Global High Fiber Feed Market Forecast

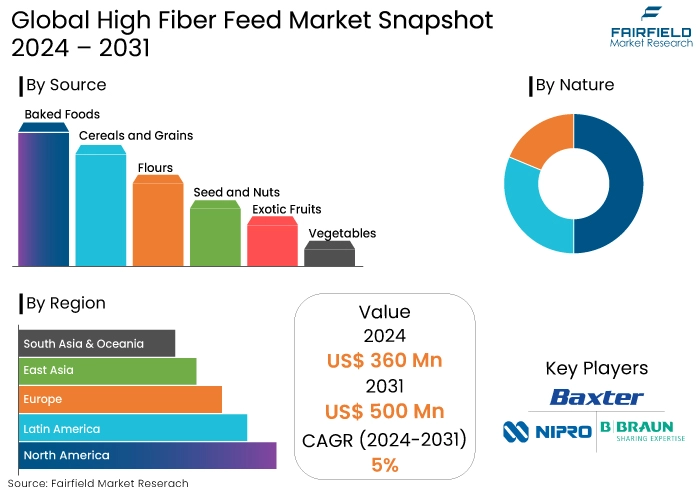

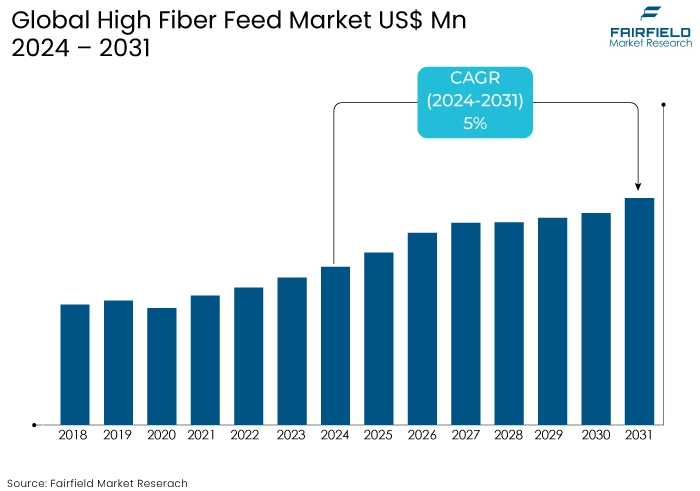

- The high fiber feed market is projected to reach a value of US$500 Mn by 2031, showing significant growth from the US$360 Mn achieved in 2024.

- The market growth is predicted to exhibit a remarkable rate of expansion with an around CAGR of 5% during the period from 2024 to 2031.

High Fiber Feed Market Insights

- Pet owners are increasingly incorporating high fiber foods into their pets' diets.

- Regulatory bodies recognize the importance of dietary fiber in animal feed for improved livestock health and productivity.

- Technological advancements and investments in the animal nutrition sector have led to the development of high-fiber feeds with optimized nutritional compositions.

- Increased consumer awareness and demand for high fiber feed products contributing to livestock well-being and productivity.

- Price sensitivity among consumers can impact the demand for high fiber animal products

- Research studies highlight the effectiveness of these feeds in preventing and curing certain gastrointestinal diseases in animals.

- Cereals and grains exhibit rapid growth with abundance of dietary fiber sources.

- North America takes the charge in the high fiber feed market.

- Increasing demand for feeds high in fiber is a key trend in the market.

A Look Back and a Look Forward - Comparative Analysis

The high fiber feed market concertation report shows significant growth in the industry. From the Fairfield’s industry assessment, the market size in 2019 was US$234.6 Mn. Over the next four years, the market experienced steady growth, reaching US$273.4 Mn in 2023. This represents a CAGR of 3.9% during the period from 2019 to 2023.

The high fiber feed industry is shaped by factors such as regulatory support, scientific studies, market developments, and opportunities. The market is projected to continue growing after 2024.

According to Fairfield Market Research, the global high fiber feed market value is expected to reach US$385.8 Mn by 2031 with a CAGR of 4.4% from 2024 to 2031. This growth is attributed to several factors and industry trends.

Pet owners are increasingly interested to include high fiber food sources to their pet’s diet to maintain their well-being. As per the American Kennel Club, some high-fiber foods for dogs include Brussels sprouts, carrots, broccoli, and green beans. These feeds high in fiber are called roughage and usually are plant based feeds.

Regulatory bodies recognize the importance of incorporating dietary fiber in animal feed for improved livestock health and productivity. Technological advancements and investments in the animal nutrition sector have led to the development of high-fiber feeds with optimized nutritional compositions.

Key Growth Determinants

- Increasing Awareness and Demand for Healthy Livestock Nutrition

One of the significant drivers for the high fiber feed market growth is the increasing awareness and demand for healthy livestock nutrition. Consumers are becoming more conscious of the quality of animal products they consume, leading to a greater emphasis on animal welfare and nutrition.

Feeds high in fiber are known to improve digestive health, enhance nutrient absorption, and reduce the risk of certain diseases in animals. As a result, there is a growing demand for high fiber feed products that can contribute to the overall well-being and productivity of livestock. This demand is driving the growth of the market as manufacturers and suppliers strive to meet the increasing consumer expectations.

- Rising Focus on Sustainable and Eco-Friendly Practices

Another growth driver for the high fiber feed expansion is the rising focus on sustainable and environmentally friendly practices. These feeds, often sourced from natural and renewable resources, are considered more sustainable compared to traditional feed options. These feeds contribute to reducing the environmental impact of livestock production by promoting efficient digestion and minimizing waste.

Foods can help reduce the reliance on antibiotics and growth hormones, aligning with the increasing demand for natural and organic animal products. As a result, the market is witnessing an upsurge in demand from environmentally conscious consumers and livestock producers who aim to adopt sustainable practices.

- Advancements in Feed Formulation and Manufacturing

Technological advancements in feed formulation and manufacturing processes are also driving high fiber feed market demand. Researchers and manufacturers are continually exploring innovative ways to enhance the nutritional content and digestibility of high fiber foods.

Advanced formulation techniques and improved processing methods ensure that the feeds provide optimal nutritional value, palatability, and ease of consumption for livestock. These advancements not only improve the quality of fiber-enriched feeds but also contribute to their cost-effectiveness and efficiency in livestock production. As a result, livestock producers are increasingly adopting high fiber foods as a part of their feed strategies, driving the growth of the market.

Key Growth Barriers

- Limited Awareness and Adoption

One of the restraints for the high fiber feed market sales is the limited awareness and adoption of these feeds in traditional livestock farming practices. In some regions, traditional livestock farmers may have limited knowledge about the benefits of a high-fiber diet or may be resistant to change their existing feeding practices. This can hinder the market growth as it becomes challenging to penetrate these markets and convince farmers to switch to high fiber food options. Education and awareness programs targeted towards traditional livestock farmers can help address this restraint and promote the adoption of high fiber feeds.

- Cost Considerations and Price Sensitivity

Cost considerations and price sensitivity can also act as growth restraints for the high fiber feed market revenue. High fiber feeds, especially those formulated with premium ingredients and advanced processing techniques, may have a higher price compared to conventional feed options.

Livestock producers, particularly those operating on tight budgets, may be hesitant to invest in high fiber feeds if they perceive them as expensive or if they do not see a significant return on investment.

Price sensitivity among consumers can also impact the demand for high fiber animal products, which in turn affects the demand for high fiber feeds. Manufacturers and suppliers need to address these cost concerns by offering competitive pricing strategies and highlighting the long-term benefits and cost-effectiveness of high fiber feeds.

High Fiber Feed Market Trends and Opportunities

- Increasing Demand for High Fiber Feed in Livestock Industry

One prominent trend in the high fiber feed market is the increasing demand for feeds high in fiber in the livestock industry. This trend is driven by several factors, including the growing awareness of the benefits of high fiber diets for animals and the rising focus on animal welfare and nutrition.

Horse owners are highly interested in high fiber horse feeds that are known to improve digestive health, enhance nutrient absorption, and reduce the risk of certain diseases in horses. As a result, there is a growing demand for high fiber products that can contribute to the overall well-being and productivity of livestock.

The trend of increasing demand for high fiber feed is supported by research studies highlighting the effectiveness of these feeds in preventing and curing certain gastrointestinal diseases and conditions in animals. This presents several high fiber fee market opportunities for consumers and livestock producers to prioritize the health and well-being of animals.

- Expansion of High Fiber Feed Market in the Aerospace Industry

An opportunity for the high fiber feed market expansion lies in the expansion of its applications in the aerospace industry. The increasing use of high-performance fiber in aircraft, coupled with the growing number of aircraft launched in the market annually presents a significant growth opportunity for the high-performance fiber in the aerospace industry.

High fiber materials such as carbon fiber and aramid fiber offer lightweight and high-strength properties, making them suitable for various aerospace applications.

The aerospace industry including commercial and defense sectors requires materials that can withstand extreme conditions while providing structural integrity and weight reduction. This presents a substantial opportunity for high fiber feed market manufacturers to cater to the aerospace industry's needs and expand their market presence.

How Does Regulatory Scenario Shape this Industry?

The regulatory scenario plays a significant role in shaping the high fiber feed market. The use of dietary fiber, including feeds high in fiber, has gained regulatory support due to its positive impact on animal health and digestion. Regulatory bodies have recognized the importance of incorporating fibers in animal feed to improve livestock well-being and overall productivity. Additionally, positive scientific studies on the benefits of dietary fiber have contributed to the market's growth.

The high fiber feed market report shows that the regulatory scenario is also closely linked to market developments and opportunities. The market is witnessing technological advancements and developments in the animal nutrition sector, leading to the formulation of high-fiber feeds with optimized nutritional compositions. These developments are driven by substantial investments in the animal nutrition sector and the increasing demand for enhanced livestock output.

Fairfield’s Ranking Board

Segments Covered in the Report

- Cereals and Grains Exhibit Rapid Growth with Abundance of Dietary Fiber Sources

As per the high fiber feed market update, the industry is segmented into baked foods, cereals and grains, flowers, seeds and nuts, exotic fruits, vegetables, and others, which witnessed significant growth in 2021. Cereals and grains emerged as the dominant segment, driven by the abundance of dietary fiber sources such as oat, barn, corn, rice, and wheat.

The gel-forming nature of dietary fiber slows digestion, allowing complete nutrient absorption and reducing bad cholesterol levels. As per the National Institute of Health, consumption of cereals and grains reduces the risk of heart disease and diabetes.

Consumers are also intended to choose a diet that has feed high in TDN and low in fiber, which is fueling innovative feed formulations for animals. Additionally, the baked foods segment is projected to experience significant growth with bread, cakes, and pastries being the most popular products.

- Conventional Segment Takes the Steer Through Commercial Application

As per the high fiber feed market forecast, the industry can be segmented into organic and conventional categories. In 2021, the conventional segment held the largest market share, driven by its commercial application in the food and beverage industry.

The demand for high-fiber food in this industry known for its low calorie and high nutrient content is not adequately met by organic sources. To meet market demand, most players rely on conventional sources, further driving the segment growth. However, the organic Segment is projected to experience the fastest growth, driven by increasing consumer awareness and preference for purely organic products with associated health benefits.

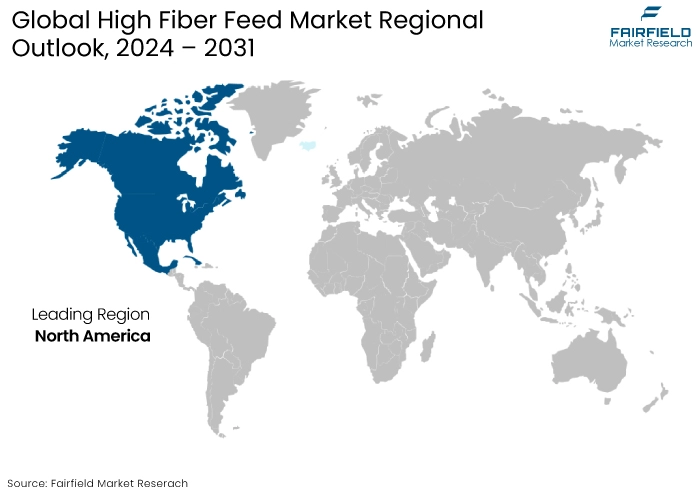

Regional Analysis

- North America Maintains Primacy in the Market

The high fiber food market is segmented by geography into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Fairfield's high fiber feed market overview shows that in 2021, North America held the largest market share, accounting for 45% of the overall market. This growth can be attributed to the increasing prevalence of obesity and diabetes in the region.

With millions of adults living with diabetes and the number projected to rise, there is a growing demand for high-fiber food to prevent these conditions. This trend is driving the growth of the high fiber feed market in North America.

- Asia-Pacific Emerges as a Leader Through Nutritional Needs and Health Concerns

As per the high fiber feed market research report, Asia Pacific is projected to experience the a notable CAGR rate in the forthcoming years. This growth is fueled by the region's efforts to meet the nutritional needs of its large population and combat obesity and related diseases like cardiovascular conditions.

The high fiber feed industry in Asian Pacific has significant potential to capture this growing market as consumers increasingly prefer high fiber options over meat products.

Fairfield’s Competitive Landscape Analysis

The competitive landscape analysis for the high fiber feed market involves understanding the market dynamics, identifying competitors, and assessing their strategies and positioning. This analysis helps in understanding the market dynamics and positioning of different players. By examining competitors' strategies, strengths, and weaknesses, companies can fine-tune their own product strategies and marketing initiatives to gain a competitive edge.

Key Market Companies

- Ardent Mills

- Cargill Inc

- Cereal Ingredients

- Crea Fill Fibers Corporation

- General Mills Inc.

- Flowers Foods Inc.

- Grain Millers Inc.

- Hodgson Mill Inc.

- Mondelez International

- International Fiber Corporation

Recent Industry Developments

- May 2024

Nestlé is launching a new frozen food brand, Vital Pursuit, aimed at people taking GLP-1 medications. The brand aims to provide essential nutrients, such as sandwich melts, pizzas, and frozen bowls with whole grains or pasta. However, experts advise against consuming processed food as the main source of food for those on GLP-1 medications. A plant-focused diet, which is closer to its natural state, can prevent various health conditions.

- July 2024

Tesco is partnering with Grosvenor Farms, a UK dairy farm, to trial a methane-reducing feed supplement for its dairy cows. The supplement, supplied by dsm-firmenich, has been shown to reduce methane emissions by up to 30%. If implemented across Grosvenor Farms, it could lead to a 12% reduction in farm greenhouse gas emissions. The supplement suppresses methane production enzymes, reducing cows' carbon footprint by about 1.3 tonnes CO2e annually.

An Expert’s Eye

- Increased interest in high fiber food sources by pet owners, including Brussels sprouts, carrots, broccoli, and green beans.

- Recognition of the importance of dietary fiber in animal feed by regulatory bodies.

- Technological advancements and investments in the animal nutrition sector leading to the development of high-fiber feeds.

- Increased demand from environmentally conscious consumers and livestock producer are fueling industry.

- The market for high fiber feed is expected to reach US$385.8 Mn by 2031 with a CAGR of 4.4% from 2024 to 2031.

High Fiber Feed Market is Segmented as-

By Nature

- Organic

- Conventional

By Source

- Baked Foods

- Cereals and Grains

- Flours

- Seed and Nuts

- Exotic Fruits

- Vegetables

- Others

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

1. Executive Summary

1.1. Global High Fiber Feed Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global High Fiber Feed Market Outlook, 2019 - 2031

3.1. Global High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

3.1.1. Key Highlights

3.1.1.1. Ruminants

3.1.1.2. Poultry

3.1.1.3. Equines

3.1.1.4. Swine

3.1.1.5. Aquatic Animals

3.1.1.6. Pets

3.1.1.7. Others

3.2. Global High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

3.2.1. Key Highlights

3.2.1.1. Soybean

3.2.1.2. Wheat

3.2.1.3. Corn

3.2.1.4. Sugar Beet

3.2.1.5. Other Sources

3.3. Global High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

3.3.1. Key Highlights

3.3.1.1. Soluble

3.3.1.2. Insoluble

3.3.1.3. Both

3.4. Global High Fiber Feed Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America High Fiber Feed Market Outlook, 2019 - 2031

4.1. North America High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

4.1.1. Key Highlights

4.1.1.1. Ruminants

4.1.1.2. Poultry

4.1.1.3. Equines

4.1.1.4. Swine

4.1.1.5. Aquatic Animals

4.1.1.6. Pets

4.1.1.7. Others

4.2. North America High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

4.2.1. Key Highlights

4.2.1.1. Soybean

4.2.1.2. Wheat

4.2.1.3. Corn

4.2.1.4. Sugar Beet

4.2.1.5. Other Sources

4.3. North America High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

4.3.1. Key Highlights

4.3.1.1. Soluble

4.3.1.2. Insoluble

4.3.1.3. Both

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America High Fiber Feed Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

4.4.1. Key Highlights

4.4.1.1. U.S. High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

4.4.1.2. U.S. High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

4.4.1.3. U.S. High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

4.4.1.4. Canada High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

4.4.1.5. Canada High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

4.4.1.6. Canada High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe High Fiber Feed Market Outlook, 2019 - 2031

5.1. Europe High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

5.1.1. Key Highlights

5.1.1.1. Ruminants

5.1.1.2. Poultry

5.1.1.3. Equines

5.1.1.4. Swine

5.1.1.5. Aquatic Animals

5.1.1.6. Pets

5.1.1.7. Others

5.2. Europe High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.2.1. Key Highlights

5.2.1.1. Soybean

5.2.1.2. Wheat

5.2.1.3. Corn

5.2.1.4. Sugar Beet

5.2.1.5. Other Sources

5.3. Europe High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.3.1. Key Highlights

5.3.1.1. Soluble

5.3.1.2. Insoluble

5.3.1.3. Both

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe High Fiber Feed Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

5.4.1. Key Highlights

5.4.1.1. Germany High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.2. Germany High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.3. Germany High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.4. U.K. High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.5. U.K. High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.6. U.K. High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.7. France High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.8. France High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.9. France High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.10. Italy High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.11. Italy High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.12. Italy High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.13. Turkey High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.14. Turkey High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.15. Turkey High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.16. Russia High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.17. Russia High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.18. Russia High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.1.19. Rest of Europe High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

5.4.1.20. Rest of Europe High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

5.4.1.21. Rest of Europe High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific High Fiber Feed Market Outlook, 2019 - 2031

6.1. Asia Pacific High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

6.1.1. Key Highlights

6.1.1.1. Ruminants

6.1.1.2. Poultry

6.1.1.3. Equines

6.1.1.4. Swine

6.1.1.5. Aquatic Animals

6.1.1.6. Pets

6.1.1.7. Others

6.2. Asia Pacific High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.2.1. Key Highlights

6.2.1.1. Soybean

6.2.1.2. Wheat

6.2.1.3. Corn

6.2.1.4. Sugar Beet

6.2.1.5. Other Sources

6.3. Asia Pacific High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.3.1. Key Highlights

6.3.1.1. Soluble

6.3.1.2. Insoluble

6.3.1.3. Both

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific High Fiber Feed Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

6.4.1. Key Highlights

6.4.1.1. China High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.2. China High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.3. China High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.1.4. Japan High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.5. Japan High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.6. Japan High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.1.7. South Korea High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.8. South Korea High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.9. South Korea High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.1.10. India High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.11. India High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.12. India High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.1.13. Southeast Asia High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.14. Southeast Asia High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.15. Southeast Asia High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.1.16. Rest of Asia Pacific High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

6.4.1.17. Rest of Asia Pacific High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

6.4.1.18. Rest of Asia Pacific High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America High Fiber Feed Market Outlook, 2019 - 2031

7.1. Latin America High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

7.1.1. Key Highlights

7.1.1.1. Ruminants

7.1.1.2. Poultry

7.1.1.3. Equines

7.1.1.4. Swine

7.1.1.5. Aquatic Animals

7.1.1.6. Pets

7.1.1.7. Others

7.2. Latin America High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

7.2.1. Key Highlights

7.2.1.1. Soybean

7.2.1.2. Wheat

7.2.1.3. Corn

7.2.1.4. Sugar Beet

7.2.1.5. Other Sources

7.3. Latin America High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

7.3.1. Key Highlights

7.3.1.1. Soluble

7.3.1.2. Insoluble

7.3.1.3. Both

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America High Fiber Feed Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

7.4.1. Key Highlights

7.4.1.1. Brazil High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

7.4.1.2. Brazil High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

7.4.1.3. Brazil High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

7.4.1.4. Mexico High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

7.4.1.5. Mexico High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

7.4.1.6. Mexico High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

7.4.1.7. Argentina High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

7.4.1.8. Argentina High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

7.4.1.9. Argentina High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

7.4.1.10. Rest of Latin America High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

7.4.1.11. Rest of Latin America High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

7.4.1.12. Rest of Latin America High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa High Fiber Feed Market Outlook, 2019 - 2031

8.1. Middle East & Africa High Fiber Feed Market Outlook, by Livestock, Value (US$ Bn), 2019 - 2031

8.1.1. Key Highlights

8.1.1.1. Ruminants

8.1.1.2. Poultry

8.1.1.3. Equines

8.1.1.4. Swine

8.1.1.5. Aquatic Animals

8.1.1.6. Pets

8.1.1.7. Others

8.2. Middle East & Africa High Fiber Feed Market Outlook, by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.2.1. Key Highlights

8.2.1.1. Soybean

8.2.1.2. Wheat

8.2.1.3. Corn

8.2.1.4. Sugar Beet

8.2.1.5. Other Sources

8.3. Middle East & Africa High Fiber Feed Market Outlook, by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.3.1. Key Highlights

8.3.1.1. Soluble

8.3.1.2. Insoluble

8.3.1.3. Both

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa High Fiber Feed Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

8.4.1. Key Highlights

8.4.1.1. GCC High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

8.4.1.2. GCC High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.4.1.3. GCC High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.4.1.4. South Africa High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

8.4.1.5. South Africa High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.4.1.6. South Africa High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.4.1.7. Egypt High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

8.4.1.8. Egypt High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.4.1.9. Egypt High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.4.1.10. Nigeria High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

8.4.1.11. Nigeria High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.4.1.12. Nigeria High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.4.1.13. Rest of Middle East & Africa High Fiber Feed Market by Livestock, Value (US$ Bn), 2019 - 2031

8.4.1.14. Rest of Middle East & Africa High Fiber Feed Market by Source Ingredient, Value (US$ Bn), 2019 - 2031

8.4.1.15. Rest of Middle East & Africa High Fiber Feed Market by Type of Fiber, Value (US$ Bn), 2019 - 2031

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. By Type of Fiber vs by Source Ingredient Heat map

9.2. Manufacturer vs by Source Ingredient Heat map

9.3. Company Market Share Analysis, 2024

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. Triple Crown Nutrition Inc

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Archer-Daniels Midland Co

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Cargill, Inc

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Fiber Fresh Feeds Ltd

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. The Pure Feed Company Limited

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Gulshan Polyols Ltd

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Dengie Crops Ltd

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Muenster Milling Co.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Manna Pro Products LLC

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Roquette Frères

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Mars Horsecare Uk Limited

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2023 |

|

2019 - 2023 |

2024 - 2031 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Source Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |