Global Glucose Management Supplements Market Forecast

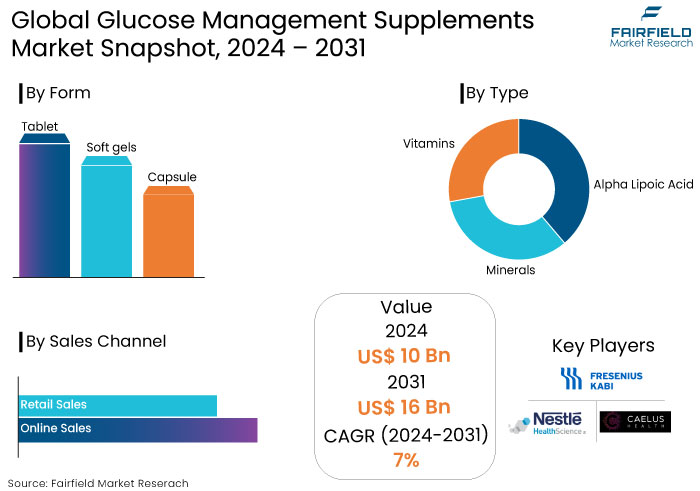

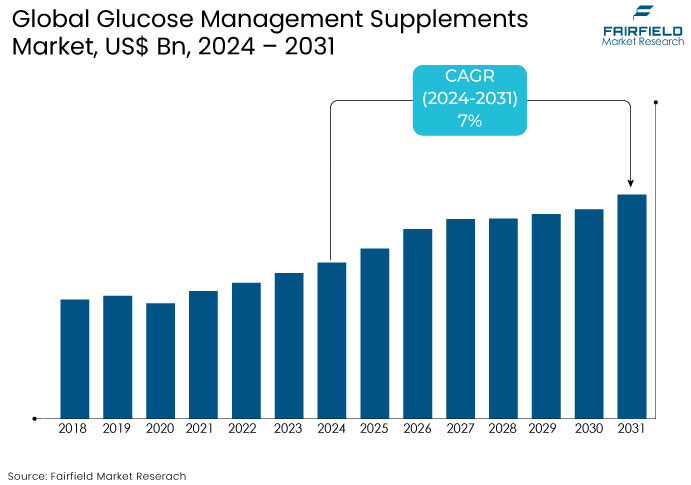

- The glucose management supplements market is projected to value at US$16 Bn by 2031, showing significant growth from the US$10 Bn achieved in 2024.

- The market for glucose management supplements is expected to show a significant expansion rate with an estimated CAGR of 7% during the forecast period from 2024 to 2031.

Glucose Management Supplements Market Insights

- The increasing global incidence of diabetes and pre-diabetes is driving demand.

- Consumers are prioritizing preventive measures including dietary supplements to manage blood sugar levels and avoid long-term health complications.

- Ingredients like berberine, chromium, cinnamon, and fenugreek are popular due to their natural glucose-regulating properties reflecting a consumer shift toward plant-based products.

- Customized glucose management solutions tailored to individual health data such as genetic and metabolic profiles are emerging as a key trend in the glucose management supplements market.

- Rapid growth in diabetes prevalence in regions like Asia Pacific and Latin America offers substantial market expansion opportunities.

- Advances in bioavailability and supplement delivery systems are improving product effectiveness and driving market differentiation.

- Growing consumer awareness about the importance of leading healthy lifestyles has expanded the glucose management supplements industry.

- Shift toward preventive healthcare is fostering a demand for glucose management supplements

A Look Back and a Look Forward - Comparative Analysis

The glucose management supplements market has experienced notable growth pre-2023, driven by rising awareness of diabetes and pre-diabetes conditions globally. Increased demand for natural and effective blood sugar control solutions, growing consumer preference for dietary supplements over pharmaceuticals, and the prevalence of sedentary lifestyles have propelled market expansion.

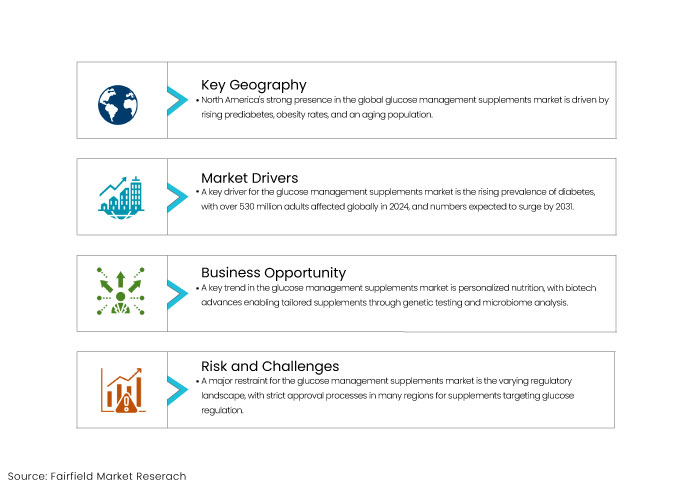

North America and Europe dominated the market due to higher healthcare awareness, a significant diabetic population, and robust dietary supplement industries. Key ingredients such as chromium, berberine, and cinnamon saw widespread adoption for their glucose-regulating properties. The global rise in health consciousness and preference for preventive healthcare further boosted market growth pre-2023.

Looking ahead to 2024 and beyond, the market is projected to accelerate driven by the increasing prevalence of diabetes particularly in developing regions like Asia Pacific and Latin America.

The market is also being propelled by growing awareness about the benefits of managing glucose levels through supplementation and the impact of technological advancements in supplement formulation.

Increasing investments in research and development of more effective supplements and expanding e-commerce platforms are expected to enhance product accessibility. The growing elderly population and a surge in metabolic disorders will further contribute to market expansion.

Regulatory scrutiny and competition from pharmaceutical glucose management options could present challenges but natural and personalized solutions innovation will likely to drive future growth.

Key Growth Determinants

- Increasing Prevalence of Diabetes and Pre-Diabetes Conditions

One of the primary growth drivers for the glucose management supplements market is the increasing prevalence of diabetes and pre-diabetes conditions worldwide. As of 2024, over 530 million adults globally were estimated to be living with diabetes with this number projected to rise sharply by 2031.

Pre-diabetes, characterized by higher-than-normal blood sugar levels affects even more individuals putting them at risk of developing type 2 diabetes. This alarming rise has heightened awareness about the importance of proactive glucose management. As a result, more consumers are seeking non-pharmaceutical solutions such as dietary supplements to help regulate their blood sugar levels naturally.

Glucose management supplements, which often contain chromium, berberine, and alpha-lipoic acid have become popular due to their potential to aid in glucose regulation. The widespread acknowledgment of lifestyle factors contributing to diabetes has driven demand for these supplements as part of a holistic approach to managing blood sugar levels thereby contributing to market growth.

- Shift Toward Preventive Healthcare and Wellness

The global shift toward preventive healthcare and wellness is another key driver for the glucose management supplements market. Consumers are increasingly focusing on maintaining their health proactively rather than relying solely on treatments after the onset of diseases. This trend is particularly relevant in managing conditions like diabetes, where early intervention and lifestyle modifications can significantly reduce the risk of progression.

With growing awareness of the risks associated with elevated blood sugar levels, even individuals without a diabetes diagnosis are turning to glucose management supplements to maintain healthy glucose metabolism and prevent future complications.

The trend is especially prominent in developed regions like North America and Europe, where consumers are more educated about preventive health practices and access a wide range of dietary supplements.

The rise of wellness-focused e-commerce platforms has made glucose management supplements more accessible, fuelling their growth in developed and emerging markets.

Key Growth Barriers

- Regulatory Challenges and Stringent Approval Processes

One of the primary growth restraints for the glucose management supplements market is the regulatory landscape, which varies significantly across regions. Many countries have stringent approval processes for dietary supplements especially those claiming to manage or improve health conditions like glucose regulation.

Regulatory bodies such as the U.S. FDA and the European Food Safety Authority (EFSA), impose strict guidelines on labeling, health claims, and ingredient safety. This can delay product launches, increase compliance costs, and limit market entry for small companies.

Classifying certain supplements as either food products or pharmaceuticals can create ambiguity further complicating the approval process. As regulatory scrutiny increases, especially regarding efficacy claims, companies may need help in gaining consumer trust, which could slow market growth.

Any adverse findings regarding the safety or efficacy of widely used ingredients could lead to recalls, negatively impacting the reputation of the market as a whole.

- Competition from Pharmaceutical Alternatives

Another significant growth restraint is the competition from pharmaceutical alternatives for glucose management such as prescription medications for diabetes and pre-diabetes. Pharmaceutical solutions are often recommended by healthcare professionals and are backed by extensive clinical research making them a preferred option for many consumers with diagnosed conditions.

While supplements are increasingly popular for preventive purposes or as complementary treatments, they may not be viewed as replacements for medication in more severe cases. Perception can limit the market potential for glucose management supplements particularly in regions where healthcare systems heavily promote pharmaceutical interventions.

Insurance coverage for pharmaceutical treatments further enhances their accessibility, while supplements often considered elective or non-essential are usually out-of-pocket expenses. As a result, the glucose management supplements market faces stiff competition from well-established pharmaceutical options, which could restrict its growth especially in markets with robust healthcare infrastructure.

Glucose Management Supplements Market Trends and Opportunities

- Personalized Nutrition and Supplementation

A growing trend in the glucose management supplements market is the increasing focus on personalized nutrition and supplementation. Advances in biotechnology particularly in genetic testing and microbiome analysis are enabling companies to offer tailored supplement solutions based on an individual’s unique biological profile.

Consumers increasingly seek products that address their specific health needs and personalized supplements are seen as a more effective approach to managing glucose levels. This trend is driven by the broader shift toward personalized healthcare, where treatments and preventive measures are customized based on genetic, lifestyle, and environmental factors.

The rise of direct-to-consumer testing kits, which conveniently provide insights into genetic predispositions, metabolic rates, and blood sugar responses, is propelling this trend forward. For example, DNA or blood tests can reveal how an individual metabolizes carbohydrates, allowing for more targeted supplement recommendations, such as specific doses of berberine or chromium.

Companies offer personalized subscription services that provide regular shipments of glucose management supplements based on ongoing health data or feedback. This increases consumer engagement and fosters brand loyalty by providing ongoing value through data-driven, individualized health solutions.

The personalization trend is likely to continue shaping the market as consumers increasingly prioritize tailored, evidence-based approaches to managing their health, including glucose control.

- Expansion in Emerging Markets

Emerging markets particularly in regions like Asia-Pacific, Latin America, and the Middle East present significant glucose management supplements market opportunities. These regions are witnessing a sharp rise in diabetes and pre-diabetes cases due to changing lifestyles, increased urbanization, and the adoption of Western diets high in refined sugars and carbohydrates.

As healthcare systems in these regions face pressure from the growing burden of chronic diseases, there is an increasing focus on preventive health measures. Consequently, creating a fertile ground for the growth of dietary supplements including those targeting glucose management.

In many of these markets, awareness of diabetes prevention and the benefits of dietary supplements is rapidly increasing, thanks to government initiatives and non-governmental organizations focused on public health education. The growing middle class in countries like India, Brazil, and China has more disposable income to spend on health and wellness products, driving demand for glucose management supplements.

E-commerce platforms are also playing a crucial role in enhancing the accessibility of these supplements in emerging markets allowing consumers in remote areas to purchase high-quality products that may not be available locally.

Companies can tap into this growing consumer base by expanding distribution networks and investing in localized marketing strategies. However, it is crucial also to tailor products to local dietary habits, as this will ensure the relevance and effectiveness of the supplements, thereby maximizing their market potential.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a critical role in shaping the glucose management supplements market influencing product development, marketing, and consumer trust.

Regulatory bodies like the U.S. Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and counterparts in other regions have stringent guidelines for dietary supplements particularly those making health claims related to glucose management. These regulations ensure product safety, efficacy, and accurate labeling, which is crucial for consumer confidence.

The growing scrutiny over the health claims made by supplement manufacturers has led to tighter oversight. Companies are now required to provide scientific evidence supporting their claims about glucose regulation, such as improved insulin sensitivity or blood sugar control.

Strict rules on ingredients, especially concerning synthetic additives or unproven herbal extracts, are shaping the market toward more natural and clinically validated formulations. The global regulatory environment is dynamically evolving to meet the rising consumer demand for transparency. This includes clear ingredient labelling, third-party testing, and certifications, which are increasingly becoming key selling points.

While these regulations may increase compliance costs, they also foster innovation and product quality thereby creating a trustworthy market for glucose management supplements that is responsive to consumer needs.

Segments Covered in the Report

- Tablet Form of Supplements Take the Lead

The glucose management supplements in the form of tablets is anticipated to experience a considerable growth rate in the glucose management supplements market. Talking about glucose management supplements, tablets are the most popular type among the general public. The reasons for this are that it has qualities that allow it to dissolve quickly, simple to package, and is economical. Additionally, it has a long shelf life than other supplements and activates quickly than those other types.

- Highest Sales Contribution Comes from Retail Sales Channel

It is anticipated that retail sales will experience a substantial increase as a result of the growing popularity of dietary supplements among the general population during the forecast period. It is more convenient for individuals to purchase supplements from retail outlets like pharmacies since they can physically choose the most suitable supplement.

It is not typically necessary to have a prescription to purchase supplements. With the help of the salesperson, a person who buys a supplement through a retail sales channel can also get their questions about the supplement answered. Nevertheless, the glucose management supplements market that is being dominated by Internet sales is also experiencing substantial expansion.

Regional Analysis

- North America Accounts for Notable Share of the Market

North America is capturing a significant portion of the global glucose management supplements market, which can be ascribed to the growing incidence of prediabetes and obesity, as well as the expanding elderly demographic.

According to the reports, over 84.1 million individuals (33.9% of the population) aged 18 and older in the U.S. were affected by prediabetes with nearly 48.3% of the elderly population experiencing prediabetes symptoms.

The United States is leading the glucose management supplement market in North America. According to the Council for Responsible Nutrition (CRN), over 60% of individuals in the U.S. utilize diabetic supplements.

- Europe Glucose Management Supplements Market to Grow Substantially

Europe is predicted to lead the global market for diabetic supplements due to factors such as the growing incidence of metabolic disorders, growing consumption of unhealthy foods, and increasing rates of prediabetes and diabetes.

Approximately 4.2 million people worldwide have diabetes in 2024 according to the British Diabetic Association. The International Diabetes Federation reports that Europe spent more than $100 billion on diabetes in 2010 and anticipates spending an additional $125 billion by 2031.

Fairfield’s Competitive Landscape Analysis

The glucose management supplements market is highly competitive, with numerous players ranging from established nutraceutical companies to emerging start-ups. Key competitors include industry leaders like NOW Foods, Nature’s Way, and Life Extension, which offer a wide range of glucose-regulating products featuring ingredients like berberine, chromium, and alpha-lipoic acid.

Companies focus on product efficacy, brand trust, and global distribution channels to maintain their market position. Small companies and start-ups are driving innovation through personalized supplement offerings targeting niche consumer groups.

E-commerce platforms and direct-to-consumer models have intensified competition making the market more accessible to new entrants. Differentiation strategies such as proprietary blends, clinical trials, and certifications play a vital role in gaining consumer trust and market share.

Key Market Companies

- Abbott Laboratories

- Danone Nutricia

- Fresenius Kabi AG

- Nestlé Health Science

- Diabetain

- Caelus Health

- Unilever

- Herbalife Nutrition Ltd.

- BestSource Nutrition Pvt. Ltd.

- Bionova Store

- Botanic Supplements

- Glucose Health, Inc.

Recent Industry Developments

- March 2023 -

NOW Foods introduced an updated version of its Glucose Support supplement, incorporating more bioavailable ingredients like chromium and berberine to enhance absorption and efficacy.

- September 2023 -

Nature’s Way expanded its Blood Sugar Balance line by introducing an organic, plant-based version, targeting the rising demand for natural and vegan-friendly products.

An Expert’s Eye

- The rise in diabetes and pre-diabetes cases along with a growing focus on preventive health will drive significant demand for glucose management supplements.

- The market's future lies in personalized nutrition with experts highlighting that custom-tailored glucose supplements based on genetic or lifestyle data will see substantial growth.

- Industry specialists predict that expanding into emerging markets like Asia Pacific and Latin America, where diabetes prevalence is rising offers vast growth opportunities for supplements.

- Enhanced bioavailability and new delivery systems will be crucial for maintaining a competitive advantage in the market.

Global Glucose Management Supplements Market is Segmented as-

By Form

- Tablet

- Soft gels

- Capsule

By Type

- Alpha Lipoic Acid

- Minerals

- Vitamins

By Sales Channel

- Online Sales

- Retail Sales

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East and Africa

1. Executive Summary

1.1. Global Glucose Management Supplements Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2023

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Glucose Management Supplements Market Outlook, 2018 - 2031

3.1. Global Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

3.1.1. Key Highlights

3.1.1.1. Alpha Lipoic Acid

3.1.1.2. Minerals

3.1.1.3. Vitamins

3.1.1.4. Others

3.2. Global Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

3.2.1. Key Highlights

3.2.1.1. Tablet

3.2.1.2. Soft gels

3.2.1.3. Capsule

3.3. Global Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

3.3.1. Key Highlights

3.3.1.1. Online Sales

3.3.1.2. Retail Sales

3.4. Global Glucose Management Supplements Market Outlook, by Region, Value (US$ Bn), 2018 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Glucose Management Supplements Market Outlook, 2018 - 2031

4.1. North America Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

4.1.1. Key Highlights

4.1.1.1. Alpha Lipoic Acid

4.1.1.2. Minerals

4.1.1.3. Vitamins

4.1.1.4. Others

4.2. North America Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

4.2.1. Key Highlights

4.2.1.1. Tablet

4.2.1.2. Soft gels

4.2.1.3. Capsule

4.3. North America Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

4.3.1. Key Highlights

4.3.1.1. Online Sales

4.3.1.2. Retail Sales

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Glucose Management Supplements Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

4.4.1.2. U.S. Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

4.4.1.3. U.S. Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

4.4.1.4. Canada Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

4.4.1.5. Canada Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

4.4.1.6. Canada Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Glucose Management Supplements Market Outlook, 2018 - 2031

5.1. Europe Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

5.1.1. Key Highlights

5.1.1.1. Alpha Lipoic Acid

5.1.1.2. Minerals

5.1.1.3. Vitamins

5.1.1.4. Others

5.2. Europe Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

5.2.1. Key Highlights

5.2.1.1. Tablet

5.2.1.2. Soft gels

5.2.1.3. Capsule

5.3. Europe Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

5.3.1. Key Highlights

5.3.1.1. Online Sales

5.3.1.2. Retail Sales

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Glucose Management Supplements Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.2. Germany Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.3. Germany Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.4. U.K. Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.5. U.K. Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.6. U.K. Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.7. France Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.8. France Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.9. France Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.10. Italy Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.11. Italy Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.12. Italy Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.13. Turkey Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.14. Turkey Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.15. Turkey Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.16. Russia Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.17. Russia Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.18. Russia Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.1.19. Rest of Europe Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

5.4.1.20. Rest of Europe Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

5.4.1.21. Rest of Europe Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Glucose Management Supplements Market Outlook, 2018 - 2031

6.1. Asia Pacific Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

6.1.1. Key Highlights

6.1.1.1. Alpha Lipoic Acid

6.1.1.2. Minerals

6.1.1.3. Vitamins

6.1.1.4. Others

6.2. Asia Pacific Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

6.2.1. Key Highlights

6.2.1.1. Tablet

6.2.1.2. Soft gels

6.2.1.3. Capsule

6.3. Asia Pacific Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

6.3.1. Key Highlights

6.3.1.1. Online Sales

6.3.1.2. Retail Sales

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Glucose Management Supplements Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

6.4.1. Key Highlights

6.4.1.1. China Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.2. China Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.3. China Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.1.4. Japan Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.5. Japan Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.6. Japan Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.1.7. South Korea Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.8. South Korea Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.9. South Korea Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.1.10. India Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.11. India Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.12. India Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.1.13. Southeast Asia Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.14. Southeast Asia Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.15. Southeast Asia Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.1.16. Rest of Asia Pacific Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

6.4.1.17. Rest of Asia Pacific Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

6.4.1.18. Rest of Asia Pacific Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Glucose Management Supplements Market Outlook, 2018 - 2031

7.1. Latin America Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

7.1.1. Key Highlights

7.1.1.1. Alpha Lipoic Acid

7.1.1.2. Minerals

7.1.1.3. Vitamins

7.1.1.4. Others

7.2. Latin America Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

7.2.1. Key Highlights

7.2.1.1. Tablet

7.2.1.2. Soft gels

7.2.1.3. Capsule

7.3. Latin America Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

7.3.1. Key Highlights

7.3.1.1. Online Sales

7.3.1.2. Retail Sales

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Glucose Management Supplements Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

7.4.1.2. Brazil Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

7.4.1.3. Brazil Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

7.4.1.4. Mexico Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

7.4.1.5. Mexico Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

7.4.1.6. Mexico Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

7.4.1.7. Argentina Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

7.4.1.8. Argentina Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

7.4.1.9. Argentina Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

7.4.1.10. Rest of Latin America Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

7.4.1.11. Rest of Latin America Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

7.4.1.12. Rest of Latin America Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Glucose Management Supplements Market Outlook, 2018 - 2031

8.1. Middle East & Africa Glucose Management Supplements Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

8.1.1. Key Highlights

8.1.1.1. Alpha Lipoic Acid

8.1.1.2. Minerals

8.1.1.3. Vitamins

8.1.1.4. Others

8.2. Middle East & Africa Glucose Management Supplements Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

8.2.1. Key Highlights

8.2.1.1. Tablet

8.2.1.2. Soft gels

8.2.1.3. Capsule

8.3. Middle East & Africa Glucose Management Supplements Market Outlook, by Sales Channel, Value (US$ Bn), 2018 - 2031

8.3.1. Key Highlights

8.3.1.1. Online Sales

8.3.1.2. Retail Sales

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Glucose Management Supplements Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

8.4.1.2. GCC Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

8.4.1.3. GCC Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

8.4.1.4. South Africa Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

8.4.1.5. South Africa Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

8.4.1.6. South Africa Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

8.4.1.7. Egypt Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

8.4.1.8. Egypt Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

8.4.1.9. Egypt Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

8.4.1.10. Nigeria Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

8.4.1.11. Nigeria Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

8.4.1.12. Nigeria Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

8.4.1.13. Rest of Middle East & Africa Glucose Management Supplements Market by Type, Value (US$ Bn), 2018 - 2031

8.4.1.14. Rest of Middle East & Africa Glucose Management Supplements Market by Form, Value (US$ Bn), 2018 - 2031

8.4.1.15. Rest of Middle East & Africa Glucose Management Supplements Market by Sales Channel, Value (US$ Bn), 2018 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Product vs Indication Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. NOW Foods

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Life Extension

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. GNC

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Natrol

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Nature Made

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Nature's Bounty

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Zenith Labs

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Blackmores

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Pure Encapsulations

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Doctor's Best

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Spring Valley

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Best Naturals

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Form Coverage |

|

|

Type Coverage |

|

|

Sales Channel Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |