Global Gas Sensors Market Forecast

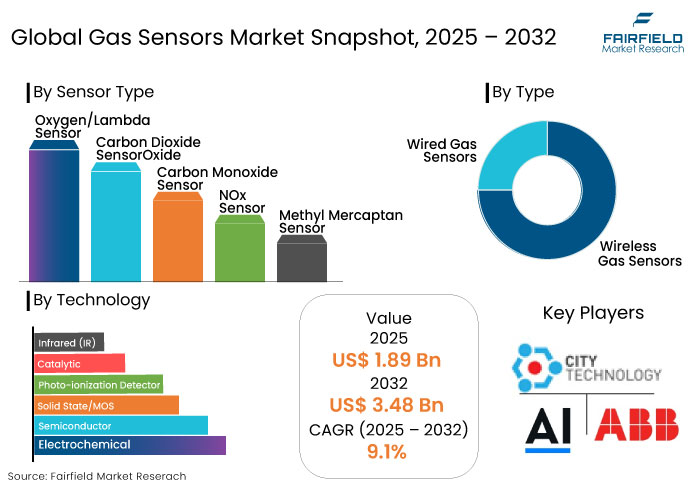

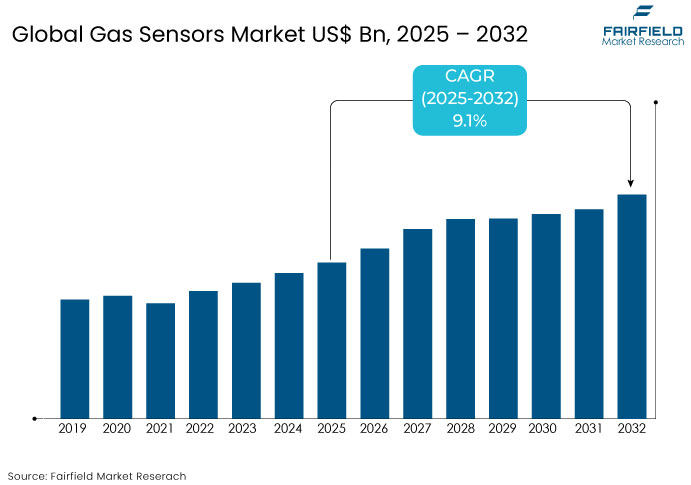

- The gas sensors market is projected to reach a size of US$ 3.48 Bn by 2032 from an estimated US$ 1.89 Bn in 2025.

- The market for gas sensors is set to show a significant CAGR of 9.1% from 2025 to 2032.

Gas Sensors Market Insights

- Increasing concerns over air pollution and environmental sustainability drive demand for gas sensors.

- Integration of gas sensors with IoT and smart technologies is transforming industries.

- Growing trend of smart home technology is pushing use of gas sensors in home automation systems.

- Governments enforce strict environmental regulations, encouraging adoption of unique gas sensors for real-time monitoring of air pollutants.

- Surging air quality monitoring projects augments demand for gas sensors that measure CO2, nitrogen oxides, and particulate matter.

- Rapid industrialization and urbanization in emerging economies contribute to the increased demand for gas sensors.

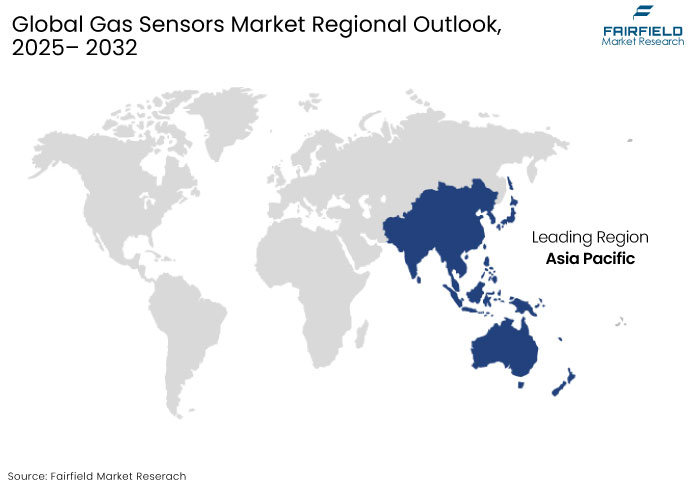

- Asia Pacific leads the global market and is set to generate 34% of the total share in 2025.

- Based on output, digital gas sensors are likely to hold around 65% of market share in 2025.

- Based on type, wireless gas sensors are projected to hold a share of 68% in 2025.

Key Growth Determinants

- Rising Demand for Air Quality Monitoring

One of the most prominent growth drivers in the gas sensors market is the increasing global demand for air quality monitoring. With growing concerns about environmental pollution, the need for effective air quality monitoring systems has never been more crucial.

According to the World Health Organization (WHO), 9 out of 10 people worldwide breathe air that exceeds the recommended levels of pollutants, highlighting the urgency for effective air quality monitoring systems. Industrialization, urbanization, and the burning of fossil fuels have resulted in escalating levels of pollutants. Governments are introducing strict environmental policies and to combat these issues, significantly increasing demand for gas sensors.

- Increasing Adoption in Industrial Safety Applications

The need for enhanced industrial safety is a leading factor propelling the gas sensors market. In sectors like oil and gas, chemical manufacturing, mining, and food processing, detecting hazardous gases is a regulatory requirement and a worker safety matter.

The deployment of gas sensors in these settings enables companies to adhere to strict safety standards, prevent potential disasters, and reduce the risk to human life and the environment. Rising automation and Industry 4.0 technologies have further propelled demand for digital and wireless gas sensors.

Key Growth Barriers

- High Initial Costs of Novel Gas Sensors

One of the primary restraints for the gas sensors market is the high initial cost associated with novel gas sensor technologies. While gas sensors are essential for air quality monitoring, industrial safety, and environmental protection, the upfront costs of high-performance sensors can be significant.

Novel sensors with wireless connectivity, real-time monitoring, and multi-gas detection are more expensive than traditional models. The high initial investment can be a deterrent for small to medium-sized businesses or organizations with tight budgets.

Gas Sensors Market Trends and Opportunities

- Integration with IoT and Smart Technologies

One of the most transformative trends in the gas sensors market lies in the integration with the Internet of Things (IoT) and smart technologies. Growing adoption of IoT devices across various industries opens up vast potential for gas sensors. These sensors can now be connected to a network of smart devices, enabling real-time data transmission and remote monitoring.

Research indicates that integrating IoT-enabled gas sensors into industrial operations can lead to up to a 25% reduction in operational costs, as they improve efficiency through predictive maintenance. Integration with IoT sensors allows for the collection of valuable insights on gas emissions, air quality, and industrial safety without manual checks.

- Rising Focus on Environmental Sustainability

The gas sensors market is booming worldwide due to surging awareness of air quality and environmental sustainability. Increasing concerns about the adverse health effects of polluted air and the need to meet regulatory standards for air quality are driving adoption of innovative gas sensors for environmental applications.

According to the World Bank, US$ 100 Bn is set to be invested globally by 2030 in air quality monitoring infrastructure and technologies. Governments, municipalities, and private organizations are investing in real-time air quality monitoring systems. These rely heavily on gas sensors to measure pollutants such as carbon dioxide, nitrogen oxides, and particulate matter.

Segments Covered in the Report

- Wireless Gas Sensors Gain Impetus Amid Ease of Deployment

Wireless gas sensors are the dominant type segment in the global gas sensors market. Growth is driven by their versatility, ease of deployment, and novel technological features. These offer enhanced flexibility, making them ideal for industrial applications such as oil and gas, chemical processing, and smart building management.

Increasing adoption of Industrial Internet of Things (IIoT) technologies is a significant driver for wireless gas sensors, as these enable seamless integration into smart systems for predictive maintenance and remote monitoring. Their ability to operate in hazardous or hard-to-reach areas makes them a preferred choice in industrial environments where safety and operational efficiency are critical.

- Digital Sensors to Lead with High Precision and Efficiency

Based on output, the gas sensors market is divided into analog and digital. Out of these, digital sensors dominate the market due to high demand for precision, efficiency, and real-time data processing across various industries. These include industrial automation, healthcare, automotive, and environmental monitoring.

Digital gas sensors offer superior accuracy by converting gas concentration measurements into digital signals that are easier to integrate with modern systems. It makes them highly compatible with IoT platforms, enabling seamless communication with smart devices and cloud-based analytics systems.

Regional Analysis

- Asia Pacific Sees Steady Growth due to Booming Industrial Sectors

Asia Pacific leads the global gas sensors market and is witnessing rapid growth due to booming industrial sectors and urbanization in countries like China, India, and Japan. The region is a hub for manufacturing, with industries such as electronics, automotive, and petrochemicals increasingly relying on gas sensors for operational efficiency and safety.

China leads the revenue charts in Asia Pacific, benefiting from government initiatives to address air pollution and workplace safety. India is also seeing a surging demand due to growth of smart city projects and investments in industrial automation. The booming consumer electronics sector and rising production of Electric Vehicles (EVs) further contribute to increasing demand for gas sensors in Asia Pacific.

- Strict Environmental Norms to Support Growth in North America

North America is anticipated to witness the fastest growth in the gas sensors market, owing to its well-established industrial base, stringent environmental regulations, and rapid adoption of novel technologies. It is also driven by automotive, oil and gas, healthcare, and manufacturing industries, which extensively utilize gas sensors for monitoring safety and emissions.

The U.S., in particular, has been a key contributor with its focus on air quality monitoring and industrial safety. Federal regulations from agencies like the Environmental Protection Agency (EPA) have mandated the use of gas sensors to ensure compliance with air quality standards.

Fairfield’s Competitive Landscape Analysis

The gas sensors market is highly competitive, with key players focusing on technological developments, product launches, and strategic partnerships to strengthen their position. Companies such as Honeywell International Inc., Siemens AG, Figaro Engineering Inc., and Sensirion AG are at the forefront. They are leveraging cutting-edge technologies like IoT-enabled gas detection systems and novel digital sensors to meet high industry demands.

Start-ups and regional players are also emerging with cost-effective solutions, intensifying competition. The market’s growth is fueled by increasing demand across industries like automotive, healthcare, oil and gas, and building automation.

Key Market Companies

- ABB Ltd.

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- GfG Gas Detection UK Ltd.

- FLIR Systems, Inc.

Recent Industry Developments

- In August 2024, Alphasense Inc. introduced the PIDX line of photoionization detectors (PIDs), offered in six distinct ranges and engineered to accommodate a broad spectrum of applications and guarantee accurate air quality monitoring in various environments.

- In October 2023, Honeywell International Inc. launched a new infrared-based (IR) device, the Fs24x plus flame detector, which swiftly and accurately identifies hydrogen flames.

Global Gas Sensors Market is Segmented as-

By Sensor Type

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

By Type

- Wireless Gas Sensors

- Wired Gas Sensors

By Output

- Analog

- Digital

By Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

By End Use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Gas Sensor Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value and Volume, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Gas Sensor Market Outlook, 2019 - 2032

3.1. Global Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Oxygen/Lambda Sensor

3.1.1.2. Carbon Dioxide Sensor

3.1.1.3. Carbon Monoxide Sensor

3.1.1.4. NOx Sensor

3.1.1.5. Methyl Mercaptan Sensor

3.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

3.2. Global Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Wireless Gas Sensors

3.2.1.2. Wired Gas Sensors

3.3. Global Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Analog

3.3.1.2. Digital

3.4. Global Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Electrochemical

3.4.1.2. Semiconductor

3.4.1.3. Solid State/MOS

3.4.1.4. Photo-ionization Detector (PID)

3.4.1.5. Catalytic

3.4.1.6. Infrared (IR)

3.4.1.7. Others

3.5. Global Gas Sensor Market Outlook, by End use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. Medical

3.5.1.2. Building Automation & Domestic Appliances

3.5.1.3. Environmental

3.5.1.4. Petrochemical

3.5.1.5. Automotive

3.5.1.6. Industrial

3.5.1.7. Agriculture

3.5.1.8. Others

3.6. Global Gas Sensor Market Outlook, by Region, Value (US$ Bn) and Volume (Unit), 2019 - 2032

3.6.1. Key Highlights

3.6.1.1. North America

3.6.1.2. Europe

3.6.1.3. Asia Pacific

3.6.1.4. Latin America

3.6.1.5. Middle East & Africa

4. North America Gas Sensor Market Outlook, 2019 - 2032

4.1. North America Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Oxygen/Lambda Sensor

4.1.1.2. Carbon Dioxide Sensor

4.1.1.3. Carbon Monoxide Sensor

4.1.1.4. NOx Sensor

4.1.1.5. Methyl Mercaptan Sensor

4.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

4.2. North America Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Wireless Gas Sensors

4.2.1.2. Wired Gas Sensors

4.3. North America Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Analog

4.3.1.2. Digital

4.4. North America Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Electrochemical

4.4.1.2. Semiconductor

4.4.1.3. Solid State/MOS

4.4.1.4. Photo-ionization Detector (PID)

4.4.1.5. Catalytic

4.4.1.6. Infrared (IR)

4.4.1.7. Others

4.5. North America Gas Sensor Market Outlook, by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. Medical

4.5.1.2. Building Automation & Domestic Appliances

4.5.1.3. Environmental

4.5.1.4. Petrochemical

4.5.1.5. Automotive

4.5.1.6. Industrial

4.5.1.7. Agriculture

4.5.1.8. Others

4.6. North America Gas Sensor Market Outlook, by Country, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1. Key Highlights

4.6.1.1. U.S. Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.2. U.S. Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.3. U.S. Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.4. U.S. Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.5. U.S. Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.6. Canada Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.7. Canada Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.8. Canada Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.9. Canada Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.1.10. Canada Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

4.6.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Gas Sensor Market Outlook, 2019 - 2032

5.1. Europe Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Oxygen/Lambda Sensor

5.1.1.2. Carbon Dioxide Sensor

5.1.1.3. Carbon Monoxide Sensor

5.1.1.4. NOx Sensor

5.1.1.5. Methyl Mercaptan Sensor

5.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

5.2. Europe Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Wireless Gas Sensors

5.2.1.2. Wired Gas Sensors

5.3. Europe Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Analog

5.3.1.2. Digital

5.4. Europe Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Electrochemical

5.4.1.2. Semiconductor

5.4.1.3. Solid State/MOS

5.4.1.4. Photo-ionization Detector (PID)

5.4.1.5. Catalytic

5.4.1.6. Infrared (IR)

5.4.1.7. Others

5.5. Europe Gas Sensor Market Outlook, by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Medical

5.5.1.2. Building Automation & Domestic Appliances

5.5.1.3. Environmental

5.5.1.4. Petrochemical

5.5.1.5. Automotive

5.5.1.6. Industrial

5.5.1.7. Agriculture

5.5.1.8. Others

5.6. Europe Gas Sensor Market Outlook, by Country, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1. Key Highlights

5.6.1.1. Germany Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.2. Germany Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.3. Germany Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.4. Germany Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.5. Germany Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.6. U.K. Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.7. U.K. Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.8. U.K. Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.9. U.K. Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.10. U.K. Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.11. France Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.12. France Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.13. France Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.14. France Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.15. France Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.16. Italy Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.17. Italy Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.18. Italy Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.19. Italy Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.20. Italy Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.21. Türkiye Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.22. Türkiye Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.23. Türkiye Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.24. Türkiye Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.25. Türkiye Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.26. Russia Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.27. Russia Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.28. Russia Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.29. Russia Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.30. Russia Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.31. Rest of Europe Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.32. Rest of Europe Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.33. Rest of Europe Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.34. Rest of Europe Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.1.35. Rest of Europe Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

5.6.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Gas Sensor Market Outlook, 2019 - 2032

6.1. Asia Pacific Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Oxygen/Lambda Sensor

6.1.1.2. Carbon Dioxide Sensor

6.1.1.3. Carbon Monoxide Sensor

6.1.1.4. NOx Sensor

6.1.1.5. Methyl Mercaptan Sensor

6.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

6.2. Asia Pacific Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Wireless Gas Sensors

6.2.1.2. Wired Gas Sensors

6.3. Asia Pacific Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Analog

6.3.1.2. Digital

6.4. Asia Pacific Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Electrochemical

6.4.1.2. Semiconductor

6.4.1.3. Solid State/MOS

6.4.1.4. Photo-ionization Detector (PID)

6.4.1.5. Catalytic

6.4.1.6. Infrared (IR)

6.4.1.7. Others

6.5. Asia Pacific Gas Sensor Market Outlook, by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. Medical

6.5.1.2. Building Automation & Domestic Appliances

6.5.1.3. Environmental

6.5.1.4. Petrochemical

6.5.1.5. Automotive

6.5.1.6. Industrial

6.5.1.7. Agriculture

6.5.1.8. Others

6.6. Asia Pacific Gas Sensor Market Outlook, by Country, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1. Key Highlights

6.6.1.1. China Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.2. China Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.3. China Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.4. China Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.5. China Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.6. Japan Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.7. Japan Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.8. Japan Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.9. Japan Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.10. Japan Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.11. South Korea Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.12. South Korea Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.13. South Korea Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.14. South Korea Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.15. South Korea Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.16. India Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.17. India Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.18. India Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.19. India Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.20. India Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.21. Southeast Asia Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.22. Southeast Asia Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.23. Southeast Asia Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.24. Southeast Asia Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.25. Southeast Asia Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.26. Rest of Asia Pacific Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.27. Rest of Asia Pacific Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.28. Rest of Asia Pacific Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.29. Rest of Asia Pacific Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.1.30. Rest of Asia Pacific Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

6.6.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Gas Sensor Market Outlook, 2019 - 2032

7.1. Latin America Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Oxygen/Lambda Sensor

7.1.1.2. Carbon Dioxide Sensor

7.1.1.3. Carbon Monoxide Sensor

7.1.1.4. NOx Sensor

7.1.1.5. Methyl Mercaptan Sensor

7.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

7.2. Latin America Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.1.1. Key Highlights

7.2.1.1. Wireless Gas Sensors

7.2.1.2. Wired Gas Sensors

7.3. Latin America Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Analog

7.3.1.2. Digital

7.4. Latin America Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Electrochemical

7.4.1.2. Semiconductor

7.4.1.3. Solid State/MOS

7.4.1.4. Photo-ionization Detector (PID)

7.4.1.5. Catalytic

7.4.1.6. Infrared (IR)

7.4.1.7. Others

7.5. Latin America Gas Sensor Market Outlook, by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Medical

7.5.1.2. Building Automation & Domestic Appliances

7.5.1.3. Environmental

7.5.1.4. Petrochemical

7.5.1.5. Automotive

7.5.1.6. Industrial

7.5.1.7. Agriculture

7.5.1.8. Others

7.6. Latin America Gas Sensor Market Outlook, by Country, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1. Key Highlights

7.6.1.1. Brazil Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.2. Brazil Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.3. Brazil Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.4. Brazil Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.5. Brazil Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.6. Mexico Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.7. Mexico Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.8. Mexico Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.9. Mexico Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.10. Mexico Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.11. Argentina Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.12. Argentina Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.13. Argentina Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.14. Argentina Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.15. Argentina Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.16. Rest of Latin America Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.17. Rest of Latin America Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.18. Rest of Latin America Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.19. Rest of Latin America Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.1.20. Rest of Latin America Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

7.6.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Gas Sensor Market Outlook, 2019 - 2032

8.1. Middle East & Africa Gas Sensor Market Outlook, by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Oxygen/Lambda Sensor

8.1.1.2. Carbon Dioxide Sensor

8.1.1.3. Carbon Monoxide Sensor

8.1.1.4. NOx Sensor

8.1.1.5. Methyl Mercaptan Sensor

8.1.1.6. Others (Hydrogen, Ammonia, Hydrogen Sulfide)

8.2. Middle East & Africa Gas Sensor Market Outlook, by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Wireless Gas Sensors

8.2.1.2. Wired Gas Sensors

8.3. Middle East & Africa Gas Sensor Market Outlook, by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Analog

8.3.1.2. Digital

8.4. Middle East & Africa Gas Sensor Market Outlook, by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Electrochemical

8.4.1.2. Semiconductor

8.4.1.3. Solid State/MOS

8.4.1.4. Photo-ionization Detector (PID)

8.4.1.5. Catalytic

8.4.1.6. Infrared (IR)

8.4.1.7. Others

8.5. Middle East & Africa Gas Sensor Market Outlook, by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. Medical

8.5.1.2. Building Automation & Domestic Appliances

8.5.1.3. Environmental

8.5.1.4. Petrochemical

8.5.1.5. Automotive

8.5.1.6. Industrial

8.5.1.7. Agriculture

8.5.1.8. Others

8.6. Middle East & Africa Gas Sensor Market Outlook, by Country, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1. Key Highlights

8.6.1.1. GCC Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.2. GCC Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.3. GCC Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.4. GCC Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.5. GCC Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.6. South Africa Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.7. South Africa Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.8. South Africa Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.9. South Africa Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.10. South Africa Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.11. Egypt Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.12. Egypt Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.13. Egypt Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.14. Egypt Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.15. Egypt Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.16. Rest of Middle East & Africa Gas Sensor Market by Sensor Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.17. Rest of Middle East & Africa Gas Sensor Market by Type, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.18. Rest of Middle East & Africa Gas Sensor Market by Output, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.19. Rest of Middle East & Africa Gas Sensor Market by Technology, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.1.20. Rest of Middle East & Africa Gas Sensor Market by End Use, Value (US$ Bn) and Volume (Unit), 2019 - 2032

8.6.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. by Output vs by Type Heat map

9.2. Manufacturer vs by Type Heat map

9.3. Company Market Share Analysis, 2025

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. ABB Ltd.

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. AlphaSense Inc.

9.5.3. City Technology Ltd.

9.5.4. Dynament

9.5.5. Figaro Engineering Inc.

9.5.6. Membrapor

9.5.7. Nemoto & Co. Ltd.

9.5.8. Robert Bosch LLC

9.5.9. Siemens

9.5.10. GfG Gas Detection UK Ltd.

9.5.11. FLIR Systems, Inc.

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Sensor Type Coverage |

|

|

Type Coverage |

|

|

Output Coverage |

|

|

Technology Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2023), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |