessors. This allows physicians greater flexibility in tailoring treatment plans for patients with diverse epilepsy presentations.

However, the market for newer generation drugs is expected to experience significant growth. These next-generation AEDs aim to address some of the limitations of existing options, offering potentially even better efficacy and tolerability profiles. Additionally, they might target specific seizure types that haven't been effectively managed with traditional medications.

Medication Remains King by Treatment Type

Medication remains the dominant treatment type for epilepsy due to several reasons. Compared to surgery or neuromodulation devices, medications offer a less invasive approach to managing epilepsy. This makes them a preferred option for many patients, especially those with milder forms of the condition. Medications, particularly oral formulations, are convenient and easy to administer. Patients can often self-manage their medication regimens, increasing treatment adherence and improving long-term outcomes.

Over decades, various medications have proven effective in managing different types of seizures. This established track record fosters trust among both patients and physicians. However, surgery and neuromodulation devices are gaining traction as viable treatment options for patients with drug-resistant epilepsy. These advancements offer hope for improved seizure control and a better quality of life for patients who haven't responded well to medication.

Regional Frontrunners

North America Remains the Global Leader

North America holds the largest market share in the epilepsy treatment landscape. This dominance can be attributed to several factors. Developed economies like the US, and Canada allocate significant budgetary resources towards healthcare. This allows for greater investment in research and development of new epilepsy treatments and facilitates access to advanced diagnostic tools and medications.

North America boasts a well-developed healthcare infrastructure with a high concentration of neurologists and epilepsy specialists. This ensures patients have access to timely diagnosis, expert treatment, and comprehensive epilepsy care. Public awareness campaigns in North America have been successful in destigmatizing epilepsy and encouraging earlier diagnosis. This early intervention allows for prompt treatment initiation, potentially improving long-term outcomes for patients. However, the growth rate in North America is expected to be surpassed by other regions in the coming years.

Asia Pacific Holds Massive Untapped Potential

The Asia Pacific region is poised for the fastest growth in the epilepsy treatment market. This rapid expansion can be attributed to several key factors. Improved diagnostics and increased awareness are leading to a surge in diagnosed epilepsy cases across Asia. This growing patient population creates a significant demand for effective treatment solutions. As economies in this region develop, there's a growing focus on improving healthcare infrastructure and access to treatment. This translates to increased healthcare spending, creating opportunities for market expansion.

Compared to North America, access to epilepsy specialists and advanced treatment options remains limited in many parts of Asia. This presents an opportunity for market players to expand their reach and cater to this underserved patient population. While the Asia Pacific region holds immense potential, challenges like ensuring affordability of treatments and improving healthcare infrastructure need to be addressed to fully tap into this growing market.

Fairfield’s Competitive Landscape Analysis

The epilepsy treatment market brims with moderate competition, featuring a blend of established pharmaceutical giants and emerging players driving innovation. Key participants include household names like Pfizer, and Abbott Laboratories, alongside innovators like UCB focusing on niche therapies. This mix fosters a dynamic environment with established players leveraging their resources for research and established distribution channels, while nimble start-ups bring fresh perspectives and specialized treatments.

Who are Leading Companies in Epilepsy Treatment Space?

- Pfizer

- Abbott Laboratories

- Johnson & Johnson

- Eisai

- GlaxoSmithKline

- Novartis

- Sanofi

- Sunovion Pharmaceuticals

- UCB

- Livanova

- Medtronic

- Boston Scientific

Recent Industry Developments

- In July 2024, epilepsy treatment at a Level 4 Epilepsy Center. It discusses two patients with epilepsy who did not respond to medication. One patient was cured with surgery after a new 7T MRI scan revealed the source of her seizures. The other patient benefitted from deep brain stimulation to interrupt seizure-causing electrical signals. Both patients are now seizure-free.

- In June 2023, UCB's epilepsy drug Brivaracetam (BRIVIACT®) has been approved in Japan for the treatment of partial-onset seizures in adults with or without secondary generalization. This approval marks the fourth for Brivaracetam in the Asia-Pacific region, offering a new option for patients seeking alternative treatment options. The drug can be used as both monotherapy (single medication) and adjunctive therapy (combined with other medications).

- In January 2024, Akumentis Healthcare, an Indian company, launched Clasepi, a new epilepsy drug in India. Clasepi is the first synthetic cannabidiol (CBD) medication specifically formulated to address seizures linked to Lennox-Gastaut Syndrome (LGS), Dravet Syndrome or Tuberous Sclerosis Complex (TSC) in patients aged one year and older. This drug is a prescription medication and has been approved by the Drugs Controller General of India (DCGI).

Global Epilepsy Treatment Market is Segmented as-

By Diagnosis & Treatment Type

- Diagnosis

- Inpatient

- Outpatient

- Treatment Type

- Drugs

- Lamotrigine

- Phenytoin

- Carbamazepine

- Valproic Acid

- Others

- Surgery Treatment

- Other Treatments

- Devices

- Monitoring Devices

- Electrocorticography (ECoG) Electrodes

- Intraoperative Patient Monitoring Devices

- Neurostimulation Devices

- Responsive Neurostimulation

- Deep Brain Stimulation

- Vagus Nerve Stimulation

By Seizure Type

- Generalized Seizures

- Focal Seizures

- Both

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Pharmacies

By Service Provider

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Specialty Clinics

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Epilepsy Treatment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Epilepsy Treatment Market Outlook, 2019-2031

3.1. Global Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Diagnosis

3.1.1.1.1. Inpatient

3.1.1.1.2. Outpatient

3.1.1.2. Treatment Type

3.1.1.2.1. Drugs

3.1.1.2.1.1. Lamotrigine

3.1.1.2.1.2. Phenytoin

3.1.1.2.1.3. Carbamazepine

3.1.1.2.1.4. Valproic Acid

3.1.1.2.1.5. Others

3.1.1.2.2. Surgery Treatment

3.1.1.2.3. Other Treatments

3.1.1.3. Devices

3.1.1.3.1. Monitoring Devices

3.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

3.1.1.3.1.2. Intraoperative Patient Monitoring Devices

3.1.1.3.2. Neurostimulation Devices

3.1.1.3.2.1. Responsive Neurostimulation

3.1.1.3.2.2. Deep Brain Stimulation

3.1.1.3.2.3. Vagus Nerve Stimulation

3.2. Global Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Generalized Seizures

3.2.1.2. Focal Seizures

3.2.1.3. Both

3.3. Global Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Hospital Pharmacies

3.3.1.2. Retail Pharmacies

3.3.1.3. Drug Stores

3.3.1.4. Online Pharmacies

3.4. Global Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. Hospitals

3.4.1.2. Ambulatory Surgical Centers

3.4.1.3. Diagnostic Centers

3.4.1.4. Specialty Clinics

3.5. Global Epilepsy Treatment Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Epilepsy Treatment Market Outlook, 2019-2031

4.1. North America Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Diagnosis

4.1.1.1.1. Inpatient

4.1.1.1.2. Outpatient

4.1.1.2. Treatment Type

4.1.1.2.1. Drugs

4.1.1.2.1.1. Lamotrigine

4.1.1.2.1.2. Phenytoin

4.1.1.2.1.3. Carbamazepine

4.1.1.2.1.4. Valproic Acid

4.1.1.2.1.5. Others

4.1.1.2.2. Surgery Treatment

4.1.1.2.3. Other Treatments

4.1.1.3. Devices

4.1.1.3.1. Monitoring Devices

4.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

4.1.1.3.1.2. Intraoperative Patient Monitoring Devices

4.1.1.3.2. Neurostimulation Devices

4.1.1.3.2.1. Responsive Neurostimulation

4.1.1.3.2.2. Deep Brain Stimulation

4.1.1.3.2.3. Vagus Nerve Stimulation

4.2. North America Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Generalized Seizures

4.2.1.2. Focal Seizures

4.2.1.3. Both

4.3. North America Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Hospital Pharmacies

4.3.1.2. Retail Pharmacies

4.3.1.3. Drug Stores

4.3.1.4. Online Pharmacies

4.4. North America Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. Hospitals

4.4.1.2. Ambulatory Surgical Centers

4.4.1.3. Diagnostic Centers

4.4.1.4. Specialty Clinics

4.5. North America Epilepsy Treatment Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.5.1. Key Highlights

4.5.1.1. U.S. Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

4.5.1.2. U.S. Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

4.5.1.3. U.S. Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.5.1.4. U.S. Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

4.5.1.5. Canada Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

4.5.1.6. Canada Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

4.5.1.7. Canada Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.5.1.8. Canada Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Epilepsy Treatment Market Outlook, 2019-2031

5.1. Europe Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Diagnosis

5.1.1.1.1. Inpatient

5.1.1.1.2. Outpatient

5.1.1.2. Treatment Type

5.1.1.2.1. Drugs

5.1.1.2.1.1. Lamotrigine

5.1.1.2.1.2. Phenytoin

5.1.1.2.1.3. Carbamazepine

5.1.1.2.1.4. Valproic Acid

5.1.1.2.1.5. Others

5.1.1.2.2. Surgery Treatment

5.1.1.2.3. Other Treatments

5.1.1.3. Devices

5.1.1.3.1. Monitoring Devices

5.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

5.1.1.3.1.2. Intraoperative Patient Monitoring Devices

5.1.1.3.2. Neurostimulation Devices

5.1.1.3.2.1. Responsive Neurostimulation

5.1.1.3.2.2. Deep Brain Stimulation

5.1.1.3.2.3. Vagus Nerve Stimulation

5.2. Europe Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Generalized Seizures

5.2.1.2. Focal Seizures

5.2.1.3. Both

5.3. Europe Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Hospital Pharmacies

5.3.1.2. Retail Pharmacies

5.3.1.3. Drug Stores

5.3.1.4. Online Pharmacies

5.4. Europe Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Hospitals

5.4.1.2. Ambulatory Surgical Centers

5.4.1.3. Diagnostic Centers

5.4.1.4. Specialty Clinics

5.5. Europe Epilepsy Treatment Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.5.1. Key Highlights

5.5.1.1. Germany Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.2. Germany Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.3. Germany Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.4. Germany Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.5. U.K. Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.6. U.K. Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.7. U.K. Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.8. U.K. Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.9. France Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.10. France Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.11. France Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.12. France Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.13. Italy Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.14. Italy Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.15. Italy Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.16. Italy Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.17. Turkey Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.18. Turkey Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.19. Turkey Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.20. Turkey Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.21. Russia Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.22. Russia Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.23. Russia Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.24. Russia Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.1.25. Rest of Europe Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

5.5.1.26. Rest of Europe Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

5.5.1.27. Rest of Europe Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.5.1.28. Rest of Europe Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Epilepsy Treatment Market Outlook, 2019-2031

6.1. Asia Pacific Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Diagnosis

6.1.1.1.1. Inpatient

6.1.1.1.2. Outpatient

6.1.1.2. Treatment Type

6.1.1.2.1. Drugs

6.1.1.2.1.1. Lamotrigine

6.1.1.2.1.2. Phenytoin

6.1.1.2.1.3. Carbamazepine

6.1.1.2.1.4. Valproic Acid

6.1.1.2.1.5. Others

6.1.1.2.2. Surgery Treatment

6.1.1.2.3. Other Treatments

6.1.1.3. Devices

6.1.1.3.1. Monitoring Devices

6.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

6.1.1.3.1.2. Intraoperative Patient Monitoring Devices

6.1.1.3.2. Neurostimulation Devices

6.1.1.3.2.1. Responsive Neurostimulation

6.1.1.3.2.2. Deep Brain Stimulation

6.1.1.3.2.3. Vagus Nerve Stimulation

6.2. Asia Pacific Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Generalized Seizures

6.2.1.2. Focal Seizures

6.2.1.3. Both

6.3. Asia Pacific Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Hospital Pharmacies

6.3.1.2. Retail Pharmacies

6.3.1.3. Drug Stores

6.3.1.4. Online Pharmacies

6.4. Asia Pacific Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. Hospitals

6.4.1.2. Ambulatory Surgical Centers

6.4.1.3. Diagnostic Centers

6.4.1.4. Specialty Clinics

6.5. Asia Pacific Epilepsy Treatment Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.5.1. Key Highlights

6.5.1.1. China Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.2. China Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.3. China Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.4. China Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.1.5. Japan Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.6. Japan Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.7. Japan Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.8. Japan Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.1.9. South Korea Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.10. South Korea Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.11. South Korea Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.12. South Korea Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.1.13. India Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.14. India Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.15. India Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.16. India Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.1.17. Southeast Asia Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.18. Southeast Asia Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.19. Southeast Asia Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.20. Southeast Asia Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.1.21. Rest of Asia Pacific Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

6.5.1.22. Rest of Asia Pacific Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

6.5.1.23. Rest of Asia Pacific Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.5.1.24. Rest of Asia Pacific Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Epilepsy Treatment Market Outlook, 2019-2031

7.1. Latin America Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Diagnosis

7.1.1.1.1. Inpatient

7.1.1.1.2. Outpatient

7.1.1.2. Treatment Type

7.1.1.2.1. Drugs

7.1.1.2.1.1. Lamotrigine

7.1.1.2.1.2. Phenytoin

7.1.1.2.1.3. Carbamazepine

7.1.1.2.1.4. Valproic Acid

7.1.1.2.1.5. Others

7.1.1.2.2. Surgery Treatment

7.1.1.2.3. Other Treatments

7.1.1.3. Devices

7.1.1.3.1. Monitoring Devices

7.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

7.1.1.3.1.2. Intraoperative Patient Monitoring Devices

7.1.1.3.2. Neurostimulation Devices

7.1.1.3.2.1. Responsive Neurostimulation

7.1.1.3.2.2. Deep Brain Stimulation

7.1.1.3.2.3. Vagus Nerve Stimulation

7.2. Latin America Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Generalized Seizures

7.2.1.2. Focal Seizures

7.2.1.3. Both

7.3. Latin America Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Hospital Pharmacies

7.3.1.2. Retail Pharmacies

7.3.1.3. Drug Stores

7.3.1.4. Online Pharmacies

7.4. Latin America Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Hospitals

7.4.1.2. Ambulatory Surgical Centers

7.4.1.3. Diagnostic Centers

7.4.1.4. Specialty Clinics

7.5. Latin America Epilepsy Treatment Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.5.1. Key Highlights

7.5.1.1. Brazil Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

7.5.1.2. Brazil Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

7.5.1.3. Brazil Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.5.1.4. Brazil Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

7.5.1.5. Mexico Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

7.5.1.6. Mexico Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

7.5.1.7. Mexico Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.5.1.8. Mexico Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

7.5.1.9. Argentina Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

7.5.1.10. Argentina Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

7.5.1.11. Argentina Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.5.1.12. Argentina Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

7.5.1.13. Rest of Latin America Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

7.5.1.14. Rest of Latin America Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

7.5.1.15. Rest of Latin America Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.5.1.16. Rest of Latin America Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Epilepsy Treatment Market Outlook, 2019-2031

8.1. Middle East & Africa Epilepsy Treatment Market Outlook, by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Diagnosis

8.1.1.1.1. Inpatient

8.1.1.1.2. Outpatient

8.1.1.2. Treatment Type

8.1.1.2.1. Drugs

8.1.1.2.1.1. Lamotrigine

8.1.1.2.1.2. Phenytoin

8.1.1.2.1.3. Carbamazepine

8.1.1.2.1.4. Valproic Acid

8.1.1.2.1.5. Others

8.1.1.2.2. Surgery Treatment

8.1.1.2.3. Other Treatments

8.1.1.3. Devices

8.1.1.3.1. Monitoring Devices

8.1.1.3.1.1. Electrocorticography (ECoG) Electrodes

8.1.1.3.1.2. Intraoperative Patient Monitoring Devices

8.1.1.3.2. Neurostimulation Devices

8.1.1.3.2.1. Responsive Neurostimulation

8.1.1.3.2.2. Deep Brain Stimulation

8.1.1.3.2.3. Vagus Nerve Stimulation

8.2. Middle East & Africa Epilepsy Treatment Market Outlook, by Seizure Type, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Generalized Seizures

8.2.1.2. Focal Seizures

8.2.1.3. Both

8.3. Middle East & Africa Epilepsy Treatment Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Hospital Pharmacies

8.3.1.2. Retail Pharmacies

8.3.1.3. Drug Stores

8.3.1.4. Online Pharmacies

8.4. Middle East & Africa Epilepsy Treatment Market Outlook, by Service Provider, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. Hospitals

8.4.1.2. Ambulatory Surgical Centers

8.4.1.3. Diagnostic Centers

8.4.1.4. Specialty Clinics

8.5. Middle East & Africa Epilepsy Treatment Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.5.1. Key Highlights

8.5.1.1. GCC Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.5.1.2. GCC Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

8.5.1.3. GCC Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.5.1.4. GCC Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

8.5.1.5. South Africa Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.5.1.6. South Africa Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

8.5.1.7. South Africa Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.5.1.8. South Africa Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

8.5.1.9. Egypt Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.5.1.10. Egypt Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

8.5.1.11. Egypt Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.5.1.12. Egypt Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

8.5.1.13. Nigeria Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.5.1.14. Nigeria Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

8.5.1.15. Nigeria Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.5.1.16. Nigeria Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

8.5.1.17. Rest of Middle East & Africa Epilepsy Treatment Market by Diagnosis & Treatment Type, Value (US$ Bn), 2019-2031

8.5.1.18. Rest of Middle East & Africa Epilepsy Treatment Market by Seizure Type, Value (US$ Bn), 2019-2031

8.5.1.19. Rest of Middle East & Africa Epilepsy Treatment Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.5.1.20. Rest of Middle East & Africa Epilepsy Treatment Market by Service Provider, Value (US$ Bn), 2019-2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Artery Type vs Indication Heatmap

9.2. Manufacturer vs Indication Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Medtronic PLC

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. GlaxoSmithKline PLC

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Sun Pharmaceutical Industries Ltd.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Novartis AG

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Teva Pharmaceutical Industries Ltd.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Zydus Cadila Healthcare Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Boston Scientific Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. ElectroCore, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. LivaNova PLC

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Nihon Kohden Corporation

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Natus Medical Incorporated

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Neurosoft, Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Pfizer, Inc.

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Diagnosis & Treatment Type Coverage |

|

|

Seizure Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Service Provider Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |