Global Flanges Market Forecast

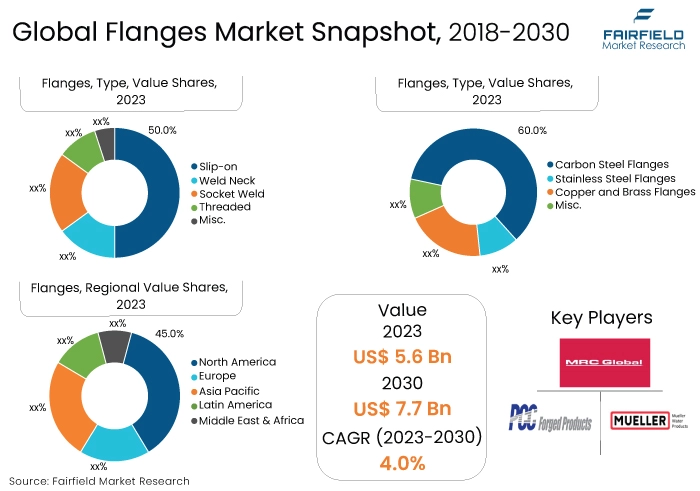

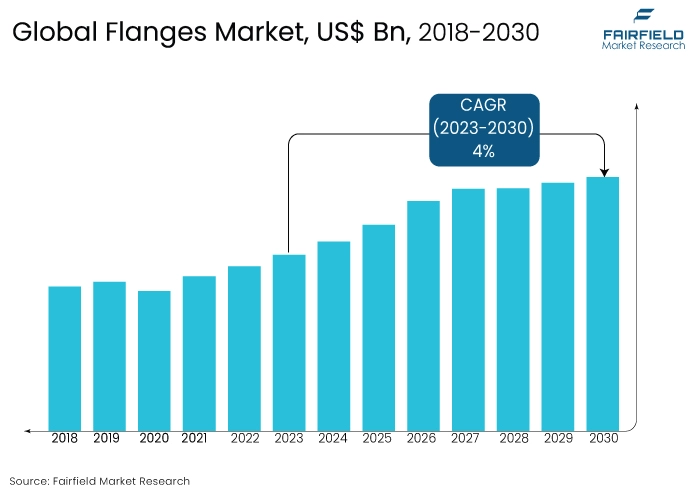

- Global flanges market size poised to see a rise from US$5.6 Bn in 2023 to US$7.7 Bn in 2030

- Flanges market revenue likely to witness a CAGR of 4% between 2023 and 2030

Quick Report Digest

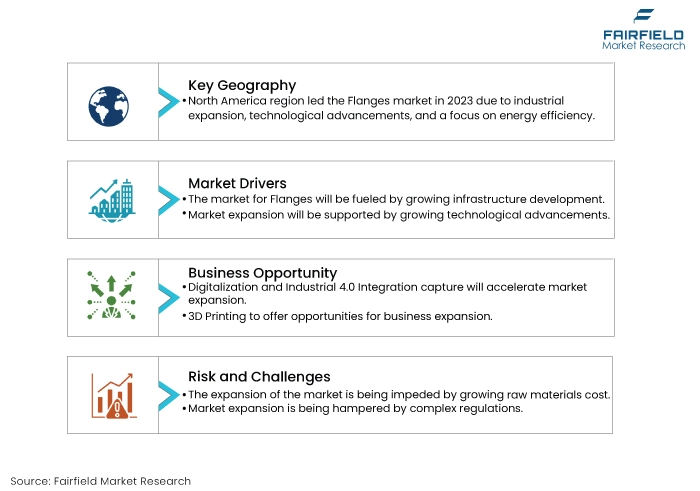

- The flanges market is growing due to increased demand in industries like oil and gas, petrochemicals, and construction. Rising infrastructure projects, expanding industrial activities, and globalisation of trade are driving the need for flanges, which play a crucial role in connecting pipes and facilitating efficient fluid and gas transportation.

- Another major market trend expected to fuel the growth of the flanges market is the rapidly expanding oil and gas industry. The market is also predicted to profit from the expanding worldwide power generation industries.

- The slip-on type flange is growing in the market due to its simplicity, cost-effectiveness, and ease of installation. Its slip-on design allows for quick alignment and welding, reducing labor costs. Additionally, its versatility and compatibility with various pipe materials contribute to its increasing popularity in diverse industrial applications.

- Carbon steel flanges are growing in the market due to their strength, durability, and cost-effectiveness. The material's high tensile strength, resistance to corrosion, and suitability for various applications make it a preferred choice. Industries appreciate its reliability in demanding conditions, contributing to the increasing demand in the flanges market.

- The oil and gas industry's growth in the flanges market is propelled by increasing global energy demand. As exploration and production activities expand, there is a rising need for flanges in pipeline construction, refining, and distribution networks. Flanges play a vital role in ensuring the integrity and efficiency of oil and gas infrastructure.

- Technological advancements drive the flanges market by introducing innovations in manufacturing processes, materials, and product design. Automation, precision machining, and digital tools enhance production efficiency, reduce costs, and improve product quality. Advanced technologies enable flange manufacturers to meet evolving industry requirements and provide solutions for diverse applications, fostering market growth.

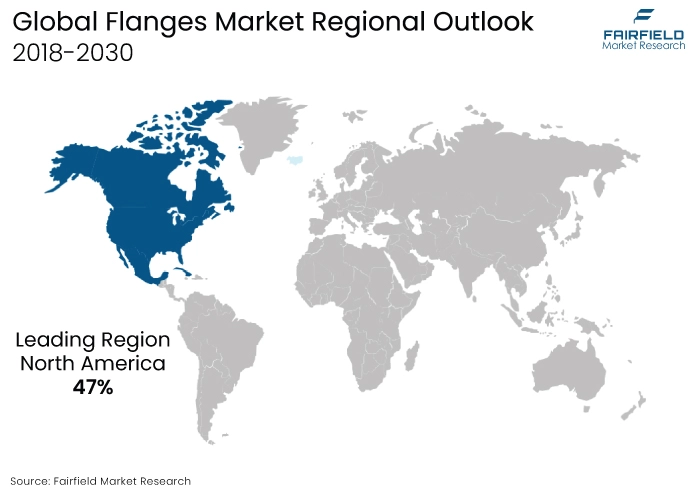

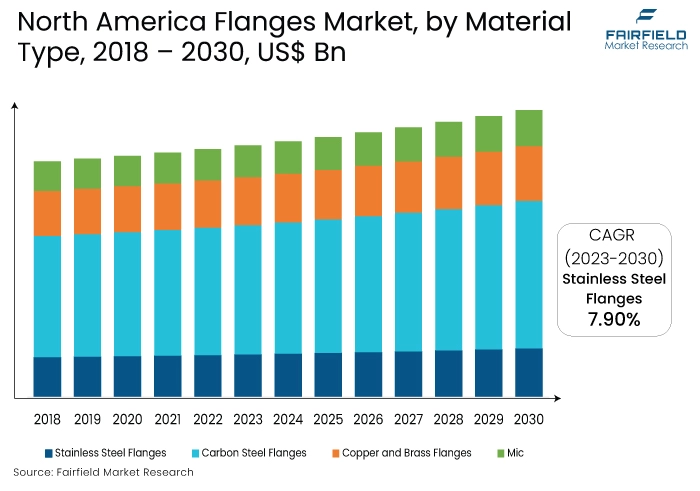

- The flanges market is growing in North America due to robust industrial development, infrastructure projects, and the expanding oil and gas sector. Increased investments in energy and manufacturing sectors, coupled with stringent quality standards, drive the demand for high-quality flanges. The region's economic growth and stability contribute to market expansion.

- The flanges market in Asia Pacific is growing due to rapid industrialisation, urbanisation, and substantial investments in infrastructure projects. Increasing demand for energy, coupled with expanding manufacturing activities, drives the need for flanges in the region. Favourable economic conditions and rising construction projects further contribute to market growth.

A Look Back and a Look Forward - Comparative Analysis

The flanges market is experiencing growth due to escalating demand in industries such as oil and gas, petrochemicals, and construction. Global infrastructure projects, expanding industrial activities, and the need for efficient fluid and gas transportation are propelling the market. Additionally, technological advancements in manufacturing processes and materials, coupled with the versatility and reliability of flanges, contribute to their increased adoption across various sectors, fostering overall market expansion.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the substantial growth of major applications such as the oil and gas industry, chemical and petrochemical industry, and water and wastewater treatment. However, in some applications, the demand for flangess has increased, including in the aerospace and defense industry, and other areas.

The future of the flanges market appears promising, driven by ongoing industrialisation, infrastructural development, and increased energy demand. Technological advancements will likely lead to more efficient manufacturing processes and innovative designs, enhancing the performance of flanges. The market is expected to witness sustained growth across diverse end-user industries, such as oil and gas, petrochemicals, and construction. Global economic expansion and the need for reliable fluid and gas transportation systems will further contribute to the continued success and evolution of the Flanges Market.

Key Growth Determinants

- Growing Infrastructural Developments

Growing infrastructure development is a significant driver for the flanges market due to the integral role flanges play in various construction applications. As nations invest in expanding their infrastructure, such as bridges, roads, and buildings, there is a heightened demand for reliable and durable components like flanges.

Flanges are crucial in connecting pipes, facilitating fluid and gas transportation, and ensuring the integrity of pipelines in construction projects. The expansion of sectors like water supply, wastewater treatment, and power generation further amplifies the need for flanges. The versatility, strength, and adaptability of flanges make them indispensable in supporting the robust growth of infrastructure development globally.

- Growing Technological Advancements

Growing technological advancements are propelling the flanges market by enhancing manufacturing processes, materials, and product design. Innovations such as precision machining, automation, and digital tools contribute to increased production efficiency, reduced costs, and improved product quality. Advanced technologies allow flange manufacturers to meet evolving industry requirements, ensuring products are more reliable and tailored to diverse applications.

Additionally, technological progress enables the development of specialised and high-performance flanges that can withstand demanding conditions. As industries increasingly embrace these advancements, the flanges market experiences a surge in demand, driven by the need for efficient, durable, and technologically advanced components in sectors like oil and gas, petrochemicals, and power generation.

- Increasing Construction Activities

Increasing construction activities are a key driver for the Flanges Market, as flanges play a crucial role in connecting pipes, ensuring structural integrity, and facilitating fluid and gas transportation. The rise in residential, commercial, and infrastructure construction projects globally demands a consistent supply of durable and reliable components like flanges.

Flanges are essential in applications such as plumbing, HVAC systems, and pipeline construction. The adaptability of flanges to diverse construction needs and their ability to provide leak-proof connections contribute to their growing demand. As construction activities expand, so does the requirement for high-quality flanges, making them integral to the success of the construction industry and driving sustained growth in the Flanges Market.

Major Growth Barriers

- Fluctuating Raw Material Prices

Fluctuating raw material prices present a challenge to the flanges market by influencing production costs and profit margins. The market relies heavily on materials like steel, and price volatility in these inputs can disrupt pricing strategies and impact the competitiveness of manufacturers.

Unpredictable raw material costs make it challenging for businesses to maintain stable pricing for flanges, affecting overall profitability and potentially hindering investment in research, development, and process improvements within the industry.

- Complex Regulations

Complex regulations pose a challenge to the flanges market as manufacturers must navigate various industry standards and certifications. Meeting stringent environmental, safety, and quality control requirements demands significant resources and expertise.

Compliance issues can lead to delays, increased costs, and reputational damage. The need for continuous adaptation to evolving regulations adds complexity to production processes, requiring manufacturers to stay informed and invest in ensuring their products meet the diverse and often intricate standards set by different industries and regions.

Key Trends and Opportunities to Look at

- Digitalisation, and Industry 4.0

Integration of digital technologies, sensors, and automation to enhance manufacturing processes, monitor equipment health, and optimise production efficiency.

- 3D Printing

We are utilising additive manufacturing techniques to produce complex and customised flange designs, reducing waste and lead times.

- Advanced Materials

Exploration of high-performance materials with enhanced durability, corrosion resistance, and temperature tolerance to improve flange performance in challenging environments.

How Does the Regulatory Scenario Shape this Industry?

The regulatory framework for the flanges market includes adherence to international standards and regional regulations. In the United States, regulatory bodies like the American National Standards Institute (ANSI) and the American Society of Mechanical Engineers (ASME) set standards for flanges. In the European Union, compliance with directives such as the Pressure Equipment Directive (PED) is essential.

Additionally, industry-specific regulations in the oil and gas sector, such as API specifications, influence the market. Changes in these regulations impact product specifications, quality standards, and market access. Region-specific modifications, such as evolving environmental standards or safety guidelines, can influence manufacturing processes and market dynamics, requiring companies to adapt to ensure regulatory compliance and market competitiveness.

Fairfield’s Ranking Board

Top Segments

- Slip-on Type Category Continues to Dominate

The slip-on type flange has captured the largest market share in the flanges market due to its simplicity, cost-effectiveness, and ease of installation. Offering quick alignment and welding capabilities, the Slip-on flange reduces labor costs and enhances efficiency. Its versatility and compatibility with various pipe materials make it a preferred choice across industries. As demand grows for easy-to-install solutions, the Slip-on type flange stands out, contributing to its significant market share within the overall flanges market.

The socket weld type flange is experiencing the highest CAGR in the flanges market due to its robust design and superior strength. Offering secure and leak-proof connections, it is widely adopted in high-pressure and high-temperature applications. As industries such as oil and gas, chemical, and power generation demand reliable and durable flange solutions, the socket weld type meets these requirements. Its effectiveness in critical conditions and the increasing focus on safety and efficiency contribute to its growing popularity, establishing it as a leading choice within the evolving flanges market.

- Carbon Steel Remains the Materials of Choice for Flanges

Carbon steel flanges have secured the largest market share in the flanges market due to their widespread use in various industries. Known for their strength, durability, and cost-effectiveness, carbon steel flanges are extensively utilised in critical applications such as oil and gas, petrochemicals, and construction. Their high tensile strength, resistance to corrosion, and compatibility with diverse applications contribute to their popularity. Additionally, the material's ability to withstand demanding conditions positions carbon steel flanges as a preferred choice, driving significant market share within the broader flanges market.

Stainless steel flanges, one the other hand, due to their superior corrosion resistance, durability, and versatility. Increasing demand for corrosion-resistant materials in critical applications, such as chemical processing and marine environments, drives the adoption of stainless steel flanges. The material's hygienic properties also contribute to its growth in industries like food and beverages. As stringent quality standards become paramount, stainless steel flanges are increasingly favoured, propelling their market share and establishing them as a leading choice for various applications within the flanges market.

- Oil and Gas Industry to be the Top End User

The oil and gas industry has secured the largest market share in the flanges market due to its extensive use of flanges in critical applications. Flanges play a pivotal role in connecting pipes, ensuring integrity and reliability in pipelines, refineries, and exploration activities. The industry's constant need for pipeline construction, maintenance, and expansion drives significant demand for flanges. As the global demand for energy continues to rise, the oil and gas sector remains a key driver for the growth of the flanges market, solidifying its position as a major market shareholder.

The food and beverage industry is growing at the highest CAGR in the flanges market due to increasing demand for food processing equipment and efficient fluid handling systems. Flanges play a crucial role in connecting pipes in food and beverage processing plants, ensuring hygiene and compliance with industry standards. As the demand for processed food and beverages rises globally, the industry invests in infrastructure, leading to a significant surge in the adoption of flanges. This trend positions the food and beverage sector as a key driver for the growth of the flanges market.

Regional Frontrunners

North America Contributes the Largest Share

North America has captured the largest market share in the flanges market due to its well-established industrial base, significant investments in oil and gas infrastructure, and ongoing technological advancements. Robust economic conditions, coupled with stringent quality standards, drive demand for high-quality flanges.

The region's focus on pipeline construction, especially in the oil and gas sector, contributes to its dominant market position. Moreover, the revival of manufacturing activities and continuous upgrades in industrial processes bolster the demand for flanges. Strong collaborations between key market players and strategic initiatives further solidify North America's position as a major contributor to the overall market share in the flanges market.

Asia Pacific’s Evolving Industrial Landscape Brings in Profits

The Asia Pacific region is experiencing the highest CAGR in the flanges market due to rapid industrialisation, infrastructure development, and economic growth. Increasing construction activities, particularly in emerging economies, drive demand for flanges.

Additionally, the expanding oil and gas industry and the rising focus on renewable energy contribute to the region's growth. A large population, and urbanisation further fuel infrastructure projects. The Asia Pacific's dynamic market conditions, and evolving industrial landscape position it as a key contributor to the increasing demand for flanges.

Fairfield’s Competitive Landscape Analysis

The presence of key players such as Weldbend Corporation, Metalfar, Sandvik AB, and Bonney Forge Corporation characterises the competitive landscape of the flanges market. Factors like technological innovation, product quality, and pricing strategies drive intense competition.

Companies focus on expanding their product portfolios, enhancing manufacturing capabilities, and global market reach to gain a competitive edge. Strategic collaborations, mergers, and acquisitions are common, contributing to the dynamic nature of the competitive landscape in the flanges market.

Who are the Leaders in the Global Flanges Space?

- MRC Global Inc.

- Mueller Water Products, Inc.

- PCC Forged Products

- Core Pipe

- Weldbend Corporation

- Jinan Hyupshin Flanges Co., Ltd.

- Forged Components, Inc.

- Maass Flange Corporation

- Rajendra Industrial Corporation

- Coastal Flange, Inc.

- Kerkau Manufacturing

- C&N Industrial Group Limited

- R&M Forge and Fittings

- Raccortubi Group

- Van Leeuwen Pipe and Tube

Significant Company Developments

New Product Launch

- November 2021: Sandvik AB has expanded its metal powder capacity for additive manufacturing (AM) by installing two extra atomisation towers at the Neath production site in the United Kingdom.

From the Analyst's Perspective

Market Demand and Future Growth

An increase in consumer demand for oil and gas industry is driving the market. The flanges market is witnessing robust demand driven by increased industrialisation, infrastructure development, and the expanding oil and gas sector. With rising global energy needs and growing construction activities, the market is poised for future growth.

Technological advancements in manufacturing processes and materials further contribute to the market's expansion. Flanges play a critical role in connecting pipes across various industries, ensuring efficiency and reliability. As demand for high-quality and durable components continues, the flanges market is expected to experience sustained growth in the foreseeable future.

Supply Side of the Market

The demand-supply dynamics in the flanges market are influenced by increasing industrialisation, infrastructure projects, and the energy sector's growth. Current pricing structures are shaped by raw material costs, manufacturing technologies, and market competition. Pricing will likely influence long-term growth, with competitive pricing strategies impacting market share.

Major trends driving competition include technological advancements, sustainability initiatives, and product innovation. Supply chain analysis is crucial, with factors like raw material availability, transportation, and geopolitical issues impacting the timely delivery of products. A focus on efficient supply chains, digitalisation, and sustainability will be key trends influencing the competitive landscape and long-term success of companies in the flanges market.

Global Flanges Market is Segmented as Below:

By Type:

- Slip-on

- Weld Neck

- Socket Weld

- Threaded

- Misc

By Material Type:

- Carbon Steel Flanges

- Stainless Steel Flanges

- Copper and Brass Flanges

- Misc (including Titanium, Inconel, others)

By End-Use Industry:

- Oil and Gas Industry

- Chemical and Petrochemical Industry

- Power Generation

- Water and Wastewater Treatment

- Food and Beverage Industry

- Construction and Infrastructure

- Automotive Industry

- Aerospace and Defense Industry

- Misc

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Flanges Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Flanges Market Outlook, 2018 - 2030

3.1. Global Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Slip-on

3.1.1.2. Weld Neck

3.1.1.3. Socket Weld

3.1.1.4. Threaded

3.1.1.5. Misc

3.2. Global Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Carbon Steel Flanges

3.2.1.2. Stainless Steel Flanges

3.2.1.3. Copper and Brass Flanges

3.2.1.4. Mic (including Titanium, Inconel, others, etc.)

3.3. Global Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Oil and Gas Industry

3.3.1.2. Chemical and Petrochemical Industry

3.3.1.3. Power Generation

3.3.1.4. Water and Wastewater Treatment

3.3.1.5. Food and Beverage Industry

3.3.1.6. Construction and Infrastructure

3.3.1.7. Automotive Industry

3.3.1.8. Aerospace and Defense Industry

3.3.1.9. Misc

3.4. Global Flanges Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Flanges Market Outlook, 2018 - 2030

4.1. North America Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Slip-on

4.1.1.2. Weld Neck

4.1.1.3. Socket Weld

4.1.1.4. Threaded

4.1.1.5. Misc

4.2. North America Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Carbon Steel Flanges

4.2.1.2. Stainless Steel Flanges

4.2.1.3. Copper and Brass Flanges

4.2.1.4. Mic (including Titanium, Inconel, others, etc.)

4.3. North America Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Oil and Gas Industry

4.3.1.2. Chemical and Petrochemical Industry

4.3.1.3. Power Generation

4.3.1.4. Water and Wastewater Treatment

4.3.1.5. Food and Beverage Industry

4.3.1.6. Construction and Infrastructure

4.3.1.7. Automotive Industry

4.3.1.8. Aerospace and Defense Industry

4.3.1.9. Misc

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Flanges Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Flanges Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.2. U.S. Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

4.4.1.3. U.S. Flanges Market End-use, Value (US$ Mn), 2018 - 2030

4.4.1.4. Canada Flanges Market by Type, Value (US$ Mn), 2018 - 2030

4.4.1.5. Canada Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

4.4.1.6. Canada Flanges Market End-use, Value (US$ Mn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Flanges Market Outlook, 2018 - 2030

5.1. Europe Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Slip-on

5.1.1.2. Weld Neck

5.1.1.3. Socket Weld

5.1.1.4. Threaded

5.1.1.5. Misc

5.2. Europe Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Carbon Steel Flanges

5.2.1.2. Stainless Steel Flanges

5.2.1.3. Copper and Brass Flanges

5.2.1.4. Mic (including Titanium, Inconel, others, etc.)

5.3. Europe Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Oil and Gas Industry

5.3.1.2. Chemical and Petrochemical Industry

5.3.1.3. Power Generation

5.3.1.4. Water and Wastewater Treatment

5.3.1.5. Food and Beverage Industry

5.3.1.6. Construction and Infrastructure

5.3.1.7. Automotive Industry

5.3.1.8. Aerospace and Defense Industry

5.3.1.9. Misc

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Flanges Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.2. Germany Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.3. Germany Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.4. U.K. Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.5. U.K. Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.6. U.K. Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.7. France Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.8. France Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.9. France Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.10. Italy Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.11. Italy Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.12. Italy Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.13. Turkey Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.14. Turkey Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.15. Turkey Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.16. Russia Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.17. Russia Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.18. Russia Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.1.19. Rest of Europe Flanges Market by Type, Value (US$ Mn), 2018 - 2030

5.4.1.20. Rest of Europe Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

5.4.1.21. Rest of Europe Flanges Market End-use, Value (US$ Mn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Flanges Market Outlook, 2018 - 2030

6.1. Asia Pacific Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Slip-on

6.1.1.2. Weld Neck

6.1.1.3. Socket Weld

6.1.1.4. Threaded

6.1.1.5. Misc

6.2. Asia Pacific Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Carbon Steel Flanges

6.2.1.2. Stainless Steel Flanges

6.2.1.3. Copper and Brass Flanges

6.2.1.4. Mic (including Titanium, Inconel, others, etc.)

6.3. Asia Pacific Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Oil and Gas Industry

6.3.1.2. Chemical and Petrochemical Industry

6.3.1.3. Power Generation

6.3.1.4. Water and Wastewater Treatment

6.3.1.5. Food and Beverage Industry

6.3.1.6. Construction and Infrastructure

6.3.1.7. Automotive Industry

6.3.1.8. Aerospace and Defense Industry

6.3.1.9. Misc

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Flanges Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.2. China Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. China Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.1.4. Japan Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.5. Japan Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Japan Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.1.7. South Korea Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.8. South Korea Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.9. South Korea Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.1.10. India Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.11. India Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.12. India Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.1.13. Southeast Asia Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.14. Southeast Asia Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.15. Southeast Asia Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Flanges Market by Type, Value (US$ Mn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Flanges Market End-use, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Flanges Market Outlook, 2018 - 2030

7.1. Latin America Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Slip-on

7.1.1.2. Weld Neck

7.1.1.3. Socket Weld

7.1.1.4. Threaded

7.1.1.5. Misc

7.2. Latin America Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Carbon Steel Flanges

7.2.1.2. Stainless Steel Flanges

7.2.1.3. Copper and Brass Flanges

7.2.1.4. Mic (including Titanium, Inconel, others, etc.)

7.3. Latin America Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Oil and Gas Industry

7.3.1.2. Chemical and Petrochemical Industry

7.3.1.3. Power Generation

7.3.1.4. Water and Wastewater Treatment

7.3.1.5. Food and Beverage Industry

7.3.1.6. Construction and Infrastructure

7.3.1.7. Automotive Industry

7.3.1.8. Aerospace and Defense Industry

7.3.1.9. Misc

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Flanges Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Flanges Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.2. Brazil Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Brazil Flanges Market End-use, Value (US$ Mn), 2018 - 2030

7.4.1.4. Mexico Flanges Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.5. Mexico Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. Mexico Flanges Market End-use, Value (US$ Mn), 2018 - 2030

7.4.1.7. Argentina Flanges Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.8. Argentina Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. Argentina Flanges Market End-use, Value (US$ Mn), 2018 - 2030

7.4.1.10. Rest of Latin America Flanges Market by Type, Value (US$ Mn), 2018 - 2030

7.4.1.11. Rest of Latin America Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Rest of Latin America Flanges Market End-use, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Flanges Market Outlook, 2018 - 2030

8.1. Middle East & Africa Flanges Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Slip-on

8.1.1.2. Weld Neck

8.1.1.3. Socket Weld

8.1.1.4. Threaded

8.1.1.5. Misc

8.2. Middle East & Africa Flanges Market Outlook, by Material Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Carbon Steel Flanges

8.2.1.2. Stainless Steel Flanges

8.2.1.3. Copper and Brass Flanges

8.2.1.4. Mic (including Titanium, Inconel, others, etc.)

8.3. Middle East & Africa Flanges Market Outlook, by End-use, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Oil and Gas Industry

8.3.1.2. Chemical and Petrochemical Industry

8.3.1.3. Power Generation

8.3.1.4. Water and Wastewater Treatment

8.3.1.5. Food and Beverage Industry

8.3.1.6. Construction and Infrastructure

8.3.1.7. Automotive Industry

8.3.1.8. Aerospace and Defense Industry

8.3.1.9. Misc

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Flanges Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Flanges Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.2. GCC Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. GCC Flanges Market End-use, Value (US$ Mn), 2018 - 2030

8.4.1.4. South Africa Flanges Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.5. South Africa Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. South Africa Flanges Market End-use, Value (US$ Mn), 2018 - 2030

8.4.1.7. Egypt Flanges Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.8. Egypt Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. Egypt Flanges Market End-use, Value (US$ Mn), 2018 - 2030

8.4.1.10. Nigeria Flanges Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.11. Nigeria Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. Nigeria Flanges Market End-use, Value (US$ Mn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Flanges Market by Type, Value (US$ Mn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Flanges Market Material Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Flanges Market End-use, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End-use vs End-use Heatmap

9.2. Manufacturer vs End-use Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. MRC Global Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Mueller Water Products, Inc.

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. PCC Forged Products

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Core Pipe

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Weldbend Corporation

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Jinan Hyupshin Flanges Co., Ltd.

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Forged Components, Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Maass Flange Corporation

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Business Strategies and Development

9.5.9. Rajendra Industrial Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Coastal Flange, Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Kerkau Manufacturing

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. C&N Industrial Group Limited

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. R&M Forge and Fittings

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Raccortubi Group

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Van Leeuwen Pipe and Tube

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2023 - 2030 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Material Type Coverage |

|

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |