Global Healthcare IoT Market Forecast

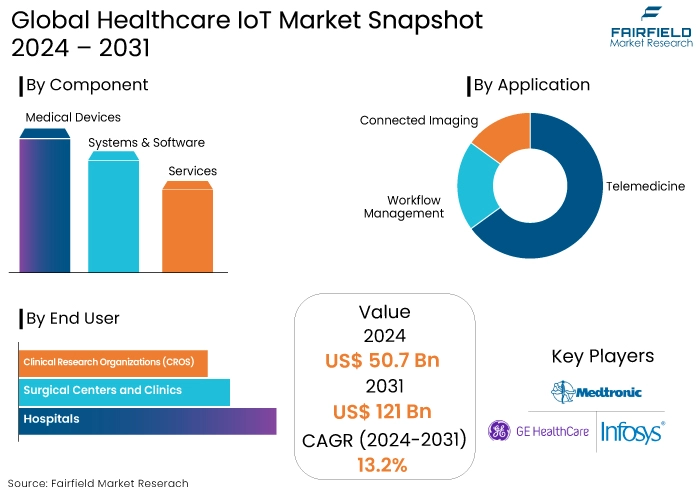

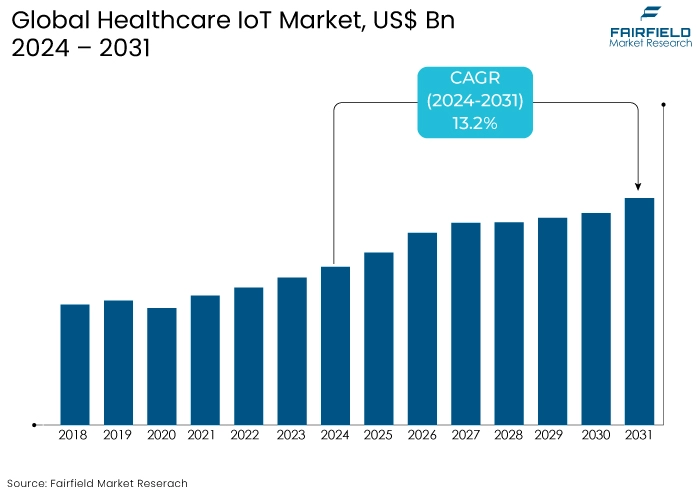

- The healthcare IoT market is projected to reach a value of US$121 Bn by 2031 showing significant growth from the US$50.7 Bn achieved in 2024.

- The market for healthcare IoT is expected to capture a CAGR of 13.2% from 2024 to 2031 during the forecast period.

Healthcare IoT Market Insights

- The increased adoption of connected devices and digital health solutions accelerates market growth.

- Integration of AI technologies into IoT devices enhance capabilities in predictive analytics and personalized healthcare.

- There is a heightened focus on cybersecurity due to rising concerns over data breaches and the need for compliance with stringent regulations.

- The expansion of telemedicine and remote patient monitoring is a key driver for the market.

- Wearable health devices such as smartwatches and fitness trackers are gaining popularity for their role in tracking vital signs and health metrics.

- Improving healthcare infrastructure shapes the market’s growth over the forecast period.

- The rising demand for affordable and scalable IoT solutions influences revenue generation.

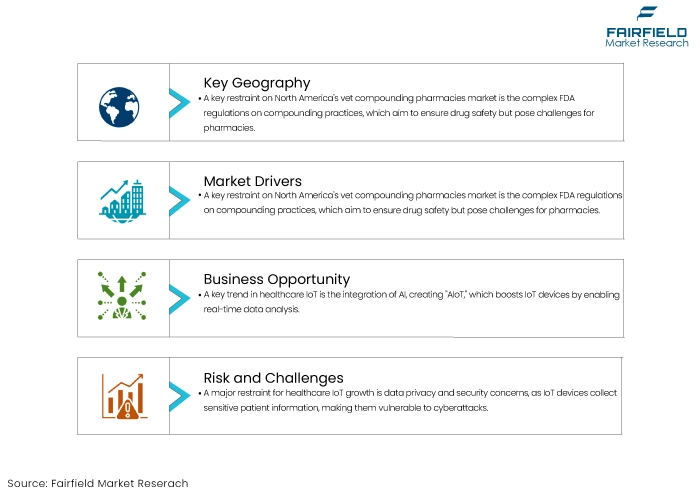

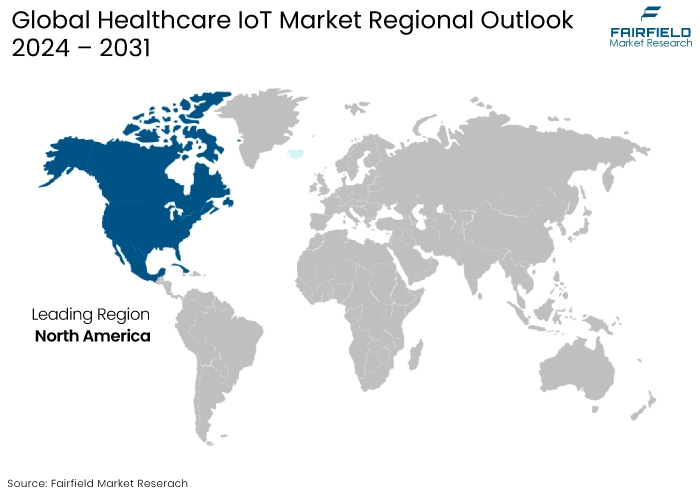

- North America dominates the healthcare IoT market accumulating 32% of the market share.

A Look Back and a Look Forward - Comparative Analysis

The healthcare internet of things (IoT) market experienced significant growth prior to 2023, driven by the increasing adoption of connected medical devices, remote patient monitoring, and telemedicine. The growing need for efficient healthcare solutions, particularly in managing chronic diseases and aging populations fueled demand for IoT-enabled healthcare systems.

Technological advancements such as cloud computing, wearable health devices, and mobile health applications also expanded the market. The COVID-19 pandemic accelerated the adoption of IoT in healthcare with hospitals and clinics increasingly relying on remote monitoring tools to manage patient care and reduce in-person visits.

The healthcare IoT market is projected to expand even further Post-2024 with advancements in artificial intelligence, 5G technology, and big data analytics enhancing IoT capabilities. Increased government initiatives to support digital health transformation particularly in developed markets will drive further investment in IoT infrastructure.

Emerging technologies such as smart sensors and blockchain for secure data management are anticipated to shape the future of healthcare IoT. The growing trend of personalized healthcare will increase demand for IoT devices that can deliver real-time and patient-specific insights.

The market is projected to witness a robust CAGR as healthcare providers increasingly embrace IoT for cost efficiency, improved outcomes, and patient convenience.

Key Growth Determinants

- Increasing Adoption of Remote Patient Monitoring

One of the primary drivers of the healthcare IoT market is the growing demand for remote patient monitoring. As healthcare systems face the challenge of managing an increasing number of chronic disease patients, IoT-enabled devices provide an efficient solution. These devices allow for continuous monitoring of patients’ vital signs such as heart rate, blood pressure, and glucose levels without the need for frequent hospital visits.

Remote monitoring not only improves patient outcomes by enabling early detection of health issues but also reduces the strain on healthcare facilities. This trend gained significant momentum during the COVID-19 pandemic when minimizing in-person interactions became a priority. The ongoing preference for virtual healthcare services continues to drive the demand for IoT in patient care.

- Technological Advancements in IoT Devices

Rapid advancements in technology particularly in wireless communication, sensors, and data analytics are driving the healthcare IoT market growth. Innovations in wearable devices such as smartwatches and fitness trackers have enabled accurate and reliable health data collection.

The integration of 5G networks is expected to enhance IoT devices’ performance by enabling fast data transmission and real-time monitoring. Advances in AI and machine learning are improving the analytical capabilities of IoT platforms allowing healthcare providers to derive actionable insights from large datasets. These technological breakthroughs are making IoT devices more accessible, affordable, and effective, further accelerating market expansion.

- Growing Focus on Personalized Medicine

The increasing emphasis on personalized medicine is a significant driver of the healthcare IoT market. Personalized medicine aims to tailor healthcare treatments to an individual’s specific genetic makeup, lifestyle, and environmental factors.

IoT-enabled devices play a key role in gathering real-time data on a patient’s condition, which is crucial for customizing treatments. This trend is particularly relevant for managing chronic diseases where continuous monitoring of symptoms and treatment efficacy is required.

IoT devices enable healthcare providers to optimize treatment plans and enhance patient outcomes by providing accurate and data-driven insights. The growing consumer demand for personalized and patient-centric care further impels the adoption of IoT solutions in healthcare.

Key Growth Barriers

- Data Privacy and Security Concerns

One of the significant restraints for the growth of the healthcare IoT market is the concern surrounding data privacy and security. IoT devices in healthcare collect vast amounts of sensitive patient information including medical records, real-time health data, and personal details. This makes healthcare systems prime targets for cyberattacks.

Breaches or unauthorized access to such data can lead to severe consequences, including identity theft and compromised patient care. Strict regulatory requirements like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe also impose high compliance costs on healthcare providers.

As healthcare systems struggle to balance innovation with stringent security protocols, these concerns may deter organizations from fully adopting IoT technologies potentially hindering market growth.

- High Implementation Costs

The high cost of implementing IoT solutions in healthcare poses a significant barrier to healthcare IoT market growth. IoT deployment involves substantial investments in infrastructure including devices, sensors, cloud storage, and data analytics platforms.

Healthcare providers need to invest in staff training, system integration, and ongoing maintenance. These costs may be prohibitive for smaller healthcare facilities, limiting the widespread adoption of IoT technologies.

Budget constraints in developing regions also slow IoT implementation reducing overall market penetration. Without financial incentives or cost-effective solutions, many healthcare providers may hesitate to adopt IoT systems slowing market expansion.

Healthcare IoT Market Trends and Opportunities

- Integration of Artificial Intelligence (AI) with IoT Devices

A key trend in the healthcare IoT market is the increasing integration of artificial intelligence (AI) with IoT devices leading to the emergence of "AIoT" (Artificial Intelligence of Things). AI enhances the capabilities of IoT devices by enabling them to analyze and interpret large volumes of healthcare data in real-time.

Integration improves the ability to detect patterns, predict health outcomes, and offer personalized treatment recommendations. For instance, AI-powered IoT devices can analyse a patient's vital signs and predict potential health risks such as heart attacks or strokes before they occur.

AI also optimizes data processing, reducing the burden on healthcare providers by automating tasks like diagnostics, reporting, and patient monitoring. As IoT devices become more prevalent in healthcare, their ability to incorporate AI-driven analytics will further enhance efficiency, precision, and decision-making capabilities. This trend is expected to significantly shape the future of healthcare, providing more accurate and timely medical interventions while reducing operational costs.

- Expansion in Emerging Markets

The healthcare IoT market presents significant growth opportunities in emerging markets. Countries like Asia-Pacific, Latin America, and Africa are witnessing rapid improvements in healthcare infrastructure, increased internet penetration, and growing adoption of mobile technologies. This creates a favourable environment for IoT-enabled healthcare solutions.

As healthcare systems in the regions evolve, there is a rising demand for affordable, scalable solutions to address the needs of large populations particularly in rural or underserved areas. IoT devices such as remote monitoring tools and telemedicine platforms can play a critical role in bridging gaps in healthcare access allowing healthcare providers to monitor patients remotely.

Governments in emerging economies are increasingly investing in digital healthcare transformation creating opportunities for healthcare IoT companies to expand their offerings in these regions. By tapping into these growing markets, companies can capitalize on the increasing demand for cost-effective, technology-driven healthcare solutions.

How Does Regulatory Scenario Shape this Industry?

The regulatory landscape is playing a crucial role in shaping the healthcare IoT market, balancing innovation with patient safety and data privacy. Governments and regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are increasingly focused on establishing guidelines for IoT-enabled healthcare devices to ensure their safety, efficacy, and reliability.

In the U.S., the FDA has implemented frameworks for connected medical devices emphasizing cybersecurity standards to protect sensitive patient data from breaches and unauthorized access. The European Union’s General Data Protection Regulation (GDPR) imposes strict requirements for handling personal health information driving the need for robust security protocols in IoT systems.

Regulations are evolving to address device interoperability and data sharing in addition to privacy and security ensuring that IoT devices can seamlessly communicate within healthcare ecosystems. While these regulatory developments aim to foster innovation, they also increase compliance costs for manufacturers and healthcare providers slowing adoption in some regions.

Segments Covered in the Report

- Medical Devices Set to Explore Excellent Prospects

The medical devices segment is experiencing rapid growth due to developments in sensor technology and connectivity. Based on component type, medical devices lead the market exhibiting 38% of market share.

The gadgets encompass wearable monitors, intelligent implants, and remote patient monitoring systems. The market is growing as a result of the rising acceptance of telemedicine and the demand for uninterrupted health monitoring solutions.

The market is experiencing expansion due to a higher demand for personalized healthcare solutions and improved efficiency in patient management. Services are a crucial component of the IoT healthcare industry encompassing all activities necessary for the implementation, management, and optimization of IoT solutions in healthcare settings.

The offering encompasses professional services such as advising, integration, and maintenance, as well as managed services that address the everyday operations and security of IoT healthcare systems.

- Telemedicine Application Owns Notable Market Share of 35%

The growth of the telemedicine application is primarily driven by the escalating prevalence of chronic diseases and the increasing demand for patient monitoring. Also, the need for IoT solutions is being driven by recent improvements in telemedicine technology and the introduction of telemedicine services.

In May 2021, Lytus Technologies, a platform services firm introduced telemedicine services in India. These services are accompanied by a network of local health institutions that provide additional services beyond virtual care.

Prominent stakeholders in the field of healthcare Internet of Things are primarily dedicated to the advancement of cutting-edge telemedicine solutions or gadgets with the aim of enhancing the healthcare system. For example,

- CareClix provides a wide array of telehealth and telemedicine services using high-definition video examinations and remote consultations. Moreover, the telemedicine sector is expected to experience the most rapid expansion within the projected timeframe.

Regional Analysis

- Extensive Use of Connected Healthcare Equipment to Drive North America Market

North America holds the largest stake in the global healthcare IoT market and is projected to experience growth in the forecast future. The North American IoT Healthcare Market encompasses the countries of the United States, Canada, and Mexico.

The market's expansion is driven by the rise in active patient involvement and patient-centric care, as well as the development and broad acceptance of high-speed network technologies for IoT connectivity.

The government's efforts to encourage digital health and the shortage of doctors, which has resulted in increased dependence on self-operated health platforms, offer profitable opportunities for market participants.

The United States dominates the market due to the extensive use of connected healthcare equipment and the growing enthusiasm and financial support for healthcare IoT solutions.

Fairfield’s Competitive Landscape Analysis

The healthcare IoT market is highly competitive with key players ranging from established technology firms to specialized healthcare solution providers. Leading companies like Philips Healthcare, GE Healthcare, and Medtronic dominate the market offering a wide range of IoT-enabled devices for patient monitoring, diagnostics, and medical imaging.

Tech giants such as IBM, Cisco, and Microsoft are also prominent leveraging their expertise in cloud computing, AI, and big data analytics to provide robust IoT platforms for healthcare applications.

Start-ups and niche players are emerging with innovative solutions particularly in wearable health devices and telemedicine. The market competition is driven by continuous innovation, with companies focusing on improving device connectivity, data analytics, and cybersecurity to gain a competitive edge.

Key Market Companies

- Medtronic

- Cisco Systems, Inc.

- IBM Corporation

- GE Healthcare

- Microsoft Corporation

- SAP SE

- Infosys Limited

- Cerner Corporation

- Amazon

- Intel Corporation

- Wipro ltd

Recent Industry Developments

September 2023 –

Infosys declared the augmentation of its strategic partnership with NVIDIA Corporation. The objective of this partnership was to create the technology and knowledge necessary to enhance productivity using generative AI applications and solutions in several industries, including healthcare.

May 2023 –

SAP SE formed a partnership with Accenture. The objective of the collaboration was to engage in cooperative efforts on many projects involving artificial intelligence and expand the range of products offered.

An Expert’s Eye

- Healthcare IoT is revolutionizing patient care with real-time monitoring and personalized treatment leading to improved outcomes and efficiency.

- Ensuring robust data privacy and security remains a critical concern with stringent regulations necessary to protect sensitive health information.

- The integration of AI with IoT devices is enhancing predictive analytics and decision-making offering significant advancements in diagnostics and patient management.

- Significant growth opportunities exist in emerging markets due to rising healthcare infrastructure and increasing demand for cost-effective IoT solutions.

Global Healthcare IoT Market is Segmented as-

By Component

- Medical Devices

- Systems & Software

- Services

By Application

- Telemedicine

- Workflow Management

- Connected Imaging

By End Use

- Hospitals

- Surgical Centers and Clinics

- Clinical Research Organizations (CROS)

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global Healthcare IoT Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. COVID-19 Impact Analysis

2.3.1. Supply

2.3.2. Demand

2.4. Value Chain Analysis

2.5. Porter’s Five Force Analysis

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Healthcare IoT Market Outlook, 2019 - 2031

3.1. Global Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Devices

3.1.1.1.1. Wearable Medical Devices

3.1.1.1.2. Wearable Biosensors

3.1.1.1.3. Ingestible Sensors

3.1.1.1.4. Others

3.1.1.2. Software

3.1.1.2.1. Patient Management & Monitoring Apps

3.1.1.2.2. Telehealth Software

3.1.1.2.3. Healthcare IoT Platforms

3.1.1.2.4. Others

3.1.1.3. Services

3.1.1.3.1. Professional Services

3.1.1.3.1.1. Consulting

3.1.1.3.1.2. Integration & Implementation

3.1.1.3.1.3. Support & Maintenance

3.1.1.3.2. Managed Services

3.2. Global Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Disease Diagnostics

3.2.1.2. Disease Management

3.2.1.3. Remote Patient Monitoring

3.2.1.4. Telemedicine

3.2.1.5. Others

3.3. Global Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Diagnostic Centers

3.3.1.2. Rehabilitation Centers

3.3.1.3. Hospitals & Clinics

3.3.1.4. Health Insurance Companies

3.3.1.5. Others

3.4. Global Healthcare IoT Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Healthcare IoT Market Outlook, 2019 - 2031

4.1. North America Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Devices

4.1.1.1.1. Wearable Medical Devices

4.1.1.1.2. Wearable Biosensors

4.1.1.1.3. Ingestible Sensors

4.1.1.1.4. Others

4.1.1.2. Software

4.1.1.2.1. Patient Management & Monitoring Apps

4.1.1.2.2. Telehealth Software

4.1.1.2.3. Healthcare IoT Platforms

4.1.1.2.4. Others

4.1.1.3. Services

4.1.1.3.1. Professional Services

4.1.1.3.1.1. Consulting

4.1.1.3.1.2. Integration & Implementation

4.1.1.3.1.3. Support & Maintenance

4.1.1.3.2. Managed Services

4.2. North America Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Disease Diagnostics

4.2.1.2. Disease Management

4.2.1.3. Remote Patient Monitoring

4.2.1.4. Telemedicine

4.2.1.5. Others

4.3. North America Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Diagnostic Centers

4.3.1.2. Rehabilitation Centers

4.3.1.3. Hospitals & Clinics

4.3.1.4. Health Insurance Companies

4.3.1.5. Others

4.4. North America Healthcare IoT Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

4.4.1.2. U.S. Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

4.4.1.3. U.S. Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

4.4.1.4. Canada Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

4.4.1.5. Canada Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

4.4.1.6. Canada Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Healthcare IoT Market Outlook, 2019 - 2031

5.1. Europe Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Devices

5.1.1.1.1. Wearable Medical Devices

5.1.1.1.2. Wearable Biosensors

5.1.1.1.3. Ingestible Sensors

5.1.1.1.4. Others

5.1.1.2. Software

5.1.1.2.1. Patient Management & Monitoring Apps

5.1.1.2.2. Telehealth Software

5.1.1.2.3. Healthcare IoT Platforms

5.1.1.2.4. Others

5.1.1.3. Services

5.1.1.3.1. Professional Services

5.1.1.3.1.1. Consulting

5.1.1.3.1.2. Integration & Implementation

5.1.1.3.1.3. Support & Maintenance

5.1.1.3.2. Managed Services

5.2. Europe Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Disease Diagnostics

5.2.1.2. Disease Management

5.2.1.3. Remote Patient Monitoring

5.2.1.4. Telemedicine

5.2.1.5. Others

5.3. Europe Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Diagnostic Centers

5.3.1.2. Rehabilitation Centers

5.3.1.3. Hospitals & Clinics

5.3.1.4. Health Insurance Companies

5.3.1.5. Others

5.4. Europe Healthcare IoT Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.2. Germany Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.3. Germany Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.4. U.K. Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.5. U.K. Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.6. U.K. Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.7. France Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.8. France Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.9. France Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.10. Italy Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.11. Italy Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.12. Italy Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.13. Türkiye Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.14. Türkiye Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.15. Türkiye Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.16. Russia Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.17. Russia Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.18. Russia Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.1.19. Rest of Europe Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

5.4.1.20. Rest of Europe Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

5.4.1.21. Rest of Europe Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Healthcare IoT Market Outlook, 2019 - 2031

6.1. Asia Pacific Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Devices

6.1.1.1.1. Wearable Medical Devices

6.1.1.1.2. Wearable Biosensors

6.1.1.1.3. Ingestible Sensors

6.1.1.1.4. Others

6.1.1.2. Software

6.1.1.2.1. Patient Management & Monitoring Apps

6.1.1.2.2. Telehealth Software

6.1.1.2.3. Healthcare IoT Platforms

6.1.1.2.4. Others

6.1.1.3. Services

6.1.1.3.1. Professional Services

6.1.1.3.1.1. Consulting

6.1.1.3.1.2. Integration & Implementation

6.1.1.3.1.3. Support & Maintenance

6.1.1.3.2. Managed Services

6.2. Asia Pacific Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Disease Diagnostics

6.2.1.2. Disease Management

6.2.1.3. Remote Patient Monitoring

6.2.1.4. Telemedicine

6.2.1.5. Others

6.3. Asia Pacific Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Diagnostic Centers

6.3.1.2. Rehabilitation Centers

6.3.1.3. Hospitals & Clinics

6.3.1.4. Health Insurance Companies

6.3.1.5. Others

6.4. Asia Pacific Healthcare IoT Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.2. China Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.3. China Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.1.4. Japan Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.5. Japan Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.6. Japan Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.1.7. South Korea Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.8. South Korea Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.9. South Korea Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.1.10. India Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.11. India Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.12. India Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.1.13. Southeast Asia Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.14. Southeast Asia Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.15. Southeast Asia Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Healthcare IoT Market Outlook, 2019 - 2031

7.1. Latin America Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Devices

7.1.1.1.1. Wearable Medical Devices

7.1.1.1.2. Wearable Biosensors

7.1.1.1.3. Ingestible Sensors

7.1.1.1.4. Others

7.1.1.2. Software

7.1.1.2.1. Patient Management & Monitoring Apps

7.1.1.2.2. Telehealth Software

7.1.1.2.3. Healthcare IoT Platforms

7.1.1.2.4. Others

7.1.1.3. Services

7.1.1.3.1. Professional Services

7.1.1.3.1.1. Consulting

7.1.1.3.1.2. Integration & Implementation

7.1.1.3.1.3. Support & Maintenance

7.1.1.3.2. Managed Services

7.2. Latin America Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Disease Diagnostics

7.2.1.2. Disease Management

7.2.1.3. Remote Patient Monitoring

7.2.1.4. Telemedicine

7.2.1.5. Others

7.3. Latin America Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Diagnostic Centers

7.3.1.2. Rehabilitation Centers

7.3.1.3. Hospitals & Clinics

7.3.1.4. Health Insurance Companies

7.3.1.5. Others

7.4. Latin America Healthcare IoT Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

7.4.1.2. Brazil Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

7.4.1.3. Brazil Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

7.4.1.4. Mexico Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

7.4.1.5. Mexico Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

7.4.1.6. Mexico Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

7.4.1.7. Argentina Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

7.4.1.8. Argentina Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

7.4.1.9. Argentina Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

7.4.1.10. Rest of Latin America Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

7.4.1.11. Rest of Latin America Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

7.4.1.12. Rest of Latin America Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Healthcare IoT Market Outlook, 2019 - 2031

8.1. Middle East & Africa Healthcare IoT Market Outlook, By Component, Value (US$ Mn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Devices

8.1.1.1.1. Wearable Medical Devices

8.1.1.1.2. Wearable Biosensors

8.1.1.1.3. Ingestible Sensors

8.1.1.1.4. Others

8.1.1.2. Software

8.1.1.2.1. Patient Management & Monitoring Apps

8.1.1.2.2. Telehealth Software

8.1.1.2.3. Healthcare IoT Platforms

8.1.1.2.4. Others

8.1.1.3. Services

8.1.1.3.1. Professional Services

8.1.1.3.1.1. Consulting

8.1.1.3.1.2. Integration & Implementation

8.1.1.3.1.3. Support & Maintenance

8.1.1.3.2. Managed Services

8.2. Middle East & Africa Healthcare IoT Market Outlook, By Application, Value (US$ Mn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Disease Diagnostics

8.2.1.2. Disease Management

8.2.1.3. Remote Patient Monitoring

8.2.1.4. Telemedicine

8.2.1.5. Others

8.3. Middle East & Africa Healthcare IoT Market Outlook, By End User, Value (US$ Mn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Diagnostic Centers

8.3.1.2. Rehabilitation Centers

8.3.1.3. Hospitals & Clinics

8.3.1.4. Health Insurance Companies

8.3.1.5. Others

8.4. Middle East & Africa Healthcare IoT Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

8.4.1.2. GCC Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

8.4.1.3. GCC Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

8.4.1.4. South Africa Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

8.4.1.5. South Africa Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

8.4.1.6. South Africa Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

8.4.1.7. Egypt Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

8.4.1.8. Egypt Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

8.4.1.9. Egypt Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

8.4.1.10. Nigeria Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

8.4.1.11. Nigeria Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

8.4.1.12. Nigeria Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa Healthcare IoT Market By Component, Value (US$ Mn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa Healthcare IoT Market By Application, Value (US$ Mn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa Healthcare IoT Market By End User, Value (US$ Mn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2024

9.2. Competitive Dashboard

9.3. Company Profiles

9.3.1. IBM Corporation

9.3.1.1. Company Overview

9.3.1.2. Product Portfolio

9.3.1.3. Financial Overview

9.3.1.4. Business Strategies and Development

9.3.2. Siemens Healthineers

9.3.2.1. Company Overview

9.3.2.2. Product Portfolio

9.3.2.3. Financial Overview

9.3.2.4. Business Strategies and Development

9.3.3. Koninklijke Philips N.V.

9.3.3.1. Company Overview

9.3.3.2. Product Portfolio

9.3.3.3. Financial Overview

9.3.3.4. Business Strategies and Development

9.3.4. Honeywell International Inc.

9.3.4.1. Company Overview

9.3.4.2. Product Portfolio

9.3.4.3. Financial Overview

9.3.4.4. Business Strategies and Development

9.3.5. GE Healthcare

9.3.5.1. Company Overview

9.3.5.2. Product Portfolio

9.3.5.3. Financial Overview

9.3.5.4. Business Strategies and Development

9.3.6. Proteus Digital Health, Inc.

9.3.6.1. Company Overview

9.3.6.2. Product Portfolio

9.3.6.3. Financial Overview

9.3.6.4. Business Strategies and Development

9.3.7. Cerner Corporation

9.3.7.1. Company Overview

9.3.7.2. Product Portfolio

9.3.7.3. Financial Overview

9.3.7.4. Business Strategies and Development

9.3.8. Bosch Health Solutions

9.3.8.1. Company Overview

9.3.8.2. Product Portfolio

9.3.8.3. Financial Overview

9.3.8.4. Business Strategies and Development

9.3.9. Huawei Technologies Co., Ltd.

9.3.9.1. Company Overview

9.3.9.2. Product Portfolio

9.3.9.3. Financial Overview

9.3.9.4. Business Strategies and Development

9.3.10. Biotronik

9.3.10.1. Company Overview

9.3.10.2. Product Portfolio

9.3.10.3. Financial Overview

9.3.10.4. Business Strategies and Development

9.3.11. Medtronic

9.3.11.1. Company Overview

9.3.11.2. Product Portfolio

9.3.11.3. Financial Overview

9.3.11.4. Business Strategies and Development

9.3.12. Capsule Technologies, Inc.

9.3.12.1. Company Overview

9.3.12.2. Product Portfolio

9.3.12.3. Financial Overview

9.3.12.4. Business Strategies and Development

9.3.13. Boston Scientific Corporation

9.3.13.1. Company Overview

9.3.13.2. Product Portfolio

9.3.13.3. Financial Overview

9.3.13.4. Business Strategies and Development

9.3.14. OSPLabs

9.3.14.1. Company Overview

9.3.14.2. Product Portfolio

9.3.14.3. Financial Overview

9.3.14.4. Business Strategies and Development

9.3.15. STANLEY Healthcare

9.3.15.1. Company Overview

9.3.15.2. Product Portfolio

9.3.15.3. Financial Overview

9.3.15.4. Business Strategies and Development

9.3.16. Microsoft Corporation

9.3.16.1. Company Overview

9.3.16.2. Product Portfolio

9.3.16.3. Financial Overview

9.3.16.4. Business Strategies and Development

9.3.17. AMD Global Telemedicine, Inc.

9.3.17.1. Company Overview

9.3.17.2. Product Portfolio

9.3.17.3. Financial Overview

9.3.17.4. Business Strategies and Development

9.3.18. Care Innovations

9.3.18.1. Company Overview

9.3.18.2. Product Portfolio

9.3.18.3. Financial Overview

9.3.18.4. Business Strategies and Development

9.3.19. HQSoftware

9.3.19.1. Company Overview

9.3.19.2. Product Portfolio

9.3.19.3. Financial Overview

9.3.19.4. Business Strategies and Development

9.3.20. Aerotel Medical Systems Ltd.

9.3.20.1. Company Overview

9.3.20.2. Product Portfolio

9.3.20.3. Financial Overview

9.3.20.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Component Coverage |

|

|

Application Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |