Europe Dental Imaging Equipment Market Forecast

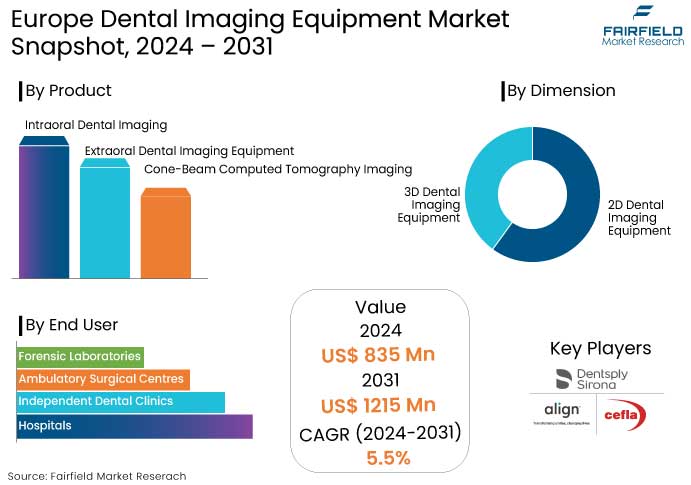

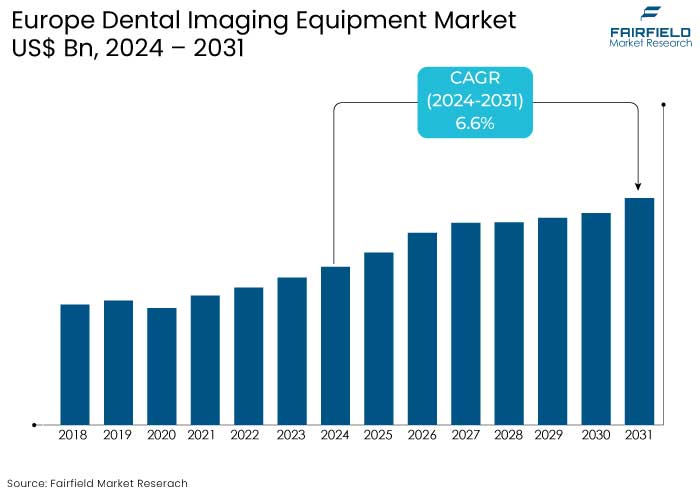

- The Europe dental imaging equipment market is projected to be valued at US$1.5 Bn by 2031, exhibiting significant growth from the US$1.1 Bn achieved in 2024.

- The Europe market for dental imaging equipment is expected to show a significant expansion rate with an a CAGR of 6.6% during the forecast period between 2024 and 2031.

Europe Dental Imaging Equipment Market Insights

- The market is divided into intraoral, extraoral systems and cone-beam computed tomography (CBCT) imaging, with popular intraoral devices.

- CBCT systems are gaining traction due to their ability to provide 3D images, enhancing diagnostic accuracy for complex procedures like implants and orthodontics.

- Independent dental clinics represent the largest end user segment, followed by hospitals, ambulatory surgical centers, and forensic labs.

- The market is expected to grow significantly through 2031 driven by technological advancements and the increasing emphasis on preventive dental care.

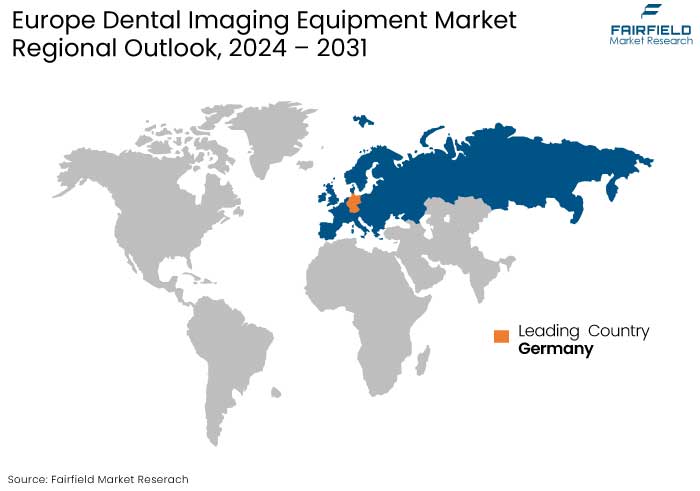

- Germany, the UK, and France dominate the Europe dental imaging equipment market due to well-developed healthcare infrastructure and high adoption rates of advanced technologies.

- Increasing dental issues, including periodontal diseases and oral cancer, alongside rising cosmetic dentistry trends, are boosting demand for imaging equipment.

- Germany leads in adoption, driven by high healthcare expenditure, while the UK sees growth in digital imaging solutions in both public and private dental care sectors.

A Look Back and a Look Forward - Comparative Analysis

Europe dental imaging equipment market went through significant transformation over the past decade, driven by the adoption of digital technologies and advancements in diagnostic tools. The market dominated by conventional 2D imaging systems such as panoramic and intraoral X-rays, which were essential for basic dental diagnostics. However, the limitations of these systems in terms of image resolution and comprehensive anatomical visualization spurred a shift toward advanced solutions.

The market has seen a transition to 3D imaging technologies in recent years particularly Cone Beam Computed Tomography (CBCT). These systems offer detailed 3D images, allowing for better treatment planning, especially for orthodontics, dental implants, and maxillofacial surgeries.

The increasing preference for minimally invasive procedures and enhanced patient care has further accelerated the adoption of digital solutions like intraoral scanners and digital radiography systems.

The market is expected to benefit from growing investments in artificial intelligence (AI) and cloud-based dental imaging platforms. AI-driven software is increasingly being integrated to assist in image interpretation, improving diagnostic accuracy and workflow efficiency for dental practices. Additionally, the trend toward personalized dental care is driving demand for imaging systems that enable precise treatment customization.

Demographic shifts such as Europe’s aging population are expected to sustain demand for dental services particularly in implantology and prosthodontics. Countries like Germany and France will likely continue to lead the market owing to well-developed healthcare infrastructure and high patient awareness.

Key Growth Determinants

- Technological Advancements in Cone-Beam Computed Tomography and AI Integration

Technological advancements in Cone-Beam Computed Tomography (CBCT) have significantly enhanced diagnostic capabilities in dental and maxillofacial imaging. This factor remains a key driver for the Europe dental imaging equipment market. CBCT provides three-dimensional images with high resolution and lower radiation doses compared to traditional CT scans. This technology has revolutionized the way dental professionals diagnose and plan treatments, offering detailed views of bone structures, teeth, and soft tissues.

The integration of Artificial Intelligence (AI) with CBCT has propelled its utility. AI algorithms can now assist in the automatic detection and diagnosis of dental pathologies, such as caries, periodontal disease, and even tumors. These algorithms analyze CBCT images with remarkable accuracy, reducing the time required for diagnosis and increasing the precision of treatment plans.

Manufacturer leading in this field is Planmeca, a company known for its innovative dental imaging solutions. Planmeca’s CBCT systems, such as the Planmeca Viso™, incorporate advanced AI features that enhance image quality and diagnostic capabilities. The AI integration in these systems aids in the automatic segmentation of anatomical structures, making the diagnostic process efficient and reliable.

Key Growth Barriers

- Expensive Setup Costs for High-End Dental Imaging Technologies

Cone beam computed tomography (CBCT) and digital intraoral scanners are the substantial upfront costs associated with their installation and maintenance. This factor remains a key barrier for the Europe dental imaging equipment market. These advanced systems require significant financial investment in equipment, infrastructure, and training, making them less accessible for small practices.

The initial capital outlay, coupled with ongoing expenses like software upgrades, calibration, and technical support can strain budgets particularly for independent dental clinics or practitioners in developing markets.

The cost of specialized training for staff to operate these machines effectively further escalates expenses. Many dental professionals may hesitate to adopt these technologies due to concerns over return on investment (ROI), particularly when patient demand for such high-end diagnostics may not justify the expense in all regions.

Financial barrier limits widespread adoption and could slow advancements in dental diagnostics. As a result, clinics that cannot afford these systems may rely on traditional imaging methods, potentially compromising the quality of care and delaying the diagnosis of dental conditions. Addressing these cost-related challenges is crucial for enabling broader access to high-end dental imaging technology.

Dental Imaging Equipment Market Trends and Opportunities

- 3D Tomosynthesis Technology Transforms Dental Diagnostics and Patient Care

The emergence of 3D tomosynthesis presents a significant opportunity in the Europe dental imaging equipment market. This innovative technology enhances diagnostic capabilities by providing volumetric images, allowing dental professionals to detect conditions such as caries and fractures with up to 36% more accuracy than traditional 2D imaging.

A notable example is the PORTRAY™ System from Surround Medical Systems, which recently received FDA 510(k) clearance. Utilizing a novel carbon nanotube (CNT) x-ray source array developed by researchers at the University of North Carolina at Chapel Hill, this system enables high-resolution imaging without increasing patient radiation exposure or imaging time.

The 3D intraoral imaging device is designed to fit seamlessly into the same space as conventional 2D intraoral imaging systems, making it a practical upgrade for dental practices. Its compatibility with existing patient management systems facilitates easy file sharing and enhances workflow efficiency.

Practitioners can quickly realize improved diagnostic outcomes by eliminating the learning curve typically associated with new technologies. As dental care increasingly prioritizes precise diagnosis and treatment planning, integrating 3D tomosynthesis into imaging equipment positions practices to deliver higher-quality care. This advancement not only underscores the potential for growth in the sector but also aligns with the industry's ongoing commitment to patient safety and comfort.

-

The Surge in CBCT Scanner Adoption and Its Benefits for Patient Care

Cone Beam Computed Tomography (CBCT) scanners are at the forefront of a significant transformation in dental imaging, marking a notable trend in the Europe dental imaging equipment market. The increasing adoption of CBCT technology is primarily driven by its ability to deliver high-resolution, three-dimensional images, which provide dental professionals with critical insights into complex anatomical structures. This technology enhances diagnostic accuracy and facilitates more effective treatment planning across various dental specialties.

One of the key reasons for the rising popularity of CBCT scanners is their versatility. Unlike traditional 2D imaging methods, CBCT offers a comprehensive view of the patient's oral and maxillofacial regions in a single scan. This capability allows for precise assessments of conditions such as dental abscesses, impacted teeth, and periodontal disease, leading to earlier detection and improved treatment outcomes.

CBCT systems can capture detailed images of bone quality, nerve pathways, and tooth orientation, all of which are essential for planning complex procedures like implants and orthodontics.

CBCT systems prioritize patient safety by minimizing radiation exposure, making them a preferred choice in modern dentistry. Notable examples include the CS 9600 from Carestream Dental, which features AI-powered positioning and a scalable 5-in-1 configuration, and the Planmeca ProMax 3D, known for its exceptional image quality and user-friendly interface. Both systems exemplify how technological advancements in CBCT scanners are reshaping the dental landscape, reflecting the industry's commitment to improving patient care and operational efficiency.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario profoundly shapes the dental imaging equipment market by establishing safety, efficacy, and quality standards that manufacturers must adhere to.

The Medical Device Regulation (MDR) sets rigorous requirements for product approval in Europe, necessitating comprehensive clinical evaluations and compliance with stringent manufacturing processes. This impacts not only the time and cost involved in bringing new imaging technologies to market but also influences the design and functionality of the equipment to meet regulatory expectations.

Regulatory frameworks affect market dynamics by determining the classification of dental imaging devices, which influences reimbursement policies and adoption rates among dental professionals. Clear guidelines on radiation safety and patient data protection further drive innovation, as manufacturers must develop technologies that enhance diagnostic capabilities while ensuring patient safety and privacy. Consequently, a well-defined regulatory environment can foster growth and innovation in the dental imaging sector, while overly complex regulations may hinder Europe dental imaging equipment market expansion.

Segments Covered in the Report

- Intraoral Dental Imaging Equipment Takes the Lead

Intraoral dental imaging equipment is the most widely used product in the Europe market because of its importance in everyday dental exams and treatment planning. This category includes tools like intraoral X-ray machines, digital sensors, and phosphor storage plates, which help capture clear, detailed images of teeth and nearby tissues. These high-resolution images are essential for spotting issues such as cavities, infections, and bone conditions early on, ensuring better outcomes.

The popularity of intraoral imaging tools is growing as more clinics prefer minimally invasive procedures and emphasize preventive care. Many practices across Europe are shifting from traditional film-based imaging to digital intraoral sensors and phosphor plate systems, which provide quicker image processing and easier storage.

Intraoral equipment supports the movement toward digital dentistry, helping clinics streamline operations and improve patient care. In countries like Germany, France, and the United Kingdom, insurance providers encourage routine dental visits, further boosting the need for reliable diagnostic tools.

As awareness about oral health increases and new technologies like wireless scanners become available, intraoral equipment is expected to remain the most popular product type in the Europe dental imaging equipment market.

- Highest Sales Contribution Comes from Independent Dental Clinics

Independent dental clinics are the leading end user of dental imaging equipment in the Europe market due to their ability to significantly adopt new technologies and respond to patient demands for advanced care. These clinics invest significantly in modern imaging tools such as intraoral scanners, digital X-rays, and Cone-Beam Computed Tomography (CBCT) systems to enhance diagnostic accuracy and streamline treatment workflows.

The shift toward digital dentistry also plays a crucial role, as independent practices seek to differentiate themselves by offering more precise and faster diagnostics, leading to better patient outcomes.

Many countries in Europe including Germany and France offer reimbursement programs and insurance coverage that support regular dental check-ups, driving consistent usage of imaging equipment in independent practices. With the increasing need for patient-centric care and personalized treatment plans, independent dental clinics are expected to maintain their leading position in the Europe dental imaging equipment market.

Regional Analysis

- Germany’s Dominance Prevails in the Europe Dental Imaging Equipment Market

Germany holds the largest share of the market in Europe, fueled by its advanced healthcare system and growing need for high-precision diagnostics. The country is recognized as a leader in dental technology with leading manufacturers like Dentsply Sirona operating significant business units there.

Clinics and Hospitals in Germany are early adopters of cutting-edge products such as CBCT (cone-beam computed tomography) systems, digital intraoral scanners, and 3D imaging technologies.

Preventive care is a key focus in Germany, with government and insurance programs supporting regular dental check-ups. This proactive approach drives the adoption of diagnostic tools, increasing the demand for advanced imaging solutions.

Germany’s aging population, which requires frequent dental care adds to the demand for innovative diagnostic tools. With continuous innovations and a shift toward digital dentistry, Germany is well-positioned to maintain its leadership in the market.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe dental imaging equipment market is moderately consolidated, with several leading players driving technological advancements and market share growth. Key companies operating in this space include, Carestream Dental LLC, Dentsply Sirona, Planmeca Oy, and Vatech Co. Ltd.

Leading companies are at the forefront of developing innovative imaging technologies such as intraoral scanners, dental cone-beam computed tomography (CBCT), and 3D imaging systems to meet the growing demand for precision diagnostics.

Some companies like Dentsply Sirona, emphasize streamlined digital workflows, while others, such as Carestream and Planmeca focus on expanding product portfolios through advanced 3D imaging technologies.

The market has also seen strategic developments, such as mergers, product launches, and regional expansions, aimed at strengthening market positions. For example, Dentsply Sirona has rolled out digital solutions to enhance clinical outcomes, while Vatech is focusing on affordable dental X-ray systems to tap into price-sensitive markets.

Key Market Companies

- Dentsply Sirona

- Align Technology, Inc.

- Planmeca Oy (KaVo Dental)

- VATECH

- Midmark Corporation

- CEFLA

- LargeV Instrument Corporation Limited

- Air Techniques

- DÜRR DENTAL

- Trident S.r.l

- Owandy Radiology

- Carestream Dental LLC.

- Merz Dental GmbH

- Acteon

Recent Industry Developments

- September 2024 -

Dentsply Sirona advanced digital dentistry by introducing the Primescan 2, a new wireless intraoral scanner. Powered by the DS Core cloud platform, the scanner is cloud-native, allowing use on any internet-connected device without the need for a dedicated computer. This launch highlights Dentsply Sirona's commitment to versatile, cutting-edge dental technology.

- July 2024 -

Align Technology, Inc., a global leader in medical devices specializing in the design, manufacture, and sale of the Invisalign® clear aligner system, iTero™ intraoral scanners, and exocad™ CAD/CAM software for restorative dentistry, launched the iTero™ Design Suite. This new offering provides doctors with an intuitive solution to streamline the design process for 3D printing of models, bite splints, and restorations directly within their practice.

- March 2023 -

Planmeca recently introduced the Viso® G3, the latest addition to its popular Viso® family of CBCT units. The multifunctional device offers comprehensive extraoral imaging capabilities, from 2D to 3D, and completes Planmeca's advanced CBCT lineup alongside the Viso® G7 and Viso® G5 models.

An Expert’s Eye

- The Europe dental imaging equipment market is evolving significantly, driven by the rising demand for accurate diagnostics, preventive care, and the shift toward digital dentistry.

- Germany plays a pivotal role, accounting for the notable share in Europe. This leadership is attributed to robust healthcare infrastructure, a large aging population with increasing dental care needs, and government-backed insurance policies that encourage regular dental check-ups.

- As digital sensors and 3D CBCT imaging technologies become more accessible, clinics are moving away from traditional film-based diagnostics to fast and efficient solutions.

Europe Dental Imaging Equipment Market is Segmented as-

By Product Type

- Intraoral Dental Imaging Equipment

- Intraoral X-ray Systems

- Wall/Floor Mounted Intraoral X-ray Systems

- Hand-Held Intraoral X-ray Systems

- Intraoral Plate Scanners

- Intraoral Sensors

- Intraoral Phosphor Storage Plates

- Intraoral Cameras

- Intraoral X-ray Systems

- Extraoral Dental Imaging Equipment

- Extra-oral X-ray Systems

- Panoramic X-ray Systems

- Cephalometric Projection Systems

- Extraoral Scanners

- Extra-oral X-ray Systems

- Cone-Beam Computed Tomography (CBCT) Imaging

By Dimension

- 2D Dental Imaging Equipment

- 3D Dental Imaging Equipment

By End User

- Hospitals

- Independent Dental Clinics

- Ambulatory Surgical Centres

- Forensic Laboratories

By Country

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

1. Executive Summary

1.1. Europe Dental Imaging Equipment Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Key Promotional Strategies, By Manufacturers

2.4. Key Regulations

2.5. Product Overview, by Product type

2.6. Value Chain Analysis

2.7. Porter’s Five Forces Analysis

2.8. COVID-19 Impact Analysis

2.8.1. Supply

2.8.2. Demand

2.9. Economic Overview

2.9.1. World Economic Projections

2.10. PESTLE Analysis

3. Price Analysis, 2019 - 2023

3.1. Europe Average Price Analysis, by Product, US$ Per Unit, 2019 - 2023

3.2. Prominent Factor Affecting Dental Imaging Equipment Prices

3.3. Europe Average Price Analysis, by Region, US$ Per Unit

4. Europe Dental Imaging Equipment Market Outlook, 2019 - 2031

4.1. Europe Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Intraoral Dental Imaging Equipment

4.1.1.1.1. Intraoral X-ray Systems

4.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

4.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

4.1.1.1.2. Intraoral Plate Scanners

4.1.1.1.3. Intraoral Sensors

4.1.1.1.4. Intraoral Phosphor Storage Plates

4.1.1.1.5. Intraoral Cameras

4.1.1.2. Extraoral Dental Imaging Equipment

4.1.1.2.1. Extra-oral X-ray Systems

4.1.1.2.1.1. Panoramic X-ray Systems

4.1.1.2.1.2. Cephalometric Projection Systems

4.1.1.2.2. Extraoral Scanners

4.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

4.2. Europe Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. 2D Dental Imaging Equipment

4.2.1.2. 3D Dental Imaging Equipment

4.3. Europe Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Independent Dental Clinics

4.3.1.3. Ambulatory Surgical Centres

4.3.1.4. Forensic Laboratories

4.4. Europe Dental Imaging Equipment Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Germany

4.4.1.2. France

4.4.1.3. U.K.

4.4.1.4. Italy

4.4.1.5. Russia

4.4.1.6. Rest of Europe

5. Germany Dental Imaging Equipment Market Outlook, 2019 - 2031

5.1. Germany Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Intraoral Dental Imaging Equipment

5.1.1.1.1. Intraoral X-ray Systems

5.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

5.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

5.1.1.1.2. Intraoral Plate Scanners

5.1.1.1.3. Intraoral Sensors

5.1.1.1.4. Intraoral Phosphor Storage Plates

5.1.1.1.5. Intraoral Cameras

5.1.1.2. Extraoral Dental Imaging Equipment

5.1.1.2.1. Extra-oral X-ray Systems

5.1.1.2.1.1. Panoramic X-ray Systems

5.1.1.2.1.2. Cephalometric Projection Systems

5.1.1.2.2. Extraoral Scanners

5.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

5.2. Germany Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. 2D Dental Imaging Equipment

5.2.1.2. 3D Dental Imaging Equipment

5.3. Germany Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Independent Dental Clinics

5.3.1.3. Ambulatory Surgical Centres

5.3.1.4. Forensic Laboratories

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. France Dental Imaging Equipment Market Outlook, 2019 - 2031

6.1. France Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Intraoral Dental Imaging Equipment

6.1.1.1.1. Intraoral X-ray Systems

6.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

6.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

6.1.1.1.2. Intraoral Plate Scanners

6.1.1.1.3. Intraoral Sensors

6.1.1.1.4. Intraoral Phosphor Storage Plates

6.1.1.1.5. Intraoral Cameras

6.1.1.2. Extraoral Dental Imaging Equipment

6.1.1.2.1. Extra-oral X-ray Systems

6.1.1.2.1.1. Panoramic X-ray Systems

6.1.1.2.1.2. Cephalometric Projection Systems

6.1.1.2.2. Extraoral Scanners

6.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

6.2. France Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. 2D Dental Imaging Equipment

6.2.1.2. 3D Dental Imaging Equipment

6.3. France Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Independent Dental Clinics

6.3.1.3. Ambulatory Surgical Centres

6.3.1.4. Forensic Laboratories

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. U.K. Dental Imaging Equipment Market Outlook, 2019 - 2031

7.1. U.K. Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Intraoral Dental Imaging Equipment

7.1.1.1.1. Intraoral X-ray Systems

7.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

7.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

7.1.1.1.2. Intraoral Plate Scanners

7.1.1.1.3. Intraoral Sensors

7.1.1.1.4. Intraoral Phosphor Storage Plates

7.1.1.1.5. Intraoral Cameras

7.1.1.2. Extraoral Dental Imaging Equipment

7.1.1.2.1. Extra-oral X-ray Systems

7.1.1.2.1.1. Panoramic X-ray Systems

7.1.1.2.1.2. Cephalometric Projection Systems

7.1.1.2.2. Extraoral Scanners

7.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

7.2. U.K. Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. 2D Dental Imaging Equipment

7.2.1.2. 3D Dental Imaging Equipment

7.3. U.K. Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Independent Dental Clinics

7.3.1.3. Ambulatory Surgical Centres

7.3.1.4. Forensic Laboratories

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Italy Dental Imaging Equipment Market Outlook, 2019 - 2031

8.1. Italy Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Intraoral Dental Imaging Equipment

8.1.1.1.1. Intraoral X-ray Systems

8.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

8.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

8.1.1.1.2. Intraoral Plate Scanners

8.1.1.1.3. Intraoral Sensors

8.1.1.1.4. Intraoral Phosphor Storage Plates

8.1.1.1.5. Intraoral Cameras

8.1.1.2. Extraoral Dental Imaging Equipment

8.1.1.2.1. Extra-oral X-ray Systems

8.1.1.2.1.1. Panoramic X-ray Systems

8.1.1.2.1.2. Cephalometric Projection Systems

8.1.1.2.2. Extraoral Scanners

8.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

8.2. Italy Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. 2D Dental Imaging Equipment

8.2.1.2. 3D Dental Imaging Equipment

8.3. Italy Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Independent Dental Clinics

8.3.1.3. Ambulatory Surgical Centres

8.3.1.4. Forensic Laboratories

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Russia Dental Imaging Equipment Market Outlook, 2019 - 2031

9.1. Russia Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Intraoral Dental Imaging Equipment

9.1.1.1.1. Intraoral X-ray Systems

9.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

9.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

9.1.1.1.2. Intraoral Plate Scanners

9.1.1.1.3. Intraoral Sensors

9.1.1.1.4. Intraoral Phosphor Storage Plates

9.1.1.1.5. Intraoral Cameras

9.1.1.2. Extraoral Dental Imaging Equipment

9.1.1.2.1. Extra-oral X-ray Systems

9.1.1.2.1.1. Panoramic X-ray Systems

9.1.1.2.1.2. Cephalometric Projection Systems

9.1.1.2.2. Extraoral Scanners

9.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

9.2. Russia Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. 2D Dental Imaging Equipment

9.2.1.2. 3D Dental Imaging Equipment

9.3. Russia Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Hospitals

9.3.1.2. Independent Dental Clinics

9.3.1.3. Ambulatory Surgical Centres

9.3.1.4. Forensic Laboratories

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Rest of Europe Dental Imaging Equipment Market Outlook, 2019 - 2031

10.1. Rest of Europe Dental Imaging Equipment Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Intraoral Dental Imaging Equipment

10.1.1.1.1. Intraoral X-ray Systems

10.1.1.1.1.1. Wall/Floor Mounted Intraoral X-ray Systems

10.1.1.1.1.2. Hand-Held Intraoral X-ray Systems

10.1.1.1.2. Intraoral Plate Scanners

10.1.1.1.3. Intraoral Sensors

10.1.1.1.4. Intraoral Phosphor Storage Plates

10.1.1.1.5. Intraoral Cameras

10.1.1.2. Extraoral Dental Imaging Equipment

10.1.1.2.1. Extra-oral X-ray Systems

10.1.1.2.1.1. Panoramic X-ray Systems

10.1.1.2.1.2. Cephalometric Projection Systems

10.1.1.2.2. Extraoral Scanners

10.1.1.3. Cone-Beam Computed Tomography (CBCT) Imaging

10.2. Rest of Europe Dental Imaging Equipment Market Outlook, by Dimension, Value (US$ Mn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. 2D Dental Imaging Equipment

10.2.1.2. 3D Dental Imaging Equipment

10.3. Rest of Europe Dental Imaging Equipment Market Outlook, by End User, Value (US$ Mn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. Hospitals

10.3.1.2. Independent Dental Clinics

10.3.1.3. Ambulatory Surgical Centres

10.3.1.4. Forensic Laboratories

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Company Market Share Analysis, 2024

11.2. Competitive Dashboard

11.3. Company Profiles

11.3.1. KaVo Imaging

11.3.1.1. Company Overview

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. Business Strategies and Development

11.3.2. Carestream Health, Inc.

11.3.2.1. Company Overview

11.3.2.2. Product Portfolio

11.3.2.3. Financial Overview

11.3.2.4. Business Strategies and Development

11.3.3. Dentsply Sirona

11.3.3.1. Company Overview

11.3.3.2. Product Portfolio

11.3.3.3. Financial Overview

11.3.3.4. Business Strategies and Development

11.3.4. Planmeca Oy

11.3.4.1. Company Overview

11.3.4.2. Product Portfolio

11.3.4.3. Financial Overview

11.3.4.4. Business Strategies and Development

11.3.5. Acteon Group

11.3.5.1. Company Overview

11.3.5.2. Product Portfolio

11.3.5.3. Financial Overview

11.3.5.4. Business Strategies and Development

11.3.6. VATECH

11.3.6.1. Company Overview

11.3.6.2. Product Portfolio

11.3.6.3. Financial Overview

11.3.6.4. Business Strategies and Development

11.3.7. Midmark Corporation

11.3.7.1. Company Overview

11.3.7.2. Product Portfolio

11.3.7.3. Financial Overview

11.3.7.4. Business Strategies and Development

11.3.8. CEFLA

11.3.8.1. Company Overview

11.3.8.2. Product Portfolio

11.3.8.3. Financial Overview

11.3.8.4. Business Strategies and Development

11.3.9. LargeV Instrument Corporation Limited

11.3.9.1. Company Overview

11.3.9.2. Product Portfolio

11.3.9.3. Financial Overview

11.3.9.4. Business Strategies and Development

11.3.10. Air Techniques

11.3.10.1. Company Overview

11.3.10.2. Product Portfolio

11.3.10.3. Financial Overview

11.3.10.4. Business Strategies and Development

11.3.11. DÜRR DENTAL

11.3.11.1. Company Overview

11.3.11.2. Product Portfolio

11.3.11.3. Financial Overview

11.3.11.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Dimension Coverage |

|

|

End User Coverage |

|

|

Country Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |