Global Farm Implements Market Forecast

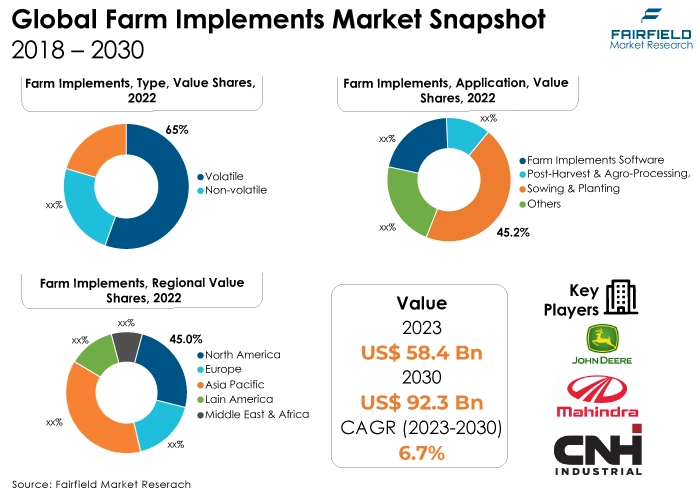

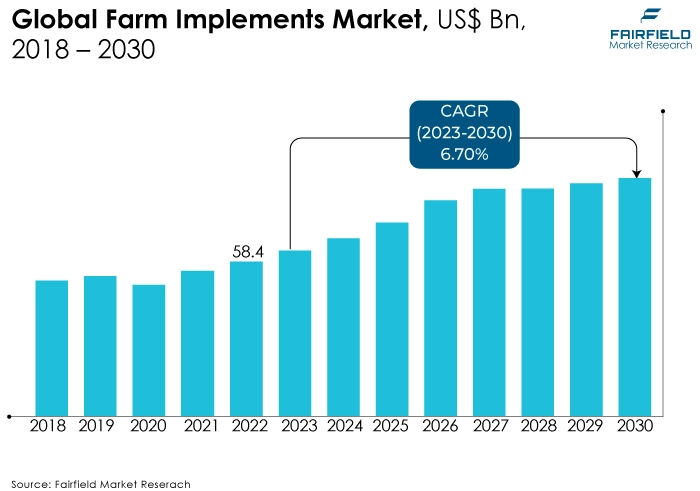

- Global farm implements market revenue poised to witness an impressive CAGR of 6.7% during 2023 - 2030

- Market size likely to reach US$92 Bn in 2030, up from US$58.4 Bn recorded in 2022

Quick Report Digest

- Precision farming tools like automated crop monitoring systems and GPS-guided tractors are becoming more and more popular. These innovations boost productivity, cut down on resource waste, and boost yield, all of which support the market expansion for farm tools as a whole.

- A growing consciousness of environmental sustainability is driving demand for eco-friendly farm tools. Tools with lower environmental effects, such as organic fertiliser spreaders and no-till seed drills, meet the growing demand for sustainable agriculture. Farmers are attempting to connect their operations with ecologically responsible ones, which is driving market growth.

- Farmers can make better decisions when smart technology like data analytics and Internet of Things sensors are integrated into agricultural implements. With increased production and lower operating costs, these solutions boost overall efficiency, enhance crop management, and maximise resource utilisation, all of which contribute to market expansion.

- The market is dominated by farm machinery and equipment because of growing mechanisation in agriculture to increase productivity and efficiency. Precision farming uses cutting-edge machinery that farmers employ to save labour and increase yields. The agricultural sector's urgent need for modernisation is what drives this segment's supremacy.

- The market is being dominated by post-harvest and agro-processing because of the growing emphasis on food preservation and processing effectiveness. The popularity of this market is driven by the desire to decrease post-harvest losses and the growing demand for processed agricultural goods.

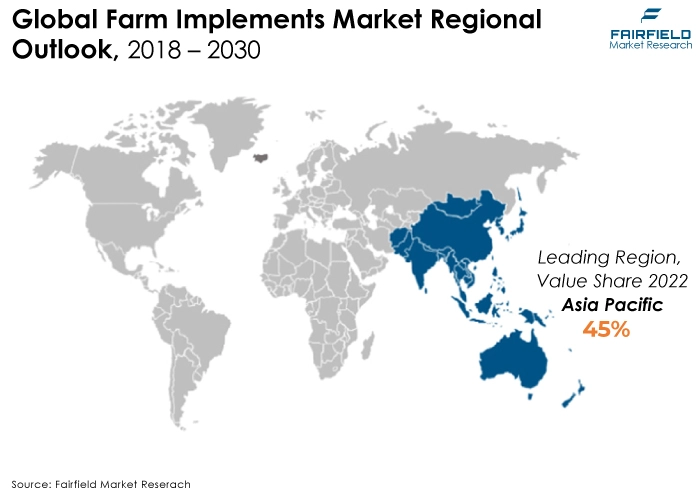

- The market for farm implements is expanding at the quickest rate in the Asia Pacific area thanks to increased agricultural mechanisation in nations like China, and India. Growing populations and larger farms drive the need for sophisticated farming equipment, which further expands the market.

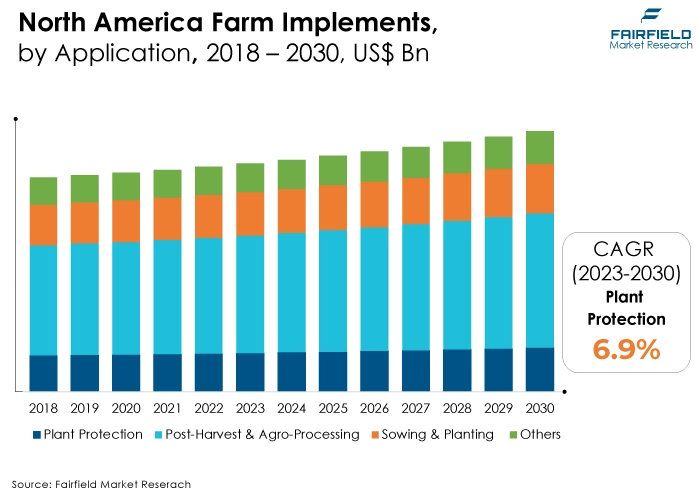

- The market for farm implements is concentrated in North America, which has a well-established agricultural industry and a high acceptance rate for cutting-edge farming technologies. The region's emphasis on precision farming and the requirement for higher productivity plays a major role in North America's market supremacy.

- The second-largest region is Europe, which is distinguished by a focus on technical innovation and sustainable farming methods. The region's significant position in the farm implements market is attributed to the adoption of precision farming technologies and government programs encouraging modernisation in agriculture.

A Look Back and a Look Forward - Comparative Analysis

The market for farm implements is expanding rapidly due to a focus on sustainable agriculture, growing mechanisation, and technological improvements. Nowadays, precise farming equipment and smart farming solutions rule the scene, streamlining agricultural practices and raising yields. The industry is characterised by a move toward self-governing equipment, which lowers the need for human labour and increases operational effectiveness.

The market for farm equipment has changed dramatically over time. In the past, conventional and manual agricultural techniques were common. The introduction of automated machinery transformed agriculture and raised yields. Technological advances, including GPS-guided tractors and sophisticated irrigation systems, reached milestones. A constant pursuit of production, sustainability, and efficiency in agricultural operations is seen in the historical trajectory.

In the near future, the market for farm equipment is expected to undergo additional changes. Future developments point to a greater integration of robotics, AI, and precision farming technologies. Eco-friendly and sustainable solutions will become more popular. In the future, data-driven decision-making and autonomous machinery will be key components in ensuring that agriculture is both ecologically responsible and productive. It is expected that the market will be crucial in addressing issues with resource optimisation and climate change while satisfying the world's food needs.

Key Growth Determinants

- Technological Advancements, and Rapid Innovation

The market for farm tools is expanding due in large part to technological developments. Traditional agricultural processes have been revolutionised by ongoing innovation in automation, data analytics, and precision farming technologies. Drones for crop monitoring, smart sensors for soil analysis, and GPS-guided tractors have all been integrated, greatly increasing farming operations' production and efficiency. These technologies enable farmers to reduce waste, maximise resource usage, and make well-informed decisions through precision agriculture.

In addition to increasing productivity overall, this technological advancement addresses issues like labour scarcity, climate change, and the requirement for sustainable farming methods. The farm implements market is expected to grow steadily as long as the sector embraces and invests in cutting-edge technologies.

- Increasing Mechanisation, and Demand for Efficiency

The market for agricultural implements is being driven primarily by the growing need for higher productivity and efficiency in agriculture. Farmers are adopting mechanised solutions globally to simplify a range of duties, including crop management, irrigation, and planting and harvesting.

Mechanisation allows farming operations to be carried out precisely and on time while also decreasing reliance on physical labour. Tractors, harvesters, and seeding equipment are examples of modern farm technology that is built to cover huge areas rapidly, which increases yields.

The need to produce more food to support a growing global population and the size of farms are two factors that highlight the need for efficiency. Consequently, there is a constant need for sophisticated and automated agricultural tools that may maximise workflow and resource efficiency, supporting the expansion of the industry.

- Increasing Emphasis on Sustainable Agriculture Practices

The worldwide transition to sustainable agricultural methods greatly impacts the market for farm equipment. Green and resource-efficient agricultural implements have become more popular as a result of growing environmental consciousness and the demand for ethical farming practices. Equipment with a low environmental impact is in high demand due to sustainable agriculture practices like precision irrigation, organic fertilising, and no-till farming.

The market is being driven further by governments and regulatory organisations, who are encouraging sustainable farming methods through laws and incentives. In addition to satisfying customer demands for eco-friendly products, the focus on sustainability also maintains biodiversity and long-term soil health. The demand for solutions that support resilient and sustainable agriculture is rising in the farm equipment market as the globe struggles with the effects of climate change.

Major Growth Barriers

- High Initial Investment Costs

The substantial upfront cost associated with implementing cutting-edge agricultural gear and technologies is a significant barrier to the market for farm implements. Financial constraints may prevent farmers, particularly those in developing nations, from purchasing costly precision farming equipment, self-driving tractors, or intelligent technologies.

These technologies come at prohibitive costs, which would slow down acceptance and impede market expansion. Modern farm implements are not widely adopted because of the high initial financial investment, which deters many farmers from using them despite the long-term benefits of enhanced production and efficiency.

- Limited Access to Technology and Education

Limited access to knowledge and technology is a major barrier to the market for farm implements. Farmers may only sometimes have access to the newest agricultural advancements or be proficient in using sophisticated farm equipment, particularly in underdeveloped nations. The digital divide and a lack of knowledge about the advantages of precision agricultural technologies hamper the widespread adoption of contemporary equipment.

Insufficient programs for training and instruction further worsen the scenario, which keeps farmers from making the most of the potential of the farm implements that are currently available. Overcoming this obstacle and promoting wider use of cutting-edge farm equipment requires closing the access gap to technology and offering thorough education.

Key Trends and Opportunities to Look at

- Digital Agriculture and Connectivity

In the market for farm implements, the rise of digital agriculture—fueled by data-driven technology and connectivity—presents a significant trend and opportunity. Real-time monitoring of crops, soil conditions, and machinery is made possible by the integration of Internet of Things (IoT) devices, sensors, and networking technologies.

The connectivity makes it easier to make decisions based on data, which maximises the use of available resources and improves farm management in general. The movement toward digital agriculture presents chances for the creation of precise technology and smart farming tools, giving farmers useful information for increased output.

- Adoption of Sustainable Practices

The expanding focus on sustainable agricultural practices represents a significant development and prospect within the market for farm implements. The need for agricultural tools that lessen their ecological footprint is being driven by consumers' and regulatory agencies' demands for ecologically friendly farming practices.

There are opportunities in the development of sustainable fertilising techniques, precision irrigation systems, and environmentally friendly technology. Manufacturers may leverage market demand for sustainable practices by leveraging innovation to develop solutions that balance social and environmental responsibility.

- Autonomous Farming Systems

The emergence of self-sufficient farming systems signifies a paradigm shift and noteworthy prospect in the industry. The creation and use of autonomous equipment, such as drones, harvesters, and tractors, presents chances for improved productivity and labour savings. Precise and efficient farming techniques result from these technologies' ability to function without direct human interference.

The potential is in the ongoing development of autonomous technology, which will enable farmers worldwide to have greater access to and affordability of these tools. Producers who invest in self-driving agricultural tools might benefit from the increasing consumer desire for technological advancements that increase productivity and decrease reliance on manual labour.

How Does the Regulatory Scenario Shape this Industry?

Strict regulations are in place to guarantee the efficiency, sustainability of the environment, and safety of agricultural machinery in the farm implements market. Global regulatory organisations set standards for emissions, noise levels, and safety features that producers must adhere to. Market players must adhere to these requirements in order to guarantee the dependability and quality of farm tools.

Regulations may also cover topics like data privacy in smart farming solutions, precision farming technologies, and adhering to sustainable agricultural practices. Respecting regulatory requirements is essential to promoting innovation in the agricultural implements market while preserving its integrity and accountability as the industry develops.

Fairfield’s Ranking Board

Top Segments

- Farm Machinery and Equipment Continue to March Ahead

The market is currently dominated by farm machinery and equipment due to agriculture's growing embrace of cutting-edge technologies. This market is becoming more and more well-known due to factors like labour shortages, the necessity to handle them, and precision agricultural techniques. Modern harvesters, tractors, and seeding equipment increase production overall, which is why farm machinery and equipment are an essential part of the growing farm implements market.

The trend of home gardening and landscaping is driving the fastest-growing segment, which is lawn and garden equipment. Lawnmowers, trimmers, and other garden equipment are in high demand due to increased urbanisation, and growing interest in outdoor areas.

As more people engage in do-it-yourself gardening and purchase products to maintain and spruce up their outside areas, the category gains. Within the larger farm tools industry, the lawn and garden equipment category grows at an accelerated rate as more people take up gardening as a recreational and aesthetic endeavor.

- Post-harvest & Agro-Processing Will Surge Ahead Throughout the Projected Period

The post-harvest and agro-processing segment dominated in 2022, which is driven by the need for effective food processing and preservation techniques around the world. The need for sophisticated sorting, packing, and processing equipment has increased as post-harvest losses are reduced, and agricultural produce's shelf-life is extended.

This segment largely contributes to the overall expansion and stability of the farm implements industry by guaranteeing the quality and commercial viability of agricultural products.

The plant protection segment is likely to be quickest rate of growth during the forecast period, which is indicative of the increased focus on precise and sustainable crop management. Farmers are adopting modern plant protection tools as worries about disease, pest control, and the environment's impact increase. These consist of precision application technology, automated pest monitoring, and smart spraying systems.

As agriculture tries to strike a balance between environmental sustainability and production, the market for farm implements is seeing significant growth in this area due to the necessity for effective and environmentally friendly plant protection solutions.

Regional Frontrunners

North America Reaps the Early Movers’s Advantage, Precision Farming Drives Leadership

North America stood as the largest market for farm implements in 2022, which has a developed and technologically advanced agricultural industry. High-quality farm machinery, automation, and the broad adoption of precision farming technology are responsible for the region's dominance. The demand for effective and sustainable agricultural methods has fueled the market's ongoing expansion, along with a strong emphasis on innovation.

North America is the market leader for farm implements and sets the global standard for sophisticated farming methods thanks to government assistance, R&D investments, and a proactive attitude to agricultural modernisation.

Rapid Agricultural Modernisation to Garner Profits for Asia Pacific

The Asia Pacific region is experiencing rapid growth in the farm implements market during the projected period, primarily due to the expanding implementation of agricultural modernisation in nations such as China, and India. The region's quick market expansion is attributed to factors such as rapid population increase, rising food consumption, and government measures encouraging the implementation of new technologies in farming.

To increase output, lessen their reliance on labour, and improve overall agricultural efficiency, farmers in Asia Pacific are embracing precision farming technology and innovative machinery, which is creating a dynamic environment for the farm implements industry.

Fairfield’s Competitive Landscape Analysis

A wide range of manufacturers competing for market share characterise the competitive landscape of the agricultural implements industry. Leading companies prioritise innovation by providing cutting-edge equipment and precise farming technologies. Industry dynamics are shaped by sustainability and adherence to changing regulations, while globalisation boosts competitiveness.

Who are the Leaders in Global Farm Implements Space?

- John Deere

- CNH Industrial

- Mahindra and Mahindra

- AGCO Corporation

- Kubota Corporation

- Claas

- Iseki

- Jain Irrigation

- SDF Group

- Agromaster Agricultural Machinery

- Maschio Gaspardo

- MaterMacc

Significant Company Developments

Product launch

- January 2023: John Deere releases the most recent version of Power and Technology 4.0 in India. To give farmers a top-notch experience, John Deere unveiled a number of new goods, innovations, and farming solutions in honor of their silver jubilee. The John Deere 5045 D Power Pro 4WD V3, a new limited-edition tractor, has also been introduced to celebrate the tractor's amazing 25-year journey.

- November 2022: The Mahindra Group's Mahindra & Mahindra Farm Equipment Sector (FES) officially opened its first farm machinery facility (non-tractor) today at Pithampur, Madhya Pradesh. At an occasion attended by important state officials, dignitaries, and top Mahindra & Mahindra executives, the new facility was officially opened by Union Minister of Agriculture and Farmers' Welfare Narendra Singh Tomar.

- May 2023: A pre-series investment round of $2 million was successfully raised by the agricultural technology business Balwaan Krishi. The company specialises in tiny farm machines. The agri-focused Caspian Leap for Agriculture Fund headed the round.

Summit

- Nov 2023: The Confederation of Indian Industry (CII) and the Tractor and Mechanisation Association (TMA) arranged the Summit on Farm Machinery Technology, which was opened in April 2023 by Union Minister of Agriculture and Farmers Welfare Shri Narendra Singh Tomar. From 2014-15 to 2022-23, the states would get Rs. 6120.85 crore for a variety of purposes, including testing, training, and the establishment of CHCs, hi-tech centers, and Farm Machinery Banks (FMBs) under the Sub-Mission on Agricultural Mechanisation (SMAM). In addition, state governments have provided 15.24 lakh farm equipment and machinery, such as tractors, power tillers, and automated machinery, at discounted prices.

An Expert’s Eye

Demand and Future Growth

The need for agricultural tools is expected to expand steadily due to advancements in technology, a growing focus on precision agriculture, and the need for food security on a worldwide scale. The growing usage of autonomous machinery, sustainable techniques, and smart farming solutions highlights a revolutionary change in agricultural operations.

Sophisticated gear and data-driven decision-making will redefine farming efficiency in the years to come. The market is anticipated to grow steadily as farmers around the world realise how important it is to increase production. Opportunities exist in developing environmentally friendly solutions and integrating cutting-edge technologies to satisfy the changing needs of contemporary agriculture.

Supply Side of the Market

According to our analysis, the market for farm implements is driven by a competitive environment on the supply side, which is made up of a wide range of strong research and development efforts that result in the introduction of cutting-edge and effective farm machinery. Manufacturers provide a wide range of items, from automated machinery to precision tools, with the goal of meeting the changing needs of the agricultural industry.

Supply chains have integrated as a result of globalisation, enabling producers to serve a variety of markets. Sustainable practices and regulatory compliance increasingly influence supply-side tactics. The supply side represents a flexible and dynamic ecosystem that adjusts to the shifting demands of contemporary agriculture.

Global Farm Implements Market is Segmented as Below:

By Type

- Farm Machinery & Equipment

- Lawn & Garden Equipment

- Others

By Application

- Plant Protection

- Post-Harvest & Agro-Processing

- Sowing & Planting

- Others

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East Africa

1. Executive Summary

1.1. Global Farm Implements Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Farm Implements Market Outlook, 2018 - 2030

3.1. Global Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Farm Machinery & Equipment

3.1.1.2. Lawn & Garden Equipment

3.1.1.3. Others

3.2. Global Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Plant Protection

3.2.1.2. Post-Harvest & Agro-Processing

3.2.1.3. Sowing & Planting

3.2.1.4. Others

3.3. Global Farm Implements Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Farm Implements Market Outlook, 2018 - 2030

4.1. North America Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Farm Machinery & Equipment

4.1.1.2. Lawn & Garden Equipment

4.1.1.3. Others

4.2. North America Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Plant Protection

4.2.1.2. Post-Harvest & Agro-Processing

4.2.1.3. Sowing & Planting

4.2.1.4. Others

4.3. North America Farm Implements Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.2. U.S. Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

4.3.1.3. Canada Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

4.3.1.4. Canada Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Farm Implements Market Outlook, 2018 - 2030

5.1. Europe Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Farm Machinery & Equipment

5.1.1.2. Lawn & Garden Equipment

5.1.1.3. Others

5.2. Europe Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Plant Protection

5.2.1.2. Post-Harvest & Agro-Processing

5.2.1.3. Sowing & Planting

5.2.1.4. Others

5.3. Europe Farm Implements Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.2. Germany Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.3. U.K. Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.4. U.K. Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.5. France Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.6. France Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.7. Italy Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.8. Italy Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.9. Turkey Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.10. Turkey Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.11. Russia Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.12. Russia Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.1.13. Rest of Europe Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

5.3.1.14. Rest of Europe Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Farm Implements Market Outlook, 2018 - 2030

6.1. Asia Pacific Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Farm Machinery & Equipment

6.1.1.2. Lawn & Garden Equipment

6.1.1.3. Others

6.2. Asia Pacific Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Plant Protection

6.2.1.2. Post-Harvest & Agro-Processing

6.2.1.3. Sowing & Planting

6.2.1.4. Others

6.3. Asia Pacific Farm Implements Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.2. China Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.3. Japan Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.4. Japan Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.5. South Korea Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.6. South Korea Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.7. India Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.8. India Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.9. Southeast Asia Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.10. Southeast Asia Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Farm Implements Market Outlook, 2018 - 2030

7.1. Latin America Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Farm Machinery & Equipment

7.1.1.2. Lawn & Garden Equipment

7.1.1.3. Others

7.2. Latin America Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

7.2.1.1. Plant Protection

7.2.1.2. Post-Harvest & Agro-Processing

7.2.1.3. Sowing & Planting

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Farm Implements Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.2. Brazil Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.3. Mexico Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.4. Mexico Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.5. Argentina Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.6. Argentina Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

7.3.1.7. Rest of Latin America Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

7.3.1.8. Rest of Latin America Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Farm Implements Market Outlook, 2018 - 2030

8.1. Middle East & Africa Farm Implements Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Farm Machinery & Equipment

8.1.1.2. Lawn & Garden Equipment

8.1.1.3. Others

8.2. Middle East & Africa Farm Implements Market Outlook, by Application, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Plant Protection

8.2.1.2. Post-Harvest & Agro-Processing

8.2.1.3. Sowing & Planting

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Farm Implements Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.2. GCC Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.3. South Africa Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.4. South Africa Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.5. Egypt Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.6. Egypt Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.7. Nigeria Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.8. Nigeria Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Farm Implements Market by Type, Value (US$ Mn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Farm Implements Market Application, Value (US$ Mn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Type vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. John Deere

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. CNH Industrial

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Mahindra and Mahindra

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. AGCO Corporation.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Kubota Corporation.

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Claas

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Iseki

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Jain Irrigation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. SDF Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Agromaster Agricultural Machinery

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Maschio Gaspardo

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. MaterMacc

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |