Food Thickening Agents Market Forecast

- The food thickening agents market is projected to reach a value of US$14.4 Bn by 2031, showing significant growth from the US$9.8 Bn achieved in 2024.

- The market revenue is expected to reach a notable expansion, with an estimated CAGR of 5.6% during 2024 - 2031.

Food Thickening Agents Market Insights

- Rapid urbanization, lifestyle changes, and consumer preferences drive the industry demand.

- Expanding food and beverage industry and introducing new products and flavors increase the demand for food thickeners.

- Growing health consciousness fueled demand for food thickeners that improve the texture and mouthfeel of reduced-fat or reduced-calorie food products.

- The surge in demand for thickening agents in the bakery and confectionery industry contributes to industry growth.

- The market is expected to continue growing, reaching US$14.4 Bn by 2031 with a growth rate of 5.6%.

- Rapid urbanization, hectic lifestyles, and changing consumer preferences have led to a rise in the consumption of ready-to-eat and processed foods.

- There is a growing preference for natural and organic thickening agents as consumers become more health-conscious.

- Growing consumer awareness of health benefits associated with certain thickening agents is boosting demand.

- Europe is set to rise with strong bakery and confectionery industry.

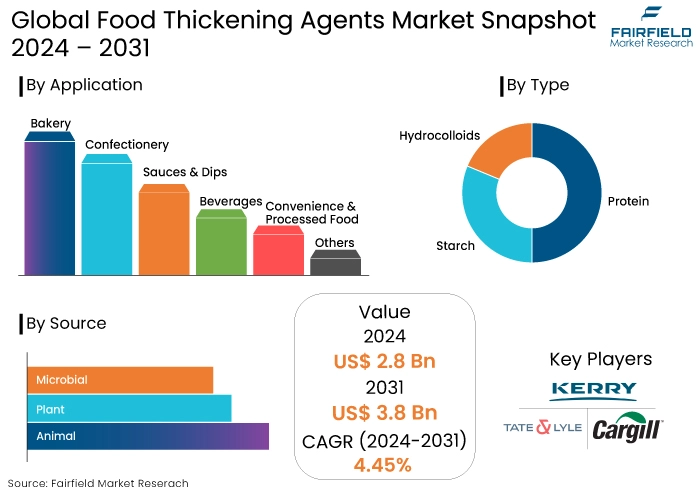

- Based on type, hydrocolloids dominate the food thickening agents market with wide applications.

A Look Back and a Look Forward - Comparative Analysis

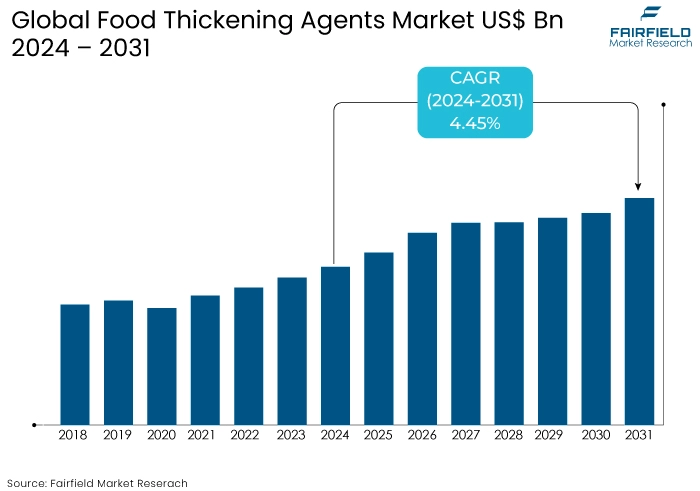

According to Fairfield’s industry assessment, the market size for food thickening agents in 2019 was US$7.8 Bn. The market exhibited a growth rate of 4.5% during the historical period from 2019 to 2023.

The surge demand for thickening agents in the bakery and confectionery industry has fueled industry growth. The market is expected to continue growing and reach from US$9.8 Bn in 2024 to US$14.4 Bn by 2031 with a growth rate of 5.6% during the period from 2024 to 2031.

Consumers are increasingly concerned about their health, leading to a surge in demand for these agents. Food thickening agents, or food thickeners, are widely recognized for their health benefits in beverage and food applications. Some examples of food thickening agents are agar-agar, carrageenan, cellulose, guar gum, pectin, and xanthan gum.

The food thickening agents market demand is also expanding due to product innovation and customer preferences, with manufacturers striving to create high-quality products. Additionally, strict government regulations and food laws ensure the safety and quality of food products, which in turn increases the demand for these agents that comply with these standards. Food thickening agent market trends like economic growth and increased consumption of various food thickeners are playing a pivotal role in the industry growth.

Key Growth Determinants

- Increasing Demand for Convenience Food

The growing demand for convenience foods is a major driver for the food thickening agents market growth. Rapid urbanization, hectic lifestyles, and changing consumer preferences have led to a rise in the consumption of ready-to-eat and processed foods. These convenience foods often require thickening agents to enhance texture, stability, and mouthfeel. As the demand for convenience foods continues to rise globally, the market is expected to witness substantial growth.

- Expanding Food and Beverage Industry

The expanding food and beverage industry is another significant growth driver for the food thickening agents market demand. The industry is constantly evolving, with new products and flavors being introduced to meet the changing tastes and preferences of consumers.

Thickening agents are widely utilized in various food and beverage applications, including bakery, confectionery, beverages, dairy products, and sauces. As the food and beverage industry continues to grow and diversify, the demand for food thickeners is expected to increase, driving market growth.

- Growing Health Consciousness

The growing focus on health and wellness is driving the demand for food products that are not only tasty but also nutritious. Many consumers are now opting for food products that are low in fat, sugar, and calories, while still providing a satisfying eating experience.

Food thickeners offer a solution by improving the texture and mouthfeel of reduced-fat or reduced-calorie food products. As the demand for healthy food options continues to rise, the food thickening agents market shares are expected to grow.

Key Growth Barriers

- High Research and Development Costs

One of the key restraints for the food thickening agents market sales is the high research and development costs associated with the development and manufacturing of food thickeners. Developing new and innovative food thickening agents requires significant investment in research, testing, and formulation.

Manufacturers need to comply with regulatory requirements and ensure the safety and quality of their products. These research and development costs can be a barrier for small companies or new entrants in the market limiting their ability to compete and innovate.

- Fluctuations in Raw Material Prices

Another growth restraint for the food thickening agents market revenue is the fluctuations in raw material prices, particularly for hydrocolloids. Hydrocolloids, such as starches and gums, are commonly used as food thickeners.

Fluctuating raw material prices can impact the production costs for food thickening agents, which may then be passed on to consumers. This can affect the affordability and profitability of food thickening agents, potentially limiting industry demand.

Food Thickening Agents Market Trends and Opportunities

- Increasing Demand for Plant-Based Food Thickeners

One prominent trend in the food thickening agents market is the increasing demand for plant-based food thickeners. Consumers are showing a growing preference for natural and plant-based ingredients in their food products, driven by factors such as health consciousness, sustainability concerns, and dietary preferences like veganism and vegetarianism. This trend has created an opportunity for the development of innovative food-thickening agents derived from plant sources, such as seaweed, legumes, and other plant-based ingredients. As the demand for plant-based food products continues to grow, several industry players exist to expand their offerings.

- Rise in Demand for Processed and Convenience Foods

Another significant opportunity for the food thickeners lies in the rise in demand for processed and convenience foods. The busy lifestyles of consumers, coupled with the need for quick and easy meal solutions, have led to an increased consumption of processed and convenience foods. These food products often require the use of food thickeners to enhance texture, stability, and overall quality.

The demand for processed and convenience foods is particularly high in developing nations like Asia-Pacific and Latin America. To cater to consumer preference, food thickening agents market companies offer innovative and high-quality solutions, fueling strong presence in the market.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a significant role in shaping the food thickening agents market expansion. According to Fairfield’s industry assessment, several regulatory bodies, such as the Food and Drugs Organization (FDA), the European Commission (EU), the European Food Safety Authority (EFSA), Health Canada, and Food Standards Australia New Zealand (FSANZ), have implemented stringent regulations for the usage of thickeners in food products. For example,

FDA (Food and Drug Administration) in the United States ensure the safety and proper use of food thickeners in various food products. The FDA evaluates the safety of food additives based on scientific evidence and sets regulations that specify the conditions of use for each approved additive.

Regulatory bodies have set guidelines and restrictions on using thickeners to ensure food safety and quality. Compliance with these regulations is essential for food thickening agent market manufacturers. The regulations cover food safety, labeling requirements, and permissible ingredients.

Fairfield’s Ranking Board

Segments Covered in the Report

- Hydrocolloids Dominated the Market with Wide Applications

As per food thickening agents market forecast, Hydrocolloids accounted for over 41.0% of global revenue in 2019. These versatile thickeners find extensive use in various food applications, serving as sugar substitutes, wheat flour alternatives, coating materials, stabilizers, bulking agents, and starch dispersants.

Starch, valued at more than US$3.2 Bn in 2019 is expected to witness a 5.5% CAGR from 2020 to 2027. Factors such as high viscosity, stability, low cost, and the increasing demand for gluten-free products drive the continued use of starch as a food thickener.

- Plant-Based Food Thickeners Lead the Market with Growing Demand for Sustainable and Vegan Options

Plant-based food thickeners commanded over 66.0% of the global revenue in 2019, finding widespread use in bakery, confectionery, and ready-to-eat meals. Their popularity is attributed to their effectiveness and competitive pricing.

With the rising trend of veganism and vegetarian diets, the demand for sustainable plant-based thickeners is expected to drive this segment's growth. Fairfield’s food thickening agents market update shows that the animal-based segment generated over USD 2.8 billion in 2019. It is estimated to witness a CAGR of 5.8% from 2020 to 2027 due to their unique thickening properties in various food applications.

- Bakery Drives the Growth with Rising Demand for Organic and Healthy Snacks

The bakery segment holds the largest market share of over 24% in the food thickeners market, and it is expected to maintain its dominance in the forecast period. The increasing demand for organic and natural baked goods, as well as the trend of healthy snacks, are key factors driving the food thickening agents market.

The rising consumer awareness and changing lifestyles are fueling the growth of the market. Also, the increasing demand for processed food products also drive the industry expansion.

Regional Analysis

- North America Leads Market with Thriving Food and Beverage Industry

As per food thickening agents market overview, in 2019, North America held over 38.0% market share, driven by strong demand from various industries in the United States and Canada. The region's dominance is attributed to its highly developed food and beverage industry, as well as the presence of multinational food processing and manufacturing companies.

North America has experienced a growing appetite for pastries, muffins, and cupcakes, prompting innovation in the bakery and confectionery sector through the use of diverse thickeners. The region witnesses the rising demand for bakery and confectionery products, further boosting market growth.

- Europe is Set to Rise with Strong Bakery and Confectionery Industry

Europe's food thickeners market is expected to experience growth due to the presence of a robust bakery and confectionery industry, along with increasing consumer demand. The region is witnessing rising demand for packaged juices and energy drinks, further propelling market growth.

Exporters in Europe offer value-added products, including blends of different thickeners and flavor ingredients. Western Europe is a hub for exporters, while manufacturers are expanding their businesses in Eastern Europe.

The food thickening agents market value growth is driven by the popularity of products like pastries, muffins, and cupcakes, with players in the bakery and confectionery industry incorporating innovation through the use of various thickeners.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the food thickening agents market is influenced by various factors, including market dynamics, industry trends, and the strategies adopted by key players. Competitive analysis helps businesses understand their competitors, identify market trends, and develop competitive advantage strategies. It involves researching competitors, market trends, and customer behavior to make informed decisions and strategic plans.

Key Market Companies

- Cargill Inc.

- Kerry Group PLC

- Tate & Lyle PLC

- Archer Daniels Midland Company (ADM)

- DowDuPont Inc.

- CP Kelco U.S. Inc

- Fuerst Day Lawson Limited

- Ashland Inc.

- Ingredion Inc.

- Koninklijke DSM N.V.

- DuPont De Nemours, Inc.

- Darling Ingredients

Recent Industry Developments

- August 2024

Morinaga Nutritional Foods Vietnam (MNFV), a subsidiary of the Morinaga Milk Industry Group, has introduced advanced products for the Vietnamese market, including Climeal, a proprietary ingredient with 10 billion LAC-Shield postbiotics, Tsururinko Quickly, a food thickener for dysphagia, and BB536 Probiotics Powder. MNFV aims to contribute to community wellness and become the leading food company in Vietnam, following Morinaga Milk's global sustainable development policy.

- February 2024

Food LEGO has developed superstructures using amaranth starch granules as building blocks using a Pickering emulsion approach. The high-protein amaranth starch, which is small, high, and tunable soft, is ideal for building fused superstructures. The granules position themselves around an oil droplet during emulsification, forming 2D sheets that can be cross-linked to reinforce them. The size of these sheets can be controlled by increasing homogenization speed or by applying controlled heating before freeze-drying. The superstructures were investigated for morphology, structural conformation, water-holding capacity, critical caking concentration, and viscosity.

An Expert’s Eye

- The expanding food and beverage industry is another significant growth driver for the demand for food thickening agents.

- The growing focus on health and wellness is driving the demand for food products that are not only tasty but also nutritious.

- The development and manufacturing of food thickeners require significant investment in research, testing, and formulation.

- Consumers are showing a growing preference for natural and plant-based ingredients in their food products.

- The demand for processed and convenience foods is particularly high in developing nations like Asia-Pacific and Latin America.

Food Thickening Agents Market is Segmented as-

By Type

- Protein

- Starch

- Hydrocolloids

By Source

- Animal

- Plant

- Microbial

By Application

- Bakery

- Confectionery

- Sauces & Dips

- Beverages

- Convenience & Processed Food

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Food Thickening Agents Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Food Thickening Agents Market Outlook, 2019 - 2031

3.1. Global Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Plant

3.1.1.1.1. Guar Gum

3.1.1.1.2. Gum Arabic

3.1.1.1.3. Locust Bean Gum

3.1.1.1.4. Pectin

3.1.1.1.5. Starches

3.1.1.1.6. Others

3.1.1.2. Seaweed

3.1.1.2.1. Carrageenan

3.1.1.2.2. Agar

3.1.1.2.3. Alginate

3.1.1.2.4. Microbial

3.1.1.2.5. Gellan Gum

3.1.1.2.6. Curdlan

3.1.1.2.7. Xanthum Gum

3.1.1.2.8. Animal (Gelatin)

3.1.1.3. Synthetic

3.1.1.3.1. Carboxy Methyl Cellulose (CMC)

3.1.1.3.2. Methyl Cellulose

3.2. Global Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Bakery and Confectionery

3.2.1.2. Meat & Poultry

3.2.1.3. Sauces & Dressings

3.2.1.4. Beverages

3.2.1.5. Dairy products

3.2.1.6. Others

3.3. Global Food Thickening Agents Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Food Thickening Agents Market Outlook, 2019 - 2031

4.1. North America Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Plant

4.1.1.1.1. Guar Gum

4.1.1.1.2. Gum Arabic

4.1.1.1.3. Locust Bean Gum

4.1.1.1.4. Pectin

4.1.1.1.5. Starches

4.1.1.1.6. Others

4.1.1.2. Seaweed

4.1.1.2.1. Carrageenan

4.1.1.2.2. Agar

4.1.1.2.3. Alginate

4.1.1.2.4. Microbial

4.1.1.2.5. Gellan Gum

4.1.1.2.6. Curdlan

4.1.1.2.7. Xanthum Gum

4.1.1.2.8. Animal (Gelatin)

4.1.1.3. Synthetic

4.1.1.3.1. Carboxy Methyl Cellulose (CMC)

4.1.1.3.2. Methyl Cellulose

4.2. North America Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Bakery and Confectionery

4.2.1.2. Meat & Poultry

4.2.1.3. Sauces & Dressings

4.2.1.4. Beverages

4.2.1.5. Dairy products

4.2.1.6. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Food Thickening Agents Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. U.S. Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

4.3.1.2. U.S. Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

4.3.1.3. Canada Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

4.3.1.4. Canada Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Food Thickening Agents Market Outlook, 2019 - 2031

5.1. Europe Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Plant

5.1.1.1.1. Guar Gum

5.1.1.1.2. Gum Arabic

5.1.1.1.3. Locust Bean Gum

5.1.1.1.4. Pectin

5.1.1.1.5. Starches

5.1.1.1.6. Others

5.1.1.2. Seaweed

5.1.1.2.1. Carrageenan

5.1.1.2.2. Agar

5.1.1.2.3. Alginate

5.1.1.2.4. Microbial

5.1.1.2.5. Gellan Gum

5.1.1.2.6. Curdlan

5.1.1.2.7. Xanthum Gum

5.1.1.2.8. Animal (Gelatin)

5.1.1.3. Synthetic

5.1.1.3.1. Carboxy Methyl Cellulose (CMC)

5.1.1.3.2. Methyl Cellulose

5.2. Europe Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Bakery and Confectionery

5.2.1.2. Meat & Poultry

5.2.1.3. Sauces & Dressings

5.2.1.4. Beverages

5.2.1.5. Dairy products

5.2.1.6. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Food Thickening Agents Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Germany Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.2. Germany Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.3. U.K. Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.4. U.K. Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.5. France Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.6. France Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.7. Italy Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.8. Italy Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.9. Turkey Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.10. Turkey Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.11. Russia Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.12. Russia Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.1.13. Rest of Europe Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

5.3.1.14. Rest of Europe Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Food Thickening Agents Market Outlook, 2019 - 2031

6.1. Asia Pacific Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Plant

6.1.1.1.1. Guar Gum

6.1.1.1.2. Gum Arabic

6.1.1.1.3. Locust Bean Gum

6.1.1.1.4. Pectin

6.1.1.1.5. Starches

6.1.1.1.6. Others

6.1.1.2. Seaweed

6.1.1.2.1. Carrageenan

6.1.1.2.2. Agar

6.1.1.2.3. Alginate

6.1.1.2.4. Microbial

6.1.1.2.5. Gellan Gum

6.1.1.2.6. Curdlan

6.1.1.2.7. Xanthum Gum

6.1.1.2.8. Animal (Gelatin)

6.1.1.3. Synthetic

6.1.1.3.1. Carboxy Methyl Cellulose (CMC)

6.1.1.3.2. Methyl Cellulose

6.2. Asia Pacific Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Bakery and Confectionery

6.2.1.2. Meat & Poultry

6.2.1.3. Sauces & Dressings

6.2.1.4. Beverages

6.2.1.5. Dairy products

6.2.1.6. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Food Thickening Agents Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. China Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.2. China Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.3. Japan Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.4. Japan Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.5. South Korea Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.6. South Korea Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.7. India Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.8. India Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.9. Southeast Asia Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.10. Southeast Asia Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.1.11. Rest of Asia Pacific Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

6.3.1.12. Rest of Asia Pacific Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Food Thickening Agents Market Outlook, 2019 - 2031

7.1. Latin America Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Plant

7.1.1.1.1. Guar Gum

7.1.1.1.2. Gum Arabic

7.1.1.1.3. Locust Bean Gum

7.1.1.1.4. Pectin

7.1.1.1.5. Starches

7.1.1.1.6. Others

7.1.1.2. Seaweed

7.1.1.2.1. Carrageenan

7.1.1.2.2. Agar

7.1.1.2.3. Alginate

7.1.1.2.4. Microbial

7.1.1.2.5. Gellan Gum

7.1.1.2.6. Curdlan

7.1.1.2.7. Xanthum Gum

7.1.1.2.8. Animal (Gelatin)

7.1.1.3. Synthetic

7.1.1.3.1. Carboxy Methyl Cellulose (CMC)

7.1.1.3.2. Methyl Cellulose

7.2. Latin America Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Bakery and Confectionery

7.2.1.2. Meat & Poultry

7.2.1.3. Sauces & Dressings

7.2.1.4. Beverages

7.2.1.5. Dairy products

7.2.1.6. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Food Thickening Agents Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Brazil Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

7.3.1.2. Brazil Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.3. Mexico Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

7.3.1.4. Mexico Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.5. Argentina Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

7.3.1.6. Argentina Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

7.3.1.7. Rest of Latin America Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

7.3.1.8. Rest of Latin America Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Food Thickening Agents Market Outlook, 2019 - 2031

8.1. Middle East & Africa Food Thickening Agents Market Outlook, by Source, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Plant

8.1.1.1.1. Guar Gum

8.1.1.1.2. Gum Arabic

8.1.1.1.3. Locust Bean Gum

8.1.1.1.4. Pectin

8.1.1.1.5. Starches

8.1.1.1.6. Others

8.1.1.2. Seaweed

8.1.1.2.1. Carrageenan

8.1.1.2.2. Agar

8.1.1.2.3. Alginate

8.1.1.2.4. Microbial

8.1.1.2.5. Gellan Gum

8.1.1.2.6. Curdlan

8.1.1.2.7. Xanthum Gum

8.1.1.2.8. Animal (Gelatin)

8.1.1.3. Synthetic

8.1.1.3.1. Carboxy Methyl Cellulose (CMC)

8.1.1.3.2. Methyl Cellulose

8.2. Middle East & Africa Food Thickening Agents Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Bakery and Confectionery

8.2.1.2. Meat & Poultry

8.2.1.3. Sauces & Dressings

8.2.1.4. Beverages

8.2.1.5. Dairy products

8.2.1.6. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Food Thickening Agents Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. GCC Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

8.3.1.2. GCC Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.3. South Africa Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

8.3.1.4. South Africa Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.5. Egypt Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

8.3.1.6. Egypt Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.7. Nigeria Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

8.3.1.8. Nigeria Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

8.3.1.9. Rest of Middle East & Africa Food Thickening Agents Market by Source, Value (US$ Bn), 2019 - 2031

8.3.1.10. Rest of Middle East & Africa Food Thickening Agents Market by Application, Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Organism Heat map

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Cargill Inc.

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Archer Daniels Midland Company

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Gustav Heese GmbH

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Henry Lamotte Oils GmbH

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Krishi Oils Limited

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Natrol LLC.

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. AOS Products Pvt. Ltd.

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Jajoo Brothers

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. OPW Ingredients

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Spectrum Chemical Mfg. Corp.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Sanmark Corp.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Sarika Ventures Pvt. Ltd.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Alberdingk Boley GmbH

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. Others (on additional request)

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. Hangzhou Choisun Bio-tech Co. Ltd.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

9.4.16. ECO Overseas

9.4.16.1. Company Overview

9.4.16.2. Product Portfolio

9.4.16.3. Financial Overview

9.4.16.4. Business Strategies and Development

9.4.17. A.G. Industries

9.4.17.1. Company Overview

9.4.17.2. Product Portfolio

9.4.17.3. Financial Overview

9.4.17.4. Business Strategies and Development

9.4.18. Vandeputte Group

9.4.18.1. Company Overview

9.4.18.2. Product Portfolio

9.4.18.3. Financial Overview

9.4.18.4. Business Strategies and Development

9.4.19. Bartoline Ltd.

9.4.19.1. Company Overview

9.4.19.2. Product Portfolio

9.4.19.3. Financial Overview

9.4.19.4. Business Strategies and Development

9.4.20. Grupo Plimon

9.4.20.1. Company Overview

9.4.20.2. Product Portfolio

9.4.20.3. Financial Overview

9.4.20.4. Business Strategies and Development

9.4.21. Merck KGaA

9.4.21.1. Company Overview

9.4.21.2. Product Portfolio

9.4.21.3. Financial Overview

9.4.21.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Source Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |