Global Farm Animal Healthcare Market Forecast

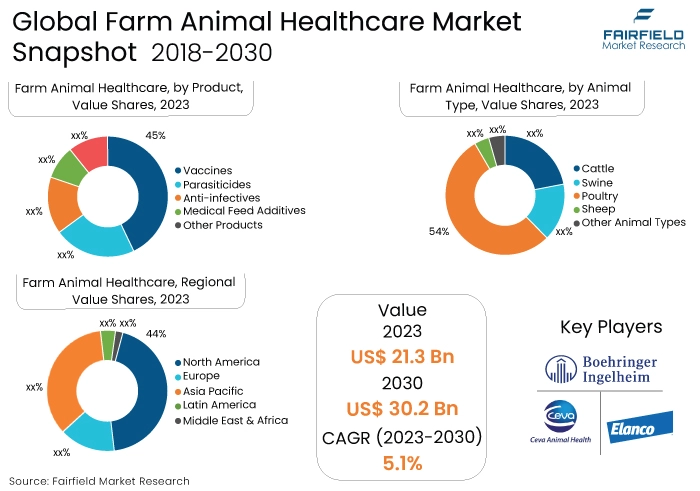

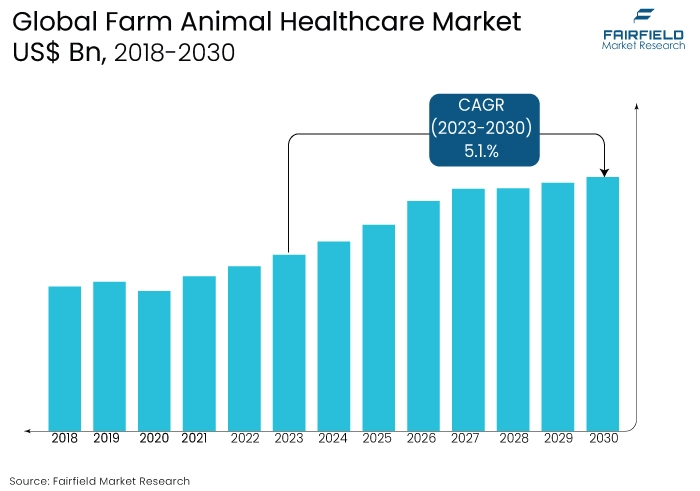

- Global farm animal healthcare market revenue to reach US$30.2 Bn in 2030, up from US$21.3 Bn recorded in 2023

- Farm animal healthcare market size poised to expand at a CAGR of 5.1% between 2023 and 2030

Quick Report Digest

- A paradigm shift is occurring in the global market for farm animal healthcare due to the incorporation of cutting-edge technologies such as telemedicine, digital health monitoring, and precision agriculture, which are reshaping the way in which animals are treated and cared for.

- A notable development in the market pertains to the increasing focus on preventative healthcare protocols for agricultural animals. Vaccinations, biosecurity measures, and early detection protocols are becoming increasingly prevalent in proactive disease management among producers worldwide.

- A discernible increase in demand has been observed for organic and sustainable agricultural methods. This phenomenon is also evident in the field of farm animal healthcare, where there is an increased emphasis on eco-friendly methods, organic remedies, and botanical supplements, which is consistent with the worldwide sustainability movement.

- The application of big data analytics is crucial to the healthcare of domestic animals. The incorporation of data-driven insights into the management of animal health, prognostication of disease outbreaks, and optimisation of treatment strategies is revolutionising agricultural productivity.

- Forecasts indicate that vaccines will hold the greatest market share among all market segments in 2023. Increasing awareness and recognition of the significance of preventative measures against infectious diseases contribute to vaccines' market dominance in farm animal healthcare.

- In 2023, poultry is anticipated to hold the largest market share among animal types. In conjunction with the increasing worldwide demand for poultry products, the poultry industry's magnitude necessitates comprehensive healthcare measures, such as immunisations and disease prevention strategies.

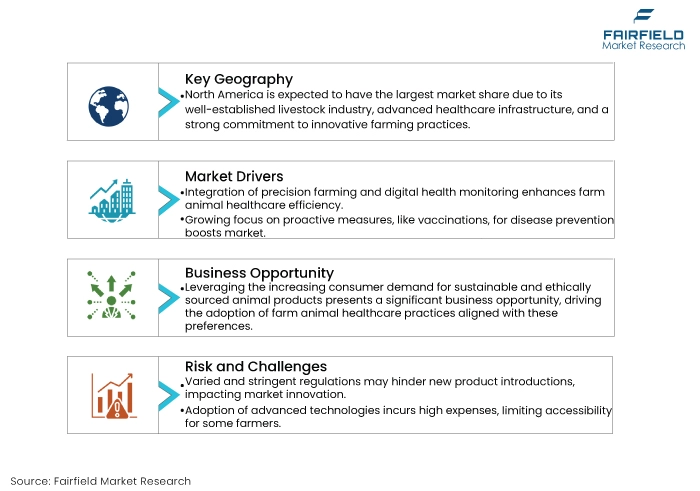

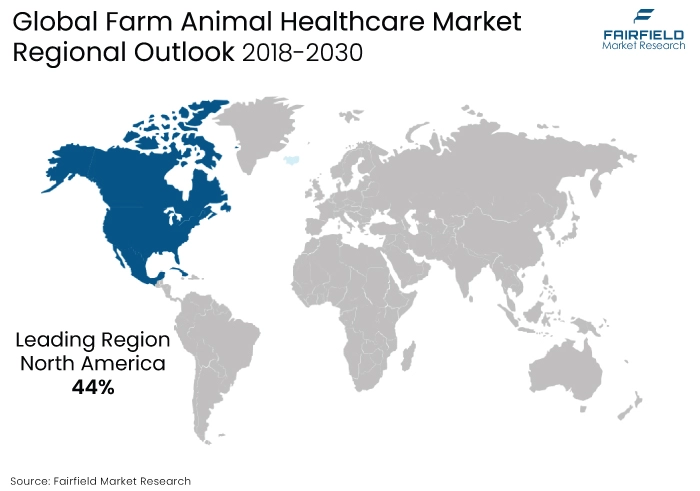

- Globally, North America is anticipated to have the highest market penetration due to its developed healthcare infrastructure and firmly established livestock industry. Strong research, development, and adoption of innovative technologies characterise the farm animal healthcare market in the region.

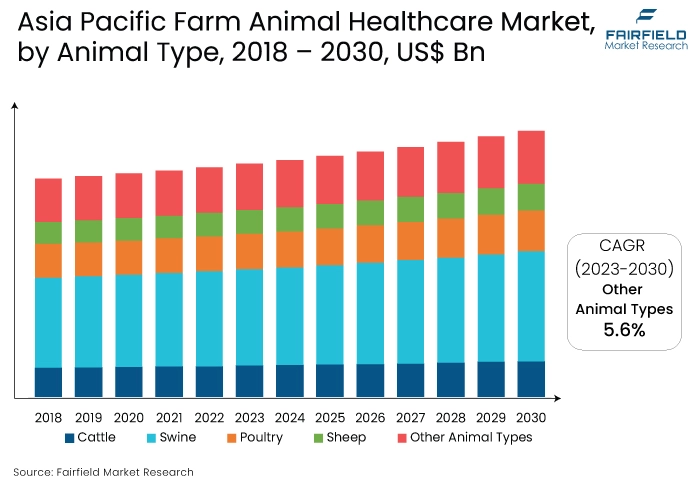

- It is anticipated that the Asia Pacific region will experience the most rapid market penetration growth. Increasing meat consumption, heightened concern for animal welfare, and improving economic conditions are all elements that contribute to the growth of the agricultural animal healthcare market in this region.

A Look Back and a Look Forward - Comparative Analysis

The worldwide market for farm animal healthcare is presently undergoing substantial expansion, propelled by technological progress, mounting apprehensions regarding animal welfare, and an expanding emphasis on preventative healthcare protocols. Innovative technologies such as digital health monitoring and precision agriculture are transforming treatment methodologies, resulting in enhanced productivity and disease control. An increasing number of businesses are adopting organic and sustainable agricultural methods, which reflects a worldwide trend toward environmentally responsible farming.

The market for farm animal healthcare has experienced significant changes over the last decade. An examination of the historical context unveils a shift from traditional treatment modalities to one that is more technologically advanced and integrated. The pervasive implementation of medical feed additives, vaccines, and parasiticides reflects a transition from reactive to proactive healthcare strategies for farm animals.

The market for farm animal healthcare is anticipated to continue expanding in the coming years. As the demand for livestock and dairy products continues to be propelled by a growing global population, preventive healthcare measures and the incorporation of big data analytics will remain focal points. Anticipated developments in treatment modalities include a continued emphasis on sustainability and the implementation of cutting-edge technologies to optimise farm management.

Key Growth Factors

- Technological Advancements in Precision Farming

The exponential expansion of precision agricultural technologies is a critical factor propelling the worldwide farm animal healthcare industry. Precision agriculture employs data analytics, IoT devices, and sensors to monitor and manage animal health in real time.

By integrating this technology, producers proactively detect health concerns, optimise their feeding methods, and execute focused treatment strategies. In addition to increasing farm output, the implementation of precision farming reduces the likelihood of disease outbreaks, thereby stimulating the market for advanced healthcare solutions.

- Growing Focus on Preventive Healthcare

The increasing focus on preventive healthcare measures is a substantial factor influencing the market for agricultural animal healthcare. There is an increasing global awareness among farmers regarding the economic advantages that can be derived from proactive disease prevention as opposed to reactive treatment.

The increased adoption of early disease detection technologies, vaccines, and biosecurity measures is a direct result of this mentality shift. Preventive healthcare serves to safeguard the welfare of farm animals while simultaneously promoting sustainable farming methods, which is in line with the increasing consumer inclination towards animal products that are sourced ethically and are healthy in nature.

- Growing Demand for Animal-Based Products

The increasing global desire for animal products such as flesh and dairy is a significant factor supporting the growth of the farm animal healthcare industry. As the world's population increases, there is a corresponding demand for a reliable and secure provision of sustenance derived from animals.

Farmers are under considerable pressure to preserve the health and productivity of their livestock in response to this demand. As a result, there is an increased emphasis on sophisticated healthcare solutions, such as medical feed additives and vaccines, in order to facilitate optimal growth, avert diseases, and satisfy the growing demands of the worldwide food supply chain.

Major Growth Barriers

- Regulatory Challenges and Compliance-Related Challenges

The market for agricultural animal healthcare is hampered by regionally diverse and complex regulatory frameworks. Market participants encounter difficulties in adhering to a variety of compliance standards, which has repercussions on the introduction and certification of new products. This complexity may restrict the market's development potential and impede innovation.

- Higher Costs

Although advantageous, the implementation of state-of-the-art technologies in farm animal healthcare is accompanied by substantial financial investments. Particularly for farmers in developing regions, the costs associated with precision farming instruments, digital health monitoring systems, and advanced diagnostics may be prohibitive. Market accessibility may be restricted and widespread adoption may be impeded by this cost barrier.

Key Trends and Opportunities to Look at

- Expanding Digital Health Monitoring Opportunities

The farm animal healthcare industry is experiencing a significant increase in the adoption of digital health monitoring, expanding at a rate of 15% per year. This phenomenon is acquiring traction in North America, Europe, and Asia Pacific.

Merck Animal Health, and Zoetis are among the companies investing in intelligent devices for real-time health monitoring. It is probable that brands will capitalise on this trend by providing integrated solutions that enable producers to obtain practical insights for proactive healthcare management and enhanced productivity.

- Sustainable and Organic Practices

The adoption of sustainable and organic farm animal healthcare practices is experiencing substantial expansion, increasing at a rate of 20% per annum. Cargill and Bayer, well-known in Europe, North America, and Latin America, are placing an emphasis on environmentally sustainable solutions.

Brands are positioned to leverage this trend by introducing herbal supplements and organic therapies, catering to consumer inclinations towards animal products that are environmentally sustainable and ethically sourced.

- Integration of Precision Farming Technologies

The implementation of precision agricultural technologies is experiencing substantial annual growth, amounting to 18%, and is particularly prevalent in the regions of North America, Europe, and Asia Pacific. Boehringer Ingelheim, and Elanco are among the major firms investing in IoT-based solutions.

It is anticipated that brands will capitalise on this trend by providing integrated platforms, optimising farm management, and strengthening disease prevention measures; this will ultimately result in increased profitability, and efficiency.

How Does the Regulatory Scenario Shape this Industry?

The worldwide market for farm animal healthcare functions within an intricate regulatory structure, wherein numerous regulatory bodies establish rigorous criteria. Animal health products are regulated by the FDA in the United States in accordance with the Federal Food, Drug, and Cosmetic Act. In the European Union, the European Medicines Agency (EMA) regulates veterinary medicines in a vital capacity. These governing bodies enforce protocols that guarantee the quality, safety, and effectiveness of animal healthcare products.

The Veterinary Medicines Regulation of the European Union, which went into effect in 2022, is an example of a recent region-specific regulatory change that prioritises greater efficacy and transparency in the approval of veterinary medicines. Regulatory changes have a significant impact on market dynamics, which in turn affects the schedules for product development and the ability to enter a market. Adhering to these dynamic standards becomes critical for participants in the market, influencing their approaches to manoeuvre through the perpetually shifting regulatory environment.

Fairfield’s Ranking Board

Top Segments

- Vaccines to Dominate Other Product Type Segments

It is anticipated that the vaccines category will hold the largest market share among the segments enumerated. Vaccines are positioned as an essential component of the farm animal healthcare market as a whole due to the growing awareness of the advantages of vaccination in disease control and the increasing emphasis on preventive healthcare practices for farm animals. Vaccine demand is primarily motivated by the imperative to safeguard the welfare of livestock and preserve a productive and robust animal population.

The market segment referred to as medical feed additives is anticipated to witness the most rapid expansion within the farm animal healthcare industry. In light of the increasing emphasis on improving the nutritional value of animal feed to enhance health outcomes, medical feed additives assume a critical function. The expansion of this sector is driven by the growing awareness of the significance of nutrition in promoting animal health, which in turn contributes to improved growth rates, disease prevention, and overall productivity on farms. In the future years, this increased awareness is anticipated to fuel the medical feed additives market's explosive growth.

- Poultry Continues to be at the Leadership Position

It is anticipated that, of the animal species enumerated, the poultry segment will hold the most substantial market share in the worldwide farm animal healthcare market. Large-scale operations characterise poultry farming, which is propelled by the rising global demand for poultry products. As a result, comprehensive healthcare measures, such as vaccinations and disease prevention strategies, are required. The prevailing market dominance of the poultry industry can be attributed to its substantial scale and economic importance.

The segment referred to as other animal types is anticipated to witness the most rapid expansion within the farm animal healthcare industry. This broad classification includes an assortment of creatures that extend beyond the primary classifications of bovine, porcine, avian, and sheep. As agricultural practices become more diversified and the public becomes more cognizant of the healthcare requirements of less conventional livestock, such as rabbits, goats, and exotic animals, this market segment expands. The market is anticipated to expand at a rapid rate due to the increased demand for healthcare solutions specifically designed for other animal types as farmers investigate novel approaches.

Regional Frontrunners

North America to Occupy the Largest Market Share

With the highest potential market share, North America is positioned to dominate the global farm animal healthcare industry. The supremacy can be ascribed to the region's firmly established livestock sector, which is bolstered by a sophisticated healthcare infrastructure and a robust emphasis on research and development.

The market dynamics are significantly influenced by the US, primarily due to its strong regulatory framework and considerable investments in technological progress. A key contributor to the industry as a whole, the farm animal healthcare market in North America is characterised by its advanced and mature status. It possesses the largest market share owing to its enduring dedication to pioneering and effective farming methodologies.

Asia Pacific to Register the Fastest CAGR Through 2030

It is anticipated that the Asia Pacific region will witness the most rapid expansion in market penetration within the worldwide farm animal healthcare industry. Increasing disposable income, a growing population, and shifting dietary preferences all contribute to the region's expanding demand for animal products. At a CAGR that surpasses that of other regions, the Asia Pacific offers substantial prospects for the expansion of markets.

A growing need for sustainable farming practices, improved economic conditions, and increased awareness of animal welfare are all contributing to the accelerated growth of the farm animal healthcare market in Asia-Pacific nations. The exponential growth of Asia Pacific establishes the region as a significant contributor to the evolution of the worldwide market.

Who are the Leaders in the Global Farm Animal Healthcare Space?

- Boehringer Ingelheim International GmbH

- Ceva Animal Health Inc.

- Elanco

- Hester Biosciences Limited

- Merck & Co. Inc.

- Phibro Animal Health

- Vetoquinol

- Zoetis Inc.

- Norbrook

- Alivira Animal Health Limited

Significant Industry Developments

New Product Launch

- November 2023: In the United States, Purina Animal Nutrition introduced the Purina EnduraSow feed additive and the Purina Endura Pig feed additive, which are designed to support, respectively, the respiratory health and immune function of piglets and sow performance and reproductive efficacy during the post-weaning period.

- April 2022: In Switzerland, ADM introduced two products from its SUCRAM series, which are in-feed sweetening solutions intended to improve the palatability of feeds for young animals, particularly weaned piglets.

An Expert’s Eye

Demand and Future Growth

Anticipated future expansion of the worldwide farm animal healthcare market is contingent upon a number of critical factors. The anticipated growth of the middle class and the expanding global population are factors that will propel the demand for animal products, thereby consistently underscoring the importance of effective and morally sound farm management.

Increasing consumer consciousness regarding food quality and safety will stimulate the demand for sophisticated healthcare solutions that guarantee disease-free and healthy livestock. Furthermore, it is expected that the rising prevalence of sustainable and organic agricultural methods will propel the market's expansion in the long run, as consumers seek animal products that are responsibly sourced.

Supply Side of the Market

Despite robust demand, industry participants encounter difficulties with regard to supply. The progress of innovation can be hindered by the timely introduction of new products due to regulatory obstacles and compliance complexities.

In developing regions, the high costs associated with the implementation of advanced healthcare technologies also present a barrier for some producers. It is imperative for market participants to strike a balance between cost-effective and efficient solutions in order to promote accessibility and inclusivity, thereby facilitating the worldwide implementation of farm animal healthcare practices.

Global Farm Animal Healthcare Market is Segmented as Below:

By Product:

- Vaccines

- Parasiticides

- Anti-infectives

- Medical Feed Additives

- Other Products

By Animal Type:

- Cattle

- Swine

- Poultry

- Sheep

- Other Animal Types

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Farm Animal Healthcare Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Farm Animal Healthcare Market Outlook, 2018 - 2030

3.1. Global Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Vaccines

3.1.1.2. Parasiticides

3.1.1.3. Anti-infectives

3.1.1.4. Medical Feed Additives

3.1.1.5. Other Products

3.2. Global Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cattle

3.2.1.2. Swine

3.2.1.3. Poultry

3.2.1.4. Sheep

3.2.1.5. Other Animal Types

3.3. Global Farm Animal Healthcare Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Farm Animal Healthcare Market Outlook, 2018 - 2030

4.1. North America Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Vaccines

4.1.1.2. Parasiticides

4.1.1.3. Anti-infectives

4.1.1.4. Medical Feed Additives

4.1.1.5. Other Products

4.2. North America Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Cattle

4.2.1.2. Swine

4.2.1.3. Poultry

4.2.1.4. Sheep

4.2.1.5. Other Animal Types

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Farm Animal Healthcare Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Farm Animal Healthcare Market Outlook, 2018 - 2030

5.1. Europe Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Vaccines

5.1.1.2. Parasiticides

5.1.1.3. Anti-infectives

5.1.1.4. Medical Feed Additives

5.1.1.5. Other Products

5.2. Europe Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cattle

5.2.1.2. Swine

5.2.1.3. Poultry

5.2.1.4. Sheep

5.2.1.5. Other Animal Types

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Farm Animal Healthcare Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Farm Animal Healthcare Market Outlook, 2018 - 2030

6.1. Asia Pacific Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Vaccines

6.1.1.2. Parasiticides

6.1.1.3. Anti-infectives

6.1.1.4. Medical Feed Additives

6.1.1.5. Other Products

6.2. Asia Pacific Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cattle

6.2.1.2. Swine

6.2.1.3. Poultry

6.2.1.4. Sheep

6.2.1.5. Other Animal Types

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Farm Animal Healthcare Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Farm Animal Healthcare Market Outlook, 2018 - 2030

7.1. Latin America Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Vaccines

7.1.1.2. Parasiticides

7.1.1.3. Anti-infectives

7.1.1.4. Medical Feed Additives

7.1.1.5. Other Products

7.2. Latin America Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cattle

7.2.1.2. Swine

7.2.1.3. Poultry

7.2.1.4. Sheep

7.2.1.5. Other Animal Types

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Farm Animal Healthcare Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Farm Animal Healthcare Market Outlook, 2018 - 2030

8.1. Middle East & Africa Farm Animal Healthcare Market Outlook, by Product, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Vaccines

8.1.1.2. Parasiticides

8.1.1.3. Anti-infectives

8.1.1.4. Medical Feed Additives

8.1.1.5. Other Products

8.2. Middle East & Africa Farm Animal Healthcare Market Outlook, by Animal Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cattle

8.2.1.2. Swine

8.2.1.3. Poultry

8.2.1.4. Sheep

8.2.1.5. Other Animal Types

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.2.3. Middle East & Africa Farm Animal Healthcare Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.2.3.1. Key Highlights

8.2.3.2. GCC Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

8.2.3.3. GCC Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

8.2.3.4. South Africa Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

8.2.3.5. South Africa Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

8.2.3.6. Egypt Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

8.2.3.7. Egypt Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

8.2.3.8. Nigeria Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

8.2.3.9. Nigeria Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

8.2.3.10. Rest of Middle East & Africa Farm Animal Healthcare Market by Product, Value (US$ Mn), 2018 - 2030

8.2.3.11. Rest of Middle East & Africa Farm Animal Healthcare Market Animal Type, Value (US$ Mn), 2018 - 2030

8.2.4. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Animal Type Heatmap

9.2. Manufacturer vs Animal Type Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Boehringer Ingelheim International GmbH

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Ceva Animal Health Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Elanco

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Hester Biosciences Limited

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Merck & Co. Inc.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Phibro Animal Health

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Vetoquinol

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Zoetis Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Norbrook

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Alivira Animal Health Limited

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Animal Type Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |