Global Foundry Chemicals Market Forecast

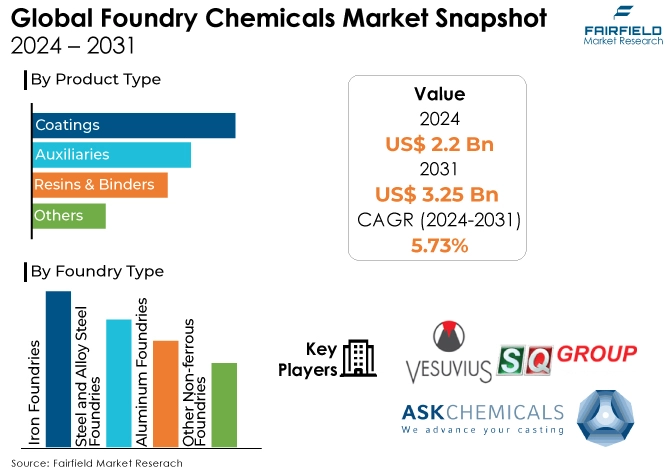

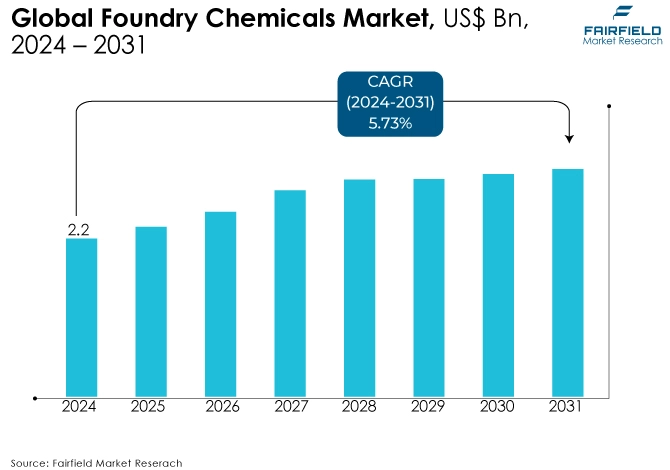

- Global foundry chemicals market size to reach US$3.25 Bn in 2031, up from US$2.2 Bn expected by the end of 2024

- Market revenue projected to exhibit a remarkable rate of expansion, at an estimated CAGR of 5.73% during 2024 - 2031

Quick Report Digest

- Global foundry chemicals market is poised to reach US$3.25 Bn by 2031 with a projected CAGR of 5.73% from 2024 to 2031.

- Experienced disruptions due to COVID-19 but poised for steady growth driven by automotive, construction, and infrastructure sectors.

- Increased demand from automotive and aerospace industries, technological advancements, and expansion in emerging markets.

- Stricter environmental regulations, fluctuating raw material prices, and adoption of alternative casting technologies.

- Shift towards sustainability, digitalisation in foundries, expansion in emerging markets, and development of high-performance chemicals.

- Driving innovation towards cleaner and safer solutions while ensuring compliance with environmental and safety standards.

- Identifies binders, additives, and fluxes as top-performing segments in the market.

- Asia Pacific leads with 40% market share, followed by Europe, and North America.

- Companies focus on R&D, forming alliances, entering new markets, and adopting sustainable practices.

- ASK Chemicals' innovative products and distribution agreements reflect industry trends towards sustainability and efficiency.

A Look Back and a Look Forward - Comparative Analysis

The foundry chemicals market witnessed a dynamic shift between 2019 and 2024, followed by a promising forecast for the upcoming years (2024-2031). While the pre-pandemic period (2019-2020) likely saw steady growth driven by factors like rising demand for metal castings in automotive, construction, and infrastructure, the latter half (2021-2023) presented challenges.

The COVID-19 pandemic disrupted production lines and supply chains, impacting market growth. However, the foundry chemicals market is expected to rebound and experience significant growth in the coming years.

Looking ahead (2024-2031), analysts predict a CAGR of around 5.73%, indicating a period of steady expansion. This growth is fuelled by several key drivers. Firstly, the increasing demand for lightweight and high-performance castings in the automotive sector, particularly for electric vehicles, will necessitate the use of specialised foundry chemicals. Secondly, growing investments in infrastructure development across the globe will create a strong demand for construction materials like metal pipes and beams, which rely heavily on foundry processes.

Additionally, the rise of automation and technological advancements in the foundry industry will likely lead to the adoption of more efficient and sustainable foundry chemicals. This trend aligns with growing environmental concerns and stricter regulations on industrial emissions. Manufacturers are actively developing "green" foundry chemicals that offer comparable performance while minimising environmental impact.

However, the market growth might not be uniform across all segments. Binders, which are crucial for holding casting materials together during mold formation, are expected to remain the dominant segment throughout the forecast period. Conversely, some traditional chemicals facing stricter regulations due to their environmental impact might experience slower growth or even decline.

It's important to remember that this forecast is based on current market trends and can be influenced by unforeseen events. Geopolitical situations, fluctuations in raw material prices, and advancements in alternative casting technologies are some factors that can impact the market's trajectory. Nevertheless, the outlook for the foundry chemicals market appears positive, driven by the increasing demand for castings across various industries and the continuous push for sustainable practices within the foundry sector.

Key Growth Determinants

- Increasing Demand from Automotive and Aerospace Industries

The need for high-quality castings in automotive and aerospace applications drives demand for superior foundry chemicals. These sectors require components that can withstand extreme conditions, elevating the importance of advanced foundry chemicals for producing strong, durable materials.

- Technological Advancements and Sustainability

Innovations in foundry processes have led to the development of new foundry chemicals that not only improve the quality of castings but also align with environmental sustainability goals. The industry's shift towards eco-friendly practices necessitates chemicals that minimise environmental impact, complying with regulatory standards and supporting corporate sustainability objectives.

- Growth of Emerging Markets

The industrialisation of countries in Asia, Africa, and South America is boosting demand for machinery, vehicles, and infrastructure, subsequently propelling the foundry industry and foundry chemicals market. This expansion into new markets fosters global growth, increasing the demand for foundry chemicals as manufacturing capabilities in these regions evolve.

Major Growth Barriers

- Environmental Regulations and Compliance Costs

Stricter environmental regulations globally are imposing significant challenges on the foundry industry, particularly in the use of certain chemicals deemed hazardous. Compliance with these regulations incurs additional costs for manufacturers in terms of adopting cleaner technologies, handling waste disposal, and modifying processes, which can hinder market growth.

- Fluctuating Raw Material Prices

The foundry chemicals market is susceptible to volatility in raw material prices. Many foundry chemicals are derived from petroleum products and minerals whose prices fluctuate due to geopolitical tensions, supply chain disruptions, and changes in global demand. This volatility can lead to increased production costs and reduced profitability for foundry chemical manufacturers, affecting market growth.

- Adoption of Alternative Technologies

The advancement and adoption of alternative casting technologies, such as 3D printing for metal parts, can pose a threat to the traditional foundry industry. These technologies offer advantages in terms of waste reduction, efficiency, and the ability to produce complex designs, which could reduce the demand for traditional foundry processes and chemicals, especially in specific applications or industries looking for innovative manufacturing solutions.

Key Trends and Opportunities to Look at

- Sustainability and Eco-friendly Products

A significant trend in the foundry chemicals market is the shift towards sustainability and the development of eco-friendly products. This trend is driven by growing environmental concerns, regulatory pressures, and a societal push towards green manufacturing practices. Companies are increasingly focusing on reducing the environmental footprint of their operations and products, leading to innovation in biodegradable binders, water-based coatings, and chemicals that minimise emissions. This shift not only helps in complying with stringent environmental regulations but also caters to the demand from industries looking to enhance their sustainability credentials.

- Digitalisation and Smart Foundries

The integration of digital technologies in the foundry sector is transforming traditional manufacturing processes. IoT (Internet of Things), AI (Artificial Intelligence), and ML (Machine Learning) are being leveraged to optimise production, reduce waste, and improve quality control. Smart foundries are becoming a reality, where digitalisation enables real-time monitoring and predictive maintenance, leading to increased efficiency and reduced downtime. This trend towards digitalisation opens new avenues for foundry chemical manufacturers to develop products compatible with automated processes and smart manufacturing environments.

- Expansion in Emerging Markets

Emerging markets represent a significant opportunity for foundry chemical market players. Countries in Asia, Africa, and South America are witnessing rapid industrial growth, leading to increased demand for machinery, automotive components, and construction materials. These markets offer vast potential for expansion due to their growing manufacturing sectors and infrastructure development projects. Tailoring products and strategies to meet the specific needs of these regions, such as affordability and local environmental regulations, can drive growth for market players.

- Development of High-performance and Specialty Chemicals

As industries demand higher quality and more durable components, there is a growing opportunity for the development of high-performance and specialty foundry chemicals. These chemicals, designed to improve casting strength, precision, and finish, can meet the specific needs of advanced manufacturing sectors like aerospace, defense, and high-end automotive. Investing in R&D to create chemicals that offer unique properties, such as enhanced heat resistance or reduced shrinkage, can differentiate market players and open up new revenue streams.

How Does the Regulatory Scenario Shape this Industry?

The regulatory landscape acts as a complex but crucial sculptor for the foundry chemicals industry. Stringent environmental regulations are at the forefront, pushing manufacturers to develop "greener" solutions. This means creating chemicals with lower emissions and potentially reformulating existing products to comply with restrictions on harmful substances. Worker safety regulations also play a significant role, with a focus on minimising exposure to hazardous chemicals. This incentivises the development of safer alternatives with lower toxicity profiles.

Beyond environmental and safety concerns, regulations can also dictate performance standards for castings produced using these chemicals. This creates a push for innovation, ensuring foundry chemicals not only meet environmental and safety standards but also deliver the desired properties and quality in the final product.

Looking globally, harmonisation of regulations across different countries can be a double-edged sword. While it creates a more predictable environment for manufacturers, allowing them to develop and market chemicals that comply with international standards and facilitate global trade, complying with these evolving regulations can be complex and expensive.

The regulatory scenario constantly shapes the foundry chemicals industry. It drives innovation towards cleaner, safer, and more efficient solutions, ultimately benefiting the environment and worker safety. However, navigating this complex landscape requires manufacturers to stay updated on changes and invest in research and development to ensure their products remain compliant.

Fairfield’s Ranking Board

Top Segments

Binders Lead the Way

Binders are critical for the foundry industry as they hold the sand mold together during the casting process. This segment has seen significant growth due to the increasing demand for high-quality castings in the automotive, aerospace, and construction industries. The evolution of binder technology, aimed at reducing emissions and enhancing mold strength, has made this segment a hotbed for innovation. Eco-friendly binders, which reduce the environmental impact of casting operations, are particularly gaining traction. As manufacturers seek more sustainable production practices, the demand for such advanced binders is expected to rise, making this segment a key growth area in the foundry chemicals market.

Additives Accelerate as the Lightweighting Trend Firms up in Auto Industry

Additives enhance the properties of casting molds and cores, including their strength, refractoriness, and casting finish. This segment is driven by the need for precision and durability in cast products, especially in sectors like automotive, where engine components require high dimensional accuracy and strength. The trend towards lightweight and complex metal parts has also boosted the demand for specialised additives that can improve the flowability of molten metal and the final product's integrity. With ongoing technological advancements and an increased focus on quality, the additives segment is poised for growth. The development of new additives that cater to specific industry requirements, such as improved environmental profiles or enhanced performance characteristics, represents a significant opportunity for innovation and market expansion.

Fluxes Continue to be at the Forefront

Fluxes constitute another critical segment within the foundry chemicals market, playing a vital role in the melting process of metals by modifying the properties of molten metals, enhancing fluidity, and facilitating the removal of impurities. This segment is essential for producing high-quality metal castings with minimal defects, crucial for industries where material properties are paramount, such as in automotive, aerospace, and heavy machinery manufacturing.

The demand for fluxes is closely tied to the overall activity in the metal casting industry, with innovations aimed at improving efficiency and environmental sustainability marking recent growth drivers. As the industry leans towards more sustainable and efficient manufacturing processes, the development and adoption of eco-friendly fluxes, which emit lower levels of greenhouse gases and reduce slag generation, are becoming increasingly important. This focus on sustainability, coupled with the need for high-quality castings, positions the fluxes segment for substantial growth. Manufacturers that can offer advanced flux formulations that meet these evolving industry standards are likely to capture significant market opportunities, making fluxes a top-performing segment in the foundry chemicals market.

Regional Frontrunners

Asia Pacific Remains the Undisputed Leader with 40% Market Share

Dominating the global market with a staggering 40% share, Asia Pacific is the undisputed leader. This dominance is fuelled by the region's rapid industrialisation, particularly in China. China's expanding power, railway, and automotive industries heavily rely on aluminum castings, which require a significant amount of foundry chemicals. Additionally, other developing nations like India are experiencing a surge in foundry chemical consumption due to their rising urbanisation and booming manufacturing activities. This region's growth trajectory is expected to remain strong for the foreseeable future.

Europe Becomes a Powerhouse with Expanding Green Focus

Europe constitutes a well-established market, holding roughly 30% of the global share. This strength stems from its long-standing manufacturing base and a growing focus on automation through Industry 4.0 initiatives. However, Europe's market is also driven by a unique factor - environmental sustainability. With heightened environmental concerns, the demand for eco-friendly foundry chemicals is on the rise. This presents a significant opportunity for manufacturers who can develop and offer sustainable solutions. Major European players like Germany, Italy, France, and the UK are at the forefront of this trend.

North America Develops a Mature Market with Ample Room for Innovation

North America boasts a well-developed foundry chemicals market with a strong presence of established industries like automotive and aerospace. While growth here might be slower compared to the Asia Pacific region, it remains a significant market with steady demand. The focus on technological advancements and process efficiency improvements can further propel the market forward. North American companies have the potential to leverage their existing infrastructure and expertise to develop innovative foundry chemicals that cater to the evolving needs of the global market.

Fairfield’s Competitive Landscape Analysis

Continuous R&D to develop new and improved products that offer better performance, efficiency, and environmental sustainability. Innovations aimed at reducing emissions, enhancing the quality of castings, and improving the recyclability of foundry waste are particularly emphasized.

Forming alliances with other companies and research institutions to combine expertise, access new technologies, and co-develop products tailored to evolving market needs. These partnerships can also extend to supply chain optimisation and co-marketing agreements.

Entering new markets, especially in emerging economies, where industrial growth presents significant opportunities for foundry chemicals. This may involve setting up new production facilities, sales offices, or forming local partnerships to better serve regional customers.

With increasing regulatory pressures and a societal shift towards environmental consciousness, companies are investing in sustainable production practices. Developing eco-friendly products and processes is not just a compliance measure but also a competitive advantage that appeals to environmentally conscious customers.

Who are the Leaders in the Foundry Chemicals Space?

- Vesuvius

- SQ Group

- Ask Chemicals

- Asahi Yukizai Corporation

- KAO Chemicals

- IVP Limited

- Hüttenes-Albertus International

- Mancuso Chemicals Limited

- Mazzon SpA

- Fincast Foundry Flux Co.

- Ceraflux India Pvt. Ltd.

- Hindusthan Adhesive & Chemicals

- Çukurova Kimya

Significant Company Developments

New Product Launch:

June 2023 ASK Chemicals debuted its innovative cold box binder, Ecocure Blue PRO, at GIFA 2023, showcasing their dedication to environmental sustainability and efficiency in the foundry industry. This advanced binder technology is designed to enhance casting properties while significantly reducing the consumption of binders and amines. The launch of Ecocure Blue PRO represents a critical step forward in minimising the environmental impact of foundry processes, providing a greener, more efficient solution for the industry.

January 2024 At the IFEX tradeshow, ASK Chemicals introduced a groundbreaking feeding system, marking a significant innovation in the foundry chemicals market. This new feeding system is poised to transform foundry operations by offering unparalleled efficiency and productivity. ASK Chemicals' introduction of this technology underscores their commitment to advancing the foundry chemicals sector through sustainable and efficient solutions, setting a new benchmark for the industry.

Distribution Agreement:

August 2020 In August 2020, Precision Castparts Corporation, and Boeing entered into a collaborative agreement to develop and commercialise advanced anodizing technology for aerospace components. This partnership is focused on enhancing the performance and durability of aerospace parts through innovative surface treatment solutions, demonstrating a strong commitment to advancing technology and sustainability within the aerospace sector.

July 2020 Norsk Hydro ASA, and Alcoa Corporation announced a joint venture in July 2020 to develop and commercialise anodizing solutions for aluminum products. This collaboration aims to leverage both companies' expertise in aluminum production and processing, offering the market advanced anodizing technologies that enhance the performance and sustainability of aluminum products. This agreement reflects a shared vision for innovation and environmental stewardship in the aluminum industry.

An Expert’s Eye

The increasing demand for casting products across various industries, such as automotive, aerospace, and construction, coupled with advancements in manufacturing technologies, is expected to drive market expansion. Moreover, the push towards lightweight materials, especially in the automotive and aerospace sectors, for enhancing fuel efficiency and reducing emissions, further bolsters the demand for innovative foundry chemicals. The market is also seeing a significant shift towards eco-friendly and sustainable products, spurred by stringent environmental regulations and a growing emphasis on reducing carbon footprints. This trend is leading to innovations in foundry chemicals, aiming to minimise environmental impact without compromising on performance.

The Asia Pacific region, particularly China, and India, is poised to lead this growth due to its expanding manufacturing base, rising industrialisation, and the increasing adoption of advanced foundry technologies. The commitment to infrastructure development in these regions presents substantial opportunities for the foundry chemicals industry. However, challenges such as raw material price volatility and stringent environmental regulations necessitating cleaner production practices may impact market dynamics.

The Global Foundry Chemicals Market is Segmented as Below:

By Product Type:

- Coatings

- Solvent-based Coatings

- Water-based Coatings

- Others

- Auxiliaries

- Resins & Binders

- Cold Box Systems

- Alkaline Phenolic Resins

- CO2 Cured Resins

- Others

- No-bake Systems

- Furan Resins

- Phenolic Urethane Resins

- Others

- Hot Box / Shell Systems

- Others

By Foundry Type:

- Iron Foundries

- Steel and Alloy Steel Foundries

- Aluminum Foundries

- Other Non-ferrous Foundries

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa

1. Executive Summary

1.1. Global Foundry Chemicals Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.8. PESTLE Analysis

3. Production Output and Trade Statistics

3.1. Key Highlights

3.2. Global Foundry Chemicals Production, by Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trends Analysis and Future Projects, 2019 - 2031

4.1. Global Average Price Analysis, By Product Type

4.2. Prominent Factors Affecting Foundry Chemicals Prices

4.3. Global Average Price Analysis, by Region

5. Global Foundry Chemicals Market Outlook, 2019 - 2031

5.1. Global Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Coatings

5.1.1.1.1. Solvent Based Coatings

5.1.1.1.2. Water Based Coatings

5.1.1.1.3. Others

5.1.1.2. AUXILIARIES

5.1.1.3. Resins and Binders

5.1.1.3.1. Cold Box Systems

5.1.1.3.1.1. Alkaline Phenolic Resin

5.1.1.3.1.2. CO2 Cured Resin

5.1.1.3.1.3. Others

5.1.1.3.2. No-Bake Systems

5.1.1.3.2.1. Furan resin

5.1.1.3.2.2. Phenolic urethane resin

5.1.1.3.2.3. Others

5.1.1.3.3. Hot Box / Shell Systems

5.1.1.4. Others

5.2. Global Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Iron Foundry

5.2.1.2. Steel and Alloy Steel Foundry

5.2.1.3. Aluminium Foundry

5.2.1.4. Other Non-ferrous Foundry

5.3. Global Foundry Chemicals Market Outlook, By Region, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Foundry Chemicals Market Outlook, 2019 - 2031

6.1. North America Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Coatings

6.1.1.1.1. Solvent Based Coatings

6.1.1.1.2. Water Based Coatings

6.1.1.1.3. Others

6.1.1.2. AUXILIARIES

6.1.1.3. Resins and Binders

6.1.1.3.1. Cold Box Systems

6.1.1.3.1.1. Alkaline Phenolic Resin

6.1.1.3.1.2. CO2 Cured Resin

6.1.1.3.1.3. Others

6.1.1.3.2. No-Bake Systems

6.1.1.3.2.1. Furan resin

6.1.1.3.2.2. Phenolic urethane resin

6.1.1.3.2.3. Others

6.1.1.3.3. Hot Box / Shell Systems

6.1.1.4. Others

6.2. North America Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Iron Foundry

6.2.1.2. Steel and Alloy Steel Foundry

6.2.1.3. Aluminium Foundry

6.2.1.4. Other Non-ferrous Foundry

6.3. North America Foundry Chemicals Market Outlook, By Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.2. U.S. Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.3. Canada Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.3.1.4. Canada Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Foundry Chemicals Market Outlook, 2019 - 2031

7.1. Europe Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Coatings

7.1.1.1.1. Solvent Based Coatings

7.1.1.1.2. Water Based Coatings

7.1.1.1.3. Others

7.1.1.2. AUXILIARIES

7.1.1.3. Resins and Binders

7.1.1.3.1. Cold Box Systems

7.1.1.3.1.1. Alkaline Phenolic Resin

7.1.1.3.1.2. CO2 Cured Resin

7.1.1.3.1.3. Others

7.1.1.3.2. No-Bake Systems

7.1.1.3.2.1. Furan resin

7.1.1.3.2.2. Phenolic urethane resin

7.1.1.3.2.3. Others

7.1.1.3.3. Hot Box / Shell Systems

7.1.1.4. Others

7.2. Europe Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Iron Foundry

7.2.1.2. Steel and Alloy Steel Foundry

7.2.1.3. Aluminium Foundry

7.2.1.4. Other Non-ferrous Foundry

7.3. Europe Foundry Chemicals Market Outlook, By Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.2. Germany Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.3. U.K. Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.4. U.K. Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.5. France Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.6. France Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.7. Italy Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.8. Italy Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.9. Russia Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.10. Russia Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.11. Rest of Europe Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.1.12. Rest of Europe Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Foundry Chemicals Market Outlook, 2019 - 2031

8.1. Asia Pacific Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Coatings

8.1.1.1.1. Solvent Based Coatings

8.1.1.1.2. Water Based Coatings

8.1.1.1.3. Others

8.1.1.2. AUXILIARIES

8.1.1.3. Resins and Binders

8.1.1.3.1. Cold Box Systems

8.1.1.3.1.1. Alkaline Phenolic Resin

8.1.1.3.1.2. CO2 Cured Resin

8.1.1.3.1.3. Others

8.1.1.3.2. No-Bake Systems

8.1.1.3.2.1. Furan resin

8.1.1.3.2.2. Phenolic urethane resin

8.1.1.3.2.3. Others

8.1.1.3.3. Hot Box / Shell Systems

8.1.1.4. Others

8.2. Asia Pacific Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Iron Foundry

8.2.1.2. Steel and Alloy Steel Foundry

8.2.1.3. Aluminium Foundry

8.2.1.4. Other Non-ferrous Foundry

8.3. Asia Pacific Foundry Chemicals Market Outlook, By Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.2. China Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.3. Japan Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.4. Japan Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.5. South Korea Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.6. South Korea Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.7. India Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.8. India Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.9. Southeast Asia Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.10. Southeast Asia Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Foundry Chemicals Market Outlook, 2019 - 2031

9.1. Latin America Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Coatings

9.1.1.1.1. Solvent Based Coatings

9.1.1.1.2. Water Based Coatings

9.1.1.1.3. Others

9.1.1.2. AUXILIARIES

9.1.1.3. Resins and Binders

9.1.1.3.1. Cold Box Systems

9.1.1.3.1.1. Alkaline Phenolic Resin

9.1.1.3.1.2. CO2 Cured Resin

9.1.1.3.1.3. Others

9.1.1.3.2. No-Bake Systems

9.1.1.3.2.1. Furan resin

9.1.1.3.2.2. Phenolic urethane resin

9.1.1.3.2.3. Others

9.1.1.3.3. Hot Box / Shell Systems

9.1.1.4. Others

9.2. Latin America Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. Iron Foundry

9.2.1.2. Steel and Alloy Steel Foundry

9.2.1.3. Aluminium Foundry

9.2.1.4. Other Non-ferrous Foundry

9.3. Latin America Foundry Chemicals Market Outlook, By Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.2. Brazil Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.3. Mexico Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.4. Mexico Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.5. Rest of Latin America Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.1.6. Rest of Latin America Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Foundry Chemicals Market Outlook, 2019 - 2031

10.1. Middle East & Africa Foundry Chemicals Market Outlook, By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Coatings

10.1.1.1.1. Solvent Based Coatings

10.1.1.1.2. Water Based Coatings

10.1.1.1.3. Others

10.1.1.2. AUXILIARIES

10.1.1.3. Resins and Binders

10.1.1.3.1. Cold Box Systems

10.1.1.3.1.1. Alkaline Phenolic Resin

10.1.1.3.1.2. CO2 Cured Resin

10.1.1.3.1.3. Others

10.1.1.3.2. No-Bake Systems

10.1.1.3.2.1. Furan resin

10.1.1.3.2.2. Phenolic urethane resin

10.1.1.3.2.3. Others

10.1.1.3.3. Hot Box / Shell Systems

10.1.1.4. Others

10.2. Middle East & Africa Foundry Chemicals Market Outlook, By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. Iron Foundry

10.2.1.2. Steel and Alloy Steel Foundry

10.2.1.3. Aluminium Foundry

10.2.1.4. Other Non-ferrous Foundry

10.3. Middle East & Africa Foundry Chemicals Market Outlook, By Country, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.2. GCC Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.3. South Africa Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.4. South Africa Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.5. Egypt Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.6. Egypt Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.7. Rest of Middle East & Africa Foundry Chemicals Market By Product Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.1.8. Rest of Middle East & Africa Foundry Chemicals Market By Foundry Type, Volume (Kilo Tons) and Value (US$ Bn), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2024

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. ASK Chemicals

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Vesuvius

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. SQ Group

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Mazzon SpA

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. ASAHI YUKIZAI CORPORATION

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. KAO Chemicals

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. IVP Limited

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Hüttenes-Albertus International

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Business Strategies and Development

11.5.9. Forace Polymers Pvt Ltd.

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Fincast Foundry Flux co.

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Ceraflux India Pvt. Ltd.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Hindusthan Adhesive & Chemicals

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Çukurova Kimya

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Mancuso Chemicals Limited

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion Volume: KILO Tons |

||

|

REPORT FEATURES |

DETAILS |

|

Product Type Coverage |

|

|

Foundry Coverage |

|

|

Region Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |