Global Hard Disk Drive Market Forecast

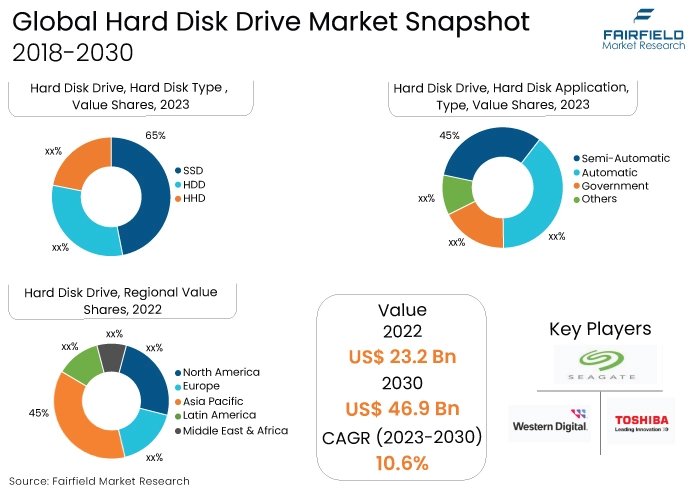

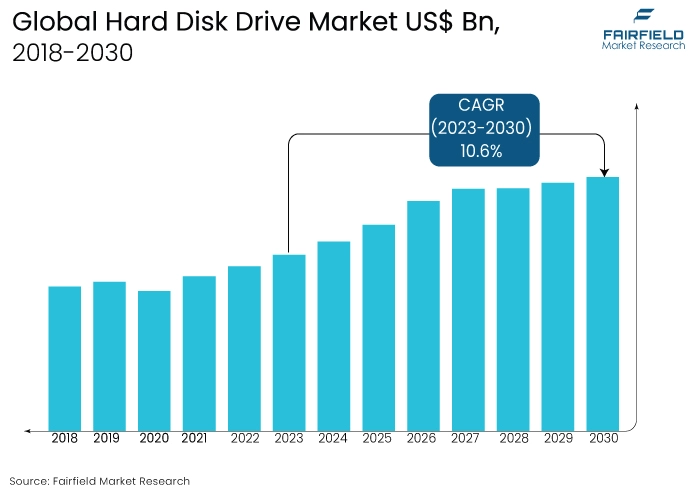

- The approximately US$23.2 Bn market for hard disk drives (2023) poised to reach a valuation of US$46.9 Bn in 2030

- Global hard disk drive market size likely to expand at a CAGR of 10.6% between 2023 and 2030

Quick Report Digest

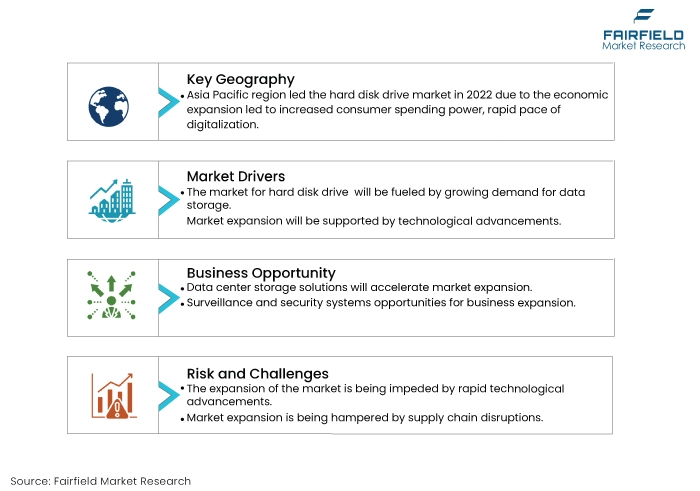

- The key trend anticipated to fuel the hard disk drive market growth is the increasing digitalisation across various sectors, coupled with the rising demand for data storage solutions, which serves as a significant market driver.

- Another major market trend expected to fuel the hard disk drive market growth is technological innovations leading to higher data transfer speeds and improved storage capacities are driving the HDD market.

- In 2022, SSDs will dominate the category due to their lightning-fast read and write speeds, making them ideal for personal use devices and commercial applications requiring high-performance data storage.

- In terms of market share for hard disk drives globally, HDD is the fastest-growing category, especially in cost-sensitive markets. They find extensive use in personal computers and budget-friendly commercial systems, providing ample storage capacities at a competitive price point.

- In 2022, the personal use category dominated the industry with approximately 45% due to the increasing demand for storage in everyday computing. SSDs are popular for their speed, while HDDs remain prevalent in budget-friendly devices. SSDs hold the majority share in this segment due to their superior performance, contributing significantly to the market.

- Commercial applications hold a significant market share, approximately 35%, with a focus on reliable, scalable storage solutions. HDDs are favoured for their balance between performance and cost, making them suitable for businesses managing large volumes of data. Their versatility and cost efficiency contribute to their dominance in commercial sectors.

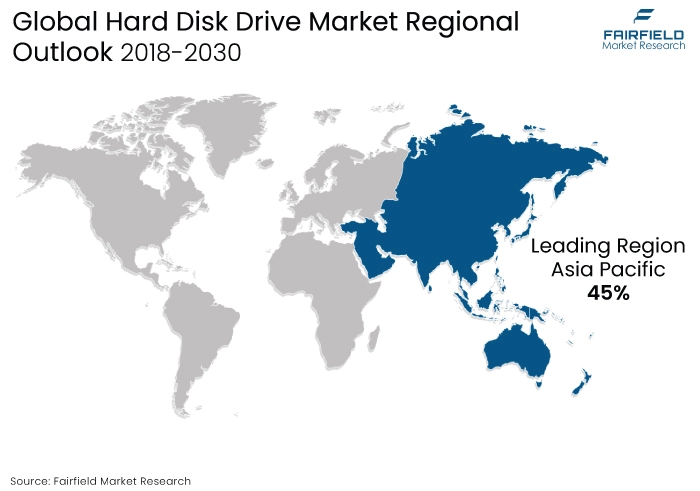

- The dominance of the Asia Pacific region in the hard disk drive (HDD) market is due to robust manufacturing capabilities, allowing them to produce a significant portion of the world's hard disk drives.

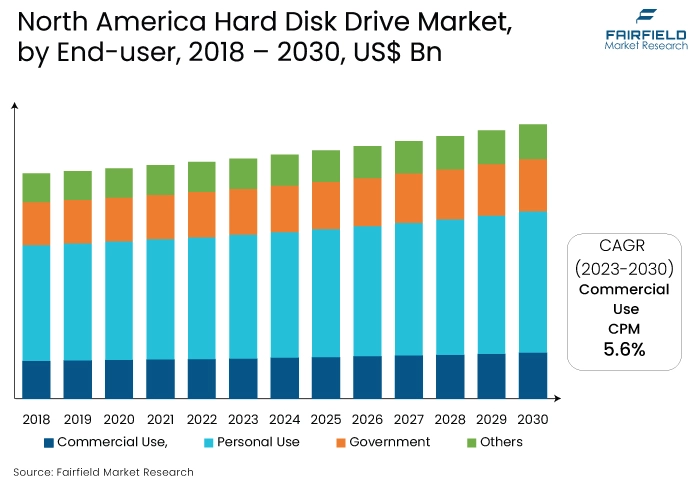

- The market for hard disk drives is expanding in North America due to technological advancements, high consumer purchasing power, and the presence of key market players.

A Look Back and a Look Forward - Comparative Analysis

In the current hard disk drive (HDD) market, the demand for high-capacity data storage solutions is at an all-time high. The industry is witnessing a shift towards solid state drives (SSDs) due to their superior speed and efficiency, especially in personal computing and data-intensive applications. However, traditional hard disk drives remain prevalent, particularly in cost-sensitive applications and large-scale data centres. Asia Pacific dominates the market, driven by manufacturing hubs in China, and Taiwan and a surge in digitalisation across sectors.

The market witnessed staggered growth during the historical period 2018 – 2022. This is due to the leading innovations like hybrid hard drives (HHDs) that combined the strengths of both technologies. Manufacturers invested heavily in research, improving storage capacities and read/write speeds. Asia Pacific emerged as the epicentre of production, catering to global demand. During this period, HDDs found stability in diverse applications, from personal computers to enterprise-level data centres, cementing their position as reliable, high-capacity storage solutions.

The HDD market is poised for continued evolution. SSDs will continue to dominate in high-performance applications, while HDDs will find their niche in large-scale data storage needs, including archival systems and cloud servers. Technological advancements, such as heat-assisted magnetic recording (HAMR), promise higher capacities for HDDs. Moreover, environmental concerns and sustainable technology initiatives will drive the development of energy-efficient HDDs.

Key Growth Determinants

- Increasing Data Generation and Storage Needs

The rapid digital transformation across industries has led to an exponential increase in data generation. Businesses, individuals, and government agencies are generating vast volumes of data daily. This surge in data creation, coupled with the need for data retention for regulatory compliance and analytics, drives the demand for high-capacity storage solutions like HDDs. The ability to store terabytes of data cost-effectively makes HDDs an essential choice, propelling market growth.

- Technological Advancements, and Performance Enhancements

The hard disk drive market benefits from continuous technological advancements. Innovations in magnetic recording techniques, such as heat-assisted magnetic recording (HAMR), and shingled magnetic recording (SMR), enable higher storage capacities and data transfer rates. Improved read/write speeds and lower latency make HDDs suitable for various applications, including cloud storage, data centres, and personal computing.

The industry's commitment to enhancing performance and reliability sustains market growth. Additionally, the market benefits from the increasing demand for data storage solutions in sectors such as healthcare, finance, and entertainment. This drives the need for more advanced HDD technologies that can handle larger volumes of data and ensure efficient data management.

- Cost Efficiency, and Versatility of HDDs

HDDs offer a cost-effective storage solution, especially when compared to solid state drives (SSDs). This cost-efficiency is a significant driver for both consumers and businesses seeking economic data storage options. HDDs find applications in a wide range of sectors, from personal use to large-scale data centres, government agencies, and commercial enterprises. Their versatility, compatibility with existing systems, and ability to handle high-capacity data storage requirements make them a preferred choice, fostering market expansion.

Additionally, HDDs are known for their durability and ability to withstand harsh environmental conditions, making them suitable for industries such as aerospace and defence. Furthermore, the lower power consumption of HDDs compared to SSDs is another factor that contributes to their popularity in energy-conscious environments.

Major Growth Barriers

- Rapid Adoption of SSDs

The increasing adoption of solid state drives (SSDs) poses a significant restraint on the hard disk drive (HDD) market. SSDs offer faster data access, lower power consumption, and enhanced durability compared to traditional HDDs. As SSD prices continue to drop, consumers and businesses are opting for SSDs, especially in high-performance applications.

This trend limits the growth potential of HDDs, particularly in the personal computing and enterprise sectors. Furthermore, SSDs are also more compact and lightweight, making them a preferred choice for portable devices such as laptops and tablets.

- Sustainability Concerns

The HDD market faces challenges related to environmental sustainability. HDDs contain various materials, including metals and magnets, which can be difficult to recycle. Proper disposal and recycling of old HDDs pose ecological concerns. As environmental regulations tighten globally, manufacturers face the challenge of developing eco-friendly production processes and disposal methods, adding complexity and cost to the HDD industry. Meeting stringent sustainability standards becomes crucial to ensuring market viability.

Key Trends and Opportunities to Look at

- Emergence of High-Capacity Helium-filled HDDs

Helium-filled hard disk drives (HDDs) are gaining traction due to their lower air resistance, allowing for more platters and increased storage capacity. This trend is popular worldwide, with key players like Seagate, and Western Digital investing in helium technology, ensuring substantial growth in storage capacities and data centres' efficiency.

The helium-filled HDDs have also shown significant improvements in power efficiency, as the reduced air resistance lowers the energy required for the platters to spin. Additionally, the helium technology helps minimise vibrations and noise, resulting in a quieter and more stable operation of the hard disk drives.

- Solid State Hybrid Drives (SSHDs) for Enhanced Performance

Solid state hybrid drives (SSHDs) combine HDD storage with a small SSD cache, providing faster access to frequently used data. This trend is prominent in regions with a demand for improved system performance, like North America and Europe. Brands like Toshiba and Seagate are focusing on SSHDs, enhancing both speed and storage capacities.

- Sustainable and Energy-Efficient HDD Solutions

The market sees a rise in demand for sustainable and energy-efficient HDDs, especially in environmentally conscious regions like Europe. Manufacturers like Western Digital, and Toshiba are investing in energy-efficient technologies, leveraging renewable energy sources and recyclable materials. This trend aligns with global sustainability goals, enhancing brand reputation and meeting consumer expectations for eco-friendly products.

How Does the Regulatory Scenario Shape this Industry?

The hard disk drive (HDD) industry operates within a complex regulatory landscape that significantly shapes its development and practices. Regulatory frameworks such as the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive impose strict standards on the materials used in HDD manufacturing. Compliance with these directives is essential for market access, encouraging manufacturers to develop eco-friendly products by restricting hazardous substances and promoting recycling.

Additionally, international standards like the International Electrotechnical Commission (IEC) standards and specific regional guidelines influence HDD manufacturing processes and product quality. Industry players must adhere to these standards to ensure product reliability and market acceptance. Region-specific regulations also play a crucial role. For instance, in the United States, the Federal Communications Commission (FCC) oversees electromagnetic interference regulations, ensuring HDDs do not interfere with other electronic devices. In China, the China Compulsory Certification (CCC) mark is mandatory for electronic products, including HDDs, for market entry.

Fairfield’s Ranking Board

Top Segments

- SSD Category Continues to Dominate over HDD Segments

The SSD segment dominated the market in 2022. SSDs dominate the market by approximately 65% due to their rapid data access speeds, reliability, and durability. As technology advances, SSD prices decrease, driving their adoption. They excel in personal computing, gaming consoles, and data-intensive applications. In 2022, SSDs held a significant market share due to their high demand in consumer electronics and enterprise-level data centres.

Furthermore, the HDD category is projected to experience the fastest market growth with 30% of the market share. Cost-sensitive applications. HDDs offer substantial storage capacities at lower costs per gigabyte, making them ideal for mass data storage needs in servers and large-scale enterprises. Although SSDs have gained ground, HDDs remain relevant, especially in regions where budget-friendly solutions are essential. As of 2022, HDDs continued to contribute significantly to the overall market share, especially in sectors prioritising cost-efficient storage solutions.

- Personal Use to Surge Ahead Throughout the Forecast Period

In 2022, the personal use category dominated the industry with approximately 45% due to the increasing demand for storage in everyday computing. SSDs are popular for their speed, while HDDs remain prevalent in budget-friendly devices. SSDs hold the majority share in this segment due to their superior performance, contributing significantly to the market.

Commercial applications hold a significant market share, approximately 35%, with a focus on reliable, scalable storage solutions. HDDs are favoured for their balance between performance and cost, making them suitable for businesses managing large volumes of data. Their versatility and cost efficiency contribute to their dominance in commercial sectors.

Regional Frontrunners

Asia Pacific Remains the Largest Revenue Contributor

Asia Pacific remains the largest region in the hard disk drive market due to several key factors. The region hosts major manufacturing hubs, particularly in countries like China, Taiwan, Japan, and South Korea, where leading HDD manufacturers are headquartered. These countries benefit from robust infrastructures, skilled labour forces, and economies of scale, allowing for efficient production and distribution of HDDs.

Additionally, the Asia Pacific region experiences significant demand for electronic devices, including personal computers, laptops, and servers. The rapid growth of IT industries, data centres, and increasing digitalisation in sectors like telecommunications and manufacturing fuel the demand for storage solutions, boosting HDD sales.

North America Stands out and Anticipates Fastest Growth Rate

North America stands out as the fastest-growing market for Hard Disk Drives. The region's growth is attributed to technological advancements, increasing investments in research and development, and a strong focus on innovation. North American consumers exhibit a high preference for high-capacity storage devices, driven by the expanding gaming industry, cloud computing, and the proliferation of data-centric applications.

Additionally, the region's robust e-commerce sector further propels the demand for HDDs in data centres and servers. Market players in North America benefit from a tech-savvy consumer base and a competitive landscape, fostering innovation and driving market expansion. Furthermore, the presence of leading technology companies and research institutions in North America encourages collaboration and the development of cutting-edge storage solutions.

Fairfield’s Competitive Landscape Analysis

The competitive landscape of the HDD market is intense, with established players and emerging entrants striving to gain a competitive edge. Major manufacturers are investing in research to develop higher-capacity drives and improve overall performance. Price competition is fierce, leading to constant adjustments in the pricing structure. However, sustaining profit margins amid these price fluctuations remains a challenge.

Who are the Leaders in Global Hard Disk Drive Space?

- Western Digital Co

- Seagate Technology

- Toshiba Co

- Sony Co

- Transcend Information.

- Samsung Electronics

- ADATA Technology Co

- Hewlett Packard Enterprise

- Apple Inc.

- Quantum Corp.

- SK Hynix Inc.

- Intel Corporation

- Mushkin Enhanced

- Micron Technology Inc.

- SanDisk

Significant Company Developments

New Product Launch

- April 2017: Western Digital Corporation began shipping its fourth generation of Helium hard disk drives. The first model was a 12TB Hitachi Global Storage Technologies (HGST) branded Ultrastar He12 hard drive. The HGST Ultrastar He12 hard drive is the next generation of the company's high-capacity enterprise-grade HDDs integrated with HelioSeal technology.

- July 2022: Western Digital stated that it had begun distributing its new 22TB HDDs aimed at three important segments: IT/data centre channel customers, WD Purple Pro for smart video/surveillance, and WD Red Pro for network attached storage (NAS). These drives use OptiNAND innovation, energy-assisted PMR (ePMR), triple-stage actuator (TSA), and HelioSeal to achieve 2.2TB per platter density.

- March 2022: Toshiba Electronics Europe GmbH (TEE) revealed that Toshiba Electronic Devices and Storage Corporation had established its business growth approach for Nearline Hard Disk Drives (HDDs). The corporation has taken this step to enable additional engineering advancements in HDD technology, resulting in a substantial boost in storage capacity.

Distribution Agreement

- November 2018: Seagate Technology LLC and IBM entered into a partnership to utilise blockchain technology to trace and authenticate hard disk drives. This partnership aims to use IBM's blockchain platform and Seagate's security to develop a system that addresses counterfeit and fake hard disk drives and ensures security and compliance for enterprises that rely on HDDs.

- In October 2020: Prominent US data storage manufacturer Seagate Technology plc declared that it will begin to ship its 18TB SkyHawk AI drives in bulk. This is the first purpose-built hard drive designed specifically for AI-enabled surveillance systems, enabling more informed and efficient decision-making.

An Expert’s Eye

Demand and Future Growth

The key driving force lies in the ever-expanding digital landscape. As businesses and individuals continue to generate vast amounts of data, the demand for high-capacity storage solutions like HDDs remains robust. The proliferation of data-intensive applications, cloud computing, and the growing significance of big data analytics will sustain this demand in the long term.

Additionally, the surge in digital content creation, especially in the entertainment and gaming sectors, is set to further bolster HDD sales. The market's future growth is intricately tied to these technological advancements and the persistent need for reliable, high-capacity storage devices.

Supply Side of the Market

According to our analysis, on the supply side, manufacturers are continually innovating to meet the increasing demand. Technological advancements, such as helium-filled HDDs and shingled magnetic recording (SMR) technology, are enhancing storage capacities and data transfer speeds. However, challenges on the supply side include securing a stable supply chain for raw materials and ensuring efficient manufacturing processes.

Moreover, stringent environmental regulations necessitate eco-friendly manufacturing practices, which require significant investments in research and development. Additionally, the rapid growth of data-driven industries, such as cloud computing and artificial intelligence, further intensifies the need for storage solutions that can keep up with the increasing demand. To address these challenges, companies are also exploring alternative materials and sustainable manufacturing techniques to minimise their environmental footprint while meeting the growing storage needs of various sectors.

Global Hard Disk Drive Market is Segmented as Below:

By Hard Disk Type:

- SSD

- HDD

- HHD

By Hard Disk Application:

- Personal Use

- Commercial Use

- Government

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Hard Disk Drive Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Hard Disk Drive Market Outlook, 2018 - 2030

3.1. Global Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. SSD

3.1.1.2. HDD

3.1.1.3. HHD

3.2. Global Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Personal Use

3.2.1.2. Commercial Use

3.2.1.3. Government

3.2.1.4. Others

3.3. Global Hard Disk Drive Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Hard Disk Drive Market Outlook, 2018 - 2030

4.1. North America Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. SSD

4.1.1.2. HDD

4.1.1.3. HHD

4.2. North America Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Personal Use

4.2.1.2. Commercial Use

4.2.1.3. Government

4.2.1.4. Others

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Hard Disk Drive Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Hard Disk Drive Market Outlook, 2018 - 2030

5.1. Europe Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. SSD

5.1.1.2. HDD

5.1.1.3. HHD

5.2. Europe Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Personal Use

5.2.1.2. Commercial Use

5.2.1.3. Government

5.2.1.4. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Hard Disk Drive Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Hard Disk Drive Market Outlook, 2018 - 2030

6.1. Asia Pacific Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. SSD

6.1.1.2. HDD

6.1.1.3. HHD

6.2. Asia Pacific Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Personal Use

6.2.1.2. Commercial Use

6.2.1.3. Government

6.2.1.4. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Hard Disk Drive Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Hard Disk Drive Market Outlook, 2018 - 2030

7.1. Latin America Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. SSD

7.1.1.2. HDD

7.1.1.3. HHD

7.2. Latin America Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Personal Use

7.2.1.2. Commercial Use

7.2.1.3. Government

7.2.1.4. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Hard Disk Drive Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Hard Disk Drive Market Outlook, 2018 - 2030

8.1. Middle East & Africa Hard Disk Drive Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. SSD

8.1.1.2. HDD

8.1.1.3. HHD

8.2. Middle East & Africa Hard Disk Drive Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Personal Use

8.2.1.2. Commercial Use

8.2.1.3. Government

8.2.1.4. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Hard Disk Drive Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Hard Disk Drive Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Hard Disk Drive Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Mushkin Enhanced

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Seagate Technology

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Toshiba Co

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Sony Co.

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Transcend Information.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. SAMSUNG ELECTRONICS

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. ADATA Technology Co

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Hewlett Packard Enterprise

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Business Strategies and Development

9.4.9. Apple Inc

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Quantum Corp.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. SK Hynix Inc

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. Intel Corporation

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

9.4.13. Mushkin Enhanced

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Development

9.4.14. MICRON TECHNOLOGY INC.

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Development

9.4.15. SanDisk

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Hard Disk Type Coverage |

|

|

Hard Disk Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |