Global High Purity Alumina Market Forecast

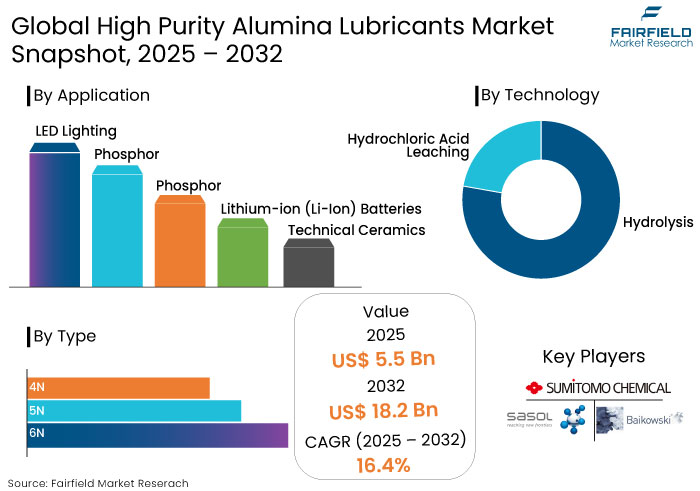

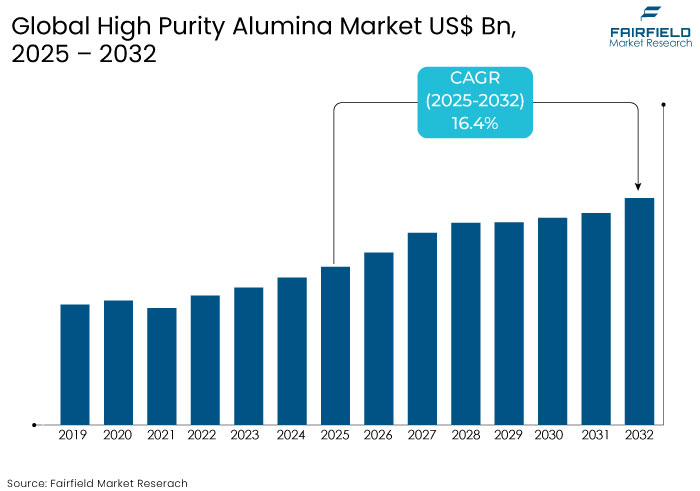

- The high purity alumina market is projected to reach a size of US$ 18.6 Bn by 2032, showing significant growth from the US$ 5.8 Bn achieved in 2025.

- The market for high purity alumina is expected to show a significant expansion rate, with an estimated CAGR of 18.1% from 2025 to 2032.

High Purity Alumina Market Insights

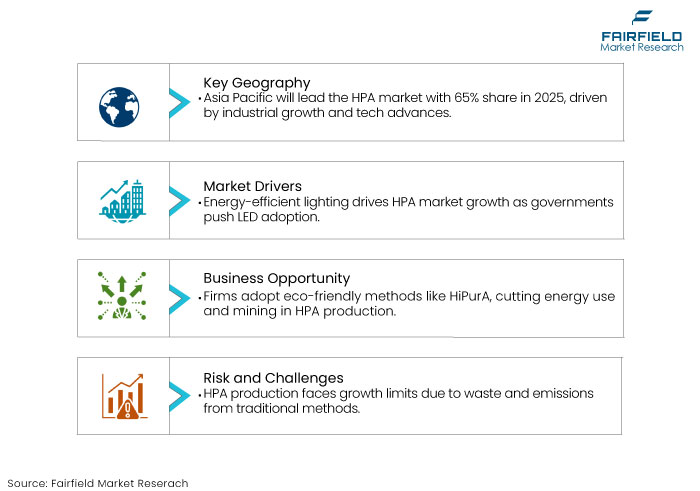

- Growth in the HPA market is projected to be driven by its rising demand in LEDs, and electric vehicles (EVs).

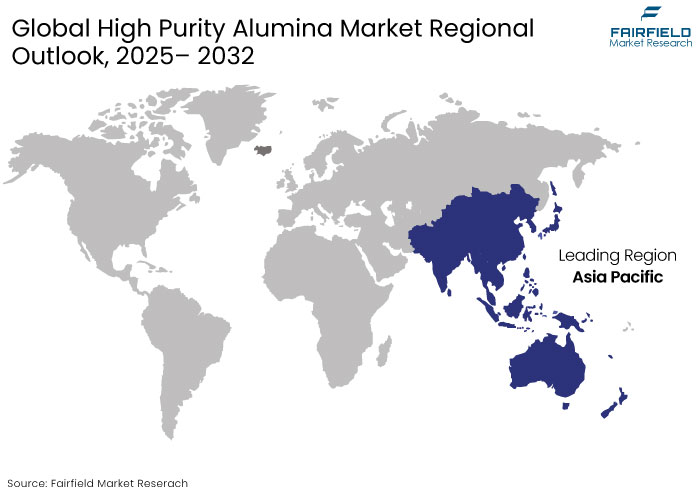

- Asia Pacific is anticipated to hold a share of 65% in 2025, led by China, Japan, and South Korea, due to their strong manufacturing capabilities and demand for LEDs and EVs.

- Transition to energy-efficient lighting globally has increased HPA demand for sapphire substrates in LED production.

- Rapid adoption of EVs and advancements in lithium-ion and solid-state battery technologies are key growth drivers for the HPA market.

- Increasing use of HPA in semiconductors, 5G components, and optical lenses drives expansion.

- New eco-friendly methods, like acid recycling and advanced hydrolysis techniques, are gaining traction to reduce environmental impact.

- Key players are anticipated to focus on partnerships and capacity expansion to strengthen their market positions.

- North America and Europe are emerging markets driven by EV adoption and investments in advanced technologies.

A Look Back and a Look Forward - Comparative Analysis

During the historical period ranging between 2019 and 2023, the high purity alumina (HPA) market experienced steady growth. This expansion was primarily driven by increasing adoption of LEDs in energy-efficient lighting along with the widespread use of consumer electronics.

Governments worldwide implemented policies encouraging energy efficiency, propelling the demand for LEDs requiring HPA for sapphire substrates. The rise of electric vehicles (EVs) spurred demand for HPA in lithium-ion battery separators. Market expansion, however, was slightly constrained by high production costs and environmental challenges associated with traditional HPA production methods.

Over the forecast period, the HPA market is projected to witness accelerated growth due to advancements in EV technology, expanded semiconductor applications, and rising investments in sustainable production processes. The transition to solid-state batteries in EVs, requiring ultra-high-purity alumina, is expected to be a major growth driver.

The proliferation of 5G technology and the Internet of Things (IoT) is anticipated to amplify the demand for HPA in advanced electronics. Governments and industries are focusing on adopting eco-friendly production technologies to meet stringent environmental regulations, creating market innovation opportunities. Asia-Pacific is expected to maintain its dominance, while North America and Europe witness substantial growth due to increasing investments in research and development.

Key Growth Determinants

- Rising Demand for LEDs in Energy-Efficient Lighting

Growing adoption of energy-efficient lighting solutions is a significant driver of the high purity alumina (HPA) market growth. Governments worldwide are implementing policies to phase out incandescent and fluorescent lights, promoting LEDs as a more sustainable alternative.

LEDs consume significantly less energy, have a longer lifespan, and rely on HPA for sapphire substrates, ensuring high durability and brightness. In emerging economies, rapid urbanization and the adoption of smart city projects further amplify the demand for LED lighting in residential and commercial applications.

The Asia Pacific region, particularly China, Japan, and India, lead the market due to large-scale LED production. This manufacturing is further supported by government subsidies and favourable policies.

It is estimated that 80% of global lighting will be LED-based by 2025, compared to just 30% in 2015. This rapid shift will continue fuelling HPA demand for LED manufacturing.

- Advancements in Energy Storage Systems

HPA is used in sophisticated energy storage systems, particularly lithium-ion (Li-ion) batteries. It is utilized in separators to augment battery performance by enhancing thermal stability and mitigating thermal runaway risks.

Energy storage solutions are essential for integrating renewable energy and electric cars (EVs), boosting the demand for HPA. The global transition to renewable energy sources necessitates the development of grid-scale energy storage devices capable of storing surplus electricity when supply surpasses demand.

HPA is utilized in energy storage systems that are essential for grid stabilization by storing energy for subsequent utilization. As the electric vehicle market progresses, the demand for extensive battery storage systems, particularly in charging infrastructure, is estimated to increase. Progress in solid-state batteries (SSBs) and other advanced energy storage technologies is creating new applications for HPA.

The grid-scale energy storage market is projected to grow to USD 22.7 billion by 2027, driven by the need to store energy from renewable sources like wind and solar.

Key Growth Barriers

- Environmental Concerns and Stringent Regulations

Environmental concerns associated with HPA production processes significantly restrain growth. Traditional methods of alumina extraction generate waste and emissions, raising concerns about their ecological impact.

Governments worldwide are enforcing stringent environmental regulations, like waste discharge and emissions restrictions, which can increase operational costs for manufacturers. Compliance with these regulations requires significant investments in sustainable production technologies and waste management systems.

Efforts are being made to adopt eco-friendly processes, like recycling hydrochloric acid during production. Environmental challenges remain a critical hurdle for the HPA market, especially in regions with strict regulatory frameworks.

Key Growth Opportunities

- Advancements in Manufacturing and Logistics

Companies are progressively investing in sustainable and efficient production methods like ChemX Materials' HiPurA technology. This scalable and modular technique obviates the need for conventional mining, reducing energy usage and the environmental impact typically connected with HPA manufacturing.

The HiPurA process facilitates the generation of ultra-high-purity alumina with a reduced carbon footprint. Numerous organizations are concentrating on establishing production facilities near their end markets.

Companies are progressively implementing decentralized and modular manufacturing systems to diminish their reliance on extensive mining operations and to ensure a robust supply chain. Flexibility of these systems facilitates manufacturing scale-up and modification based on specific requirements of end customers, enhancing market positioning.

- Growth in Advanced Ceramics

High purity alumina is essential for manufacturing advanced ceramics, particularly for components subjected to high temperatures and significant stress. HPA-based ceramics are increasingly utilized in the aerospace sector for engine components, sensors, and other essential elements that demand exceptional temperature resistance and strength.

The materials’ biocompatibility and wear resilience increase its applications in the medical sector as it requires HPA for joint applications, dental implants, and bio ceramic materials. The market for advanced ceramics in electronics, including substrates for integrated circuits, insulators for electronic components, and capacitors, is projected to witness expansion.

This growth is attributable to the need for high-performance and compact gadgets. The production of sapphire substrates for LED and semiconductor applications is a significant growth area for HPA-based ceramics.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape is pivotal in shaping the high purity alumina market, as governments and industry bodies emphasize sustainability and quality standards across various end-use sectors. Regulations aimed at decreasing carbon footprints, particularly in LED lighting and electric vehicles (EVs), are boosting the demand for HPA, a key component in energy-efficient technologies.

Stringent policies encouraging the adoption of energy-efficient lighting systems, like the European Union's Eco design Directive are driving the use of high-quality alumina in LEDs. Regulatory frameworks supporting the expansion of renewable energy and EV infrastructure indirectly boost the HPA market by increasing demand for lithium-ion battery separators, where HPA is a critical material. Compliance with international quality standards like ISO and ASTM ensures that products meet global benchmarks, driving innovation and competition within the industry.

Segment Covered in the Report

- Cost-Efficiency and Performance characteristics of 4N HPA to Foster Growth

4N is anticipated to capture a share of 48% in 2025, owing to their extensive applicability and compatibility with industry requirements. The predominant use of 4N grade HPA in LED substrates and phosphor applications is due to its adequate purity, which enhances brightness and durability at a lower cost than higher purity grades. 4N HPA strikes an optimal balance between performance and cost, rendering it a preferred option for large-scale industrial applications.

Manufacturers are intensifying their focus on 4N production to meet the escalating demand while maintaining production cost efficiency, facilitating broader adoption in price-sensitive markets. Exceptional characteristics of 4N alumina, such as its elevated thermal conductivity, chemical stability, and electrical insulation, have facilitated its utilization in industries demanding rigorous material specifications.

- Hydrolysis to Gain Traction Owing to its Cost-Effective Production Methods

The market value of hydrolysis segment is anticipated to surpass US$ 6.2 billion by the year 2032. The segment's dominance is attributed to its strong demand for production methods that are both cost-effective and environment friendly.

Hydrolysis of aluminum alkoxide produces high-purity and high-quality alumina, which is vital for developing innovative applications such as light-emitting diodes (LEDs), lithium-ion batteries, and high-performance ceramics. The technology facilitates enhanced control over the purity and size of the alumina produced, ensuring compliance with stringent industry standards.

Market expansion is predicted to benefit from the rising popularity of water scrubbing. This typically necessitates lower temperatures and little energy consumption compared to alternative methods for decreasing production and environmental expenses.

Regional Analysis

- Asia Pacific to Dominate the HPA Market owing to its Robust Industrial Growth

Asia Pacific is the largest and fastest-growing region in the global HPA market, commanding a share of 65% in 2025. The region's dominance is attributed to robust industrial growth, technological advancements, and supportive government policies across key economies like China, Japan, South Korea, and India.

The region is a global hub for the manufacturing of consumer electronics, semiconductors, and LED lighting systems. Countries like China, South Korea, and Japan are home to leading electronics manufacturers, creating a steady demand for high-purity alumina.

Rapid adoption of electric vehicles, particularly in China, surge the demand for lithium-ion batteries. HPA plays a critical role in improving battery separators' thermal stability and performance. China, the world's largest EV producer, significantly drives this demand.

Government authorities in the region are actively promoting the adoption of energy-efficient lighting solutions, like LEDs, to decrease carbon emissions. The availability of raw materials like kaolin and aluminum-rich bauxite, along with low-cost labour and advanced manufacturing capabilities, makes Asia Pacific a cost-competitive region for HPA production.

- Substantial Investments in Renewable Energy in North America Makes it the Second Largest Region

North America ranks as the second-largest market, contributing to 18% of the global market share in 2025. Advancements in LED technology along with the increasing deployment of electric vehicles and substantial investments in renewable energy are predicted to drive growth.

The U.S. is anticipated to lead regional market, supported by the presence of prominent HPA manufacturers and a strong focus on research and development to improve production efficiency and sustainability.

Government incentives promoting the adoption of energy-efficient lighting and electric mobility bolster demand. The region's stringent regulatory standards, emphasizing high-quality and sustainable production methods, also encourage the use of premium-grade HPA.

Fairfield’s Competitive Landscape Analysis

The high purity alumina (HPA) market is marked by intense competition, driven by increasing demand in electronics, LED manufacturing, and electric vehicle batteries. Key players including Altech Chemicals Ltd., Orbital Corporation Ltd., and Nippon Light Metal Holdings dominate the landscape, leveraging advanced technologies and strategic partnerships to strengthen their positions.

Companies are heavily investing in research and development to enhance production efficiency and achieve cost advantages. Regional competition is significant, with Asia Pacific being a central hub due to its growing electronics and EV sectors. Market players are focusing on expanding production capacities and enhancing supply chain networks to meet the surging global demand for high-grade alumina.

Key Market Companies

- Sumitomo Chemical Co. Ltd

- Sasol Ltd.

- Baikowski

- Nippon Light Metal Co. Ltd

- Alcoa Inc.

- Altech Chemicals Ltd.

- Honghe Chemicals

- Hebei Heng Bo New Materials Technology Co. Ltd.

- Xuancheng Jingrui New Material Co. Ltd

- Dalian Hiland Photoelectric Material Co. Ltd

- Alpha HPA

- FYI Resources

Recent Industry Developments

- In April 2024, prominent chemical supplier Alpha HPA introduced its new high-purity aluminum nitrate, achieving a purity level of 99.99% with the potential to transform battery safety.

- In March 2024, Powerchip Semiconductor Manufacturing Corporation Taiwan, in collaboration with Tata Electronics Private Limited declared their plan to construct a semiconductor manufacturing facility in Gujarat.

An Expert’s Eye

- Industry experts emphasize the importance of developing sustainable production processes to align with stringent environmental regulations and decrease production costs.

- HPA's growing use in solid-state batteries and advanced semiconductors is a transformative factor for market expansion.

- Analysts suggest that continuous research and development efforts are crucial to improve production efficiency, enhance product quality, and discover new applications.

- Experts predict a sustained growth for the HPA market, driven by increasing demand from industries like LEDs, electric vehicles, and advanced electronics.

Global High Purity Alumina Market is Segmented as-

By Application

- LED Lighting

- Phosphor

- Semiconductor

- Lithium-ion (Li-Ion) Batteries

- Technical Ceramics

- Other Applications

By Type

- 4N

- 5N

- 6N

By Technology

- Hydrolysis

- Hydrochloric Acid Leaching

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global High Purity Alumina Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global High Purity Alumina Market Outlook, 2019 - 2032

3.1. Global High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. LED Lighting

3.1.1.2. Phosphor

3.1.1.3. Semiconductor

3.1.1.4. Lithium-ion (Li-Ion) Batteries

3.1.1.5. Technical Ceramics

3.1.1.6. Other Applications

3.2. Global High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. 4N

3.2.1.2. 5N

3.2.1.3. 6N

3.3. Global High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Hydrolysis

3.3.1.2. Hydrochloric Acid Leaching

3.4. Global High Purity Alumina Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America High Purity Alumina Market Outlook, 2019 - 2032

4.1. North America High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. LED Lighting

4.1.1.2. Phosphor

4.1.1.3. Semiconductor

4.1.1.4. Lithium-ion (Li-Ion) Batteries

4.1.1.5. Technical Ceramics

4.1.1.6. Other Applications

4.2. North America High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. 4N

4.2.1.2. 5N

4.2.1.3. 6N

4.3. North America High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Hydrolysis

4.3.1.2. Hydrochloric Acid Leaching

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America High Purity Alumina Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. U.S. High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.2. U.S. High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.3. U.S. High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.4. Canada High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.5. Canada High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.1.6. Canada High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe High Purity Alumina Market Outlook, 2019 - 2032

5.1. Europe High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. LED Lighting

5.1.1.2. Phosphor

5.1.1.3. Semiconductor

5.1.1.4. Lithium-ion (Li-Ion) Batteries

5.1.1.5. Technical Ceramics

5.1.1.6. Other Applications

5.2. Europe High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. 4N

5.2.1.2. 5N

5.2.1.3. 6N

5.3. Europe High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Hydrolysis

5.3.1.2. Hydrochloric Acid Leaching

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe High Purity Alumina Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Germany High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.2. Germany High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.3. Germany High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.4. U.K. High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.5. U.K. High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.6. U.K. High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.7. France High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.8. France High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.9. France High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.10. Italy High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.11. Italy High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.12. Italy High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.13. Turkey High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.14. Turkey High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.15. Turkey High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.16. Russia High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.17. Russia High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.18. Russia High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.19. Rest of Europe High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.20. Rest of Europe High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.1.21. Rest of Europe High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific High Purity Alumina Market Outlook, 2019 - 2032

6.1. Asia Pacific High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. LED Lighting

6.1.1.2. Phosphor

6.1.1.3. Semiconductor

6.1.1.4. Lithium-ion (Li-Ion) Batteries

6.1.1.5. Technical Ceramics

6.1.1.6. Other Applications

6.2. Asia Pacific High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. 4N

6.2.1.2. 5N

6.2.1.3. 6N

6.3. Asia Pacific High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Hydrolysis

6.3.1.2. Hydrochloric Acid Leaching

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific High Purity Alumina Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. China High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.2. China High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.3. China High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.4. Japan High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.5. Japan High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.6. Japan High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.7. South Korea High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.8. South Korea High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.9. South Korea High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.10. India High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.11. India High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.12. India High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.13. Southeast Asia High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.14. Southeast Asia High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.15. Southeast Asia High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.16. Rest of Asia Pacific High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.17. Rest of Asia Pacific High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.1.18. Rest of Asia Pacific High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America High Purity Alumina Market Outlook, 2019 - 2032

7.1. Latin America High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. LED Lighting

7.1.1.2. Phosphor

7.1.1.3. Semiconductor

7.1.1.4. Lithium-ion (Li-Ion) Batteries

7.1.1.5. Technical Ceramics

7.1.1.6. Other Applications

7.2. Latin America High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. 4N

7.2.1.2. 5N

7.2.1.3. 6N

7.3. Latin America High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Hydrolysis

7.3.1.2. Hydrochloric Acid Leaching

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America High Purity Alumina Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Brazil High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.2. Brazil High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.3. Brazil High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.4. Mexico High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.5. Mexico High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.6. Mexico High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.7. Argentina High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.8. Argentina High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.9. Argentina High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.10. Rest of Latin America High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.11. Rest of Latin America High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.1.12. Rest of Latin America High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa High Purity Alumina Market Outlook, 2019 - 2032

8.1. Middle East & Africa High Purity Alumina Market Outlook, by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. LED Lighting

8.1.1.2. Phosphor

8.1.1.3. Semiconductor

8.1.1.4. Lithium-ion (Li-Ion) Batteries

8.1.1.5. Technical Ceramics

8.1.1.6. Other Applications

8.2. Middle East & Africa High Purity Alumina Market Outlook, by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. 4N

8.2.1.2. 5N

8.2.1.3. 6N

8.3. Middle East & Africa High Purity Alumina Market Outlook, by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Hydrolysis

8.3.1.2. Hydrochloric Acid Leaching

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa High Purity Alumina Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. GCC High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.2. GCC High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.3. GCC High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.4. South Africa High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.5. South Africa High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.6. South Africa High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.7. Egypt High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.8. Egypt High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.9. Egypt High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.10. Nigeria High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.11. Nigeria High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.12. Nigeria High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.13. Rest of Middle East & Africa High Purity Alumina Market by Application, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.14. Rest of Middle East & Africa High Purity Alumina Market by Type, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.1.15. Rest of Middle East & Africa High Purity Alumina Market by Technology, Value (US$ Bn) and Volume (Tons), 2019 - 2032

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Type Heatmap

9.2. Company Market Share Analysis, 2023

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Sumitomo Chemical Co. Ltd

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Sasol Ltd.

9.4.3. Baikowski

9.4.4. Nippon Light Metal Co. Ltd

9.4.5. Alcoa Inc.

9.4.6. Altech Chemicals Ltd.

9.4.7. Honghe Chemicals

9.4.8. Hebei Heng Bo New Materials Technology Co. Ltd.

9.4.9. Xuancheng Jingrui New Material Co. Ltd

9.4.10. Dalian Hiland Photoelectric Material Co. Ltd

9.4.11. Alpha HPA

9.4.12. FYI Resources.

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Application Coverage |

|

|

Type Coverage |

|

|

Technology Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |