Global Lubricants Market Forecast

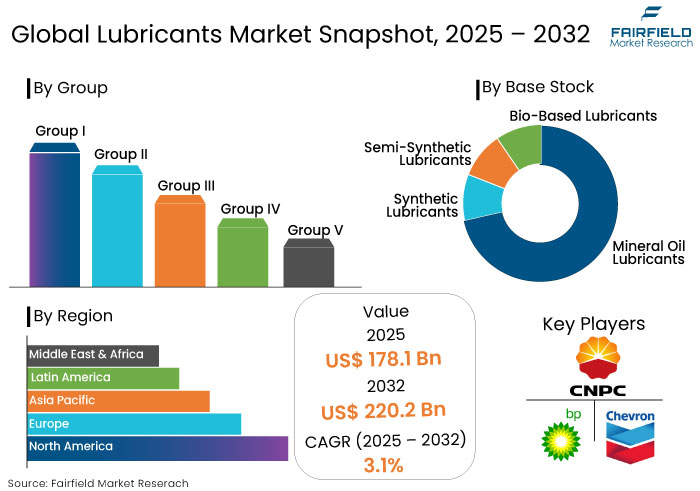

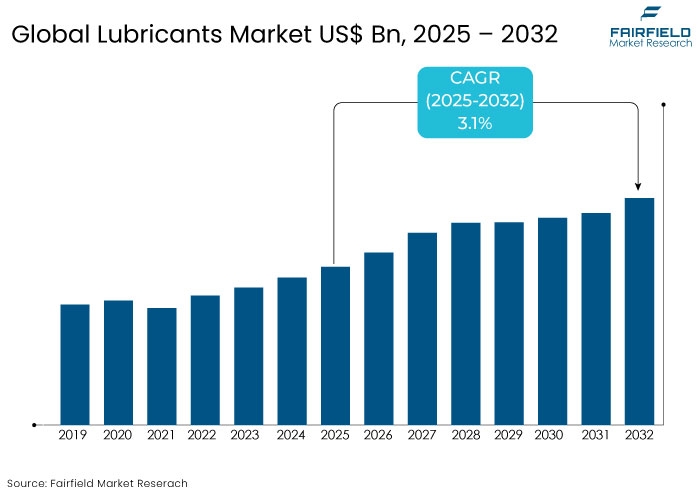

- The lubricants market is projected to reach a size of US$ 220.2 Bn by 2032, showing significant growth from the US$ 178.1 Bn achieved in 2025.

- The market for lubricants is expected to show a significant expansion rate, with an estimated CAGR of 3.1% from 2025 to 2032.

Lubricants Market Insights

- Eco-friendly and bio-based lubricants are gaining traction as industries face stringent environmental regulations.

- The market is driven by increasing automotive sales, industrial expansion, and rising demand for high-performance lubricants.

- Shift towards synthetic lubricants is accelerating, owing to their superior performance, longer lifespan, and efficiency in extreme operating conditions.

- Automotive applications dominate lubricant demand, driven by vehicle fleet maintenance, oil changes, and the growth of electric and hybrid vehicles.

- Asia Pacific is likely to emerge as a key growth market with a share of 45% in 2025, owing to rising industrialization, automotive demand, and infrastructure development.

- Industrial sectors like power generation, heavy machinery, and manufacturing are prominent consumers of lubricants, driving demand for specialized fluids like metalworking and hydraulic oils.

- Governments across the globe are enforcing stricter fuel efficiency and emission standards, influencing the shift towards advanced lubricants that improve energy efficiency and reduce carbon footprints.

- Growth of electric vehicles is creating new opportunities for specialized lubricants for battery cooling, electric motors, and transmission components.

A Look Back and a Look Forward - Comparative Analysis

The lubricants market witnessed steady growth from 2019 to 2023, driven by the global expansion of the automotive, industrial, and manufacturing sectors. Lubricant demand was primarily fueled by the growing automotive fleet, industrial production, and infrastructure development. Rise in industrial activities, especially in emerging economies, drove the need for lubricants in sectors like heavy machinery, power generation, and manufacturing.

Over the forecast period, the lubricants market is expected to experience a transformative expansion due the push for sustainability and environmental concerns. The industry is also estimated to witness a growing demand for bio-based, eco-friendly, and high-performance synthetic lubricants throughout the assessment period.

Stringent environmental regulations and the transition toward electric vehicles (EVs) are expected to influence market dynamics. The rise of EVs, which require specialized lubricants for battery and electric motor components, are likely to create new opportunities for lubricant manufacturers.

Key Growth Determinants

- Increased Demand for High-Performance Engines

Increasing demand for high-performance engines is a primary catalyst for developing and expanding the lubricants market. Advanced cars, machinery, and industrial equipment necessitate lubricants that correspond to the performance and efficiency of these technological engines.

- Shell Rotella's extensive testing and development process demonstrates its commitment to meeting the evolving demands of modern engines. The company conducted hundreds of engine tests and thousands of bench tests, accumulating 40 million miles of on-road driving and 50,000 hours of vocational vehicle testing to ensure the performance and reliability of their API CK-4 oils.

Contemporary high-performance engines are designed to function at elevated speeds, temperatures, and pressures. Engines utilized in advanced automobiles, industrial machinery, or airplanes necessitate lubrication solutions that are capable of enduring harsh circumstances without failure.

Traditional lubricants, adequate for older and less demanding engines, often fail to deliver the requisite protection in challenging situations. The lubricant market has had to devise creative concepts and develop superior formulations to meet the evolving demands of contemporary engines.

- Increasing Demand from the Transportation and Logistics Sector

The transportation and logistics sector is a significant lubricant user owing to its varied vehicle fleet and comprehensive supply chain operations. Globalization of trade and the expansion of supply chains has made lubricants essential for facilitating the transportation of goods and commodities across various countries.

Commercial fleets, comprising trucks, freight carriers, and public vehicles, are significantly dependent on lubricant solutions tailored for commercial vehicle uses. Lubricants are crucial in the aerospace and marine sectors, where they are able withstand the harsh conditions experienced during flight and maritime activities.

Lubricants are vital to ensure efficient functioning of these vehicles by minimizing friction, dissipating heat, and safeguarding against wear and corrosion. The ongoing expansion of the transportation and logistics industry along with the changing regulatory environment is likely to support the need for premium lubricants.

Key Growth Barriers

- Rigorous Environmental Regulations and Governmental Reforms

The lubricants market encounters substantial obstacles due to rigorous environmental rules and ongoing governmental reforms. These regulatory demands are compelling enterprises to re-evaluate their product formulations, manufacturing methods, and company strategies.

Increasing global emphasis on sustainability and minimizing the environmental effects of lubricants has significantly transformed business practices. Adhering to rigorous rules for the environmental impact of lubricants, particularly concerning emissions, waste management, and the utilization of hazardous materials, is a primary concern.

Governments worldwide are implementing stringent regulations to limit the discharge of dangerous substances in the environment. This further impacts the formulation and composition of oils.

Lubricants Market Trends and Opportunities

- Increasing Demand for Renewable Energy

The rising demand for renewable energy presents significant opportunities for the lubricants market. Enhanced renewable energy infrastructure, including wind turbines, solar farms, and hydropower facilities, necessitates sophisticated lubrication solutions for optimal efficiency and reliability.

The need to decrease dependence on fossil fuels to alleviate climate change and embrace sustainable energy sources presents the opportunity to provide specialized solutions for renewable energy systems. Wind represents one of the fastest-growing sectors in renewable energy, creating a particularly appealing opportunity for lubricants.

High-performance lubricants that can endure tough working circumstances, like extreme temperatures, wetness, and varied loads, are being utilized to minimize wear and extend the lifespan of critical components.

- Synthetic Lubricants and High-Performance Solutions

Synthetic lubricants are gaining traction owing to their superior performance, longer service life, and ability to operate effectively under extreme conditions. Unlike conventional mineral oils, synthetic lubricants are engineered using advanced technologies to offer enhanced properties.

Higher stability, greater resistance to oxidation, and superior temperature performance offered by these lubricants make them well-suited for high-performance applications, like automotive, aerospace, and heavy machinery.

Increasing adoption of electric vehicles (EVs) and hybrid vehicles presents immense opportunities as they require specialized lubricants for components like battery cooling systems, electric motor cooling, and drivetrain lubricants. Rise of these vehicles necessitates the development of lubricants specifically designed to optimize performance in electric and hybrid drivetrains.

- Nye Lubricants has been developing lubricant solutions for next-generation electric vehicles, addressing the unique challenges EV components pose. According to a report by Bloomberg New Energy Finance, electric vehicles are projected to account for 58% of new car sales worldwide by 2040.

Synthetic lubricants also contribute to sustainability by increasing fuel efficiency and decreasing emissions. This is particularly important in regions having stringent regulatory frameworks.

How is Regulatory Scenario Shaping this Industry?

The regulatory landscape is pivotal in shaping the global lubricants market by driving innovation, sustainability, and compliance. Government and environmental agencies worldwide, like the U.S. Environmental Protection Agency (EPA) and the European Union's REACH regulations, enforce stringent norms to decrease emissions, environmental impact, and dependence on non-renewable resources.

- Policies like the Corporate Average Fuel Economy (CAFE) standards in the U.S. encourage using advanced lubricants to improve vehicle performance and fuel economy.

- The European Green Deal promotes the development of sustainable lubricants in industrial applications.

In emerging economies, government initiatives to modernize industrial operations while adhering to global sustainability goals are increasing the demand for high-performance lubricants. Manufacturers are responding by investing in research and development activities to innovate eco-friendly and compliant products.

As regulations evolve, the market is shifting toward synthetic and biodegradable lubricants. This gives manufacturers opportunities for innovation while challenging them to meet higher performance and sustainability standards.

Segment Covered in the Report

- Rising Preference for Engine Oil Owing to its Longevity

Engine oil is anticipated to account for a share of 35% in 2025. It serves essential functions like reducing friction, dissipating heat, cleaning engine components, and protecting against rust and corrosion.

All of these contribute to improved engine performance and longevity. Rising vehicle production and sales along with increasing consumer awareness about vehicle maintenance is fuelling the demand for engine oil.

Advancements in synthetic engine oil formulations tailored for modern high-performance engines continues to strengthen its market position. With the ongoing growth of the automotive industry and technological innovations, engine oil is expected to maintain its dominance in the lubricants market.

- Regular Vehicle Maintenance in Automotive and Other Transportation Drive Demand

The automotive and other transportation sector is anticipated to dominate owing to its extensive use of lubricants in vehicles for engine performance, transmission, and overall maintenance. Automobiles require regular application of various lubricants, including engine oils, transmission fluids, and greases, to ensure optimal performance and longevity.

- According to reports, in 2024, the U.S. was the largest consumer of lubricants in North America, holding 78% of the region's total lubricant consumption.

Regular vehicle maintenance, including lubricant replacement, is standard practice driving demand. Lubricants play an essential role in vehicle operation with the automotive industry witnessing continuous growth.

Regional Analysis

- Asia Pacific to Witness Growing Demand for Lubricants owing to Rapid Industrialization

Asia Pacific is anticipated to dominate with a share of 45% in 2025. It integrates economic, industrial, and demographic factors that converge to create a dynamic and growing demand for lubricants.

Vigorous economic development, industrialization, and expanding customer base in the region contribute to the growing need for innovative lubrication solutions across various sectors. The economic growth in the region has been a significant driving force in the lubricants market.

Asia Pacific encompasses the world's rapidly expanding economies, like China and India. These countries are witnessing a significant surge in industrial machinery production, automobile ownership, and various manufacturing endeavours.

Demand for lubricants is witnessing a spike across several applications, including automotive and industrial machinery. Rapid industrialization of the emerging economies in the region stimulates growth, as new infrastructure initiatives and manufacturing plants necessitate high-quality lubricants to guarantee operational efficiency and prolonged equipment longevity.

- Industrial Sector of North America to Pose Significant Demand

North America lubricants market is witnessing rapid growth owing to its well-established automotive sector, advanced industrial base, and technological innovation. The region is dominated by the U.S., contributing to 75% of the consumption owing to its extensive automotive and industrial output.

Automotive lubricants, including engine oils and transmission fluids, are witnessing high demand in the region. This growth is attributed to routine maintenance practices and the adoption of high-performance synthetic oils.

The industrial sector, spanning manufacturing, power generation, and heavy machinery, further bolsters lubricant consumption with products like hydraulic and metalworking fluids. Technological advancements have positioned North America as a leader in developing eco-friendly and synthetic lubricants, driven by stringent environmental regulations and the rise of electric vehicles.

Canada is focused on industrial applications like mining and Mexico is predicted to emerge as a manufacturing hub, benefiting from the increasing demand for sustainable and high-efficiency lubricants. Despite challenges like high competition and economic fluctuations, North America remains a cornerstone of the global lubricants market.

Fairfield’s Competitive Landscape Analysis

The global lubricants market is highly competitive, with key players focusing on product innovation, strategic partnerships, and mergers to strengthen their presence. Leading companies including ExxonMobil Corporation, Royal Dutch Shell PLC, and TotalEnergies SE, dominate the industry due to their extensive distribution networks and diverse product portfolios.

Prominent manufacturers are investing in the development of advanced synthetic and bio-based lubricants to cater to the evolving environmental regulations and consumer preferences. Regional players also play a significant role, catering to niche markets and local industries.

The increasing demand for sustainable solutions and technological advancements further intensify the competition. Businesses in the industry are therefore prompted to invest in research and development efforts to expand their geographic reach.

Key Market Companies

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- MOTUL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- TotalEnergies

- Valvoline

Recent Industry Developments

- In January 2024, Shell PLC signed a deal to buy MIDEL and MIVOLT from M&I Materials Ltd. in Manchester to cater to changing requirements.

- In July 2024, BP PLC and Castrol signed a collaboration deal to co-engineer fuels and oils to help Audi's F1 Power Unit run efficiently while meeting stringent environmental standards.

An Expert’s Eye

- Shift toward sustainable and bio-based lubricants is crucial to meet the global environmental regulations and consumer demand for greener alternatives.

- Rise of EVs presents new opportunities for specialized lubricants, mainly in electric motor cooling, battery management, and transmission systems.

- Rapid industrialization and growing automotive markets in Asia-Pacific are expected to drive significant demand.

- Increasing demand for high-performance lubricants that can deliver better efficiency while maintaining cost competitiveness remains a challenge for manufacturers.

Global Lubricants Market is Segmented as-

By Group

- Group I

- Group II

- Group III

- Group IV

- Group V

By Base Stock

- Mineral Oil Lubricants

- Synthetic Lubricants

- Semi-Synthetic Lubricants

- Bio-Based Lubricants

By Product Type

- Engine Oil

- Transmission and Hydraulic Fluid

- Metalworking Fluid

- General Industrial Oil

- Gear Oil

- Grease

- Process Oil

- Others

By End User

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Food and Beverage

- Metallurgy and Metal Working

- Chemical Manufacturing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Lubricants Market Snapshot

1.2. Key Market Trends

1.3. Future Projections

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.1.1. Driver A

2.2.1.2. Driver B

2.2.1.3. Driver C

2.2.2. Restraints

2.2.2.1. Restraint 1

2.2.2.2. Restraint 2

2.2.3. Market Opportunities Matrix

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Pre-covid Scenario

2.5.2. Supply

2.5.3. Demand

2.6. Government Regulations

2.7. Technology Landscape

2.8. Raw Material Impact Analysis

2.9. Economic Analysis

2.10. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2022

3.1. Lubricants Supply-Demand Analysis

3.2. Regional Production Statistics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

3.3. Trade Statistics

4. Price Trends Analysis and Future Projects, 2019 - 2030

4.1. Key Highlights

4.2. Prominent Factors Affecting Prices

4.3. By Grade

4.4. By End-users

4.5. By Region

5. Global Lubricants Market Outlook, 2019 - 2030

5.1. Global Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

5.1.1. Key Highlights

5.1.1.1. Mineral

5.1.1.2. Synthetic

5.1.1.3. Semi-synthetic

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Global Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

5.2.1. Key Highlights

5.2.1.1. Engine Oils

5.2.1.2. Transmission Oils

5.2.1.3. Gear Oils

5.2.1.4. Metalworking Fluids

5.2.1.5. Hydraulic Oils

5.2.1.6. Process Oils

5.2.1.7. Greases & Misc.

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Global Lubricants Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

5.3.1. Key Highlights

5.3.1.1. Automotive

5.3.1.1.1. Passenger Cars

5.3.1.1.2. Light Commercial Vehicles

5.3.1.1.3. Heavy Commercial Vehicles

5.3.1.2. Industrial

5.3.1.3. Marine

5.3.1.4. Aviation

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Global Lubricants Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. North America Lubricants Market Outlook, 2019 - 2030

6.1. North America Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

6.1.1. Key Highlights

6.1.1.1. Mineral

6.1.1.2. Synthetic

6.1.1.3. Semi-synthetic

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. North America Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

6.2.1. Key Highlights

6.2.1.1. Engine Oils

6.2.1.2. Transmission Oils

6.2.1.3. Gear Oils

6.2.1.4. Metalworking Fluids

6.2.1.5. Hydraulic Oils

6.2.1.6. Process Oils

6.2.1.7. Greases & Misc.

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Lubricants Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

6.3.1. Key Highlights

6.3.1.1. Automotive

6.3.1.1.1. Passenger Cars

6.3.1.1.2. Light Commercial Vehicles

6.3.1.1.3. Heavy Commercial Vehicles

6.3.1.2. Industrial

6.3.1.3. Marine

6.3.1.4. Aviation

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. North America Lubricants Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

6.4.1. Key Highlights

6.4.1.1. U.S.

6.4.1.2. Canada

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Lubricants Market Outlook, 2019 - 2030

7.1. Europe Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

7.1.1. Key Highlights

7.1.1.1. Mineral

7.1.1.2. Synthetic

7.1.1.3. Semi-synthetic

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Europe Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

7.2.1. Key Highlights

7.2.1.1. Engine Oils

7.2.1.2. Transmission Oils

7.2.1.3. Gear Oils

7.2.1.4. Metalworking Fluids

7.2.1.5. Hydraulic Oils

7.2.1.6. Process Oils

7.2.1.7. Greases & Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Lubricants Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

7.3.1. Key Highlights

7.3.1.1. Automotive

7.3.1.1.1. Passenger Cars

7.3.1.1.2. Light Commercial Vehicles

7.3.1.1.3. Heavy Commercial Vehicles

7.3.1.2. Industrial

7.3.1.3. Marine

7.3.1.4. Aviation

7.4. Europe Lubricants Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

7.4.1. Key Highlights

7.4.1.1. Germany

7.4.1.2. France

7.4.1.3. U.K.

7.4.1.4. Italy

7.4.1.5. Spain

7.4.1.6. Turkey

7.4.1.7. Russia

7.4.1.8. Rest of Europe

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Lubricants Market Outlook, 2019 - 2030

8.1. Asia Pacific Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

8.1.1. Key Highlights

8.1.1.1. Mineral

8.1.1.2. Synthetic

8.1.1.3. Semi-synthetic

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Asia Pacific Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

8.2.1. Key Highlights

8.2.1.1. Engine Oils

8.2.1.2. Transmission Oils

8.2.1.3. Gear Oils

8.2.1.4. Metalworking Fluids

8.2.1.5. Hydraulic Oils

8.2.1.6. Process Oils

8.2.1.7. Greases & Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Lubricants Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

8.3.1. Key Highlights

8.3.1.1. Automotive

8.3.1.1.1. Passenger Cars

8.3.1.1.2. Light Commercial Vehicles

8.3.1.1.3. Heavy Commercial Vehicles

8.3.1.2. Industrial

8.3.1.3. Marine

8.3.1.4. Aviation

8.4. Asia Pacific Lubricants Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

8.4.1. Key Highlights

8.4.1.1. China

8.4.1.2. Japan

8.4.1.3. South Korea

8.4.1.4. India

8.4.1.5. Southeast Asia

8.4.1.6. Rest of Asia Pacific

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Lubricants Market Outlook, 2019 - 2030

9.1. Latin America Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

9.1.1. Key Highlights

9.1.1.1. Mineral

9.1.1.2. Synthetic

9.1.1.3. Semi-synthetic

9.1.2. BPS Analysis/Market Attractiveness Analysis

9.2. Latin America Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

9.2.1. Key Highlights

9.2.1.1. Engine Oils

9.2.1.2. Transmission Oils

9.2.1.3. Gear Oils

9.2.1.4. Metalworking Fluids

9.2.1.5. Hydraulic Oils

9.2.1.6. Process Oils

9.2.1.7. Greases & Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Lubricants Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

9.3.1. Key Highlights

9.3.1.1. Automotive

9.3.1.1.1. Passenger Cars

9.3.1.1.2. Light Commercial Vehicles

9.3.1.1.3. Heavy Commercial Vehicles

9.3.1.2. Industrial

9.3.1.3. Marine

9.3.1.4. Aviation

9.4. Latin America Lubricants Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

9.4.1. Key Highlights

9.4.1.1. Brazil

9.4.1.2. Mexico

9.4.1.3. Rest of Latin America

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Lubricants Market Outlook, 2019 - 2030

10.1. Middle East & Africa Lubricants Market Outlook, by Grade, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

10.1.1. Key Highlights

10.1.1.1. Mineral

10.1.1.2. Synthetic

10.1.1.3. Semi-synthetic

10.1.2. BPS Analysis/Market Attractiveness Analysis

10.2. Middle East & Africa Lubricants Market Outlook, by Type, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

10.2.1. Key Highlights

10.2.1.1. Engine Oils

10.2.1.2. Transmission Oils

10.2.1.3. Gear Oils

10.2.1.4. Metalworking Fluids

10.2.1.5. Hydraulic Oils

10.2.1.6. Process Oils

10.2.1.7. Greases & Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Lubricants Market Outlook, by End-user, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

10.3.1. Key Highlights

10.3.1.1. Automotive

10.3.1.1.1. Passenger Cars

10.3.1.1.2. Light Commercial Vehicles

10.3.1.1.3. Heavy Commercial Vehicles

10.3.1.2. Industrial

10.3.1.3. Marine

10.3.1.4. Aviation

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Lubricants Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

10.4.1. Key Highlights

10.4.1.1. GCC

10.4.1.2. South Africa

10.4.1.3. Egypt

10.4.1.4. Rest of Middle East & Africa

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Company Market Share Analysis, 2021

11.2. Competitive Dashboard

11.3. Product vs Application Heatmap

11.4. Company Manufacturing Footprint Analysis

11.5. Company Profiles

11.5.1. ExxonMobile

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Royal Dutch Shell

11.5.3. BP

11.5.4. Chevron

11.5.5. Total

11.5.6. SINOPEC

11.5.7. The Idemitsu Kosan Company, Ltd.

11.5.8. FUCHS

11.5.9. Lukoil

11.5.10. JX Holdings

11.5.11. Philips 66

11.5.12. Valvoline

11.5.13. Indian Oil

11.5.14. Petronas

11.5.15. Petrobras

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Group Coverage |

|

|

Base Stock Coverage |

|

|

Product Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |