Global Flexible Packaging Market Forecast

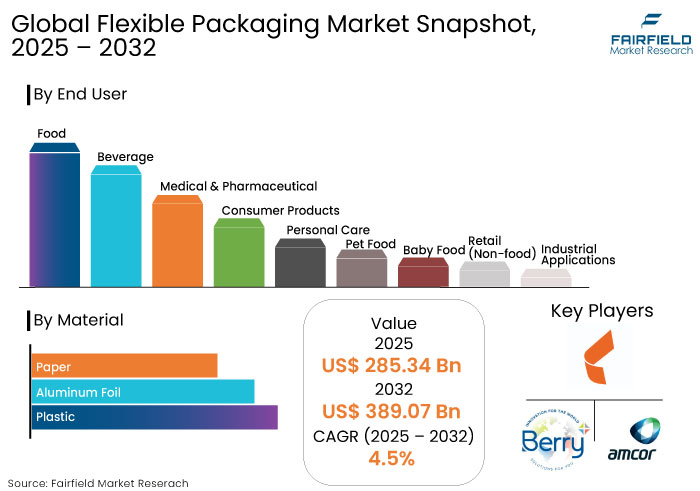

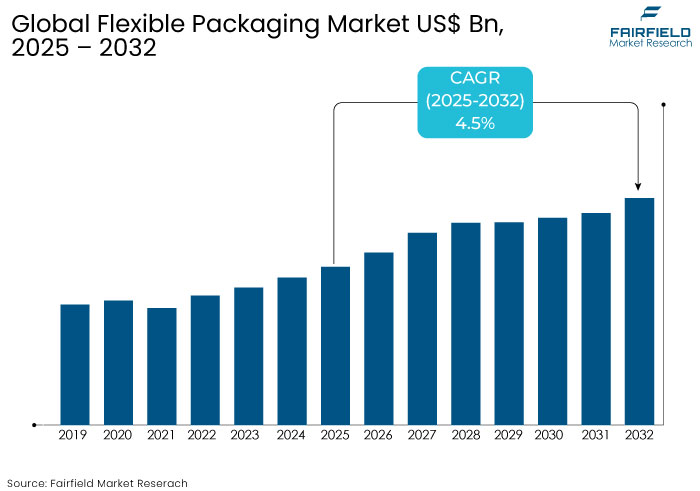

- The flexible packaging market is projected to reach US$ 389.07 Bn by 2032 from US$ 285.34 Bn estimated in 2025.

- The market for flexible packaging is set to witness a CAGR of 4.5% from 2025 to 2032.

Flexible Packaging Market Insights

- Rising preference for single-serve and ready-to-eat products is fueling demand for flexible packaging.

- Increasing environmental concerns are set to propel demand for biodegradable, recyclable, and compostable flexible packaging solutions.

- Lightweight nature of flexible packaging reduces shipping costs and makes it an economical choice for manufacturers across industries.

- Innovations such as smart packaging with temperature-sensitive labels enhance functionality, traceability, and customer engagement.

- The food industry is projected to account for 40% of total share in 2025 due to rising demand for convenience and longer shelf life.

- Growing demand for functional packaging is likely to augment innovation in the future.

- Plastic is anticipated to dominate in terms of material in the flexible packaging industry.

- Asia Pacific is projected to accumulate 43% of the global market share in 2025.

Key Growth Determinants

- High Demand for Convenient and Lightweight Packaging

One of the primary growth drivers for the flexible packaging market is the increasing consumer preference for convenient and lightweight packaging solutions. Flexible packaging offers features such as reseal ability, portability, and enhanced barrier properties, making it ideal for various applications, especially in the food, beverage, and personal care sectors.

With modern consumers' busy lifestyles, there is a high demand for single-serve and ready-to-eat packaged products. These rely heavily on flexible packaging formats like pouches and wraps. Flexible packaging's lightweight nature reduces shipping costs, making it an economical choice for manufacturers.

- Skyrocketing Demand from Baby Food Market

Flexible packaging is becoming immensely popular in the baby food market due to its increased shelf life, convenience, and safety. On-the-go feeding solutions are a top need for modern parents, and flexible packaging like resealable bags and pouches with spouts, makes feeding infants simple and mess-free. These pouches are ideal for working parents who travel or need quick meal options because they are portable, easy to store, and take up less space than conventional glass jars.

Another important reason fueling this trend is safety. To guarantee that food stays uncontaminated, flexible infant food packaging is made using BPA-free materials and tamper-evident seals.

Flexible pouches help lower dangers and are a safer option for babies than glass containers, which can shatter and lead to hazards. Furthermore, improvements in barrier protection brought about by packaging technology have extended the shelf life of infant food without the need for artificial preservatives. Owing to the aforementioned factors, the flexible packaging market is estimated to surge through 2032.

Key Growth Barriers

- Rising Environmental Concerns of Plastic Waste

While flexible packaging is lightweight and efficient, its reliance on plastic materials has become a significant restraint due to high environmental concerns. Single-use flexible packaging, such as pouches and plastic films, often lacks proper recycling infrastructure and contributes to landfill waste or marine pollution.

Governments worldwide are imposing strict regulations to limit plastic use and enforce recycling standards, which could impact the production of conventional flexible packaging. Eco-conscious consumers are shifting toward alternative packaging solutions, such as glass or rigid paper, which they perceive as more sustainable.

Such challenges have increased the pressure on manufacturers to invest in costly research and development for sustainable and biodegradable materials. Although progress is being made, the transition to eco-friendly options is gradual, which can hamper flexible packaging market growth.

Flexible Packaging Market Trends and Opportunities

- Need for Sustainable and Eco-friendly Packaging Solutions

One of the most transformative opportunities in the flexible packaging market lies in developing sustainable and eco-friendly materials. With increasing environmental awareness and strict government regulations on plastic waste, demand for biodegradable, recyclable, and compostable flexible packaging is surging.

Brands can capitalize on this trend by introducing innovative packaging solutions from plant-based plastics, paper laminates, or water-soluble films. This shift addresses consumer demand for eco-friendly products and aligns with corporate sustainability goals.

Around 74% of consumers are willing to pay more for sustainable packaging, with younger demographics (millennials and Gen Z) leading this trend. By adopting circular economy principles and emphasizing reusable or minimal-waste designs, companies can differentiate themselves in the market and attract eco-conscious consumers.

- Emergence of NFC-enabled Tags and QR Codes

Integration of smart technologies into flexible packaging represents another transformative opportunity. Features such as QR codes, temperature-sensitive labels, and NFC-enabled tags can provide real-time product information, improve supply chain transparency, and enhance customer engagement.

Industries like food, pharmaceuticals, and beverages are increasingly adopting smart, flexible packaging to ensure freshness, traceability, and security. Around 50% of consumers in a global survey prefer products with QR codes that provide additional information about the product’s origin, ingredients, or usage.

Temperature-indicating packaging is gaining traction for perishable goods and vaccines, while QR codes allow consumers to verify product authenticity or learn more about the product’s journey. The trend surges the value of flexible packaging and opens possibilities for premium pricing, creating new avenues for the flexible packaging market.

Segments Covered in the Report

- Plastic Gains Impetus Amid High Durability and Versatility

Plastic continues to dominate the flexible packaging market, holding the largest share due to its exceptional versatility, durability, and lightweight properties. Plastic materials such as Polyethylene (PE), Polypropylene (PP), and Polyethylene Terephthalate (PET) are widely used as these offer excellent barrier properties, protecting products from moisture, oxygen, and contamination.

Such features make plastic the preferred choice for food packaging, personal care products, and pharmaceuticals, ensuring freshness and extended shelf life. Despite concerns over environmental impact, innovations in recyclable and biodegradable plastics are transforming the market and addressing sustainability challenges.

Demand for flexible plastic packaging is also fueled by its cost-effectiveness and ability to support diverse designs and formats, such as pouches, films, and wraps. As industries adopt eco-friendly plastic solutions, this segment is anticipated to retain its dominance while aligning with rising consumer preferences for sustainable packaging.

- Food Industry Seeks Lightweight Flexible Packaging Solutions

The food industry is the dominant end user segment in the flexible packaging market. It is set to be driven by rising demand for lightweight, durable, and cost-efficient packaging solutions that ensure product safety and extend shelf life.

Flexible packaging formats such as pouches, wraps, and films are highly favored in the food industry due to their superior barrier properties that protect products from moisture, air, and contaminants. Surging demand for ready-to-eat meals, snack foods, and frozen products has further boosted the adoption of flexible packaging. The trend of single-serving and portion-controlled packaging has increased with booming consumer demand for convenience and portability.

Regional Analysis

- Asia Pacific to See High Demand from Pharmaceutical Industry

Asia Pacific has experienced a substantial rise in disposable income among modern consumers, which allows them to purchase goods from several retail establishments. Prominent manufacturers in the region have commenced investments to enhance production processes to safeguard product integrity.

In September 2023, Sealed Air partnered with Sparck Technologies to enhance its packaging operations with automated packaging technologies. It offers 3D automated packaging solutions in Australia, New Zealand, Japan, and South Korea.

China’s flexible packaging market has experienced significant growth in demand from end-use sectors, including food and beverage, pharmaceuticals, cosmetics, and household care. These sectors will likely generate substantial demand throughout the projected period.

Stringent rules implemented by the government to mitigate packaging waste and enhance sustainability in packaging can facilitate demand for flexible packaging in China. The industry in India is projected to rise at a CAGR of 6.5% from 2025 to 2032. The swift evolution of dietary preferences in the country and a rising demand for convenient packaging have bolstered the use of flexible packaging products, including stand-up and flat pouches.

- North America Witnesses Government Programs to Surge Traceability

North America houses several flexible packaging manufacturers, such as Amcor plc, ProAmpac, Mondi, American Packaging Corporation, Cheer Pack North America, and Eagle Flexible Packaging. Key players are constantly developing sustainable, flexible packaging options for various end-use industries to strengthen their market presence. It can help increase the penetration of flexible packaging solutions in North America.

Government programs focused on increasing the labeling and traceability of packaging circulating in the region are driving companies to adopt flexible packaging solutions. In April 2023, Cheer Pack North America developed a new flexible packaging solution for ScottsMiracle-Gro’s weed and grass killer concentrate. The company developed 5-ounce flexible spouted pouches that are the first of their kind in the lawn care market.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the flexible packaging market is dynamic, with leading players constantly innovating to meet evolving consumer demands. Key companies such as Amcor, Mondi Group, Sealed Air, and Berry Global focus on sustainable solutions, including recyclable and biodegradable materials, to align with the surging preference for eco-friendly packaging.

Technological developments like smart and active packaging have also become a focal point, offering enhanced product protection and shelf-life extension. The market sees strong competition due to regional players catering to local needs and global companies broadening their footprint through strategic partnerships and acquisitions. With the increasing demand from the food, beverage, and pharmaceutical sectors, businesses are leveraging innovation and sustainability to differentiate themselves in this rapidly developing market.

Key Market Companies

- Berry Global Inc.

- Amcor

- Mondi Group

- Crown Holdings, Inc.

- WestRock

- Constantia Flexibles

- Sealed Air

- Ball Corp.

- Clondalkin Group

- Tetra Pak International S.A.

- International Paper Co.

- Huhtamäki Oyj

- Sonoco

- Oji Holdings

- Stora Enso

- Coveris Holding S.A

- PKGMAKER

Recent Industry Developments

- In February 2024, Amcor signed an agreement with Cadbury to procure around 1,000 tons of post-consumer recycled plastic for packaging its chocolate products.

- In June 2024, Sonoco Products Company declared a deal to purchase Eviosys, the leading Europe-based manufacturer of food cans, caps, and closures, from KPS Capital Partners for around US$ 3.9 Bn.

Global Flexible Packaging Market is Segmented as-

By Material

- Plastic

- PP

- PE

- PVC

- PET

- EVA

- BOPP

- Others

- Aluminum Foil

- Paper

By End User

- Food

- Beverage

- Medical & Pharmaceutical

- Consumer Products

- Personal Care

- Pet Food

- Baby Food

- Retail (Non-food)

- Industrial Applications

- Others (Tobacco)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Flexible Packaging Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Global Flexible Packaging Market Outlook, 2019 - 2032

3.1. Global Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Plastic

3.1.1.1.1. PP

3.1.1.1.2. PE

3.1.1.1.3. PVC

3.1.1.1.4. PET

3.1.1.1.5. EVA

3.1.1.1.6. BOPP

3.1.1.1.7. Misc.

3.1.1.2. Aluminum Foil

3.1.1.3. Paper

3.1.1.4. Misc.

3.2. Global Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Food

3.2.1.2. Beverage

3.2.1.3. Medical & Pharmaceutical

3.2.1.4. Consumer Products

3.2.1.5. Personal Care

3.2.1.6. Pet Food

3.2.1.7. Baby Food

3.2.1.8. Retail (Non-food)

3.2.1.9. Industrial Applications

3.2.1.10. Misc. (Tobacco, etc.)

3.3. Global Flexible Packaging Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Flexible Packaging Market Outlook, 2019 - 2032

4.1. North America Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Plastic

4.1.1.1.1. PP

4.1.1.1.2. PE

4.1.1.1.3. PVC

4.1.1.1.4. PET

4.1.1.1.5. EVA

4.1.1.1.6. BOPP

4.1.1.1.7. Misc.

4.1.1.2. Aluminum Foil

4.1.1.3. Paper

4.1.1.4. Misc.

4.2. North America Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Food

4.2.1.2. Beverage

4.2.1.3. Medical & Pharmaceutical

4.2.1.4. Consumer Products

4.2.1.5. Personal Care

4.2.1.6. Pet Food

4.2.1.7. Baby Food

4.2.1.8. Retail (Non-food)

4.2.1.9. Industrial Applications

4.2.1.10. Misc. (Tobacco, etc.)

4.3. North America Flexible Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

4.3.1.2. U.S. Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

4.3.1.3. Canada Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

4.3.1.4. Canada Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Flexible Packaging Market Outlook, 2019 - 2032

5.1. Europe Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Plastic

5.1.1.1.1. PP

5.1.1.1.2. PE

5.1.1.1.3. PVC

5.1.1.1.4. PET

5.1.1.1.5. EVA

5.1.1.1.6. BOPP

5.1.1.1.7. Misc.

5.1.1.2. Aluminum Foil

5.1.1.3. Paper

5.1.1.4. Misc.

5.2. Europe Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Food

5.2.1.2. Beverage

5.2.1.3. Medical & Pharmaceutical

5.2.1.4. Consumer Products

5.2.1.5. Personal Care

5.2.1.6. Pet Food

5.2.1.7. Baby Food

5.2.1.8. Retail (Non-food)

5.2.1.9. Industrial Applications

5.2.1.10. Misc. (Tobacco, etc.)

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Flexible Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.2. Germany Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.3. U.K. Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.4. U.K. Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.5. France Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.6. France Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.7. Italy Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.8. Italy Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.9. Turkey Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.10. Turkey Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.11. Russia Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.12. Russia Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.1.13. Rest of Europe Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

5.3.1.14. Rest of Europe Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Flexible Packaging Market Outlook, 2019 - 2032

6.1. Asia Pacific Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Plastic

6.1.1.1.1. PP

6.1.1.1.2. PE

6.1.1.1.3. PVC

6.1.1.1.4. PET

6.1.1.1.5. EVA

6.1.1.1.6. BOPP

6.1.1.1.7. Misc.

6.1.1.2. Aluminum Foil

6.1.1.3. Paper

6.1.1.4. Misc.

6.2. Asia Pacific Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Food

6.2.1.2. Beverage

6.2.1.3. Medical & Pharmaceutical

6.2.1.4. Consumer Products

6.2.1.5. Personal Care

6.2.1.6. Pet Food

6.2.1.7. Baby Food

6.2.1.8. Retail (Non-food)

6.2.1.9. Industrial Applications

6.2.1.10. Misc. (Tobacco, etc.)

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Flexible Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.2. China Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

6.3.1.3. Japan Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.4. Japan Flexible Packaging Market End Use, Value (US$ Bn), 2019 - 2032

6.3.1.5. South Korea Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.6. South Korea Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

6.3.1.7. India Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.8. India Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

6.3.1.9. Southeast Asia Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.10. Southeast Asia Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

6.3.1.11. Rest of Asia Pacific Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

6.3.1.12. Rest of Asia Pacific Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Flexible Packaging Market Outlook, 2019 - 2032

7.1. Latin America Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Plastic

7.1.1.1.1. PP

7.1.1.1.2. PE

7.1.1.1.3. PVC

7.1.1.1.4. PET

7.1.1.1.5. EVA

7.1.1.1.6. BOPP

7.1.1.1.7. Misc.

7.1.1.2. Aluminum Foil

7.1.1.3. Paper

7.1.1.4. Misc.

7.2. Latin America Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Food

7.2.1.2. Beverage

7.2.1.3. Medical & Pharmaceutical

7.2.1.4. Consumer Products

7.2.1.5. Personal Care

7.2.1.6. Pet Food

7.2.1.7. Baby Food

7.2.1.8. Retail (Non-food)

7.2.1.9. Industrial Applications

7.2.1.10. Misc. (Tobacco, etc.)

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Flexible Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.2. Brazil Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

7.3.1.3. Mexico Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.4. Mexico Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

7.3.1.5. Argentina Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.6. Argentina Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

7.3.1.7. Rest of Latin America Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

7.3.1.8. Rest of Latin America Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Flexible Packaging Market Outlook, 2019 - 2032

8.1. Middle East & Africa Flexible Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Plastic

8.1.1.1.1. PP

8.1.1.1.2. PE

8.1.1.1.3. PVC

8.1.1.1.4. PET

8.1.1.1.5. EVA

8.1.1.1.6. BOPP

8.1.1.1.7. Misc.

8.1.1.2. Aluminum Foil

8.1.1.3. Paper

8.1.1.4. Misc.

8.2. Middle East & Africa Flexible Packaging Market Outlook, by End User, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Food

8.2.1.2. Beverage

8.2.1.3. Medical & Pharmaceutical

8.2.1.4. Consumer Products

8.2.1.5. Personal Care

8.2.1.6. Pet Food

8.2.1.7. Baby Food

8.2.1.8. Retail (Non-food)

8.2.1.9. Industrial Applications

8.2.1.10. Misc. (Tobacco, etc.)

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Flexible Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.2. GCC Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

8.3.1.3. South Africa Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.4. South Africa Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

8.3.1.5. Egypt Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.6. Egypt Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

8.3.1.7. Nigeria Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.8. Nigeria Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

8.3.1.9. Rest of Middle East & Africa Flexible Packaging Market by Material, Value (US$ Bn), 2019 - 2032

8.3.1.10. Rest of Middle East & Africa Flexible Packaging Market End User, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End Use vs End User Heatmap

9.2. Manufacturer vs End User Heatmap

9.3. Company Market Share Analysis, 2025

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Berry Global Inc.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Off-trade Strategies and Development

9.5.2. Amcor

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Off-trade Strategies and Development

9.5.3. Mondi Group

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Off-trade Strategies and Development

9.5.4. Crown Holdings, Inc.

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Off-trade Strategies and Development

9.5.5. WestRock

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Off-trade Strategies and Development

9.5.6. Constantia Flexibles

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Off-trade Strategies and Development

9.5.7. Sealed Air

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Off-trade Strategies and Development

9.5.8. Ball Corp.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Off-trade Strategies and Development

9.5.9. Clondalkin Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Off-trade Strategies and Development

9.5.10. Tetra Pak International S.A.'

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Off-trade Strategies and Development

9.5.11. International Paper Co.

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Off-trade Strategies and Development

9.5.12. Huhtamäki Oyj

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Off-trade Strategies and Development

9.5.13. Sonoco

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Off-trade Strategies and Development

9.5.14. Oji Holdings

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Off-trade Strategies and Development

9.5.15. Stora Enso

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Off-trade Strategies and Development

9.5.16. Coveris Holding S.A

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Off-trade Strategies and Development

9.5.17. PKGMAKER

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Off-trade Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Material Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |