Global Fire Resistant Fluid Market Forecast

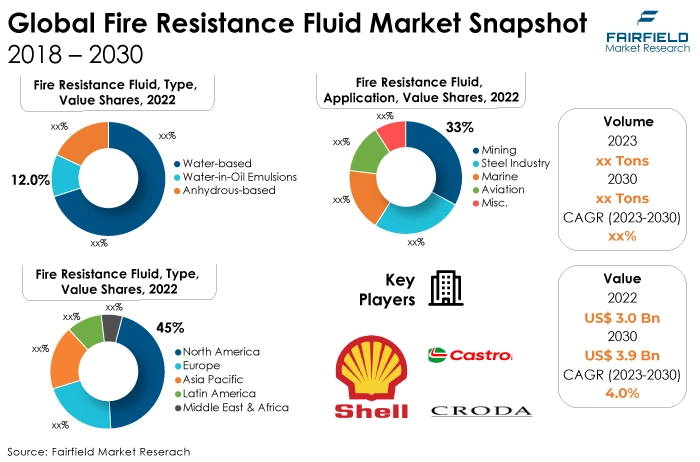

- Fire resistant fluid market size will jump from US$3 Bn (2022) to US$3.9 Bn (2030)

- Market size expansion poised at a moderate CAGR of 4% between 2023 and 2030

Quick Report Digest

- The key trends anticipated to fuel the global fire resistant fluid market growth are increasing concerns about the health & safety of workers and growing demand for renewable energy.

- Another major market trend expected to fuel the growth is the global fire resistant fluid market, a rapidly expanding global metal industry. The market is also predicted to profit from the expanding worldwide metal industry.

- The high cost of synthetic fire resistant fluids, like HFDU and HFDR, poses a challenge in the fire resistant fluid market. Industries seek cost-effective alternatives, hindering adoption despite their superior fire resistance properties.

- In 2022, the Water-based type dominated the industry. Water-based fire resistant fluids, especially water-glycol (HFC) dominate the market due to their cost-effectiveness, environmental friendliness, and excellent fire suppression properties. They are preferred in various industries to comply with safety regulations while minimizing the environmental impact.

- Mining applications often require fire resistant fluids due to the presence of flammable materials and the risk of fires in machinery. This critical need for safety has led mining to capture a significant market share in the fire resistant fluid market.

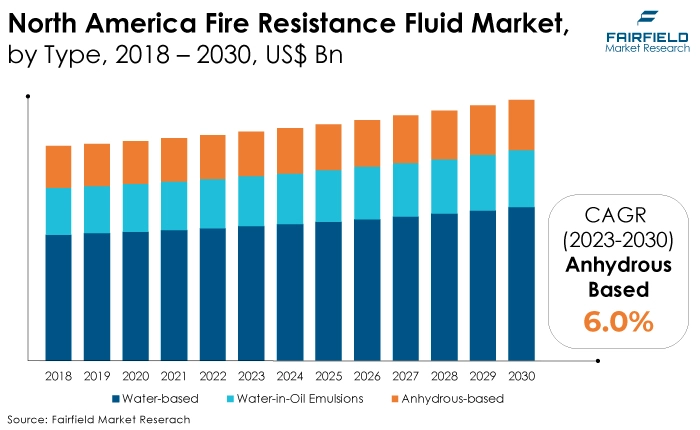

- North America dominates the fire resistant fluid market due to stringent safety regulations, a strong industrial presence, and a focus on advanced technology. High manufacturing, construction, and aerospace adoption rates contribute to its leading market share.

- Asia Pacific region is projected to experience the highest CAGR in the fire resistant fluid market due to rapid industrialisation, infrastructure development, and increasing awareness of fire safety measures, driving substantial demand for fire resistant fluids across various industries.

- The toxic nature of some HFDU, i.e., hydraulic fluids, synthetic, fire resistant, phosphate ester-based fluids hinders market expansion as safety and environmental concerns arise. Regulatory restrictions and the need for safer alternatives impact their adoption.

A Look Back and a Look Forward - Comparative Analysis

The fire resistant fluid market is witnessing growth due to heightened awareness of fire safety across industries like manufacturing, construction, and oil & gas. Stricter safety regulations and the need to protect critical infrastructure are driving the demand for fire resistant fluids, which can suppress and prevent fires.

Additionally, ongoing technological advancements in fire resistant formulations contribute to the market's expansion as they offer improved performance and environmental sustainability.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors such as marine, aviation and others. Marine applications have seen increased demand in the fire resistant fluid market due to stricter maritime safety regulations, emphasizing fire prevention. Fire resistant fluids are essential to safeguard vessels, equipment, and personnel, driving growth in this segment.

The prospects of the fire resistant fluid market look promising. The anticipated growth is driven by stringent safety regulations, increasing awareness of fire prevention measures, and the growing adoption of environmentally friendly and biodegradable formulations.

Industries like manufacturing, construction, mining, and aerospace will continue to rely on these fluids to ensure safety and operational reliability. Technological advancements, including IoT integration and predictive maintenance, will enhance market potential by offering efficient and proactive safety solutions.

Key Growth Determinants

- Increased Demand from Metal Industry

The growing demand from the metal industry is a key driver behind the expanding market for fire resistant fluids. Metalworking processes often involve high temperatures, and the risk of fires or hydraulic system failures is a significant concern.

Fire resistant fluids such as water glycol or synthetic esters, offer crucial fire protection and hydraulic performance. They can withstand extreme heat and reduce the risk of combustion, ensuring the safety of personnel and equipment.

Additionally, environmental regulations have prompted the metal industry to adopt more environmentally friendly hydraulic fluids. Fire resistant fluids, which are less toxic and biodegradable, align with these regulations.

As the metal industry continues to expand globally and prioritise safety and environmental responsibility, the demand for fire resistant fluids is expected to grow significantly, driving the market forward.

- Growing Demand of Renewable Energy

The increasing demand for renewable energy sources like wind and solar power drives the fire resistant fluid market. These energy systems often use hydraulic equipment that requires fire resistant fluids to ensure safety.

Fire resistant fluids prevent ignition and combustion, reducing the risk of catastrophic fires in renewable energy installations. As the renewable energy sector continues to expand to meet sustainability goals, the demand for fire resistant fluids for hydraulic systems in these applications is expected to grow substantially, propelling the market forward.

- Rising Concerns of Occupational and Labour Health & Safety

The rising concerns about the health and safety of workers are propelling the fire resistant fluid market. Industries such as metalworking, mining, and construction, where fire hazards are prevalent, are increasingly adopting fire resistant fluids to mitigate the risk of accidents and protect workers.

These fluids prevent fires and reduce the severity of burns, ensuring a safer working environment. As workplace safety regulations become more stringent globally and employers prioritise the well-being of their workforce, the demand for fire resistant fluids is growing as an essential component of ensuring employee safety.

Major Growth Barriers

- High Costs of HFDU and HFDR

The high cost of hydraulic fluids phosphate ester-based (HFDU), and hydraulic fluids polyol ester-based (HFDR) fire resistant fluids presents a challenge to the fire resistant fluid market. These specialised fluids are more expensive than conventional hydraulic fluids, which can deter cost-conscious industries from adopting them.

While the benefits of fire resistance are crucial for safety, the upfront investment can be a barrier. Manufacturers, and end users are exploring ways to reduce costs, such as extending fluid life through better filtration and maintenance practices, to address this challenge and promote wider adoption of fire resistant fluids.

- Toxic Nature of HFDU

The toxic nature of HFDU fire resistant fluids challenges the fire resistant fluid market. While effective in fire prevention, these fluids can be hazardous to human health and the environment if not handled and disposed of properly.

The toxicity concern can lead to stricter regulations, increased disposal costs, and a reluctance to use HFDU fluids in certain applications. The industry is actively researching and developing less toxic alternatives to address these challenges and promote safer and more environmentally friendly fire resistant solutions.

Key Trends and Opportunities to Look at

- Biodegradable Fire Resistant Fluids

A heightened emphasis on environmental sustainability drives the growing use of biodegradable fire resistant fluids. These fluids, derived from eco-friendly materials, offer reduced environmental impact in case of leaks or spills.

Industries such as manufacturing, construction, and agriculture are increasingly adopting biodegradable fire resistant fluids to align with stricter environmental regulations and reduce carbon footprint while maintaining fire safety standards in hydraulic systems.

- Synthetic Fire Resistant Fluids

The increasing use of synthetic fire resistant fluids is attributed to their superior fire resistance and performance compared to traditional mineral oil-based fluids.

Industries like aviation, metalworking, and steel production prefer synthetic fluids for their high-temperature stability, oxidation resistance, and reduced risk of fire incidents.

As a result, the adoption of synthetic fire resistant fluids is on the rise, enhancing safety and operational efficiency in various high-risk applications.

- IoT and Predictive Maintenance

The Fire resistant fluid Market is witnessing a surge in the adoption of IoT and predictive maintenance technologies. IoT sensors and data analytics enable real-time monitoring of hydraulic systems, allowing for early fault detection and predictive maintenance scheduling.

The proactive approach enhances system reliability, reduces downtime, and improves overall safety, making it a pivotal trend in the industry, especially for critical applications like manufacturing and industrial processes.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape of the fire resistant fluid market varies by region and depends on the type of fluid used. Generally, fire resistant fluids are subject to stringent safety and environmental regulations. In the United States, regulatory bodies like the Occupational Safety and Health Administration (OSHA), and the Environmental Protection Agency (EPA) oversee workplace safety and environmental compliance.

In the European Union, the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation controls the use of hazardous substances in chemicals, including fire resistant fluids.

International standards such as ISO 12922 and ASTM D6450 also provide fire resistant fluid testing and performance guidelines. Compliance with these regulations is crucial for manufacturers and end-users to ensure worker safety and environmental protection while using fire resistant fluids.

Fairfield’s Ranking Board

Top Segments

- Water-based Fluids Dominate Anhydrous-based Ctegory

Water-based fire resistant fluids have captured the largest market share in the fire resistant fluid market due to several key advantages. Firstly, they are environmentally friendly, as they do not contain hazardous chemicals and have low toxicity, aligning with stringent environmental regulations.

Moreover, water-based fluids are cost-effective, making them attractive to various industries. Thirdly, they provide excellent fire suppression capabilities, offering effective protection in case of fires.

Furthermore, their compatibility with various equipment and ease of maintenance contribute to their popularity. These factors collectively drive the widespread adoption of water-based, fire resistant fluids, making them the dominant choice in the market.

Anhydrous-based fire resistant fluids are the fastest-growing segment in the fire resistant fluid market due to their exceptional fire suppression capabilities and adaptability to high-risk environments. These fluids excel in applications where traditional water-based fluids, such as metalworking and heavy industry, may not be effective.

Additionally, their thermal stability and extended service life offer cost-effectiveness over time. As industries prioritise safety and the need to protect critical equipment and personnel from fire hazards grows, anhydrous-based fire resistant fluids are increasingly in demand, contributing to their rapid growth in the market.

- Mining Activities Will Surge Ahead

Mining application has captured the largest market share in the fire resistant fluid market due to the high fire risk in mining operations. Mining activities involve machinery operating in challenging conditions, such as underground tunnels and remote locations with prevalent fire hazards.

Fire resistant fluids prevent and suppress fires and safeguard equipment and personnel. Additionally, stringent safety regulations and a growing awareness of the importance of fire prevention in mining have driven the adoption of these fluids.

As mining operations expand globally and prioritise safety, the demand for fire resistant fluids in this sector continues to grow, solidifying its dominant market position.

The aviation application is experiencing the fastest growth in the fire resistant fluid market due to several factors. Aviation demands stringent fire safety measures to protect both passengers and valuable aircraft. Fire resistant fluids are critical in aviation for suppressing fires in hydraulic systems, reducing the risk of catastrophic accidents.

As air travel continues to grow globally and regulatory authorities tighten safety standards, the demand for fire resistant fluids in the aviation sector is rising significantly. Developing more advanced and efficient fluid formulations tailored to aviation applications also drives this rapid growth.

Regional Frontrunners

North America Tops the List of Performers

North America has stringent safety and environmental regulations, particularly in industries with prevalent fire hazards, such as manufacturing, mining, and construction. These regulations have mandated using fire resistant fluids to enhance workplace safety and environmental protection.

The region has a well-developed industrial base, including heavy machinery, automotive, and manufacturing sectors, key users of fire resistant fluids. The emphasis on safety and risk reduction in these industries has driven the adoption of fire resistant fluids.

North American industries are highly aware of the benefits of fire resistant fluids in preventing catastrophic fires and protecting equipment and personnel.

Ongoing research and development efforts have led to development of advanced and environmentally friendly fire resistant fluid formulations, further boosting their adoption.

Asia Pacific

Due to several key drivers, Asia Pacific is the fastest-growing region in the fire resistant fluid market. Rapid industrialisation and urbanisation in countries like China, and India have increased demand for fire resistant fluids in manufacturing, construction, and mining industries.

Stricter safety regulations and a growing awareness of the importance of fire prevention are pushing regional companies to invest in these fluids. Additionally, expanding renewable energy projects and infrastructure development further drive the market.

Asia Pacific's burgeoning automotive and aerospace sectors are also adopting fire resistant fluids, contributing to the region's remarkable growth in this market.

Fairfield’s Competitive Landscape Analysis

The global Fire resistant fluid market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Fire resistant fluid Market Space?

- FUCHS PETROLUB SE

- Idemitsu Kosan Co., Ltd.

- Castrol Limited

- Shell Plc

- Klüber Lubrication

- Quaker Chemical Corporation

- Houghton International Inc.

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- Eastman Chemical Company

- Nynas AB

- Croda International Plc

Significant Company Developments

New Product Launches

- July 2022: Quaker Houghton has announced a partnership with the SKF Group to integrate SKF Group's Double Separation Technology with Quaker Houghton's industrial oils and fluids. This collaboration aims to enhance resource efficiency within the industry.

- July 2022: Exxon Mobil Corporation has entered into an exclusive partnership as the sole supplier of aviation lubricants for Ethiopian Airlines' expanding fleet. This includes providing products like Mobil HyJet V and Mobil HyJet IV-Aplus.

- April 2022: Exxon Mobil Corporation has unveiled a collaboration with Kalitta Air and Mesa Air Group, Inc. The partnership involves the procurement of aviation lubricants from Exxon Mobil Corporation and adopting Mobil HyJet IV-Aplus for use across their entire fleet.

- March 2021: TotalEnergies SE introduced a new fire resistant hydraulic fluid named Hydransafe HFC-E. This innovation aims to mitigate fire risks in underground mines while enhancing equipment reliability.

Distribution Agreement

- November 2021: TotalEnergies SE has disclosed a six-month agreement with the City Rail Link (CRL) project to solidify its position as the primary supplier for Hydransafe and the complete range of lubricants across all CRL sites.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in metal is driving the market. The demand for fire resistant fluids in the market continues to grow steadily. Industries such as manufacturing, construction, mining, and aerospace rely on these fluids to enhance safety in hydraulic systems, minimizing the risk of fires.

Stringent safety regulations, environmental concerns, and the need for operational reliability drive the demand. Additionally, the rise in infrastructure development projects and increasing awareness of fire prevention measures further boosts the demand for fire resistant fluids in various applications.

Supply Side of the Market

Manufacturers in this market are typically specialised chemical companies, oil and lubricant manufacturers, and hydraulic system component suppliers. These manufacturers develop a range of fire resistant fluid formulations, including water-based fluids, synthetic fluids, and specialty formulations designed for specific applications. They invest in research and development to improve fluid performance, fire resistance, and environmental sustainability.

Distribution channels play a crucial role in supply, with distributors and suppliers connecting manufacturers to end-users, including manufacturing, construction, mining, and aerospace.

Efficient supply chain management ensures timely delivery and availability of fire resistant fluids. The suppliers are also influenced by regulatory standards and environmental considerations, driving to develop eco-friendly and biodegradable products.

Overall, the supply side of the fire resistant fluid market is dynamic, adapting to technological advancements, industry regulations, and evolving customer demands for safer and more sustainable solutions.

Global Fire Resistant Fluid Market is Segmented as Below:

By Type:

- Water-based

- HFA

- HFC

- Water-in-Oil Emulsions

- Anhydrous-based

By Application:

- Mining

- Steel Industry

- Marine

- Aviation

- Miscellaneous

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Fire Resistant Fluid Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Fire Resistant Fluid Market Outlook, 2018 - 2030

3.1. Global Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Water-based

3.1.1.1.1. HFA

3.1.1.1.2. HFC

3.1.1.2. Water-in-Oil Emulsions

3.1.1.3. Anhydrous-based

3.2. Global Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Mining

3.2.1.2. Steel Industry

3.2.1.3. Marine

3.2.1.4. Aviation

3.2.1.5. Misc.

3.3. Global Fire Resistant Fluid Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Fire Resistant Fluid Market Outlook, 2018 - 2030

4.1. North America Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Water-based

4.1.1.1.1. HFA

4.1.1.1.2. HFC

4.1.1.2. Water-in-Oil Emulsions

4.1.1.3. Anhydrous-based

4.2. North America Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Mining

4.2.1.2. Steel Industry

4.2.1.3. Marine

4.2.1.4. Aviation

4.2.1.5. Misc.

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Fire Resistant Fluid Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.3.1.2. U.S. Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.3.1.3. Canada Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.3.1.4. Canada Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Fire Resistant Fluid Market Outlook, 2018 - 2030

5.1. Europe Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Water-based

5.1.1.1.1. HFA

5.1.1.1.2. HFC

5.1.1.2. Water-in-Oil Emulsions

5.1.1.3. Anhydrous-based

5.2. Europe Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Mining

5.2.1.2. Steel Industry

5.2.1.3. Marine

5.2.1.4. Aviation

5.2.1.5. Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Fire Resistant Fluid Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.2. Germany Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.3. U.K. Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.4. U.K. Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.5. France Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.6. France Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.7. Italy Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.8. Italy Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.9. Russia Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.10. Russia Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.11. Rest of Europe Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.1.12. Rest of Europe Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Fire Resistant Fluid Market Outlook, 2018 - 2030

6.1. Asia Pacific Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Water-based

6.1.1.1.1. HFA

6.1.1.1.2. HFC

6.1.1.2. Water-in-Oil Emulsions

6.1.1.3. Anhydrous-based

6.2. Asia Pacific Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Mining

6.2.1.2. Steel Industry

6.2.1.3. Marine

6.2.1.4. Aviation

6.2.1.5. Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Fire Resistant Fluid Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.2. China Fire Resistant Fluid Market by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.3. Japan Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.4. Japan Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.5. South Korea Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.6. South Korea Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.7. India Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.8. India Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.9. Southeast Asia Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.10. Southeast Asia Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Fire Resistant Fluid Market Outlook, 2018 - 2030

7.1. Latin America Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Water-based

7.1.1.1.1. HFA

7.1.1.1.2. HFC

7.1.1.2. Water-in-Oil Emulsions

7.1.1.3. Anhydrous-based

7.2. Latin America Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Mining

7.2.1.2. Steel Industry

7.2.1.3. Marine

7.2.1.4. Aviation

7.2.1.5. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Fire Resistant Fluid Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1.2. Brazil Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1.3. Mexico Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1.4. Mexico Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1.5. Rest of Latin America Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.1.6. Rest of Latin America Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Fire Resistant Fluid Market Outlook, 2018 - 2030

8.1. Middle East & Africa Fire Resistant Fluid Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Water-based

8.1.1.1.1. HFA

8.1.1.1.2. HFC

8.1.1.2. Water-in-Oil Emulsions

8.1.1.3. Anhydrous-based

8.2. Middle East & Africa Fire Resistant Fluid Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Mining

8.2.1.2. Steel Industry

8.2.1.3. Marine

8.2.1.4. Aviation

8.2.1.5. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Fire Resistant Fluid Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1.2. GCC Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1.3. South Africa Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1.4. South Africa Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1.5. Rest of Middle East & Africa Fire Resistant Fluid Market Type, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.1.6. Rest of Middle East & Africa Fire Resistant Fluid Market Application, Value (US$ Mn) and Volume (Tons), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Capacity vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Quaker Chemical Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Houghton International Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. ExxonMobil Corporation

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. TotalEnergies SE

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Chevron Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Eastman Chemical Company

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Nynas AB

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Croda International Plc

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. FUCHS PETROLUB SE

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Idemitsu Kosan Co., Ltd.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Castrol Limited

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Shell Plc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Klüber Lubrication

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |