Europe Building & Industrial Insulation Material Market Forecast

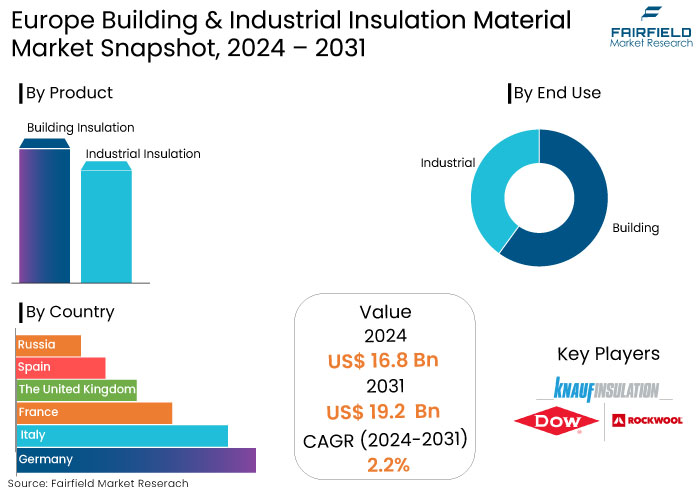

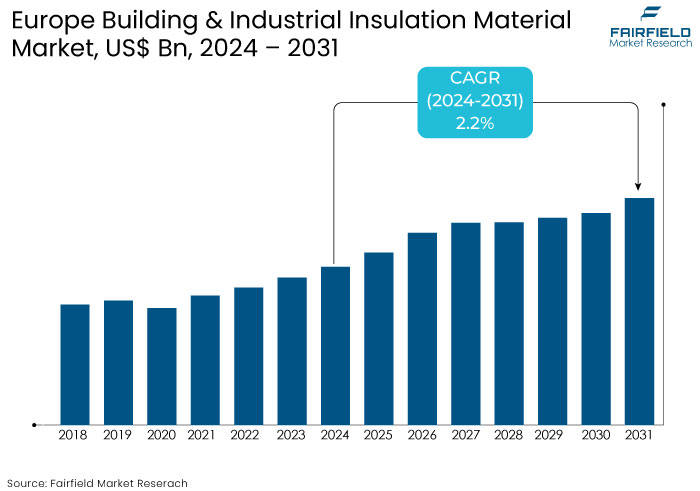

- Europe building & industrial insulation material market is projected to be valued at US$19.2 Bn by 2031 exhibiting significant growth from the US$ 16.8 Bn achieved in 2024.

- The market for building & industrial insulation material is expected to show a significant expansion rate with a CAGR of 2.2% during the forecast period between 2024 and 2031.

Europe Building & Industrial Insulation Material Market Insights

- A growing emphasis on Eco- friendly construction materials is driving demand for insulation solutions that enhance energy efficiency and reduce carbon footprints.

- The residential segment holds the high market share, primarily due to ongoing renovation activities and government incentives aimed at improving energy efficiency in existing homes.

- Innovations in insulation materials such as eco-friendly foamed plastics and mineral wool are propelling Europe building & industrial insulation material market growth as companies like Knauf Insulation and Rockwool International invest in research and development.

- EU policies targeting carbon neutrality by 2045 are fostering investments in energy-efficient buildings creating a robust demand for insulation products across various construction sectors.

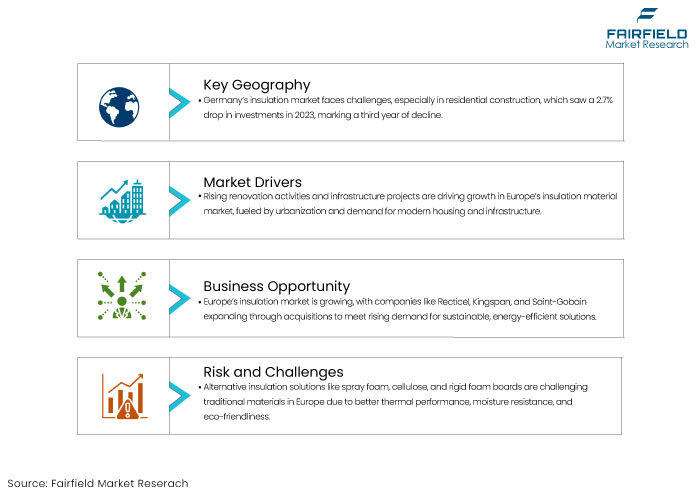

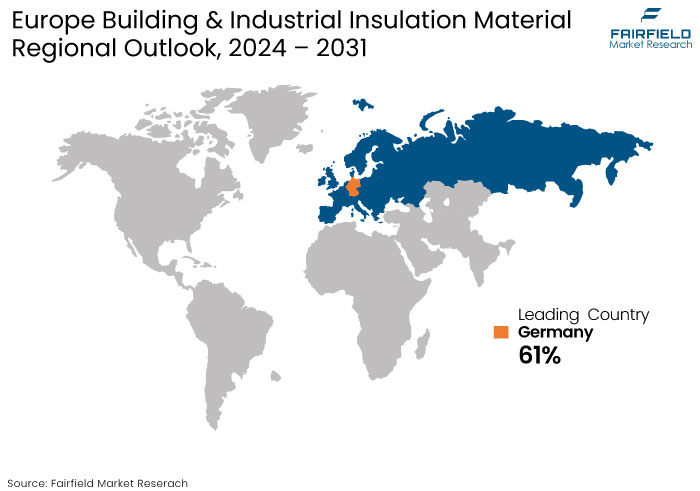

- Countries like Germany and U.K. are significant players in the market with Germany experiencing strong demand for energy-efficient renovations benefiting from recovery projects under its national plan.

- The increasing urban population is driving the need for housing and infrastructure.

- Leading manufacturers like Saint-Gobain and Dow Inc. are actively pursuing mergers and partnerships to enhance their product offerings and market presence, thereby strengthening their competitive edge.

- Following a period of sharp price increases the stabilization of construction material prices is expected to facilitate more construction projects positively.

A Look Back and a Look Forward Comparative Analysis

Europe building and industrial insulation material market has experienced significant fluctuations from 2019 to 2023 marked by varying demand driven by economic conditions and environmental regulations. In this period, companies like Saint-Gobain S.A and Knauf Insulation focused on enhancing their product portfolios by launching eco-friendly insulation solutions to meet the growing demand for sustainable construction. For instance, Rockwool International A/S made strides in expanding its mineral wool offerings, capitalizing on the increasing emphasis on energy efficiency and fire safety.

The market also faced challenges such as material shortages and rising prices particularly evident in 2022, which led to a contraction in construction investments. Despite these obstacles, the sector demonstrated resilience, with the residential insulation segment maintaining a strong market share due to continued renovations and a shift toward energy-efficient homes.

Market is poised for growth, driven by factors such as increasing urbanization, government initiatives for energy efficiency, and rising construction activities across the continent. Leading players like Kingspan Group Plc and BASF SE are likely to invest in research and development to introduce innovative insulation materials that comply with stringent environmental regulations.

The shift toward carbon neutrality will spur significant investment in energy-efficient renovations by 2045 positioning the renovation sector as a key driver of market growth. Collaborations and joint ventures such as those anticipated between Dow Inc. and other manufacturers will further accelerate technological advancements in insulation products.

Key Growth Determinants

- Rising Building Renovation Activities and Infrastructure Development

The surge in building renovation activities and ongoing infrastructure development is a pivotal factor propelling the Europe building and industrial insulation material market growth across Europe. Urbanization and population growth are creating an urgent need for modern housing, commercial spaces, and improved infrastructure leading to increased renovation and construction efforts.

According to data from the European Union, the construction sector has faced challenges, with a projected contraction of 2.3% in 2024. However, certain countries are experiencing growth, such as Greece, which recorded a 21.2% increase in 2023 due to its Recovery and Resilience Plan. As old buildings are upgraded to meet contemporary energy efficiency standards, the demand for high-performance insulation solutions that enhance energy efficiency and indoor comfort is rising.

- Stringent Energy Efficiency Regulations Remains a Key Driver

Stringent energy efficiency regulations are a driving force for the Europe building and industrial insulation material market growth. The European Union (EU) has established ambitious targets to reduce greenhouse gas emissions and enhance energy security, positioning energy efficiency as a key strategy. Central to these efforts are comprehensive regulations like the Energy Performance of Buildings Directive (EPBD) and the Nearly Zero-Energy Buildings (NZEB) standards, which mandate significant improvements in the energy performance of buildings and industrial facilities.

Enhancing insulation is critical to achieving these objectives with buildings accounting for about 40% of the EU's energy consumption and 36% of greenhouse gas emissions. As compliance with these stringent regulations becomes mandatory, builders, developers, and facility managers are increasingly required to incorporate high-performance insulation materials in their projects. This regulatory pressure is fostering innovation within the sector, prompting manufacturers to invest in research and development for advanced insulation solutions that meet enhanced thermal performance and sustainability criteria.

Products such as aerogel insulation, vacuum insulation panels (VIPs), and phase change materials (PCMs) are emerging as competitive alternatives to traditional insulation materials. The adoption of these high-performance solutions not only aligns with regulatory requirements but also offers substantial economic benefits including reduced energy costs and improved returns on investment for building owners.

The drive for energy efficiency is not just reshaping building practices but also contributing significantly to the EU's goal of transitioning to a low-carbon and resource-efficient economy.

Key Growth Barriers

- Availability of Alternative Insulation Solutions

The increasing presence of alternative insulation solutions is creating challenges for traditional materials in the Europe building and industrial insulation material market. Options like spray foam, cellulose, and rigid foam boards are gaining favor due to their superior thermal performance, moisture resistance, and eco-friendly properties.

Spray foam, for instance, offers excellent air-sealing capabilities and a higher R-value, making it more effective in preventing energy loss, while cellulose insulation appeals to sustainability-focused builders with its recycled content and fire-resistant treatment. As these alternatives grow in popularity, conventional insulation materials like fiberglass and mineral wool are facing competitive pressure.

Builders and consumers are drawn to the versatility and energy efficiency that newer solutions provide particularly in meeting modern energy codes and environmental standards. This shift is pushing traditional insulation manufacturers to either innovate or risk losing market share in an industry that increasingly prioritizes sustainability and high-performance solutions.

- Impact of Geopolitical Tensions and Economic Slowdown

Geopolitical tensions, such as trade disputes and sanctions, pose a significant challenge to the Europe building and industrial insulation material market. These tensions disrupt global supply chains, increasing costs and creating material shortages that hinder production and availability of insulation products.

Political instability and volatile business environments further discourage investments, impacting construction and industrial activities that drive demand for insulation solutions. Economic slowdowns exacerbate these challenges by reducing construction activity, industrial output, and infrastructure investments.

Market Trends and Opportunities

- Strategic Acquisitions Fuel Innovation and Sustainability in Insulation Materials

Europe building and industrial insulation material market is witnessing significant growth opportunities driven by strategic acquisitions and portfolio expansions. Companies like Recticel, Kingspan, and Saint-Gobain are making moves to enhance their market positions and meet the growing demand for sustainable and energy-efficient solutions.

Recticel's acquisition of REX Panels & Profiles in December 2023 and Trimo in March 2022 strengthens its foothold in the insulated panels segment, allowing the company to innovate and offer more sustainable products. By divesting its Engineered Foams division to Carpenter Co., Recticel can now focus exclusively on its core insulation operations, aligning itself with the market’s shift toward eco-friendly and high-performance materials. These developments underscore the opportunity for companies to leverage acquisitions to streamline operations and accelerate their growth in the insulation sector.

- Products Launch Activities Shape Insulation Trends

Europe building and industrial insulation material market is experiencing a transformative wave of innovation largely fueled by strategic product launches that prioritize sustainability and performance. A notable example is Knauf Insulation’s introduction of its Performance+™ portfolio at the 2024 ICAA Convention, which includes products such as EcoBatt®, EcoRoll®, and Jet Stream Max. These offerings come with asthma & allergy-friendly® and Verified Healthier Air™ certifications, setting a new standard for indoor air quality in insulation solutions.

The market is witnessing the emergence of low-carbon footprint insulation products from companies like Energystore and KORE, which utilize BASF’s innovative Neopor® BMB technology. Energystore's launch of the energystore+ range reflects a commitment to sustainability and effective insulation, while KORE’s selection for a significant housing project underscores the increasing preference for environmentally responsible building materials.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario in Europe significantly shapes the Europe building & industrial insulation material market by enforcing stringent energy efficiency standards, sustainability mandates, and fire safety regulations. Initiatives like the EU’s Energy Performance of Buildings Directive drive demand for high-performance insulation, while environmental regulations encourage the use of eco-friendly materials.

Compliance with chemical regulations such as REACH affects production processes and material availability. Additionally, government incentives for energy-efficient projects boost market growth, and waste management laws promote the development of recyclable insulation products. Collectively, these regulations guide innovation, material selection, and market dynamics

Segments Covered in the Report

- Dominance of Foamed Plastic in Insulation

The foamed plastic segment holds the largest share in the Europe building and industrial insulation material market, driven by its exceptional thermal performance, lightweight properties, and versatility in applications.

Materials such as polyurethane and polystyrene foams are particularly favored for their excellent insulation properties, making them ideal for residential, commercial, and industrial applications. Their resistance to moisture and ease of installation further enhances their appeal to builders and contractors.

Advancements in manufacturing techniques have improved the sustainability of foamed plastic products, aligning with the growing demand for eco-friendly construction materials. As energy efficiency regulations tighten, the reliance on foamed plastics is expected to continue, solidifying its position as a key player in the insulation market.

- Residential Segment Takes the Lead

The residential segment holds the highest share in the Europe building and industrial insulation material market, driven by increasing demand for energy-efficient homes and government initiatives promoting sustainable building practices. According to the European Union, residential buildings account for nearly 40% of total energy consumption in Europe, highlighting the need for effective insulation solutions.

Manufacturers such as Kingspan and Rockwool have been at the forefront, providing innovative insulation products designed to enhance thermal performance and reduce energy costs.

Countries like Germany and the United Kingdom are witnessing significant investments in residential insulation projects, propelled by the growing awareness of energy efficiency and climate change. This trend is expected to continue as homeowners seek to improve comfort while reducing their carbon footprints.

Country wise Analysis

- Infrastructure Developments Reshape Germany Insulation Landscape

The building and industrial insulation market in Germany is currently navigating a challenging landscape, particularly within the residential construction sector, which accounts for 61% of total construction investments. According to the European Construction Industry Federation, in 2023, this sector experienced its third consecutive year of decline, with construction investments falling by 2.7% on a price-adjusted basis.

The drop in new residential construction permits down by 27% highlights the adverse conditions impacting this segment. Rising mortgage interest rates, which surged from 1.3% to over 4% in two years, combined with increased construction material prices have made housing investments less affordable for both private households and commercial investors.

Several factors are poised to drive the market forward despite these challenges. The German government has set ambitious targets for achieving a carbon-neutral building stock by 2045, necessitating significant investments in energy-efficient renovations. This focus on sustainability is likely to boost demand for high-performance insulation solutions that enhance energy efficiency and align with climate objectives.

- Ongoing Push for Energy Efficiency Drives the U.K. Market Forward

The building and industrial insulation market in the United Kingdom is influenced by a combination of factors including the ongoing push for energy efficiency, sustainability, and legislative changes.

As of December 2023, Saint-Gobain's agreement to sell a majority stake in its polyisocyanurate insulation (PIR) activity under the Celotex brand to SOPREMA exemplifies a strategic shift toward refining product offerings and enhancing market focus. This move underscores the increasing demand for specialized insulation solutions that meet stringent energy performance regulations and align with evolving consumer preferences for sustainable building materials.

As the UK government continues to implement policies aimed at reducing carbon emissions and enhancing energy efficiency, the insulation market is poised for growth, particularly in the residential and commercial sectors where energy retrofitting initiatives are prioritized.

Rising awareness around climate change and energy conservation is driving innovations in insulation technologies, with manufacturers investing in research and development to produce Eco- friendly materials. The UK market is seeing a growing preference for advanced insulation solutions, such as spray foam, mineral wool, and sustainable wood fiber insulation, which are designed to meet the increasing demand for higher thermal performance and energy efficiency.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe building and industrial insulation material market is characterized by strategic mergers, acquisitions, and technological advancements among key players. For instance, Saint-Gobain S.A recently entered an agreement to sell a majority stake in its polyisocyanurate insulation activity to SOPREMA, allowing it to streamline its product portfolio.

Kingspan Group Plc is focusing on expanding its sustainable insulation solutions, reinforcing its commitment to energy efficiency in the residential sector. Dow Inc. continues to innovate with new product launches aimed at enhancing thermal performance, while Rockwool International A/S is investing in the development of eco-friendly insulation materials.

Key Market Companies

- Dow Inc.

- Saint-Gobain S.A

- Rockwool International A/S

- Knauf Insulation

- Owens Corning Inc.

- BASF SE

- Recticel Group

- Cabot Corporation

- Covestro AG

- Kingspan Group Plc.

- Armacell

- KCC Corporation

- Aspen Aerogels Inc.

- CNBM Group Co. Ltd.

- Huntsman International LLC

Recent Industry Developments

- Sept 2024 –

Knauf Insulation launched its residential Performance+™ portfolio of thermal and acoustical fiberglass insulation at the 2024 ICAA Convention, featuring asthma & allergy friendly® and Verified Healthier Air™ certifications. The product line includes Performance+™ EcoBatt®, EcoRoll®, Jet Stream® Ultra, EcoFill® WX, and Jet Stream Max, setting new industry standards for indoor air quality and energy efficiency.

- August 2024 -

Covestro LLC announced a collaboration with Carlisle Construction Materials to enhance sustainable construction using bio-attributed materials. Covestro will supply methylene diphenyl diisocyanate (MDI) derived from ISCC PLUS certified bio-circular raw materials, offering a CO2 reduction potential of up to 99% compared to fossil-based products. This partnership will enable Carlisle to produce high-performance polyurethane building insulation with significantly lower embodied carbon, reinforcing both companies' commitment to environmentally friendly building solutions.

- December 2023 -

Saint-Gobain signed an agreement with SOPREMA for the sale of a majority stake in its polyisocyanurate insulation (PIR) activity in the United Kingdom under the Celotex brand. The company signed this agreement to refine its product portfolio and focus its efforts in a manner that best serves its customers.

An Expert’s Eye

- Continued investment in energy-efficient insulation technologies will be crucial to meet growing environmental regulations and consumer demand for sustainable building materials.

- Emphasizing research and development in eco-friendly materials such as wood-based insulation products, can capture emerging trends in the Europe building and industrial insulation material market toward sustainability.

- Strengthening collaborations and partnerships among manufacturers can enhance innovation and expand market reach, particularly in underpenetrated regions.

- Monitoring government policies and incentives in key markets of Europe will provide opportunities for manufacturers to align their product offerings with funding programs aimed at energy efficiency.

- Focusing on the residential construction segment will yield significant returns, especially as renovation activities continue to rise in response to aging building stocks.

- Addressing skilled labor shortages through training programs and partnerships with educational institutions will help sustain growth in the construction and insulation sectors.

Europe Building & Industrial Insulation Material Market is Segmented as-

By Product Type

- Building Insulation

- Foamed Plastics

- Expanded Polystyrene (EPS)

- Polyurethane and Polyisocyanurate

- Extruded Polystyrene (xps)

- Other Foamed Plastics

- Fiberglass

- Batts & Blankets

- Loose Fill

- Roof Deck Board

- Pipe & Duct Wrap

- Mineral or Stone Wool

- Batts & Blankets

- Board

- Loose Fill

- Biobased Materials

- Wood

- Denim

- Sheep Wool

- Hemp

- Straw

- Other Materials

- Aerogels

- Cellulose

- Reflective Insulation & Radiant Barriers

- Perlite

- Vermiculite

- Foamed Plastics

- Industrial Insulation

- Fiberglass Insulation

- Foamed Plastics

- Mineral Wool

By End Use

- Building

- Residential

- Commercial

- Industrial

- HVAC

- OEMs

- Marine

- Oil & Gas

- Power Plants

By Country

- Germany

- Italy

- France

- The United Kingdom

- Spain

- Russia

- Rest of Europe

1. Executive Summary

1.1. Europe Building & Industrial Insulation Material Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunity

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Europe Building & Industrial Insulation Material Market Outlook, 2019 - 2031

3.1. Europe Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Building Insulation

3.1.1.1.1. Foamed Plastics

3.1.1.1.1.1. Expanded Polystyrene (EPS)

3.1.1.1.1.2. Polyurethane and Polyisocyanurate

3.1.1.1.1.3. Extruded Polystyrene (xps)

3.1.1.1.1.4. Other Foamed Plastics

3.1.1.1.2. Fiberglass

3.1.1.1.2.1. Batts & Blankets

3.1.1.1.2.2. Loose Fill

3.1.1.1.2.3. Roof Deck Board

3.1.1.1.2.4. Pipe & Duct Wrap

3.1.1.2. Mineral or Stone Wool

3.1.1.2.1. Batts & Blankets

3.1.1.2.2. Board

3.1.1.2.3. Loose Fill

3.1.1.3. Biobased Materials

3.1.1.3.1. Wood

3.1.1.3.2. Denim

3.1.1.3.3. Sheep Wool

3.1.1.3.4. Hemp

3.1.1.3.5. Straw

3.1.1.4. Other Materials

3.1.1.4.1. Aerogels

3.1.1.4.2. Cellulose

3.1.1.4.3. Reflective Insulation & Radiant Barriers

3.1.1.4.4. Perlite

3.1.1.4.5. Vermiculite

3.1.2. Industrial Insulation

3.1.2.1. Fiberglass Insulation

3.1.2.2. Foamed Plastics

3.1.2.3. Mineral Wool

3.1.2.4. Misc.

3.2. Europe Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Building

3.2.1.1.1. Residential

3.2.1.1.2. Commercial

3.2.1.2. Industrial

3.2.1.2.1. HVAC

3.2.1.2.2. OEMs

3.2.1.2.3. Marine

3.2.1.2.4. Oil & Gas

3.2.1.2.5. Power Plants

3.2.1.2.6. Misc.

3.3. Europe Building & Industrial Insulation Material Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Germany

3.3.1.2. Italy

3.3.1.3. France

3.3.1.4. U.K.

3.3.1.5. Spain

3.3.1.6. Russia

3.3.1.7. Rest of Europe

4. Germany Building & Industrial Insulation Material Market Outlook, 2019 - 2031

4.1. Germany Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Building Insulation

4.1.1.1.1. Foamed Plastics

4.1.1.1.1.1. Expanded Polystyrene (EPS)

4.1.1.1.1.2. Polyurethane and Polyisocyanurate

4.1.1.1.1.3. Extruded Polystyrene (xps)

4.1.1.1.1.4. Other Foamed Plastics

4.1.1.1.2. Fiberglass

4.1.1.1.2.1. Batts & Blankets

4.1.1.1.2.2. Loose Fill

4.1.1.1.2.3. Roof Deck Board

4.1.1.1.2.4. Pipe & Duct Wrap

4.1.1.2. Mineral or Stone Wool

4.1.1.2.1. Batts & Blankets

4.1.1.2.2. Board

4.1.1.2.3. Loose Fill

4.1.1.3. Biobased Materials

4.1.1.3.1. Wood

4.1.1.3.2. Denim

4.1.1.3.3. Sheep Wool

4.1.1.3.4. Hemp

4.1.1.3.5. Straw

4.1.1.4. Other Materials

4.1.1.4.1. Aerogels

4.1.1.4.2. Cellulose

4.1.1.4.3. Reflective Insulation & Radiant Barriers

4.1.1.4.4. Perlite

4.1.1.4.5. Vermiculite

4.1.1.5. Industrial Insulation

4.1.1.5.1. Fiberglass Insulation

4.1.1.5.2. Foamed Plastics

4.1.1.5.3. Mineral Wool

4.1.1.5.4. Misc.

4.2. Germany Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Building

4.2.1.1.1. Residential

4.2.1.1.2. Commercial

4.2.1.2. Industrial

4.2.1.2.1. HVAC

4.2.1.2.2. OEMs

4.2.1.2.3. Marine

4.2.1.2.4. Oil & Gas

4.2.1.2.5. Power Plants

4.2.1.2.6. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

5. Italy Building & Industrial Insulation Material Market Outlook, 2019 - 2031

5.1. Italy Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Building Insulation

5.1.1.1.1. Foamed Plastics

5.1.1.1.1.1. Expanded Polystyrene (EPS)

5.1.1.1.1.2. Polyurethane and Polyisocyanurate

5.1.1.1.1.3. Extruded Polystyrene (xps)

5.1.1.1.1.4. Other Foamed Plastics

5.1.1.1.2. Fiberglass

5.1.1.1.2.1. Batts & Blankets

5.1.1.1.2.2. Loose Fill

5.1.1.1.2.3. Roof Deck Board

5.1.1.1.2.4. Pipe & Duct Wrap

5.1.1.2. Mineral or Stone Wool

5.1.1.2.1.1. Batts & Blankets

5.1.1.2.1.2. Board

5.1.1.2.1.3. Loose Fill

5.1.1.3. Biobased Materials

5.1.1.3.1.1. Wood

5.1.1.3.1.2. Denim

5.1.1.3.1.3. Sheep Wool

5.1.1.3.1.4. Hemp

5.1.1.3.1.5. Straw

5.1.1.4. Other Materials

5.1.1.4.1.1. Aerogels

5.1.1.4.1.2. Cellulose

5.1.1.4.1.3. Reflective Insulation & Radiant Barriers

5.1.1.4.1.4. Perlite

5.1.1.4.1.5. Vermiculite

5.1.2. Industrial Insulation

5.1.2.1. Fiberglass Insulation

5.1.2.2. Foamed Plastics

5.1.2.3. Mineral Wool

5.1.2.4. Misc.

5.2. Italy Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Building

5.2.1.1.1. Residential

5.2.1.1.2. Commercial

5.2.1.2. Industrial

5.2.1.2.1. HVAC

5.2.1.2.2. OEMs

5.2.1.2.3. Marine

5.2.1.2.4. Oil & Gas

5.2.1.2.5. Power Plants

5.2.1.2.6. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

6. France Building & Industrial Insulation Material Market Outlook, 2019 - 2031

6.1. France Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Building Insulation

6.1.1.1.1. Foamed Plastics

6.1.1.1.1.1. Expanded Polystyrene (EPS)

6.1.1.1.1.2. Polyurethane and Polyisocyanurate

6.1.1.1.1.3. Extruded Polystyrene (xps)

6.1.1.1.1.4. Other Foamed Plastics

6.1.1.1.2. Fiberglass

6.1.1.1.2.1. Batts & Blankets

6.1.1.1.2.2. Loose Fill

6.1.1.1.2.3. Roof Deck Board

6.1.1.1.2.4. Pipe & Duct Wrap

6.1.1.2. Mineral or Stone Wool

6.1.1.2.1.1. Batts & Blankets

6.1.1.2.1.2. Board

6.1.1.2.1.3. Loose Fill

6.1.1.3. Biobased Materials

6.1.1.3.1.1. Wood

6.1.1.3.1.2. Denim

6.1.1.3.1.3. Sheep Wool

6.1.1.3.1.4. Hemp

6.1.1.3.1.5. Straw

6.1.1.4. Other Materials

6.1.1.4.1.1. Aerogels

6.1.1.4.1.2. Cellulose

6.1.1.4.1.3. Reflective Insulation & Radiant Barriers

6.1.1.4.1.4. Perlite

6.1.1.4.1.5. Vermiculite

6.1.2. Industrial Insulation

6.1.2.1. Fiberglass Insulation

6.1.2.2. Foamed Plastics

6.1.2.3. Mineral Wool

6.1.2.4. Misc.

6.2. France Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Building

6.2.1.1.1. Residential

6.2.1.1.2. Commercial

6.2.1.2. Industrial

6.2.1.2.1. HVAC

6.2.1.2.2. OEMs

6.2.1.2.3. Marine

6.2.1.2.4. Oil & Gas

6.2.1.2.5. Power Plants

6.2.1.2.6. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

7. U.K. Building & Industrial Insulation Material Market Outlook, 2019 - 2031

7.1. U.K. Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Building Insulation

7.1.1.1.1. Foamed Plastics

7.1.1.1.1.1. Expanded Polystyrene (EPS)

7.1.1.1.1.2. Polyurethane and Polyisocyanurate

7.1.1.1.1.3. Extruded Polystyrene (xps)

7.1.1.1.1.4. Other Foamed Plastics

7.1.1.1.2. Fiberglass

7.1.1.1.2.1. Batts & Blankets

7.1.1.1.2.2. Loose Fill

7.1.1.1.2.3. Roof Deck Board

7.1.1.1.2.4. Pipe & Duct Wrap

7.1.1.2. Mineral or Stone Wool

7.1.1.2.1.1. Batts & Blankets

7.1.1.2.1.2. Board

7.1.1.2.1.3. Loose Fill

7.1.1.3. Biobased Materials

7.1.1.3.1.1. Wood

7.1.1.3.1.2. Denim

7.1.1.3.1.3. Sheep Wool

7.1.1.3.1.4. Hemp

7.1.1.3.1.5. Straw

7.1.1.4. Other Materials

7.1.1.4.1.1. Aerogels

7.1.1.4.1.2. Cellulose

7.1.1.4.1.3. Reflective Insulation & Radiant Barriers

7.1.1.4.1.4. Perlite

7.1.1.4.1.5. Vermiculite

7.1.2. Industrial Insulation

7.1.2.1. Fiberglass Insulation

7.1.2.2. Foamed Plastics

7.1.2.3. Mineral Wool

7.1.2.4. Misc.

7.2. U.K. Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Building

7.2.1.1.1. Residential

7.2.1.1.2. Commercial

7.2.1.2. Industrial

7.2.1.2.1. HVAC

7.2.1.2.2. OEMs

7.2.1.2.3. Marine

7.2.1.2.4. Oil & Gas

7.2.1.2.5. Power Plants

7.2.1.2.6. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

8. Spain Building & Industrial Insulation Material Market Outlook, 2019 - 2031

8.1. Spain Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Building Insulation

8.1.1.1.1. Foamed Plastics

8.1.1.1.1.1. Expanded Polystyrene (EPS)

8.1.1.1.1.2. Polyurethane and Polyisocyanurate

8.1.1.1.1.3. Extruded Polystyrene (xps)

8.1.1.1.1.4. Other Foamed Plastics

8.1.1.1.2. Fiberglass

8.1.1.1.2.1. Batts & Blankets

8.1.1.1.2.2. Loose Fill

8.1.1.1.2.3. Roof Deck Board

8.1.1.1.2.4. Pipe & Duct Wrap

8.1.1.2. Mineral or Stone Wool

8.1.1.2.1.1. Batts & Blankets

8.1.1.2.1.2. Board

8.1.1.2.1.3. Loose Fill

8.1.1.3. Biobased Materials

8.1.1.3.1.1. Wood

8.1.1.3.1.2. Denim

8.1.1.3.1.3. Sheep Wool

8.1.1.3.1.4. Hemp

8.1.1.3.1.5. Straw

8.1.1.4. Other Materials

8.1.1.4.1.1. Aerogels

8.1.1.4.1.2. Cellulose

8.1.1.4.1.3. Reflective Insulation & Radiant Barriers

8.1.1.4.1.4. Perlite

8.1.1.4.1.5. Vermiculite

8.1.2. Industrial Insulation

8.1.2.1. Fiberglass Insulation

8.1.2.2. Foamed Plastics

8.1.2.3. Mineral Wool

8.1.2.4. Misc.

8.2. Spain Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Building

8.2.1.1.1. Residential

8.2.1.1.2. Commercial

8.2.1.2. Industrial

8.2.1.2.1. HVAC

8.2.1.2.2. OEMs

8.2.1.2.3. Marine

8.2.1.2.4. Oil & Gas

8.2.1.2.5. Power Plants

8.2.1.2.6. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

9. Russia Building & Industrial Insulation Material Market Outlook, 2019 - 2031

9.1. Russia Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Building Insulation

9.1.1.1.1. Foamed Plastics

9.1.1.1.1.1. Expanded Polystyrene (EPS)

9.1.1.1.1.2. Polyurethane and Polyisocyanurate

9.1.1.1.1.3. Extruded Polystyrene (xps)

9.1.1.1.1.4. Other Foamed Plastics

9.1.1.1.2. Fiberglass

9.1.1.1.2.1. Batts & Blankets

9.1.1.1.2.2. Loose Fill

9.1.1.1.2.3. Roof Deck Board

9.1.1.1.2.4. Pipe & Duct Wrap

9.1.1.2. Mineral or Stone Wool

9.1.1.2.1.1. Batts & Blankets

9.1.1.2.1.2. Board

9.1.1.2.1.3. Loose Fill

9.1.1.3. Biobased Materials

9.1.1.3.1.1. Wood

9.1.1.3.1.2. Denim

9.1.1.3.1.3. Sheep Wool

9.1.1.3.1.4. Hemp

9.1.1.3.1.5. Straw

9.1.1.4. Other Materials

9.1.1.4.1.1. Aerogels

9.1.1.4.1.2. Cellulose

9.1.1.4.1.3. Reflective Insulation & Radiant Barriers

9.1.1.4.1.4. Perlite

9.1.1.4.1.5. Vermiculite

9.1.2. Industrial Insulation

9.1.2.1. Fiberglass Insulation

9.1.2.2. Foamed Plastics

9.1.2.3. Mineral Wool

9.1.2.4. Misc.

9.2. Russia Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Building

9.2.1.1.1. Residential

9.2.1.1.2. Commercial

9.2.1.2. Industrial

9.2.1.2.1. HVAC

9.2.1.2.2. OEMs

9.2.1.2.3. Marine

9.2.1.2.4. Oil & Gas

9.2.1.2.5. Power Plants

9.2.1.2.6. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

10. Rest of Europe Building & Industrial Insulation Material Market Outlook, 2019 - 2031

10.1. Rest of Europe Building & Industrial Insulation Material Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.1.1. Key Highlights

10.1.2. Building Insulation

10.1.2.1.1. Foamed Plastics

10.1.2.1.1.1. Expanded Polystyrene (EPS)

10.1.2.1.1.2. Polyurethane and Polyisocyanurate

10.1.2.1.1.3. Extruded Polystyrene (xps)

10.1.2.1.1.4. Other Foamed Plastics

10.1.2.1.2. Fiberglass

10.1.2.1.2.1. Batts & Blankets

10.1.2.1.2.2. Loose Fill

10.1.2.1.2.3. Roof Deck Board

10.1.2.1.2.4. Pipe & Duct Wrap

10.1.2.1.3. Mineral or Stone Wool

10.1.2.1.3.1. Batts & Blankets

10.1.2.1.3.2. Board

10.1.2.1.3.3. Loose Fill

10.1.2.1.4. Biobased Materials

10.1.2.1.4.1. Wood

10.1.2.1.4.2. Denim

10.1.2.1.4.3. Sheep Wool

10.1.2.1.4.4. Hemp

10.1.2.1.4.5. Straw

10.1.2.1.5. Other Materials

10.1.2.1.5.1. Aerogels

10.1.2.1.5.2. Cellulose

10.1.2.1.5.3. Reflective Insulation & Radiant Barriers

10.1.2.1.5.4. Perlite

10.1.2.1.5.5. Vermiculite

10.1.3. Industrial Insulation

10.1.3.1. Fiberglass Insulation

10.1.3.2. Foamed Plastics

10.1.3.3. Mineral Wool

10.1.3.4. Misc.

10.2. Rest of Europe Building & Industrial Insulation Material Market Outlook, by End Use, Value (US$ Bn) and Volume (Tons), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Building

10.2.1.1.1. Residential

10.2.1.1.2. Commercial

10.2.1.2. Industrial

10.2.1.2.1. HVAC

10.2.1.2.2. OEMs

10.2.1.2.3. Marine

10.2.1.2.4. Oil & Gas

10.2.1.2.5. Power Plants

10.2.1.2.6. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Manufacturer vs by End Use Heatmap

11.2. Company Market Share Analysis, 2023

11.3. Competitive Dashboard

11.4. Company Profiles

11.4.1. Dow Inc.

11.4.1.1. Company Overview

11.4.1.2. Product Portfolio

11.4.1.3. Financial Overview

11.4.1.4. Business Strategies and Development

11.4.2. Saint-Gobain S.A

11.4.3. Rockwool International A/S

11.4.4. Knauf Insulation

11.4.5. Owens Corning Inc.

11.4.6. BASF SE

11.4.7. Recticel Group

11.4.8. Cabot Corporation

11.4.9. Covestro AG

11.4.10. Kingspan Group Plc.

11.4.11. Armacell

11.4.12. KCC Corporation

11.4.13. Aspen Aerogels Inc.

11.4.14. CNBM Group Co. Ltd.

11.4.15. Huntsman International LLC

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |