Europe Refurbished and Used Mobile Phones Market Forecast

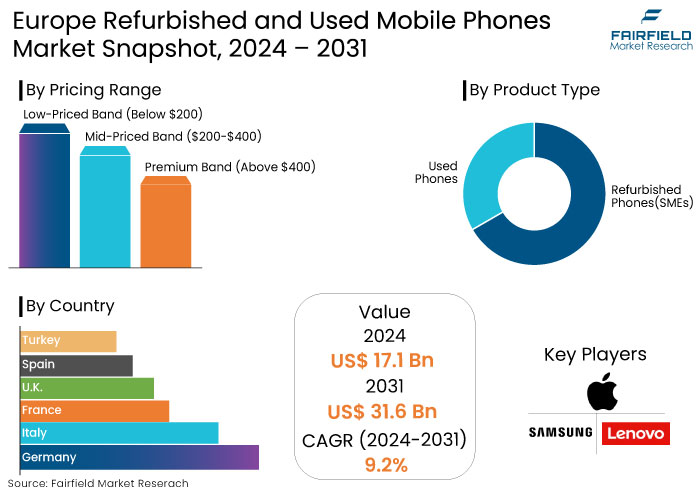

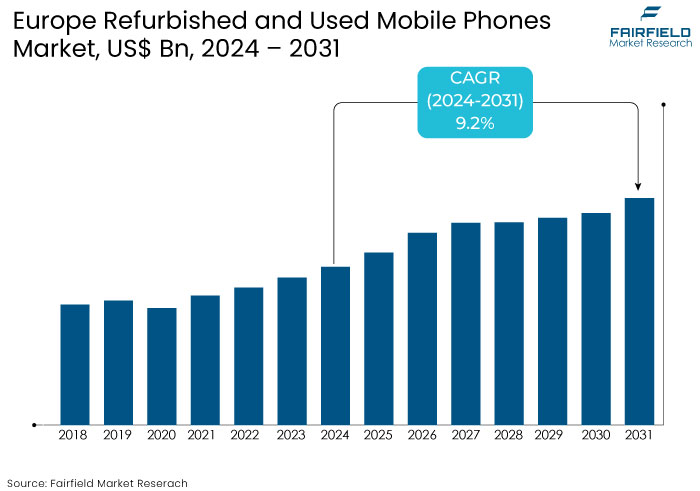

- Europe refurbished and used mobile phones market is projected to be valued at US$ 31.6 Bn by 2031, exhibiting significant growth from the US$ 17.1 Bn achieved in 2024.

- The Europe market for refurbished and used mobile phones is anticipated to show a significant expansion rate with an a CAGR of 9.2% during the forecast period from 2024 and 2031.

Europe Refurbished and Used Mobile Phones Market Insights

- Rising consumer demand for affordable devices and sustainability concerns are driving the Europe refurbished and used mobile phones market.

- Growing awareness of electronic waste and stringent regulations like the EU's WEEE Directive are prompting consumers to choose refurbished products significantly influencing the market's expansion.

- Counterfeit mobile phones challenge consumer trust in refurbished devices, while frequent new model releases with advanced features intensify competition against refurbished offerings.

- Market growth bolstered by advancements in refurbishment technology and acceptance of refurbished products as alternatives to new devices.

- Manufacturer refurbishment initiatives from companies like Apple and Samsung are transforming the market by providing certified refurbished phones that adhere to high-quality standards, boosting consumer trust.

- Germany holds a 26.2% market share in Europe driven by strong sustainability interest, supportive government initiatives, and established online platforms offering certified refurbished devices.

- The growth of e-commerce is reshaping consumer purchasing behaviors, with platforms like Amazon and eBay enhancing access to refurbished mobile phones. It is a trend expected to continue as retail e-commerce expands significantly.

- As new mobile phone prices keep rising, more consumers are opting for refurbished and used phones as a budget-friendly option

A Look Back and a Look Forward - Comparative Analysis

Europe refurbished and used mobile phones market has experienced steady growth, driven by rising consumer demand for affordable devices and sustainability concerns. Historically, the market benefited from increased acceptance of refurbished products, cost savings, and eco-friendly practices.

The market is projected to expand further driven by advancements in refurbishment technology, e-commerce growth, and supportive regulations encouraging circular economies. Challenges include competition from new budget-friendly models and inconsistent quality standards. The focus on sustainability and cost efficiency is estimated to continue to drive market opportunities.

Key Growth Determinants

- Increasing Awareness of Electronic Waste

E-waste, comprising discarded electrical or electronic devices poses a significant environmental challenge for Europe refurbished and used mobile phones market. Growing awareness of its harmful impact has led consumers to favor refurbished electronics over new products. This shift is driven by sustainability initiatives, economic factors, and regulations aimed at reducing e-waste.

In Europe, government efforts like the EU's Waste Electrical and Electronic Equipment (WEEE) Directive mandate proper collection, recycling, and recovery of e-waste. These regulations have prompted manufacturers and retailers to establish take-back programs and refurbishment schemes enhancing the availability of high-quality refurbished electronics.

The issue is particularly pronounced in Europe where it is estimated that 11 out of every 72 household electronic items are broken or unusable. Each year, residents accumulate 4-5 kg of unused electronic products, eventually discarded.

In France, between 54 and 113 million mobile phones weighing 10-20 tonnes are unused and stored in homes. Such figures underscore the urgent need for effective e-waste management and sustainable practices in the refurbished electronics market.

- Affordable Solutions for Price-Conscious Consumers in Europe

Amid economic volatility, consumers are increasingly price-conscious making used phones an attractive alternative to new models. Offering significant savings, refurbished devices appeal to a broad audience from budget-conscious students to eco-minded consumers aiming to reduce e-waste.

The refurbishment process has advanced with companies like Back Market and Reboxed implementing stringent testing procedures to ensure high-quality standards. Major brands like Apple and Samsung also offer certified refurbishment programs boosting consumer trust by providing rigorously tested devices with warranties.

Younger buyers find refurbished phones particularly appealing, with businesses like Back Market and RefurbMe offering certified products at 40–50% lower prices than new models. For example, a refurbished iPhone may cost $150–$400 compared to $800 for a new one.

The COVID-19 pandemic has further accelerated the shift to online shopping expanding the availability of refurbished products on platforms like Amazon and eBay. The outlook for refurbished phones in Europe is promising driven by increased consumer focus on sustainability, cost savings, and responsible digital consumption.

Key Growth Barriers

- Impact of Counterfeit Mobile Phones on the Refurbished Market in Europe

Counterfeit mobile phones often resembling genuine devices, fall short in quality and performance leading to customer dissatisfaction and loss of trust in the refurbished market. A buyer might purchase what appears to be a refurbished iPhone, only to discover poor-quality components and performance issues, harming the reputation of reputable sellers.

The proliferation of fake phones disrupts Europe refurbished and used mobile phones market dynamics, impacting retailers, manufacturers, and consumers. The issue is significant in the mobile phone sector, where buyers increasingly seek cheap options without understanding the risks.

A European Commission report indicates that 5% of imports into the EU are counterfeit with electronics being a leading category. In 2022, 86 million counterfeit items worth over €2 billion were seized, with Italy accounting for a significant share.

China remains the primary source of counterfeit goods, followed by Turkey and Hong Kong. This widespread counterfeiting damages consumer confidence in refurbished products, hurting sales for genuine providers offering quality reconditioned devices at competitive prices.

- Consumer Preferences and the Impact of New Models

Europe refurbished and used mobile phones market faces strong competition from new phones, which frequently feature cutting-edge technology like fast processors and better cameras. Launches such as the iPhone 15 or Samsung Galaxy Z series often draw consumer attention, overshadowing refurbished options.

New phone manufacturers including Apple and Samsung use aggressive marketing offering financing, trade-ins, and discounts to attract buyers. Refurbished phone sellers struggle to compete with these marketing efforts, which dominate social media and advertising.

The European Commission's circular economy report highlights the lack of standardized quality assurance and warranty regulations for refurbished phones resulting in inconsistent quality and reduced consumer confidence. While smartphone replacement cycles have lengthened to every 24-30 months. Concerns about obsolescence and quality continue to challenge the refurbished market’s growth

Refurbished and Used Mobile Phones Market Trends and Opportunities

- Rise of Manufacturer Refurbishment Programs and Subscription Services

Manufacturer refurbishment programs are reshaping Europe refurbished and used mobile phones market by enhancing sustainability and creating business opportunities. Companies like Apple and Samsung offer certified refurbished phones at reduced prices, meeting strict quality standards after thorough testing, repairs, and updates.

Warranties on these devices help reduce the stigma around used electronics appealing to both budget-conscious and environmentally-aware consumers. Apple’s certified refurbished program, for example, provides rigorously tested iPhones with genuine parts and a one-year warranty offering a premium alternative for those unable to afford the latest models.

The growing circular economy benefits as refurbishment programs extend device lifecycles and reduce environmental impact. This shift supports the EU’s sustainability goals driving consumer demand for refurbished products while fostering a market where affordability meets quality. The approach contributes to decreasing e-waste and aligns with circular economy principles in the region.

Mobile subscription services are gaining traction in Europe offering refurbished phones for monthly rental fees. Companies like Grover and Recommerce allow customers to upgrade models without upfront costs attracting young, tech-savvy Europeans. This model supports device reuse and recycling while making technology accessible to more people.

- Rise of e-commerce Remains a Promising Opportunity

The rise of online shopping has reshaped consumer behavior, increasing demand for affordable and sustainable technology. Platforms like Amazon, eBay, and specialized retailers such as Back Market offer a broad selection of refurbished and used mobile phones making it easy for consumers to compare prices and features. This accessibility helps expand the Europe refurbished and used mobile phones market while enabling informed purchasing decisions.

Cost savings are a significant factor driving interest in refurbished devices with models like refurbished iPhones costing up to 50% less than new ones. This is particularly appealing during economic uncertainty as consumers seek budget-friendly alternatives.

With Europe’s retail e-commerce market projected to grow to US$902.3 Bn by 2027, the demand for refurbished mobile phones is set to increase. This trend presents a sustainable and cost-effective option for consumers offering substantial opportunities for businesses in the refurbished technology market to thrive.

Growth of the Circular Economy and Eco-labeling

The circular economy, which emphasizes reducing waste and extending product lifecycles through repair, refurbishment, and recycling is gaining traction in the mobile phones industry. This approach addresses environmental concerns particularly the e-waste generated by discarded electronics, while offering cost-effective alternatives to new devices.

The increasing demand for refurbished phones in Europe reflects consumers' growing awareness of smartphone production's environmental impact. Government policies such as the European Green Deal are key to fostering the Europe refurbished and used mobile phones market.

The "Right to Repair" legislation, adopted in 2021 requires manufacturers to prioritize reparability and provide spare parts for at least ten years supporting longer device lifecycles. The EU's eco-labeling and certification programs further encourage sustainable practices by highlighting repairable smartphones or those made from recycled materials.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario in Europe significantly influences the refurbished and used mobile phones market through a combination of environmental policies and consumer protection laws.

The European Union's focus on sustainability, exemplified by directives such as the Waste Electrical and Electronic Equipment (WEEE) directive encourages the recycling and refurbishment of electronic devices. This not only helps reduce e-waste but also promotes the availability of affordable alternatives for consumers.

By incentivizing responsible disposal and encouraging companies to adopt refurbishment practices, these regulations help create a more robust market for used devices. Additionally, stringent consumer protection laws enhance trust in refurbished products. Regulations ensure that these devices meet specific safety and quality standards, giving consumers confidence in their purchases. T

he General Data Protection Regulation (GDPR) further reinforces this trust by mandating that data is securely wiped from devices before resale, thereby addressing privacy concerns. Together, these regulatory frameworks not only stimulate market growth but also align with broader environmental goals, making refurbished and used mobile phones a more appealing option for consumers looking for cost-effective solutions

Segments Covered in the Report

- Refurbished Phones Lead the Product Category

Refurbished phones continue to dominate the Europe refurbished and used mobile phones market. These serve as the top product category due to their cost advantages and sustainability benefits.

Consumers are increasingly drawn to refurbished phones as a budget-friendly alternative to new models, especially in light of rising living costs and economic uncertainty. These devices offer substantial savings often costing 40–50% less than brand-new phones making them appealing to price-conscious customers.

The refurbished phones market also benefits from the growing emphasis on sustainability and the circular economy across Europe. As awareness of e-waste and resource conservation rises, more consumers are choosing refurbished phones to reduce their environmental footprint.

Advancements in refurbishment processes and quality assurance have improved consumer confidence driving the continued popularity of refurbished phones over other used mobile devices.

Country Analysis

- Germany to Acquire Notable Market Share

Germany holds a notable position in the Europe refurbished and used mobile phones market, accounting for a 26.2% market share. The country's significant market size is driven by several factors including a strong consumer focus on sustainability and cost-effectiveness.

Consumers in Germany are increasingly opting for refurbished phones due to their affordability and reduced environmental impact aligning with the country’s growing emphasis on eco-friendly practices.

Government initiatives promoting the circular economy along with supportive legislation such as the "Right to Repair" laws, have further fueled the demand for refurbished electronics in Germany. Additionally, the presence of established refurbishment companies and online platforms offering certified used devices has made refurbished phones more accessible to consumers. Consequently, boosting their appeal across various customer segments in the country.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe refurbished and used mobile phones market is characterized by a mix of established brands and specialized retailers. Key players like Back Market, Swappie, and Amazon dominate the market offering extensive selections and competitive pricing.

Leading manufacturers such as Apple and Samsung have also entered the refurbished space with official programs enhancing quality assurance and consumer trust. The market growth is fueled by rising consumer demand for affordable and sustainable alternatives prompting continuous innovation and marketing strategies from both retailers and manufacturers to capture market share.

Key Market Companies

- Apple

- Samsung

- Lenovo

- Sony

- OnePlus

- LG

- HTC

- Huawei

- Xiaomi

- Motorola

- Nokia

- Amazon

- QwikFone

- ebay

- Swappie

- FoneGiant

- WeSellTek

- Phoenix Cellular Limited

Recent Industry Developments

- March 2024 -

A Vodafone study reveals that over 52% of Europeans are open to buying refurbished smartphones, with 67% citing affordability as the main reason, and the global second-hand market expected to reach 431 million units by 2027.

An Expert’s Eye

- The growing emphasis on sustainability among consumers is reshaping the Europe refurbished and used mobile phones market. Refurbished devices are increasingly seen as eco-friendly alternatives, driving demand and encouraging brands to adopt circular economy practices.

- Rigorous testing and certification processes are vital in building consumer trust in refurbished phones.

- The surge in online shopping has significantly boosted the refurbished phones market. E-commerce platforms provide consumers with easy access to a diverse range of options, fostering informed purchasing decisions.

- Leading manufacturers like Apple and Samsung are launching their refurbishment programs, ensuring high-quality standards.

- As the refurbished market grows, so does the risk of counterfeit products. Consumer education is crucial to mitigate this issue, helping buyers identify genuine refurbished devices.

Europe Refurbished and Used Mobile Market is Segmented as-

By Product Type

- Refurbished Phones

- Used Phones

By Pricing Range

- Low-Priced Band (Below $200)

- Mid-Priced Band ($200-$400)

- Premium Band (Above $400)

By Sales Channel

- Online

- Offline

- Brick-and-Mortar Stores

- Third-Party Retailers

By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Turkey

1. Executive Summary

1.1. Europe Refurbished and Used Mobile Phones Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Europe Refurbished and Used Mobile Phones Market Outlook, 2019 - 2031

3.1. Europe Refurbished and Used Mobile Phones Market Outlook, by Product Type, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Refurbished Phones

3.1.1.2. Used Phones

3.2. Europe Refurbished and Used Mobile Phones Market Outlook, by Pricing Range, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Low-priced Brands (Less Than US$ 200)

3.2.1.2. Mid-priced Brands (US$ 200 to US$ 500)

3.2.1.3. Premium-priced Brands (More Than US$ 500)

3.3. Europe Refurbished and Used Mobile Phones Market Outlook, by Sales Channel, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Online/e-Commerce

3.3.1.2. Physical Retail Stores

3.3.1.2.1. Organized Retailers

3.3.1.2.2. Unorganized Retailers

3.4. Europe Refurbished and Used Mobile Phones Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

3.5. Europe Nebulizer Devices Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. Germany Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.2. Germany Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.3. Germany Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.4. U.K. Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.5. U.K. Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.6. U.K. Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.7. France Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.8. France Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.9. France Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.10. Italy Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.11. Italy Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.12. Italy Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.13. Turkey Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.14. Turkey Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.15. Turkey Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.16. Russia Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.17. Russia Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.18. Russia Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

3.5.1.19. Rest of Europe Nebulizer Devices Market by Product Type, Value (US$ Mn), 2019 - 2031

3.5.1.20. Rest of Europe Nebulizer Devices Market by Pricing Range, Value (US$ Mn), 2019 - 2031

3.5.1.21. Rest of Europe Nebulizer Devices Market by Sales Channel, Value (US$ Mn), 2019 - 2031

4. Competitive Landscape

4.1. By Product Type vs By Pricing Range Heat map

4.2. Company Market Share Analysis, 2024

4.3. Competitive Dashboard

4.4. Company Profiles

4.4.1. Apple Inc.

4.4.1.1. Company Overview

4.4.1.2. Product Portfolio

4.4.1.3. Financial Overview

4.4.1.4. Business Strategies and Development

4.4.2. Samsung

4.4.2.1. Company Overview

4.4.2.2. Product Portfolio

4.4.2.3. Financial Overview

4.4.2.4. Business Strategies and Development

4.4.3. Google

4.4.3.1. Company Overview

4.4.3.2. Product Portfolio

4.4.3.3. Financial Overview

4.4.3.4. Business Strategies and Development

4.4.4. Lenovo

4.4.4.1. Company Overview

4.4.4.2. Product Portfolio

4.4.4.3. Financial Overview

4.4.4.4. Business Strategies and Development

4.4.5. Huawei

4.4.5.1. Company Overview

4.4.5.2. Product Portfolio

4.4.5.3. Financial Overview

4.4.5.4. Business Strategies and Development

4.4.6. Xiaomi

4.4.6.1. Company Overview

4.4.6.2. Product Portfolio

4.4.6.3. Financial Overview

4.4.6.4. Business Strategies and Development

4.4.7. Motorola

4.4.7.1. Company Overview

4.4.7.2. Product Portfolio

4.4.7.3. Financial Overview

4.4.7.4. Business Strategies and Development

4.4.8. Nokia

4.4.8.1. Company Overview

4.4.8.2. Product Portfolio

4.4.8.3. Financial Overview

4.4.8.4. Business Strategies and Development

4.4.9. Sony

4.4.9.1. Company Overview

4.4.9.2. Product Portfolio

4.4.9.3. Financial Overview

4.4.9.4. Business Strategies and Development

4.4.10. OnePlus

4.4.10.1. Company Overview

4.4.10.2. Product Portfolio

4.4.10.3. Financial Overview

4.4.10.4. Business Strategies and Development

4.4.11. LG

4.4.11.1. Company Overview

4.4.11.2. Product Portfolio

4.4.11.3. Financial Overview

4.4.11.4. Business Strategies and Development

4.4.12. HTC

4.4.12.1. Company Overview

4.4.12.2. Product Portfolio

4.4.12.3. Financial Overview

4.4.12.4. Business Strategies and Development

5. Appendix

5.1. Research Methodology

5.2. Report Assumptions

5.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Pricing Range Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |