Global Forklift Battery Market Forecast

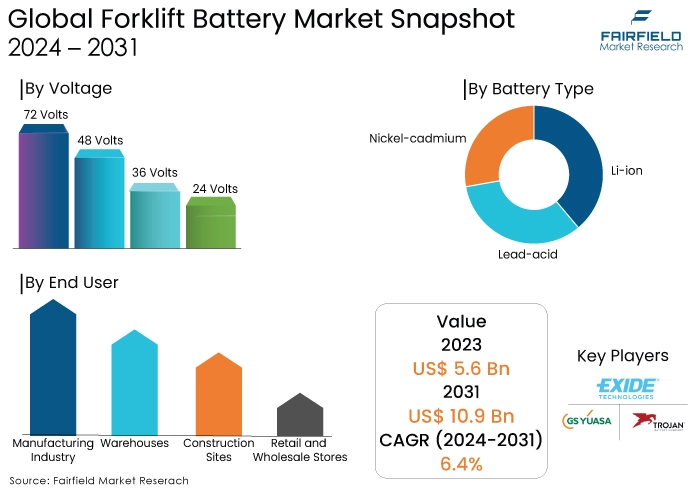

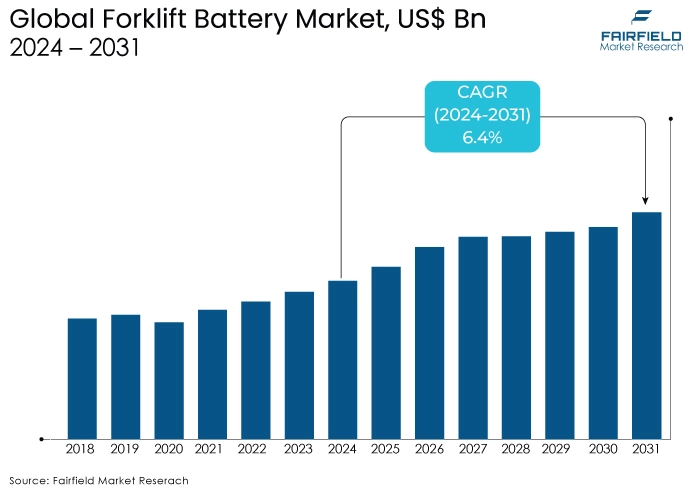

- Forklift battery market size that surpassed US$5.6 Bn in 2023 poised to reach US$10.9 Bn in 2031

- Market growth likely to witness a CAGR of 6.4% during 2024-2031

Quick Report Digest

- The global forklift battery market is expected to reach US$10.9 Bn by 2031, growing at a CAGR of 6.4% from 2024.

- The pre-pandemic period saw steady growth due to warehouse expansion, automation, and e-commerce.

- COVID-19 pandemic caused a temporary setback, but the market has rebounded with economic recovery.

- Stringent environmental regulations favour Li-ion batteries for their eco-friendliness.

- Li-ion offers faster charging, longer lifespan, and higher energy density than lead-acid batteries.

- Electrification of forklifts due to environmental concerns is driving battery demand.

- Higher initial cost of Li-ion and charging infrastructure needs remain challenges.

- Growing warehouse automation creates a surge for reliable Li-ion batteries.

- Battery technology innovation focuses on faster charging, higher energy density, and cost reduction.

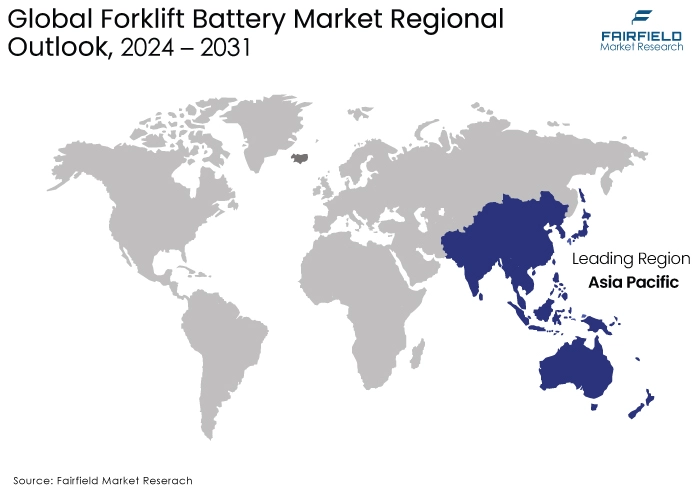

- Asia Pacific leads the market due to booming manufacturing, e-commerce, and government initiatives.

A Look Back and a Look Forward - Comparative Analysis

The global forklift battery market is a crucial segment within the industrial vehicle landscape. The pre-pandemic period witnessed a steady rise in the forklift battery market. This growth was driven by factors like expanding warehouse operations, rising automation in manufacturing, and growing e-commerce activity. These trends fuelled the need for efficient material handling solutions, leading to a surge in forklift usage and consequently, battery demand.

The emergence of COVID-19 in 2020 caused a temporary setback. Lockdowns and supply chain disruptions led to a decline in industrial activities and a decrease in new forklift orders. North America, for instance, saw a 30% production drop in Class 4-8 industrial trucks due to the economic slump [2]. However, the market has shown a robust recovery post-pandemic. As economic activities rebounded and e-commerce continued to flourish, the market demand for forklift batteries bounced back.

Key Growth Determinants

Efficiency and Sustainability Take Centre Stage

Warehouses and manufacturing facilities strive for operational excellence. Forklift batteries play a vital role in this pursuit. Lithium-ion (Li-ion) batteries, with their faster charging times, longer lifespans, and higher energy density, offer significant advantages over traditional lead-acid batteries. This translates to increased forklift uptime, reduced downtime for battery changes, and improved overall productivity.

The forklift battery market analysis reveals environmental consciousness is gaining traction across industries. Companies are increasingly seeking eco-friendly solutions to reduce their carbon footprint. Li-ion batteries, with their cleaner energy profile and potential for recycling, cater to this growing demand. Furthermore, government regulations promoting sustainable practices are creating a favourable environment for Li-ion battery adoption in forklifts.

Electrification of Forklifts on the Rise

Since past several years, an increasing preference towards adoption of sustainable energy sources has been witnessed. This is mainly due to ongoing environmental issues on the back of carbon emissions, and GHG (Green House Gas) emissions that cause pollution. That said, with an aim to achieve a net zero carbon emissions in the coming years, several companies are opting for electrification of their machines to reduce emissions.

While this has resulted in an increase in the electrification of forklifts that are widely used across industries such as warehousing, and manufacturing, the demand is also witnessing a considerable surge within industries like food and beverages, retail, and e-commerce. This shift from diesel powered forklifts to electric or battery operated forklifts continues to remain instrumental in driving the growth of the forklift battery market.

In addition, advances in the battery technology provide longer runtimes, fast charging capabilities and hassle free maintenance. This has further triggered in the use of battery powered forklifts that come with benefits such as reduced fuel costs, zero emissions and smooth functioning.

Albeit fossil fuels were the staples for forklifts, their electric counterparts are gaining high traction for outdoor and indoor material handling. This factor is expected to add fuel to the demand for advanced batteries, consequently aiding the growth of forklift battery market on the global front.

Key Growth Barriers

Higher Initial Cost of Li-ion Batteries

While Li-ion offers long-term cost savings through lower maintenance and longer life, the initial investment for these batteries is higher compared to lead-acid batteries. This can be a deterrent for some budget-conscious companies, especially in cost-sensitive industries.

Charging Infrastructure Needs

Widespread adoption of Li-ion batteries necessitates an investment in charging infrastructure. This includes installing dedicated charging stations, managing heat dissipation during charging, and training personnel on proper handling procedures. Upfront costs associated with building this infrastructure can be a hurdle for some companies.

Key Trends and Opportunities to Look at

Growing Penetration of Automation in Warehouses

The rise of automation in warehouses is transforming the way goods are stored, picked, and shipped. This trend is creating a surge in demand for automated guided vehicles (AGVs), and autonomous mobile robots (AMRs). These intelligent machines operate tirelessly, navigating warehouses with precision and efficiency. However, their smooth operation hinges on one crucial element - reliable and efficient power. This is where advanced forklift batteries, particularly lithium-ion, come into play.

Traditional lead-acid batteries, while dependable workhorses for many years, struggle to meet the demands of automated vehicles. Their longer charging times lead to downtime as robots wait for their batteries to be swapped or recharged. Additionally, lead-acid batteries have a shorter lifespan compared to Li-ion, requiring more frequent replacements, which disrupts workflows and adds to maintenance costs.

Li-ion batteries offer a compelling solution for automated warehouses. Their key advantages lie in faster charging, greater energy density, and longer lifespan.

The growing adoption of AGVs and AMRs in warehouses presents a significant opportunity for the Li-ion forklift battery market. As warehouse operators strive for increased automation and efficiency, the market demand for reliable and long-lasting power sources will continue to rise.

Manufacturers who can develop innovative Li-ion battery solutions specifically tailored to the needs of automated vehicles will be well-positioned to capitalize on this flourishing market segment.

Battery Technology Innovation

The future of the forklift battery market is brimming with exciting possibilities driven by continuous advancements in battery technology. These innovations hold immense potential to further enhance the performance, efficiency, and cost-effectiveness of Li-ion batteries, solidifying their dominance in the market.

One of the most promising areas of development is faster charging times. Researchers are exploring new electrode materials and charging protocols that could potentially reduce charging times to mere minutes. This would be a game-changer for warehouse operations, allowing AGVs and AMRs to spend more time working and less time plugged in.

Another key area of focus is improving energy density. By packing more energy into the same size battery, manufacturers can enable forklifts and automated vehicles to operate for longer durations on a single charge. This translates to increased productivity and operational flexibility.

Cost reduction is another crucial aspect of battery technology innovation. While Li-ion batteries already offer a lower total cost of ownership compared to lead-acid batteries over their lifespan, further cost reductions would make them even more accessible to a wider range of businesses. This could involve advancements in material science that utilize more affordable and readily available elements in battery production.

Finally, safety remains a top priority in battery technology development. Researchers are constantly working on improving battery management systems (BMS) and thermal management solutions to minimize the risk of thermal runaway, a rare but potentially serious safety concern with Li-ion batteries. These advancements will build trust and confidence in the technology, encouraging wider adoption across the forklift battery market.

In conclusion, the relentless pursuit of innovation in battery technology is paving the way for a future powered by efficient, reliable, and sustainable Li-ion batteries. These advancements will not only revolutionize the forklift battery market but also empower a wider range of applications across the industrial landscape. As technology continues to evolve, the potential for even more groundbreaking breakthroughs remains limitless.

How does the Regulatory Scenario Shape this Industry?

The regulatory landscape significantly impacts the forklift battery market. Stringent environmental regulations promoting cleaner technologies favor the adoption of Li-ion batteries, a key growth driver. These regulations push companies towards reducing carbon emissions, making Li-ion's eco-friendly profile attractive.

However, regulations can also pose challenges. A lack of standardization in Li-ion battery formats can create compatibility issues, hindering market growth. Additionally, regulations around battery disposal and recycling infrastructure development are still evolving in some regions, posing a hurdle for widespread Li-ion adoption. Overall, regulations act as a double-edged sword, driving the market towards sustainability but also presenting hurdles to overcome.

Fairfield’s Ranking Board

Top Segments

Lithium-ion Battery Continues to Reign Supreme

The market is segmented by battery type and application. Within battery types, Li-ion is expected to maintain its dominance. While lead-acid batteries will continue to hold a share due to their lower initial cost, Li-ion's superior performance and environmental benefits position it for long-term leadership.

The demand for lithium-ion batteries is also expected to increase as they are being technologically developed to offer long service life, high output and productivity, fast charging ability, high cost and energy savings and low maintenance. This is poised to present potential opportunities for lithium-ion batteries in the forthcoming years.

On the other hand, among several batteries available for the functioning of electric forklifts, lead acid batteries are also gaining immense popularity owing to their benefits. Lead acid battery is highly reliable and offers superior backup. In addition, these batteries provide a higher power to weight ratio for different types of forklifts, are rechargeable and cost effective.

Lead acid batteries higher energy densities with low discharge rates owing to the unique combination of graphite and lithium infused in them. These batteries offer high power output as compared to other forklift batteries owing to low net weight of the entire battery module and require less maintenance making them an apt choice for customers facing battery maintenance. This aspect has given an impetus to the sales of lead acid batteries in forklift technology, thus significantly contributing towards a sizeable forklift battery market share.

Warehousing and Manufacturing Sectors Remain Key Growth Contributors

In terms of end user, warehouses and manufacturing facilities are the primary consumers of forklift batteries and hold a significant market share. The growth of e-commerce, and the increasing automation in these sectors will continue to fuel demand within these segments.

The increasing preference for electric forklifts in manufacturing and warehousing has given an impetus to the sales of forklift batteries. In warehousing and manufacturing sectors, these forklifts have gained high traction owing to their perceived benefits such as less noise, reduced heat dissipation, less overall costing and pollution free working.

In addition, they have few moving parts and require fewer replacements of fluids such as coolants and engine oil. Moreover, the plastic components present in used forklift battery can be reused to manufacture new battery cases. This can further reduce the dumping of plastics in the environment, thus contributing towards environment health. In this background, the increasing demand for electric forklifts in warehousing and manufacturing is expected to largely complement the value growth of the forklift battery market.

Furthermore, with advancements in forklift technology, the development of autonomous forklifts is in the offing. These autonomous forklifts are integrated with different systems such as AI-integrated telematics, cameras, sensors, and radars.

Sensors in these machines identify, define and record the movement of the forklift by spotting the position of stationery objects and human beings, thus avoiding accidents. Thus, adoption of artificial intelligence in the forklift space is likely to further enhance their use across industrial applications, as a result creating potential avenues for the forklift battery market.

Regional Frontrunners

Forklift Battery Market in Asia Pacific to Witness an Upswing

The Asia Pacific region is expected to remain the dominant market due to several factors. The booming manufacturing sector in countries like China, and India fuels the demand for forklifts and consequently, forklift batteries.

The flourishing e-commerce market in the region necessitates efficient intralogistics solutions, driving demand for advanced batteries. Many Asian governments are promoting industrial automation and green technologies, favouring the adoption of Li-ion batteries for forklifts.

Developing economies in the region are likely to offer new growth opportunities for forklift battery market. This region can be considered as the base of battery production owing to widely spread downstream industries such as electronics, semiconductors, and chemicals.

The dominance of Asian markets is driven by the region's burgeoning manufacturing sector, rapid e-commerce growth, and government initiatives promoting industrial automation. China, a major manufacturing hub, is a key contributor to this regional dominance.

In addition, increasing demand for renewable power generation and decreasing price of batteries coupled with rising adoption of battery operated forklifts in industrial applications has created a favourable scenario in Asia Pacific.

Other factors such as rising manufacturing industry, warehousing, food and beverage sector and construction industry have fuelled the adoption of electric forklifts consequently complementing growth of the market in the region.

Fairfield’s Competitive Landscape Analysis

The competitive landscape is dynamic, with established players adapting to the Li-ion revolution and new entrants bringing innovative solutions to the table. The companies that can effectively balance cost, performance, and sustainability will likely emerge as leading competition parameters in this ever-evolving market.

Who are the Leading Companies in Forklift Battery Space?

- Exide Technologies

- GS Yuasa Battery Co., Ltd.

- Trojan Battery Company

- Clarios

- BYD Company Ltd.

- Samsung SDI

- LG Chem Ltd.

- SK Innovation Co., Ltd.

- Johnson Controls International plc.

- Enovate Systems Co., Ltd.

- AESC Holdings Corporation

- Hitachi, Ltd.

Recent Industry Developments

- In July 2024, Hyster launched a new electric forklift. It discusses the forklift's features and benefits. The forklift is called the E80XNL and it has a lithium-ion battery. This battery allows for fast charging and zero emissions. Other benefits include a spacious operator compartment and improved ergonomics.

- In March 2024, Flux Power, a developer of lithium-ion battery solutions, will showcase their new second-generation Li-ion battery packs for forklifts at Modex 2024. These M36-G2 and X48-G2 packs offer 630Ah and 840Ah capacities, designed for narrow aisle and counterbalance forklifts respectively. Improved features include increased power, extended uptime, and compatibility with existing forklifts.

Global Forklift Battery Market is Segmented as Below-

By Battery Type

- Li-ion

- Lead-acid

- Nickel-cadmium

By Voltage

- 24 Volts

- 36 Volts

- 48 Volts

- 72 Volts

By End User

- Manufacturing Industry

- Warehouses

- Construction Sites

- Retail and Wholesale Stores

By Region

- North America

- Latin America

- Europe

- South Asia & Oceania

- East Asia

- Middle East & Africa

1. Executive Summary

1.1. Global Forklift Battery Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2018 - 2023

3.1. Global Forklift Battery Market Production Output, by Region, Value (US$ Mn) and Volume (Tons), 2018 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East and Africa

4. Price Analysis, 2018 - 2023

4.1. Global Average Price Analysis, by Battery Type, US$ Per Tons, 2018 - 2023

4.2. Prominent Factor Affecting Forklift Battery Prices

4.3. Global Average Price Analysis, by Region, US$ Per Ton

5. Global Forklift Battery Market Outlook, 2018 - 2031

5.1. Global Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Lithium-Ion

5.1.1.2. Lead Acid

5.1.1.3. Hydrogen Fuel-Cell

5.2. Global Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Chemical

5.2.1.2. Food & Beverage

5.2.1.3. Industrial

5.2.1.4. Logistics

5.2.1.5. Retail & E-Commerce

5.2.1.6. Others

5.3. Global Forklift Battery Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Forklift Battery Market Outlook, 2018 - 2031

6.1. North America Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Lithium-Ion

6.1.1.2. Lead Acid

6.1.1.3. Hydrogen Fuel-Cell

6.2. North America Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Chemical

6.2.1.2. Food & Beverage

6.2.1.3. Industrial

6.2.1.4. Logistics

6.2.1.5. Retail & E-Commerce

6.2.1.6. Others

6.3. North America Forklift Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.3.1.2. U.S. Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.3.1.3. Canada Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.3.1.4. Canada Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Forklift Battery Market Outlook, 2018 - 2031

7.1. Europe Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Lithium-Ion

7.1.1.2. Lead Acid

7.1.1.3. Hydrogen Fuel-Cell

7.2. Europe Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Chemical

7.2.1.2. Food & Beverage

7.2.1.3. Industrial

7.2.1.4. Logistics

7.2.1.5. Retail & E-Commerce

7.2.1.6. Others

7.3. Europe Forklift Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.2. Germany Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.3. U.K. Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.4. U.K. Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.5. France Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.6. France Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.7. Italy Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.8. Italy Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.9. Turkey Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.10. Turkey Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.11. Russia Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.12. Russia Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.13. Rest of Europe Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.1.14. Rest of Europe Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Forklift Battery Market Outlook, 2018 - 2031

8.1. Asia Pacific Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Lithium-Ion

8.1.1.2. Lead Acid

8.1.1.3. Hydrogen Fuel-Cell

8.2. Asia Pacific Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Chemical

8.2.1.2. Food & Beverage

8.2.1.3. Industrial

8.2.1.4. Logistics

8.2.1.5. Retail & E-Commerce

8.2.1.6. Others

8.3. Asia Pacific Forklift Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. China Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.2. China Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.3. Japan Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.4. Japan Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.5. South Korea Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.6. South Korea Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.7. India Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.8. India Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.9. Southeast Asia Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.10. Southeast Asia Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.11. Rest of Asia Pacific Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.1.12. Rest of Asia Pacific Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Forklift Battery Market Outlook, 2018 - 2031

9.1. Latin America Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.1.1. Key Highlights

9.1.1.1. Lithium-Ion

9.1.1.2. Lead Acid

9.1.1.3. Hydrogen Fuel-Cell

9.2. Latin America Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.2.1. Key Highlights

9.2.1.1. Chemical

9.2.1.2. Food & Beverage

9.2.1.3. Industrial

9.2.1.4. Logistics

9.2.1.5. Retail & E-Commerce

9.2.1.6. Others

9.3. Latin America Forklift Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.2. Brazil Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.3. Mexico Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.4. Mexico Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.5. Argentina Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.6. Argentina Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.7. Rest of Latin America Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.1.8. Rest of Latin America Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Forklift Battery Market Outlook, 2018 - 2031

10.1. Middle East & Africa Forklift Battery Market Outlook, by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.1.1. Key Highlights

10.1.1.1. Lithium-Ion

10.1.1.2. Lead Acid

10.1.1.3. Hydrogen Fuel-Cell

10.2. Middle East & Africa Forklift Battery Market Outlook, by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.2.1. Key Highlights

10.2.1.1. Chemical

10.2.1.2. Food & Beverage

10.2.1.3. Industrial

10.2.1.4. Logistics

10.2.1.5. Retail & E-Commerce

10.2.1.6. Others

10.3. Middle East & Africa Forklift Battery Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.2. GCC Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.3. South Africa Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.4. South Africa Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.5. Egypt Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.6. Egypt Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.7. Nigeria Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.8. Nigeria Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.9. Rest of Middle East & Africa Forklift Battery Market by Battery Type, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.1.10. Rest of Middle East & Africa Forklift Battery Market by End Use, Value (US$ Mn) and Volume (Tons), 2018 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Company Market Share Analysis, 2022

11.2. Competitive Dashboard

11.3. Company Profiles

11.3.1. Crown Equipment Corporation

11.3.1.1. Company Overview

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. Business Strategies and Development

11.3.2. East Penn Manufacturing Company

11.3.2.1. Company Overview

11.3.2.2. Product Portfolio

11.3.2.3. Financial Overview

11.3.2.4. Business Strategies and Development

11.3.3. Enersys

11.3.3.1. Company Overview

11.3.3.2. Product Portfolio

11.3.3.3. Financial Overview

11.3.3.4. Business Strategies and Development

11.3.4. Amara Raja Batteries Ltd.

11.3.4.1. Company Overview

11.3.4.2. Product Portfolio

11.3.4.3. Financial Overview

11.3.4.4. Business Strategies and Development

11.3.5. Exide Industries Limited

11.3.5.1. Company Overview

11.3.5.2. Product Portfolio

11.3.5.3. Financial Overview

11.3.5.4. Business Strategies and Development

11.3.6. Hyundai Construction Equipment

11.3.6.1. Company Overview

11.3.6.2. Product Portfolio

11.3.6.3. Financial Overview

11.3.6.4. Business Strategies and Development

11.3.7. Flux Power

11.3.7.1. Company Overview

11.3.7.2. Product Portfolio

11.3.7.3. Financial Overview

11.3.7.4. Business Strategies and Development

11.3.8. Storage Battery Systems, LLC

11.3.8.1. Company Overview

11.3.8.2. Product Portfolio

11.3.8.3. Financial Overview

11.3.8.4. Business Strategies and Development

11.3.9. Navitas System, LLC

11.3.9.1. Company Overview

11.3.9.2. Product Portfolio

11.3.9.3. Financial Overview

11.3.9.4. Business Strategies and Development

11.3.10. Saft

11.3.10.1. Company Overview

11.3.10.2. Product Portfolio

11.3.10.3. Financial Overview

11.3.10.4. Business Strategies and Development

11.3.11. Microtex Energy Private Limited

11.3.11.1. Company Overview

11.3.11.2. Product Portfolio

11.3.11.3. Financial Overview

11.3.11.4. Business Strategies and Development

11.3.12. Southwest Battery Company

11.3.12.1. Company Overview

11.3.12.2. Product Portfolio

11.3.12.3. Financial Overview

11.3.12.4. Business Strategies and Development

11.3.13. Shenzhen Herculesi Technology Co., Ltd.

11.3.13.1. Company Overview

11.3.13.2. Product Portfolio

11.3.13.3. Financial Overview

11.3.13.4. Business Strategies and Development

11.3.14. Electrovaya

11.3.14.1. Company Overview

11.3.14.2. Product Portfolio

11.3.14.3. Financial Overview

11.3.14.4. Business Strategies and Development

11.3.15. EnerSys

11.3.15.1. Company Overview

11.3.15.2. Product Portfolio

11.3.15.3. Financial Overview

11.3.15.4. Business Strategies and Development

11.3.16. Optima Batteries

11.3.16.1. Company Overview

11.3.16.2. Product Portfolio

11.3.16.3. Financial Overview

11.3.16.4. Business Strategies and Development

11.3.17. Eternity Technologies FZ-LLC

11.3.17.1. Company Overview

11.3.17.2. Product Portfolio

11.3.17.3. Financial Overview

11.3.17.4. Business Strategies and Development

11.3.18. Systems Sunlight S.A.

11.3.18.1. Company Overview

11.3.18.2. Product Portfolio

11.3.18.3. Financial Overview

11.3.18.4. Business Strategies and Development

11.3.19. NITCO

11.3.19.1. Company Overview

11.3.19.2. Product Portfolio

11.3.19.3. Financial Overview

11.3.19.4. Business Strategies and Development

11.3.20. Midac Batteries SpA

11.3.20.1. Company Overview

11.3.20.2. Product Portfolio

11.3.20.3. Financial Overview

11.3.20.4. Business Strategies and Development

11.3.21. Crown Battery

11.3.21.1. Company Overview

11.3.21.2. Product Portfolio

11.3.21.3. Financial Overview

11.3.21.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2019 - 2022 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Battery Type Coverage |

|

|

Voltage Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |