Global Green Steel Market

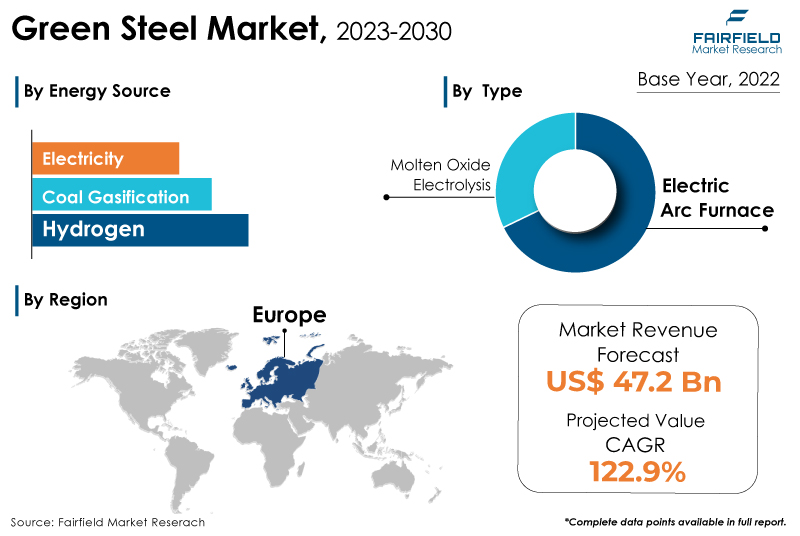

- Global green steel market to rise high at a monumental CAGR of 122.9% during the period of assessment 2023 - 2030

- The green steel market size to reach an approximate market value of around US$47.2 Bn by 2030-end

Market Analysis in Brief

Green steel describes methods of producing steel that emphasize environmental sustainability and seeks to lower the carbon emissions usually connected with steel manufacture. Traditional steel production mainly relies on coal-based operations, which contribute to the atmosphere's greenhouse gas emissions, particularly carbon dioxide. By utilising safer and more environmentally friendly techniques for producing steel, green steel aims to address these environmental issues. The commercialisation and adoption of green steel technologies have accelerated due to increased public and private sector investment in their research, development, and implementation. The transition to green steel production has been greatly aided by funding for research initiatives, pilot and demonstration facilities. Switching to green steel production techniques frequently takes large upfront expenditures in new technology, infrastructure, and equipment. Some businesses, particularly newcomers to the market, may find these upfront fees prohibitive.

Key Report Findings

- The global green steel market will expand at a stellar rate of 122.9% through 2030.

- The demand for green steel is rising due to the increasing awareness of green steel production in well-known industries.

- Demand for hydrogen remains higher in the green steel market.

- The electric arc furnace (EAF) category held revenue share in 2022.

- Europe will continue to lead, whereas the Asia Pacific green steel market will experience the strongest growth until 2030.

Growth Drivers

Increasing Awareness of Green Steel Production in Well-Known Industries

The growing interest in and demand for greener and more sustainable steel manufacturing is a result of a greater understanding of the environmental effects of traditional steel production. The expansion of the green steel sector has been boosted by this greater awareness, which is driven by several factors. The negative environmental implications of traditional steel production, such as the large carbon emissions, air and water pollution, and resource depletion, are being recognised increasingly by both businesses and consumers. An emphasis shift towards more environmentally friendly options has resulted from this concern.

Numerous well-known industries and businesses are realising the significance of integrating sustainable practices into their operations. Green steel production techniques can improve the company's reputation, achieve CSR objectives, and show that they care about the environment. The demand for items created using sustainable resources, including green steel, is rising as customers become more ecologically concerned. To meet consumer preferences, this demand pushes industries to implement greener procedures.

Overall, the green steel industry is expanding as a result of growing public awareness of the potential advantages of green steel for various industries, the environment, and society as a whole. Industries are realising the value of shifting to more environmentally friendly steel production techniques as demand for sustainable practices rises.

Investments Pouring in Greenfield Projects

One of the key factors promoting the growth of the green steel sector is the trend of market participants investing in greenfield projects. When a project is started from scratch, it is referred to as a greenfield project. These projects frequently involve constructing new buildings or plants. This strategy enables businesses to adopt cutting-edge sustainable technologies and procedures from the beginning. Starting a new project offers the chance to include the most recent green steel techniques and technology in the planning and building stages. This may result in production procedures that are more effective, economical, and environmentally friendly.

New developments are frequently subject to the most recent environmental norms and laws. Companies can more easily comply with these standards by investing in greenfield developments, which lowers the chance of upcoming compliance issues. Companies can obtain a competitive edge in the market by establishing themselves as forerunners in the manufacture of green steel through greenfield initiatives. They set themselves apart from rivals and draw clients who care about the environment. Companies that invest in greenfield initiatives are better positioned to adjust to changing consumer preferences for sustainable products and potential regulatory changes.

Growth Challenges

Volatile Carbon Pricing, and Policy Uncertainty

Carbon prices and unpredictability in government policy may significantly restrain the market for green steel. These factors may pose difficulties and uncertainties that affect the economics and viability of implementing more environmentally sustainable steel production techniques. Assigning a price to carbon emissions involves encouraging enterprises to cut their greenhouse gas emissions. However, suppose regional carbon pricing methods are inconsistent or not widely adopted, green steel producers may pay more than their rivals but are not subject to the same pricing. Products made of green steel may become less competitive as a result.

The upfront expenses of using green steel production techniques may still be higher than those of conventional steel production techniques without standardised and consistent carbon pricing. The adoption of green steel may need to be improved by industries choosing to put cost-cutting over environmental concerns. A fragmented green steel market due to inconsistent rules and regulations in various jurisdictions might make it more difficult for businesses to plan for steady market demand. If businesses believe that future policies will provide more advantageous conditions, they may put off switching to green steel production. The market's overall growth for green steel may need to be improved by this interruption.

Overview of Key Segments

Hydrogen Remains Sought-after Energy Source

The hydrogen segment will dominate the global market during the forecast period. Green steel production that uses hydrogen as a source of energy has a great deal of potential to cut carbon emissions and improve the sustainability of the steel industry. In the processes used to produce steel, hydrogen can be used as a clean substitute for carbon-based fuels, reducing or even eliminating the carbon dioxide emissions produced by conventional techniques. The direct reduction of iron ore is one of the main uses of hydrogen in the manufacturing of green steel. Traditionally, iron ore is converted to iron in a blast furnace using coke (carbon). On the other hand, hydrogen gas is used as the reducing agent in hydrogen-based reduction. A cleaner process is produced when hydrogen combines with iron ore because water vapour (H2O) is produced rather than carbon dioxide (CO2).

Hydrogen can be utilised as an additional or substitute fuel source in some steelmaking processes, such as electric arc furnaces. Injecting hydrogen into the boiler can improve combustion and lower carbon emissions. This strategy can increase steelmaking's overall sustainability. A sustainable and low-carbon approach must be utilised to create the hydrogen required to produce green steel. Green hydrogen is created by electrolysing water and separating it into hydrogen and oxygen using renewable energy sources like wind or solar energy. By using this technique, the environmental friendliness of the hydrogen feedstock is achieved.

EAF to Experience a Strong Demand Surge

The electric arc furnace (EAF) segment is expected to be the fastest-growing Green Steel market segment. A popular form of steelmaking technology used in conventional and environmentally friendly steel production is EAF. Compared to conventional steelmaking techniques, EAFs significantly reduce carbon emissions and environmental effects in the context of green steel. Recycling scrap steel into new steel products is a good fit for EAFs. This adheres to the circular economy's guiding principles of conserving resources and minimising the need for new raw materials.

Green steel certification and achieving sustainability objectives are frequently achieved through EAF-based steel production using renewable energy and recyclable scrap. Enhancing EAF technology is the subject of ongoing research and development in order to increase effectiveness, lower energy usage, and further minimise environmental impact.

Growth Opportunities Across Regions

Europe Spearheads with the Largest Revenue Share

Europe is expected to dominate the green steel market during the forecast period. The European Union (EU) has established challenging climate goals, including reaching climate neutrality by 2050. These goals have sparked significant interest in and investment in green steel technology and a strong push towards decarbonising industries, such as steel production. Governments and private investors in Europe are spending more money to assist in the study, creation, and application of green steel technology. The market for green steel is expanding more quickly in the area due to funding projects.

The goals of the green steel industry are well-aligned with Germany's emphasis on innovation, renewable energy, and sustainable development. The development of green steel practices and technology within the nation's steel sector is probably a result of the nation's policies, investments, and cooperative efforts.

New Business Opportunities to Flock Asia Pacific

The demand for green steel is rising due to the Asia Pacific region's tremendous industrial expansion and urbanisation. Using green steel production techniques can lessen the effects of this expansion on the environment. Numerous nations in Asia have abundant renewable energy sources, like wind and solar energy. Using these resources to produce green steel can improve the steel industry's sustainability.

The need for low-carbon, sustainable steel is rising globally, and Australia has the potential to become a significant exporter of green steel products. As a result, Australia may gain a competitive edge in the global marketplace for green steel. Due to its abundance of solar and wind energy, Australia is well-positioned to produce green hydrogen. The nation's emphasis on establishing a hydrogen economy opens doors for utilising green hydrogen in steelmaking and expanding the green steel industry. Australia is aggressively setting itself up to dominate the green steel market by utilising its renewable energy resources, cutting-edge research, and governmental commitments to promote adopting environmentally friendly steel production methods.

Green Steel Market: Competitive Landscape

Some of the leading players at the forefront in the global green steel industry include Arcelor Mittal, Tata Steel Ltd., POSCO, Aço Verde do Brasil, Blastr Green Steel, SSAB AB, Voestalpine AG, and ThyssenKrupp AG.

Recent Notable Developments

In April 2023, POSCO promoted proactive low-carbon steel raw material procurement in Australia. To become carbon neutral by 2050, the company is making a lot of effort to source low-carbon steel raw materials in Australia.

In March 2023, With assistance from the SMS group, Düsseldorf, ThyssenKrupp Steel planned to construct the world's first direct reduction facility that runs on hydrogen. This marks the start of one of the biggest industrial decarbonisation projects ever, which will immediately stop more than 3.5 million metric tons of CO2 from being discharged into the environment each year.

In February 2022, The French government announced to contribute EUR 1.7 Bn (about US$1.7 Bn) to ArcelorMittal's decarbonisation project in France. By 2030, ArcelorMittal's CO2 emissions in France will be down 7.8 million tons, or 40%, due to this investment, which will dramatically transform the country's steel industry.

The Global Green Steel Market is Segmented as Below:

By Energy Source

- Hydrogen

- Coal Gasification

- Electricity

By Type

- Electric Arc Furnace (EAF)

- Molten Oxide Electrolysis (MOE)

By End User

- Building & Construction

- Mechanical Equipment

- Automotive

- Metal Products

- Electronics

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Green Steel Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Statistics, 2018 - 2022

3.1. Key Highlights

3.2. Production Output, by Region

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Latin America

3.2.5. Middle East & Africa

4. Price Trend Analysis, 2018 - 2030

4.1. Key Highlights

4.2. Key Factors Affecting Prices

4.3. Price by Technology

4.4. Price by Region

5. Global Green Steel Market Outlook, 2018 - 2030

5.1. Global Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Hydrogen

5.1.1.2. Coal Gasification

5.1.1.3. Electricity

5.2. Global Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Electric Arc Furnace (EAF)

5.2.1.2. Molten Oxide Electrolysis (MOE)

5.3. Global Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Building & Construction

5.3.1.2. Mechanical Equipment

5.3.1.3. Automotive

5.3.1.4. Metal Products

5.3.1.5. Electronics

5.3.1.6. Misc.

5.4. Global Green Steel Market Outlook, by Region, Value (US$ Mn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. North America

5.4.1.2. Europe

5.4.1.3. Asia Pacific

5.4.1.4. Latin America

5.4.1.5. Middle East & Africa

6. North America Green Steel Market Outlook, 2018 - 2030

6.1. North America Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Hydrogen

6.1.1.2. Coal Gasification

6.1.1.3. Electricity

6.2. North America Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Electric Arc Furnace (EAF)

6.2.1.2. Molten Oxide Electrolysis (MOE)

6.3. North America Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Building & Construction

6.3.1.2. Mechanical Equipment

6.3.1.3. Automotive

6.3.1.4. Metal Products

6.3.1.5. Electronics

6.3.1.6. Misc.

6.3.2. Market Attractiveness Analysis

6.4. North America Green Steel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. U.S. Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

6.4.1.2. U.S. Green Steel Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.3. U.S. Green Steel Market End User, Value (US$ Mn), 2018 - 2030

6.4.1.4. Canada Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

6.4.1.5. Canada Green Steel Market Type, Value (US$ Mn), 2018 - 2030

6.4.1.6. Canada Green Steel Market End User, Value (US$ Mn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Green Steel Market Outlook, 2018 - 2030

7.1. Europe Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Hydrogen

7.1.1.2. Coal Gasification

7.1.1.3. Electricity

7.2. Europe Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Electric Arc Furnace (EAF)

7.2.1.2. Molten Oxide Electrolysis (MOE)

7.3. Europe Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Building & Construction

7.3.1.2. Mechanical Equipment

7.3.1.3. Automotive

7.3.1.4. Metal Products

7.3.1.5. Electronics

7.3.1.6. Misc.

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Europe Green Steel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Germany Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.2. Germany Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.3. Germany Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.4. U.K. Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.5. U.K. Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.6. U.K. Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.7. France Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.8. France Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.9. France Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.10. Italy Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.11. Italy Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.12. Italy Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.13. Russia Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.14. Russia Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.15. Russia Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.1.16. Rest of Europe Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

7.4.1.17. Rest of Europe Green Steel Market Type, Value (US$ Mn), 2018 - 2030

7.4.1.18. Rest of Europe Green Steel Market End User, Value (US$ Mn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Green Steel Market Outlook, 2018 - 2030

8.1. Asia Pacific Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Hydrogen

8.1.1.2. Coal Gasification

8.1.1.3. Electricity

8.2. Asia Pacific Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Electric Arc Furnace (EAF)

8.2.1.2. Molten Oxide Electrolysis (MOE)

8.3. Asia Pacific Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Building & Construction

8.3.1.2. Mechanical Equipment

8.3.1.3. Automotive

8.3.1.4. Metal Products

8.3.1.5. Electronics

8.3.1.6. Misc.

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Asia Pacific Green Steel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. China Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.2. China Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.3. China Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.4. Japan Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.5. Japan Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.6. Japan Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.7. South Korea Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.8. South Korea Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.9. South Korea Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.10. India Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.11. India Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.12. India Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.13. Southeast Asia Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.14. Southeast Asia Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.15. Southeast Asia Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.1.16. Rest of Asia Pacific Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

8.4.1.17. Rest of Asia Pacific Green Steel Market Type, Value (US$ Mn), 2018 - 2030

8.4.1.18. Rest of Asia Pacific Green Steel Market End User, Value (US$ Mn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Green Steel Market Outlook, 2018 - 2030

9.1. Latin America Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. Hydrogen

9.1.1.2. Coal Gasification

9.1.1.3. Electricity

9.2. Latin America Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Electric Arc Furnace (EAF)

9.2.1.2. Molten Oxide Electrolysis (MOE)

9.3. Latin America Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Building & Construction

9.3.1.2. Mechanical Equipment

9.3.1.3. Automotive

9.3.1.4. Metal Products

9.3.1.5. Electronics

9.3.1.6. Misc.

9.3.2. BPS Analysis/Market Attractiveness Analysis

9.4. Latin America Green Steel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

9.4.1. Key Highlights

9.4.1.1. Brazil Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

9.4.1.2. Brazil Green Steel Market Type, Value (US$ Mn), 2018 - 2030

9.4.1.3. Brazil Green Steel Market End User, Value (US$ Mn), 2018 - 2030

9.4.1.4. Mexico Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

9.4.1.5. Mexico Green Steel Market Type, Value (US$ Mn), 2018 - 2030

9.4.1.6. Mexico Green Steel Market End User, Value (US$ Mn), 2018 - 2030

9.4.1.7. Rest of Latin America Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

9.4.1.8. Rest of Latin America Green Steel Market Type, Value (US$ Mn), 2018 - 2030

9.4.1.9. Rest of Latin America Green Steel Market End User, Value (US$ Mn), 2018 - 2030

9.4.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Green Steel Market Outlook, 2018 - 2030

10.1. Middle East & Africa Green Steel Market Outlook, by Energy Source, Value (US$ Mn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. Hydrogen

10.1.1.2. Coal Gasification

10.1.1.3. Electricity

10.2. Middle East & Africa Green Steel Market Outlook, by Type, Value (US$ Mn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Electric Arc Furnace (EAF)

10.2.1.2. Molten Oxide Electrolysis (MOE)

10.3. Middle East & Africa Green Steel Market Outlook, by End User, Value (US$ Mn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. Building & Construction

10.3.1.2. Mechanical Equipment

10.3.1.3. Automotive

10.3.1.4. Metal Products

10.3.1.5. Electronics

10.3.1.6. Misc.

10.3.2. BPS Analysis/Market Attractiveness Analysis

10.4. Middle East & Africa Green Steel Market Outlook, by Country, Value (US$ Mn), 2018 - 2030

10.4.1. Key Highlights

10.4.1.1. GCC Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

10.4.1.2. GCC Green Steel Market Type, Value (US$ Mn), 2018 - 2030

10.4.1.3. GCC Green Steel Market End User, Value (US$ Mn), 2018 - 2030

10.4.1.4. South Africa Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

10.4.1.5. South Africa Green Steel Market Type, Value (US$ Mn), 2018 - 2030

10.4.1.6. South Africa Green Steel Market End User, Value (US$ Mn), 2018 - 2030

10.4.1.7. Rest of Middle East & Africa Green Steel Market by Energy Source, Value (US$ Mn), 2018 - 2030

10.4.1.8. Rest of Middle East & Africa Green Steel Market Type, Value (US$ Mn), 2018 - 2030

10.4.1.9. Rest of Middle East & Africa Green Steel Market End User, Value (US$ Mn), 2018 - 2030

10.4.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Product vs Application Heatmap

11.2. Manufacturer vs Application Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Tata Steel Ltd.

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Arcelor Mittal

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Aço Verde do Brasil

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Blastr Green Steel

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. SSAB AB

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. ThyssenKrupp AG

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Voestalpine AG

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Salzgitter AG

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Emirates Steel

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Hesteel Group Company Limited

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Jindal Steel and Power

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Algoma Group

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Energy Source Coverage |

|

|

Type Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |