Europe Managed Learning Services Market Forecast

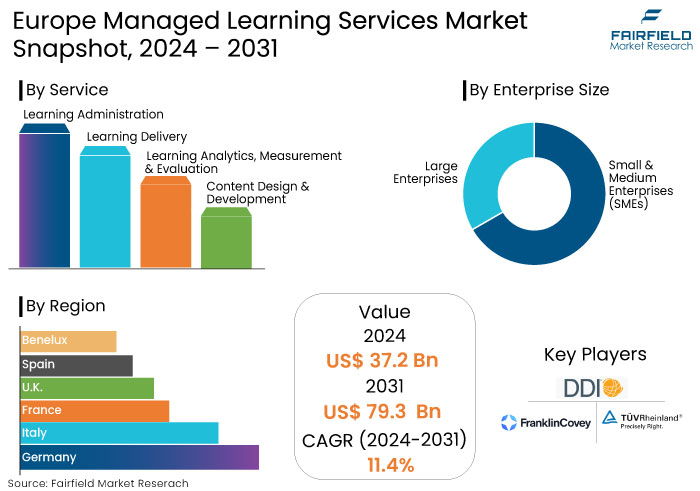

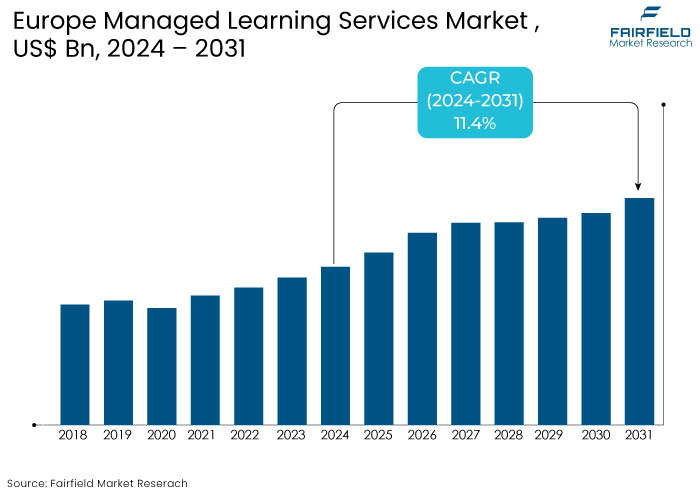

- Europe managed learning services market is projected to be valued at US$79.3 Bn by 2031 showing significant growth from the US$37.2 Bn achieved in 2024.

- The market is projected to exhibit a remarkable rate of expansion, with an estimated CAGR of 11.4% during the forecast period from 2024 to 2031.

Europe Managed Learning Services Market Insights

- Europe managed learning services market expansion is driven by demand for digital transformation and adaptability to remote learning environments.

- Rise in workflow automation, leadership development, team building, and curriculum design are driving the need for managed learning services.

- The market needs more skilled IT security personnel to effectively manage and protect sensitive data associated with learning management systems.

- AI technologies are enhancing the personalization and effectiveness of training programs boosting industry demand.

- The learning administration segment is projected to lead the market contributing the largest share in 2022.

- Germany is projected to reach an impressive market share of about 19.7% by the end of 2024.

- The large enterprises segment is poised to dominate the market by accumulating a 73.4% share in 2024

- The U.K. is poised to become a leading market for managed learning services in Europe with its market size projected to reach 10.8% CAGR by 2031.

A Look Back and a Look Forward - Comparative Analysis

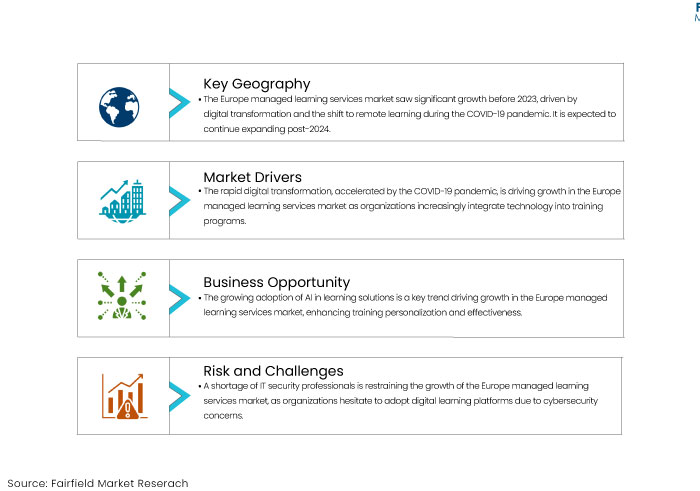

The Europe managed learning services market has experienced notable growth trends both pre-2023 and is projected to continue expanding post-2024. Prior to 2023, the market was primarily driven by the increasing demand for digital transformation and the need for organizations to adapt to remote learning environments especially during the COVID-19 pandemic.

Companies began investing significantly in e-learning solutions to enhance employee engagement and ensure compliance with regulatory requirements. This foundational shift set the stage for sustained growth.

The market is anticipated to expand at a significant 11.4% CAGR during the forecast period from 2024 to 2031. Several market trends and factors are fueling this growth

The increasing demand for workflow automation in Europe is driving the need for managed learning services. Additionally, the rising focus on leadership development, team building, and curriculum design within organizations across the continent is estimated to propel the adoption of managed learning services (MLS) in the coming years.

A significant factor contributing to market growth is the heightened emphasis on personalized learning services. The surge in the use of digital technology and internet-enabled devices in education has played a crucial role in popularizing personalized learning across European countries in recent years. This trend reflects a broad shift toward tailored educational experiences that meet the unique needs of learners, enhancing engagement and effectiveness in training programs.

Key Growth Determinants

- Digital Transformation and E-Learning Adoption

The rapid pace of digital transformation across various sectors is a primary driver for the Europe managed learning services market growth. Organizations are increasingly realizing the importance of integrating technology into their training and development programs. This shift has been accelerated by the COVID-19 pandemic, which necessitated a sudden move to remote work and online learning.

As companies seek to enhance employee engagement and retention, they are turning to e-learning platforms that offer flexibility and accessibility. Managed learning services provide a robust framework for organizations to implement these digital solutions effectively, ensuring that training is not only streamlined but also tailored to meet specific business needs.

The ability to leverage advanced technologies such as artificial intelligence, machine learning, and data analytics within MLS allows companies to create personalized and effective learning experiences further driving the adoption of these services.

- Emphasis on Continuous Learning and Upskilling

In an era characterized by rapid technological advancements and evolving job roles, there is an increasing emphasis on continuous learning and upskilling within the Europe workforce. To remain competitive, organizations must invest in the ongoing development of their employees. This necessity has led to a surge in Europe managed learning services market which can provide tailored training programs designed to equip employees with the latest skills and knowledge.

MLS providers offer comprehensive solutions that include needs assessments, content development, and learning management systems allowing companies to implement effective learning strategies seamlessly. Moreover, as industries such as technology, finance, and healthcare continue to evolve, the need for specialized training becomes more pronounced. By partnering with MLS providers, organizations can ensure that their workforce is well-prepared to navigate changes in their respective fields ultimately enhancing productivity and innovation.

- Regulatory Compliance and Standardization

The increasing complexity of regulatory compliance across various industries serves as a key driver for the Europe managed learning services market expansion. Organizations are faced with a myriad of regulations that require consistent training and certification for their employees, particularly in sectors like finance, healthcare, and manufacturing.

Managed learning services play a crucial role in helping businesses navigate these compliance requirements by providing structured training programs that meet regulatory standards. By partnering with MLS providers, organizations can ensure that their training initiatives are aligned with industry regulations, thereby mitigating risks associated with non-compliance.

The push for standardization in training programs across Europe has opened up opportunities for MLS providers to develop accredited courses that cater to specific industry needs. This focus on compliance not only protects organizations from potential legal repercussions but also enhances their reputation in the marketplace.

Key Growth Barriers

- Lack of IT Security Professionals

One of the significant restraints impacting the growth of the Europe managed learning services market is the shortage of IT security professionals. As organizations increasingly adopt digital learning platforms, the need for robust cybersecurity measures becomes paramount.

The current market faces a critical shortage of skilled IT security personnel who can effectively manage and protect sensitive data associated with learning management systems. This lack of expertise can lead to vulnerabilities making organizations hesitant to fully embrace managed learning solutions. Thus, businesses may opt for in-house training programs rather than outsourcing to MLS providers limiting the market potential growth.

The challenge of recruiting and retaining qualified IT security professionals not only hampers the implementation of secure learning environments but also raises concerns about compliance with regulations such as GDPR, further constraining the MLS market's expansion in Europe.

- High Initial Setup Costs

Another significant restraint for the Europe managed learning services market revenue in Europe is the high initial setup costs associated with implementing these services. Organizations often face substantial financial barriers when transitioning to managed learning solutions, including costs related to technology infrastructure, content development, and integration with existing systems.

For many businesses especially small and medium-sized enterprises (SMEs), these upfront investments can be daunting leading to reluctance to adopt MLS. Additionally, the perceived return on investment (ROI) may not be immediately evident causing further hesitation among decision-makers. This financial burden can deter organizations from outsourcing their learning and development needs opting instead for traditional in-house training methods that may need to be more effective. As a result, the high initial costs associated with managed learning services can significantly limit market growth.

Europe Managed Learning Services Market Trends and Opportunities

- Increased Adoption of Artificial Intelligence in Learning Solutions

A significant trend shaping the Europe managed learning services market growth is the increased adoption of artificial intelligence (AI) in learning solutions. Organizations are leveraging AI technologies to enhance the personalization and effectiveness of training programs.

AI-driven platforms can analyze employee performance data, identify skill gaps, and recommend tailored learning paths that align with individual career goals and organizational needs. This capability not only improves engagement but also ensures that training is relevant and impactful.

AI can automate administrative tasks such as scheduling and tracking progress allowing learning and development teams to focus on strategic initiatives. As companies continue to embrace digital transformation, the integration of AI into MLS is expected to grow, providing organizations with innovative tools to enhance their training efforts. This trend not only reflects the evolving landscape of learning but also positions MLS providers as essential partners in driving workforce development through advanced technology solutions.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape for Europe managed learning services market is notably influencing growth. With increasing scrutiny on data protection and privacy, particularly under the General Data Protection Regulation (GDPR), organizations are compelled to ensure that their learning platforms comply with stringent data handling and user consent requirements. This has led to great emphasis on secure and compliant learning solutions driving demand for MLS providers who can navigate these complexities effectively.

Regulatory bodies are advocating for standardized training and certification across various industries particularly in sectors like finance and healthcare. This push for compliance training is creating opportunities for MLS providers to offer tailored solutions that meet specific regulatory requirements, thereby enhancing their value proposition.

The rise of digital transformation initiatives across Europe is prompting regulators to establish frameworks that support innovative learning technologies while ensuring consumer protection. This regulatory support fosters an environment conducive to growth, encouraging organizations to invest in managed learning services and creating several market opportunities.

Segments Covered in the Report

- Learning Administration to Lead Market Through Surge in Outsourcing

The learning administration segment is poised to lead the Europe managed learning services market contributing the largest share in 2022. This segment is projected to experience significant growth expanding 2.8 times in market value from 2024 to 2031

As organizations across Europe increasingly outsource their training and learning functions, they can minimize challenges, reduce time wastage, and enhance efficiency. This strategic decision allows businesses to reinvest resources into other critical areas, thereby driving up the demand for learning administration services. Consequently, this segment is set to play a pivotal role in shaping the future landscape of managed learning services across the region.

- Large Enterprises Gain Traction

The large enterprises segment is set to dominate the Europe managed learning services market, accounting for a substantial 73.4% share in 2024. Learning and development initiatives have emerged as a top priority among business leaders in the region, reflecting their commitment to fostering a skilled workforce.

By collaborating with managed learning service providers, organizations can streamline their operations and deliver high-quality learning experiences swiftly and efficiently. This partnership enables businesses to effectively address the evolving training needs of their employees.

Many prominent companies have begun to engage training partners to automate their learning and development lifecycles. This shift toward automation is significantly contributing to the growth of the managed learning services market highlighting the increasing importance of effective training solutions in large enterprises.

Country Analysis

- Germany Managed Learning Services Market to Dominate with a 19.7% Share

Germany is anticipated to experience significant growth in the Europe managed learning services market during the forecast period. By the end of 2024, Germany is projected to capture an impressive market share of around 19.7%, positioning it as a leading country in Europe market.

Many German companies are increasingly outsourcing their learning services recognizing the benefits of collaborating with integrated training providers. This strategic shift allows organizations to automate their learning and development (L&D) lifecycle, enhancing efficiency and effectiveness in training delivery.

By leveraging the expertise of these providers, businesses can focus on core operations while ensuring their workforce receives high-quality training. This trend underscores the growing importance of managed learning services in driving organizational success and adaptability in a competitive market.

- U.K. Managed Learning Services Market to Emerge as a Leader

The U.K. is poised to become a leading market for managed learning services in Europe, with its market size projected to grow 2.8 times by 2031, reflecting a robust CAGR of 10.88% during the forecast period. This significant expansion highlights the increasing importance of effective learning solutions in the country.

The U.K. has made notable advancements in the Human Capital Index (HCI) over the past decade establishing itself as a frontrunner in human capital investment and development. By prioritizing these services, the U.K. aims to foster a more skilled and adaptable workforce.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe managed learning services market is characterized by a mix of established players and innovative newcomers. One notable example is Skillsoft, which has launched several innovative products since 2022, including its Percipio platform enhancements. This platform integrates AI-driven personalized learning paths and offers a vast library of content tailored to various industries addressing the growing demand for customized training solutions.

Key Market Companies

- BTS Europe

- DDI UK

- Hemsley Fraser

- FranklinCovey U.K.

- 2logical

- KnowledgePool

- TÜV Rheinland

- The Cegos Group

- Center for Creative Leadership

- EY Lane4

- GP Strategies Corporation

- Wilson Learning

- The Ken Blanchard Companies

- Linkage, Inc.

Recent Industry Developments

- May 2023 -

NIIT Limited, a global talent development corporation, announced a strategic partnership aimed at enhancing its managed training services. This initiative focuses on integrating advanced technologies into their learning solutions, allowing organizations to better align their training programs with business objectives. The partnership is expected to drive innovation in the learning and development landscape, providing clients with more effective and tailored training experiences.

- November 2023 -

Accenture launched specialized services designed to help companies customize and manage foundation models for their learning and development needs. This new offering enables organizations to leverage artificial intelligence and machine learning to create personalized learning paths for employees. By utilizing these advanced technologies, Accenture aims to enhance the effectiveness of training programs and improve workforce skills in significantly changing business environment.

An Expert’s Eye

- The rapid pace of digital transformation and e-learning adoption are driving the Europe managed learning services market

- The market is influenced by increasing scrutiny on data protection and privacy, particularly under the General Data Protection Regulation (GDPR).

- Regulatory bodies are advocating for standardized training and certification across various industries, creating opportunities for MLS providers.

- The rise of digital transformation initiatives across Europe is prompting regulators to establish frameworks supporting innovative learning technologies.

Europe Managed Learning Services Market is Segmented as-

By Service

- Learning Administration

- Learning Delivery

- Learning Analytics, Measurement & Evaluation

- Content Design & Development

- Others

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Country

- Germany

- Italy

- France

- U.K.

- Spain

- BENELUX

- Russia

- Rest of Europe

1. Executive Summary

1.1. Europe Managed Learning Services Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Europe Managed Learning Services Market Outlook, 2019-2031

3.1. Europe Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Learning Administration

3.1.1.2. Learning Delivery

3.1.1.3. Learning Analytics, Measurement & Evaluation

3.1.1.4. Content Design & Development

3.1.1.5. Others

3.2. Europe Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Small & Medium Enterprises (SMEs)

3.2.1.2. Large Enterprises

3.3. Europe Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Banking, Financial Services, and Insurance (BFSI)

3.3.1.2. Consumer Goods and Retail

3.3.1.3. Telecommunication & IT

3.3.1.4. Healthcare

3.3.1.5. Education

3.3.1.6. Manufacturing

3.3.1.7. Others

3.4. Europe Managed Learning Services Market Outlook, by Country, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. Germany

3.4.1.2. U.K.

3.4.1.3. France

3.4.1.4. Italy

3.4.1.5. Russia

3.4.1.6. Rest of Europe

4. Germany Managed Learning Services Market Outlook, 2019-2031

4.1. Germany Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Learning Administration

4.1.1.2. Learning Delivery

4.1.1.3. Learning Analytics, Measurement & Evaluation

4.1.1.4. Content Design & Development

4.1.1.5. Others

4.2. Germany Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Small & Medium Enterprises (SMEs)

4.2.1.2. Large Enterprises

4.3. Germany Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Banking, Financial Services, and Insurance (BFSI)

4.3.1.2. Consumer Goods and Retail

4.3.1.3. Telecommunication & IT

4.3.1.4. Healthcare

4.3.1.5. Education

4.3.1.6. Manufacturing

4.3.1.7. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. U.K. Managed Learning Services Market Outlook, 2019-2031

5.1. U.K. Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Learning Administration

5.1.1.2. Learning Delivery

5.1.1.3. Learning Analytics, Measurement & Evaluation

5.1.1.4. Content Design & Development

5.1.1.5. Others

5.2. U.K. Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Small & Medium Enterprises (SMEs)

5.2.1.2. Large Enterprises

5.3. U.K. Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Banking, Financial Services, and Insurance (BFSI)

5.3.1.2. Consumer Goods and Retail

5.3.1.3. Telecommunication & IT

5.3.1.4. Healthcare

5.3.1.5. Education

5.3.1.6. Manufacturing

5.3.1.7. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. France Managed Learning Services Market Outlook, 2019-2031

6.1. France Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Learning Administration

6.1.1.2. Learning Delivery

6.1.1.3. Learning Analytics, Measurement & Evaluation

6.1.1.4. Content Design & Development

6.1.1.5. Others

6.2. France Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Small & Medium Enterprises (SMEs)

6.2.1.2. Large Enterprises

6.3. France Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Banking, Financial Services, and Insurance (BFSI)

6.3.1.2. Consumer Goods and Retail

6.3.1.3. Telecommunication & IT

6.3.1.4. Healthcare

6.3.1.5. Education

6.3.1.6. Manufacturing

6.3.1.7. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Italy Managed Learning Services Market Outlook, 2019-2031

7.1. Italy Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Learning Administration

7.1.1.2. Learning Delivery

7.1.1.3. Learning Analytics, Measurement & Evaluation

7.1.1.4. Content Design & Development

7.1.1.5. Others

7.2. Italy Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

7.2.1. Key Highlights

7.2.1.1. Small & Medium Enterprises (SMEs)

7.2.1.2. Large Enterprises

7.3. Italy Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Banking, Financial Services, and Insurance (BFSI)

7.3.1.2. Consumer Goods and Retail

7.3.1.3. Telecommunication & IT

7.3.1.4. Healthcare

7.3.1.5. Education

7.3.1.6. Manufacturing

7.3.1.7. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Russia Managed Learning Services Market Outlook, 2019-2031

8.1. Russia Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Learning Administration

8.1.1.2. Learning Delivery

8.1.1.3. Learning Analytics, Measurement & Evaluation

8.1.1.4. Content Design & Development

8.1.1.5. Others

8.2. Russia Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Small & Medium Enterprises (SMEs)

8.2.1.2. Large Enterprises

8.3. Russia Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Banking, Financial Services, and Insurance (BFSI)

8.3.1.2. Consumer Goods and Retail

8.3.1.3. Telecommunication & IT

8.3.1.4. Healthcare

8.3.1.5. Education

8.3.1.6. Manufacturing

8.3.1.7. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Rest of Europe Managed Learning Services Market Outlook, 2019-2031

9.1. Rest of Europe Managed Learning Services Market Outlook, by Service, Value (US$ Bn), 2019-2031

9.1.1. Key Highlights

9.1.1.1. Learning Administration

9.1.1.2. Learning Delivery

9.1.1.3. Learning Analytics, Measurement & Evaluation

9.1.1.4. Content Design & Development

9.1.1.5. Others

9.2. Rest of Europe Managed Learning Services Market Outlook, By Enterprise Size, Value (US$ Bn), 2019-2031

9.2.1. Key Highlights

9.2.1.1. Small & Medium Enterprises (SMEs)

9.2.1.2. Large Enterprises

9.3. Rest of Europe Managed Learning Services Market Outlook, by Industry, Value (US$ Bn), 2019-2031

9.3.1. Key Highlights

9.3.1.1. Banking, Financial Services, and Insurance (BFSI)

9.3.1.2. Consumer Goods and Retail

9.3.1.3. Telecommunication & IT

9.3.1.4. Healthcare

9.3.1.5. Education

9.3.1.6. Manufacturing

9.3.1.7. Others

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Competitive Landscape

10.1. Company Market Share Analysis, 2024

10.2. Competitive Dashboard

10.3. Company Profiles

10.3.1. TÜV Rheinland

10.3.1.1. Company Overview

10.3.1.2. Product Portfolio

10.3.1.3. Financial Overview

10.3.1.4. Business Strategies and Development

10.3.2. BTS Europe

10.3.2.1. Company Overview

10.3.2.2. Product Portfolio

10.3.2.3. Financial Overview

10.3.2.4. Business Strategies and Development

10.3.3. DDI UK

10.3.3.1. Company Overview

10.3.3.2. Product Portfolio

10.3.3.3. Financial Overview

10.3.3.4. Business Strategies and Development

10.3.4. Hemsley Fraser

10.3.4.1. Company Overview

10.3.4.2. Product Portfolio

10.3.4.3. Financial Overview

10.3.4.4. Business Strategies and Development

10.3.5. FranklinCovey U.K.

10.3.5.1. Company Overview

10.3.5.2. Product Portfolio

10.3.5.3. Financial Overview

10.3.5.4. Business Strategies and Development

10.3.6. 2logical

10.3.6.1. Company Overview

10.3.6.2. Product Portfolio

10.3.6.3. Financial Overview

10.3.6.4. Business Strategies and Development

10.3.7. KnowledgePool

10.3.7.1. Company Overview

10.3.7.2. Product Portfolio

10.3.7.3. Financial Overview

10.3.7.4. Business Strategies and Development

10.3.8. The Cegos Group

10.3.8.1. Company Overview

10.3.8.2. Product Portfolio

10.3.8.3. Financial Overview

10.3.8.4. Business Strategies and Development

10.3.9. Wilson Learning

10.3.9.1. Company Overview

10.3.9.2. Product Portfolio

10.3.9.3. Financial Overview

10.3.9.4. Business Strategies and Development

10.3.10. Center for Creative Leadership

10.3.10.1. Company Overview

10.3.10.2. Product Portfolio

10.3.10.3. Financial Overview

10.3.10.4. Business Strategies and Development

10.3.11. EY Lane4

10.3.11.1. Company Overview

10.3.11.2. Product Portfolio

10.3.11.3. Financial Overview

10.3.11.4. Business Strategies and Development

10.3.12. GP Strategies Corporation

10.3.12.1. Company Overview

10.3.12.2. Product Portfolio

10.3.12.3. Financial Overview

10.3.12.4. Business Strategies and Development

10.3.13. The Ken Blanchard Companies

10.3.13.1. Company Overview

10.3.13.2. Product Portfolio

10.3.13.3. Financial Overview

10.3.13.4. Business Strategies and Development

10.3.14. Linkage, Inc.

10.3.14.1. Company Overview

10.3.14.2. Product Portfolio

10.3.14.3. Financial Overview

10.3.14.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Service Coverage |

|

|

Enterprise Size Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |