Global Foodservice Packaging Market Forecast

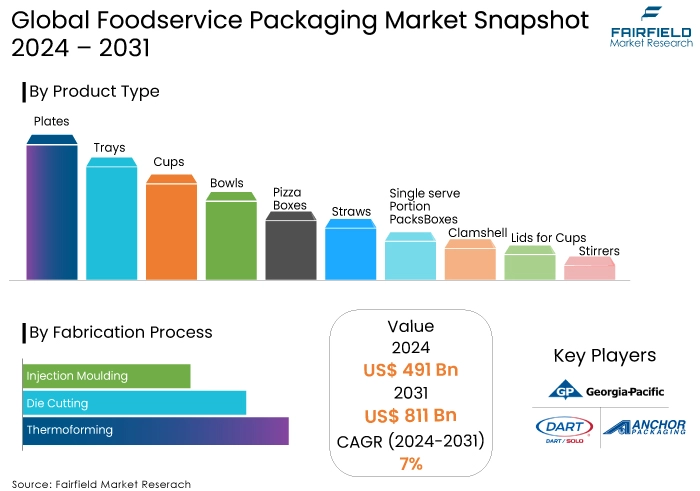

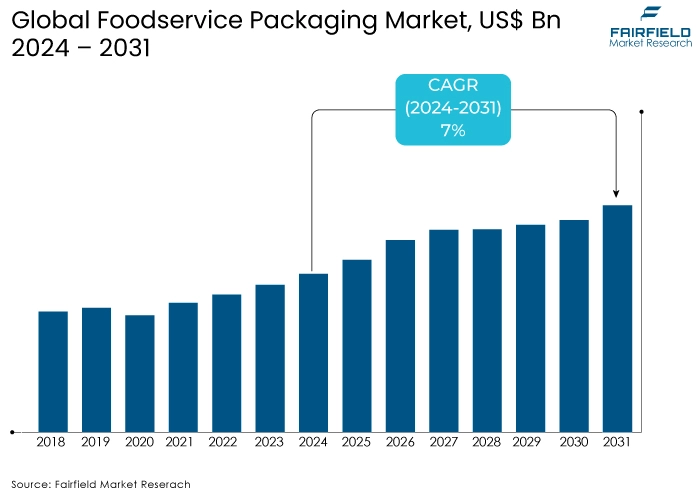

- The approximately US$491 Bn foodservice packaging market size likely to reach US$811 Bn by the end of 2031

- Global foodservice packaging market revenue all set to experience a CAGR of 7% during 2024-2031

Foodservice Packaging Market Insights

- Foodservice packaging is a growing market driven by QSRs, delivery, and urbanization.

- Plastic dominates the market but faces challenges from sustainable alternatives like paperboard.

- Containers and cups are the primary product segments, while thermoforming and injection molding are key fabrication processes.

- Foodservice outlets remain the largest end-user, but online food ordering is rapidly expanding.

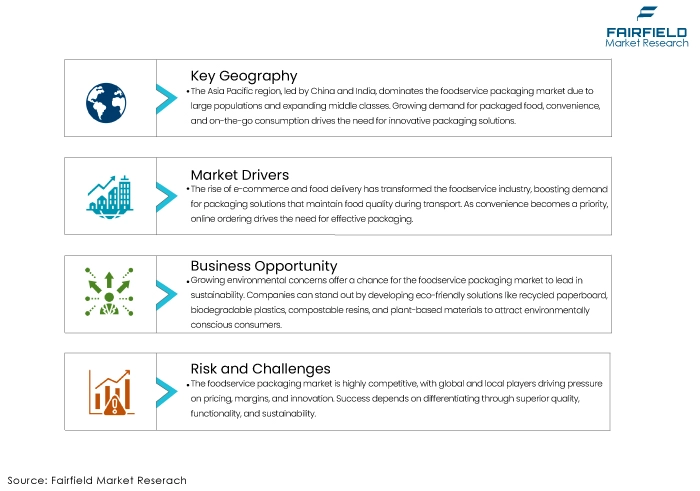

- Asia Pacific is the leader in the global foodservice packaging market, followed by North America.

- Sustainability is a major trend, with a shift towards eco-friendly materials and designs.

- Intense competition, economic fluctuations, and regulatory challenges are key market hurdles.

- Consumers increasingly prioritize health and convenience, influencing packaging choices.

- E-commerce and food delivery are reshaping packaging needs, requiring innovative solutions.

- The industry is ripe for innovation in materials, design, and business models.

A Look Back and a Look Forward - Comparative Analysis

Market growth has been a steady climb during the historical years of projection. The foodservice packaging market exhibited steady growth in the pre-2023 era, primarily propelled by the expansion of the foodservice sector, particularly quick-service restaurants (QSRs), and food delivery services. The increasing preference for convenient and on-the-go meal options, coupled with the growing urban population, fueled demand for effective packaging solutions.

Plastic, owing to its versatility and cost-effectiveness, dominated the market. However, this growth trajectory was tempered by mounting environmental concerns and the growing awareness of plastic pollution, which began to influence consumer behavior and regulatory landscapes.

Post-2024, the market is expected to witness an accelerated growth outlook. The foodservice packaging market is poised for a period of accelerated growth post-2024, driven by a confluence of factors. The surge in online food ordering and delivery services, spurred by the COVID-19 pandemic and sustained by consumer convenience, remains a primary catalyst. The increasing emphasis on sustainability and consumer preference for eco-friendly alternatives is compelling manufacturers to innovate with biodegradable and compostable packaging solutions.

Advancements in packaging design and materials science, such as barrier coatings, active packaging, and smart packaging, are further propelling market expansion. Moreover, the growing middle class in emerging economies presents lucrative opportunities for packaging manufacturers. While challenges such as raw material price fluctuations and economic uncertainties persist, the overall outlook for the market is optimistic.

The contrast between the steady growth of the pre-2023 era and the projected accelerated growth post-2024 underscores the dynamic nature of the foodservice packaging market. While the pre-2023 period was largely driven by the expansion of the foodservice industry and consumer demand for convenience, the post-2024 landscape is characterized by a greater emphasis on sustainability, technological innovation, and changing consumer preferences.

How is Regulatory Scenario Shaping this Industry?

The foodservice packaging industry operates in a complex regulatory landscape, with governments worldwide imposing stringent standards to protect public health, safety, and the environment. Adherence to these regulations is crucial for market participation and maintaining consumer trust. Compliance necessitates significant investments in research and development, leading to increased product development costs.

Moreover, these regulations are driving a shift towards sustainable packaging solutions. The emphasis on recycling, composting, and reducing packaging waste has compelled manufacturers to explore and adopt eco-friendly materials and designs. While this transition involves initial challenges and increased costs, it also presents opportunities to capture the growing market for sustainable products in the foodservice packaging market.

However, inconsistent regulations across different regions can create complexities for businesses operating on a global scale. The regulatory environment is influencing market performance by shaping product development, increasing costs, and driving industry focus towards sustainability. Companies that can effectively navigate these regulatory challenges while maintaining product quality and affordability are likely to gain a competitive advantage.

Key Growth Determinants

E-commerce and Food Delivery

The convergence of e-commerce and food delivery has dramatically reshaped the foodservice landscape, propelling demand in the global foodservice packaging market. As consumers increasingly prioritize convenience and time-saving options, online platforms have emerged as preferred channels for ordering food. This shift has necessitated robust packaging solutions capable of preserving food quality during transportation.

Moreover, the growing popularity of meal kits and prepared food delivery services has created a demand for specialized packaging that protects delicate ingredients and ensures product integrity. The rise of ghost kitchens and cloud kitchens, which primarily operate for delivery, further amplifies the need for packaging that is optimized for transportation and maintains food temperature.

Growing Health and Wellness Consciousness

The heightened focus on health and wellness has significantly influenced consumer behavior and purchasing decisions, including food packaging preferences. Consumers are increasingly seeking packaging options that align with their health-conscious lifestyles. This trend has led to a demand for packaging materials that are perceived as safe, hygienic, and free from harmful chemicals.

Moreover, there is a growing emphasis on transparent packaging that allows consumers to visually assess the contents, fostering trust and transparency. Additionally, packaging solutions that preserve the nutritional value of food, such as vacuum-sealed or modified atmosphere packaging, are gaining traction.

Expanding Foodservice Industry

The dynamic evolution of the foodservice industry, characterized by the emergence of new formats and concepts, is driving growth in the foodservice packaging market. The proliferation of quick-service restaurants (QSRs), casual dining establishments, and fine dining restaurants has created a diverse range of packaging requirements.

QSRs, for instance, demand packaging solutions that prioritize speed, convenience, and portability. On the other hand, fine dining restaurants often require premium packaging that complements the dining experience. Additionally, the rise of food trucks, catering services, and food halls has expanded the market for specialized packaging solutions tailored to specific food types and consumption occasions.

Major Growth Barriers

Intense Market Competition

The foodservice packaging market is characterized by a fiercely competitive landscape, with a diverse array of players ranging from global conglomerates to regional and local manufacturers. This intense rivalry exerts significant pressure on pricing, profit margins, and the need for continuous innovation. To thrive in this environment, companies must differentiate their product offerings through superior quality, functionality, and sustainability.

Building a strong brand identity is essential to establish customer loyalty and premium pricing. Additionally, efficient distribution networks and robust supply chain management are crucial for reaching target markets and ensuring timely delivery. The ability to adapt to evolving consumer preferences and market trends is paramount for maintaining a competitive edge.

Economic Fluctuations

The foodservice packaging industry is inherently susceptible to economic fluctuations. During periods of economic downturn, consumer spending on foodservice tends to decline, leading to a corresponding decrease in demand for packaging materials. This can result in lower sales volumes and reduced revenue for packaging manufacturers. Furthermore, the industry is exposed to volatility in raw material prices, such as oil and paper, which are essential components of many packaging products.

Price increases for these raw materials can erode profit margins and necessitate price adjustments for finished products. To mitigate these challenges, effective cost management strategies, including optimizing production processes, sourcing materials efficiently, and exploring alternative raw materials, are crucial. Building a resilient supply chain capable of adapting to changing market conditions is also essential for long-term success.

Foodservice Packaging Market Trends and Opportunities

Growing Focus on Sustainability

The escalating global concern for environmental preservation presents a compelling opportunity in the foodservice packaging market to position itself as a leader in sustainable practices. By prioritizing research and development of eco-friendly packaging solutions, companies can differentiate themselves in the market and attract environmentally conscious consumers. This involves exploring and adopting materials such as recycled paperboard, biodegradable plastics, compostable resins, and plant-based alternatives.

Moreover, optimizing packaging design to minimize material usage and enhance recyclability is crucial. By embracing sustainability, companies can not only enhance their brand reputation but also contribute to a greener future. Additionally, aligning with evolving consumer preferences and complying with increasingly stringent environmental regulations can provide a competitive advantage.

Expansion into Developing Markets

The rapid economic growth and urbanization of emerging markets, such as India, China, and Brazil, offer immense potential for the foodservice packaging industry. The burgeoning middle class in these countries is driving increased consumption of packaged food and beverages, creating a robust demand for packaging solutions. Adapting to local tastes, preferences, and cultural nuances is essential for success.

Moreover, understanding the regulatory landscape and establishing strong distribution networks are crucial for penetrating these markets. By leveraging cost-effective manufacturing processes and localized sourcing, companies can gain a competitive edge. Additionally, focusing on packaging solutions that address specific needs, such as affordability, convenience, and food safety, can drive the foodservice packaging market penetration.

Segments Covered in Foodservice Packaging Market Report

Containers (Plates, Trays, Bowls) to be the Bestselling Product Category

Containers represent the cornerstone of the foodservice packaging market, accounting for a substantial portion of overall sales. Their versatility in accommodating a wide range of food items, from hot meals to salads and desserts, drives their high demand. Both dine-in and takeaway food services rely heavily on containers, contributing significantly to their sales. Moreover, the increasing popularity of meal kits and ready-to-eat meals has further boosted the demand for containers that are suitable for food preparation and reheating.

Cups Capture a Measurable Share of Total Sales

Cups constitute another significant segment within the foodservice packaging market. The ubiquitous consumption of hot and cold beverages across various settings, including restaurants, cafes, and on-the-go consumption, has fueled robust sales in this category. The convenience and disposable nature of cups have made them indispensable for both foodservice establishments and consumers. Additionally, the growing popularity of coffee chains and specialty beverage shops has contributed to the expansion of this segment, with a focus on customized cup designs and sizes.

Plastic Remains the Materials of Choice

Plastic remains the dominant material in the foodservice packaging market due to its exceptional versatility. Its malleability allows for the creation of a wide range of products, from thin films for wraps to rigid containers for hot meals. Furthermore, plastic offers excellent barrier properties, protecting food from external contaminants and preserving freshness. Its cost-effectiveness has also been a significant factor in its widespread adoption. However, growing environmental concerns and increasing regulations are prompting a shift towards more sustainable alternatives.

Paperboard Experiencing Substantial Growth in Demand

Paperboard has experienced substantial growth in the foodservice packaging market, primarily driven by its renewability and recyclability. Its adoption has been particularly strong in containers, cups, and food trays, where it offers a suitable balance of strength, rigidity, and printability. The increasing emphasis on sustainability has accelerated the shift towards paperboard as consumers become more conscious of their environmental impact. Additionally, advancements in paperboard technology have led to the development of higher-performance materials with improved barrier properties, expanding its application possibilities within the foodservice sector.

Thermoforming Fabrication Process Remains Preferred, Popularity of Injection Molding Soars

Thermoforming is a dominant fabrication process in the foodservice packaging market due to its versatility and efficiency. It involves heating a plastic sheet to a pliable state and forming it into a desired shape using a mold. This process is widely used to produce a variety of packaging products, including plates, trays, and cups. Thermoforming offers flexibility in terms of shape and design, enabling manufacturers to create packaging solutions that meet diverse consumer needs.

Injection molding is another key fabrication process in the foodservice packaging industry, particularly for producing rigid containers and cutlery. This process involves injecting molten plastic into a mold, allowing for precise control over product dimensions and quality. Injection molding is often preferred for high-volume production due to its efficiency and ability to create complex shapes with intricate details.

Foodservice Outlets Lead the Way by End Use, Online Ordering Gears up for Momentous Growth

Foodservice outlets, including restaurants, cafes, and quick-service establishments, constitute the primary end-use in the foodservice packaging market. These businesses rely heavily on packaging to serve food and beverages to customers both on-premise and for takeaway. The choice of packaging often depends on the type of food, brand image, and environmental considerations.

The online food ordering segment has also witnessed rapid growth in recent years, driven by the increasing popularity of food delivery services. This has led to a surge in demand for packaging solutions that are suitable for transportation, maintain food quality, and protect the environment. Packaging manufacturers are focusing on developing innovative solutions that meet the specific requirements of this growing market, such as insulated packaging for hot food and leak-proof containers.

Regional Analysis

Asia Pacific Remains the Dominant Force

The Asia Pacific region stands as a behemoth in the foodservice packaging market. Countries like China, and India, with their burgeoning populations and rapidly expanding middle classes, are driving immense demand for packaged food and beverages. The region's diverse culinary landscape, coupled with a growing preference for convenience and on-the-go consumption, has fueled the need for innovative packaging solutions.

Additionally, the e-commerce boom and increasing urbanization have accelerated the growth of food delivery services, further boosting the demand for packaging. While the region faces challenges related to environmental concerns and plastic pollution, it also presents significant opportunities for sustainable packaging solutions.

North America Represents a Mature Market with High Growth Potential

North America is a mature market for foodservice packaging, characterized by a high level of competition and a strong focus on sustainability. The region boasts a well-established foodservice industry, with a diverse range of restaurants, cafes, and convenience stores.

Consumers in North America have a growing preference for healthy and convenient food options, driving demand for packaging solutions that meet these criteria. The increasing emphasis on sustainability has led to a surge in demand for eco-friendly packaging materials. While the market is relatively mature, continued innovation in packaging design and materials, coupled with a focus on sustainability, can drive future growth of the foodservice packaging market.

Fairfield’s Competitive Landscape Analysis

The foodservice packaging market is highly competitive, characterized by a mix of global conglomerates and regional players. Key players often possess strong brand recognition, extensive distribution networks, and a diverse product portfolio.

Intense competition drives innovation, focusing on sustainability, cost-efficiency, and customization. Smaller players often differentiate through niche offerings, regional focus, or specialized material expertise. Consolidation through mergers and acquisitions is common, as companies strive to expand their market share and product range.

Key Market Players

- Dart Container Corporation

- Georgia-Pacific LLC

- Anchor Packaging Inc.

- Pactiv LLC

- D&W Fine Pack

- Gold Plast SPA

- Berry Global Group Inc.

- Dopla S.p.A.

- Smurfit Kappa Group

- WestRock Company

- Huhtamäki Oyj

- New WinCup Holdings, Inc.

- Linpac Packaging Ltd

- Graphic Packaging Holding Company

Recent Industry Developments

- In June 2023, Pactiv Evergreen expanded its sustainable product line with the launch of a new range of plant-based cutlery. Made from renewable resources, these compostable utensils offer a more eco-friendly alternative to traditional plastic cutlery, aligning with the company's commitment to reducing plastic waste.

- Huhtamaki introduced a groundbreaking line of fiber-based food trays in June 2023. These trays offer superior heat resistance and grease resistance while maintaining a high level of recyclability. This innovation demonstrates Huhtamaki's dedication to providing sustainable packaging solutions without compromising performance.

- In a strategic move in June 2023, Berry Global announced a partnership to develop advanced recycling technology. This collaboration aims to increase the recyclability of plastic packaging and create high-quality recycled resins for new packaging products, contributing to a circular economy for plastics.

Global Foodservice Packaging Market is Segmented as-

By Product Type

- Plates

- Trays

- Cups

- Bowls

- Pizza Boxes

- Straws

- Single serve Portion Packs

- Clamshell

- Lids for Cups

- Stirrers

- Cutlery (Knives, Forks, Spoons)

By Material

- Aluminium

- Paperboard

- Moulded Fibres

- Plastic

- Polystyrene

- Polypropylene

- Polyethylene

- Polyethylene Terephthalate

- Poly Lactic Acid

- Wood

By Fabrication Process

- Thermoforming

- Die Cutting

- Injection Moulding

By End Use

- Foodservice Outlets

- Institutional Foodservice

- Online Food Ordering

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

1. Executive Summary

1.1. Global Foodservice Packaging Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Foodservice Packaging Market Outlook, 2019 - 2031

3.1. Global Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Plates

3.1.1.2. Trays

3.1.1.3. Cups

3.1.1.4. Bowls

3.1.1.5. Pizza Boxes

3.1.1.6. Straws

3.1.1.7. Single serve Portion Packs

3.1.1.8. Clamshell

3.1.1.9. Lids for Cups

3.1.1.10. Stirrers

3.1.1.11. Cutlery (Knives, Forks, Spoons)

3.2. Global Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Aluminium

3.2.1.2. Paperboard

3.2.1.3. Moulded Fibres

3.2.1.4. Plastic

3.2.1.5. Polystyrene

3.2.1.6. Polypropylene

3.2.1.7. Polyethylene

3.2.1.8. Polyethylene Terephthalate

3.2.1.9. Poly Lactic Acid

3.2.1.10. Wood

3.3. Global Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Thermoforming

3.3.1.2. Die Cutting

3.3.1.3. Injection Moulding

3.4. Global Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. Foodservice Outlets

3.4.1.2. Institutional Foodservice

3.4.1.3. Online Food Ordering

3.5. Global Foodservice Packaging Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

4. North America Foodservice Packaging Market Outlook, 2019 - 2031

4.1. North America Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Plates

4.1.1.2. Trays

4.1.1.3. Cups

4.1.1.4. Bowls

4.1.1.5. Pizza Boxes

4.1.1.6. Straws

4.1.1.7. Single serve Portion Packs

4.1.1.8. Clamshell

4.1.1.9. Lids for Cups

4.1.1.10. Stirrers

4.1.1.11. Cutlery (Knives, Forks, Spoons)

4.2. North America Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Aluminium

4.2.1.2. Paperboard

4.2.1.3. Moulded Fibres

4.2.1.4. Plastic

4.2.1.5. Polystyrene

4.2.1.6. Polypropylene

4.2.1.7. Polyethylene

4.2.1.8. Polyethylene Terephthalate

4.2.1.9. Poly Lactic Acid

4.2.1.10. Wood

4.3. North America Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Thermoforming

4.3.1.2. Die Cutting

4.3.1.3. Injection Moulding

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. Foodservice Outlets

4.4.1.2. Institutional Foodservice

4.4.1.3. Online Food Ordering

4.4.2. BPS Analysis/Market Attractiveness Analysis

4.5. North America Foodservice Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.5.1. Key Highlights

4.5.1.1. U.S. Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

4.5.1.2. U.S. Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

4.5.1.3. U.S. Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

4.5.1.4. U.S. Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

4.5.1.5. Canada Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

4.5.1.6. Canada Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

4.5.1.7. Canada Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

4.5.1.8. Canada Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Foodservice Packaging Market Outlook, 2019 - 2031

5.1. Europe Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Plates

5.1.1.2. Trays

5.1.1.3. Cups

5.1.1.4. Bowls

5.1.1.5. Pizza Boxes

5.1.1.6. Straws

5.1.1.7. Single serve Portion Packs

5.1.1.8. Clamshell

5.1.1.9. Lids for Cups

5.1.1.10. Stirrers

5.1.1.11. Cutlery (Knives, Forks, Spoons)

5.2. Europe Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Aluminium

5.2.1.2. Paperboard

5.2.1.3. Moulded Fibres

5.2.1.4. Plastic

5.2.1.5. Polystyrene

5.2.1.6. Polypropylene

5.2.1.7. Polyethylene

5.2.1.8. Polyethylene Terephthalate

5.2.1.9. Poly Lactic Acid

5.2.1.10. Wood

5.3. Europe Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Thermoforming

5.3.1.2. Die Cutting

5.3.1.3. Injection Moulding

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Foodservice Outlets

5.4.1.2. Institutional Foodservice

5.4.1.3. Online Food Ordering

5.4.2. BPS Analysis/Market Attractiveness Analysis

5.5. Europe Foodservice Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.5.1. Key Highlights

5.5.1.1. Germany Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.2. Germany Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.3. Germany Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.4. Germany Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.5. U.K. Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.6. U.K. Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.7. U.K. Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.8. U.K. Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.9. France Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.10. France Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.11. France Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.12. France Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.13. Italy Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.14. Italy Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.15. Italy Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.16. Italy Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.17. Turkey Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.18. Turkey Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.19. Turkey Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.20. Turkey Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.21. Russia Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.22. Russia Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.23. Russia Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.24. Russia Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.1.25. Rest of Europe Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

5.5.1.26. Rest of Europe Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

5.5.1.27. Rest of Europe Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

5.5.1.28. Rest of Europe Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Foodservice Packaging Market Outlook, 2019 - 2031

6.1. Asia Pacific Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Plates

6.1.1.2. Trays

6.1.1.3. Cups

6.1.1.4. Bowls

6.1.1.5. Pizza Boxes

6.1.1.6. Straws

6.1.1.7. Single serve Portion Packs

6.1.1.8. Clamshell

6.1.1.9. Lids for Cups

6.1.1.10. Stirrers

6.1.1.11. Cutlery (Knives, Forks, Spoons)

6.2. Asia Pacific Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Aluminium

6.2.1.2. Paperboard

6.2.1.3. Moulded Fibres

6.2.1.4. Plastic

6.2.1.5. Polystyrene

6.2.1.6. Polypropylene

6.2.1.7. Polyethylene

6.2.1.8. Polyethylene Terephthalate

6.2.1.9. Poly Lactic Acid

6.2.1.10. Wood

6.3. Asia Pacific Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Thermoforming

6.3.1.2. Die Cutting

6.3.1.3. Injection Moulding

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. Foodservice Outlets

6.4.1.2. Institutional Foodservice

6.4.1.3. Online Food Ordering

6.4.2. BPS Analysis/Market Attractiveness Analysis

6.5. Asia Pacific Foodservice Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.5.1. Key Highlights

6.5.1.1. China Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.2. China Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.3. China Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.4. China Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.5. Japan Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.6. Japan Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.7. Japan Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.8. Japan Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.9. South Korea Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.10. South Korea Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.11. South Korea Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.12. South Korea Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.13. India Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.14. India Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.15. India Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.16. India Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.17. Southeast Asia Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.18. Southeast Asia Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.19. Southeast Asia Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.20. Southeast Asia Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.1.21. Rest of Asia Pacific Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

6.5.1.22. Rest of Asia Pacific Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

6.5.1.23. Rest of Asia Pacific Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

6.5.1.24. Rest of Asia Pacific Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Foodservice Packaging Market Outlook, 2019 - 2031

7.1. Latin America Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Plates

7.1.1.2. Trays

7.1.1.3. Cups

7.1.1.4. Bowls

7.1.1.5. Pizza Boxes

7.1.1.6. Straws

7.1.1.7. Single serve Portion Packs

7.1.1.8. Clamshell

7.1.1.9. Lids for Cups

7.1.1.10. Stirrers

7.1.1.11. Cutlery (Knives, Forks, Spoons)

7.2. Latin America Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Aluminium

7.2.1.2. Paperboard

7.2.1.3. Moulded Fibres

7.2.1.4. Plastic

7.2.1.5. Polystyrene

7.2.1.6. Polypropylene

7.2.1.7. Polyethylene

7.2.1.8. Polyethylene Terephthalate

7.2.1.9. Poly Lactic Acid

7.2.1.10. Wood

7.3. Latin America Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Thermoforming

7.3.1.2. Die Cutting

7.3.1.3. Injection Moulding

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Foodservice Outlets

7.4.1.2. Institutional Foodservice

7.4.1.3. Online Food Ordering

7.4.2. BPS Analysis/Market Attractiveness Analysis

7.5. Latin America Foodservice Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.5.1. Key Highlights

7.5.1.1. Brazil Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

7.5.1.2. Brazil Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

7.5.1.3. Brazil Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

7.5.1.4. Brazil Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.5. Mexico Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

7.5.1.6. Mexico Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

7.5.1.7. Mexico Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

7.5.1.8. Mexico Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.9. Argentina Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

7.5.1.10. Argentina Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

7.5.1.11. Argentina Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

7.5.1.12. Argentina Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.1.13. Rest of Latin America Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

7.5.1.14. Rest of Latin America Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

7.5.1.15. Rest of Latin America Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

7.5.1.16. Rest of Latin America Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Foodservice Packaging Market Outlook, 2019 - 2031

8.1. Middle East & Africa Foodservice Packaging Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Plates

8.1.1.2. Trays

8.1.1.3. Cups

8.1.1.4. Bowls

8.1.1.5. Pizza Boxes

8.1.1.6. Straws

8.1.1.7. Single serve Portion Packs

8.1.1.8. Clamshell

8.1.1.9. Lids for Cups

8.1.1.10. Stirrers

8.1.1.11. Cutlery (Knives, Forks, Spoons)

8.2. Middle East & Africa Foodservice Packaging Market Outlook, by Material, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Aluminium

8.2.1.2. Paperboard

8.2.1.3. Moulded Fibres

8.2.1.4. Plastic

8.2.1.5. Polystyrene

8.2.1.6. Polypropylene

8.2.1.7. Polyethylene

8.2.1.8. Polyethylene Terephthalate

8.2.1.9. Poly Lactic Acid

8.2.1.10. Wood

8.3. Middle East & Africa Foodservice Packaging Market Outlook, by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Thermoforming

8.3.1.2. Die Cutting

8.3.1.3. Injection Moulding

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Foodservice Packaging Market Outlook, by End Use, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. Foodservice Outlets

8.4.1.2. Institutional Foodservice

8.4.1.3. Online Food Ordering

8.4.2. BPS Analysis/Market Attractiveness Analysis

8.5. Middle East & Africa Foodservice Packaging Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.5.1. Key Highlights

8.5.1.1. GCC Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

8.5.1.2. GCC Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

8.5.1.3. GCC Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.5.1.4. GCC Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.5. South Africa Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

8.5.1.6. South Africa Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

8.5.1.7. South Africa Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.5.1.8. South Africa Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.9. Egypt Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

8.5.1.10. Egypt Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

8.5.1.11. Egypt Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.5.1.12. Egypt Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.13. Nigeria Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

8.5.1.14. Nigeria Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

8.5.1.15. Nigeria Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.5.1.16. Nigeria Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.1.17. Rest of Middle East & Africa Foodservice Packaging Market by Product Type, Value (US$ Bn), 2019 - 2031

8.5.1.18. Rest of Middle East & Africa Foodservice Packaging Market by Material, Value (US$ Bn), 2019 - 2031

8.5.1.19. Rest of Middle East & Africa Foodservice Packaging Market by Fabrication Process, Value (US$ Bn), 2019 - 2031

8.5.1.20. Rest of Middle East & Africa Foodservice Packaging Market by End Use, Value (US$ Bn), 2019 - 2031

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Type vs by Material Heat map

9.2. Manufacturer vs by Material Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Dart Container Corporation

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Georgia-Pacific LLC

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Anchor Packaging Inc.

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Pactiv LLC

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. D&W Fine Pack

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Gold Plast SPA

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Berry Global Group Inc.

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Dopla S.p.A.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Smurfit Kappa Group

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. WestRock Company

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Huhtamäki Oyj

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. New WinCup Holdings, Inc.

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Linpac Packaging Ltd

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Graphic Packaging Holding Company

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Others (on request)

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Material Coverage |

|

|

Fabrication Process Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |