Global Fragrance Ingredients Market Forecast

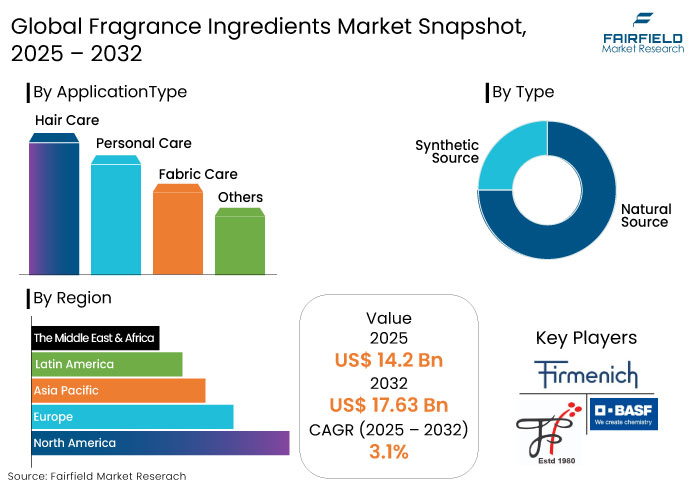

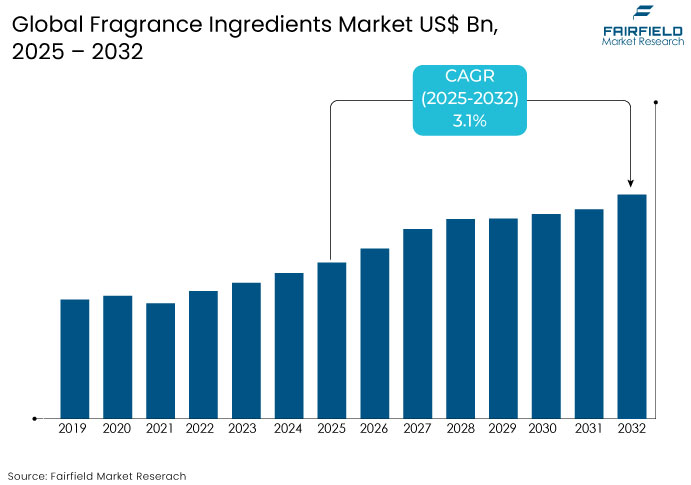

- The fragrance ingredients market is projected to reach US$ 17.63 Bn by 2032 from US$ 14.2 Bn in 2025.

- The fragrance ingredients market is estimated to witness a CAGR of 3.1% from 2025 to 2032.

Fragrance Ingredients Market Insights

- Preference for natural and organic fragrance ingredients to be driven by awareness of health and environmental impacts.

- Personal care industry to be a key consumer with uses in products like shampoos, deodorants, and lotions.

- Innovations such as AI-based scent creation and biotech-derived fragrance molecules are transforming the market.

- North America is set to lead with around 30% of the global market share in 2025.

- Online retail platforms fuel growth by making premium fragrance products accessible to a global audience.

- Consumers seek personalized fragrances catering to individual tastes, driving demand for bespoke products.

- Based on type, the synthetic source is anticipated to lead with 60% of market share in 2025.

- In regions like the Middle East, cultural preferences for fragrances propel demand for premium and niche products.

Key Growth Determinants

- Increasing Popularity of Sustainable Fragrances

Consumers are becoming more environmentally conscious, which greatly impacts the fragrance ingredients market. The demand for sustainable and natural fragrance ingredients has surged as consumers seek effective and ethically sourced products.

Brands that embrace sustainability are gaining customer loyalty as they meet the demand for transparency and eco-conscious practices. This shift is particularly influencing the beauty and personal care industries, with several companies opting to replace synthetic fragrances with plant-based, biodegradable ingredients.

- Rising Demand for Personal Care Products

Growing consumer focus on personal hygiene and wellness is a significant driver of the fragrance ingredients market. In the U.S., 88% of consumers actively seek out personal care products made with natural ingredients, reflecting a strong preference for clean-label options.

As people become more aware of the benefits of personal care routines, they are increasingly turning to products like perfumes, deodorants, lotions, and shampoos that offer a sensory experience. The rise of e-commerce platforms has also facilitated easy access to premium personal care products, making it convenient for customers to discover and purchase fragrances that match their style and well-being, further boosting market growth.

Key Growth Barriers

- High Cost of Natural Fragrance Ingredients

One key restraint for the fragrance ingredients market is the high cost of sourcing natural ingredients. These ingredients are often more expensive than synthetic alternatives due to the labor-intensive harvesting processes, limited supply, and higher production costs. The price disparity can be a barrier for manufacturers and consumers, particularly regarding premium products.

Natural fragrances are in high demand due to their perceived health and environmental benefits, but the higher cost can make these products less accessible to a broader market. To combat this, companies are exploring ways to reduce costs by improving production methods and seeking more cost-effective sourcing. However, premium pricing remains a challenge for broader adoption.

Fragrance Ingredients Market Trends and Opportunities

- Emergence of Cruelty-free Fragrance Ingredients

A key trend shaping the fragrance ingredients market is the growing consumer preference for eco-friendly ingredients. Consumers are prioritizing brands that use sustainable, cruelty-free, and biodegradable fragrance ingredients, driven by concerns about environmental impact and personal health.

In Japan, consumer behavior reflects a strong inclination toward eco-friendly products, with 25% of beauty product consumers opting for items that boast environmental or eco-friendly claims. Companies are also exploring alternatives to synthetic fragrances, which are often linked to adverse environmental impacts.

- Market Players to Expand in Emerging Countries

Emerging markets such as Asia Pacific, Latin America, and the Middle East offer immense growth potential for the fragrance ingredients market. Several emerging economies are experiencing robust economic growth, which has led to high disposable income. This enables consumers to spend more on premium and luxury products, including fine fragrances and scented personal care items.

Middle-class expansion in countries like India, China, Brazil, and Indonesia is particularly significant. As these consumers seek to improve their lifestyles, demand for products with appealing fragrances, such as skincare, cosmetics, and home care items, is on the rise.

Segments Covered in the Report

- Synthetic Sources to Lead with High Cost-effectiveness

Synthetically sourced fragrances lead the fragrance ingredients market and are set to hold around 60% of share in 2025. Among the vast varieties of synthetically sourced fragrances, synthetic aroma chemicals are favored for their affordability, versatility, and consistent quality.

Producing synthetic fragrance ingredients is significantly cheaper than sourcing natural alternatives, making luxurious scents more accessible to a broader audience. Synthetic aroma chemicals allow perfumers to craft unique and complex fragrances that might be difficult or impossible to replicate using natural sources alone.

- Surging Disposable Income to Spur Personal Care Application

Based on application, the personal care segment will likely hold 58% market share in 2025. Rising disposable income and increased awareness of personal hygiene as well as appearance fuel the personal care industry's growth. As people become more conscious of their well-being, there is a high demand for products that serve functional purposes and offer pleasant sensory experiences.

Consumers increasingly seek items formulated with natural fragrance ingredients, reflecting a broader movement toward eco-friendly and health-conscious choices. The personal care segment's dominance in the fragrance ingredients market is a testament to evolving consumer behaviors and preferences.

Regional Analysis

- North America to Witness High Demand for Premium Products

North America holds the largest share of the global fragrance ingredients market, driven by a well-established personal care and cosmetics industry. The region’s consumers strongly prefer premium and luxury products, including perfumes, skincare items, and home care products enhanced with high-quality fragrances. The widespread availability of prominent fragrance brands and novel distribution networks has solidified North America’s dominance.

The U.S., as the most significant contributor to the region’s revenue, benefits from continuous product innovation and rising consumer interest in clean-label fragrance ingredients. Leading companies, such as Estée Lauder and Procter & Gamble, also invest heavily in marketing and sustainable practices, further bolstering regional growth.

- Entry of International Fragrance Brands to Boost Asia Pacific

Asia Pacific is rapidly emerging as a key region in the fragrance ingredients market. The region’s share, currently at 28%, is set to increase significantly in the next ten years. Countries such as China, India, and South Korea are leading this growth, with consumers prioritizing personal grooming and luxury goods. India is the fastest-growing market in the region, supported by a young population, rising awareness of grooming products, and presence of international fragrance brands.

Cultural preferences in Asia Pacific, such as using fragrances in daily rituals and traditional ceremonies, further fuel demand for personal and fabric care products. With consumers increasingly leaning toward products made with natural fragrance ingredients, manufacturers are extending their portfolios to cater to these preferences.

Fairfield’s Competitive Landscape Analysis

The fragrance ingredients market is highly competitive, with key players focusing on innovation, sustainability, and extending product portfolios. Companies like Givaudan, Firmenich, and International Flavors & Fragrances (IFF) dominate the market, leveraging unique research and development to introduce unique, eco-friendly scents.

Emerging players are also catering to niche markets and offering region-specific fragrances. Strategic collaborations, acquisitions, and partnerships are common strategies to strengthen their presence. As consumer preferences shift toward clean-label products, companies emphasize transparency and traceability, fostering customer trust and loyalty while staying ahead in the dynamic fragrance industry.

Key Market Companies

- BASF SE

- Fine Fragrance Pvt. Ltd

- Firmenich SA (Sentarom SA)

- Givaudan

- International Flavors & Fragrances Inc.

- Kalpsutra Chemicals Pvt. Ltd.

- Mane SA

- Robertet Group

- S H Kelkar & Co. Limited

- Hasegawa Co. Ltd

Recent Industry Developments

- In October 2024, Givaudan introduced L'Appartement 125 in Shanghai, enhancing its presence in the fragrance ingredients market by creating a direct collaboration hub with China-based manufacturers.

- In May 2023, Firmenich International SA signed an acquisition deal with DSM, establishing DSM-Firmenich AG, a leading innovation partner in nutrition, health, and beauty.

Global Fragrance Ingredients Market is Segmented as-

By Type

- Natural Source

- Synthetic Source

By Application

- Hair Care

- Personal Care

- Fabric Care

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Fragrance Ingredients Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Economic Overview

2.6.1. World Economic Projections

2.7. PESTLE Analysis

3. Price Analysis, 2019 - 2024

3.1. Global Average Price Analysis by Type, 2019 - 2024

3.2. Prominent Factor Affecting Fragrance Ingredients Prices

3.3. Global Average Price Analysis by Region

4. Global Fragrance Ingredients Market Outlook, 2019 - 2032

4.1. Global Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Natural Source

4.1.1.2. Synthetic Source

4.2. Global Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Hair Care

4.2.1.2. Personal Care

4.2.1.3. Fabric Care

4.2.1.4. Others

4.3. Global Fragrance Ingredients Market Outlook, by Region, Value (US$ Bn) and Volume (Units), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. North America

4.3.1.2. Europe

4.3.1.3. Asia Pacific

4.3.1.4. Latin America

4.3.1.5. Middle East & Africa

5. North America Fragrance Ingredients Market Outlook, 2019 - 2032

5.1. North America Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Natural Source

5.1.1.2. Synthetic Source

5.2. North America Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Hair Care

5.2.1.2. Personal Care

5.2.1.3. Fabric Care

5.2.1.4. Others

5.2.2. Attractiveness Analysis

5.3. North America Fragrance Ingredients Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. U.S. Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1.2. U.S. Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1.3. Canada Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

5.3.1.4. Canada Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6. Europe Fragrance Ingredients Market Outlook, 2019 - 2032

6.1. Europe Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Natural Source

6.1.1.2. Synthetic Source

6.2. Europe Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Hair Care

6.2.1.2. Personal Care

6.2.1.3. Fabric Care

6.2.1.4. Others

6.2.2. Attractiveness Analysis

6.3. Europe Fragrance Ingredients Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Germany Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.2. Germany Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.3. U.K. Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.4. U.K. Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.5. France Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.6. France Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.7. Italy Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.8. Italy Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.9. Türkiye Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.10. Türkiye Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.11. Russia Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.12. Russia Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.13. Rest of Europe Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

6.3.1.14. Rest of Europe Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7. Asia Pacific Fragrance Ingredients Market Outlook, 2019 - 2032

7.1. Asia Pacific Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Natural Source

7.1.1.2. Synthetic Source

7.2. Asia Pacific Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Hair Care

7.2.1.2. Personal Care

7.2.1.3. Fabric Care

7.2.1.4. Others

7.2.2. Attractiveness Analysis

7.3. Asia Pacific Fragrance Ingredients Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. China Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.2. China Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.3. Japan Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.4. Japan Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.5. South Korea Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.6. South Korea Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.7. India Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.8. India Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.9. Southeast Asia Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.10. Southeast Asia Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.11. Rest of Asia Pacific Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

7.3.1.12. Rest of Asia Pacific Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8. Latin America Fragrance Ingredients Market Outlook, 2019 - 2032

8.1. Latin America Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Natural Source

8.1.1.2. Synthetic Source

8.2. Latin America Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Hair Care

8.2.1.2. Personal Care

8.2.1.3. Fabric Care

8.2.1.4. Others

8.2.2. Attractiveness Analysis

8.3. Latin America Fragrance Ingredients Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Brazil Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.2. Brazil Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.3. Mexico Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.4. Mexico Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.5. Argentina Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.6. Argentina Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.7. Rest of Latin America Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

8.3.1.8. Rest of Latin America Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9. Middle East & Africa Fragrance Ingredients Market Outlook, 2019 - 2032

9.1. Middle East & Africa Fragrance Ingredients Market Outlook, by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.1.1. Key Highlights

9.1.1.1. Natural Source

9.1.1.2. Synthetic Source

9.2. Middle East & Africa Fragrance Ingredients Market Outlook, by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.2.1. Key Highlights

9.2.1.1. Hair Care

9.2.1.2. Personal Care

9.2.1.3. Fabric Care

9.2.1.4. Others

9.2.2. Attractiveness Analysis

9.3. Middle East & Africa Fragrance Ingredients Market Outlook, by Country, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1. Key Highlights

9.3.1.1. GCC Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.2. GCC Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.3. South Africa Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.4. South Africa Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.5. Egypt Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.6. Egypt Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.7. Nigeria Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.8. Nigeria Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.9. Rest of Middle East & Africa Fragrance Ingredients Market by Type, Value (US$ Bn) and Volume (Units), 2019 - 2032

9.3.1.10. Rest of Middle East & Africa Fragrance Ingredients Market by Application, Value (US$ Bn) and Volume (Units), 2019 - 2032

10. Competitive Landscape

10.1. By Type vs by Application Heatmap

10.2. Company Market Share Analysis, 2024

10.3. Competitive Dashboard

10.4. Company Profiles

10.4.1. BASF SE

10.4.1.1. Company Overview

10.4.1.2. Product Portfolio

10.4.1.3. Financial Overview

10.4.1.4. Business Strategies and Development

10.4.2. Fine Fragrance Pvt. Ltd

10.4.2.1. Company Overview

10.4.2.2. Product Portfolio

10.4.2.3. Financial Overview

10.4.2.4. Business Strategies and Development

10.4.3. Firmenich SA (Sentarom SA)

10.4.3.1. Company Overview

10.4.3.2. Product Portfolio

10.4.3.3. Financial Overview

10.4.3.4. Business Strategies and Development

10.4.4. Givaudan

10.4.4.1. Company Overview

10.4.4.2. Product Portfolio

10.4.4.3. Financial Overview

10.4.4.4. Business Strategies and Development

10.4.5. International Flavors & Fragrances Inc.

10.4.5.1. Company Overview

10.4.5.2. Product Portfolio

10.4.5.3. Financial Overview

10.4.5.4. Business Strategies and Development

10.4.6. Kalpsutra Chemicals Pvt. Ltd.

10.4.6.1. Company Overview

10.4.6.2. Product Portfolio

10.4.6.3. Financial Overview

10.4.6.4. Business Strategies and Development

10.4.7. Mane SA

10.4.7.1. Company Overview

10.4.7.2. Product Portfolio

10.4.7.3. Financial Overview

10.4.7.4. Business Strategies and Development

10.4.8. Robertet Group

10.4.8.1. Company Overview

10.4.8.2. Product Portfolio

10.4.8.3. Financial Overview

10.4.8.4. Business Strategies and Development

10.4.9. S H Kelkar & Co. Limited

10.4.9.1. Company Overview

10.4.9.2. Product Portfolio

10.4.9.3. Financial Overview

10.4.9.4. Business Strategies and Development

10.4.10. T.Hasegawa Co. Ltd

10.4.10.1. Company Overview

10.4.10.2. Product Portfolio

10.4.10.3. Financial Overview

10.4.10.4. Business Strategies and Development

11. Appendix

11.1. Research Methodology

11.2. Report Assumptions

11.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |