Global Generic Oncology Drugs Market Forecast

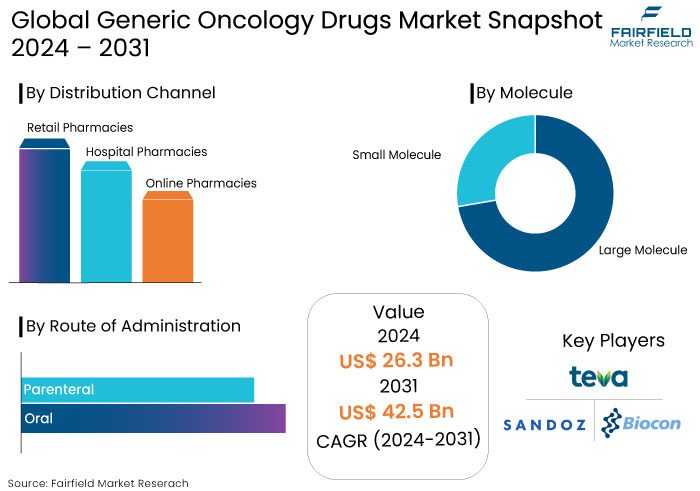

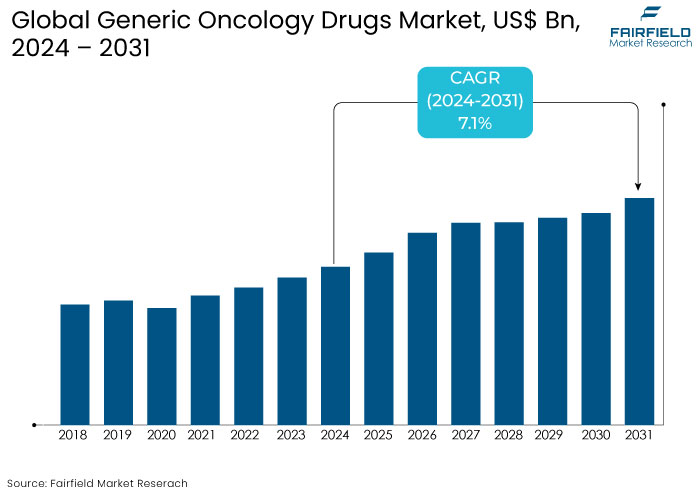

- The generic oncology drugs market is projected to be valued at US$42.5 Bn by 2031, exhibiting significant growth from US$26.3 Bn achieved in 2024.

- The market for generic oncology drugs is expected to show a significant expansion rate with projected CAGR of 7.1% during the period between 2024 and 2031.

Generic Oncology Drugs Market

- Patent expiration of blockbuster oncology drugs has opened significant opportunities for the generic drug manufacturers globally.

- Growing adoption of generic and biosimilar medicines have led to billions in savings for healthcare systems and patients globally.

- Leading pharmaceutical companies like Sandoz Group AG and Fresenius Kabi AG are leveraging on their extensive expertise in research and development to enhance their portfolios of generic oncology drugs.

- Generic oncology drugs are increasingly being developed for a range of therapeutic areas including breast cancer, lung cancer, and haematological malignancies. This expansion allows for treatment options, improving access to affordable therapies and addressing diverse patient needs in cancer care.

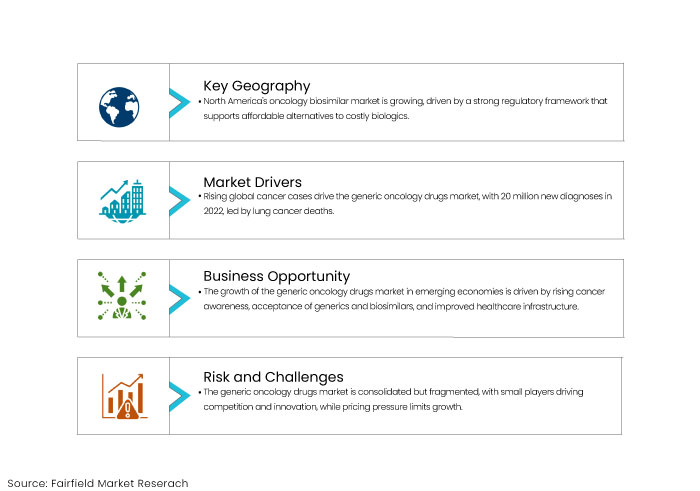

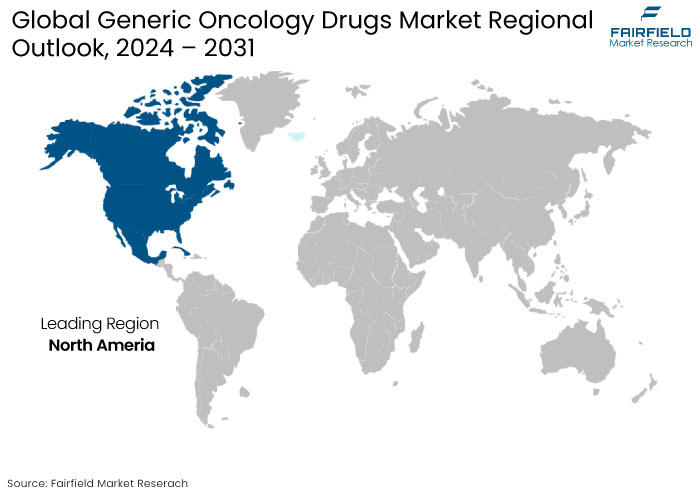

- North America holds significant market share due to presence of large number of leading players actively involved in the development of biosimilars.

- Surge in demand for cancer treatments and oncology medication remains a key driver for generic oncology drugs market

- Countries like China and India are the hub for generic manufacturers due to their robust pharmaceutical production capabilities and lower manufacturing costs, thus, enabling them to supply a wide range of affordable generic oncology drugs.

A Look Back and a Look Forward - Comparative Analysis

The generic oncology drugs market has experienced significant growth over the past decade, driven by the expiration of patents for blockbuster cancer therapies, allowing generic manufacturers to introduce affordable alternatives.

The introduction of generics and biosimilars has further broadened the treatment landscape, as it allowed a wide patient population to access essential treatments at a fraction of the original cost. This shift has alleviated the financial burden on healthcare systems significantly as well as prompted a growing acceptance of generic drugs among healthcare providers.

The treatment options available for oncological conditions have significantly broadened, further increasing competition and driving down prices with the emergence of biosimilars, biologic medical products highly similar to already approved reference products.

The market is poised for further expansion, with increasing incidence of cancer globally, coupled with an increasing emphasis on cost-effective treatments. Asian countries like India and China, being the pivotal hub for generic drug manufacturing are likely to drive sustained demand for generic medications, owed to their robust production capabilities and lower operational costs.

Growing advancements in drug formulation and delivery methods, development of long acting injectables and oral formulations, and adoption of digital health technologies are expected to play a crucial role in expanding patient access to generic oncology drugs.

Key Growth Determinants

- Growing Incidence of Cancer Cases Globally

Growing cases of cancer cases globally is a primary driver for the global generic oncology drugs market. This rising number directly demands for effective and accessible treatment options. According to American Cancer Society, Global Cancer Statistics’ 2024 report findings state that, an estimated 20 million cancer cases were newly diagnosed in 2022, with lung cancer being one of the leading causes of cancer deaths.

Lung cancer was diagnosed in 1 out of every 8 cancer patients with around 2.5 million new cases reported in 2022. Around 1800 women were diagnosed with cervical cancer everyday while 1000 women died from this disease in 2022 globally.

Globally, only 36% of the women have undergone screening for cervical cancer, while only 15% of eligible girls have received the vaccine against the human papillomavirus (HPV). Generic oncology drugs provide a viable solution by offering cost-effective alternatives to branded medications. Thus, encouraging healthcare providers to prescribe effective treatments without financial constraints, thereby improving adherence and patient outcomes.

- Innovations in Drug Formulation and Delivery Systems

Advancement in technology is crucial for the evolution of generic oncology treatments as it enhances the drug efficacy and convenience. Innovations in drug formulation and delivery system enables pharmaceutical companies to create more effective medications to meet diverse needs of patients.

The emergence of long-acting injectables and controlled-release formulations helps maintain therapeutic drug levels in the bloodstream over extended periods while the development of advanced oral formulations allows for easy administration.

Improvements in drug delivery systems, such as nanotechnology and smart delivery mechanisms are paving the way for more personalized treatment options. Such technologies enable tailored therapies that can adapt to the specific needs of individual patients, optimizing efficacy and reducing toxicity. These advancements allow for more precise targeting of cancer cells, minimizing side effects and improving the overall therapeutic index of generic oncology drugs.

Key Growth Barriers

- Intense Competition and Pricing Pressure among Generic Manufacturers

The generic oncology drugs market is consolidated; however, the presence of numerous small players contributes to a fragmented landscape, fostering competition and innovation within this sector. Intense pricing pressure is a significant restraint for the market growth.

As competition among generic manufacturers escalates, particularly following the expiration of patents for blockbuster cancer treatments, companies often resort to aggressive pricing strategies to capture market share. While this may benefit patients by providing more affordable treatment options, it severely impacts the profitability of manufacturers.

Sustaining operational costs become increasingly challenging for the generic manufacturers, as pricing continues to decline, thus resulting in fewer innovations in generic formulations and limiting the introduction of new products to the market. Moreover, intense pricing pressure leads to market consolidation, where only large firms with great resources survive the competitive landscape.

- Complex Regulatory Requirements and Approval Processes

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent guidelines to ensure the safety and efficacy of medications. While these regulations are crucial for ensuring drug safety, they often lead to lengthy approval timelines for generic oncology drugs.

Manufacturers must conduct extensive clinical trials, submit comprehensive documentation, and undergo rigorous inspections, all of which require significant time and financial investment. Such delays hinder the timely availability of affordable treatments, especially following the patent expiration of branded drugs.

The evolving nature of regulations can create uncertainty for generic manufacturers, as frequent changes in regulatory requirements can necessitate additional adjustments in clinical and manufacturing processes, further complicating market entry. Thus, challenges associated with regulatory frameworks can significantly impede the growth of the generic oncology drugs market, affecting both the availability of new treatments and the overall competitiveness of the sector.

Generic Oncology Drugs Market Trends and Opportunities

- Unlocking Potential of Generic Oncology in Emerging Countries

The expansion of generic oncology drugs market presents a substantial growth potential in emerging economies. Increasing awareness of timely cancer diagnosis and treatments, increasing recognition of effectiveness of generic and biosimilar options and robust healthcare infrastructure are few factors contributing to the growth of global market.

Countries like India and China are emerging as key manufacturing hubs for generic and biosimilar drugs, driven by their established pharmaceutical industries, cost-effective production capabilities, and skilled workforce. Regulatory bodies in these countries are also streamlining approval processes for generics and biosimilars, further facilitating market entry and boosting production.

The growing acceptance of biosimilars and support from regulatory bodies in streamlining approval processes for generics and biosimilars in emerging markets present a fertile landscape for generic oncology drugs sector growth.

- Navigating the Transition from Blockbuster to Biosimilar

The global generic oncology drugs market is witnessing significant growth driven by rising demand for biosimilars especially as numerous blockbuster biologic drugs face patent expirations for oncology therapeutics. As patents for numerous high-revenue biologics expire, the entry of biosimilars becomes increasingly viable, allowing generic manufacturers to capitalize on the established clinical benefits of these therapies while providing more affordable treatment options for patients.

The transition from blockbuster biologics to biosimilars presents several promising opportunities for the generic oncology drugs manufacturers such as introduction of cost-effective drugs, increase in R&D investments and expanding patient base. Thus, highlighting the economic benefits of biosimilars to healthcare providers and payers, marking a transformative era in the oncology landscape, filled with opportunities for growth and enhanced patient care.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape plays a crucial role in shaping the generic oncology drugs market by influencing approval processes, pricing, and market entry barriers. In many countries, generic drugs must go through a stringent approval process to ensure they meet the safety, efficacy, and quality standards of the originator brand.

For oncology drugs, which are often high-cost treatments, regulatory agencies like the U.S. FDA or the European Medicines Agency (EMA) require detailed clinical data to demonstrate bioequivalence to the branded products. The FDA, for example, has a specialized pathway for oncology drugs, which can expedite the approval process for generics in certain circumstances.

The regulatory support for generic oncology drugs, including mechanisms like abbreviated new drug applications (ANDAs) and biosimilar pathways, fosters competition but also requires close monitoring of product quality and manufacturing standards to ensure patient safety. Thus, the regulatory scenario is a double-edged sword—it can either facilitate greater access to affordable treatments or delay generic competition, depending on the regulatory policies in place.

Segments Covered in the Report

- Parenteral Route Remain Top Route of Administration

Owed to the benefits associated such as rapid absorption of drugs dosing precision, patient compliance to treatment regimens and greater stability and efficacy compared to oral counterparts, parenteral route remained the top administration method for generic oncology drugs.

Parenteral mode of administration is highly favoured in the oncology as parenteral administration ensures complete bioavailability, bypassing the gastrointestinal tract where absorption can be variable and unreliable, especially for sensitive cancer therapies. Furthermore, this method also allows for precise dosing especially during continuous infusion or sustained-release formulations, providing more consistent therapeutic levels in the body.

- Online Pharmacies Set for Substantial Expansion

Within the generic oncology drugs sector, online pharmacies segment is poised for significant expansion. Growing integration of telehealth services, preference for remote consultations, tailored medication management and support by pharmacists, and increasing patient’s confidence in procuring prescriptions online are few factors boosting the acceptance of e-pharmacies globally.

As patients increasingly seek cost-effective treatment options, these digital platforms offer convenient access to a variety of generic cancer medications. This shift not only enhances accessibility but also fosters competition among online pharmacies, leading to better pricing and improved services for patients.

Regional Analysis

- North America’s Role in Advancing Generic Oncology Therapies

North America generic oncology drugs market for biosimilar drugs have seen significant growth in recent years, influenced by increasing utilization of biosimilars for oncology therapeutics. With a well-established regulatory framework, the region facilitates the approval and market entry of biosimilars. Consequently, allowing manufacturers to offer cost-effective alternatives to high-priced biologic treatments.

Ongoing patent expirations for blockbuster biologics create significant opportunities for the launch of new biosimilars. This landscape encourages innovation making North America a critical hub for the development and distribution of generic oncology therapies.

The rise in healthcare insurance coverage and government initiatives designed to lower drug costs improve access to generic oncology therapies, contributing to the broad transition toward value-based care within healthcare systems. North America’s strong healthcare infrastructure, coupled with the growing emphasis on affordability creates a robust environment for the expansion of the generic oncology drugs market.

- Surging Healthcare Infrastructure Investments Drive Asia Pacific Market

Asia Pacific oncology drugs market for generic and biosimilar medicines is rapidly expanding, driven by a strong push for affordable treatment options. In the context of biosimilar manufacturing, South Korea is emerging as a key region, supported by significant government investments and favourable regulatory frameworks.

Government initiatives such as generous tax incentives and the establishment of a consulting program to navigate the biosimilars approval process, have significantly boosted local companies. Likewise, Japanese market for biosimilars is also gaining traction, with the introduction of policies aimed at enhancing prescriber confidence and removing barriers to biosimilar use. The establishment of the Japan Biosimilar Association has further strengthened this effort, addressing challenges in market penetration.

Meanwhile, China and India are positioning themselves as significant players in the biosimilars landscape, with recent guidelines fostering local production and commercialization. China's government initiatives facilitate the development of multinational clinical centres and streamline approval processes, enhancing access to biosimilars. The "Make in India" campaign in India has stimulated biotechnology growth, supported by collaborations aimed at advancing biopharmaceutical research.

Countries like Singapore, Malaysia, Thailand, Indonesia, and Taiwan are developing regulatory frameworks for biosimilars, which increases market availability and patient access. As these nations continue to enhance their biosimilars markets, the APAC region is set to become a critical hub for innovative and cost-effective oncology therapies.

Fairfield’s Competitive Landscape Analysis

The global generic oncology drugs market is witnessing significant advancements as leading companies like Teva Pharmaceuticals, Sandozs Group AG and Fresenius Kabi are leveraging significant resources for research and development to enhance their generic portfolios. By focusing on developing low-cost generic drugs, these manufacturers are enhancing patient access to essential medications.

Strategic collaborations by companies like Apotex Inc., enable access to new technologies, share resources, and improve market reach, ultimately leading to increased competitiveness and better patient outcomes in the healthcare landscape.

The increasing focus on biosimilars further intensifies competition, as these products offer additional options for treatment. The market is dynamic, with ongoing competition driving advancements and improving patient access to affordable oncology therapies.

Key Market Companies

- Teva Pharmaceutical Industries Ltd.

- Sandoz Group AG

- Mylan N.V. (Viatris)

- Biocon

- Sun Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals

- Fresenius Kabi AG

- Pfizer Inc.

- Lupin Pharmaceuticals

- Zydus Cadila

Recent Industry Developments

- September 2024 -

Apotex Corp., a subsidiary of Apotex Inc., released dasatinib tablets, a generic version of Sprycel®, in the United States, accompanied by 180 days of exclusivity. Dasatinib is a kinase inhibitor indicated for the treatment of specific types of leukemia in adults and children aged one year and older, including cases where prior treatments were ineffective or poorly tolerated.

- August 2024 -

Lupin Limited introduced Doxorubicin Hydrochloride Liposome Injection in the United States, offering the product in two strengths: 20 mg/10 mL (2 mg/mL) and 50 mg/25 mL (2 mg/mL), provided in single-dose vials. This injection serves as a generic equivalent to Doxil (Liposomal) from Baxter Healthcare Corporation and is indicated for treating ovarian cancer, AIDS-related Kaposi’s Sarcoma, and multiple myeloma.

- July 2024

Apotex Inc. signed an exclusive agreement with Coherus Biosciences, Inc. to acquire the Canadian rights to toripalimab, an anti-PD-1 monoclonal antibody. Under this agreement, Apotex will be responsible for marketing and distributing toripalimab in Canada once it obtains regulatory approval. This deal represents a significant growth opportunity for Apotex's oncology portfolio, as toripalimab will be the company’s first novel branded biologic medication.

- March 2024 -

Cipla Limited and its wholly owned subsidiary, Cipla USA Inc., received final approval from the USFDA for their Abbreviated New Drug Application (ANDA) for Lanreotide Injection in 120 mg/0.5 mL, 90 mg/0.3 mL, and 60 mg/0.2 mL formulations.

An Expert’s Eye

- The generic oncology drugs market is experiencing significant growth as healthcare systems seek cost-effective solutions to manage cancer treatment expenses. Industry experts encourage pharmaceutical companies to capitalize on this trend by expanding their portfolios of generic oncology medications.

- Strategies for entering the generic oncology space differ across regions; for instance, North America emphasizes regulatory compliance and patent expirations, while Asia-Pacific is witnessing a surge in demand driven by increasing cancer prevalence and healthcare access improvements.

- The market is also seeing innovations aimed at reducing production costs, such as advanced manufacturing technologies and streamlined supply chains, which help enhance the affordability and availability of generic cancer therapies.

Global Generic Oncology Drugs Market is Segmented as-

By Molecule

- Large Molecule

- Small Molecule

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Generic Oncology Drugs Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Generic Oncology Drugs Market Outlook, 2019-2031

3.1. Global Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

3.1.1. Key Highlights

3.1.1.1. Large Molecule

3.1.1.2. Small Molecule

3.2. Global Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

3.2.1. Key Highlights

3.2.1.1. Oral

3.2.1.2. Parenteral

3.3. Global Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

3.3.1. Key Highlights

3.3.1.1. Hospital Pharmacy

3.3.1.2. Retail Pharmacy

3.3.1.3. Online Pharmacies

3.3.1.4. Managed Care Institutions

3.4. Global Generic Oncology Drugs Market Outlook, by Region, Value (US$ Bn), 2019-2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Generic Oncology Drugs Market Outlook, 2019-2031

4.1. North America Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

4.1.1. Key Highlights

4.1.1.1. Large Molecule

4.1.1.2. Small Molecule

4.2. North America Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

4.2.1. Key Highlights

4.2.1.1. Oral

4.2.1.2. Parenteral

4.3. North America Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

4.3.1. Key Highlights

4.3.1.1. Hospital Pharmacy

4.3.1.2. Retail Pharmacy

4.3.1.3. Online Pharmacies

4.3.1.4. Managed Care Institutions

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Generic Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019-2031

4.4.1. Key Highlights

4.4.1.1. U.S. Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

4.4.1.2. U.S. Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

4.4.1.3. U.S. Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.1.4. Canada Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

4.4.1.5. Canada Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

4.4.1.6. Canada Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Generic Oncology Drugs Market Outlook, 2019-2031

5.1. Europe Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

5.1.1. Key Highlights

5.1.1.1. Large Molecule

5.1.1.2. Small Molecule

5.2. Europe Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

5.2.1. Key Highlights

5.2.1.1. Oral

5.2.1.2. Parenteral

5.3. Europe Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

5.3.1. Key Highlights

5.3.1.1. Hospital Pharmacy

5.3.1.2. Retail Pharmacy

5.3.1.3. Online Pharmacies

5.3.1.4. Managed Care Institutions

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Generic Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019-2031

5.4.1. Key Highlights

5.4.1.1. Germany Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.2. Germany Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.3. Germany Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.4. U.K. Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.5. U.K. Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.6. U.K. Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.7. France Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.8. France Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.9. France Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.10. Italy Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.11. Italy Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.12. Italy Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.13. Turkey Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.14. Turkey Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.15. Turkey Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.16. Russia Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.17. Russia Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.18. Russia Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.1.19. Rest of Europe Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

5.4.1.20. Rest of Europe Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

5.4.1.21. Rest of Europe Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Generic Oncology Drugs Market Outlook, 2019-2031

6.1. Asia Pacific Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

6.1.1. Key Highlights

6.1.1.1. Large Molecule

6.1.1.2. Small Molecule

6.2. Asia Pacific Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

6.2.1. Key Highlights

6.2.1.1. Oral

6.2.1.2. Parenteral

6.3. Asia Pacific Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

6.3.1. Key Highlights

6.3.1.1. Hospital Pharmacy

6.3.1.2. Retail Pharmacy

6.3.1.3. Online Pharmacies

6.3.1.4. Managed Care Institutions

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Generic Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019-2031

6.4.1. Key Highlights

6.4.1.1. China Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.2. China Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.3. China Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.4. Japan Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.5. Japan Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.6. Japan Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.7. South Korea Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.8. South Korea Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.9. South Korea Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.10. India Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.11. India Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.12. India Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.13. Southeast Asia Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.14. Southeast Asia Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.15. Southeast Asia Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.1.16. Rest of Asia Pacific Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

6.4.1.17. Rest of Asia Pacific Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

6.4.1.18. Rest of Asia Pacific Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Generic Oncology Drugs Market Outlook, 2019-2031

7.1. Latin America Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.1.1.1. Large Molecule

7.1.1.2. Small Molecule

7.2. Latin America Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

7.1.1. Key Highlights

7.2.1.1. Oral

7.2.1.2. Parenteral

7.3. Latin America Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

7.3.1. Key Highlights

7.3.1.1. Hospital Pharmacy

7.3.1.2. Retail Pharmacy

7.3.1.3. Online Pharmacies

7.3.1.4. Managed Care Institutions

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Generic Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019-2031

7.4.1. Key Highlights

7.4.1.1. Brazil Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

7.4.1.2. Brazil Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

7.4.1.3. Brazil Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.4. Mexico Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

7.4.1.5. Mexico Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

7.4.1.6. Mexico Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.7. Argentina Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

7.4.1.8. Argentina Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

7.4.1.9. Argentina Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.1.10. Rest of Latin America Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

7.4.1.11. Rest of Latin America Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

7.4.1.12. Rest of Latin America Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Generic Oncology Drugs Market Outlook, 2019-2031

8.1. Middle East & Africa Generic Oncology Drugs Market Outlook, by Molecule, Value (US$ Bn), 2019-2031

8.1.1. Key Highlights

8.1.1.1. Large Molecule

8.1.1.2. Small Molecule

8.2. Middle East & Africa Generic Oncology Drugs Market Outlook, by Route of Administration, Value (US$ Bn), 2019-2031

8.2.1. Key Highlights

8.2.1.1. Oral

8.2.1.2. Parenteral

8.3. Middle East & Africa Generic Oncology Drugs Market Outlook, by Distribution Channel, Value (US$ Bn), 2019-2031

8.3.1. Key Highlights

8.3.1.1. Hospital Pharmacy

8.3.1.2. Retail Pharmacy

8.3.1.3. Online Pharmacies

8.3.1.4. Managed Care Institutions

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Generic Oncology Drugs Market Outlook, by Country, Value (US$ Bn), 2019-2031

8.4.1. Key Highlights

8.4.1.1. GCC Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

8.4.1.2. GCC Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

8.4.1.3. GCC Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.4. South Africa Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

8.4.1.5. South Africa Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

8.4.1.6. South Africa Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.7. Egypt Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

8.4.1.8. Egypt Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

8.4.1.9. Egypt Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.10. Nigeria Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

8.4.1.11. Nigeria Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

8.4.1.12. Nigeria Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.1.13. Rest of Middle East & Africa Generic Oncology Drugs Market by Molecule, Value (US$ Bn), 2019-2031

8.4.1.14. Rest of Middle East & Africa Generic Oncology Drugs Market by Route of Administration, Value (US$ Bn), 2019-2031

8.4.1.15. Rest of Middle East & Africa Generic Oncology Drugs Market by Distribution Channel, Value (US$ Bn), 2019-2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Distribution Channel vs by Route of Administration Heat map

9.2. Manufacturer vs by Route of Administration Heatmap

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Novartis

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Pfizer

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. GSK

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Celgene

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Teva Pharmaceuticals

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Merck & Company

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Aurobindo Pharma

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Hikma Pharmaceuticals

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Mylan

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Gland Pharma

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. NATCO Pharma

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Molecule Coverage |

|

|

Route of Administration Coverage |

|

|

Distribution Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |