Global Foot Care Products Market Forecast

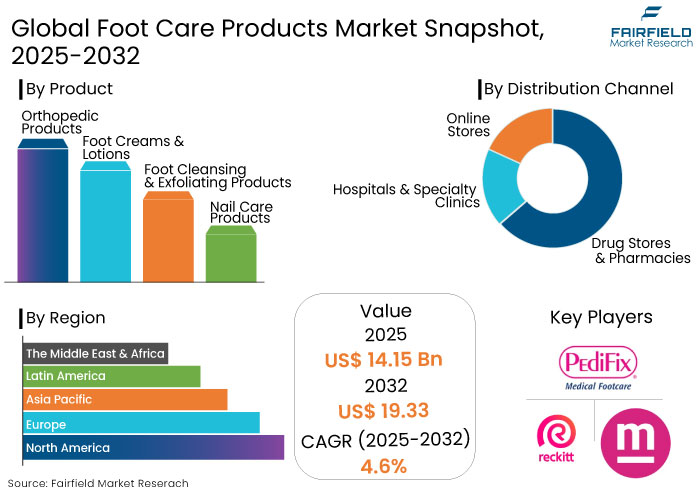

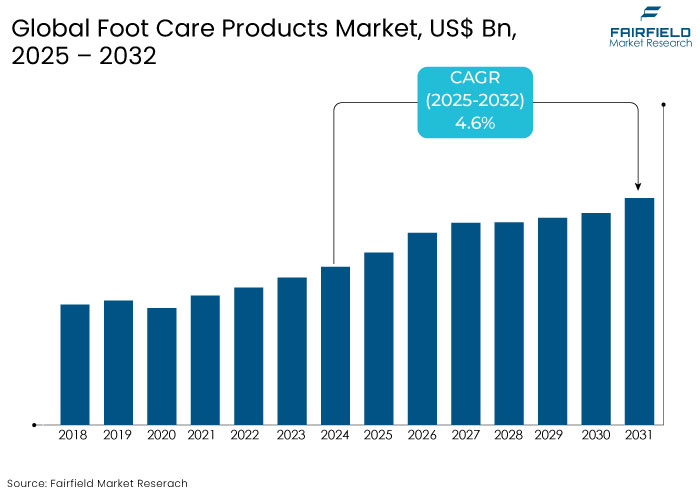

- The foot care products market is projected to reach a size of US$ 19.33 Bn by 2032 from US$ 14.15 Bn predicted in 2025.

- The market for foot care products is likely to witness a significant CAGR of 4.6% from 2025 to 2032.

Foot Care Products Market Insights

- Rising elderly population, particularly those with arthritis, is surging the demand for specialized foot care products.

- Growing wellness and self-care movement has increased demand for foot relaxation therapies, aromatherapy foot creams, and at-home pedicure kits.

- As the number of diabetic individuals rises globally, demand for diabetic foot care products is increasing rapidly.

- Athletes and fitness enthusiasts are increasingly turning to foot care products for relief from conditions such as plantar fasciitis and stress fractures.

- Development of AI-driven foot health monitoring tools and temperature-sensitive materials is enhancing the effectiveness of foot care products.

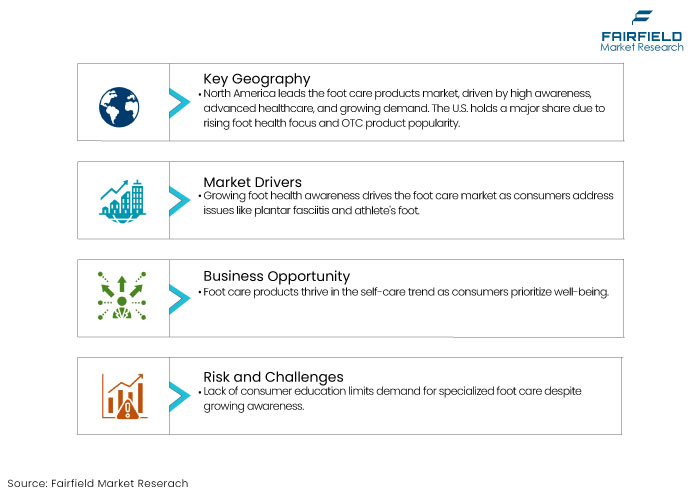

- North America is anticipated to dominate in terms of the global sales of foot care products through 2032.

- Online stores are projected to lead by distribution channel with 40% of market share in 2025.

- Orthopedic products are anticipated to dominate by product type category with 45% of the market share in 2025.

Key Growth Determinants

- Increasing Awareness of Foot Health

Rising awareness about the importance of foot health is one of the key growth drivers for the foot care products market. With rising concerns about conditions like plantar fasciitis, bunions, athlete's foot, and other foot-related issues, consumers are becoming increasingly conscious about taking proper care of their feet.

Rise of social media, blogs, and health influencers has played a significant role in educating the public about foot health. People are increasingly looking for solutions that can help lower foot pain, improve comfort, and maintain foot hygiene.

Foot care brands are hence introducing various products designed to meet these needs, from moisturizing lotions to specialized creams that target specific foot issues. As more consumers recognize the long-term benefits of foot care, the market continues to rise.

- Rising Prevalence of Foot Disorders and Conditions

Increasing prevalence of foot-related disorders and conditions has significantly surged the foot care products market growth. Conditions such as diabetic neuropathy, arthritis, heel pain, and bunions are on the rise, especially among older individuals and those with sedentary lifestyles.

Growing burden of foot health issues is driving the need for specialized orthopedic foot care products, such as arch support insoles and therapeutic foot creams. As people spend more time on their feet due to work and leisure activities, they become more prone to foot problems, increasing the demand for solutions like foot cleansing and exfoliating products.

With the rise of electric foot massagers and other therapeutic foot care devices, consumers are turning to products that relieve foot pain and enhance comfort. The trend will likely continue as more individuals seek preventive measures and solutions to common foot ailments.

Key Growth Barriers

- Lack of Consumer Education on Foot Health is a Key Barrier

Despite surging awareness, a significant lack of comprehensive consumer education on proper foot care remains a key challenge. Several consumers still underestimate the importance of foot health, leading to insufficient demand for specialized foot care products.

Lack of awareness hinders the market's potential, particularly in regions where foot health issues are not a primary concern. Consumers often overlook the long-term benefits of foot care products, such as foot exfoliating creams and therapeutic insoles, due to limited education on the risks of neglecting foot health. This restraint is particularly noticeable in emerging markets, where more urgent health concerns often overshadow foot care.

To overcome this challenge, companies must educate consumers about the significance of proper foot care, particularly in preventing common ailments like bunions and plantar fasciitis. Until this knowledge gap is bridged, market growth may remain slower than expected.

Foot Care Products Market Trends and Opportunities

- Integration of Foot Care with Wellness and Self-care Trends

Foot care products are increasingly incorporated into the broader wellness and self-care movement, which presents a transformative growth opportunity. As more consumers prioritize their well-being, foot health is gaining attention as an essential aspect of self-care.

Foot relaxation therapies, aromatherapy foot creams, and at-home pedicure kits are gaining popularity, especially as consumers seek holistic approaches to relaxation and health. This trend has opened the door for foot care brands to align their products with wellness lifestyles, tapping into the high demand for natural and organic foot care products.

- Rising Demand for Foot Care Solutions among Aging Populations

One of the most transformative opportunities in the foot care products market is addressing the needs of the aging population. As the global population ages, foot health has become a significant concern, especially among seniors who experience conditions such as arthritis, plantar fasciitis, and diabetic neuropathy.

Growing awareness of the importance of foot care has led to a surging demand for products like orthopedic insoles, foot creams for dryness, and specialized foot health solutions. The elderly are increasingly seeking products that can provide comfort, relieve pain, and improve mobility. This shift presents a unique opportunity for brands to offer targeted foot care products that cater to specific age-related concerns.

Due to the increasing prevalence of diabetes worldwide, there is a rising demand for diabetic foot care products. Companies can capitalize on this opportunity by developing products that address these specific needs, further tapping into a large, underserved market segment.

Segment Covered in the Report

- Orthopedic Products to Lead Amid Urgent Need to Alleviate Pain

Orthopedic products hold the dominant position based on product type in the foot care products market, accumulating around 45% of the total share in 2025. The segment includes a wide range of products designed to address specific foot health issues, such as foot orthotics, insoles, heel cups, arch supports, and similar corrective footwear.

Orthopedic foot care products are showcasing high demand as more people seek effective solutions for managing foot pain, particularly in regions with an aging population or rising incidences of chronic foot conditions. Rising number of consumers, especially among older adults who experience foot-related issues or those involved in physical activities, is a key factor driving the segment's growth.

- Online Stores to Gain Traction with Easy Access to Products

Online stores have witnessed substantial growth in the past few years in the foot care products market. It was due to increasing consumer preference for the convenience and variety offered by e-commerce platforms. With a simple click, customers can access a wide range of foot care products, including orthopedic items, foot creams, nail care solutions, and exfoliating products, all from the comfort of their homes.

Direct-to-consumer brands, e-commerce giants like Amazon and Walmart, and specialized platforms for health and wellness products have significantly boosted online sales of foot care items. Consumers are increasingly relying on these platforms not only for the convenience of shopping but also for the availability of personalized recommendations and targeted marketing that aligns with their foot care needs.

Growing trend of digitalization and the rise in mobile commerce are contributing to the rapid growth of the online segment. As more people prioritize self-care and health, online stores remain a convenient and accessible option for purchasing foot care products. With continuous improvements in e-commerce technologies, including faster shipping and easier return policies, the online store distribution channel is likely to maintain its leading position in the market.

Regional Analysis

- North America to Dominate Amid High Demand for Insoles and Creams

North America dominates the foot care products market due to high consumer awareness, novel healthcare infrastructure, and increasing demand for personal care items. The U.S. holds a significant share, driven by a surging emphasis on foot health and rising popularity of over-the-counter foot care products such as insoles, creams, and specialized footwear.

North America-based consumers increasingly prioritize natural and organic foot care options, further broadening the eco-friendly and sustainable products market. The region’s extensive retail networks, e-commerce platforms, and innovative product offerings are key contributors to its leadership in the market.

- Europe Sees Steady Growth Amid Prevalence of Arthritis

Europe stands as the second-largest foot care products market, with significant contributions from countries like Germany, the U.K., and France. The region benefits from a rising awareness of foot health, particularly among the aging population, which requires more foot care due to age-related issues such as bunions and arthritis.

Local consumers have increasingly preferred high-quality, clinically tested foot care products, including antifungal treatments, creams, and insoles. Sustainability is another key driver in this region, as several consumers are shifting toward brands that prioritize eco-friendly packaging and natural ingredients.

Fairfield’s Competitive Landscape Analysis

The foot care products market is highly competitive, with a mix of established players and emerging brands boosting innovation. Leading companies focus on enhancing product efficacy and sustainability, often incorporating natural ingredients to appeal to eco-conscious consumers.

New entrants, especially those emphasizing organic and vegan formulations, are making their mark, capitalizing on the high demand for health-conscious foot care products. Key market trends include the rise of athleisure and increased foot health awareness, contributing to the demand for superior-quality, performance-driven foot care items. The dynamic landscape creates ample opportunities for innovation, particularly in personalized foot care solutions.

Key Market Companies

- Reckitt Benckiser Group Plc

- Pedifix Inc

- Medi GmbH & Co. KG

- Aetna Foot Products

- Alva-Amco Pharmacal Companies, Inc.

- Blistex Inc.

- GlaxoSmithKline Plc.

- HoMedics USA LLC

Recent Industry Developments

- In November 2024, Birkenstock launched the Care Essentials Range, a line of foot care products designed to relax, exfoliate, and care for feet.

- In March 2023, Enertor Medical signed a collaboration deal with RSscan Lab to create an efficient foot-scanning device for clinics.

Global Foot Care Products Market is Segmented as-

By Product Type

- Orthopedic Products

- Foot Creams and Lotions

- Foot Cleansing and Exfoliating Products

- Nail Care Products

By Distribution Channel

- Drug Stores & Pharmacies

- Hospitals & Specialty Clinics

- Online Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Foot Care Products Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. PESTLE Analysis

3. Global Foot Care Products Market Outlook, 2019 - 2032

3.1. Global Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Orthopedic Products

3.1.1.2. Foot Creams and Lotions

3.1.1.3. Foot Cleansing and Exfoliating Products

3.1.1.4. Nail Care Products

3.1.1.5. Others

3.2. Global Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Drug Stores & Pharmacies

3.2.1.2. Hospitals & Specialty Clinics

3.2.1.3. Online Stores

3.2.1.4. Others

3.3. Global Foot Care Products Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Foot Care Products Market Outlook, 2019 - 2032

4.1. North America Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Orthopedic Products

4.1.1.2. Foot Creams and Lotions

4.1.1.3. Foot Cleansing and Exfoliating Products

4.1.1.4. Nail Care Products

4.1.1.5. Others

4.2. North America Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Drug Stores & Pharmacies

4.2.1.2. Hospitals & Specialty Clinics

4.2.1.3. Online Stores

4.2.1.4. Others

4.3. North America Foot Care Products Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

4.3.1.2. U.S. Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.3.1.3. Canada Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

4.3.1.4. Canada Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Foot Care Products Market Outlook, 2019 - 2032

5.1. Europe Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Orthopedic Products

5.1.1.2. Foot Creams and Lotions

5.1.1.3. Foot Cleansing and Exfoliating Products

5.1.1.4. Nail Care Products

5.1.1.5. Others

5.2. Europe Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Drug Stores & Pharmacies

5.2.1.2. Hospitals & Specialty Clinics

5.2.1.3. Online Stores

5.2.1.4. Others

5.3. Europe Foot Care Products Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.2. Germany Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.3. U.K. Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.4. U.K. Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.5. France Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.6. France Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.7. Italy Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.8. Italy Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.9. Turkey Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.10. Turkey Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.11. Russia Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.12. Russia Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.1.13. Rest of Europe Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.14. Rest of Europe Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Foot Care Products Market Outlook, 2019 - 2032

6.1. Asia Pacific Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Orthopedic Products

6.1.1.2. Foot Creams and Lotions

6.1.1.3. Foot Cleansing and Exfoliating Products

6.1.1.4. Nail Care Products

6.1.1.5. Others

6.2. Asia Pacific Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Drug Stores & Pharmacies

6.2.1.2. Hospitals & Specialty Clinics

6.2.1.3. Online Stores

6.2.1.4. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Foot Care Products Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.2. China Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.3. Japan Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.4. Japan Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.5. South Korea Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.6. South Korea Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.7. India Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.8. India Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.9. Southeast Asia Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.10. Southeast Asia Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.1.11. Rest of Asia Pacific Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.12. Rest of Asia Pacific Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Foot Care Products Market Outlook, 2019 - 2032

7.1. Latin America Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Orthopedic Products

7.1.1.2. Foot Creams and Lotions

7.1.1.3. Foot Cleansing and Exfoliating Products

7.1.1.4. Nail Care Products

7.1.1.5. Others

7.2. Latin America Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Drug Stores & Pharmacies

7.2.1.2. Hospitals & Specialty Clinics

7.2.1.3. Online Stores

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Foot Care Products Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.2. Brazil Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.3. Mexico Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.4. Mexico Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.5. Argentina Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.6. Argentina Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.1.7. Rest of Latin America Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.8. Rest of Latin America Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Foot Care Products Market Outlook, 2019 - 2032

8.1. Middle East & Africa Foot Care Products Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Orthopedic Products

8.1.1.2. Foot Creams and Lotions

8.1.1.3. Foot Cleansing and Exfoliating Products

8.1.1.4. Nail Care Products

8.1.1.5. Others

8.2. Middle East & Africa Foot Care Products Market Outlook, by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Drug Stores & Pharmacies

8.2.1.2. Hospitals & Specialty Clinics

8.2.1.3. Online Stores

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Foot Care Products Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.2. GCC Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.3. South Africa Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.4. South Africa Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.5. Egypt Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.6. Egypt Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.7. Nigeria Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.8. Nigeria Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.1.9. Rest of Middle East & Africa Foot Care Products Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.10. Rest of Middle East & Africa Foot Care Products Market by Distribution Channel, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. Reckitt Benckiser Group Plc

9.3.1.1. Company Overview

9.3.1.2. Therapy Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Pedifix Inc.

9.3.2.1. Company Overview

9.3.2.2. Therapy Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Medi GmbH & Co. KG

9.3.3.1. Company Overview

9.3.3.2. Therapy Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Aetna Foot Products

9.3.4.1. Company Overview

9.3.4.2. Therapy Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. Alva-Amco Pharmacal Companies, Inc.

9.3.5.1. Company Overview

9.3.5.2. Therapy Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Blistex Inc.

9.3.6.1. Company Overview

9.3.6.2. Therapy Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. GlaxoSmithKline Plc.

9.3.7.1. Company Overview

9.3.7.2. Therapy Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. HoMedics USA LLC

9.3.8.1. Company Overview

9.3.8.2. Therapy Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Others

9.3.9.1. Company Overview

9.3.9.2. Therapy Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |