Heat Shrink Tube Market Forecast

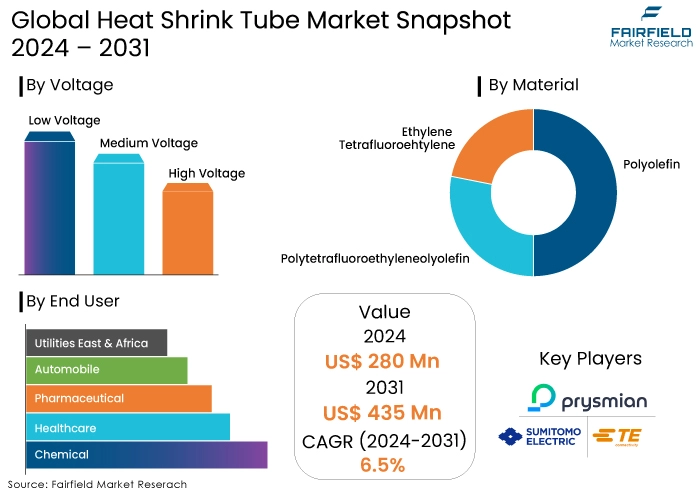

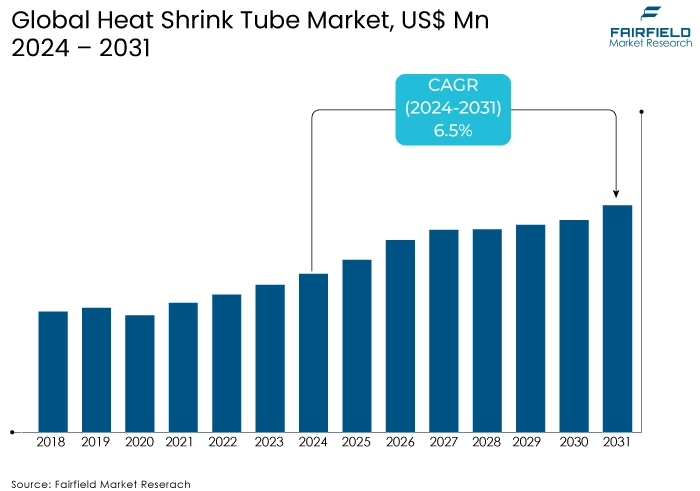

- Heat shrink tube market size is poised to reach US$435 Mn in 2031, up from US$280 Mn attained in 2024.

- Global heat shrink tube market revenue is estimated to capture a CAGR of 6.5% during the forecast period from 2024 to 2031.

Heat Shrink Tube Market Insights

- Heat shrink tubing is a thermoplastic tube that contracts in size when heated.

- Heat shrink tubing protects against corrosion, abrasion, cutting, and scuffing. These protective features render the heat shrink tubing suitable for use in environments subject to moisture, dust, and chemicals.

- The increasing adoption of renewable energy sources like solar and wind power is driving demand for heat shrink tubes for insulation and protection of electrical components.

- Heat shrink tubes are produced using a variety of chemical compositions, with the manufacturing technique primarily determined by the intended application of the tubes.

- The heat shrink tube market flourishes in North America due to its robust industrial infrastructure, particularly in sectors like automotive, aerospace, and electronics.

- Heat shrink tubes are commonly used to encase and safeguard certain areas and then external heat is introduced. Subsequently, the tubes contract and transform into a tailored sheath to protect the surface beneath.

- Heat shrink tubes safeguard cables and wires from potential harm, including corrosion and abrasion.

- Heat shrink tubes are finding applications in new areas beyond traditional electrical insulation, such as medical devices, aerospace, and marine industries.

- Catheter makers might utilize more economical materials, increasing their profit margins. This sets the stage for numerous opportunities to reinvest in the upcoming years, particularly since the cost of capital is a crucial factor in several industrial sectors.

A Look Back and a Look Forward - Comparative Analysis

The global heat shrink tube market witnessed steady growth between 2019 and 2023, driven by its versatility and protective properties. This growth is expected to continue through 2031, fuelled by increasing industry demand.

During the historical period from 2019 to 2023, the market witnessed a rise in adoption across sectors like telecommunication, aerospace, automotive, and medical, particularly in the Asia Pacific region.

The growth can be attributed to the expanding infrastructure, growing emphasis on electrical safety, and rising demand for lightweight and durable solutions in these industries. The market for heat shrink tube is expected to maintain a positive trajectory due to several factors.

The increasing focus on improving electrical safety regulations and the growing adoption of automation in various industries will likely to drive demand for heat shrink tubing for insulation and wire protection.

Developing new materials with improved properties like flame retardancy and higher temperature resistance will further broaden the market's reach. However, factors like fluctuating raw material prices and the potential for competition from alternative insulation solutions could challenge the market's growth.

Key Growth Determinants

- Growing Demand in Electronics and Computing Industries

The increasing demand in the electronics and computing industries significantly drives the heat shrink tube market. As electronic devices, such as smartphones, laptops, and high-performance computing systems, become more powerful, they generate more heat.

Effective heat management is considered to be an important element to maintain the performance and longevity of these devices. Heat shrink tubes, which efficiently dissipate heat away from sensitive components, are essential.

The trend toward miniaturization and high processing speed in consumer electronics further amplifies the need for advanced thermal management solutions. This growing demand fosters innovation and expansion in the market for heat shrink tube as manufacturers strive to meet the specific cooling requirements of next-generation electronic devices.

- Advancements in Thermal Management Technologies

Technological advancements in thermal management are propelling the heat shrink tube market forward. Innovations such as the development of new materials with higher thermal conductivity, improved manufacturing processes like 3D printing, and the integration of intelligent cooling systems are enhancing the efficiency and performance of heat shrinks.

Using materials like graphene and carbon nanotubes in heat shrink tubes offers superior heat dissipation capabilities compared to traditional materials. Additionally, design advancements, such as optimizing fin structures and using phase change materials, are leading to more compact and efficient heat shrink solutions.

Technological advancements are meeting the increasing thermal management demands of modern electronic devices and industrial applications and opening up new market opportunities.

- Expansion of Renewable Energy Sector

The renewable energy sector's expansion, particularly in solar and wind energy systems, is another critical driver for the heat shrink tube market. In solar power systems, heat shrinks are vital for cooling photovoltaic cells and power inverters, ensuring efficient energy conversion and system reliability. Similarly, in wind turbines, heat shrinks manage the heat generated by electronic control systems and power converters.

As the global emphasis on sustainable energy solutions intensifies, the deployment of solar panels and wind turbines is increasing, thereby driving the demand for effective thermal management solutions, including heat shrink tubes. This trend boosts market growth and encourages the development of more efficient and durable heat shrink technologies tailored for renewable energy applications.

Key Growth Barriers

- High Manufacturing Costs

One of the primary restraints in the heat shrink tube market is the high manufacturing cost. Producing heat shrink tubes involves advanced materials like aluminium, copper, and sometimes exotic materials such as graphene or carbon nanotubes, which are expensive.

The manufacturing process requires precision engineering and specialized equipment to ensure high thermal conductivity and efficient heat dissipation. Techniques such as extrusion, die-casting, and CNC machining contribute to the overall cost.

For small and medium-sized enterprises (SMEs), these high production costs can be prohibitive, limiting their ability to compete with larger, well-established companies. Furthermore, the fluctuating prices of raw materials add uncertainty and financial strain to manufacturers, making it challenging to maintain consistent pricing and profitability

- Regulatory and Environmental Concerns

Regulatory and environmental concerns also significantly restrain the heat shrink tube market. The manufacturing of heat shrink tubes often involves energy-intensive processes that generate waste, which can have environmental impacts.

Stringent regulations aimed at reducing carbon footprints and managing waste disposal add to the operational costs for manufacturers. Compliance with environmental standards, such as the Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives, requires manufacturers to invest in cleaner technologies and sustainable practices, which can be costly.

Non-compliance can lead to hefty fines and damage to the company’s reputation. These regulatory pressures can hinder market growth by increasing the complexity and cost of production, particularly for small firms.

Heat Shrink Tube Market Trends and Opportunities

- Increasing Use of Advanced Materials

A significant trend in the heat shrink tube market is the increasing use of advanced materials to enhance thermal management performance. Traditional materials like aluminium and copper are being supplemented and, in some cases, replaced by materials with superior thermal conductivity properties, such as graphene and carbon nanotubes.

Graphene, known for its exceptional thermal and electrical conductivity, is being integrated into heat shrink designs to improve heat dissipation efficiency while maintaining lightweight and flexible properties. This trend is driven by the growing demand for more efficient thermal management solutions in high-power electronics, data centres, and renewable energy systems.

The ability of these advanced materials to manage higher thermal loads more effectively allows for the development of smaller, more efficient heat shrinks that can be integrated into increasingly compact electronic devices.

The integration of these materials enhances performance and contributes to the miniaturization of electronic components, a critical requirement in modern electronics. As research and development in nanotechnology and materials science continue to advance, adopting these materials in the market for heat shrink tube is expected to rise.

- Expansion into Electric Vehicles (EV) Market

The expansion of the electric vehicle (EV) market presents a significant opportunity for the heat shrink tube market. As EV adoption grows globally, driven by increasing environmental concerns and supportive government policies, the demand for efficient thermal management solutions in EVs is rising.

Heat shrinks are crucial for managing the thermal loads of EV components such as batteries, power electronics, and electric motors. Efficient thermal management is vital to ensure these components' performance, safety, and longevity, making advanced heat shrink tubes indispensable in EV design.

The rapid advancements in EV technology, such as the development of high-density batteries and more powerful electric drivetrains, generate substantial heat that must be effectively dissipated to maintain optimal performance.

The demand creates a substantial market opportunity for heat shrink tube manufacturers to supply the automotive industry with innovative thermal management solutions. Additionally, the ongoing research in lightweight materials for automotive applications aligns with the trend of using advanced materials in heat shrink designs, further enhancing the potential for growth in this sector.

Moreover, as EV manufacturers strive to improve vehicle range and efficiency, the demand for compact and high-performance thermal management systems will continue to increase.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario is significantly shaping the heat shrink tube market by establishing standards that ensure safety, performance, and environmental sustainability.

In many regions, regulations mandate compliance with specific standards for materials used in heat shrink tubes, such as those related to flammability, chemical resistance, and electrical insulation properties. For instance,

Regulations from agencies like the UL (Underwriters Laboratories) and IEC (International Electro Technical Commission) set criteria that manufacturers must meet, influencing product design and quality.

Environmental regulations are increasingly impacting the market. There is a growing emphasis on reducing the environmental footprint of manufacturing processes and using materials that are recyclable or have minimal environmental impact.

Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) affects material choices and production methods.

Regulatory requirements drive innovation in the market for heat shrink tube by pushing companies to develop more advanced, compliant, and eco-friendly products. Adhering to these regulations helps manufacturers maintain market access and meet consumer demands for safe and sustainable products.

Fairfield’s Ranking Board

Segments Covered in the Report

- Demand from IT & Telecom Sector Climbs up

The IT & telecom sector drives demand for heat shrink tubes primarily for cable management and protection purposes. With the rapid expansion of data centres and telecommunications networks, there is a constant need for reliable and durable cable insulation solutions.

Heat shrink tubes offer excellent protection against moisture, abrasion, and other environmental factors, ensuring the longevity and performance of sensitive electronic components.

- Manufacturing Sector Presents the Most Extensive Applications

In the manufacturing sector, heat shrink tubes find extensive applications in wire harnessing, insulation of electrical connections, and component labelling. As manufacturing processes become more automated and sophisticated, there is a growing need for efficient and reliable electrical insulation solutions to ensure operational safety and reliability.

Heat shrink tubes offer a cost-effective method for protecting wires and cables from mechanical stress, chemical exposure, and temperature fluctuations, reducing the risk of electrical failures and downtime in manufacturing facilities.

The demand for humanized mice models in this research is expected to be high as long as cancer continues to be a global health issue, driving progress and innovation in cancer treatments.

Regional Analysis

- North America Gains from the Robust Industrial Infrastructure

The heat shrink tube market flourishes in North America due to its robust industrial infrastructure, particularly in sectors like automotive, aerospace, and electronics. The region's mature manufacturing landscape demands reliable insulation solutions, driving the adoption of heat shrink tubes.

Stringent regulations further bolster this demand, pushing manufacturers to invest in innovative materials and technologies. As a result, North America experiences sustained market expansion, fuelled by a continuous stream of advancements and applications across various industries.

Asia Pacific emerges as a significant player in the market for heat shrink tube, leveraging its status as a manufacturing powerhouse. Countries like China, Japan, and South Korea lead the region's rapid industrialization and urbanization, spurring demand for heat shrink tubes across diverse electronics, telecommunications, and automotive sectors.

Fairfield’s Competitive Landscape Analysis

The global heat shrink tube market boasts a competitive landscape marked by several prominent players vying for market share. Leading companies such as 3M, TE Connectivity, Sumitomo Electric Industries, HellermannTyton, and Panduit Corp have established significant footholds in the industry.

Key players employ various growth strategies to maintain their competitive edge, including product innovation, strategic partnerships, mergers and acquisitions, and geographical expansion.

Product innovation remains a focal point, with companies continually investing in research and development to enhance heat shrink tubes' performance and durability while catering to evolving customer needs.

Strategic partnerships and acquisitions enable companies to broaden their product portfolios and access new markets. Geographical expansion allows for tapping into emerging markets and diversifying revenue streams.

By leveraging these growth strategies, leading players aim to solidify their positions and capitalize on the expanding demand for heat shrink tube solutions across diverse industries.

Key Market Companies

- TE Connectivity

- Sumitomo Electric Industries, Ltd.

- Prysmian Group

- ABB Ltd.

- 3M

- Alpha Wire

- Assembly Fasteners, Inc.

- Dasheng Group

- Gremco GmbH

- Molex

Recent Industry Developments

- In April 2023, TE Connectivity introduced the EV Single Wall (EVSW) tubing, engineered explicitly for high-voltage applications and provides effective insulation and protection for conductive components and cables.

- In February 2023, Molex published a paper on miniaturization, which presented expert opinions and advancements in product design engineering and cutting-edge connectivity. By implementing miniaturized techniques, the corporation has enhanced the efficiency and safety of its products. This advancement bolstered the company's range of products and positively expanded the worldwide heat shrink tubing market.

An Expert’s Eye

- Emerging trends like the increasing demand for heat shrink tubes in the automotive and electronics industries due to their insulating and protective properties.

- There is a growing trend toward the development and use of eco-friendly materials in heat shrink tubes, with increasing emphasis on sustainability and environmental regulations.

- There is a growing trend towards customization in the Heat Shrink Tube Market, where manufacturers are offering tailored solutions to meet the specific requirements of different industries.

Heat Shrink Tube Market is Segmented as -

By End-Use Industry

- IT & Telecom

- Manufacturing

- Energy and Utility

- Healthcare

- Logistics and Transportation

- Railways

- Others

- Mining

- Oil and Gas

- Construction

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

1. Executive Summary

1.1. Global Heat Shrink Tube Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019-2023

3.1. Global Heat Shrink Tube, Production Output, by Region, 2019 - 2023

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

4. Price Trend Analysis, 2019-2023,

4.1. Key Highlights

4.2. Global Average Price Analysis, by Material Type/ End-Use Industry, US$ per Unit

4.3. Prominent Factors Affecting Heat Shrink Tube Prices

4.4. Global Average Price Analysis, by Region, US$ per Unit

5. Global Heat Shrink Tube Market Outlook, 2019 - 2031

5.1. Global Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Polyolefin

5.1.1.2. Fluoropolymer (e.g., PTFE)

5.1.1.3. PVC (Polyvinyl Chloride)

5.1.1.4. Kynar (e.g., PVDF)

5.1.1.5. Misc

5.2. Global Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. IT & Telecom

5.2.1.2. Manufacturing

5.2.1.3. Energy and Utility

5.2.1.4. Healthcare

5.2.1.5. Logistics and Transportation

5.2.1.5.1. Railways

5.2.1.5.2. Others

5.2.1.6. Mining

5.2.1.7. Oil and Gas

5.2.1.8. Construction

5.3. Global Heat Shrink Tube Market Outlook, by Region, Value (US$ Bn) & Volume (Units), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Heat Shrink Tube Market Outlook, 2019 - 2031

6.1. North America Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Polyolefin

6.1.1.2. Fluoropolymer (e.g., PTFE)

6.1.1.3. PVC (Polyvinyl Chloride)

6.1.1.4. Kynar (e.g., PVDF)

6.1.1.5. Misc

6.2. North America Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. IT & Telecom

6.2.1.2. Manufacturing

6.2.1.3. Energy and Utility

6.2.1.4. Healthcare

6.2.1.5. Logistics and Transportation

6.2.1.5.1. Railways

6.2.1.5.2. Others

6.2.1.6. Mining

6.2.1.7. Oil and Gas

6.2.1.8. Construction

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. North America Heat Shrink Tube Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. U.S. Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.2. U.S. Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.3. Canada Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.1.4. Canada Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Heat Shrink Tube Market Outlook, 2019 - 2031

7.1. Europe Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Polyolefin

7.1.1.2. Fluoropolymer (e.g., PTFE)

7.1.1.3. PVC (Polyvinyl Chloride)

7.1.1.4. Kynar (e.g., PVDF)

7.1.1.5. Misc

7.2. Europe Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. IT & Telecom

7.2.1.2. Manufacturing

7.2.1.3. Energy and Utility

7.2.1.4. Healthcare

7.2.1.5. Logistics and Transportation

7.2.1.5.1. Railways

7.2.1.5.2. Others

7.2.1.6. Mining

7.2.1.7. Oil and Gas

7.2.1.8. Construction

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Heat Shrink Tube Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Germany Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.2. Germany Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.3. U.K. Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.4. U.K. Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.5. France Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.6. France Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.7. Italy Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.8. Italy Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.9. Turkey Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.10. Turkey Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.11. Russia Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.12. Russia Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.13. Rest of Europe Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.1.14. Rest of Europe Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Heat Shrink Tube Market Outlook, 2019 - 2031

8.1. Asia Pacific Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Polyolefin

8.1.1.2. Fluoropolymer (e.g., PTFE)

8.1.1.3. PVC (Polyvinyl Chloride)

8.1.1.4. Kynar (e.g., PVDF)

8.1.1.5. Misc

8.2. Asia Pacific Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. IT & Telecom

8.2.1.2. Manufacturing

8.2.1.3. Energy and Utility

8.2.1.4. Healthcare

8.2.1.5. Logistics and Transportation

8.2.1.5.1. Railways

8.2.1.5.2. Others

8.2.1.6. Mining

8.2.1.7. Oil and Gas

8.2.1.8. Construction

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Heat Shrink Tube Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. China Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.2. China Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.3. Japan Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.4. Japan Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.5. South Korea Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.6. South Korea Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.7. India Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.8. India Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.9. Southeast Asia Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.10. Southeast Asia Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.11. Rest of Asia Pacific Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.1.12. Rest of Asia Pacific Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Heat Shrink Tube Market Outlook, 2019 - 2031

9.1. Latin America Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.1.1. Key Highlights

9.1.1.1. Polyolefin

9.1.1.2. Fluoropolymer (e.g., PTFE)

9.1.1.3. PVC (Polyvinyl Chloride)

9.1.1.4. Kynar (e.g., PVDF)

9.1.1.5. Misc

9.2. Latin America Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.2.1. Key Highlights

9.2.1.1. IT & Telecom

9.2.1.2. Manufacturing

9.2.1.3. Energy and Utility

9.2.1.4. Healthcare

9.2.1.5. Logistics and Transportation

9.2.1.5.1. Railways

9.2.1.5.2. Others

9.2.1.6. Mining

9.2.1.7. Oil and Gas

9.2.1.8. Construction

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Heat Shrink Tube Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1. Key Highlights

9.3.1.1. Brazil Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.2. Brazil Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.3. Mexico Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.4. Mexico Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.5. Argentina Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.6. Argentina Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.7. Rest of Latin America Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.1.8. Rest of Latin America Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Heat Shrink Tube Market Outlook, 2019 - 2031

10.1. Middle East & Africa Heat Shrink Tube Market Outlook, by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.1.1. Key Highlights

10.1.1.1. Polyolefin

10.1.1.2. Fluoropolymer (e.g., PTFE)

10.1.1.3. PVC (Polyvinyl Chloride)

10.1.1.4. Kynar (e.g., PVDF)

10.1.1.5. Misc

10.2. Middle East & Africa Heat Shrink Tube Market Outlook, by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.2.1. Key Highlights

10.2.1.1. IT & Telecom

10.2.1.2. Manufacturing

10.2.1.3. Energy and Utility

10.2.1.4. Healthcare

10.2.1.5. Logistics and Transportation

10.2.1.5.1. Railways

10.2.1.5.2. Others

10.2.1.6. Mining

10.2.1.7. Oil and Gas

10.2.1.8. Construction

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Heat Shrink Tube Market Outlook, by Country, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1. Key Highlights

10.3.1.1. GCC Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.2. GCC Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.3. South Africa Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.4. South Africa Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.5. Egypt Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.6. Egypt Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.7. Nigeria Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.8. Nigeria Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.9. Rest of Middle East & Africa Heat Shrink Tube Market by Material Type, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.1.10. Rest of Middle East & Africa Heat Shrink Tube Market by End-Use Industry, Value (US$ Bn) & Volume (Units), 2019 - 2031

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Industry vs End-Use Industry Heatmap

11.2. Manufacturer vs End-Use Industry Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. TE Connectivity

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. Sumitomo Electric Industries, Ltd.

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Prysmian Group

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. ABB Ltd.

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. 3M

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Alpha Wire

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Assembly Fasteners, Inc.

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Dasheng Group

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Financial Overview

11.5.8.4. Business Strategies and Development

11.5.9. Gremco GmbH

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. HellermannTyton

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. Qualtek Electronics Corp.

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. SAB Cable

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. W. L. Gore & Associates

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Cotronics Corporation

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Molex LLC

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million Volume: UNITS |

||

|

REPORT FEATURES |

DETAILS |

|

End-Use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |