Europe Soft Serve Market Forecast

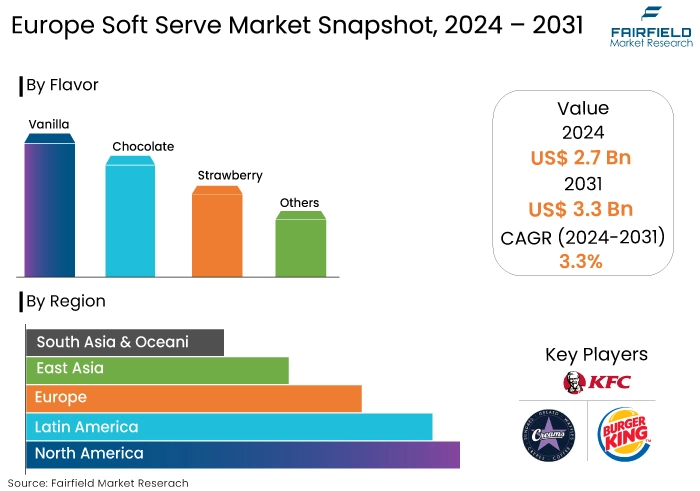

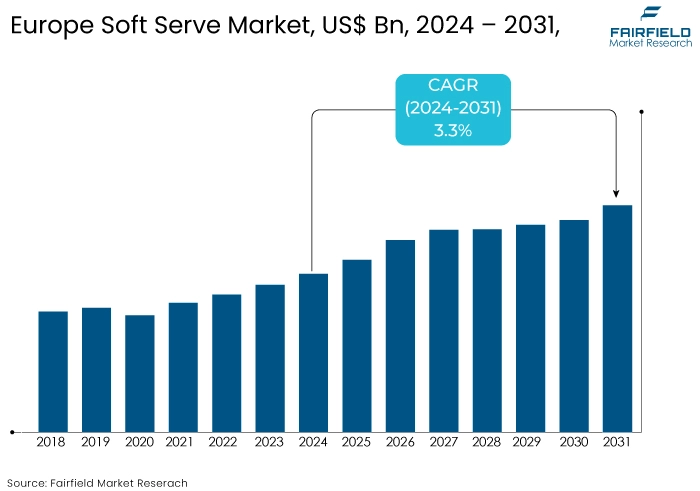

- The market size for Europe soft serve is projected to reach US$3.3 Bn in 2031, showing significant growth from the US$2.7 Bn achieved in 2024.

- The Europe soft serve industry revenue is projected to exhibit a remarkable expansion rate, with an estimated CAGR of 3.3% from 2024 to 2031.

Europe Soft Serve Market Insights

- The Europe soft serve market experienced significant growth during the historical period from 2019 to 2023, reaching US$2.6 Bn in 2023.

- The market value is expected to reach US$3.3 Bn by 2031, at a CAGR of 3.3% from 2024 to 2031.

- The increasing demand for healthy and innovative soft serve options influences the market growth.

- Soft-serve ice cream has gained immense popularity among consumers of all age groups due to its smooth and creamy texture.

- The proliferation of quick-service restaurants, cafes, and dessert parlors has created a vast distribution network for soft serve products.

- The variety of flavors and creative toppings are driving the industry's growth in Europe.

- Increased consumer demand for frozen treats is one of the key market driving element.

- Rapid expansion of food service outlet businesses globally helps the market’s growth.

- Growing health consciousness among people caters to the market growth over the forecast period.

- The rapid adoption of e-commerce platforms in food industry is aiding the market’s revenue generation.

A Look Back and a Look Forward - Comparative Analysis

The Europe soft serve market experienced significant growth and witnessed notable trends in past years. As per the Fairfield’s industry assessment, the market size in 2019 was US$2.3 Bn. Over the next four years, the market experienced steady growth, reaching US$2.6 Bn in 2023.

The market growth is driven by factors such as increasing consumer preference for frozen desserts, rising disposable incomes, and the growing popularity of soft serve as a refreshing treat.

Soft-serve machines became more accessible, and a wide range of flavors and toppings were introduced to cater to diverse consumer preferences. Additionally, the market benefited from the expansion of food service chains and the rising demand for on-the-go desserts.

The Europe soft serve market research report shows an upward trajectory post-2024. The market value is expected to reach from US$2.7 Bn in 2024 to US$3.3 Bn by 2031, with a CAGR of 3.3% from 2024 to 2031.

The market was influenced by the increasing demand for healthier and more innovative soft serve options, including dairy-free, vegan, and low-sugar alternatives.

Consumers became more conscious of their dietary choices and sought out soft serve products that aligned with their preferences and dietary restrictions.

The market also saw an emphasis on premium and artisanal soft serve offerings, with gourmet flavors and unique toppings gaining popularity. These market trends are playing a significant role in boosting the demand, as consumers sought photogenic and shareable soft serve creations.

Key Growth Determinants

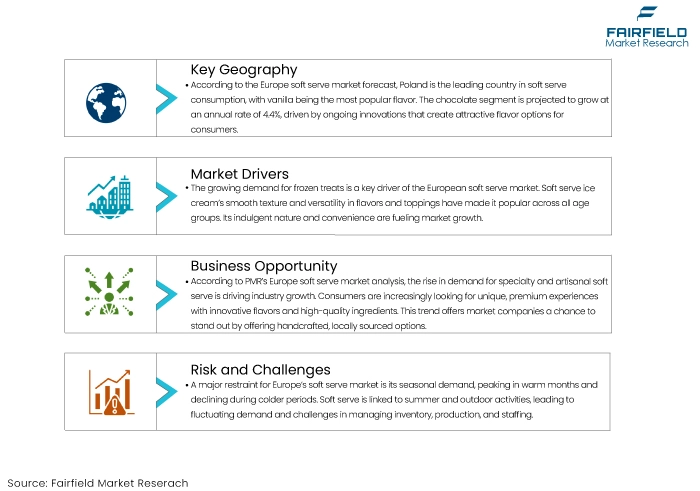

- Increasing Consumer Demand for Frozen Treats

One of the key drivers fueling Europe soft serve market demand is the increasing consumer demand for frozen treats. Soft serve ice cream, with its smooth and creamy texture, has gained immense popularity among consumers of all age groups. The indulgent and refreshing nature of soft serve appeals to a wide range of consumers, making it a sought-after dessert option.

Soft serve offers versatility in terms of flavors, toppings, and customization options as consumers seek out unique and novel experiences. This growing consumer demand for frozen treats, coupled with the convenience and accessibility of soft serve options, is driving the market's growth.

- Expansion of Foodservice Outlets

The expansion of food service outlets across Europe is another significant growth driver for the market. The proliferation of quick-service restaurants, cafes, and dessert parlors has created a vast distribution network for soft serve products. These establishments recognize the popularity of soft serve among consumers and have incorporated it into their menus as a staple dessert offering.

The increased availability of soft serve in various food service outlets has contributed to boost in the Europe soft serve market shares by ensuring wider accessibility and great market penetration. Additionally, the increasing trend of on-the-go consumption and the rising demand for convenience has further fueled the expansion of food service outlets, thereby supporting the growth of the soft-serve market.

- Innovation in Flavors and Toppings

Innovation in flavors and toppings is driving the growth of the Europe soft serve market revenue. Soft serve manufacturers and food service outlets are constantly introducing new and exciting flavors to cater to evolving consumer preferences.

From classic flavors like vanilla and chocolate to unique options like matcha, salted caramel, and exotic fruit flavors, the variety of soft serve flavors available continues to expand. Moreover, creative and eye-catching toppings such as sprinkles, sauces, candies, and fresh fruits enhance the visual appeal and taste of soft serve, making it even more enticing for consumers.

The continuous innovation in flavors and toppings not only attracts new customers but also encourages purchases, driving the growth of the soft serve industry in Europe.

Key Growth Barriers

- Seasonal Demand and Weather Conditions

One of the key restraints affecting Europe soft serve market sales is the seasonal demand and weather conditions. Soft serve is primarily consumed during warm months and is often associated with summer and outdoor activities. As a result, the demand for soft serve experiences fluctuations throughout the year, with peak demand during the summer season.

The demand for soft serve decreases significantly during colder months or in regions with harsh winters. This seasonality poses a challenge for businesses operating in the soft serve market in Europe, as they need to manage inventory, production, and staffing levels accordingly.

Adverse weather conditions, such as heavy rainfall or prolonged periods of cold weather, can further impact the demand for soft serve, leading to a restraint in market growth.

- Increasing Health Consciousness and Dietary Restrictions

The increasing health consciousness among consumers and the rise in dietary restrictions pose another growth restraint for the Europe soft serve market value. As consumers become more aware of the impact of their food choices on their health, there is a growing demand for healthier alternatives, including desserts.

Soft serve, traditionally associated with indulgence and high sugar content, may face challenges in meeting the evolving dietary preferences of health-conscious consumers. Moreover, individuals with dietary restrictions, such as lactose intolerance or vegan diets, may be limited in their options when it comes to soft serve. These factors can restrain the growth of the soft serve market as consumers seek out healthier and more inclusive dessert alternatives.

Europe Soft Serve Market Trends and Opportunities

- Growing Demand for Specialty and Artisanal Soft Serve

As per Fairfield Market Research's Europe soft serve market analysis, the increasing demand for specialty and artisanal soft serve is a prominent trend fueling industry expansion. Consumers are seeking unique and premium soft serve experiences that go beyond traditional flavors and toppings. This trend is driven by the desire for more indulgent and high-quality desserts.

Artisanal soft serve offers a handcrafted approach, often using locally sourced ingredients and innovative flavor combinations. This growing demand for specialty and artisanal soft serve presents an opportunity for market companies to differentiate themselves in the market.

- Expansion of E-commerce and Online Platforms

The expansion of e-commerce and online platforms presents significant Europe soft serve market opportunities. E-commerce platforms provide an avenue for businesses to reach a broader customer base and expand their market reach beyond physical locations.

Online platforms allow for direct-to-consumer sales, enabling the Europe soft serve market players to establish their brand presence and build customer loyalty. By leveraging e-commerce and online platforms, soft-serve businesses can tap into the growing trend of online food delivery and capitalize on convenience-driven consumer behavior.

How is Regulatory Scenario Shaping this Industry?

The regulatory scenario is shaping the Europe soft serve market growth through the implementation of new regulations and acts. The Digital Markets Act (DMA) and the Digital Services Act (DSA) have been enacted to address the challenges posed by the rapid development in the digital and technology sectors.

Acts aim to create a safe digital space and protect the fundamental rights of users of digital services. Additionally, the recommendation on relevant markets sets out predefined markets susceptible to regulation, allowing for the imposition of remedies to address market failures. These regulatory measures help to ensure a level playing field and focus regulatory intervention where significant market failures persist.

The regulatory landscape plays a crucial role in shaping the market expansion by promoting fair competition, protecting consumer rights, and fostering innovation in the industry.

Segment Covered in the Report

Top Segments

- Vanilla Soft Serve Leads the Market with its Crowd-Pleasing Dessert Staple

The Europe soft serve market overview shows that Vanilla soft serve is a favorite among all age groups, with a projected segment value of US$ 669 million in 2024 exhibiting a 3.4% CAGR growth rate from 2024 to 2031, reaching a projected value of US$ 953 million.

Its mild and sweet profile appeals to children and adults alike, and its versatility makes it a perfect accompaniment to pies, cakes, and pastries. Being the standard offering in most establishments, its consistent availability makes it a convenient and popular choice, driving its demand.

Country Analysis

- Poland Looms the Market Growth Through Vanilla Flavor Reigns Supreme

As per Europe soft serve market forecast, Poland leads in soft serve consumption, with vanilla as the preferred flavor. The chocolate segment is expected to grow at a 4.4% annual rate, thanks to constant innovation in creating appealing flavors for customers. Manufacturers continue to develop new offerings to cater to consumer preferences.

- Germany Rules the Market Through Quick-Service Restaurants and Increasing Consumption

The Europe soft serve market update shows that Germany dominates the European market with a 40% share in 2023, with soft serve demand reaching US$ 961.5 million in 2022.

Quick-service and full-service restaurants are expected to contribute significantly, estimated at US$ 409.8 million in 2023. This segment is projected to grow at a 4% CAGR until 2033. The popularity of soft serve in Germany can be attributed to its easy production and consumption, catering to the fast-paced lifestyles of consumers.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the Europe soft serve market entails comprehending market dynamics, identifying competitors, and evaluating their strategies and positions. This analysis aids in understanding the market environment and the positioning of various players.

By scrutinizing competitors' strategies, strengths, and weaknesses, companies can refine their own product strategies and marketing initiatives to achieve a competitive advantage.

Key Market Companies

- Burger King

- Creams Franchising Ltd.

- Flat Iron

- KFC

- Korean Dinner Party

- MAX Burgers AB.

- McDonald’s

- Mister Softee UK

- MrWhippy

- Vegan Softice

- Wendy’s

Recent Industry Developments

- In April 2024, McDonald's has introduced the Remix Menu, a new menu featuring items that blend popular components in innovative ways, resulting in fresh offerings. Notable creations include the Chicken Cheeseburger, Sweet Chili Junior Chicken sandwich, Surf N' Turf Burger, and Apple Pie McFlurry. The menu features four mash-up classics: Chicken Cheeseburger, Surf 'N Turf Burger, Junior Chili Sweet Chili Chicken, and Apple Pie McFlurry. Following the announcement, social media platforms saw a surge in user engagement, with one fan expressing excitement about trying the Apple Pie McFlurry with the chicken cheeseburger.

- In May 2024, Flora Professional has introduced a plant-based ice cream mix to cater to diverse dietary preferences and allergens. The one-to-one replacement offers a smooth texture, rich flavor, and indulgent mouthfeel. It serves as a base for soft serve and gelato creations, offering options like chocolate, vanilla, strawberry, and stroopwafel. Flora Professional's plant-based ice cream mix aligns with ESG commitments.

An Expert’s Eye

- Experts highlight a steady growth in the Europe soft serve market, driven by increasing consumer preference for low-fat and healthier dessert options.

- The rise of artisanal and gourmet soft-serve products is a significant trend, with consumers interested in unique flavors and high-quality ingredients.

- Innovations such as automated soft serve machines and mobile dispensing units are becoming popular, catering to the demand for convenience and mobility.

- Experts note a shift toward health-conscious consumption, with consumers favoring soft serve options that offer nutritional benefits, such as probiotic and fortified versions.

- Opportunities lie in expanding into emerging markets, developing new product lines, and leveraging digital marketing strategies to engage younger consumers.

Europe Soft Serve Market is Segmented as

By Flavor

- Vanilla

- Chocolate

- Strawberry

- Others

By Region

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Rest of Middle East & Africa

1. Executive Summary

1.1. Europe Soft Serve Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Europe Soft Serve Market Outlook, 2019 - 2031

3.1. Europe Soft Serve Market Outlook, by Flavor, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Physical Exam

3.1.1.2. Laboratory Tests

3.1.1.3. Imaging Tests

3.1.1.3.1. Mammogram or X-Ray

3.1.1.3.2. Breast Magnetic Resonance Imaging (MRI)

3.1.1.4. Genetic Tests

3.2. Europe Soft Serve Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Research Labs

3.2.1.2. Cancer Institutes

3.2.1.3. Diagnostic Centres

3.2.1.4. Others

3.3. Europe Soft Serve Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Europe

4. Europe Soft Serve Market Outlook, 2019 - 2031

4.1. Europe Soft Serve Market Outlook, by Flavor, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Vanilla

4.1.1.2. Chocolate

4.1.1.3. Strawberry

4.1.1.4. Other Flavors

4.2. Europe Soft Serve Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Quick-Service Restaurants (QSRs) & Full-Service Restaurants (FSRs)

4.2.1.2. Ice Cream Parlors, Trucks, and Vans

4.2.1.3. Amusement Parks/Malls/Multiplexes

4.2.1.4. Vending Machines/Self-Service Kiosks

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. Europe Soft Serve Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Germany Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.2. Germany Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.3. U.K. Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.4. U.K. Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.5. France Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.6. France Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.7. Italy Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.8. Italy Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.9. Turkey Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.10. Turkey Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.11. Russia Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.12. Russia Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.1.13. Rest of Europe Europe Soft Serve Market by Flavor, Value (US$ Bn), 2019 - 2031

4.3.1.14. Rest of Europe Europe Soft Serve Market by Distribution Channel, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Competitive Landscape

5.1. Manufacturer vs by Distribution Channel Heatmap

5.2. Company Market Share Analysis, 2024

5.3. Competitive Dashboard

5.4. Company Profiles

5.4.1. Burger King

5.4.1.1. Company Overview

5.4.1.2. Product Portfolio

5.4.1.3. Financial Overview

5.4.1.4. Business Strategies and Development

5.4.2. Creams Franchising Ltd.

5.4.2.1. Company Overview

5.4.2.2. Product Portfolio

5.4.2.3. Financial Overview

5.4.2.4. Business Strategies and Development

5.4.3. Flatiron

5.4.3.1. Company Overview

5.4.3.2. Product Portfolio

5.4.3.3. Financial Overview

5.4.3.4. Business Strategies and Development

5.4.4. KFC

5.4.4.1. Company Overview

5.4.4.2. Product Portfolio

5.4.4.3. Financial Overview

5.4.4.4. Business Strategies and Development

5.4.5. Korean Dinner Party

5.4.5.1. Company Overview

5.4.5.2. Product Portfolio

5.4.5.3. Financial Overview

5.4.5.4. Business Strategies and Development

5.4.6. MAX Burgers AB.

5.4.6.1. Company Overview

5.4.6.2. Product Portfolio

5.4.6.3. Financial Overview

5.4.6.4. Business Strategies and Development

5.4.7. McDonald's

5.4.7.1. Company Overview

5.4.7.2. Product Portfolio

5.4.7.3. Financial Overview

5.4.7.4. Business Strategies and Development

5.4.8. Mister Softee UK

5.4.8.1. Company Overview

5.4.8.2. Product Portfolio

5.4.8.3. Financial Overview

5.4.8.4. Business Strategies and Development

5.4.9. MrWhippy

5.4.9.1. Company Overview

5.4.9.2. Product Portfolio

5.4.9.3. Financial Overview

5.4.9.4. Business Strategies and Development

5.4.10. Vegan Softice

5.4.10.1. Company Overview

5.4.10.2. Product Portfolio

5.4.10.3. Financial Overview

5.4.10.4. Business Strategies and Development

5.4.11. Wendy's

5.4.11.1. Company Overview

5.4.11.2. Product Portfolio

5.4.11.3. Financial Overview

5.4.11.4. Business Strategies and Development

6. Appendix

6.1. Research Methodology

6.2. Report Assumptions

6.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Flavor Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |