Global Epoxy Molding Compound Market Forecast

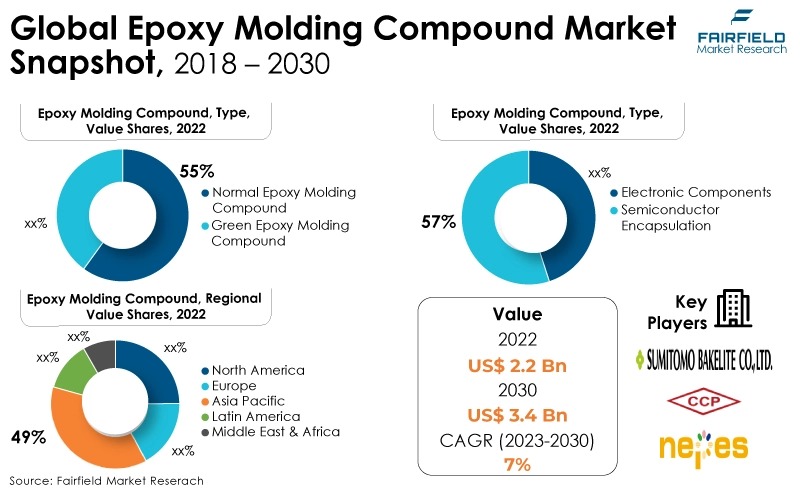

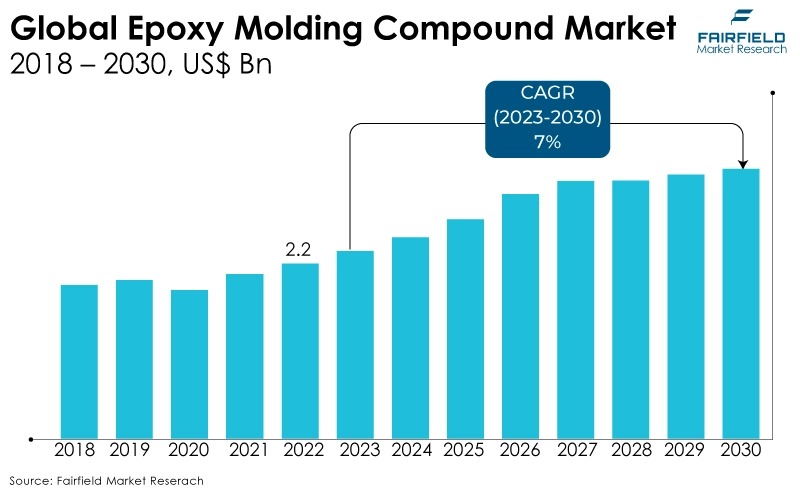

- The approximately US$2.2 Bn market for epoxy molding compound (2022) poised to reach a revenue of US$3.4 Bn by the end of 2030

- Market valuation likely to see around 7% CAGR between 2023 and 2030

Quick Report Digest

- In order to protect various delicate electronic gadgets, epoxy molding compound (EMC) is used. To meet the requirements and standards of various clients, Starem EMC offers a wide range of halogen-free compounds. These factors mostly drive the market for epoxy molding worldwide.

- The growing adoption of technology to improve product efficiency and quality is a prominent trend in the market for epoxy molding compounds. Innovative goods that exceed conventional alternatives in terms of efficacy and efficiency are being created with the help of cutting-edge technology like blockchain, artificial intelligence, and machine learning.

- Changes may hamper the market's expansion in the cost of the raw materials required to make epoxy molding compounds, including resins, fillers, and additives. Therefore, producers' main difficulty is increasing productivity while maintaining cheap costs and a simple structure.

- In 2022, due to their broad qualities, such as high thermal stability, exceptional coating capability, UV protection, corrosion prevention, and others, normal epoxy molding compound segments are utilized extensively in various industries.

- The semiconductor encapsulation applications is expanding rapidly worldwide. The market has grown because demand has increased across several industries. To protect semiconductors against corrosion, heat dissipation, moisture, etc., epoxy molds are frequently used to coat the components.

- Electronics was the leading end-user and is exhibiting the most growth. When subjected to extreme heat and abrasive circumstances, epoxy molding compounds exhibit corrosion resistance, thermal strength, and heat resistance qualities.

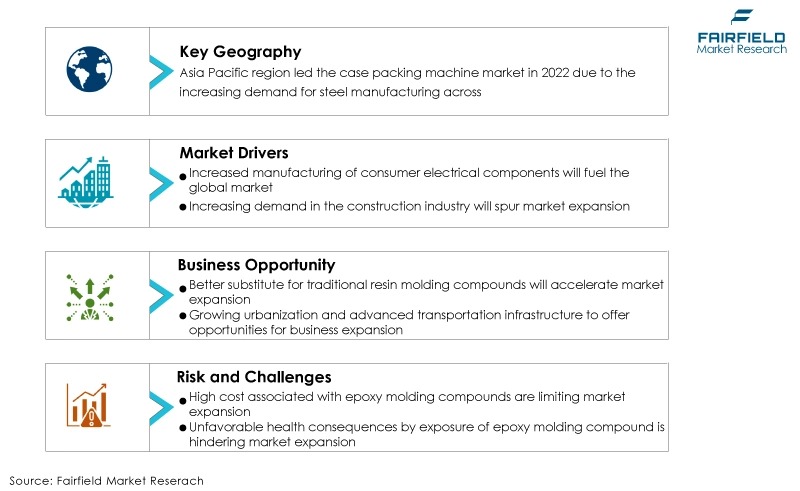

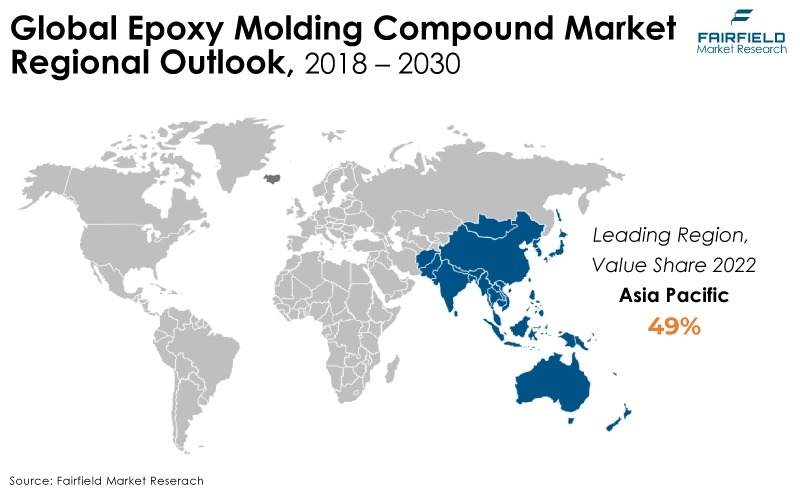

- Asia Pacific region is anticipated to account for the highest share of the global epoxy molding compound market owing to to the increasing demand for steel manufacturing across various end-use industries, including infrastructure building, the automotive industry, and others.

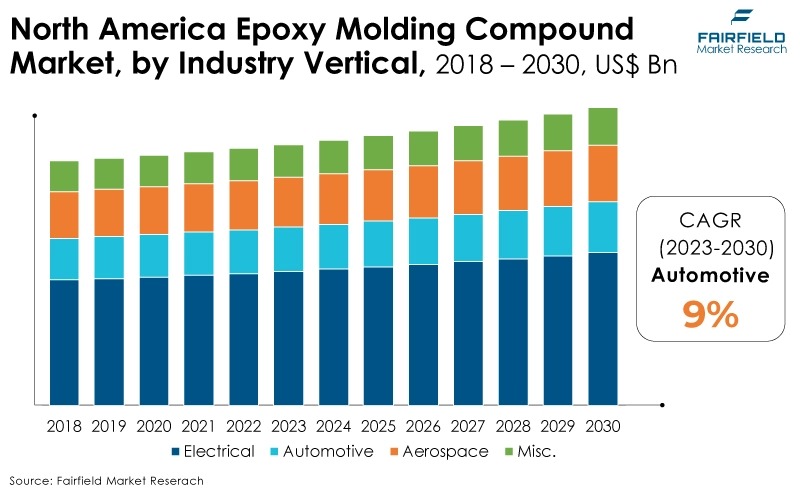

- North America will have a significant growth rate in the epoxy molding compound market during the forecast period. Market expansion in the North American areas has been fueled by rising consumer buying power in the US and Canada.

A Look Back and a Look Forward – Comparative Analysis

The majority of consumers are replacing conventional materials as the market changes. Products based on epoxy molding compounds are used instead of these conventional materials, propelling the market for epoxy molding compounds. These substances offer dimensional stability, heat resistance, and corrosion resistance. Due to their reduced weight and improved fuel efficiency, these compounds are also increasingly utilized in the automotive sector. Using these compounds in automobiles will lower fuel emissions because of their lightweight and lower fuel consumption. These elements are fueling the market expansion for epoxy molding compounds.

Throughout the historical period of 2018-2022, the market had staggered growth. The market was only driven by an increase in electronic industry applications. Thermoset molding compounds offer anti-corrosive and heat-resistant qualities that lengthen product life and improve Electronics application efficiency, boosting the market.

Epoxy molding compounds are widely utilized in the fabrication of films and wraps as well as the packaging of a variety of consumer goods as a result of the increased awareness of hygiene-related activities. The industry is expected to grow significantly over the next few years due to increased investments in building infrastructure in nations including the United States, China, Japan, Mexico, and India.

Key Growth Determinants

- Increased Manufacturing of Consumer Electronics

The demand for consumer Electronics components is rising due to the complexity and variety of mobile phone functions and the rising popularity of 5G communication technologies.

Adding new application modules, such as wireless charging, multi-camera modules, 3D sensors, off-screen fingerprint readers, etc., necessitates using more passive components in mobile phones to regulate voltage, filter, and current and guarantee the equipment's steady operation.

It is common for wearable technology to include motion sensors, environmental sensors, biosensors, etc., and there is a high demand for Electronics components with sensing capabilities. The market for epoxy molding compounds will continue to expand as it plays a significant role in manufacturing consumer Electronics components.

- Increasing Demand from Construction Industry

The epoxy molding compounds market is anticipated to grow over the projected period as a result of increasing demand in the building industry. The construction industry covers various tasks, including building and infrastructure development, product supply and manufacturing, repair, upkeep, and disposal. Epoxy molding compounds thus create various building materials and components, including plastics, flooring, paints, varnishes, primers and sealants, adhesives, and more.

Due to their outstanding resistance to blistering, stains, fractures, chemicals, and extreme temperatures, these compounds are frequently utilized in various industries, including the marine industry, the automotive industry, wastewater treatment facilities, and commercial and residential buildings. They perform exceptionally well in adhesion, anti-corrosion, and low-volatile organic compound production.

- Increasing Adoption by Semiconductor Industry

The epoxy mold compound is essential for the packaging and defense of electronic parts. With the help of this cutting-edge material, semiconductors can be reliable and long-lasting in various applications.

The EMC's remarkable mechanical qualities, low coefficient of thermal expansion, and excellent thermal conductivity guarantee effective heat dissipation and reduce the possibility of stress-related failures.

Along with protecting fragile integrated circuits from external conditions, its excellent adhesion and moisture resistance also increase their performance and lifespan. EMC is still crucial in enabling cutting-edge electronic gadgets and ensuring their flawless performance as technology develops. Thus, this is anticipated to boost market expansion.

Major Growth Barriers

- High Costs

The use of epoxy molding compounds adds complexity and has a high starting cost, which causes issues in the manufacturing industries. Furthermore, market restrictions for the growth of the epoxy molding compound are projected to come from high costs linked to growing difficulties and problems with recycling.

- Potential Health Consequences by EMC Exposure

The market expansion is hampered by the unfavorable health consequences of exposure to epoxy molding compounds, which are industrial plastics widely utilized in the industrial sector and can cause eye irritation, coughing, throat infections, and skin irritation. This element controls the market for epoxy molding compounds slowing down.

Key Trends and Opportunities to Look at

- Better Substitute for Traditional Resin Molding Compounds

Traditionally, casting resins were employed as a mold; however, epoxy resin solves some of the drawbacks of the conventional resin mold, which fuels the market expansion for epoxy molding compounds.

In terms of heat resistance, corrosion resistance, UV protection, tolerance, hardness, and other factors, epoxy molds are superior to conventional resins. Such elements fuel the market's expansion for epoxy molding compounds.

- Growing Urbanisation, and Advanced Transportation Infrastructure

Due to rising urbanisation and the ensuing expansion of the transportation system, there is a boost in demand for epoxy molding compounds, which propels market expansion.

Comparing epoxy molding compounds to traditional ones reveals their durability and other advantages. Epoxy molding compounds are in high demand worldwide because of these factors.

- Growth in Demand for Eco-friendly EMC

The green epoxy molds are constructed of plant-based materials like legumes and plant latex, safer for the environment than conventional polyester or chemical-driven molding compounds.

Traditional molding compounds contain chemicals that might irritate the skin. These elements fuel the market expansion for epoxy molding compounds.

How Does the Regulatory Scenario Shape this Industry?

Several national, regional, and sector-specific laws govern epoxy molding compounds used in electronics production. A significant law that prohibits using specific hazardous compounds in Electronics and electronic equipment (EEE) is the Restriction of Hazardous Substances (RoHS) directive. The use of materials like lead, mercury, cadmium, and others is restricted by the RoHS regulations; therefore, EMCs used in electronics packaging must adhere to these rules.

Furthermore, the electronics industry also uses the Association Connecting Electronics Industries (IPC) standards. These standards cover various topics related to electronic assembly, including production methods and materials. In the sector, adherence to IPC standards is frequently required.

Fairfield’s Ranking Board

Top Segments

- Normal Epoxy Molding Compounds Dominant

The normal epoxy molding compounds segment dominated the market in 2022. Normal epoxy molding compound segments are used extensively in various sectors due to their advantages, including excellent heat stability, UV protection, corrosion avoidance, improved coating capabilities, etc. They are a coating substance designed to shield electronics circuits and transistors from outside influences such as moisture, shock, dirt, and dust.

The normal epoxy molding compounds segment's market dominance results from various reasons, including a classic production process, low-cost processing, and straightforward maintenance.

The green epoxy molding compounds category is expected to grow significantly over the forecast period. The production procedures or materials used to create the green epoxy molding compounds are environmentally beneficial. These chemicals might be made using less harmful substances, with less of an impact on the environment, or with recycling in mind.

Additionally, green EMCs usually adhere to the RoHS directive, which limits the use of some hazardous compounds, including lead, mercury, and cadmium, in electronic equipment.

- Semiconductor Encapsulation Leading Application

In 2022, the semiconductor encapsulation sector dominated the market and is predicted to grow significantly throughout the forecast period. The rise in demand across different industries has caused the market to expand. To shield them from moisture, heat dissipation, corrosion, etc., epoxy molds are widely used to coat semiconductors. Encapsulation covers a semiconductor chip in a solid shell using an epoxy mold.

Furthermore, the electronic components category is expected to expand significantly. Various Electronics, electronic, and home appliance goods are produced using EMC. These goods include fuses, switchgear, televisions, refrigerators, coffee makers, toasters, irons, and air conditioners. Additionally, over the projection period, increasing urbanization and strong population growth will likely fuel demand for such products.

- The Electronics Category Spearheads

The Electronics held the majority of the market share. Electronicss have traditionally used epoxy molding compounds to provide insulation, moisture resistance, and protection against short circuits. A thermosetting plastic is used as the epoxy molding component. It may be shaped into various forms and sizes for various applications, including Electronics items like switch gears and automobile components.

During the forecasted years, the automotive category accounts for the second-largest market share due to the epoxy molding compounds' ability to resist rust and corrosion on the body and other important metal sections of vehicles, which lowers maintenance costs and lengthens the average vehicle lifespan. They are used in valve corners, headlight liners, and mounting for electric motors.

Regional Frontrunners

Asia Pacific Takes up the Largest Share of the Pie

The region with the biggest market share for epoxy molding compounds is expected to be Asia Pacific during that forecast period. This can be due to the increasing demand for steel manufacturing across various end-use industries, including infrastructure building, the automotive industry, and others. Additionally, the need for iron and steel has increased, which has resulted in a large production of molding compounds with temperature stability.

China currently dominates the epoxy mold market in Asia Pacific region with a substantial share followed by Japan. The Chinese consumer goods industry has concentrated on projects like corrosion resistance, a key driver of epoxy market expansion throughout APAC.

North America to Ascend Rapidly

The epoxy molding compounds market is expanding at the fastest rate in North America, which presents a significant opportunity for the industry. The automotive and energy industries' expanding use of epoxy molding compounds is propelling market revenue growth in this area. The market has changed as a result of technological advances in chemical processing. The United States is also a world leader in developing and manufacturing electric vehicles (EVs).

In addition, major industry players are investing heavily, which is expected to spur innovation and support market growth. These investments are generally directed at creating new goods and the growth of distribution systems, both of which will increase demand in the future. These factors will significantly fuel the market growth during the anticipated period.

Fairfield’s Competitive Landscape Analysis

As per the Fairfields analysis, the market for epoxy molding compounds will expand even more due to major market participants' significant investments in R&D to diversify their product offerings. Significant market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants also engage in various strategic initiatives to increase their market share.

Who are the Leaders in Global Epoxy Molding Compound Space?

- Sumitomo Bakelite Ltd.

- Hitachi Chemical

- Chang Chun Petrochemical

- Hysol Huawei Electronics Ltd.

- Panasonic

- Kyocera

- KCC Corporation

- Samsung SDI

- Eternal Materials

- Jiangsu NOVORAY New Material Co., Ltd.

- Shin-Etsu Chemical

- Hexion

- Nepes

- Tianjin Kaihua Insulating Material

- Nitto Denko Corporation

Significant Company Developments

New Product Launches

- December 2021: The next generation of wearable medical devices are anticipated to feature electrophysiological dry electrodes and high elasticity wiring materials recently disclosed by the Japanese business Shin-Etsu.

- August 2018: A granular semiconductor specifically created for panel-level packaging (PLP) and fan-out water-level packaging (FOWLP) has been made commercially available, according to Panasonic Corporation in Osaka, Japan. The produced products are anticipated to increase semiconductor package productivity while lowering manufacturing costs.

- May 2017: The building high-a thermal-conductivity epoxy molding compound with a 6W/mK thermal conductivity range was introduced by the Kyoto/London-based Kyocera Corporation. The manufacture of semiconductor components increased significantly as a result of this progress.

Distribution Agreements

- July 2021: To broaden its product offering, Sumitomo Bakelite Co. Ltd. announced an expansion in production by installing an equipment manufacturing facility and semiconductor packaging. Sumitomo now holds a 40% market share in the epoxy molding compound market, making it the industry leader.

- May 2020: Epoxy Resin Encapsulation Materials will be produced by Sumitomo Bakelite Co., Ltd. for use in European automobiles. To address rising demand in the mobility sector in Europe, Sumitomo Bakelite will construct a new manufacturing line to create epoxy resin encapsulation materials for automotive usage in its Belgian production unit.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, the market for epoxy molding compounds is expanding due to several important factors, such as rising consumer demand, technological improvements, and changing customer tastes.

Additionally, there are many opportunities for epoxy molding compounds in many areas due to the rise in health and hygiene awareness. Epoxy molds are widely used in the packaging industry throughout the world. The market is projected to benefit from regular investments in other sectors during the forecast period and has a good chance of expanding.

Supply Side of the Market

According to our analysis, one of the key factors driving manufacturers in the epoxy molding compound market to focus on the producers is now producing normal epoxy molding compounds due to the industry's growing use in the automotive and electronics sectors.

A further development is the increased attention of major manufacturers on producing green epoxy molding compounds since they are ecologically benign. Additionally, the manufacturers must keep up with changing laws and standards, perform testing and certification as appropriate, and modify their procedures and products to comply with local restrictions.

Furthermore, local manufacturing to reduce operational costs is one of the most important business strategies producers employ in the epoxy molding compound industry to assist customers and expand the market sector.

Global Epoxy Molding Compound Market is Segmented as Below:

By Type

- Normal Epoxy Molding Compound

- Green Epoxy Molding Compound

By Application

- Semiconductor Encapsulation

- Electronic Components

By End-use Industry

- Electronics

- Automotive

- Aerospace

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Epoxy Molding Compound Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Epoxy Molding Compound Market Outlook, 2018 - 2030

3.1. Global Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Normal Epoxy Molding Compound

3.1.1.2. Green Epoxy Molding Compound

3.2. Global Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Semiconductor encapsulation

3.2.1.2. Electronic components

3.3. Global Epoxy Molding Compound Market Outlook, by Industry Vertical, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Electronics

3.3.1.2. Automotive

3.3.1.3. Aerospace

3.3.1.4. Misc.

3.4. Global Epoxy Molding Compound Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Epoxy Molding Compound Market Outlook, 2018 - 2030

4.1. North America Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Normal Epoxy Molding Compound

4.1.1.2. Green Epoxy Molding Compound

4.2. North America Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Semiconductor encapsulation

4.2.1.2. Electronic components

4.3. North America Epoxy Molding Compound Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Electronics

4.3.1.2. Automotive

4.3.1.3. Aerospace

4.3.1.4. Misc.

4.3.2. Market Attractiveness Analysis

4.4. North America Epoxy Molding Compound Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Epoxy Molding Compound Market Outlook, 2018 - 2030

5.1. Europe Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Normal Epoxy Molding Compound

5.1.1.2. Green Epoxy Molding Compound

5.2. Europe Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Semiconductor encapsulation

5.2.1.2. Electronic components

5.3. Europe Epoxy Molding Compound Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Electronics

5.3.1.2. Automotive

5.3.1.3. Aerospace

5.3.1.4. Misc.

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Epoxy Molding Compound Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.13. Russia Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Russia Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.15. Russia Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.1.16. Rest of Europe Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Rest of Europe Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

5.4.1.18. Rest of Europe Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Epoxy Molding Compound Market Outlook, 2018 - 2030

6.1. Asia Pacific Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Normal Epoxy Molding Compound

6.1.1.2. Green Epoxy Molding Compound

6.2. Asia Pacific Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Semiconductor encapsulation

6.2.1.2. Electronic components

6.3. Asia Pacific Epoxy Molding Compound Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Electronics

6.3.1.2. Automotive

6.3.1.3. Aerospace

6.3.1.4. Misc.

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Epoxy Molding Compound Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Epoxy Molding Compound Market Application, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Epoxy Molding Compound Market End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Epoxy Molding Compound Market Outlook, 2018 - 2030

7.1. Latin America Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Normal Epoxy Molding Compound

7.1.1.2. Green Epoxy Molding Compound

7.2. Latin America Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Semiconductor encapsulation

7.2.1.2. Electronic components

7.3. Latin America Epoxy Molding Compound Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Electronics

7.3.1.2. Automotive

7.3.1.3. Aerospace

7.3.1.4. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Epoxy Molding Compound Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.1.7. Rest of Latin America Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Rest of Latin America Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.9. Rest of Latin America Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Epoxy Molding Compound Market Outlook, 2018 - 2030

8.1. Middle East & Africa Epoxy Molding Compound Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Normal Epoxy Molding Compound

8.1.1.2. Green Epoxy Molding Compound

8.2. Middle East & Africa Epoxy Molding Compound Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Semiconductor encapsulation

8.2.1.2. Electronic components

8.3. Middle East & Africa Epoxy Molding Compound Market Outlook, by End-use Industry, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Electronics

8.3.1.2. Automotive

8.3.1.3. Aerospace

8.3.1.4. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Epoxy Molding Compound Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.1.7. Rest of Middle East & Africa Epoxy Molding Compound Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Rest of Middle East & Africa Epoxy Molding Compound Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.9. Rest of Middle East & Africa Epoxy Molding Compound Market by End-use Industry, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Sumitomo Bakelite Co. Ltd.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Hitachi Chemical

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Chang Chun Petrochemical

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hysol Huawei Electronics Co. Ltd.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Panasonic

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Kyocera

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. KCC Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Samsung SDI

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Eternal Materials

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Jiangsu NOVORAY New Material Co., Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Shin-Etsu Chemical

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Hexion

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Nepes

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Tianjin Kaihua Insulating Material

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Nitto Denko Corporation

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |