Global Facility Management Market Forecast

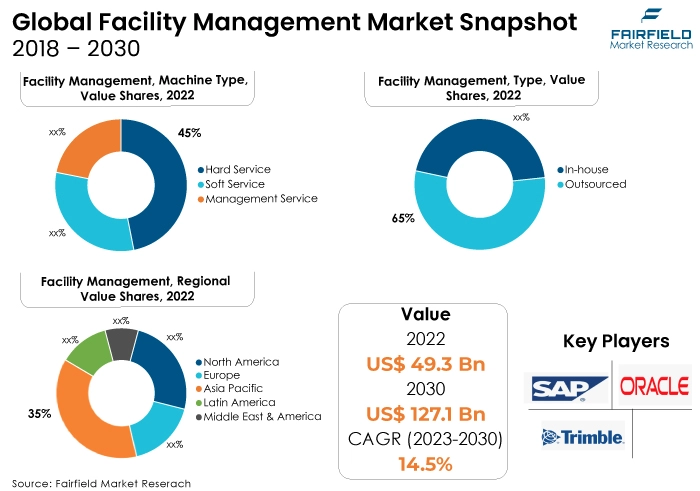

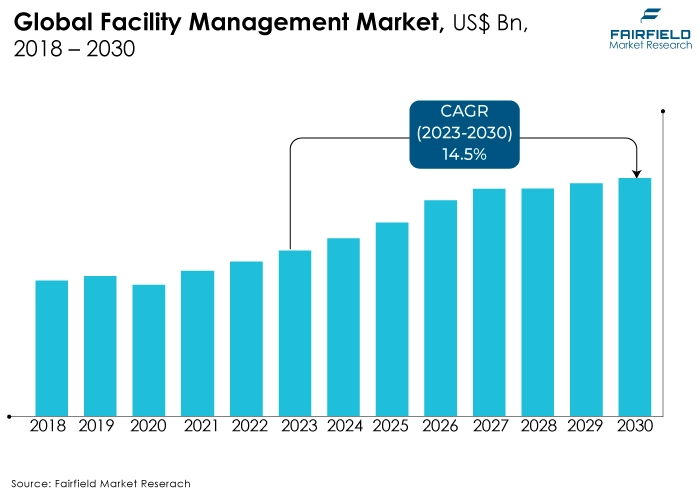

- The approximately US$49.3 Bn market for facility management (2022) likely to reach US$127.1 Bn in 2030

- Facility management market size poised to demonstrate a staggering 14.5% CAGR between 2023 and 2030

Quick Report Digest

- The key trend anticipated to fuel the facility management market growth is rapid technological developments, including IoT, AI, and data analytics, which are driving innovations in facility management, optimising operations and enhancing efficiency.

- Another major market trend expected to fuel businesses is increasingly outsourcing facility management services to reduce operational costs, allowing them to focus on core competencies and strategic initiatives.

- In 2022, growing environmental concerns are leading to the adoption of sustainable practices, making energy-efficient facility management solutions highly desirable.

- In terms of market share for facility management globally, outsourced services provide specialised expertise, cost-effectiveness, and flexibility, making them the preferred choice for businesses focusing on core activities.

- In 2022, management services encompass comprehensive oversight, including strategic planning, vendor management, and regulatory compliance, offering holistic solutions valued by diverse sectors.

- Commercial spaces, including offices and retail centres, demand tailored management solutions due to their diverse needs, leading to a high demand for facility management services.

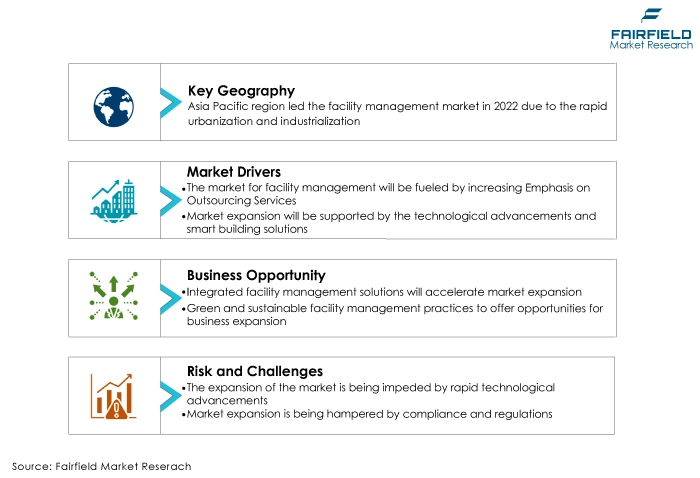

- Rapid urbanisation, infrastructural growth, and increasing business activities are fuelling the demand for facility management services in the Asia Pacific region. Emerging economies and development projects contribute to its dominance.

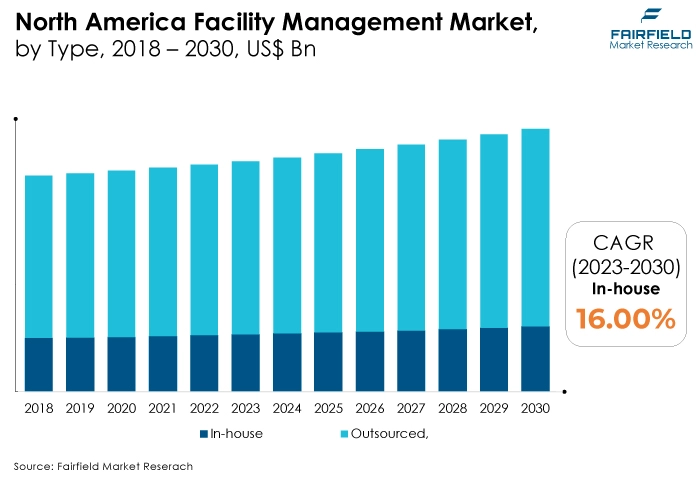

- The market for Facility Management is expanding in North America due to technological advancements, stringent regulatory compliance, and a focus on sustainable practices that drive the facility management market in North America. Increasing investments in smart technologies contribute to its rapid growth.

A Look Back and a Look Forward - Comparative Analysis

The facility management market is currently experiencing robust growth due to the increasing emphasis on efficient and sustainable operational practices. Technological advancements, especially in IoT, AI, and data analytics, have revolutionised facility management, optimising resources and enhancing user experiences. The demand for outsourced facility management services is on the rise, driven by businesses looking to streamline operations and focus on core competencies.

The market witnessed staggered growth during the historical period 2018 – 2022. the facility management market witnessed significant expansion. Advancements in automation and smart technologies transformed traditional approaches. Outsourced facility management gained traction, especially in commercial and industrial sectors, as businesses sought expertise to navigate complex regulatory landscapes. The period also marked a shift toward sustainability, with a focus on energy-efficient solutions and eco-friendly practices becoming standard in facility management strategies.

The facility management industry is poised for continued growth. The integration of IoT devices and AI-driven analytics will further enhance predictive maintenance, ensuring optimal facility performance. Customised solutions catering to specific industry needs, such as healthcare facility compliance or commercial space optimisation, will become more prevalent.

Additionally, the rise of remote facility management, enabled by advanced digital tools, will redefine the industry landscape, allowing for real-time monitoring and proactive problem-solving. Sustainable practices will remain a cornerstone, with an increasing focus on circular economy principles, driving innovation and shaping the future of facility management.

Key Growth Determinants

- Technological Advancements, and Automation

Technological innovations and automation are fundamental drivers propelling the facility management market. The integration of IoT devices, sensors, and smart building technologies has revolutionised how facilities are managed. These advancements enable real-time monitoring, predictive maintenance, and energy optimisation.

Automated systems, driven by Artificial Intelligence (AI), enhance operational efficiency, reduce downtime, and lower costs. Businesses are increasingly adopting these technologies to streamline facility operations, ensuring a seamless and responsive environment for occupants.

- Focus on Sustainability, and Environmental Compliance

The growing emphasis on sustainability and environmental compliance is a key driver shaping the facility management industry. Enterprises are under mounting demands to curtail their carbon emissions and comply with strict environmental policies. Facility managers are implementing energy-efficient solutions, green technologies, and sustainable practices to minimise environmental impact. Green certifications like Leadership in Energy and Environmental Design (LEED) are influencing facility management strategies, encouraging the adoption of eco-friendly initiatives. Companies are leveraging sustainable practices not only for compliance but also as a market differentiator, attracting environmentally conscious clients and customers.

- Demand for Outsourcing and Specialised Services

The trend toward outsourcing facility management services is a significant market driver. Many organisations, especially in sectors like healthcare, education, and commercial real estate, are opting to outsource facility management tasks to specialised service providers. Businesses may concentrate on their core skills through outsourcing, while professionals take care of facility operations effectively.

Additionally, there is a rising demand for specialised facility management services tailored to specific industries. For instance, healthcare facilities require compliance with strict regulatory standards, leading to the demand for specialised healthcare facility management experts.

Major Growth Barriers

- Budget Constraints, and Cost Pressures

Budget constraints pose a significant challenge in the facility management market. Organisations, especially in economically uncertain times, often face limitations in allocating sufficient funds for facility maintenance and upgrades. Tight budgets can lead to deferred maintenance, impacting the overall efficiency and condition of facilities. Cost pressures also affect the ability to invest in advanced technologies and skilled manpower, hindering the implementation of optimal facility management solutions.

- Resistance to Change and Technological Adoption

Resistance to change and the adoption of new technologies can restrain the facility management market. Traditional facility management practices, deeply embedded in some organisations, may resist transitioning to modern, technology-driven approaches. Resistance often stems from employee apprehension, lack of awareness, or a reluctance to invest in new systems.

For modern facility management technology and practises to be successfully integrated, it is imperative that resistance to change and an innovative culture be fostered. Educational efforts and demonstrating the long-term benefits of technological adoption are essential to overcoming this challenge.

Key Trends and Opportunities to Look at

- Sustainable Facility Management Practices

Cross regions, there is a growing trend toward sustainable facility management. Companies are adopting eco-friendly technologies, energy-efficient systems, and green building certifications. Major players like Johnson Controls and CBRE are investing in sustainable solutions, aligning with global environmental goals.

- Integrated IoT Solutions

Integrated Internet of Things (IoT) solutions are gaining popularity. IoT-enabled devices enhance real-time monitoring and predictive maintenance. Companies like IBM, and Siemens are developing IoT platforms, ensuring seamless facility operations. Brands are leveraging this trend to offer comprehensive, data-driven facility management services.

- Outsourcing Complex Services

Companies are increasingly outsourcing specialised facility management services. This trend is prevalent in the healthcare and industrial sectors. Key players like Cushman & Wakefield, and Sodexo are expanding their service portfolios. Brands are leveraging this trend to provide tailored, outsourced solutions, meeting diverse facility needs efficiently.

How Does the Regulatory Scenario Shape this Industry?

The facility management industry operates within a complex regulatory landscape shaped by various entities and standards globally. In the United States, OSHA (Occupational Safety and Health Administration) regulations, particularly the OSH Act of 1970, set stringent safety standards, influencing facility safety protocols. The European Committee for Standardization (CEN) oversees the development of standards like ISO 41001, harmonizing facility practices across E.U. nations.

Nation-specific regulations, such as the UK's Health and Safety at Work Act and Germany's DIN standards, add layers of compliance complexity. Region-specific initiatives, like the E.U.'s Green Deal, emphasize sustainable practices, impacting facility management strategies profoundly.

Compliance with these diverse regulations necessitates continuous adaptation by industry players, ensuring operations align with evolving standards fostering safe and sustainable facility management practices. These regulations not only require facility managers to stay updated on the latest standards but also to implement necessary changes in their operations. This includes investing in new technologies, training employees on safety protocols, and regularly auditing their facilities to ensure compliance.

Fairfield’s Ranking Board

Top Segments

- Outsourced Category Continues to Dominate over In-house Segment

Outsourced services have emerged as the dominant 2022, choice for businesses worldwide. Outsourced facility management provides companies with specialised expertise, cost-efficiency, and flexibility. Many businesses prefer outsourcing to dedicated service providers who can ensure the optimal functioning of their facilities, allowing in-house teams to focus on core business activities. As a result, outsourced facility management services have secured a significant market share, estimated at approximately 65% globally.

Furthermore, in-house facility management, while still prevalent, is experiencing a shift in focus. Smaller organisations and certain niche sectors prefer in-house management for the direct control it offers over facility operations. However, the market share for in-house facility management has been relatively stable, hovering around 35%. While some businesses continue to maintain in-house teams, the trend indicates a gradual increase in outsourcing.

- Hard Service to Surge Ahead with Nearly 45% Share

In 2022, hard services have established themselves as the dominant category, constituting a substantial share of approximately 45% of the global market. Hard services encompass essential physical and technical maintenance tasks, such as HVAC systems, plumbing, and structural repairs. Businesses prioritise hard services due to their critical role in ensuring the structural integrity and functionality of facilities. These services are indispensable for maintaining a safe, comfortable, and efficient environment for employees and visitors alike.

Soft services, including cleaning, catering, security, and landscaping, represent the fastest-growing category in the facility management market. Soft services contribute to about 40% of the market share and are experiencing rapid expansion due to their vital role in enhancing the overall experience within facilities. Businesses increasingly recognise the significance of creating pleasant and secure environments to foster employee productivity and customer satisfaction.

- Commercial Sector Accounts for 30% Demand Share

The commercial sector emerges as the dominant category, commanding a significant market share of approximately 30%. Commercial spaces, including offices, retail establishments, and shopping complexes, require diverse facility management services ranging from maintenance of HVAC systems to janitorial services. The commercial sector's dominance is attributed to the vast number of businesses operating in these spaces globally, emphasizing the need for efficient and comprehensive facility management.

The healthcare sector stands out as the fastest-growing category in facility management, holding a market share of around 20%. Healthcare facilities, including hospitals, clinics, and laboratories, demand specialised and stringent facility management services due to the critical nature of their operations. The focus on patient safety, sanitation, and compliance with healthcare regulations propels the need for advanced facility management solutions in this sector.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Generator

Asia Pacific stands as the powerhouse in the global facility management market, contributing the largest share of approximately 35% to the industry's revenue. Several factors contribute to the region's dominance. The rapid urbanisation and industrialisation in countries like India, China, and southeast Asian nations have led to a surge in the construction of commercial spaces, manufacturing units, and public infrastructures. This boom in construction activities naturally drives the demand for facility management services, propelling the market forward.

Additionally, the increasing focus on sustainable practices and energy efficiency in building management, coupled with the rising awareness regarding the benefits of outsourced facility management services, further fuels the market in Asia Pacific. Furthermore, the region's smart city projects and the government's encouraging activities provide significant prospects for facility management firms, which in turn propels the market's expansion.

North America’s Becomes a Hotspot for Facility Management Activity

North America is poised to experience substantial growth in facility management services, and it is expected to capture a significant market share of approximately 30%. Several factors contribute to this growth, making it a hotspot for facility management activities. The region's advanced technological infrastructure and the rapid adoption of IoT-based solutions in building management systems create a robust demand for innovative facility management services.

Companies in North America are increasingly focusing on integrating smart technologies to optimise energy consumption, enhance security, and streamline maintenance processes, driving the need for specialised facility management solutions. The region's stringent regulatory environment regarding workplace safety, energy efficiency, and environmental sustainability forces businesses to invest in professional facility management services. Compliance with these regulations necessitates expertise, making outsourced facility management an attractive option for businesses striving to meet the standards.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the facility management market is evolving rapidly. Companies that invest in research and development to create innovative, customised solutions tailored to specific industry needs will gain a competitive edge. Leveraging data analytics for predictive maintenance and customer-focused service delivery will be key trends shaping competition. Opportunities abound in emerging markets where urbanisation, and commercial development are on the rise.

Who are the Leaders in the Global Facility Management Space?

- Oracle Corporation (US)

- International Business Machines Corporation (US)

- Trimble Inc. (US)

- SAP SE (Germany)

- MRI Software LLC (US)

- Fortive (US)

- Infor (US)

- Planon (US)

- Facilities Management eXpress (US)

- Service Works Global (UK)

- Causeway Technologies (UK)

- Space well International (Belgium)

- UpKeep Maintenance Management (US)

- Archidata Inc. (Canada)

- JadeTrack Energy Management Software (US)

Significant Company Developments

New Product Launch

- July 2021: Farnek has recently launched the HITEK solution 4.0, which is expected to yield significant savings in manpower costs. By transitioning from traditional facility management operational management to HITEK's smart management, Farnek estimates potential savings of up to 17%.

- January 2022: A: Aramark, a worldwide corporation involved in uniform provision and food and facilities management, has recently revealed a strategic alliance with Patient Engagement Advisors (PEA). This innovative technological platform connects patients with transition specialists.

- September 2021: Disrupt-X collaborated with Imdaad to introduce numerous technological advancements in the field of facility management services in the UAE. These innovations make use of Intel's cutting-edge technology and edge-to-cloud solutions.

Distribution Agreement

- November 2021: CBRE Group, Inc. and Turner & Townsend Holdings Limited have successfully concluded their acquisition. CBRE has acquired a majority ownership share of 60% in the company and has established a strategic partnership with Turner & Townsend. Turner & Townsend provides program management, project management, cost consulting, and advisory consulting services to customers in 46 countries. Their areas of expertise span across three business segments, namely real estate, infrastructure, and natural resources.

- June 2020: To give customers quality assurance, Sodexo, and Bureau Veritas partnered to introduce a hygiene verification label for its service offerings. This partnership encompasses on-site facility management and catering services. Initially launched in the UK, France, the US, and Canada, the label has since been gradually introduced in various other countries worldwide.

An Expert’s Eye

Demand and Future Growth

The future appears promising and multifaceted, driven by evolving market demands. Increasingly, businesses are recognising the strategic importance of efficient facility management in enhancing productivity, employee satisfaction, and brand image. As companies expand globally, the demand for integrated facility management services is expected to surge.

Key sectors like healthcare, technology, and manufacturing are anticipated to be major contributors to this demand, aiming for solutions that integrate cutting-edge technologies for smarter, sustainable, and safer operations.

Supply Side of the Market

According to our analysis, the supply side, the industry faces challenges in adapting swiftly to technological advancements. Incorporating IoT devices, AI-driven analytics, and predictive maintenance tools into facility management practices requires significant investment and expertise. Companies must invest in upskilling their workforce to harness the full potential of these technologies.

Furthermore, ensuring a robust supply chain for the necessary equipment, software, and skilled personnel is essential. Collaborations between facility management providers, tech companies, and equipment manufacturers will be crucial in creating a streamlined supply network.

These collaborations can help in identifying the specific needs of facility management practices and developing customised solutions. Additionally, regular training programs and knowledge-sharing sessions can be organised to keep the workforce updated with the latest advancements in technology and maintenance practices.

Global Facility Management Market is Segmented as Below:

By Type:

- Outsourced

- In-house

By Service:

- Hard Service

- Soft Service

- Management Service

By Application:

- Education

- Commercial

- Transportation

- Industrial

- Government & Public

- Healthcare

By Geographic Coverage:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Facility Management Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Facility Management Market Outlook, 2018 – 2030

3.1. Global Facility Management Market Outlook, by Type,Value (US$ Bn), 2018 – 2030

3.1.1. Key Highlights

3.1.1.1. Outsourced

3.1.1.2. In-house

3.2. Global Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

3.2.1. Key Highlights

3.2.1.1. Hard Service

3.2.1.2. Soft Service

3.2.1.3. Management Service

3.3. Global Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

3.3.1. Key Highlights

3.3.1.1. Education

3.3.1.2. Commercial

3.3.1.3. Transportation

3.3.1.4. Industrial

3.3.1.5. Government & Public

3.3.1.6. Healthcare

3.4. Global Facility Management Market Outlook, by Region, Value (US$ Bn), 2018 – 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Facility Management Market Outlook, 2018 – 2030

4.1. North America Facility Management Market Outlook, by Type, Value (US$ Bn), 2018 – 2030

4.1.1. Key Highlights

4.1.1.1. Outsourced

4.1.1.2. In-house

4.2. North America Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

4.2.1. Key Highlights

4.2.1.1. Hard Service

4.2.1.2. Soft Service

4.2.1.3. Management Service

4.3. North America Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

4.3.1. Key Highlights

4.3.1.1. Education

4.3.1.2. Commercial

4.3.1.3. Transportation

4.3.1.4. Industrial

4.3.1.5. Government & Public

4.3.1.6. Healthcare

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Facility Management Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

4.4.1.2. U.S. Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

4.4.1.3. U.S. Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

4.4.1.4. Canada Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

4.4.1.5. Canada Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

4.4.1.6. Canada Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Facility Management Market Outlook, 2018 – 2030

5.1. Europe Facility Management Market Outlook, by Type, Value (US$ Bn), 2018 – 2030

5.1.1. Key Highlights

5.1.1.1. Outsourced

5.1.1.2. In-house

5.2. Europe Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

5.2.1. Key Highlights

5.2.1.1. Hard Service

5.2.1.2. Soft Service

5.2.1.3. Management Service

5.3. Europe Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

5.3.1. Key Highlights

5.3.1.1. Education

5.3.1.2. Commercial

5.3.1.3. Transportation

5.3.1.4. Industrial

5.3.1.5. Government & Public

5.3.1.6. Healthcare

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Facility Management Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

5.4.1. Key Highlights

5.4.1.1. Germany Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.2. Germany Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.3. Germany Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.4. U.K. Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.5. U.K. Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.6. U.K .Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.7. France Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.8. France Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.9. France Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.10. Italy Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.11. Italy Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.12. Italy Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.13. Turkey Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.14. Turkey Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.15. Turkey Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.16. Russia Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.17. Russia Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.18. Russia Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.1.19. Rest of Europe Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

5.4.1.20. Rest of Europe Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

5.4.1.21. Rest of Europe Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Facility Management Market Outlook, 2018 – 2030

6.1. Asia Pacific Facility Management Market Outlook, by Type, Value (US$ Bn), 2018 – 2030

6.1.1. Key Highlights

6.1.1.1. Outsourced

6.1.1.2. In-house

6.2. Asia Pacific Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

6.2.1. Key Highlights

6.2.1.1. Hard Service

6.2.1.2. Soft Service

6.2.1.3. Management Service

6.3. Asia Pacific Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

6.3.1. Key Highlights

6.3.1.1. Education

6.3.1.2. Commercial

6.3.1.3. Transportation

6.3.1.4. Industrial

6.3.1.5. Government & Public

6.3.1.6. Healthcare

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Facility Management Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

6.4.1. Key Highlights

6.4.1.1. China Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.2. China Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.3. China Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.1.4. Japan Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.5. Japan Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.6. Japan Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.1.7. South Korea Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.8. South Korea Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.9. South Korea Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.1.10. India Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.11. India Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.12. India Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.1.13. Southeast Asia Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.14. Southeast Asia Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.15. Southeast Asia Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.1.16. Rest of Asia Pacific Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

6.4.1.17. Rest of Asia Pacific Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

6.4.1.18. Rest of Asia Pacific Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Facility Management Market Outlook, 2018 – 2030

7.1. Latin America Facility Management Market Outlook, by Type, Value (US$ Bn), 2018 – 2030

7.1.1. Key Highlights

7.1.1.1. Outsourced

7.1.1.2. In-house

7.2. Latin America Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

7.2.1. Key Highlights

7.2.1.1. Hard Service

7.2.1.2. Soft Service

7.2.1.3. Management Service

7.3. Latin America Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

7.3.1. Key Highlights

7.3.1.1. Education

7.3.1.2. Commercial

7.3.1.3. Transportation

7.3.1.4. Industrial

7.3.1.5. Government & Public

7.3.1.6. Healthcare

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Facility Management Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

7.4.1.2. Brazil Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

7.4.1.3. Brazil Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

7.4.1.4. Mexico Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

7.4.1.5. Mexico Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

7.4.1.6. Mexico Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

7.4.1.7. Argentina Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

7.4.1.8. Argentina Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

7.4.1.9. Argentina Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

7.4.1.10. Rest of Latin America Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

7.4.1.11. Rest of Latin America Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

7.4.1.12. Rest of Latin America Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Facility Management Market Outlook, 2018 – 2030

8.1. Middle East & Africa Facility Management Market Outlook, by Type, Value (US$ Bn), 2018 – 2030

8.1.1. Key Highlights

8.1.1.1. Outsourced

8.1.1.2. In-house

8.2. Middle East & Africa Facility Management Market Outlook, by Service, Value (US$ Bn), 2018 – 2030

8.2.1. Key Highlights

8.2.1.1. Hard Service

8.2.1.2. Soft Service

8.2.1.3. Management Service

8.3. Middle East & Africa Facility Management Market Outlook, by Application, Value (US$ Bn), 2018 – 2030

8.3.1. Key Highlights

8.3.1.1. Education

8.3.1.2. Commercial

8.3.1.3. Transportation

8.3.1.4. Industrial

8.3.1.5. Government & Public

8.3.1.6. Healthcare

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Facility Management Market Outlook, by Country, Value (US$ Bn), 2018 – 2030

8.4.1. Key Highlights

8.4.1.1. GCC Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

8.4.1.2. GCC Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

8.4.1.3. GCC Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

8.4.1.4. South Africa Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

8.4.1.5. South Africa Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

8.4.1.6. South Africa Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

8.4.1.7. Egypt Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

8.4.1.8. Egypt Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

8.4.1.9. Egypt Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

8.4.1.10. Nigeria Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

8.4.1.11. Nigeria Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

8.4.1.12. Nigeria Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

8.4.1.13. Rest of Middle East & Africa Facility Management Market by Type, Value (US$ Bn), 2018 – 2030

8.4.1.14. Rest of Middle East & Africa Facility Management Market, by Service, Value (US$ Bn), 2018 – 2030

8.4.1.15. Rest of Middle East & Africa Facility Management Market, by Application, Value (US$ Bn), 2018 – 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs ApplicationHeatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Oracle Corporation

9.4.1.1. Company Overview

9.4.1.2. Type Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. International Business Machines Corporation

9.4.2.1. Company Overview

9.4.2.2. Type Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Trimble Inc.

9.4.3.1. Company Overview

9.4.3.2. Type Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. SAP SE

9.4.4.1. Company Overview

9.4.4.2. Type Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. MRI Software LLC

9.4.5.1. Company Overview

9.4.5.2. Type Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Fortive

9.4.6.1. Company Overview

9.4.6.2. Type Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Infor

9.4.7.1. Company Overview

9.4.7.2. Type Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Planon

9.4.8.1. Company Overview

9.4.8.2. Type Portfolio

9.4.8.3. Business Strategies and Development

9.4.9. Facilities Management eXpress

9.4.9.1. Company Overview

9.4.9.2. Type Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Service Works Global

9.4.10.1. Company Overview

9.4.10.2. Type Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Causeway Technologies

9.4.11.1. Company Overview

9.4.11.2. Type Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Space well International

9.4.12.1. Company Overview

9.4.12.2. Type Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.12.5. UpKeep Maintenance Management

9.4.12.6. Company Overview

9.4.12.7. Type Portfolio

9.4.12.8. Financial Overview

9.4.12.9. Business Strategies and Development

9.4.13. Archidata Inc.

9.4.13.1. Company Overview

9.4.13.2. Type Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.13.5. JadeTrack Energy Management Software

9.4.13.6. Company Overview

9.4.13.7. Type Portfolio

9.4.13.8. Financial Overview

9.4.13.9. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Service Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |