Exfoliating Serum Market Growth Forecast

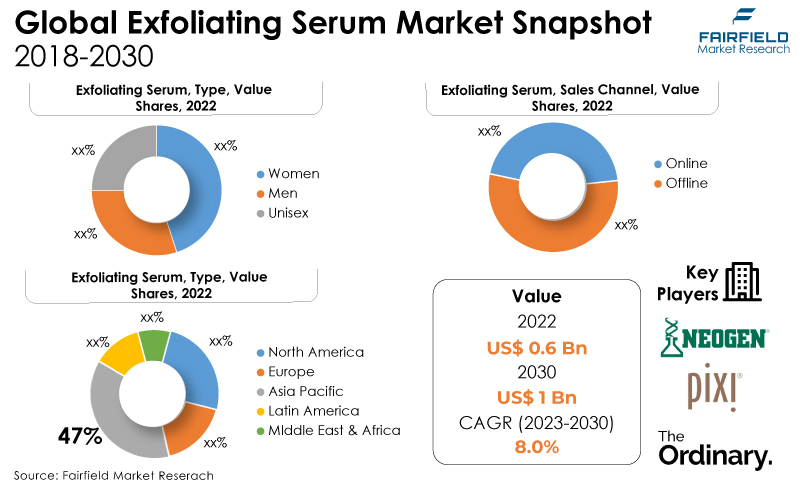

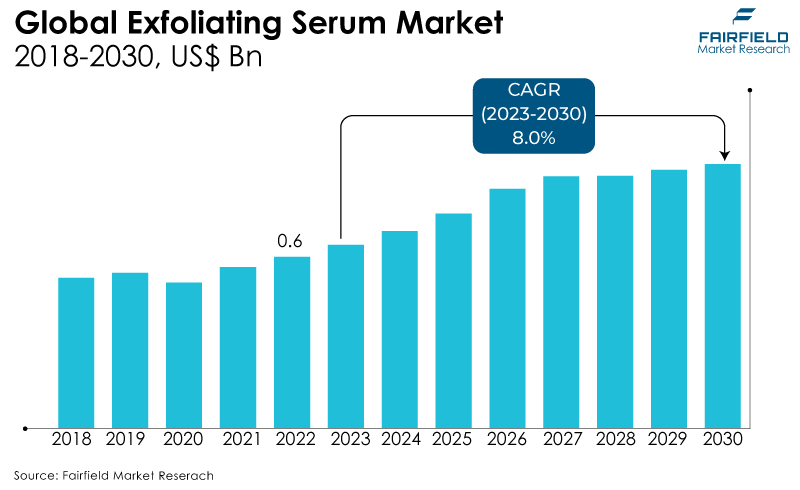

- Global market for exfoliating serum that was worth US$0.6 Bn in 2022 to reach the mark of US$ 1 Bn by 2030

- Market valuation to expand at a CAGR of 8.3% between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the exfoliating serum market growth is customers, especially millennials, who value cost and convenience and are demanding more home-use exfoliating face serum kits.

- Another major market trend expected to fuel the exfoliating serum market growth is the rising importance of skin health among men and women.

- Brands of cosmetics that incorporate animal testing are less popular. It motivates companies to introduce cruelty-free product lines to maintain market share.

- The availability of inexpensive alternatives and the predicted overprice of branded goods will likely restrain the market's expansion for exfoliating serum during the forecast period.

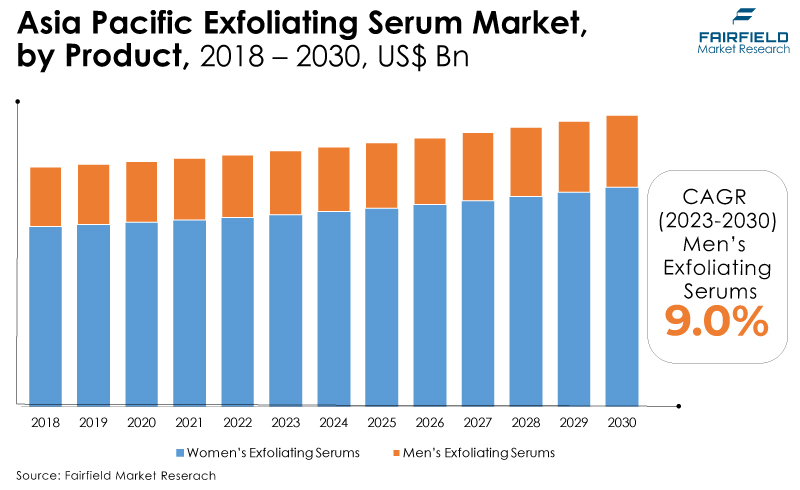

- In 2022, the women’s exfoliating serums segment category dominated the industry. To improve their self-confidence and appearance, women increasingly incorporate personal grooming products into their daily routines, which has greatly accelerated the segment's growth.

- In terms of market share for exfoliating serum globally, the offline segment is anticipated to dominate. All clients should use offline channels because they offer significant advantages, including choice, lower prices, and excellent visibility of global brands.

- The market for exfoliating serum is anticipated to be dominated by the Asia-Pacific region. It is projected that the expansion of the chemical industry in China, and India, both of which get government assistance, would guarantee continued access to raw materials for manufacturers of skincare products and, as a result, have a favourable effect on the Asia Pacific market during the projection period.

- The market for exfoliating serum is expanding in North America. Customers in North American countries like the U.S. and Canada are willing to shell out a lot of cash for skin that shines and appears more youthful.

Current, Historical, and Futuristic Analysis

The primary drivers influencing the global exfoliating serum market are an increase in disposable income, a lifestyle change, and an increase in product introductions to meet the rising consumer demand. The influence of viral content producers and the rise of organic skin care trends have contributed significantly to the market growth for exfoliating serum.

The market witnessed staggered growth during the historical period 2018 – 2022. Over the past few years, the exfoliating serum industry has significantly shifted towards natural and organic goods. The demand for organic and natural exfoliating serum has increased as consumers' awareness of their health and worries about environmental sustainability have grown. Products that are eco-friendly, sustainably made, vegan, organic, and organically created were increasingly found in consumers' exfoliating serums.

High consumer expectations and the rising requirement for quick delivery have driven e-retailers to employ operational innovations for swift order fulfillment and to maintain market competitiveness. This presents a big opportunity for the exfoliating serum to gain quick traction in the online retail market in the ensuing years. Because of the growing appeal of K-beauty, many consumers have expressed a strong interest in Korean exfoliating serum and will be eager to try Korean exfoliating serum.

Key Growth Determinants

- Rising Fashion and Cosmetic Industry

The major driver of the rising demand for exfoliating serum is the informed consumer's emphasis on facial beauty and wellness. Numerous academics have predicted that the global cosmetics industry is expanding rapidly.

The global market for cosmetics expanded by more than 15% in 2022 compared to the previous year. One of the key reasons for skin issues is rising pollution, which also negatively affects the skin, along with an improper diet and rising stress levels.

Additionally, increasing pollution and increased skin-related issues like acne, spots, and wrinkles on the face are predicted to increase demand for exfoliating serum.

- Increasing Beneficial Awareness of Facial Serum

One of the main advantages of exfoliating serum is that it has components that actively moisturise the skin. The component of the facial moisturizer that maintains skin moisturised, silky, and smooth is hyaluronic acid.

Anti-inflammatory components in exfoliating serum help to calm skin that has sensitive areas. Exfoliating serums, especially those with skin-lightening chemicals, help remove skin imperfections.

The serum's antioxidants, Vitamin C, retinol, resveratrol, and other active ingredients fight wrinkles, fine lines, and other ageing-related symptoms.

Additionally, the market is blooming due to the accessibility of exfoliating serum through various sales channels, including department shops, hypermarkets, supermarkets, retail outlets, and online sales channels.

- Expanding Urban Population

Immigration is a major contributor to population expansion in a region. Many people are forced to relocate to metropolitan areas for employment, education, and housing.

The number of urban residents is rising globally due to the growing working-class population. The metropolitan populace is comparatively more concerned with their appearance and fashion sense.

Additionally, the working class in these urban areas constantly aspires to distinguish themselves by their personalities, which gives them self-confidence and, inadvertently, a reputation in society. As a result, the urban population is becoming increasingly conscious of proper skincare practices and products.

Major Growth Barriers

- Availability of Counterfeit Serum

In the cosmetics sector, counterfeiting is a widespread practice. Numerous fraudulent organisations produce or package fake goods using the name, logo, and packaging of well-known brands to defraud customers and profit.

Products that are counterfeited have much lower quality requirements than genuine products. However, with a far smaller budget and little awareness, such bogus businesses can entice a certain population segment. Even the skin is seriously harmed by these fake products.

- Increasing Number of Domestic and Niche Brands

The product adoption periods of reputable suppliers are frequently prolonged by cost-effectiveness and customer loyalty. Domestic companies continue to be heavily patronised since they are seen to understand local consumers' needs, preferences, skin types, and related problems better.

As a result, they continue to receive a lot of business, which forces many established brands to compete for shelf space at important specialty shops, hypermarkets, and supermarkets.

Key Trends and Opportunities to Look at

- Natural and Organic Exfoliating Face Serums

The global surge in interest in health and well-being has also impacted the cosmetics and personal care industries. Since customers are making more conscientious purchases, natural and organic items are becoming significant product categories in the market.

Additionally, to meet the demands of the rising number of consumers who avoid products with synthetic ingredients, manufacturers are creating natural and organic cosmetics items.

For example, the Maine Chaga Age-Defying Face Serum employs a novel fungus formula rich in antioxidants and amino acids. The recipe also contains melanin and betulin, which are not often found in vitamin C serums.

- Home-Use Exfoliating Face Serum

According to data provided by an e-commerce company, there has been a huge increase in demand for homemade skincare goods during the pandemic, with more customers being concerned about practicing self-care.

Aloe vera has emerged as the season's favourite, with consumers searching for homemade aloe vera-based products twice as frequently as last year.

According to the report, the sale of products such as homemade aloe vera gel, handcrafted soaps, moisturizers, shampoo, and aloe vera juice, powder, and capsules has also been a commensurate increase.

- Innovative Packaging Solutions

To market cosmetics, manufacturers rely heavily on advertising through various platforms. Innovation in packaging is essential for drawing customers, which will affect the overall expansion of the exfoliating serum industry over the coming years.

To gain a competitive edge, the exfoliating serum industry has seen a surge in new entrants and product and packaging innovation. Businesses have also started to concentrate on the middle-class consumer market. This has led to corporations introducing compact packaging for their products, influencing the industry's demand.

How Does the Regulatory Scenario Shape this Industry?

Over the last three years, cosmetic industry standards have focused on consumer skin health. Cosmetics are governed by many regulatory agencies worldwide, each with its own set of rules and regulations.

Although cosmetic product rules are increasingly harmonised to decrease international trade barriers, there are still significant variances to consider when marketing or selling cosmetics in key countries worldwide.

Drugs and Cosmetics Rules 1945 and Act 1940, as well as Labelling Declarations issued by the Bureau of Indian Standards (BIS), govern cosmetic items in India. BIS establishes cosmetics standards for products included in Schedule 'S' of the Cosmetics and Drugs Rules 1945.

Cosmetic items are not subject to pre-market review in the United States, and companies are not required to submit product information or register cosmetic production enterprises.

On the other hand, manufacturers and distributors of cosmetics may voluntarily submit information about their goods through the Food and Drug Administration's (FDA) Voluntary Cosmetic Registration Programme (VCRP).

Fairfield’s Ranking Board

Top Segments

- Women’s Exfoliating Serums Continue to Dominate over Men’s

The women’s exfoliating serums segment dominated the market in 2022. Women increasingly incorporate personal grooming items into their daily routines to boost their confidence and attractiveness, driving sector growth. Furthermore, the growing prominence of self-care has led women to consciously construct calming self-care experiences at home through complicated skincare routines.

Furthermore, the unisex exfoliating serums category is projected to experience the fastest market growth. Growing male awareness of regular grooming and personal hygiene, greater product launches, celebrity endorsements, and rising disposable income drive the segment's growth.

Men's skin care product preferences are shifting away from traditional grooming goods like deodorants, razors, and face wash and towards more specialised skincare products like anti-ageing and sun protection lotions.

- Offline Channel Will Surge Ahead

In 2022, the offline channel dominated the industry. The key element contributing to the significant market share is consumers' strong preference for offline retail stores selling cosmetics.

The easy availability of cosmetics and personal care goods in brick-and-mortar retail venues such as department stores, specialty-multi retailers, and salons and spas increased sales in the offline channel sector.

The online channel is anticipated to grow substantially throughout the projected period. The rise of the e-commerce sector in developing economies is a significant driver of market growth. Online buying for cosmetics is growing increasingly popular in China, and India.

Furthermore, the industry is expected to have lots of opportunities soon due to the growing link between large e-commerce corporations and makers of cosmetic goods in emerging nations.

Regional Frontrunners

Asia Pacific Contributes the Maximum Share

In the forecast period, exfoliating serum adoption is anticipated to dominate in the Asia Pacific region. The development of the chemical industry in China, and India, both of which get government assistance, would guarantee ongoing access to raw materials for manufacturers of exfoliating serum products and, as a result, have a favourable effect on the Asia Pacific market over the projection period.

China is one of the primary countries aiding the global market for exfoliating serum in terms of consumption and production. Because of the Western lifestyle and use of beauty products, the Asia Pacific region's working women population is increasing, which promotes market growth. Furthermore, several government initiatives are increasing the country's demand for exfoliating serum.

North America Set for Significant Growth in Sales

Consumers in North American nations like the US, and Canada are willing to pay more for skin that is more radiant and youthful looking. Rising consumer demand for specialised skin care treatments and increased awareness of certain substances are projected to drive demand for exfoliating serum.

Exfoliating serum demand is projected to be supported by the presence of well-known product producers in North America, including Procter & Gamble and Unilever, as well as growing retail infrastructure. Environmentally friendly exfoliating serum developments are increasing market expansion potential.

Fairfield’s Competitive Landscape Analysis

The exfoliating serum industry is concentrated with few significant companies present worldwide. The major firms are launching new items and enhancing their distribution networks to increase their global footprint. In addition, Fairfield Market Research anticipates that there will be further market consolidation during the next few years.

Who are the Leaders in Global Exfoliating Serum Space?

- Pixi Beauty

- l.f. Cosmetics

- Amorepacific Corporation

- First Aid Beauty

- Drunk Elephant

- Sunday Riley

- THE ORDINARY

- Paula’s Choice

- Neogen

- Biologique Recherche

- Dermalogica

- Farmacy Beauty

- REN Clean Skincare

- Kate Somerville

- TATCHA

Significant Company Developments

Acquisition Agreement

- June 2021: Unilever announced the acquisition of the premier digital-led skincare brand Paula's Choice from TA Associates. Paula's Choice is a forerunner in the field of science-backed products and direct-to-consumer (DTC) e-commerce. Paula Begoun founded the business in 1995, and it is known for its industry-leading innovation, simple jargon-free science, high-performing ingredients, and cruelty-free products.

Product Launches

- September 2022: Raw Beauty Wellness announced the launch of a new line of vegan skincare and haircare products including an eye serum, exfoliating serum, leave in hair serum, prebiotic gel deodorant, lip oil, and antioxidant serum, as the gender neutral personal care brand expands its product offering.

- July 2021: Shiseido Co. Ltd. has announced the Japanese release of ULTIMUNE Power Infusing Concentrate III. The serum is a revitalisation of the classic serum ULTIMUNE Power Infusing Concentrate N, with a new upgraded recipe and packaging. The items will be offered in Japan at around 380 locations, mostly department stores, and on Shiseido's complete beauty website "Watashi Plus."

- October 2020: Amway India offered customised skincare solutions with the launch of Artistry Signature Select Personalised Serum. Artistry's new launch marks the company's foray into the personalised skincare market in India, where it is the indisputable No. 1 premium skincare brand. Globally, the product has had a great response from consumers in terms of meeting many skincare needs, and Amway anticipates a similar trend in the Indian market.

Distribution Agreement

- May 2021: Estee Lauder Companies has partnered with Uber Eats to deliver cosmetic products in conjunction with meal orders. For now, only two of its brands, Jo Malone and Origins, have items available for delivery via Uber Eats in 20 cities across the United States. It's a pilot program that, if successful, might be expanded to other American brands.

- June 2021: Following the success of its NX NIVEA Accelerator in Seoul, South Korea, Beiersdorf is bringing the program to Shanghai, China, and has already chosen the top five firms for the first cohort. NX NIVEA was created in Korea as Beiersdorf's first global beauty business accelerator and has subsequently risen to the top of the Korean market. The accelerator program promotes and grows indie brands and beauty tech businesses that share Beiersdorf's vision of shaping, creating, and delivering the future of skin care to customers.

An Expert’s Eye

Market Demand and Future Growth

As per Fairfield’s Analysis, an increase in skin conditions such as acne, pimples, open pores, and blackheads is driving the market. The rising demand for working women may result in a growth in exfoliating serum, whereas the ease of availability of exfoliating serum in brick-and-mortar stores and the expanding cosmetic e-commerce sector is favoured in large quantities, increasing the need for exfoliating serum.

Furthermore, technological developments have greatly aided the growth and development of various exfoliating serums. However, the exfoliating serum market is expected to face considerable challenges because of the local manufacturers and the increased counterfeiting.

Supply Side of the Market

According to our analysis, exfoliating serum producers are concentrating on improving product quality by releasing new items that will aid end users in working more effectively and efficiently.

Exfoliating serum producers are working on natural and organic exfoliating serum as their demand is increasing because of the growing demand for organic and plant-based goods, the growing popularity of natural cosmetics in mainstream retail channels, and the growing consumer knowledge of the advantages of employing natural components.

Many businesses are also developing eco-friendly packaging in response to growing environmental concerns. The packaging of exfoliating serum may entail using eco-friendly materials and optimising package designs to save waste.

Global Exfoliating Serum Market is Segmented as Below:

By End User

- Women

- Men

- Unisex

By Sales Channel

- Online

- Offline

By Application

- Hyperpigmentation

- Acne-prone skin

- Sensitive skin

- Anti-ageing

- Skin Brightening

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of Middle East & Africa

1. Executive Summary

1.1. Global Cycling Helmet Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value/Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Cycling Helmet Market Outlook, 2018 - 2030

3.1. Global Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Road Helmet

3.1.1.2. Sports Helmet

3.1.1.3. MTB Helmet

3.1.1.4. Others

3.2. Global Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Daily Transportation

3.2.1.2. Sports/ Adventure

3.2.1.3. Recreation

3.2.1.4. Misc.

3.3. Global Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Men

3.3.1.2. Women

3.4. Global Cycling Helmet Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Cycling Helmet Market Outlook, 2018 - 2030

4.1. North America Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Road Helmet

4.1.1.2. Sports Helmet

4.1.1.3. MTB Helmet

4.1.1.4. Others

4.2. North America Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Daily Transportation

4.2.1.2. Sports/ Adventure

4.2.1.3. Recreation

4.2.1.4. Misc.

4.3. North America Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Men

4.3.1.2. Women

4.4. North America Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Cycling Helmet Market Outlook, 2018 - 2030

5.1. Europe Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Road Helmet

5.1.1.2. Sports Helmet

5.1.1.3. MTB Helmet

5.1.1.4. Others

5.2. Europe Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Daily Transportation

5.2.1.2. Sports/ Adventure

5.2.1.3. Recreation

5.2.1.4. Misc.

5.3. Europe Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Men

5.3.1.2. Women

5.4. Europe Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Cycling Helmet Market Outlook, 2018 - 2030

6.1. Asia Pacific Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Road Helmet

6.1.1.2. Sports Helmet

6.1.1.3. MTB Helmet

6.1.1.4. Others

6.2. Asia Pacific Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Daily Transportation

6.2.1.2. Sports/ Adventure

6.2.1.3. Recreation

6.2.1.4. Misc.

6.3. Asia Pacific Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Men

6.3.1.2. Women

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Cycling Helmet Market Outlook, 2018 - 2030

7.1. Latin America Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Road Helmet

7.1.1.2. Sports Helmet

7.1.1.3. MTB Helmet

7.1.1.4. Others

7.2. Latin America Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Daily Transportation

7.2.1.2. Sports/ Adventure

7.2.1.3. Recreation

7.2.1.4. Misc.

7.3. Latin America Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Men

7.3.1.2. Women

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Cycling Helmet Market Outlook, 2018 - 2030

8.1. Middle East & Africa Cycling Helmet Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Road Helmet

8.1.1.2. Sports Helmet

8.1.1.3. MTB Helmet

8.1.1.4. Others

8.2. Middle East & Africa Cycling Helmet Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Daily Transportation

8.2.1.2. Sports/ Adventure

8.2.1.3. Recreation

8.2.1.4. Misc.

8.3. Middle East & Africa Cycling Helmet Market Outlook, by End-User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Men

8.3.1.2. Women

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Cycling Helmet Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Cycling Helmet Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Cycling Helmet Market by Application, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Cycling Helmet Market by End-User, Value (US$ Mn), 2018 - 2030

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Polisport Group

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Vista Outdoor Operations LLC

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Specialized Bicycle Components, Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. UVEX WINTER HOLDING GmbH and Co. KG

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Trek Bicycle Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. MET -Helmets

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Limar Srl

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Tiivra

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Lazer

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Business Strategies and Development

9.4.10. Hexr

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Nox Cycles

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. BMZ Group

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Tocsen

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. SCOTT Sports SA

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Giant Bicycle India

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

End User Coverage |

|

|

Sales Channel Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |